Professional Documents

Culture Documents

General Principles and Concepts

General Principles and Concepts

Uploaded by

Charry Ramos67%(3)67% found this document useful (3 votes)

3K views2 pagesThis document contains 15 true/false questions related to taxation principles in the Philippines. Some key points covered include:

- Taxation is a way for the government to apportion costs of governance among citizens who benefit from it.

- The power of taxation allows the state to enforce contributions through taxes even without explicit constitutional authorization as it is an inherent power.

- Tax exemptions can be used to encourage economic growth.

- Tax laws must be construed strictly against the government and liberally in favor of taxpayers in cases of ambiguity.

Original Description:

Law

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 15 true/false questions related to taxation principles in the Philippines. Some key points covered include:

- Taxation is a way for the government to apportion costs of governance among citizens who benefit from it.

- The power of taxation allows the state to enforce contributions through taxes even without explicit constitutional authorization as it is an inherent power.

- Tax exemptions can be used to encourage economic growth.

- Tax laws must be construed strictly against the government and liberally in favor of taxpayers in cases of ambiguity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

67%(3)67% found this document useful (3 votes)

3K views2 pagesGeneral Principles and Concepts

General Principles and Concepts

Uploaded by

Charry RamosThis document contains 15 true/false questions related to taxation principles in the Philippines. Some key points covered include:

- Taxation is a way for the government to apportion costs of governance among citizens who benefit from it.

- The power of taxation allows the state to enforce contributions through taxes even without explicit constitutional authorization as it is an inherent power.

- Tax exemptions can be used to encourage economic growth.

- Tax laws must be construed strictly against the government and liberally in favor of taxpayers in cases of ambiguity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

General Principles and Concepts

1

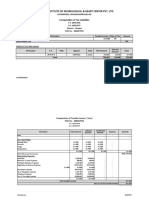

Problem 1-1

True or False

Write True if the statement is correct or False if the statement is

incorrect.

1

2

3

4

5

6

9

10

11

12

13

14

Eminent domain and police power can effectively be

performed even without taxation. F ( government needs

revenue to carry out all its functions)

Taxes may be imposed to encourage economic growth by

granting tax exemptions. T

Taxation is a way of apportioning the cost of government

among those who are privileged to enjoy its benefits. T

The state can enforce contributions upon its citizens in the

form of taxes even without a provision in the Constitution

authorizing it. T (this is an inherent power of the state)

The police power of the government may be exercised

through taxation.

When the power to tax is delegated to the local

government, only the legislative branch of the local

government can exercise the power.

The power of taxation can be exercised without limitation

because its scope is unlimited. F ( it has inherent and

constitutional limitations)

The power of taxation is absolute because it is the

strongest of all powers of the government. F ( subject to

inherent and constitutional limitations

Taxation presupposes an equivalent compensation. T

There is no imposition of amount in police power. F

Police power and eminent domain may defeat the

constitutional rights of a person.

Tax exemption applies only to government entities that

exercise proprietary functions. F ( government functions)

All government entities regardless of their functions are

exempted from taxes because it would be impractical for

the government to be taxing itself. F

The state can still exercise its taxing powers over its citizen

outside its territory. T (privity of relationship)

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Problem 1-3 True or False

Write True if the statement is correct or False if the statement is

incorrect.

1

Problem 1-2 True or False

Write True if the statement is correct or False if the statement is

incorrect.

No law granting any tax exemption shall be passed without

the concurrence of two thirds of the members of the

congress. F (only majority is required)

Churches are exempt from payment of income taxes. F

(exempt from real property taxes only)

A tax may be levied for the support of religious activities as

long as all churches benefit from it. F

A bill not signed by the President can still become law. T

(2/3 of members of the house is required)

No person shall be imprisoned for nonpayment of income

tax.

Taxation is considered as the lifeblood of the government

and every government unit must exercise this power.

