Professional Documents

Culture Documents

Wisconsin Income Tax: Tax District Check Below Then Fill in Either The Name

Wisconsin Income Tax: Tax District Check Below Then Fill in Either The Name

Uploaded by

test100Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wisconsin Income Tax: Tax District Check Below Then Fill in Either The Name

Wisconsin Income Tax: Tax District Check Below Then Fill in Either The Name

Uploaded by

test100Copyright:

Available Formats

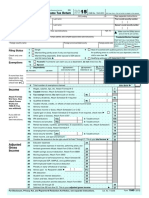

DO NOT STAPLE

WI-Z

Wisconsin

income tax

2014

Complete form using BLACK INK

Your legal last name

Legal first name

M.I.

Your social security number

If a joint return, spouses legal last name

Spouses legal first name

M.I.

Spouses social security number

Home address (number and street). If you have a PO Box, see page 6.

City or post office

State

Apt. No.

Zip code

Tax district Check below then fill in either the name

of city, village, or town and the county in which you

lived at the end of 2014.

City, village,

or town

Filing status

(check below)

City

Village

Town

County of

Single

School district number (see page23)

Married filing joint return

(even if only one had income)

Special

conditions

Print numbers like this

NO COMMAS; NO CENTS

Not like this

.00

1 Adjusted gross income from line 4 of federal Form 1040EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

ENCLOSE withholding statements

2 If your parent (or someone else) can claim you (or your spouse) as a dependent, check here . 2

3 Fill in the standard deduction for your filing status from table, page 31. But if you

checked line 2, fill in the amount from worksheet on back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.00

4 Subtract line 3 from line 1. If line 3 is larger than line 1, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . . 4

.00

5 Deduction for exemptions. Fill in $700 ($1,400 if married, or 0 if you checked line2 see

instructions on back) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6 Subtract line 5 from line 4. If line 5 is larger than line 4, fill in 0. This is your taxable income . 6

.00

7 Tax. Use amount on line 6 to find your tax using table, page 24 . . . . . . . . . . . . . . . . . . . . . . . 7

.00

8 School property tax credit

8a Rent paid in 2014 heat included . . . .

.00

Rent paid in 2014 heat not included .

.00

8b Property taxes paid on home in 2014 .

.00

9 Married couple credit. Wages 9a Yourself

(see instructions

9b Spouse

on reverse side)

.00

PAPER CLIP check or money order here

Find credit from

table page 12 ..... 8a

.00

Find credit from

table page 13 ..... 8b

.00

.00 x .03 = .... 9c

.00

.00

9c Fill in smaller of 9a or 9b but no more than $16,000

10 Add credits on lines 8a, 8b, and 9c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.00

11 Subtract line 10 from line 7. If line 10 is larger than line 7, fill in 0. This is your net tax . . . . . . . 11

.00

12 Sales and use tax due on Internet, mail order, or other out-of-state purchases (see page 14) . . . 12

.00

If you certify that no sales or use tax is due, check here. . . . . . . . . . . . . . . . . . . . . . . . .

13 Donations (decreases refund or increases amount owed)

a Endangered resources .

.00

f Firefighters memorial . . . . . . .

.00

b Packers football stadium .

.00

g Military family relief . . . . . . . . .

.00

c Cancer research . . . . . .

.00

h Second Harvest/Feeding Amer.

.00

.00

d Veterans trust fund . . . .

i Red Cross WI Disaster Relief .

.00

.00

e Multiple sclerosis . . . . . .

j Special Olympics Wisconsin . .

.00

Total (add lines a through j) . .

13k

14 Add lines 11, 12, and 13k . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

I-090i (R. 10-14)

.00

.00

2014 Form WIZ Name

SSN

Page 2 of2

15 Amount from line14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.00

16 Wisconsin income tax withheld. Enclose readable withholding statements . . . . . . . . . . . . . . . . 16

.00

17 If line 16 is larger than line 15, subtract line 15 from line 16 . . . . . . . . . This is YOUR REFUND 17

.00

18 If line 15 is larger than line 16, subtract line 16 from line 15 . . This is the AMOUNT YOU OWE 18

.00

Third Do you want to allow another person to discuss this return with the department (see page19)?

Party

Designees

Phone

no. ( )

Designee name

No

Sign below

Your signature

Yes Complete the following.

