Professional Documents

Culture Documents

Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On Inflows

Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On Inflows

Uploaded by

aravindascribdCopyright:

Available Formats

You might also like

- Group Assignment FIN533 - Group 4Document22 pagesGroup Assignment FIN533 - Group 4Muhammad Atiq100% (1)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (19)

- NSE F&O Stocks Lot SizeDocument12 pagesNSE F&O Stocks Lot SizeSamir Xalxo100% (3)

- Managing Personal FinanceDocument7 pagesManaging Personal FinanceCarl Joseph BalajadiaNo ratings yet

- IMS Proschool CFP EbookDocument140 pagesIMS Proschool CFP EbookNielesh AmbreNo ratings yet

- Financial Planning ReportDocument75 pagesFinancial Planning ReportAruna Ambastha100% (7)

- MIT15 053S13 Ps6solDocument8 pagesMIT15 053S13 Ps6solErkin KorayNo ratings yet

- 0111 Futures MagDocument64 pages0111 Futures MagTradingSystem100% (1)

- Halal Industry Master Plan: P Ro M in enDocument16 pagesHalal Industry Master Plan: P Ro M in enNote 8100% (1)

- Chapter 07 Sales Objectives and QoutasDocument33 pagesChapter 07 Sales Objectives and QoutasAshish Singh50% (2)

- Advertising Strategy and Effectiveness of KingfisherDocument53 pagesAdvertising Strategy and Effectiveness of Kingfisherimad50% (2)

- Black Book ProjectDocument69 pagesBlack Book Projectganeshsable247No ratings yet

- What Is Personal FinanceDocument15 pagesWhat Is Personal Financemavol18877No ratings yet

- Wealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pDocument98 pagesWealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pSajal AroraNo ratings yet

- Financial Planning and Tax ManagementDocument11 pagesFinancial Planning and Tax Managementrohit maddeshiyaNo ratings yet

- Digital Assignment - 1: Submitted To: Submitted byDocument7 pagesDigital Assignment - 1: Submitted To: Submitted byMonashreeNo ratings yet

- Weekly Report 1Document10 pagesWeekly Report 1NidhiKachhawaNo ratings yet

- Unit 1 MaterialDocument29 pagesUnit 1 MaterialSheetal DwevediNo ratings yet

- Research Report Financial PlanningDocument43 pagesResearch Report Financial PlanningManasi KalgutkarNo ratings yet

- Ifp 1 Introduction To Financial Planning PDFDocument5 pagesIfp 1 Introduction To Financial Planning PDFIMS ProschoolNo ratings yet

- Ifp 1 Introduction To Financial PlanningDocument5 pagesIfp 1 Introduction To Financial PlanningSukumarNo ratings yet

- What Is Financial Planning?: Life GoalsDocument16 pagesWhat Is Financial Planning?: Life GoalsrahsatputeNo ratings yet

- Investigate: Learn To Know-How of InvestingDocument6 pagesInvestigate: Learn To Know-How of InvestingJay Calalang ManatadNo ratings yet

- Objectives of Financial PlanningDocument52 pagesObjectives of Financial PlanninggulnazgaimaNo ratings yet

- FM AssignmentDocument10 pagesFM Assignmentaryamakumari3No ratings yet

- Financial Advisor PRINTDocument6 pagesFinancial Advisor PRINTNMRaycNo ratings yet

- Chapter 1Document22 pagesChapter 1Trushant MandharkarNo ratings yet

- Blackbook Project On InsuranceDocument78 pagesBlackbook Project On Insurancesai saiNo ratings yet

- Financial AccountingDocument221 pagesFinancial AccountingAditya AgnihotriNo ratings yet

- Financial PlanningDocument47 pagesFinancial PlanningNishaTambeNo ratings yet

- Financial AdvisorsDocument100 pagesFinancial AdvisorsNipul BafnaNo ratings yet

- Chapter 6Document7 pagesChapter 6Erika GueseNo ratings yet

- Introduction To Personal FinanceDocument5 pagesIntroduction To Personal FinanceMukul MishraNo ratings yet

- Introduction To SIMPLUSDocument2 pagesIntroduction To SIMPLUSSoundarya H GNo ratings yet

- Personal Financial PlanningDocument7 pagesPersonal Financial PlanningNur IzanNo ratings yet

- Objective of Financial PlanningDocument21 pagesObjective of Financial PlanningmayawalaNo ratings yet