The amount of taxes may be increased to curve spending

power and minimize inflation. T ( to decrease money

supply and consequently minimize inflation and spending

power)

Benefits from taxation have to be experienced to justify the

legitimacy of collection of taxes from the people. F

Taxes may be used as a tool and weapon in international

relations and protect trade relations. T

The power of legislative review in taxation is limited only to

the interpretation and application of tax laws. F ( judicial)

The rule of ex post facto law is applicable for tax

purposes. F

Real estate tax and income tax collected on the same real

estate property is double taxation. F (different nature)

A tax evader sidesteps the law, while the tax avoider

breaks it. F ( reverse)

Tax exemption is transferable and assignable. F ( it is

personal in nature)

Taxation is the governments legitimate means of

interfering with the private properties of its subjects.T

The doctrine of equitable recoupment is applicable to cases

where the taxes involved are totally unrelated.

Protection is the basic consideration that justifies tax situs.

T

The tax situs for occupation is the place where occupation

is pursued even if the criterion for nationality is given.

4 There is no direct double taxation by taxing corporate

income and corporate stockholders dividends from the

same corporation. T (different objects)

5 Tax laws are given retroactive effects. F

6 In the imposition of taxes, public purpose is presumed. T

7 Taxes are obligations created by law.

8 Taxes collected by the BIR are local taxes. F

9 Nonpayment of license fee makes the business illegal. T

10 In taxation, it is ones civil liability to pay taxes which gives

rise to criminal liability. T

11 Tax laws must be construed strictly against the

government, and tax exemptions must be construed

strictly against the taxpayer. T

12 As a rule doubts must be resolved liberally in favor of the

government and strictly against the taxpayer. F

13 The Philippine tax laws are not political and penal in

nature. T

14 When there is ambiguity of tax laws, the rules of statutory

construction may be used to search for the legislative

intent. However, when the meaning of the law is clear, the

statute must be enforced as written. T

15 Revenue regulations that are inconsistent with law have

the effect and force of law if they are useful and

reasonable. F

You might also like

- Audit of Stockholders EquityDocument25 pagesAudit of Stockholders Equityxxxxxxxxx87% (39)

- CHAPTER 7 Caselette - Audit of PPEDocument34 pagesCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- Income TaxationDocument190 pagesIncome TaxationRagnar Lothbrok44% (9)

- Tax Quiz 1Document4 pagesTax Quiz 1Peng GuinNo ratings yet

- CHAP 1 GEN. PRIN 7th PDFDocument87 pagesCHAP 1 GEN. PRIN 7th PDFJericho Luis100% (9)

- Nature and Scope of The Power of TaxationDocument4 pagesNature and Scope of The Power of Taxationwiggie2782% (17)

- Corporation ActivityDocument4 pagesCorporation ActivityLFGS FinalsNo ratings yet

- M6 - Deductions P4 (13C) Students'Document43 pagesM6 - Deductions P4 (13C) Students'micaella pasionNo ratings yet

- Situs of TaxationDocument18 pagesSitus of Taxationgerlyn montilla50% (2)

- Quiz Week 1Document10 pagesQuiz Week 1Katherine Ederosas50% (2)

- Principles of Taxation ReportDocument23 pagesPrinciples of Taxation Reportmangpat100% (1)

- Business and Transfer Taxation Chapter 13A Discussion Questions AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13A Discussion Questions AnswerKarla Faye Lagang100% (1)

- Essential Elements of A TaxDocument31 pagesEssential Elements of A TaxJosephine Berces100% (5)

- Activities Modules Memory Q&aDocument55 pagesActivities Modules Memory Q&aElla Marie LopezNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Special Exam TaxDocument11 pagesSpecial Exam TaxKenneth Bryan Tegerero TegioNo ratings yet

- Chapter 14 Income Taxation For IndividualsDocument19 pagesChapter 14 Income Taxation For IndividualsShane Sigua-Salcedo100% (2)

- True or False Questions Plus Multiple ChoiceDocument9 pagesTrue or False Questions Plus Multiple ChoiceRen A EleponioNo ratings yet

- IM Ch8-7e - WRLDocument21 pagesIM Ch8-7e - WRLAnonymous FFeOk16cINo ratings yet

- IM Ch14-7e - WRLDocument25 pagesIM Ch14-7e - WRLCharry RamosNo ratings yet

- Aspects of TaxationDocument1 pageAspects of TaxationJuvie AnNo ratings yet

- Dealings in Property-Income TaxationDocument70 pagesDealings in Property-Income TaxationKana Lou Cassandra Besana67% (3)

