Professional Documents

Culture Documents

Bringing Health Care To Your Fingertips Ahead of The Curve Series

Bringing Health Care To Your Fingertips Ahead of The Curve Series

Uploaded by

powerforwardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bringing Health Care To Your Fingertips Ahead of The Curve Series

Bringing Health Care To Your Fingertips Ahead of The Curve Series

Uploaded by

powerforwardCopyright:

Available Formats

Equity

Research

Health Care IT & Distribution

Telehealth: Bringing Health Care

To Your Fingertips

February 20, 2015

Telehealth is evolving towards a

broader means of delivering healthcare

services in an on-demand, consumercentric manner that could change

healthcare delivery.

We estimate the market opportunity for

conditions currently treated by

telehealth at $5.7B, with another $12.5B

from expansion into additional

conditions.

Telehealth is already part of many

public companies strategy, including:

ATHN, HUM, KND, MDRX, RAD, UHS,

UNH, and WBA.

Charles Rhyee

646.562.1376

charles.rhyee@cowen.com

James Auh

646.562.1352

james.auh@cowen.com

Zachary Wachter

646.562.1353

zachary.wachter@cowen.com

Please see addendum

of this report for important

disclosures.

Cowen and Company

Equity Research

February 20, 2015

This page left blank intentionally.

www.cowen.com

Equity Research

Industry Overview

February 20, 2015

Health Care Technology & Distribution:

Health Care IT

Health Care Technology & Distribution:

Drug Retailers

Charles Rhyee

646.562.1376

charles.rhyee@cowen.com

James Auh

646.562.1352

james.auh@cowen.com

Zachary Wachter

646.562.1353

zachary.wachter@cowen.com

Telehealth: Bringing Health Care To Your

Fingertips - Ahead of the Curve Series

The Cowen Insight

Telehealth has been around for awhile but is about to break into the mainstream

as a confluence of regulatory and technological change has enabled telehealth to

benefit from the fast evolving healthcare landscape. We see a multi-billion dollar

market opportunity driving strategies of public companies and fostering new company

formation, particularly in the area of on-demand healthcare services.

Telehealth is benefiting from the changing healthcare landscape

We are seeing an evolution of telehealth towards a broader means of delivering

healthcare services in an on-demand, consumer-centric manner that we believe

will change the way healthcare is delivered. Recent regulatory and technological

disruptions are driving the evolution led by: 1) health reform, which represents a

positive tailwind as millions of new lives are added to an already cost-burdened

system generating demand for lower-cost services; 2) recent legislation making

telehealth a more viable option for providers by relaxing regulations against its use

and improving licensure standards and reimbursement; and 3) technology which has

evolved to the point where smartphones are ubiquitous, enabling services such as

healthcare to be delivered to consumers fingertips at a moments notice.

Significant market opportunity for on-demand healthcare services

We estimate the total addressable market for outpatient spending on conditions

currently treated by telehealth is approximately $57B. Furthermore, we see an

additional $125B in the total addressable market for conditions telehealth could

address in the future, including the management of chronic diseases. Assuming a

10% penetration rate, this would put the market opportunity for currently treated

conditions at $5.7B and the additional potentially treatable conditions at $12.5B.

Successful telehealth players need to provide an engaging consumer experience, but

more importantly they need to provide a compelling business case to providers, payors

and employers, who are the primary purchasers of telehealth services. For example,

we believe telehealth can help providers extend their brand and acquire new patients

without significant increase in costs.

Investors should begin to pay attention, as telehealth has already become

embedded in the strategy of many companies

While there are limited direct investment ideas for investors today, except perhaps in

the area of remote patient monitoring (ex., possibly MDT and DXCM), investors should

begin to pay attention as we expect telehealth to not only be directly investable in

the near future, but also to play an important strategic role for other constituents in

healthcare. For example, UNH currently works with 16 telehealth partners. HUM has a

pilot program for seniors enrolled in its MA plans using in-home sensors and remote

monitoring. ANTM recently launched LiveHealth Online, in partnership with American

Well, which it expects to roll-out nationally. UHS provides general telemedicine

services to ERs and SNFs in Georgia. CYH and THC are investors in MDLive. WBA

recently partnered with MDLive to offer virtual consultations through its app. And

RAD is piloting HealthSpot's telehealth kiosks in some of its Ohio stores.

www.cowen.com

Please see addendum of this report for important disclosures.

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

Investment Summary

The terms telehealth and telemedicine are often used interchangeably, but both

describe the use of medical information exchanged from one site to another via

electronic communications to improve the patients health status. In this report, we

look at the evolution of telehealth towards a broader means of delivering healthcare

services in an on-demand, consumer-centric manner. We believe telehealth is about

to break into the mainstream as a confluence of recent regulatory and technological

disruption has enabled telehealth to benefit from the fast evolving healthcare

landscape. In particular:

Health reform represents a positive tailwind as millions of new lives are added to an

already cost-burdened system generating greater demand for lower-cost services

such as telehealth.

Recent legislation has made telehealth a more viable option for providers by

relaxing regulations against its use and improving associated licensure standards

and reimbursement in its favor.

Technology has evolved to the point where smartphones are ubiquitous, enabling

services such as healthcare to be delivered to consumers fingertips at a moments

notice.

As the U.S. health system transitions from a fee-for-service model to a fee-foroutcomes model, we see telehealth being embraced by providers, payors, employers

and consumers. Further, we believe the recent push into telehealth from all

stakeholders is part of the wider digital health movement encompassing clinical

analytics and Big Data, consumer engagement technologies, wearables and

biosensing, and population health management. While there are limited direct

investment ideas for investors today, except perhaps in the area of remote patient

monitoring (ex., Medtronic and possibly Dexcom), we believe investors should begin

to pay attention as we expect telehealth to not only be directly investable in the

relatively near future, but also to play an important strategic role for other constituents

in healthcare, including medical device, diagnostics, managed care, providers and

drug retailers.

In this report, we largely focus on the delivery of healthcare services in an on-demand,

consumer-centric manner. We see the larger near-term opportunity for telehealth

companies geared more towards general practice over specialist care. Leading

telehealth service companies, such as American Well, Teladoc, and MDLive, remain at

the forefront of this movement to on-demand, consumer-centric healthcare. We

estimate the total addressable market for outpatient spending on conditions currently

treated by telehealth is approximately $57 billion (Figure 2). Furthermore, we see an

additional $125 billion in the total addressable market for conditions telehealth could

address in the future, including the management of chronic diseases. Assuming a 10%

penetration rate, this would put the market opportunity for currently treated conditions

at $5.7 billion and the additional potentially treatable conditions at $12.5 billion. In

general, we think successful telehealth players will be able to deliver on two broad

characteristics:

A strong consumer experience thats able to deliver the right care at the right time.

Higher out-of-pocket costs will make consumers more selective of how they

purchase healthcare services.

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

A compelling business case to providers, payors and employers, who we see as the

primary purchasers of services from telehealth companies. Successful telehealth

players will be able to demonstrate strong ROI in the areas of brand extension,

market reach, and customer acquisition and retention.

We have already begun to see telehealth become a part of the strategy of companies

inside and outside our coverage universe, including:

Health plans: UNH currently has 16 telehealth partners they work with outside

physicians offices, and is already managing upwards of 350,000 telehealth

consultations a day including 20,000 people remotely monitored in their homes.