- Are You Also Wasting Your Financial Potential?: If Only You Act Fast, You Too Can Surpass Your 'Ambitious' GoalsDocument13 pagesAre You Also Wasting Your Financial Potential?: If Only You Act Fast, You Too Can Surpass Your 'Ambitious' GoalskvijayasokNo ratings yet

- RM - J229 - Research PaperDocument10 pagesRM - J229 - Research PaperRishikaNo ratings yet

- Financial Planning Made Easy: A Beginner's Handbook to Financial SecurityFrom EverandFinancial Planning Made Easy: A Beginner's Handbook to Financial SecurityNo ratings yet

- Bba V PFP Unit 1Document15 pagesBba V PFP Unit 1RaghuNo ratings yet

- 7 Investment Planning PDPDocument8 pages7 Investment Planning PDPManish ChandwaniNo ratings yet

- SDBDFDDocument2 pagesSDBDFDMuhibur's EntertainmentNo ratings yet

- Introduction To Personal Finance.Document26 pagesIntroduction To Personal Finance.djdannex791No ratings yet

- PFM Blackbook 19022014Document57 pagesPFM Blackbook 19022014dp100% (1)

- Financial Planning ArticleDocument3 pagesFinancial Planning ArticlevaradNo ratings yet

- Wealth: From Zero to Hero: A Beginner's Guide to Private WealthFrom EverandWealth: From Zero to Hero: A Beginner's Guide to Private WealthNo ratings yet

- KMBN FM02 Financial Planning and Tax ManagementDocument25 pagesKMBN FM02 Financial Planning and Tax ManagementShubham SinghNo ratings yet

- LESSON 20: What Is Personal Finance? TargetDocument8 pagesLESSON 20: What Is Personal Finance? TargetMai RuizNo ratings yet

- What You Should Know About Financial PlanningDocument16 pagesWhat You Should Know About Financial PlanningrvarathanNo ratings yet

- Saving ProjectDocument48 pagesSaving Projectthen12345No ratings yet

- Personal Finance for Beginner's - A Comprehensive User GuideFrom EverandPersonal Finance for Beginner's - A Comprehensive User GuideNo ratings yet

- Handout in Unit 4D and 4EDocument10 pagesHandout in Unit 4D and 4EArgie Cayabyab CagunotNo ratings yet

- FINAL MahantheshDocument138 pagesFINAL MahantheshKapil DevNo ratings yet

- Dissertation 1Document98 pagesDissertation 1Krishana vNo ratings yet

- Financial Planning Vs ForecastingDocument12 pagesFinancial Planning Vs ForecastingKhiezna PakamNo ratings yet

- Personal FDXFFinancial PlanningDocument34 pagesPersonal FDXFFinancial Planningmanali.270694No ratings yet

- For A Rich Future: Owning A Car, A HouseDocument11 pagesFor A Rich Future: Owning A Car, A Housedbsmba2015No ratings yet

- CFP EbookDocument81 pagesCFP EbookNikhil parabNo ratings yet

- Financial PlanningDocument6 pagesFinancial PlanningSheikh NadeemNo ratings yet

- FT 405 FMAJ Investment Advisor - NotesDocument43 pagesFT 405 FMAJ Investment Advisor - NotesanjaliNo ratings yet

- APO Decomission List FY18 Phase 1 PROGDocument59 pagesAPO Decomission List FY18 Phase 1 PROGaravindascribdNo ratings yet

- HANA: Evolution and Architecture: Week 1 Unit 2: ABAP Meets SAPDocument14 pagesHANA: Evolution and Architecture: Week 1 Unit 2: ABAP Meets SAParavindascribdNo ratings yet

- Ecr No Description ReleaseDocument2 pagesEcr No Description ReleasearavindascribdNo ratings yet

- Tools: Week 1 Unit 5: Your DevelopmentDocument11 pagesTools: Week 1 Unit 5: Your DevelopmentaravindascribdNo ratings yet

- 2 PageDocument1 page2 PagearavindascribdNo ratings yet

- Zebra Printing Methods in SAPDocument7 pagesZebra Printing Methods in SAParavindascribd100% (1)

- Managing Customer Items and Installations: The Customer Installed BaseDocument4 pagesManaging Customer Items and Installations: The Customer Installed BasearavindascribdNo ratings yet

- 3 PageDocument1 page3 PagearavindascribdNo ratings yet

- Workflow Execution: SAP Business Workflow Run-Time SystemDocument4 pagesWorkflow Execution: SAP Business Workflow Run-Time SystemaravindascribdNo ratings yet

- Central User Access: The Integrated Inbox: Work Items and Mail in A Common InboxDocument2 pagesCentral User Access: The Integrated Inbox: Work Items and Mail in A Common InboxaravindascribdNo ratings yet

