Professional Documents

Culture Documents

Newsletter: Fraud: "Ghost Money", "Funny Money", "Ready, Willing, Able To Deliver (Rwad) " "Advance Fee Fraud"

Newsletter: Fraud: "Ghost Money", "Funny Money", "Ready, Willing, Able To Deliver (Rwad) " "Advance Fee Fraud"

Uploaded by

Deoo Milton EximoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Newsletter: Fraud: "Ghost Money", "Funny Money", "Ready, Willing, Able To Deliver (Rwad) " "Advance Fee Fraud"

Newsletter: Fraud: "Ghost Money", "Funny Money", "Ready, Willing, Able To Deliver (Rwad) " "Advance Fee Fraud"

Uploaded by

Deoo Milton EximoCopyright:

Available Formats

Number

Year

1993

FSC Newsletter

Fraud : "Ghost Money", "Funny Money", "Ready, Willing,

Able To Deliver (Rwad)" "Advance Fee Fraud"

e are becoming increasingly aware both from local contacts and from

authorities in other countries that Gibraltar has become the target of

fraudsters involved particularly in the types of fraud mentioned above.

These scams have been on the increase world-wide in the last few years and we have

recently seen two 'live' transactions in Gibraltar which could have resulted in

substantial losses for the Banks concerned if they had not exercised due diligence.

For the purpose of this newsletter we will call the fraudulent transactions 'Ghost

Money'.

So what is this fraud?

Advance Fee

In its simplest form, the Advance Fee operator persuades a company or person

requiring a loan that he has the capability to arrange such a facility. An agreement is

signed by which the operator will use his best endeavours to obtain the required loan in

exchange for an up front fee. This fee can be as small as 5000 or as large as

100,000 depending on the credibility of the scam and the gullibility of the borrower.

Needless to say rarely does a facility materialise whilst the up front fee disappears.

Other authorities are aware of several operators who have continued for years using

method to finance a high life style.

Ghost Money

Interlinked, but more complex than the Advance Fee Fraud is the extensive Ghost

Money deal.

What are the characteristics of a Ghost Money transaction? You will be made aware

of: Large transactions (US$25 million to $100 million or much more).

Promises of further sizeable transactions. (Often huge sums US$100 billion).

Small first transaction with several subsequent tranches to follow.

Unusual currencies (i.e Billions of New Kuwaiti Dinars).

Prime Bank Guarantees (PBG's) being offered or being the "Product" to be financed.

Proposals received by FAX.

Letterheads of companies which could have been easily produced by Laser Printer.

Letters, possibly forged, from respectable banks being used to support the

documentation.

Strange, weird, confusing and complex transactions, hazy descriptions.

Financial Services Commission

Overwhelming amount of transaction description along with supporting papers and

even flowcharts of the transaction.

Further Common

Characteristics Of

Ghost Money

Transactions.

Text in the transaction documents may include phrases such as:

Ready Willing and Able.

Prime Bank Guarantees.

Guaranteed by Top 100 World Prime Bank.

Collateral First.

Unconditional S.W.I.F.T. Wire Transfer.

Reference to I.C.C. Rules (ICC 400).

Key Tested Telex (KTT).

Closing Bank.

Issuing Bank.

Large commission, even large "Bonus" or large "Discount" or "Spread" being

offered to the bank.

Outlandish projects, difficult to verify.e.g Financing of Island Resort on far away

(unknown) island.

Retirement Home Village in far away country.

Documents will invariably be signed by "The President" or "The Chairman of the

Board" or "Chief Executive Officer".

A Power of Attorney document may be produced, duly authenticated by a bank

and/or lawyer.

The Ghost Money fraudster appears to have his own vocabulary and some of his most

frequently used verbiage is as follows: Top 50 (100) banks in the world.

Bank Menu.

International Banking Days.

ICC (International Chamber of Commerce ) 400.

UCC (Uniform Commercial Code) Form references.

KTT (Key Tested Telex).

Banking co-ordinates.

Collateral First Transaction.

Fresh Cut Paper.

Seasoned Paper.

Collateral Houses, Collateral Source, Collateral Supplier.

Grand Master Collateral Commitment.

Validation of the MCC (Master Collateral Commitment).

Collateral Purchase Orders.

Instruments delivered free of all liens and/or encumbrances.

Prime Bank Guarantees. (PBG's).

Prime Bank Notes. (PBN's).

Non-Circumvention and Non-disclosure agreements.

Freely negotiable, irrevocable, clear SWIFT wire transfers.