HUM has a pilot program for 100 seniors enrolled in its Medicare Advantage plans,

whereby through the use of in-home sensors and remote monitoring technology

elderly patients can remain in their homes longer on their own. ANTM recently

launched a new online service, LiveHealth Online in partnership with American

Well, which it expects to roll-out nationally to its 33 million members.

Providers: As early as 2009, UHS implemented a telemental health program at

Anchor Hospital near Atlanta to reach the behavioral needs of remote communities

nearby, which has now expanded to general telemedicine services for hospital ERs

and nursing homes throughout Georgia. KND uses remote monitoring for a number

of its home-care patients, who have seen readmission rates consistently below state

and national averages. CYH and THC are members of a consortium of healthcare

companies that founded the Heritage Group, a VC firm that led a round of

investment in MDLive in early 2014.

Drug retailers: WBA recently announced a partnership with MDLive, which will offer

virtual consultations through Walgreens smartphone app. WBA also recently

announced a partnership with WebMD to offer a virtual wellness-coach. RAD has

formed a partnership with HealthSpot to pilot its telehealth kiosks in some of RADs

Ohio stores. CVS has been piloting telehealth in some of its MinuteClinic locations.

Traditional Healthcare IT: MDRX was one of the first major HCIT vendor to integrate

telehealth capabilities into its EHR when it announced a partnership with American

Well in 2012 enabling providers to document online voice and video telehealth

interactions into the EHR. Privately-held Epic has partnered with AMC Health to

integrate its telehealth solution into Epics EHR.

What Is Telehealth?

According to the Center for Connected Health Policy, telehealth is defined as a

collection of means or methods for enhancing health care, public health, and health

education delivery and support using telecommunications technologies. Telehealth

has the potential to provide better quality and more appropriate care for each patient,

as well as more efficient use of healthcare resources by potentially reducing the need

for expensive hospital care. Or more simply, telehealth expands access to care at

lower cost. While the definitions of the various categories within telehealth are very

fluid and sometimes cross borders, we would generally categorize telehealth into the

following domains:

Real-Time Interaction (Synchronous): Live, two-way interaction between a person

and a provider using audiovisual telecommunications technology. This can either be

done through traditional videoconferencing (more synonymous with traditional

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

telemedicine), through traditional phone calls, or increasingly through mobile

devices and kiosks.

Store-and-Forward (Asynchronous): Transmission of recorded health history

through an electronic communications system to a practitioner, usually a specialist,

who uses the information to evaluate the case or render a service outside of a realtime or live interaction. Images can be captured using a smartphones camera or

through the use of specialized attachments, and then uploaded to a server to be

viewed by a specialist later.

Remote Patient Monitoring (RPM): Personal health and medical data collection from

an individual in one location via electronic communication technologies, which is

transmitted to a healthcare provider in a different location for use in care and

related support.

Traditionally, telemedicine/telehealth served as a means of improving access to care

to those in remote areas. For instance, with nearly 20 percent of the U.S. population

spread across approximately 80 percent of the nations countryside, telehealth

enabled providers to meet the healthcare needs of those in remote areas. Additionally,

there were other barriers for remote populations to obtain healthcare in a prompt and

timely manner beyond just proximity to care, including the ability to attract and retain

healthcare providers.

We would argue that health reform has compounded the issue of access to care.

Millions of people have gained insurance coverage through exchanges or Medicaid,

but there hasnt been a corresponding surge in new healthcare providers. Access to

care is no longer a rural issue but a national one. Recently, however, driven by

technological advances, government legislation and consumerism, telehealth has

evolved as one way to improve the access to care equation, thus increasing the

efficiency in the U.S. healthcare system by reducing healthcare expenditures and, at

the same time, improving overall patient health.

What Telehealth Is Not

While we believe that telehealth has the ability to change the way healthcare is

delivered today, it is not a replacement for the direct relationship between a patient

and his/her doctor. We see telehealth used as a supplement to a persons relationship

with his/her primary physician. We believe a risk for consumers is that they replace

their primary physician relationship for ad hoc usage of on-demand services, which

not only includes telehealth but other services like urgent care centers and retail

clinics.

Telehealth Needs To Be Consumer-Facing, But At Its Core A B2B Play

We think in order to build a successful telehealth business, companies need to adopt

B2B business models that partner with providers, employers and payors by providing

them incentives to deploy telehealth services given that they are the primary

purchasers of telehealth services. We think the use cases are compelling as telehealth

can in different instances help extend reach and brand, increase volumes, lower costs,

and improve patient engagement. At the same time, successful telehealth companies

will be able to provide an engaging consumer experience, which is critical as

consumers faced with greater out-of-pocket costs will become more selective in

buying healthcare services.

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

Telehealth Is Going Mainstream And Pivoting Towards On-Demand Healthcare

Services

As mentioned earlier, telehealth is no longer simply about treating patients in remote,

rural locations or patients with certain chronic conditions. The need to improve access

to care, while managing costs is helping telehealth break into the mainstream,

pivoting towards virtual, on-demand, consumer-centric healthcare services. Given the

rapid rise in the adoption of smartphones, telehealth has essentially developed into

healthcare at your fingertips (Figure 1). In addition, as the U.S. health system

transitions from a fee-for-service model to a fee-for-outcomes model, we see

telehealth being increasingly embraced by providers, payors, employers and

consumers.

Figure 1 . Evolution of Telehealth

1870 1880

1890

1900 1910

1920

1930 1940

1950

1960

NOW

Source: Cowen and Company

Significant Multi-Billion Dollar Market Opportunity For Telehealth

While telehealth remains an emerging industry whose potential market is difficult to

appropriately size, particularly on the software side which is in the much earlier

innings than the device side, we still see a significant market opportunity. In

determining the market opportunity, we first look at total outpatient spending by

medical condition and then narrow it to conditions that are currently being treated

through telehealth and those that could be in the future. We estimate the total

addressable market for outpatient spending on conditions currently treated by

telehealth is approximately $57 billion (Figure 2). This group of conditions includes

among others: headache, flu, upper respiratory infections, skin disorders, and mental

disorders. Furthermore, we see an additional $125 billion in the total addressable

market for conditions telehealth could address in the future, including the

management of chronic diseases such as diabetes, COPD, asthma and hypertension. If

we assume a 10% penetration rate, this would put the market opportunity for currently

treated conditions at $5.7 billion and the additional potentially treatable conditions at

$12.5 billion.

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

Figure 2 . Total Addressable Market for Current and Potential Telehealth Conditions, 2012

35,000

Current Telehealth Conditions

Potential Telehealth Conditions

Other Conditions

People who sought outpatient care for disease (thousands)

30,000

Hypertension

$13.4B

Osteoarthritis

$27.1B

COPD,

asthma

$14.1B

Acute

bronchitis &

URI

$6.6B

25,000

Mental

disorders

$24.2B

20,000

Skin

disorders

$17.3B

Diabetes

$13.2B

15,000

Back

problems

$22.4B

Heart

conditions

$19.2B

Cancer

Infectious

diseases

10,000

Flu

$0.8B

Upper GI

disorder

$5.8B

Otitis

media

$2.4B

UTI

$1.6B

5,000

Sexual

health

$6.3B

Thyroid

disease

Headache

$3.7B

Allergic reactions

Glaucoma $2.1B

Pneumonia

Intestinal infection

$0.8B

0

1

Cerebrovascular

disease

Stomach and intestinal

disorders $1.6B

Anemia

# of outpatient visits per patient per year

Source: Agency for Healthcare Research and Quality and Cowen and Company

This significant market opportunity has not gone unnoticed by the venture community,

which has poured significant dollars into telehealth specifically and digital health more

broadly. According to Rock Health, telehealth funding saw 315% y/y growth in 2014,

as licensing and reimbursement have become increasingly favorable for the industry,

to reach $285 million making it the fastest growing segment in digital health in 2014

(Figure 3).