- Customer Service Projects: HighlightsDocument3 pagesCustomer Service Projects: HighlightsaravindascribdNo ratings yet

- 7k Strips Distributed Among 51 Druggists: HC: What's Your Strategy To Curb Sound Pollution?Document1 page7k Strips Distributed Among 51 Druggists: HC: What's Your Strategy To Curb Sound Pollution?aravindascribdNo ratings yet

- Billing of Services: HighlightsDocument5 pagesBilling of Services: Highlightsaravindascribd100% (1)

- More by Design Than Accident: CoverDocument1 pageMore by Design Than Accident: CoveraravindascribdNo ratings yet

- Patient ManagementDocument21 pagesPatient ManagementaravindascribdNo ratings yet

- Service Management in The R/3 SystemDocument6 pagesService Management in The R/3 SystemaravindascribdNo ratings yet

- R/3 System SAP Automotive: Functions in DetailDocument1 pageR/3 System SAP Automotive: Functions in DetailaravindascribdNo ratings yet

- Mohit SinghDocument91 pagesMohit SinghmohitsinghmontyNo ratings yet

- Applied EconomicsDocument5 pagesApplied EconomicsMaritess Madrid EsperanzaNo ratings yet

- Profit & Loss - PC ViewDocument18 pagesProfit & Loss - PC ViewKabir BhaiNo ratings yet

- The Accra Beach Hotel CaseDocument5 pagesThe Accra Beach Hotel CaseNehaBajaj100% (2)

- Reclamation Manual: Subject: PurposeDocument11 pagesReclamation Manual: Subject: PurposealfonsxxxNo ratings yet

- Marketing Strategy by BataDocument12 pagesMarketing Strategy by BataHARSHIT THUKRALNo ratings yet

- (Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionDocument2 pages(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionHRish BhimberNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Credit Sources and Credit CardsDocument11 pagesCredit Sources and Credit CardsPoonam VermaNo ratings yet

- Avexa Annual Report 2013Document64 pagesAvexa Annual Report 2013shoaiba1No ratings yet

- Quick Lube FranchiseDocument5 pagesQuick Lube FranchisemorgytrashNo ratings yet

- Banking Capital MarketsDocument9 pagesBanking Capital Marketsyadavmihir63No ratings yet

- Chemfiles Vol. 9, No. 2 - CatalysisDocument24 pagesChemfiles Vol. 9, No. 2 - CatalysisSigma-AldrichNo ratings yet

- 24568-Article Text-38705-1-10-20220412Document11 pages24568-Article Text-38705-1-10-20220412Yuni SaraswatiNo ratings yet

- Module 2-Asset Allocation-Questions AwniW26jEKDocument21 pagesModule 2-Asset Allocation-Questions AwniW26jEKKp PatelNo ratings yet

- SBA Ombudsman Bio - Esther VassarDocument2 pagesSBA Ombudsman Bio - Esther VassarVirgin Islands Youth Advocacy CoalitionNo ratings yet

- Kalyani SIP ReportDocument63 pagesKalyani SIP Reportreshma puriNo ratings yet

- Rapiscan Integrated Cargo ScanningDocument2 pagesRapiscan Integrated Cargo ScanningAmit ChaudharyNo ratings yet

- SAP+MM++Practice+Book+ IDocument25 pagesSAP+MM++Practice+Book+ Isaisundargatti365No ratings yet

- Insider TradingDocument14 pagesInsider TradingSyed Nabeel Ahmed WarsiNo ratings yet

- 131-Article Text-408-1-10-20161111Document6 pages131-Article Text-408-1-10-20161111Prabhakar RaoNo ratings yet

- Dalandan CandyDocument3 pagesDalandan Candykriss WongNo ratings yet

- W6 NoteDocument1 pageW6 NoteAkyrioz FoxNo ratings yet

Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On Inflows

Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On Inflows

Uploaded by

aravindascribdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On Inflows

Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On Inflows

Uploaded by

aravindascribdCopyright:

Available Formats

11

THE TIMES OF INDIA, BENGALURU

TUESDAY, NOVEMBER 25, 2014

Fin Planning Goes Beyond Saving Taxes

Its a round-the-year exercise that helps provide for goals, create wealth

Partha Sinha | TNN

ans, one of the first steps of

financial planning is to profile the person, map his/her

financial goals, pinpoint the

kind of risks he/she should

be open to taking and then

put in place the type of assets

he/she should be investing in

or a large number of

Indians, especially

the salaried class,

financial planning

starts and ends with

tax planning. And for several

of these people, it starts

around January of every

year and ends by March of

the same year. However, the reality

is financial planning should be a

round-the-year

exercise, in

which tax planning is an integral part, but not

an end in itself.