Irrevocable Pay Order.

Irrevocable, irretractable commitment of funds to purchase instruments.

Lending Bank, Funding Bank, Closing Bank, Collateral Provider, Fiduciary Bank.

Good Clean cleared funds of non-criminal origin.

With full corporate and legal responsibility.

Interest at seven and one half per cent, payable annually in arrears.

5, 10, 20 years etc, plus one week or one day.

2

Financial Services Commission

Fully binding commercial letter contract.

Client Company Principals.

Transaction Tranches.

Millions or Billions of US dollars with rolls and extensions.

Emissions, remissions, commissions and fallout.

Transaction parameters.

There is to be no communication with our bank other than through normal bank

channels, no phone calls allowed.

What Is The Aim Of

A Ghost Money

Fraudster?

His aim is to convince a bank that he legitimately represents either an investor, or

sometimes both the investor and a borrower (in which case he will request a bank to act

as the CLOSING BANK) and therefore seeks a bank's endorsement to the proposed

deal. This endorsement usually takes the form of:A letter issued by a bank undertaking to provide finance at some future date is called a

"Funding Commitment" or a;

"Ready, Willing and Able" .................... RWA Letter.

There is a further letter of undertaking known as a "Collateral Commitment" whereby a

confirmation is given of the receipt by the writer of some form of security to be held to

the order of the bank which is to advance funds against that security.

In this case, the Ghost Money scam will be referred to as a;

"Collateral First Transaction"

Such commitments have a value, as they can be used by a potential borrower to

convince other banks to provide "Prime Bank Guarantees" ............ PBG's". More of

which later.

How Does The Ghost Money Fraudster Set About His Task?

The Fraudster may allege that he represents an "Investor", however, he will be

deliberately misleading in describing both the "Investor" and the funds alleged to be

available for investment, so that no checks may be made. The Fraudster may state that

he is the representative of an "Investor" who wishes to remain anonymous.

The Fraudster may use as a front a variety of "Company" names which may often mix

up the words: "Nation-wide"; "Universal; "International"; "World-wide"; "Resources";

"Capital"; "Commercial"; "Trading"; etc. Many may claim to represent recognised

bodies, such as; The United Nations, or, Government Departments abroad.

The Companies that the Fraudster may allege to represent may be evidenced by

letterheads, which are nearly always submitted in Fax copy form and could have been

easily manufactured on a Laser printer. Those Companies, if indeed they exist,

(although the professional fraudster is likely to have incorporated such), may well be

described as having been incorporated in such places as the Isle of Man, Monaco,

Luxembourg, Liechtenstein, the United States, as well as the old favourite, certain

islands of the Caribbean (and Gibraltar!). For sure they will almost always be

incorporated somewhere in the world that will make it difficult for you to run a check.

Any letters demonstrated originating from such companies are rarely written by anyone

other than the: "Chairman of the Board" and "Chief Executive Officer" or "The

President".

3

Financial Services Commission

It is possible that the Fraudster may be in possession of a letter of endorsement or

confirmation from another "bank" seeking to legitimise the availability of funds and

confirming the genuineness of the Company name chosen. Take care, for the name of

that "bank" may well be either than of a well known genuine bank, but at an address

where there is no legitimate branch, or, it may be a described very closely to the name

of a genuine bank. ANY ATTEMPT BY YOU TO MAKE CONTACT WITH THAT

"BANK" BY TELEPHONE, LETTER OR TELEX MAY WELL BE ANSWERED

BY ASSOCIATES OF THE FRAUDSTER.

The Fraudster may well be in possession of a "Power of Attorney" document from those

he is alleged to represent. Such document may have been duly notarised somewhere in

the world, where, once again it will be difficult for you to check its validity. That

notarisation may well be by a genuine Law Firm and the signature of the Fraudster may

additionally carry an endorsement from a banker as to its genuineness. That Power of

Attorney may appear authentic and add credence to the transaction, however, it should

be viewed with suspicion and as serving only to confirm that the Fraudster may have

identified himself and signed the document in the presence of the banker and/or the

lawyer, who otherwise probably does not know him.

You may well be presented with a letter from a genuine Law Firm in another

jurisdiction confirming that they act for the Fraudster. They may very well do so,

and in most cases the lawyer will have no idea of the underlying activity of their

client.

The types of funds available to be invested may be variously described as "Trusts",

"Foundations", "Private funds belonging to wealthy individuals (middle East perhaps)"

"Investment Consortiums"; "Pension Funds" and "Health Insurance Funds". All of

which you are told are seeking a better return on their huge cash reserves.