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

Figure 3 . Fastest Growing Categories of Digital Health From 2013-2014

Source: Rock Health Funding Database

The growth of funding for telehealth mirrors the broader growth in Digital Health

technology services, encompassing clinical analytics and Big Data, consumer

engagement technologies, wearables and biosensing, and population health

management. The overall space has seen huge demand, exhibited by the over $4.1

billion in venture capital funding received by U.S. Digital Health companies, of deals

over $2 million, in 2014. This is almost as much funding as the space received in the

last three years combined and represents 125% y/y growth in funding relative to 2013.

Funding in Digital health has seen a CAGR of 45% from 2011-2014 (Figure 4).

Figure 4 . U.S. Digital Health Venture Capital Funding From 2011-2014

Source: Rock Health Funding Database

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

Not All Telehealth Is The Same

Telehealth is an all-encompassing term and as such there are numerous categories

within it. Below we outline some of the major forms of telehealth.

Telehealth (synchronous): The use of telephone or secure online

videoconferencing, via computer, tablet or smartphone, to provide 24/7 virtual,

on-demand patient consultations with Board Certified physicians for the

diagnosis and treatment of non-emergency or chronic medical conditions.

Telecardiology (asynchronous and RPM): The digital transmission between health

care professionals of information relating to electrocardiograms,

echocardiograms, angioplasty, and cardiac pacemaker monitoring.

Teledermatology (synchronous and asynchronous): The use of

telecommunications technologies, whether store-and-forward or full-motion

video, for the diagnosis, consultation and treatment of dermatological conditions

and tumors of the skin.

Teleneurology (synchronous and asynchronous): The use of telecommunications

technology for the consultation of neurological conditions, including headache,

dementia, epilepsy, stroke, movement disorders and multiple sclerosis, as well as

the viewing of medical images, such as X-rays, MRI and CT scans.

Telepathology (asynchronous): The transmission of pathology images and

associated clinical information for the purpose of diagnosis, education and

research.

Telepsychiatry (synchronous): The use of video conferencing technology to

connect patients to qualified mental health providers. It has also been used to

provide patients with second opinions in areas where only one psychiatrist is

available, as well as improve collaborative services between mental health

professionals.

Teleradiology (asynchronous): The transmission of radiological patient images,

such as x-rays, CTs and MRIs, from one location to another for the purposes of

diagnosing and sharing studies with other radiologists and physicians.

Telesurgery/Remote Surgery (synchronous): Surgery performed by a surgeon by

means of a computer or satellite link and robotic surgical system, which generally

consists of one or more arms (controlled by the surgeon), a master controller

(console) and a sensory system giving feedback to the user.

Teletrauma (synchronous): The use of telecommunications technology to evaluate

and triage patients in need of advanced trauma and emergency medical care

often in a critical setting, such as a major accident or natural disaster.

Competitive Landscape

Telehealth is very much an emerging and fragmented industry with numerous players

within various subsectors. In Figure 5, we outline largely pure-play telehealth

companies within their respective subsectors. While this outline is not all

encompassing, we believe it provides a general overview of the market.

10

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

Figure 5 . Telehealth Competitive Landscape

Subse c tor

24/7 Virtual, OnDemand Doctor Visits

Teledermatology

De sc r iption

The use of phone or secure online video to

provide virtual, on-demand patient consultations

with Board Certified physicians for the diagnosis

and treatment of non-emergency or chronic

medical issues

The use of telecommunication technologies for

the diagnosis, consultation and treatment of

dermatological conditions and tumors of the skin

Telepsychiatry

The use of video conferencing technology to

connect patients to qualified mental health

providers

Teleneurology

The use of telecommunications technology for

the consultation of neurological conditions and

the viewing of medical images

Teleradiology

The transmission of radiological patient images,

such as x-rays, CTs and MRIs, from one location

to another for the purposes of diagnosing and

sharing studies with other radiologists and

physicians.

Re pr e se nta tive Com pa nie s

AmeriDoc

MDLIVE

American Well

Teladoc

Carena

Virtuwell

Consult A Doctor

Doctor on Demand

DermatologistOnCall

iDoc24

DermLink

YoDerm

Direct Dermatology

FirstDerm

Iagnosis

Arcadian TelePsychiatry

InSight Telepsychiatry

CloudVisit

JSA Health Telepsychiatry

C3O Telemedicine

My Psychiatrist

Encounter Telepsychiatry

Specialists On Call

FasPsych

C3O Telemedicine

InTouch Health

Krixi Corp

NeuroCall

Specialists On Call

Argus Radiology

Teleradiology Solutions

Horizon Radiology

USARAD.com

Imaging On Call

vRad

NightHawk Radiology

Rays

Source: Cowen and Company

Telehealth Isnt New By Any Stretch

Telehealth is not a new concept and has been in existence for over a century as a

means of delivering healthcare to populations in distant and/or inaccessible regions.

Throughout history, healthcare providers have utilized the most current

communications technology at their disposal to extend the reach of healthcare. The

earliest manifestation of telehealth can be traced back to the 19th century by means of

one of the earliest forms of communications technology: the telegraph. In 1874, Dr.

Charles Gosse, a South Australian surgeon, was able to provide instructions for the

proper treatment of wounded patients by transmitting a telegraph to Barrow Creek

Telegraph Station, one of the most isolated areas in and along the entire Overland

Telegraph line. This was followed by the transmission of electrocardiograms by a

Dutch physician named Dr. Willem Einthoven from a hospital to his laboratory 1.5

kilometers away via telephone cables in 1905, effectively the origin of telecardiology.

From the 1920s through the 1940s, physicians delivered radio consultations from

medical centers in Norway, Italy and France to patients aboard ships at sea and on

remote islands. By 1955, a remote clinic in Nebraska established a closed circuit

television connection with a hospital 100 miles away, essentially the first

videoconferencing consultation.

www.cowen.com

11

Cowen and Company

Equity Research

February 20, 2015

Telehealth Helps Address The Needs Of Healthcare Reform

In recent years there has been mounting political pressure to cap healthcare

spending, which is ballooning towards 20% of total U.S. GDP (Figure 6). Healthcare

costs are expected to continue to grow faster than national income, which presents a

significant budgetary challenge going forward. Additionally, the Affordable Care Act

(ACA), which took effect in early 2013, is expected to add coverage to about 30 million

Americans who are currently uninsured or underinsured, adding further burden to the

delivery system. While healthcare reform is designed with incentives to trim excess

costs, by adding tens of millions of people to an already unsustainable system, reform

is actually expected to increase overall health spending by 2% by 2020. As a result,

many healthcare stakeholders have looked even more urgently to cut low-hanging

fruit from high cost segments, such as chronic and acute care.