Financial planning also involves

providing for ones

retirement, childs education and marriage,

putting in place a plan for

healthcare and medical

emergencies for the whole

family, life insurance, other

financial exigencies, etc.

Involve your entire family

The process of financial

planning also involves the

whole family and its not just

for an individual, unless

theres no immediate family.

So remember to take your

spouse along when you are

going to meet your financial

planner. Lately, financial advisers are also insisting on

involving teenaged children

so that the ideas, values and

benefits of financial planning could be ingrained in

their minds very early in

their lives so that unlike

their parents they have a

head start on the same.

According to a Mumbaibased financial planner, it is

seen that not all members of

Aim for emergency

fund, better returns

a family have

similar ideas about

the family's future needs.

Once a person came to us for

financial planning but was

very reluctant to bring his

wife along. When we insisted,

she joined us. While setting

goals, we saw that the person

had no idea about the expenses the family could incur for

their daughters wedding at

least 15 years down the line,

but his wife was very clear

about what the family will

need to do. From then on, that

person always came to us

with his wife, the financial

planner said.

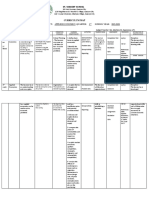

Illustration: Ram

BUILDING BRIDGE TO BETTER LIFE

Start early and invest regularly

Map investments to goals and risk profiles

Value of goals should be inflation-adjusted

Invest every month for tax planning, and not just before

the financial year-end

Consider asset allocation & diversify across asset classes

Repay high-cost loans early

Plan to buy a house early in life

Consider term plan over other insurance plans

Have a family health insurance plan in addition to the

company-sponsored one (if any)

Have contingency fund for up to 6 months of expenses

Be ready to spend time

According to industry veter-

Clearly define your financial goals

before calling on a financial adviser

Mukund Seshadri

will submit the fact-finder

within a week, Ramesh

Ahuja (name changed) had

said. He seemed excited about

being helped by a financial

planner, and interested in going

through the entire planning

process. However, its been almost three months since and

the questionnaire necessary

for a financial planner to get a

better idea about an investor

is yet to reach us.

Often, people approach a

financial planner in right earnest and then delay sending

the relevant data and papers.

The reasons given are lack of

time, unavailable data, missing documents, etc. Often

such delays could be simply

the lack of priority on their

part. People spend lot of time

earning money, but spend

very little time so that their

hard-earned money works

harder for them.

Once in a training programme, the trainer asked

me, I am ready to coach you,

but are you coachable? The

situation is similar here: A

financial planner can deliver

the best results if his/her client and his/her family get

completely involved in the

entire process and together

take it in the right direction.

Here are five key requirements that you should be

ready with or at least start

to reach those financial goals.

This is an exhaustive process and the family of the person should be willing to spend

some quality time with the financial planner for better longterm results. Once the initial

meetings and planning are

over, the follow-up meetings

are, usually, not so time-consuming, according to planners and advisers.

working on before meeting a

financial planner:

Income: This includes income from salaries (including

bonus), house and property,

business and profession,

capital gains and other sources. This gives a clearer picture of ones cash inflows. For

salaried individuals, income

in hand is quite clear. However, for others it could be

calculated from income tax

returns and bank statements.

Expenses: Expenses are of

easily. Even if the amount is

small, you should track it

since it may eventually make

a big difference to your life.

Assets: Assets are those that

generate or have the potential

to generate returns. So a car

for a person in the travel business is an asset, but for an

individual it is not. Another

example is a self-occupied

property. This will surely

have some value, but if the

property is going to be used

only to stay and not rented

It is also important to

divide your milestones as

needs and desires. This is

because needs are

uncompromising and

should be high on priority,

while desires are not

two types: Fixed and variable.

Fixed expenses are easy to

track and are more or less

streamlined. They may include society maintenance

fees, salaries to domestic

help, etc. However, its slightly tricky to calculate variable

expenses, but these should be

closely monitored. Sometimes entertainment expenses can be detrimental to some

serious goals, like your own

retirement. Hence, it is very

important you keep track of

this. There are many apps

that can help you track this

out or sold then valuing the

same does not make sense.

While calculating assets and

investments, you should also

look at investments that are

not done voluntarily but are

available to you due to the

nature of employment. For

example, the employee provident fund, gratuity, superannuation, vested ESOPs, etc.