Personal

identification

number (PIN)

Under penalties of law, I declare that this return is true, correct, and complete to the best of my knowledge and belief.

Spouses signature (if filing jointly, BOTH must sign)

Date

Daytime phone

( )

Mail your return to:

Wisconsin Department of Revenue

If refund or no tax due ........PO Box 59, Madison WI 53785-0001

If tax due ............................PO Box 268, Madison WI 53790-0001

INSTRUCTIONS

Read Which Form to File for 2014 on page 3 of the Form 1A

instructions to see which form is right for you.

Filling in Your Return Use black ink to complete the copy

of the form that you file with the department. Round off cents

to the nearest dollar. Drop amounts under 50 and increase

amounts from 50 through 99 to the next dollar. If completing

the form by hand, do not use commas when filling in amounts.

Name and Address Print your legal name and address. If you

filed a joint return for 2013 and are filing a joint return for 2014

with the same spouse, enter your names and social security

numbers in the same order as on your 2013 return.

Line 2 Dependents Check line 2 if your parent (or someone

else) can claim you (or your spouse) as a dependent on his or her

return. Check line2 even if that person chose not to claim you.

Line 3 If you checked line 2, use this worksheet to figure the

amount to fill in on line 3.

A. Wages, salaries, and tips included in

line 1 of Form WIZ. (Do not include

interest income or taxable scholarships

or fellowships not reported on a W2.). . .

B. Addition amount . . . . . . . . . . . . . . . . . . . .

C. Add lines A and B. If total is less

than $1,000, fill in $1,000 . . . . . . . . . . . . .

D. Fill in the standard deduction for your

filing status using table, page 31 . . . . . . .

E. Fill in the SMALLER of line C or D

here and on line 3 of Form WIZ. . . . . . . .

A.

B.

.00

350.00

C.

.00

D.

.00

E.

.00

Line 5 A personal exemption is not allowed for a person who

can be claimed as a dependent on someone elses return. If

you are single and can be claimed as a dependent, fill in 0 on

line 5. If you are married and both spouses can be claimed as a

dependent, fillin 0 on line 5. If you are married and only one of

you can be claimed as a dependent, fill in $700 on line5.

Lines 8a and 8b School Property Tax Credit You may claim

a credit if, during 2014, you paid rent for living quarters used

as your primary residence OR you paid property taxes on your

home. See the instructions for lines 20a and 20b of Form1A.

The total credits on lines 8a and 8b cannot exceed $300.

Line 9 Married Couple Credit If you are married and you and

your spouse were both employed in 2014, you may claim the

married couple credit. Complete the following steps:

(1) Fill in your 2014 wages on line 9a. Fill in your spouses wages

on line 9b.

(2) Fill in the smaller of line 9a or 9b (but not more than $16,000)

in the space provided on line 9c.

(3) Multiply the amount determined in Step 2 by .03 (3%).

(4) Fill in the result (but not more than $480) on line 9c.

Line 12 Sales and Use Tax Due on Out-of-State Purchases

Ifyou made purchases from out-of-state firms during 2014 and

did not pay a sales and use tax, you may owe Wisconsin sales

and use tax. See the instructions for line 25 of Form 1A.

Line 13 Donations You may designate amounts as a donation

to one or more of the programs listed on lines13a through 13j.

Your donation will either reduce your refund or be added to tax

due. Add the amounts on lines13a through 13j and fill in the

total on line13k. See the instructions for line26 of Form1A for

further information on how your donation will be used.

Line 16 Wisconsin Income Tax Withheld Fill in the total

amount of Wisconsin income tax withheld as shown on your

withholding statements (W2s). Do not include income tax

withheld for any state other than Wisconsin. Enclose your

withholding statements.

Line 17 or 18 Fill in line 17 or 18 to determine your refund or

amount you owe. If you owe an amount, paper clip your check

or money order to FormWIZ. See page18 of the Form1A

instructions for information on paying by credit card or online.

Third Party Designee See page19 of the Form1A instructions.

Sign and Date Your Return Form WI-Z is not a valid return

unless you sign it. If married, your spouse must also sign.

Enclosures See Form 1A instructions (page19) for enclosures

that may be required. Do not enclose a copy of your federal

return.