While the healthcare industry must make cuts to maintain the sustainability of the

system, it must be careful not to sacrifice the quality of care. After all, sacrificing

quality could have the second-order effect of higher costs related to readmissions or

more courses of treatment than necessary. As a result, reimbursement models have

been changing to focus more on patient outcomes rather than on services rendered.

The ACA included a number of value-based purchasing provisions whereby hospitals

serving Medicare patients with common conditions will be reimbursed based on the

quality of care provided rather than quantity of services. A recent

PricewaterhouseCoopers survey of U.S. health insurers found over 80% were already

requiring evidence of cost savings or clinical benefits to include products on their

formularies. We see this push for outcomes continuing to expand over the coming

years with at-risk contracting becoming increasingly prevalent among providers

through ACOs and other new forms of healthcare delivery systems. We believe

telehealth can become an important tool for providers to extend their reach into their

markets to attract new patients and generate incremental revenue to offset the

expected drop in volumes tied to population management and at-risk reimbursement

models.

Technology involved in telehealth has become increasingly cost-effective and widely

available making adoption even easier today. We believe telehealth solutions can help

support value-based reimbursement by delivering care at lower cost, or by tracking

patient outcomes and aggregating data to display the impact of treatments. Remote

monitoring can track patient vital signs allowing healthcare providers to leverage

telehealth solutions to make treatment adjustments and early interventions based on

the data they receive. Additionally, these solutions can help improve adherence with

improved feedback mechanisms and easier access to care for patients. Telehealth

solutions are promising for their ability to supplement delivery systems that are more

patient-centric than traditional practices by using technology to simultaneously cut

costs and improve quality of care.

12

www.cowen.com

Cowen and Company

February 20, 2015

Figure 6 . National Health Expenditures as a percentage of U.S. GDP

25%

Historical

Projected

20%

Percentage of U.S. GDP

15%

10%

5%

2020

2018

2016

2014

2012

2010

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

1988

1986

1984

1982

1980

1978

1976

1974

1972

1970

1968

1966

1964

1962

0%

1960

Equity Research

Source: CMS and Cowen and Company

Telehealth Has Already Demonstrated Clinical Efficacy On Both Cost And Quality

Two of telehealths most frequent use cases involve chronic and acute patient

settings, which make up a major portion of current healthcare costs that could be

better managed with telehealth solutions. A number of peer-reviewed clinical studies

have already demonstrated telehealths effectiveness in reducing healthcare costs,

while at the same time improving patient outcomes.

Cost Effectiveness Of Telehealth

A number of recent studies have concluded telehealth solutions save patients,

providers and payors money when compared to traditional approaches to care. In a

study done at Albuquerque, New Mexico-based Presbyterian Healthcare Services, the

Hospital at Home model taken from Johns Hopkins School of Medicine was applied

to provide hospital-level acute care to the home, in part through remote patient

monitoring. Patients in this study displayed comparable or better clinical outcomes to

similar patients treated in the hospital, as well as reported higher levels of satisfaction.

This program saved 19% for Medicare Advantage and Medicaid patients with

common acute care diagnoses over similar inpatients. Savings were generated mostly

from lower average length of stay and fewer lab and diagnostic tests than hospital

inpatients (Cryer, Shannon et. al, 2012).

In looking at how integrated telehealth could produce savings for Medicare patients

with chronic diseases, another study found integrating remote patient monitoring with

care management found significant savings. Against controls, these Medicare

beneficiaries using the telehealth tool realized savings of 7.7%-13.3% ($312-$542) per

person per quarter. This study suggests the ability to better coordinate care for

chronically ill patients via telehealth can be highly effective (Baker, Johnson et. al,

2011).

www.cowen.com

13

Cowen and Company

Equity Research

February 20, 2015

Quality Of Care

Clinical studies have similarly proven that telehealth solutions that allow for remote

monitoring of patients with chronic diseases or help expand the reach of specialists

result in comparable or improved care. In a meta-analysis of 29 studies on the effect

of home telehealth on clinical outcomes, telehealth was found to have a moderately

positive and statistically significant effect on outcomes. More detailed analysis

indicated telehealth solutions had positive significant effects for treatment of heart

disease and psychiatric conditions (Dellifraine and Dansky, 2008). Overall the metaanalysis indicated telehealth positively impacted clinical outcomes across disparate

patient populations.

Additional Case Studies

The United States Department of Veteran Affairs (VA) is recognized as one of the

world leaders in telehealth, having developed a home telehealth program more than a

decade ago. In 2012, the VA specific Telehealth Applications provided care from 150

VA medical centers and 750 community based outpatient clinics to over 485,000

patients and completed nearly 1.4 million telehealth consultations. The VAs home

telehealth program reported a 53% reduction in bed days of care, a 30% reduction in

hospital admissions, a travel reduction savings of $34.45 per consultation, and savings

of $1,999 per patient on an annual basis. Interestingly, the VA also reported a mean

score of 86% in patient satisfaction.

The United Kingdoms Department of Healths Whole System Demonstrator program,

launched in 2008, generated favorable results as well. The 12-month study involved

179 general practices in three areas in England and 3,230 patients with diabetes,

chronic obstructive pulmonary disease (COPD), or heart failure. The study included

1,584 control patients and 1,570 intervention patients. Intervention participants

received a package of telehealth equipment and monitoring services for 12 months.

The results showed that intervention participants were admitted to the hospital less

often (42.9% of intervention patients versus 48.2% of control patients) and significantly

fewer of them died (4.6% of intervention patients versus 8.3% of control patients). The

intervention group also had 0.54 emergency admissions per head, compared to 0.68

amongst control group participants. Additionally, tariff costs per head were 188 lower

for intervention participants.

Telehealth May Help To Truly Engage The Healthcare Consumer

The rise of the healthcare consumer has been driven primarily by the increasing cost

of healthcare. Patients have been forced to become healthcare consumers as the

relative cost burden of healthcare has shifted from employers to employees through

the proliferation of high-deductible, consumer-directed health plans (CDHPs). These

allow employers to fix their healthcare contribution and reduce their risk exposure. But

while employers are shifting the cost burden onto employees, at the same time they

want to give employees tools to succeed in the new healthcare landscape. An

example would be Castlights transparency tool that empowers employees to make

more informed purchasing decisions. According to a 2015 survey by the National

Business Group on Health and Towers Watson, up to 2/3 of employers in 2014 began

to use incentives to reward or penalize employees based on whether they participate

in workplace wellness programs. We see additional pressures on employers to move

more employees towards high deductible plans in coming years, particularly as the

Cadillac Tax is looming on the horizon set to take effect in 2018, which will penalize

employers for having high-cost medical plans beyond certain thresholds.

14

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

The net result of this shift towards CDHPs is that consumers are now paying 90%

more for healthcare than they did ten years ago. Data from the Commonwealth Fund

concluded that premium and out-of-pocket cost growth far outstrips the recent rise in

workers wages. As a result, high deductibles may lead many patients to forego care

and avoid filling prescriptions. According to data from the Kaiser Family foundation, as

many as one in four Americans skip some care due to the high cost they must bear.