You will be led to believe that enormous sums will be available for the proposed

transactions, these may range from US$25 million to US$100 million or even amounts

in billions of dollars. Although other currencies may be specified, US dollars seem to

be the favourite. Those funds may be offered in tranches, with perhaps a small first

tranche.

What Is His Aim?

He wishes to obtain endorsements for his scheme, particularly from banks but will use

legitimate organisations (particularly in our jurisdiction those entities that have the

stamp of respectability, i.e a Financial Services Licensee) to do so.

He will certainly seek a letter either from a bank or any respected organisation,

addressed to himself, his "company" or a third party.

He would like to open a bank account, awaiting receipt of funds, of course, there may

be talk of PRIME BANK GUARANTEES also known as PBG's.

What Is A PBG:A Prime Bank Guarantee is a promise by the issuing bank to pay at some future date

the amount shown on the guarantee.

The Guarantee can cover the Capital element of the loan, the Interest only, or both

Capital and Interest.

It is not only the issue of the PBG which is sought after by those intent on fraud. Any

letter or representation by a first class bank which states, or implies, that a particular

4

Financial Services Commission

transaction or proposed facility is being viewed favourably is valuable to the fraudster,

who would wish to use it in order to obtain credit from another bank.

How Is The Approach Made By The Ghost Money Fraudster?

Many operators will attempt the direct cold contact with banks by phone, mail fax or in

person.

However, the truly professional and sophisticated fraudster will direct his thrust

through apparently legitimate fronts, organisations including lawyers, company

managers, etc in many jurisdictions.

The two live transactions mentioned at the beginning of this letter involved accounts

being opened with local banks with introductions (seemingly genuine) from

intermediaries outside Gibraltar, through local licensees.

Unfortunately, experience has shown elsewhere that legitimate organisations who have

innocently or otherwise (particularly when staff fraud has occurred) have been

persuaded to participate in such transactions and have incurred substantial losses, even

several years later.

What Advice Can We Give From All The Information We Have Received?

(1) When you receive a direct approach from such operators, obviously use extreme

care.

Never send anything by fax, letter or memo to them. DO NOT even give out your

business card.

In need, consult us, as we have a database of previous operators. We now have access

to other authorities who are only too keen to help, either from their records or

establishing the credentials of the operator concerned.

Where a Gibraltar company has been registered, always keep us informed.

(2) Indirect approaches from intermediaries in either jurisdictions may not give rise

to any suspicion. We can only reiterate the guidance we gave in our Money

Laundering Newsletter in that all licensees should "know their customer" not only

in the form of references etc, but by obtaining greater detail on why a Gibraltar

company is required.

On our part, we have made recommendations to Government that "Loan Arranging"

becomes a "controlled activity" and will be subjected to the normal Financial Services

Ordinance requirements. This should be in place shortly.

West Africa:

You may already have seen in the local press details of a scam originating from

Nigeria, or you may even have received a specific request yourselves. The initial

contact is usually via means of a letter or fax with a West African address. The

originator's purport, generally, to have strong relations with the government of the

country, holding themselves to have access to some government sponsored contract.

The intermediary is asked to provide a bank account into which funds will be

transferred from their country for onward transmission to their contractors, with a

subsequent slice of the funds for the intermediary.

Prospective intermediaries are asked to submit blank:5

Financial Services Commission

letterheaded paper;

pro-forma invoices;

bank account name, number, swift number etc;

names of bank officials.

NO ATTEMPT SHOULD BE MADE TO REPLY TO THIS ENQUIRY. The

originators will attempt to use the company letterhead paper and names to provide a

bona-fide for some other part of the fraudulent transaction or to make a transfer out of

the bank accounts for which the details have been provided.