- Act 3Document8 pagesAct 3Memey C.No ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- HOMEWORK 5 Exclusion From Gross IncomeDocument3 pagesHOMEWORK 5 Exclusion From Gross Incomefitz garlitos100% (1)

- Business and TRansfer Taxation Chapter 12 Discussion Question AnswersDocument3 pagesBusiness and TRansfer Taxation Chapter 12 Discussion Question AnswersKarla Faye Lagang100% (1)

- Assignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYDocument2 pagesAssignment 2 TAXES, TAX LAWS AND TAX ADMIN ANSWER KEYRonna Mae DungogNo ratings yet

- Final Withholding Tax FWT and CapitalDocument40 pagesFinal Withholding Tax FWT and CapitalEdna PostreNo ratings yet

- Acct Chapter 15BDocument20 pagesAcct Chapter 15BEibra Allicra100% (1)

- Income Taxation by Nick Aduana Answer KeyDocument113 pagesIncome Taxation by Nick Aduana Answer KeyJonbon Tabas100% (1)

- Domondon's MCQDocument2 pagesDomondon's MCQAmer Hassan Guiling GuroNo ratings yet

- TaxationDocument13 pagesTaxationEmperiumNo ratings yet

- Minimum Wage EarnerDocument1 pageMinimum Wage EarnerJonna LynneNo ratings yet

- Sample Problems With Suggested Answers 2Document9 pagesSample Problems With Suggested Answers 2AnthonyNo ratings yet

- Statement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheDocument7 pagesStatement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheEdward Glenn Bagui0% (1)

- Law in PartnershipDocument15 pagesLaw in Partnershipmelody agravanteNo ratings yet

- Midterm ExamDocument3 pagesMidterm Examfitz garlitosNo ratings yet

- Final Income Taxation: Lesson 5Document28 pagesFinal Income Taxation: Lesson 5lc50% (4)

- STC Vat Test Bank 1Document29 pagesSTC Vat Test Bank 1alden123No ratings yet

- Tax Reviewer PDFDocument2 pagesTax Reviewer PDFwhin LimboNo ratings yet

- TaxationDocument13 pagesTaxationDea Lyn BaculaNo ratings yet

- Tax Reviewer General PrinciplesDocument28 pagesTax Reviewer General PrinciplesLouiseNo ratings yet

- Percentage Taxes NotesDocument4 pagesPercentage Taxes Notesrajahmati_28No ratings yet

- Strategic Management: Challenges in The External EnvironmentDocument8 pagesStrategic Management: Challenges in The External EnvironmentJhen-Jhen Geol-oh BaclasNo ratings yet

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- BFJPIA Cup 4 Business Law and TaxationDocument8 pagesBFJPIA Cup 4 Business Law and TaxationJerecko Ace ManlangatanNo ratings yet

- Tax Rev GenPrinciplesDocument8 pagesTax Rev GenPrinciplesAngela AngelesNo ratings yet

- Income Taxation: Rex B. Banggawan, Cpa, MbaDocument17 pagesIncome Taxation: Rex B. Banggawan, Cpa, Mbadeeznuts100% (1)

- SW06Document6 pagesSW06Nadi HoodNo ratings yet

- G. Nature, Construction, Application, and Sources of Tax LawsDocument12 pagesG. Nature, Construction, Application, and Sources of Tax LawsDon Dupio100% (1)

- Quiz On Chapter 13B&CDocument23 pagesQuiz On Chapter 13B&Cdianne caballeroNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource Waschiji chzzzmeowNo ratings yet

- Business Organization Case DigestsDocument40 pagesBusiness Organization Case Digestsjase100% (1)

- TaxationDocument10 pagesTaxationJash Angelo Garcia100% (2)

- Gacer, Ann Mariellene L. (Assignment No.2) TaxDocument6 pagesGacer, Ann Mariellene L. (Assignment No.2) TaxAnn Mariellene Gacer50% (2)

- IADocument7 pagesIANoreen Ledda100% (1)

- Chapter 1-2Document23 pagesChapter 1-2Add AllNo ratings yet

- Chapter 1 General Principles and Concepts of TaxationDocument14 pagesChapter 1 General Principles and Concepts of TaxationDea Lyn Bacula25% (4)