As deductibles continue to rise, we think it incentivizes consumers to become more

price-conscious as well as more engaged in their care.

But for all the talk about the healthcare consumer and consumer-directed healthcare,

we have not seen meaningful consumer engagement with their health. This is because

in large part healthcare doesnt look like a consumer product, nor is it structured in a

format that is easy for consumers to engage. We believe todays telehealth solutions,

along other solutions such as mHealth and wellness platforms, could help improve

consumer engagement. Recent data suggests that consumers will increasingly use

telehealth solutions given their convenience and cost effectiveness. A recent Anthem

market survey found that 74% of consumers indicated they would use telehealth

services if available. We expect this number to increase as more baby boomers retire

and millenials become increasingly engaged in their healthcare. While many observers

see demand for telehealth primarily being driven by this older baby boomer

demographic most at risk for chronic conditions or others in rural locations with

limited access to care, we see a growing retail market for telehealth amongst

millenials who have grown up in the on-demand world of Amazon.

We see this further supported by a recent 2015 consumer survey from American Well,

which noted interest in telehealth was highest amongst 18-44 year olds, though

overall interest spanned across all age groups. The survey also noted that the primary

reason consumers would use telehealth was for convenience. Additionally, a report

from Salesforce.com called the 2015 State of the Connected Patient found that 60%

of millenials support the use of telehealth in place of physician visits and 71% would

like their provider to use an app to schedule appointments, review data and actively

manage their well-being. With new mobile device apps such as Apples HealthKit that

will integrate with Epics EMR recently coming out, we see millenials growing

increasingly engaged in their healthcare. In 2012, more than 13,000 mobile health

apps for consumers were available from the Apple App Store at an average cost of

just $3.21. Mobile apps such as American Wells AmWell app also give consumers the

ability to select which physician they would like to use from a number of options with

their credentials on demand (Figure 7). Based on American Wells consumer survey,

this is a valuable aspect of telehealth for consumers, as 88% would prefer to select

their physician rather than be randomly assigned.

www.cowen.com

15

Cowen and Company

Equity Research

February 20, 2015

Figure 7 . American Wells Mobile Application Interface

Source: American Well

Telehealth can improve outcomes and efficiencies by managing care outside of the

traditional healthcare setting, such as hospitals and clinics. By monitoring and

communicating with patients between visits or post-discharge through remote patient

monitoring, telehealth consultations and consumer health engagement websites,

healthcare providers should be better informed to provide the most clinically

appropriate and financially viable option for the patient as well as drive efficiencies by

reducing clinical waste. This means of monitoring and engaging the consumer should

also enable healthcare providers to intervene when appropriate. Telehealth and

remote patient monitoring will find synergies with the tidal wave of inexpensive and

user friendly wearable devices, which will emit data to the cloud through which

healthcare providers can collect and analyze the data.

Furthermore, remote patient monitoring should also enable healthcare providers to

measure and manage the adherence of prescriptions, as well as ensure patients are

not experiencing harmful side effects. Not only is this critical given 30% of

prescriptions written in the U.S. are not filled, but it allows payers and providers to

demonstrate improved outcomes. Additionally, results from a recent American Well

survey suggest at least 70% of consumers would rather have an online video visit to

obtain a prescription than travel to their doctors office. In addition, consumer health

engagement websites and telehealth services should drive further healthier outcomes,

16

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

as they provide a platform for patients to speak with healthcare providers outside of

the traditional healthcare setting.

Demand For Telehealth Is Growing From Major Stakeholders

As a result of the shifting healthcare landscape from reform and the demographic

shifts underway in the U.S., the use of telehealth is quickly becoming an imperative for

all healthcare stakeholders. We see demand for telehealth services coming from

various constituents in healthcare.

Payors

We believe the use of telehealth services will find meaningful interest from payors,

given the opportunity to lower costs through its use. For example, a problem of access

that telehealth helps solve is best displayed by misuse of the ER. According to a 2012

study by the American College of Emergency Physicians, 85% of Americans who

visited the ER said they couldnt wait to see their regular medical provider and 50%+

of visits were for non-emergency issues. Large payors, such as Unitedhealth, have

increasingly focused on telehealth solutions in order to bend the cost curve as the

nations healthcare system moves towards more performance-based reimbursement

over the next five years. UNH currently has 16 telehealth partners they work with

outside physicians offices. The company is already managing upwards of 350,000

telehealth consultations a day, adding up to billions of transactions per year. This

includes 20,000 people remotely monitored in their homes per day. While this is

meaningful progress for telehealth amongst payors, we note UNH is one of the more

progressive insurers leaving a large runway for growth in telehealth services.

Humana has discussed in the past how it sees technologies such as telehealth

flattening the healthcare delivery system by increasing the access points to care

along the care continuum, which enables the consumer to be both better educated

and receive a better care experience. HUM has an ongoing pilot program for 100

seniors enrolled in its Medicare Advantage plans. HUM notes the pilot will measure

the impact in-home sensors and remote monitoring technology have on improving

health outcomes and reducing frailty and fall-related hospital admissions for Medicare

members with chronic health conditions. HUM has also developed a larger scale

remote monitoring program for 2,000 elderly patients with congestive health failure in

33 states. In less than a year, this program has enabled HUM to reach remote patients

that would have otherwise gone unmonitored or treated. Encouragingly, 94% of these

patients found the platform easy to use and 93% said they would recommend it.

Anthem also recently launched a new online care service, LiveHealth Online, in

partnership with American Well, which it expects to roll-out nationally to its 33 million

members. This service is a 24/7 telehealth service available to anyone for $49 per

online visit and to many commercially-insured ANTM members for about $20. Early

users of the service have reported an average savings of $71 per visit, while also

saving most patients 2 to 3 hours per visit spent traveling to a physicians office. Other

insurers such as Aetna and Cigna have also started offering telehealth services, with

nationwide e-visits. AET has covered telemedicine services for most of the past

decade including all primary care physicians and about 30 specialties in its program.

CI also started offering the services on a broader basis more recently to self-insured

clients through a partnership with MDLive.

Employers have similarly noted the need to increase use of telehealth services to

contain costs as those who bear the risk of employee healthcare consumption seek

lower cost, more convenient alternatives to ER and urgent care visits. Additionally, the

www.cowen.com

17

Cowen and Company

Equity Research

February 20, 2015

efficient, time-saving aspect of telehealth visits can improve employee productivity by

getting them back to work faster. A 2012 Towers Watson survey found 17% of

employers planned to offer telehealth in 2013 and another 27% were considering it for

2014 and 2015. An updated 2014 study from Towers Watson suggests as much as $6

billion will be saved through the adoption of telehealth and as much as 71% of

employers are expected to offer telehealth services by 2017.

Providers

Moving to value-based reimbursement comes with many changes including lower

volumes, which means providers must look for new ways to drive volume in order to

leverage fixed infrastructure costs. Data suggests providers are already starting to

move towards telehealth. In a 2014 survey by American Well, 90% of healthcare

executives reported they were developing or implementing at least one telehealth

solution. Furthermore, according to the American Telemedicine Association, almost

half of all hospitals already use some form of telehealth solutions today.