Financial Services Commission

PO Box 940

Suite 943

Europort

Gibraltar

March 1993

You might also like

- The Letter of Ready Willing and Able (Rwa)Document1 pageThe Letter of Ready Willing and Able (Rwa)Deoo Milton Eximo100% (2)

- Living in The PrivateDocument31 pagesLiving in The Privatepanamahunt2294% (31)

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDocument16 pagesICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementPravin Namokar100% (1)

- Banking FraudsDocument38 pagesBanking Fraudssamfisher0528100% (1)

- Securitization 1 1Document23 pagesSecuritization 1 1Lewis John100% (7)

- This Study Resource WasDocument5 pagesThis Study Resource WasDevia SuswodijoyoNo ratings yet

- The UNITED NATIONS Convention On International Bills of Exchange and International Promissory NotesDocument8 pagesThe UNITED NATIONS Convention On International Bills of Exchange and International Promissory NotesDanton Lawson100% (1)

- Borrower Uses PromissoryNoteDocument5 pagesBorrower Uses PromissoryNoteCharles Kimbrough Sr.100% (11)

- 15fighting ForeclosureDocument19 pages15fighting ForeclosureKeith Muhammad: Bey86% (7)

- Explanation of SecuritizationDocument15 pagesExplanation of Securitizationchickie10No ratings yet

- All Loans Are Fraud - XDocument5 pagesAll Loans Are Fraud - Xmedjool100% (1)

- China, U.SDocument11 pagesChina, U.SZubair PirachaNo ratings yet

- Banking Frauds ProjectDocument15 pagesBanking Frauds ProjectJenny jainNo ratings yet

- Bank Frauds.Document6 pagesBank Frauds.Pawan SainiNo ratings yet

- Reference For BusinessDocument5 pagesReference For BusinessNi W SulastriNo ratings yet

- Bank FraudsDocument8 pagesBank FraudsShivi GuptaNo ratings yet

- Bank Frauds in IndiaDocument31 pagesBank Frauds in IndiagopalushaNo ratings yet

- Explanation and Overview of The Loan Securitization Process GenericDocument8 pagesExplanation and Overview of The Loan Securitization Process GenericChemtrails Equals Treason100% (2)

- Bank Fraud InfoDocument7 pagesBank Fraud InfoturmekarsNo ratings yet

- Report Your Securitized Loan To The IrsDocument3 pagesReport Your Securitized Loan To The IrsMatt Brockman100% (2)

- Banking ScamsDocument24 pagesBanking Scamssaifeez18100% (1)

- Real EstateDocument1 pageReal EstateElias AbboudNo ratings yet

- Banking Secrets That Banks Don 1Document5 pagesBanking Secrets That Banks Don 1lyocco191% (11)

- Introduction To Memorandum of Law: Life-Cycle of A "Loan" October 2010Document18 pagesIntroduction To Memorandum of Law: Life-Cycle of A "Loan" October 2010Cairo AnubissNo ratings yet

- AssignmentDocument12 pagesAssignmentEdisonNo ratings yet

- Economics Project AmanDocument18 pagesEconomics Project AmanAman KumarNo ratings yet

- Bank FraudDocument8 pagesBank FraudHuman Being50% (2)

- MSFraud Forum PageDocument23 pagesMSFraud Forum PageJohn Reed100% (1)

- MM11 - Bank Fraud - WikipediaDocument8 pagesMM11 - Bank Fraud - WikipediaAtul Sharma50% (2)

- Robo-Signers, MERS, Slandered Titles and The Terror LurkingDocument7 pagesRobo-Signers, MERS, Slandered Titles and The Terror LurkingForeclosure FraudNo ratings yet

- Debt Elimination Is Based On Understanding How YouDocument20 pagesDebt Elimination Is Based On Understanding How YouHorton Glenn100% (16)

- Module 4: Trade Finance Meaning of International Bank: Foreign ExchangeDocument4 pagesModule 4: Trade Finance Meaning of International Bank: Foreign ExchangeAnita VarmaNo ratings yet

- Advance Fee Fraud and BanksDocument10 pagesAdvance Fee Fraud and Banksbudi626No ratings yet

- 07 1231-The Essence of The FraudDocument30 pages07 1231-The Essence of The Fraudsumthintado100% (1)

- Can Mers Foreclose or Assign MortgageDocument35 pagesCan Mers Foreclose or Assign Mortgagecfinley19100% (1)

- Fractional Bank FraudDocument13 pagesFractional Bank FraudStevee BatesNo ratings yet

- Banking LiesDocument13 pagesBanking LiesJua90% (10)

- War & Peace, by MR MagooDocument6 pagesWar & Peace, by MR MagooSenateBriberyInquiryNo ratings yet

- Mers Huffing Ton Post 1-24-11 Randal Wray Editorial On MersDocument6 pagesMers Huffing Ton Post 1-24-11 Randal Wray Editorial On MersJulie Hatcher-Julie Munoz JacksonNo ratings yet

- Custom and PracticeDocument5 pagesCustom and PracticeRichard Franklin KesslerNo ratings yet