Liabilities: Liabilities can be

in the form of various loans

like home, car, personal, company, outstanding on credit

cards, etc. You should

also know the rate

at which the loan is being repaid, the tenure, current outstanding amount and the

terms of repayment.

Milestones: This is the most

crucial aspect of a financial

plan since its the one single

factor that makes the plan

customized. This has to be

done by involving the entire

family because financial

planning is always for the

family and not for a single

individual. It is also important to divide your milestones

as needs and desires. Needs

are uncompromising and

should be high on priority,

while desires are not. This

helps allocate assets to those

goals which will deliver the

best result in the given contours of ones finances. This

is the starting point of any

financial plan and, hence,

clarity here is crucial.

A financial planner can

make a significant difference

to your life, but data adequacy

is the foundation on which

the entire process of planning is based. Your financial

data has to be accurate.

Hence, to ensure successful

goal accomplishment, it is

important that you are ready

with your data or at least

start work on them before you

approach a financial planner.

The writer is founder,

MSVentures

Financial Planners

DEMYSTIFIER

What is insider trading?

Swatantra Kumar answers: Last week, market regulator Sebi came out with a new set

of rules aimed at making insider trading tougher than before. As the term suggests,

insider trading refers to the act of buying or selling the stock of a company by

someone who has access to news from the inside of

the company which, in most cases, is not available

to the general public. Although insider trading could

be legal or illegal, the term itself has a negative

connotation. Regulators around the world have put in

place strict guidelines about such trading. So, if the

trading by an insider is done while staying within the

limits of the rules, it is perfectly clean. Several

traders and investors look at insider trading

disclosures to gain vital information about the

happenings within a company.

Send in your suggestions, queries to investor.swatantra@gmail.com;

for a free financial planning booklet, please SMS EDU to 5676756

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

Advisers and planners also say that,

since salaried people

have a regular cash

flow, they are less likely to put in place a plan

to meet any financial

exigencies. In todays

world where hire and fire

is almost becoming the

norm at the workplace, every

individual should have an

emergency corpus to take

care of monthly expenses for

at least six months, according to financial planners.

Another common trait

among salaried people is that

they are usually risk-averse

in nature and prefer investing in debt instruments over

equities. However, given the

high rate of inflation that a

country like India faces, they

should always look at investing in assets that have the

potential to beat the rate of

inflation in the long run,

says a top executive at a mutual fund house.

Equities form the best

asset class that has in the

past beaten inflation and investors should look at this

seriously. If you are not qualified or experienced enough

to invest in equities directly,

you can take the mutual fund

route, the executive adds.

Monitor your budget

to keep tabs on inflows

Vishal Dhawan

few months ago, I was

talking to the passing

out batch of a business

school. I thought to myself:

These students had everything going for them except

one essential thing, that is

their level of financial education and awareness about personal finance. Incidentally, the

topic of that session was financial planning, and whether it makes your life any better

when you have a plan.

Here are some of the benefits of having a financial plan

for you and/or having a financial planner on your side:

A master view of all your

finances: A financial plan

helps investors understand all

the moving parts of their financial lives and make more

sense of how all the pieces fit

together to achieve what they

want with their money.

Priorities and trade-offs: A

financial plan can help you

prioritize the goals that your

investments would go towards. For example, would

you be jeopardizing your

childs education by upgrading your home/car, and such

trade-offs. The implications of

such trade-offs would also be

clearly understood through a

financial plan.

What gets measured, gets

monitored: As part of a financial plan, you are required to monitor budgets

and surpluses. Thus, you

would be more aware of your

cash flows. A common com-

KNOW YOUR ASSETS

NEXT WEEK

n our next edition, we will tell

you how mutual fund

investments could accelerate

wealth creation for you.

plaint of investors having a

financial plan is that, We

dont know where my money

goes. The planning process

would help in this regard.

Similarly, an adviser would

also track your investment

performance to understand

where you are with respect to

your lifes goals.

Investments are in line

with what you need: Many

a times, we have invested in

products that may be risky or

may be locked-in, thereby not

having access to our own

money when we need it. This

happened because a friend or

relative suggested some investment and you just went

ahead with it without paying

heed to whether that was relevant to you or not. For example, a PPF account may be a

good investment, but not if

you plan to become an entrepreneur in two years and need

contingency provisions.

Preparedness for surprises:

We all know that life is full of

surprises. A financial plan

helps you gear up for such

eventualities by suggesting an

appropriate risk-management

plan for your life, health and

other assets.