Telehealth offers providers the ability to extend their reach into the community and

drive greater scale by accessing patients who were previously out of reach but at a

lower cost. In this way, provider networks will be able to build scale even as traditional

inpatient volumes continue to shrink. Providers can also benefit from telehealths

ability to improve patient compliance via daily monitoring and early interventions to

address health issues before they become acute and more costly. Telehealth can also

help improve data sharing between providers and allow physicians and nurses to work

most efficiently in their particular fields of expertise. This follows the push for care

delivery to become more collaborative by centralizing available data and streamlining

tasks between multiple providers. As telehealth connects more effectively with data

repositories such as EHRs, the effectiveness for telehealth to help manage population

health will become more evident.

A number of publicly traded health systems are already involved in the telehealth

ecosystem. As early as 2009, UHS implemented a telemental health program at

Anchor Hospital near Atlanta to reach the behavioral needs of remote communities

nearby. This hospital uses live videoconferencing to assess and treat patients who

would not normally have access to care in these remote locations. Now, Anchor has

expanded to general telemedicine services for hospital ERs and nursing homes

throughout the state of Georgia. Kindred also uses remote monitoring for a number of

its home-care patients, who have seen readmission rates consistently below state and

national averages. CYH and THC are members of a consortium of healthcare

companies that founded the Heritage Group, a VC firm that led a round of investment

in MDLive in early 2014. This round of funding was completed to help MDLive build

out its cloud-based offerings and integrate a Second Opinion program for patients.

In a study done by Partners HealthCare that looked at a number of provider-toprovider use cases for telehealth including nationwide implementations in Emergency

Rooms, Correctional facilities and Nursing Homes telehealth was seen as providing

significant cost savings. In emergency rooms, hybrid telehealth technologies could be

used to avoid 850,000 transports with cost savings of $537 million a year across the

U.S. In correctional facilities, total annual cost savings would total over $270 million

and in nursing homes cost savings would total over $800 million.

Drug Retailers

Retail pharmacies such as Walgreens Boots Alliance, Rite Aid and CVS Health have

also realized the potential for telehealth adoption amongst its consumers. WBA

recently announced a partnership with telehealth provider MDLive, which will offer

18

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

virtual consultations through Walgreens smartphone app. Additionally, Walgreens

recently announced a partnership with WebMD where the company will offer a virtual

wellness-coach powered by WebMD on Walgreens.com. Walgreens Balance Rewards

and e-prescription services will also be integrated into the WebMD mobile app to

track and reward healthy behavior as they look to improve consumer engagement.

Rite Aid is also getting involved in telehealth with its pilot partnership with HealthSpot

to trial its telehealth kiosks in Ohio. Meanwhile, CVS has been piloting telehealth in

some of its MinuteClinic locations. We see this roll-out of telehealth by retail

pharmacies as complementary to their overall clinic strategy that seeks to improve

consumer convenience while filling gaps in care left by the shortage of primary care

providers.

Traditional Healthcare IT Vendors

We expect traditional HCIT companies to look for partnership opportunities with

providers of telehealth services to integrate and share data to and from the EHR.

MDRX was one of the first major HCIT vendor to integrate telehealth capabilities into

its EHR when it announced a partnership with American Well in 2012. This offered

patients the ability to document their online voice and video telehealth interactions via

their EHRs, in order to allow for improved care coordination between providers. In

2013, Epic and Stanford Hospital & Clinics announced an integrated telehealth service

that allows web video visits via Epics EHR. Then in 2014, Epic announced that it would

integrate AMC Healths telemedicine product with its EHR. These partnerships

between EHR and telehealth companies allow clinicians increased access to biometric

data stored from telehealth visits in patients EHRs. Ultimately, we also think patient

portals such as MDRXs FollowMyHealth could also play a role here as patients are

able to maintain their own records of telehealth visits as they become increasingly

engaged in their care.

Legal and Regulatory Hurdles Are Easing

The complex legal and regulatory environment of the U.S. health system has been the

greatest impediment to the widespread adoption of telehealth. More specifically,

overcoming the differing laws and medical board standards from state to state have

been a significant challenge to fully unlocking the clinical and financial potential of

telehealth, especially with the current transition to a fee-for-outcomes-based

healthcare model. This problem is rooted in Article X of the U.S. Constitution, which

established that states have the authority to regulate activities that affect the health,

safety and welfare of their citizens including the practice of healing arts within their

borders with the intent of the state licensure authorities to ensure that healthcare

professionals are qualified. However, the Federation of State Medical Boards (FSMB)

has recently taken measures to address some of the issues.

FSMB Adopts Standardized Framework For Telehealth

Telehealth achieved a major milestone with the FSMBs adoption the Model Policy for

the Appropriate Use of Telemedicine Technologies in the Practice of Medicine (the

Model Policy) on April 26, 2014, replacing its 2002 Model Guidelines for the

Appropriate Use of the Internet in Medical Practice. Though state medical boards are

not required to adopt the Model Policy as it is non-binding, the Model Policy serves as

a standardized framework for state regulators as they consider the use of telehealth

technologies within their states and across borders. It addresses many of the concerns

of state medical boards in regards to telehealth, including establishing a physicianpatient relationship, continuity of care, referrals for emergency services, patient

privacy and prescribing medication based on a telehealth consultation. Notably, the

Model Policy outlines a direct-to-consumer approach to telehealth, whereby

www.cowen.com

19

Cowen and Company

Equity Research

February 20, 2015

mandating that diagnosis and treatment of a patient using telehealth should be held

to the same standards of care as traditional, in-person interactions.

Licensure

This issue of licensure portability has also been a hindrance to the adoption of

telehealth, however this barrier may be diminishing. Currently, there are ten state

medical boards that issue special licenses or certificates related to telehealth. These

licenses allow an out-of-state provider to render telehealth services in a state where

they are not located, or allow a provider to render services via telehealth in a state if

certain conditions are met, such as agreeing not to open a medical office in that state.

Furthermore, on September 5, 2014, the FSMB released the final version of their

proposal of Interstate Medical Licensure Compact (Compact) language (Figure 8). The

goals of the Compact are to develop a comprehensive process that complements

exiting licensing and regulating authority of state boards, ensure the safety of patient

and enhance the portability of a medical license, while providing a streamlined

process that allows physicians to become licensed in multiple states. Amongst the

largest hindrance regarding licensure for telehealth providers is the length of time the

process takes to receive a license in another state. The Compact would modernize and

streamline medical licensing while maintaining state oversight, accountability and

patient safety, more specifically it would expedite the interstate licensing process by

streamlining some of the repetitive aspects such as having information such as

medical education and results of examinations not have to be primary source verified

again if the physician was already primary source verified by the principal state of

license (Figure 9). Recently, the legislative chambers of South Dakota, Utah and

Wyoming passed the Compact. We expect more states to follow as ten other states

have formally introduced the legislation in their legislative chambers and more than 25

state medical and osteopathic boards have publicly expressed support for the

Compact.

Figure 8 . FSMB Interstate Medical Licensure Compact Application Process

Physician files

application for

expedited license w/

board of state of

principal license

Board of state of

principal license

evaluated if physician

eligible for expedited

license & issues

qualification letter

Source: Center for Connected Health Policy

20

www.cowen.com

After verification,

physician completes

interstate commission

registration process

for license of member

state (fees paid)

After receiving

verification of

eligibility & any fees

paid, member board

issues expedited

license to physician

Cowen and Company

Equity Research

February 20, 2015

Figure 9 . States with Telehealth Licenses or Certificates

States with Telehealth Licenses or Certificates

States without Telehealth Licenses or Certificates

Source: The Center for Connected Health Policy

Reimbursement Landscape Is Improving

Limited reimbursement has been another significant barrier to the widespread

adoption of telehealth. However, many regulating entities are recognizing the benefits

and potential of telehealth, helping to drive an improving reimbursement landscape.