You might also like

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- Week 2 Form 1040Document2 pagesWeek 2 Form 1040Linda100% (2)

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- Grammar Practice Worksheets - Simple Present - FromDocument1 pageGrammar Practice Worksheets - Simple Present - FromLeonel Agsgdf100% (7)

- F 1040Document2 pagesF 1040Kevin RowanNo ratings yet

- 2014 Federal 1040 (Esther)Document2 pages2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- Tax Return ProjectDocument62 pagesTax Return ProjectGiovaniPerez100% (1)

- Thin-Walled Tube Sampling of Fine-Grained Soils For Geotechnical PurposesDocument10 pagesThin-Walled Tube Sampling of Fine-Grained Soils For Geotechnical PurposesabualamalNo ratings yet

- Nestle HRM ReportDocument6 pagesNestle HRM Reporttarar580% (1)

- Construction Safety and Health ProgramDocument17 pagesConstruction Safety and Health ProgramJohny Lou Luza100% (2)

- MO-1040A Fillable Calculating - 2015 PDFDocument3 pagesMO-1040A Fillable Calculating - 2015 PDFAnonymous 3RVba19mNo ratings yet

- U.S. Individual Income Tax Return 1040A: Filing StatusDocument3 pagesU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNo ratings yet

- FORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short FormDocument2 pagesFORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short Formpixel986No ratings yet

- Senior Circuit Breaker 2014Document2 pagesSenior Circuit Breaker 2014Scott LieberNo ratings yet

- BilndDocument3 pagesBilndxabehe6146No ratings yet

- Form 9465-PDF Reader ProDocument2 pagesForm 9465-PDF Reader ProEdward FederisoNo ratings yet

- Worksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsDocument1 pageWorksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsKelly Phillips ErbNo ratings yet

- Installment Agreement RequestDocument2 pagesInstallment Agreement Request0scarNo ratings yet

- Schedule CB For Tax Year 2012Document2 pagesSchedule CB For Tax Year 2012Scott LieberNo ratings yet

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet

- Zuckerman2015 Tax ReturnDocument3 pagesZuckerman2015 Tax ReturnAnonymous 2zbzrvNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- Irs Form 9465 ExampleDocument2 pagesIrs Form 9465 ExampleScottNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax Returnmarxvera158No ratings yet

- F 1040 NRDocument5 pagesF 1040 NRsrao_919525No ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- 2010 Pa-1000Document2 pages2010 Pa-1000joekehmNo ratings yet

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- Credits For Qualifying Children and Other Dependents: Schedule 8812 (Form 1040) 47Document2 pagesCredits For Qualifying Children and Other Dependents: Schedule 8812 (Form 1040) 47plainnuts420No ratings yet

- F 1040Document2 pagesF 1040Sue BosleyNo ratings yet

- Fernando Vazquez567935467Document21 pagesFernando Vazquez567935467Richivee100% (2)

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- Form 9465 (Installment Agreement Request)Document2 pagesForm 9465 (Installment Agreement Request)Benne JamesNo ratings yet

- Indiana Full-Year Resident Individual Income Tax Return: State Form 154 (R9 / 9-10)Document2 pagesIndiana Full-Year Resident Individual Income Tax Return: State Form 154 (R9 / 9-10)surferdude1888No ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Document4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)ts0m3No ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- 2012 Federal ReturnDocument1 page2012 Federal Return24male86No ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- Complete A Separate Part III On Page 2 For Each Student For Whom You're Claiming Either Credit Before You Complete Parts I and IIDocument2 pagesComplete A Separate Part III On Page 2 For Each Student For Whom You're Claiming Either Credit Before You Complete Parts I and IIYum BuckerNo ratings yet

- Qualified Dividends and Capital Gains WorksheetDocument1 pageQualified Dividends and Capital Gains WorksheetBetty Ann LegerNo ratings yet

- 2021IowaRentReimbursementClaim (54130) 0Document2 pages2021IowaRentReimbursementClaim (54130) 0Tina EvansNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnadrianaNo ratings yet

- Pennsylvania Income Tax Return: Official Use OnlyDocument2 pagesPennsylvania Income Tax Return: Official Use OnlyVioleta BusuiocNo ratings yet