Everythings in one place:

Several investor families we

deal with as an adviser have

given this feedback. The ease

of knowing that all your financial details, documents,

investments, details of assets

and liabilities, etc basically

all things related to the familys finances are documented with your adviser and can

be accessed quickly is a big

comfort for most.

Helps pass on wealth to

your next generation: The

answer to the question Does

your family know about your

finances? is usually a No

in the Indian context as, mostly, the lady in the house does

not want to be involved in financial matters. Increasingly,

this is changing among the

younger population since a

financial plan/planner could

help aid the process to smoothly pass on all your hardearned wealth to your spouse

and to your next generation in

the most efficient manner.

If you take care of all of

these points in right earnest,

then you must have planned

well financially. Else, its

time to get that financial

plan in place.

The writer is founder,

Plan Ahead Wealth Advisors

You might also like

- Group Assignment FIN533 - Group 4Document22 pagesGroup Assignment FIN533 - Group 4Muhammad Atiq100% (1)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (19)

- NSE F&O Stocks Lot SizeDocument12 pagesNSE F&O Stocks Lot SizeSamir Xalxo100% (3)

- Managing Personal FinanceDocument7 pagesManaging Personal FinanceCarl Joseph BalajadiaNo ratings yet

- IMS Proschool CFP EbookDocument140 pagesIMS Proschool CFP EbookNielesh AmbreNo ratings yet

- Financial Planning ReportDocument75 pagesFinancial Planning ReportAruna Ambastha100% (7)

- MIT15 053S13 Ps6solDocument8 pagesMIT15 053S13 Ps6solErkin KorayNo ratings yet

- 0111 Futures MagDocument64 pages0111 Futures MagTradingSystem100% (1)

- Halal Industry Master Plan: P Ro M in enDocument16 pagesHalal Industry Master Plan: P Ro M in enNote 8100% (1)

- Chapter 07 Sales Objectives and QoutasDocument33 pagesChapter 07 Sales Objectives and QoutasAshish Singh50% (2)

- Advertising Strategy and Effectiveness of KingfisherDocument53 pagesAdvertising Strategy and Effectiveness of Kingfisherimad50% (2)

- Black Book ProjectDocument69 pagesBlack Book Projectganeshsable247No ratings yet

- What Is Personal FinanceDocument15 pagesWhat Is Personal Financemavol18877No ratings yet

- Wealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pDocument98 pagesWealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pSajal AroraNo ratings yet

- Financial Planning and Tax ManagementDocument11 pagesFinancial Planning and Tax Managementrohit maddeshiyaNo ratings yet

- Digital Assignment - 1: Submitted To: Submitted byDocument7 pagesDigital Assignment - 1: Submitted To: Submitted byMonashreeNo ratings yet

- Weekly Report 1Document10 pagesWeekly Report 1NidhiKachhawaNo ratings yet

- Unit 1 MaterialDocument29 pagesUnit 1 MaterialSheetal DwevediNo ratings yet

- Research Report Financial PlanningDocument43 pagesResearch Report Financial PlanningManasi KalgutkarNo ratings yet

- Ifp 1 Introduction To Financial Planning PDFDocument5 pagesIfp 1 Introduction To Financial Planning PDFIMS ProschoolNo ratings yet

- Ifp 1 Introduction To Financial PlanningDocument5 pagesIfp 1 Introduction To Financial PlanningSukumarNo ratings yet

- What Is Financial Planning?: Life GoalsDocument16 pagesWhat Is Financial Planning?: Life GoalsrahsatputeNo ratings yet

- Investigate: Learn To Know-How of InvestingDocument6 pagesInvestigate: Learn To Know-How of InvestingJay Calalang ManatadNo ratings yet

- Objectives of Financial PlanningDocument52 pagesObjectives of Financial PlanninggulnazgaimaNo ratings yet

- FM AssignmentDocument10 pagesFM Assignmentaryamakumari3No ratings yet

- Financial Advisor PRINTDocument6 pagesFinancial Advisor PRINTNMRaycNo ratings yet

- Chapter 1Document22 pagesChapter 1Trushant MandharkarNo ratings yet

- Blackbook Project On InsuranceDocument78 pagesBlackbook Project On Insurancesai saiNo ratings yet

- Financial AccountingDocument221 pagesFinancial AccountingAditya AgnihotriNo ratings yet

- Financial PlanningDocument47 pagesFinancial PlanningNishaTambeNo ratings yet

- Financial AdvisorsDocument100 pagesFinancial AdvisorsNipul BafnaNo ratings yet

- Chapter 6Document7 pagesChapter 6Erika GueseNo ratings yet

- Introduction To Personal FinanceDocument5 pagesIntroduction To Personal FinanceMukul MishraNo ratings yet