Medicare

Further enabling telehealths move towards mainstream adoption, the Centers for

Medicare and Medicaid (CMS) recently expanded its telehealth physician

reimbursement current procedural terminology (CPT) codes which included seven

new procedure codes in its 2015 Medicare physician fee schedule for telehealth

services. The seven new covered CPT codes for telehealth include psychotherapy,

services prolonged services in the office and annual wellness visits. Currently, CMS

recognizes 75 CPT codes for telehealth services.

While this sounds like a significant expansion, Medicares coverage of telehealth is

still quite limited. Medicare reimburses only for specific services when they are

delivered via live video. It also requires the beneficiary to be located in a designated

rural area and to receive the telehealth encounter within a facility setting. Store-andforward-delivered services are prohibited, except for CMS demonstration programs in

Alaska and Hawaii. We expect CMSs expansion of telehealth physician

reimbursement codes to serve as a catalyst for wider spread acceptance of telehealth

amongst commercial payors, as they typically follow CMS rules, even if the practical

application by Medicare remains rather limited for now.

Medicaid

The federal government does not mandate reimbursement for telehealth under

Medicaid, however states have the option to reimburse for Medicaid services provided

via telehealth. Currently, 46 states in the U.S. and the District of Columbia provide

www.cowen.com

21

Cowen and Company

Equity Research

February 20, 2015

some form of Medicaid reimbursement for telehealth services. States categorize

telehealth services under Medicaid as video conferencing, store-and-forward and

remote patient monitoring (Figure 10). The most widely covered telehealth service

under Medicaid is video conferencing with 46 states and the District of Columbia

providing reimbursement. In contrast, only ten states provide reimbursement for storeand-forward telehealth services and 13 states reimburse for remote patient

monitoring.

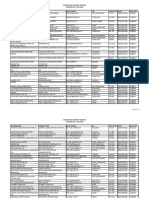

Figure 10 . Telehealth Services Reimbursed by Medicaid

Sta te

Vi de o

Co nfe r e nci ng

Sto r e -a ndFo r w a r d

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

R e m o te Pa ti e nt

M o ni to r i ng

Sta te

Vi de o

Co nfe r e nci ng

Montana

Nebraska

Nevada

New Jersey

X

X

New York

Delaware

North Carolina

District of Columbia

North Dakota

Florida

Ohio

Georgia

Oklahoma

Hawaii

Oregon

Pennsylvania

Idaho

X

X

Indiana

X

X

X

X

Rhode Island

X

Iowa

Kansas

R e m o te Pa ti e nt

M o ni to r i ng

New Hampshire

New Mexico

Illinois

Sto r e -a ndFo r w a r d

South Carolina

South Dakota

Tennessee

Texas

Utah

Kentucky

Louisiana

Maine

Vermont

Maryland

Virginia

Washington

Michigan

West Virginia

Massachusetts

Minnesota

Wisconsin

Mississippi

Wyoming

Missouri

X

X

X

Source: Cowen and Company

Private Payors

While there is no federal law mandating private payors to provide coverage for

telehealth services, some states, recognizing the benefits, have passed legislation that

require private payors to provide plans that reimburse at least some form of telehealth.

Currently, 21 states and the District of Columbia require private payor reimbursement.

Some states mandate reimbursement equivalent to comparable in-person care,

while other states just require some level of reimbursement. Currently, 21 states and

the District of Columbia require private insurance plans to cover telehealth services

(Figure 11).

Furthering the momentum, New York recently passed legislation mandating that

private insurers provide reimbursement for telehealth services, effective January 1,

2016. In addition, other states, such as Indiana and Iowa, are considering passing

similar laws, while other states, such as Oregon, are advocating for legislation to

expand existing telehealth coverage. Oregon lawmakers are pushing for the passage

22

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

of legislation that would provide health insurance coverage to patients who receive

telehealth services in any form and not just if it took place at a medical facility, as it

currently stands.

Meanwhile, some private payors are taking matters into their own hands and

providing reimbursement for telehealth services regardless of whether the state

requires it. For instance, Horizon Blue Cross Blue Shield of New Jersey announced the

creation of Horizon CareOnline, a telehealth service offering online video conferencing

to a physician 24 hours a day, seven days a week at no cost to its individual plan

members through American Well. Self-insured employers are deploying telehealth

solutions as well, recognizing its benefits.

Figure 11 . States with Medicaid and Private Insurance Reimbursement for Telehealth Services

Medicaid and Private Insurance Coverage for Telehealth

Medicaid Coverage for Telehealth

Private Insurance Coverage for Telehealth

No Required Coverage for Telehealth

Source: The Center for Connected Health Policy

Some Hurdles To Adoption Remain

Healthcare is an industry that historically has been known to be slow to adopt new

technologies or workflows that radically change the status quo. While much progress

has been made to overcome these hurdles and drive greater telehealth adoption, a

number of challenges remain to more widespread adoption.

Regulation And Reimbursement Challenges

Although telehealth policies have been evolving both nationally and state by state,

limited reimbursement and disparate state regulations remain major barriers to

greater adoption. The FSMBs recent adoption of the Model Policy for the Appropriate

Use of Telemedicine Technologies in the Practice of Medicine addresses many of the

concerns of state medical boards in regards to telehealth, however state medical

boards are not required to adopt the it as it is non-binding. In addition, the issue of

licensure portability has been a hindrance to the adoption of telehealth. Currently,

there are only ten state medical boards that issue special licenses or certificates

www.cowen.com

23

Cowen and Company

Equity Research

February 20, 2015

related to telehealth, allow an out-of-state provider to render telehealth services in a

state where they are not located, or allow a provider to render services via telehealth

in a state if certain conditions are met.

Medicare reimbursement has a number of restrictions, including the patient must be

located in an eligible location with an eligible provider for a Current Procedure

Terminology (CPT) billing code. Medicare will then reimburse a small facility fee and

while a significant number of telehealth solutions are store-and-forward technologies,

Medicare only reimburses real-time services. Meanwhile, Medicaid covers telehealth

services in 46 states with some form of reimbursement, only ten states provide

reimbursement for store-and-forward telehealth services and 13 states reimburse for

remote patient monitoring. Private payor reimbursement is set by states, similar to

Medicaid, with 21 states currently reimbursing for telehealth.

Cybersecurity And Privacy Concerns Could Slow Consumer Adoption

A major part of the healthcare industrys reluctance to adopt technology is not only

due to organizational sluggishness, but also concerns over liabilities related to patient

privacy. Providers could fear legal repercussions for patient data leakage, while

consumers have their own concerns on the cybersecurity of any telehealth system.