- Bank Fraud Modus KindsDocument18 pagesBank Fraud Modus KindsThessaloe B. FernandezNo ratings yet

- Is Your Local Banker Involved inDocument4 pagesIs Your Local Banker Involved incmoffett1217No ratings yet

- 05 Anti Money LaunderingDocument15 pages05 Anti Money LaunderingRaghu PalatNo ratings yet

- The Vigilant Investor: A Former SEC Enforcer Reveals How to Fraud-Proof Your InvestmentsFrom EverandThe Vigilant Investor: A Former SEC Enforcer Reveals How to Fraud-Proof Your InvestmentsNo ratings yet

- Transferring Rights To A NoteDocument6 pagesTransferring Rights To A NoteDavid Hernandez100% (2)

- Get Psalms 1st Edition Tremper Longman Iii PDF Full ChapterDocument24 pagesGet Psalms 1st Edition Tremper Longman Iii PDF Full Chapterrohilydagmar100% (6)

- Securitized Distrust Part 2Document18 pagesSecuritized Distrust Part 2John ReedNo ratings yet

- MERS® - Good Strawman or Bad Strawman?: by Phillip C. Querin, QUERIN LAW, LLC Contact InfoDocument8 pagesMERS® - Good Strawman or Bad Strawman?: by Phillip C. Querin, QUERIN LAW, LLC Contact InfoQuerpNo ratings yet

- Money LaunderingDocument28 pagesMoney LaunderingKhinci KeyenNo ratings yet

- Mortgage Servicing Fraud (See Msfraud Dot Org For More Info)Document3 pagesMortgage Servicing Fraud (See Msfraud Dot Org For More Info)StopGovt Waste100% (1)

- Bank FraudsDocument15 pagesBank FraudsPradnya RaneNo ratings yet

- Credit Card Service Agreement (1) - ACS Credir ServicesDocument12 pagesCredit Card Service Agreement (1) - ACS Credir Serviceslyocco1100% (2)

- Frauds in BanksDocument17 pagesFrauds in BanksDr. Shiraj Sherasia100% (2)

- Recordation FraudDocument42 pagesRecordation FraudJeff Wilner78% (9)

- Finding Fraud in The Loan DocumentsDocument3 pagesFinding Fraud in The Loan Documentsrodclassteam100% (1)

- Paul Renner C6 - KYCmap - Preventing Financial Instrument FraudDocument6 pagesPaul Renner C6 - KYCmap - Preventing Financial Instrument FraudPaul RennerNo ratings yet

- How To Search The SEC For A Securitized TrustDocument7 pagesHow To Search The SEC For A Securitized TrustDarrell Hughes100% (7)

- What Is Securitization2Document14 pagesWhat Is Securitization2John Foster100% (2)

- Samsaman, Mary Joy G. 2BSA-2: InstructionsDocument4 pagesSamsaman, Mary Joy G. 2BSA-2: InstructionsCalvin Errol SalasNo ratings yet

- Ponzimonium: How Scam Artists Are Ripping Off AmericaFrom EverandPonzimonium: How Scam Artists Are Ripping Off AmericaNo ratings yet

- Financial Serial Killers: Inside the World of Wall Street Money Hustlers, Swindlers, and Con MenFrom EverandFinancial Serial Killers: Inside the World of Wall Street Money Hustlers, Swindlers, and Con MenNo ratings yet

- 809 Hollyoffshore Sale Notice - K NagendranDocument4 pages809 Hollyoffshore Sale Notice - K NagendranDeoo Milton EximoNo ratings yet

- Assignement Details To Be Uploaded Till August 2023Document57 pagesAssignement Details To Be Uploaded Till August 2023Deoo Milton EximoNo ratings yet

- Mahindra Bolero Pik Up Extra Long CBC 1.7t BrochureDocument8 pagesMahindra Bolero Pik Up Extra Long CBC 1.7t BrochureDeoo Milton EximoNo ratings yet

- Chronos Oml-1140 B: MarketsDocument2 pagesChronos Oml-1140 B: MarketsDeoo Milton EximoNo ratings yet

- Cashew Value Chain DiagnosticsDocument66 pagesCashew Value Chain DiagnosticsDeoo Milton EximoNo ratings yet

- Cashew Nut Processing: Sources of Environmental Pollution and StandardsDocument7 pagesCashew Nut Processing: Sources of Environmental Pollution and StandardsDeoo Milton EximoNo ratings yet

- Cashew Processing PDFDocument5 pagesCashew Processing PDFDeoo Milton EximoNo ratings yet