- Introduction To SIMPLUSDocument2 pagesIntroduction To SIMPLUSSoundarya H GNo ratings yet

- Personal Financial PlanningDocument7 pagesPersonal Financial PlanningNur IzanNo ratings yet

- Objective of Financial PlanningDocument21 pagesObjective of Financial PlanningmayawalaNo ratings yet

- Are You Also Wasting Your Financial Potential?: If Only You Act Fast, You Too Can Surpass Your 'Ambitious' GoalsDocument13 pagesAre You Also Wasting Your Financial Potential?: If Only You Act Fast, You Too Can Surpass Your 'Ambitious' GoalskvijayasokNo ratings yet

- RM - J229 - Research PaperDocument10 pagesRM - J229 - Research PaperRishikaNo ratings yet

- Financial Planning Made Easy: A Beginner's Handbook to Financial SecurityFrom EverandFinancial Planning Made Easy: A Beginner's Handbook to Financial SecurityNo ratings yet

- Bba V PFP Unit 1Document15 pagesBba V PFP Unit 1RaghuNo ratings yet

- 7 Investment Planning PDPDocument8 pages7 Investment Planning PDPManish ChandwaniNo ratings yet

- SDBDFDDocument2 pagesSDBDFDMuhibur's EntertainmentNo ratings yet

- Introduction To Personal Finance.Document26 pagesIntroduction To Personal Finance.djdannex791No ratings yet

- PFM Blackbook 19022014Document57 pagesPFM Blackbook 19022014dp100% (1)

- Financial Planning ArticleDocument3 pagesFinancial Planning ArticlevaradNo ratings yet

- Wealth: From Zero to Hero: A Beginner's Guide to Private WealthFrom EverandWealth: From Zero to Hero: A Beginner's Guide to Private WealthNo ratings yet

- KMBN FM02 Financial Planning and Tax ManagementDocument25 pagesKMBN FM02 Financial Planning and Tax ManagementShubham SinghNo ratings yet

- LESSON 20: What Is Personal Finance? TargetDocument8 pagesLESSON 20: What Is Personal Finance? TargetMai RuizNo ratings yet

- What You Should Know About Financial PlanningDocument16 pagesWhat You Should Know About Financial PlanningrvarathanNo ratings yet

- Saving ProjectDocument48 pagesSaving Projectthen12345No ratings yet

- Personal Finance for Beginner's - A Comprehensive User GuideFrom EverandPersonal Finance for Beginner's - A Comprehensive User GuideNo ratings yet

- Handout in Unit 4D and 4EDocument10 pagesHandout in Unit 4D and 4EArgie Cayabyab CagunotNo ratings yet

- FINAL MahantheshDocument138 pagesFINAL MahantheshKapil DevNo ratings yet

- Dissertation 1Document98 pagesDissertation 1Krishana vNo ratings yet

- Financial Planning Vs ForecastingDocument12 pagesFinancial Planning Vs ForecastingKhiezna PakamNo ratings yet

- Personal FDXFFinancial PlanningDocument34 pagesPersonal FDXFFinancial Planningmanali.270694No ratings yet

- For A Rich Future: Owning A Car, A HouseDocument11 pagesFor A Rich Future: Owning A Car, A Housedbsmba2015No ratings yet

- CFP EbookDocument81 pagesCFP EbookNikhil parabNo ratings yet

- Financial PlanningDocument6 pagesFinancial PlanningSheikh NadeemNo ratings yet

- FT 405 FMAJ Investment Advisor - NotesDocument43 pagesFT 405 FMAJ Investment Advisor - NotesanjaliNo ratings yet

- APO Decomission List FY18 Phase 1 PROGDocument59 pagesAPO Decomission List FY18 Phase 1 PROGaravindascribdNo ratings yet

- HANA: Evolution and Architecture: Week 1 Unit 2: ABAP Meets SAPDocument14 pagesHANA: Evolution and Architecture: Week 1 Unit 2: ABAP Meets SAParavindascribdNo ratings yet

- Ecr No Description ReleaseDocument2 pagesEcr No Description ReleasearavindascribdNo ratings yet

- Tools: Week 1 Unit 5: Your DevelopmentDocument11 pagesTools: Week 1 Unit 5: Your DevelopmentaravindascribdNo ratings yet

- 2 PageDocument1 page2 PagearavindascribdNo ratings yet

- Zebra Printing Methods in SAPDocument7 pagesZebra Printing Methods in SAParavindascribd100% (1)