- F1040nre 2012 PDFDocument2 pagesF1040nre 2012 PDFJohanna AriasNo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- 2013 Form IL-1040: Personal InformationDocument2 pages2013 Form IL-1040: Personal Informationvimal_pro222-scribdNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- 2011 Pa-40Document2 pages2011 Pa-40Hesam AhmadiNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- f1040 Draft 2015Document3 pagesf1040 Draft 2015Anonymous IpryXQAKZNo ratings yet

- Ivan Incisor CH 2 Tax Return - For - FilingDocument4 pagesIvan Incisor CH 2 Tax Return - For - FilingShakilaMissz-KyutieJenkins100% (1)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354No ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- Fayaz CVDocument3 pagesFayaz CVQAIYUM khanNo ratings yet

- Skull Atlas: Anatomy & PhysiologyDocument6 pagesSkull Atlas: Anatomy & PhysiologyFrancheska Kyla GomezNo ratings yet

- EREC-43 Load ScheduleDocument61 pagesEREC-43 Load SchedulePartha SundarNo ratings yet

- Core Barrel Retrieval Systems-Low Res PDFDocument174 pagesCore Barrel Retrieval Systems-Low Res PDFAdair RivNo ratings yet

- Service Canada: Medical CertificateDocument1 pageService Canada: Medical CertificateHanoi JoeNo ratings yet

- Activity 3-Cognitive Diffusion Mindfulness Meditation 1Document3 pagesActivity 3-Cognitive Diffusion Mindfulness Meditation 1api-568093192No ratings yet

- 2.01 AssignmentDocument8 pages2.01 Assignmentanshi christinaNo ratings yet

- Touch HD Android EngDocument2 pagesTouch HD Android Engvaitheeswaran kumaravelNo ratings yet

- Malnutritiom and Anemia ImciDocument30 pagesMalnutritiom and Anemia ImcibaridacheNo ratings yet

- Primary Survey AssessmentDocument52 pagesPrimary Survey Assessmentlapkas donjuanNo ratings yet

- Part II PDFDocument28 pagesPart II PDFAdrian OprisanNo ratings yet

- Cooling Tower. Merkel Theory - TreybalDocument39 pagesCooling Tower. Merkel Theory - TreybalMarx CesarNo ratings yet

- Approaches of Community DevelopmentDocument26 pagesApproaches of Community DevelopmentWasafAliAzmatNo ratings yet

- XR 4 Manual Master 1Document1,226 pagesXR 4 Manual Master 1dragos43100% (1)

- Model Xql14/6Yb Hydraulic Power Tong: Operation ManualDocument12 pagesModel Xql14/6Yb Hydraulic Power Tong: Operation ManualMartinez Mauricio Martinez GomezNo ratings yet

- Various Methods of Packaging-Packaging Materials and TransportDocument17 pagesVarious Methods of Packaging-Packaging Materials and TransportvasantsunerkarNo ratings yet

- Acrylic YarnDocument3 pagesAcrylic Yarnmdfazle165No ratings yet

- A Study On Water AbsorbingDocument2 pagesA Study On Water AbsorbingInternational Journal of Innovative Science and Research Technology100% (1)

- Works MenuDocument2 pagesWorks Menuthescore25No ratings yet

- Short Notes Form 4 Biology Chapter 1 4 PDFDocument6 pagesShort Notes Form 4 Biology Chapter 1 4 PDFTanUeiHorngNo ratings yet

- Avanti wc3201d User ManualDocument17 pagesAvanti wc3201d User ManualElla MariaNo ratings yet

- RMO No. 34-2020Document1 pageRMO No. 34-2020Joel SyNo ratings yet

- Assessment Year: 2020 - 2021: Form of Return of Income Under The Income-Tax Ordinance, 1984 (XXXVI OF 1984)Document3 pagesAssessment Year: 2020 - 2021: Form of Return of Income Under The Income-Tax Ordinance, 1984 (XXXVI OF 1984)Shamim IqbalNo ratings yet

- Sect 1 CH 1 Ra Coswp 2010Document19 pagesSect 1 CH 1 Ra Coswp 2010hsaioudNo ratings yet

- Huawei Tds Sun2000-330ktl-H1 enDocument2 pagesHuawei Tds Sun2000-330ktl-H1 enMuhammad Ali HaiderNo ratings yet