- Cashew Value Chain 19.12.2014Document15 pagesCashew Value Chain 19.12.2014Deoo Milton EximoNo ratings yet

- Plantation Crops Cashew: Climate and SoilDocument5 pagesPlantation Crops Cashew: Climate and SoilDeoo Milton EximoNo ratings yet

- Cashew Processing PDFDocument5 pagesCashew Processing PDFDeoo Milton EximoNo ratings yet

- Economic 20130321 Adopted - Report PDFDocument91 pagesEconomic 20130321 Adopted - Report PDFDeoo Milton EximoNo ratings yet

- InvoiceDocument1 pageInvoiceYuvraj MishraNo ratings yet

- Vendor Application Form: (Please Click For A Sample Format)Document3 pagesVendor Application Form: (Please Click For A Sample Format)MITRANZO PAYANo ratings yet

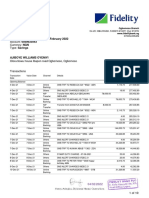

- Account Statement 4000Document1 pageAccount Statement 4000ebmk oeibNo ratings yet

- ReceiptDocument1 pageReceiptjohn belhaNo ratings yet

- PDFDocument4 pagesPDFIndranil MitraNo ratings yet

- Sap Fi/Co: Transaction CodesDocument51 pagesSap Fi/Co: Transaction CodesReddaveni NagarajuNo ratings yet

- Adjusting Entry - AnswerDocument8 pagesAdjusting Entry - AnswerReighjon Ashley C. TolentinoNo ratings yet

- Global Derivatives 2010Document14 pagesGlobal Derivatives 2010bezi1985No ratings yet

- Credit Cards and Debit CardsDocument14 pagesCredit Cards and Debit CardsAltaf Hyssain100% (1)

- Presentation - Virtual Currency - Money LaundryDocument9 pagesPresentation - Virtual Currency - Money LaundryLuiz EduardoNo ratings yet

- TM Tut 13 Credit Derivatives Revision PDFDocument5 pagesTM Tut 13 Credit Derivatives Revision PDFQuynh Ngoc DangNo ratings yet

- Account Statement For:: Sumit Kumar SahuDocument2 pagesAccount Statement For:: Sumit Kumar SahuGunupur PeopleNo ratings yet

- Chapter Three PPE Copy 2Document15 pagesChapter Three PPE Copy 2nachmarket30No ratings yet

- ADAS Presentation UpdatedDocument43 pagesADAS Presentation UpdatedDivine GamingNo ratings yet

- Macroeconomics Final Study Guide-1Document4 pagesMacroeconomics Final Study Guide-1Jesse Adler100% (1)

- Exep FebDocument48 pagesExep FebAccounting IndonesiaNo ratings yet

- Calculating Profit - Extra ExercisesDocument4 pagesCalculating Profit - Extra ExercisesРустам РажабовNo ratings yet

- Unifi PDFDocument7 pagesUnifi PDFAmato GelatoNo ratings yet

- IELTS Writing Band 9 Samples PDFDocument21 pagesIELTS Writing Band 9 Samples PDFRytqewadsfhgkjn XzfdhgytqewznbvNo ratings yet

- Full Report MIFSDocument22 pagesFull Report MIFSWeiXin Yeo100% (1)

- IGCSE Business Studies Chapter 09 NotesDocument5 pagesIGCSE Business Studies Chapter 09 NotesemonimtiazNo ratings yet

- Merchant BankingDocument235 pagesMerchant BankingKarthikeyan Elangovan100% (1)

- Comparative Analysis On Non Performing Assets of Private and Public Sector BanksDocument106 pagesComparative Analysis On Non Performing Assets of Private and Public Sector BanksNeerajNo ratings yet

- Reserve Bank's Clean Note Policy: An Overview Special Notes: R. K. JainDocument18 pagesReserve Bank's Clean Note Policy: An Overview Special Notes: R. K. JainAnkit DubeyNo ratings yet

- Block 2Document102 pagesBlock 2msk_1407No ratings yet

- The Liquidity Time Bomb by Nouriel Roubini - Project SyndicateDocument3 pagesThe Liquidity Time Bomb by Nouriel Roubini - Project SyndicateNickmann Ba'alNo ratings yet

- Cost Control NotesDocument4 pagesCost Control NotesAlice Margaret Hargest100% (1)

- Dena Bank ClericalChallanDocument1 pageDena Bank ClericalChallanSourav ChavanNo ratings yet