- Managing Customer Items and Installations: The Customer Installed BaseDocument4 pagesManaging Customer Items and Installations: The Customer Installed BasearavindascribdNo ratings yet

- 3 PageDocument1 page3 PagearavindascribdNo ratings yet

- Workflow Execution: SAP Business Workflow Run-Time SystemDocument4 pagesWorkflow Execution: SAP Business Workflow Run-Time SystemaravindascribdNo ratings yet

- Central User Access: The Integrated Inbox: Work Items and Mail in A Common InboxDocument2 pagesCentral User Access: The Integrated Inbox: Work Items and Mail in A Common InboxaravindascribdNo ratings yet

- Customer Service Projects: HighlightsDocument3 pagesCustomer Service Projects: HighlightsaravindascribdNo ratings yet

- 7k Strips Distributed Among 51 Druggists: HC: What's Your Strategy To Curb Sound Pollution?Document1 page7k Strips Distributed Among 51 Druggists: HC: What's Your Strategy To Curb Sound Pollution?aravindascribdNo ratings yet

- Billing of Services: HighlightsDocument5 pagesBilling of Services: Highlightsaravindascribd100% (1)

- More by Design Than Accident: CoverDocument1 pageMore by Design Than Accident: CoveraravindascribdNo ratings yet

- Patient ManagementDocument21 pagesPatient ManagementaravindascribdNo ratings yet

- Service Management in The R/3 SystemDocument6 pagesService Management in The R/3 SystemaravindascribdNo ratings yet

- R/3 System SAP Automotive: Functions in DetailDocument1 pageR/3 System SAP Automotive: Functions in DetailaravindascribdNo ratings yet

- Mohit SinghDocument91 pagesMohit SinghmohitsinghmontyNo ratings yet

- Applied EconomicsDocument5 pagesApplied EconomicsMaritess Madrid EsperanzaNo ratings yet

- Profit & Loss - PC ViewDocument18 pagesProfit & Loss - PC ViewKabir BhaiNo ratings yet

- The Accra Beach Hotel CaseDocument5 pagesThe Accra Beach Hotel CaseNehaBajaj100% (2)

- Reclamation Manual: Subject: PurposeDocument11 pagesReclamation Manual: Subject: PurposealfonsxxxNo ratings yet

- Marketing Strategy by BataDocument12 pagesMarketing Strategy by BataHARSHIT THUKRALNo ratings yet

- (Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionDocument2 pages(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionHRish BhimberNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Credit Sources and Credit CardsDocument11 pagesCredit Sources and Credit CardsPoonam VermaNo ratings yet

- Avexa Annual Report 2013Document64 pagesAvexa Annual Report 2013shoaiba1No ratings yet

- Quick Lube FranchiseDocument5 pagesQuick Lube FranchisemorgytrashNo ratings yet

- Banking Capital MarketsDocument9 pagesBanking Capital Marketsyadavmihir63No ratings yet

- Chemfiles Vol. 9, No. 2 - CatalysisDocument24 pagesChemfiles Vol. 9, No. 2 - CatalysisSigma-AldrichNo ratings yet

- 24568-Article Text-38705-1-10-20220412Document11 pages24568-Article Text-38705-1-10-20220412Yuni SaraswatiNo ratings yet

- Module 2-Asset Allocation-Questions AwniW26jEKDocument21 pagesModule 2-Asset Allocation-Questions AwniW26jEKKp PatelNo ratings yet

- SBA Ombudsman Bio - Esther VassarDocument2 pagesSBA Ombudsman Bio - Esther VassarVirgin Islands Youth Advocacy CoalitionNo ratings yet

- Kalyani SIP ReportDocument63 pagesKalyani SIP Reportreshma puriNo ratings yet

- Rapiscan Integrated Cargo ScanningDocument2 pagesRapiscan Integrated Cargo ScanningAmit ChaudharyNo ratings yet

- SAP+MM++Practice+Book+ IDocument25 pagesSAP+MM++Practice+Book+ Isaisundargatti365No ratings yet

- Insider TradingDocument14 pagesInsider TradingSyed Nabeel Ahmed WarsiNo ratings yet

- 131-Article Text-408-1-10-20161111Document6 pages131-Article Text-408-1-10-20161111Prabhakar RaoNo ratings yet

- Dalandan CandyDocument3 pagesDalandan Candykriss WongNo ratings yet

- W6 NoteDocument1 pageW6 NoteAkyrioz FoxNo ratings yet