These issues were compounded by changes to the Health Insurance Portability and

Accountability Act (HIPAA), which requires safeguards to ensure the confidentiality

and integrity of electronic protected health information (PHI). Additions to the Act

include increased scope of telehealth oversight, increased maximum penalty for

negligence, increased data breach notification requirements and new requirements

for providers around telehealth marketing. Recent government data also suggests

cyberattacks are increasingly targeting healthcare data stored on the cloud. Providers

looking to institute telehealth services must therefore establish stringent security

measures to reduce the risk of patient privacy breaches, which could increase their

costs to comply as well. At the same time, patient trust for these services must be

gained in order to drive greater consumer adoption.

Provider Liability Fears And Unwillingness To Change Workflows

Physician malpractice is a major concern amongst providers that may also limit

telehealth adoption amongst physicians. By not being able to see their patients faceto-face, providers may have less confidence in making accurate diagnoses and may

therefore be more concerned with potential malpractice suits involved in e-visits.

Additionally, if patients choose to use telehealth consults in lieu of real physician visits

entirely, it could lead to poor outcomes. Even major telehealth supporters such as

HealthTap CEO Ron Gutman have recognized the need to use telehealth as a feature

in the virtual care continuum, and not view it as a cure-all.

Different vendors handle the liability in different ways, as Teledoc covers the cost of

malpractice insurance per provider encounter. American Well takes a similar approach

where it covers all participating providers by integrating malpractice insurance into

their online care. Even still, physicians may be averse to changing the status quo of

their practices and adopting new workflows in a system known to lag in technological

development.

EHR Connectivity/Interoperability Remains A Challenge

There is widespread concern within the healthcare community over the

interoperability of many EHR providers. Many have limited data sharing capabilities,

which severely hampers the potential to effectively leverage patient data from

telehealth consultations across disparate providers. Clinical data interoperability is a

24

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

challenge throughout all of healthcare as building effective HIEs is also a challenging

prospect. For providers looking for successful ROI, telehealth implementation will take

more than device installations and will more importantly focus on the network

infrastructure that is implemented.

Broadband Access Remains Limited For Those With The Greatest Need

Access to a broadband connection and speed of connection remain important issues,

particularly when most telehealth services will involve HD video-conferencing used for

consultations and diagnosis. This issue could be a challenge for some, particularly the

elderly and poor, who could benefit the most from telehealth services to manage

chronic conditions but may lack adequate broadband connectivity due to lack of

understanding or cost. According to the Pew Internet and an American Life Project

Survey, only 62% of adults with chronic diseases have internet access, while 81% of

those without chronic diseases use the internet (Figure 12). Overall, 74% of American

adults use the internet. This gap in connectivity access is something that may also be

an issue in location, as more rural locations lack adequate network infrastructure.

Additionally, many providers may be limited in their connectivity. In 2010 the FCC

reported that more than 3,000 small provider groups lacked adequate broadband

connectivity for telehealth use.

Figure 12 . Internet Access Is Relatively Low For Those With Chronic Diseases

Lung condition

68%

Cancer

62%

High blood pressure

57%

Diabetes

50%

Heart condition

47%

2+ chronic conditions

52%

1 chronic condition

68%

1+ chronic conditions

62%

No chronic condition

81%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

% of adults with internet access

Source: Pew Internet, American Life Project Survey and Cowen and Company

www.cowen.com

25

Cowen and Company

Equity Research

February 20, 2015

This page left blank intentionally.

26

www.cowen.com

Cowen and Company

Equity Research

February 20, 2015

Ticker

Rating

Price*

Price Target

Ticker

Rating

Price*

Price Target

MDRX

CERN

MDAS

WBA

Outperform

Outperform

Outperform

Market Perform

$12.29

$71.26

$18.19

$77.10

$20.00

$76.00

$20.00

$74.00

ATHN

CVS

RAD

Outperform

Outperform

Outperform

$132.59

$102.62

$7.99

$172.00

$107.00

$10.00

*As of 02/19/2015

Valuation Methodology And Risks

Valuation Methodology

Health Care Technology & Distribution:

We use a five-year discounted cash flow analysis as our primary valuation method

to derive our 12-month price target. We generally assume a 10% discount rate

but may apply appropriate adjustments depending on company and/or industry

specific factors. We also assume a terminal growth rate that is dependent on our

long-term view of the specific sub-industries under coverage. We note our discount

rate assumption could be viewed as conservative relative to the actual weighted

average cost of capital, but we view our 10% assumption as reasonable over the

long run. Lowering our discount rate assumption or increasing our terminal growth

rate assumption would lead to a higher estimated value per share. As a secondary

measure, we look at the forward P/E multiple and EV/Sales ratio implied by our DCF

analysis and compare that to historical averages.

Investment Risks

Health Care IT:

There are potential risks associated with the HCIT space: (1) a significant amount

of spending on HCIT has been driven by government related programs (i.e., HITECH

Act), and any slowdown or cuts in such programs could negatively impact spending

on HCIT; (2) constrained hospital budgets could potentially lead to a decrease in

HCIT-related investments; (3) customer losses as a result of facility consolidation in

both the inpatient and outpatient markets could create challenges for a number of

vendors; (4) greater price competition in the HCIT industry; and (5) the current focus

on Meaningful Use incentives could delay purchasing decisions for non-EHR related

solutions and services.

Drug Retailers:

We see a number of risks associated with the drug retail space: (1) the industry

is highly competitive with retail drugstore chains, independent pharmacies, mailorder providers, as well as other retailers including grocery stores, mass merchants,

warehouse clubs and online stores all competing in the space which could further

pressure front-end sales and margins, (2) the current wave of drug patent expirations

and the positive impact on profitability derived from generics are expected to taper off

significantly over the next several years, (3) while specialty has provided a significant

tailwind for the most part we believe there could be some concerns around the

sustainability of high growth in this area, and (4) we believe the impact of PPACA

and the expected increase in volumes could be more subdued depending on the

implementation and execution.

www.cowen.com

27

Cowen and Company

Equity Research

February 20, 2015

Addendum

Analyst Certification

Each author of this research report hereby certifies that (i) the views expressed in the research report accurately reflect his or her personal views about any and all of the subject

securities or issuers, and (ii) no part of his or her compensation was, is, or will be related, directly or indirectly, to the specific recommendations or views expressed in this report.

Important Disclosures

This report constitutes a compendium report (covers six or more subject companies). As such, Cowen and Company, LLC chooses to provide specific disclosures for the companies

mentioned by reference. To access current disclosures for the all companies in this report, clients should refer to https://cowen.bluematrix.com/sellside/Disclosures.action or

contact your Cowen and Company, LLC representative for additional information.

Cowen and Company, LLC compensates research analysts for activities and services intended to benefit the firm's investor clients. Individual compensation determinations for

research analysts, including the author(s) of this report, are based on a variety of factors, including the overall profitability of the firm and the total revenue derived from all sources,

including revenues from investment banking. Cowen and Company, LLC does not compensate research analysts based on specific investment banking transactions.

Disclaimer

This research is for our clients only. Our research is disseminated primarily electronically and, in some cases, in printed form. Research distributed electronically is available

simultaneously to all Cowen and Company, LLC clients. All published research can be obtained on the Firm's client website, https://cowenlibrary.bluematrix.com/client/library.jsp.

Further information on any of the above securities may be obtained from our offices. This report is published solely for information purposes, and is not to be construed as an offer

to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Other than disclosures relating to Cowen and Company, LLC,