- TaxationDocument188 pagesTaxationNikolajay MarrenoNo ratings yet

- Income Tax CHAPTER 1:: Problem 1-1 True or FalseDocument8 pagesIncome Tax CHAPTER 1:: Problem 1-1 True or FalseMargaret LachoNo ratings yet

- (Tax) Gen Principles MCQDocument12 pages(Tax) Gen Principles MCQReginald ValenciaNo ratings yet

- Income Taxation Compressed SummaryDocument190 pagesIncome Taxation Compressed SummaryYvette RufoNo ratings yet

- TAX BOOK PRELIMS MASTER LIST CTRL F ANSWER KEYDocument79 pagesTAX BOOK PRELIMS MASTER LIST CTRL F ANSWER KEYAyen ArobintoNo ratings yet

- PRTC - Final PREBOARD Solution Guide (1 of 2)Document4 pagesPRTC - Final PREBOARD Solution Guide (1 of 2)Charry RamosNo ratings yet

- CRC Solution Set A & Set BDocument2 pagesCRC Solution Set A & Set BCharry RamosNo ratings yet

- Ap PRTC 07.29.13Document17 pagesAp PRTC 07.29.13Charry RamosNo ratings yet

- DONORS TAX - Theory 1 of 5Document5 pagesDONORS TAX - Theory 1 of 5Joey Acierda BumagatNo ratings yet

- Ap PRTC 07.29.13Document17 pagesAp PRTC 07.29.13Charry RamosNo ratings yet

- TOA 2012 Mock ExamDocument8 pagesTOA 2012 Mock ExamCharry RamosNo ratings yet

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsDocument7 pagesBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaNo ratings yet

- Bl.m-1402.Law On ContractsDocument23 pagesBl.m-1402.Law On ContractsCharry RamosNo ratings yet

- Cpar - Toa 07.27.13Document12 pagesCpar - Toa 07.27.13Charry Ramos100% (3)

- Certs - Auditing Problems Quizzers 2013Document14 pagesCerts - Auditing Problems Quizzers 2013Charry RamosNo ratings yet

- (Sffis: The 8tel. 735 9807 AccountancyDocument18 pages(Sffis: The 8tel. 735 9807 AccountancyCharry RamosNo ratings yet

- Practical Accounting 1: I ExamcoverageDocument12 pagesPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- CHAPTER 1 Caselette - Accounting CycleDocument51 pagesCHAPTER 1 Caselette - Accounting Cyclemjc24No ratings yet

- Segment ReportingDocument1 pageSegment ReportingCharry RamosNo ratings yet

- CHAPTER 6 Caselette - Audit of InvestDocument34 pagesCHAPTER 6 Caselette - Audit of InvestMr.AccntngNo ratings yet

- Aud TheoDocument30 pagesAud TheoCharry RamosNo ratings yet

- CHAPTER 2 Caselette - Correction of ErrorsDocument37 pagesCHAPTER 2 Caselette - Correction of Errorsmjc24100% (4)

- PRTC - Final PREBOARD Solution Guide (1 of 2)Document4 pagesPRTC - Final PREBOARD Solution Guide (1 of 2)Charry RamosNo ratings yet

- CRC Ace PW AudtheoryDocument27 pagesCRC Ace PW AudtheoryCharry RamosNo ratings yet

- Taxation of Individuals QuizzerDocument37 pagesTaxation of Individuals QuizzerCharry Ramos62% (13)

- Preweek Auditing Theory 2014Document31 pagesPreweek Auditing Theory 2014Charry Ramos33% (3)

- CRC Ace PW AudtheoryDocument27 pagesCRC Ace PW AudtheoryCharry RamosNo ratings yet

- Resa Pw-AtDocument24 pagesResa Pw-AtCharry Ramos100% (1)

- Contribution BEP MOS Sensitivity AnalysisDocument4 pagesContribution BEP MOS Sensitivity Analysissuresh sivadasanNo ratings yet

- 6) Stakeholders in Business Activities As Notes Final (D)Document12 pages6) Stakeholders in Business Activities As Notes Final (D)CRAZYBLOBY 99No ratings yet

- Bookkeeping AssessmentDocument6 pagesBookkeeping AssessmentGeraldNo ratings yet

- TATA aIG pRDOUCTSDocument6 pagesTATA aIG pRDOUCTSNakul MehtaNo ratings yet

- CH 26Document4 pagesCH 26Kurt Del RosarioNo ratings yet

- Taxation Law Review Final ExaminationsDocument4 pagesTaxation Law Review Final ExaminationsRufino Gerard MorenoNo ratings yet

- FAR 07 & 08 - Property, Plant and EquipmentDocument6 pagesFAR 07 & 08 - Property, Plant and Equipmentmrsjeon0501No ratings yet

- Sample Analysis PaperDocument30 pagesSample Analysis PaperRichard BorjaNo ratings yet

- Ola Cab BillDocument3 pagesOla Cab BillManish DamaniNo ratings yet

- CH #12Document5 pagesCH #12BWB DONALDNo ratings yet

- San Francisco Budget BasicsDocument6 pagesSan Francisco Budget Basicsadmin5057No ratings yet

- Kathmandu Hospital UpdatedDocument7 pagesKathmandu Hospital Updatedone twoNo ratings yet

- G.R. No. L-14519 July 26, 1960 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellant, vs. LUIS G. ABLAZA, Defendant. FactsDocument2 pagesG.R. No. L-14519 July 26, 1960 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellant, vs. LUIS G. ABLAZA, Defendant. FactsLiezl Oreilly VillanuevaNo ratings yet

- Pagcor Vs BirDocument2 pagesPagcor Vs BirMarie ChieloNo ratings yet

- FBS 112 Exam 2019Document10 pagesFBS 112 Exam 2019siyoliseworkNo ratings yet

- Damodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaDocument19 pagesDamodaram Sanjivayya National Law University Visakhapatnam, A.P., Indiashanika100% (1)

- GSTDocument9 pagesGSTAnonymous MkwpS2No ratings yet

- Learning Activity 10 Evidence 6: Video "Steps To Export"Document4 pagesLearning Activity 10 Evidence 6: Video "Steps To Export"Vanessa BabativaNo ratings yet

- Staff Emails ALL PDFDocument54 pagesStaff Emails ALL PDFRecordTrac - City of OaklandNo ratings yet

- A Study On Housing Finance Scheme and Its Tax Benefits With Special Reference To HDFC BankDocument99 pagesA Study On Housing Finance Scheme and Its Tax Benefits With Special Reference To HDFC BankDipesh KumarNo ratings yet

- Merak Fiscal Model Library: Kurdistan PSC (2006)Document2 pagesMerak Fiscal Model Library: Kurdistan PSC (2006)Libya TripoliNo ratings yet

- Ratio Analysis XII Class NotesDocument36 pagesRatio Analysis XII Class NotesRajesh NangaliaNo ratings yet

- Pre BayanDocument2 pagesPre BayanhassanbafcoNo ratings yet

- In Re Integration of The Bar 49 SCRA 22Document4 pagesIn Re Integration of The Bar 49 SCRA 22Ace QuebalNo ratings yet

- Balance B/F 0.00 Payments/RefundsDocument2 pagesBalance B/F 0.00 Payments/RefundssharonNo ratings yet

- Republic of The Philippines, Petitioner, Arcadio Ivan A. Santos Iii, and Arcadio C. Santos, JR., RespondentsDocument114 pagesRepublic of The Philippines, Petitioner, Arcadio Ivan A. Santos Iii, and Arcadio C. Santos, JR., RespondentsDonaldDeLeonNo ratings yet

- Furukawa Electric Autoparts Philippines IncDocument1 pageFurukawa Electric Autoparts Philippines IncMary Cris GenilNo ratings yet

- CP-22E IRS Response LetterDocument4 pagesCP-22E IRS Response LetterTRISTARUSA100% (2)

- Example - Assignable Purchase AgreementDocument2 pagesExample - Assignable Purchase AgreementRiangelli Exconde100% (1)

- My Case Study - MacroeconomicsDocument4 pagesMy Case Study - MacroeconomicsMarjorie Edurece CencesNo ratings yet