Professional Documents

Culture Documents

6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EUR

6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EUR

Uploaded by

api-25889552Copyright:

Available Formats

You might also like

- First American Bank Case SolutionDocument13 pagesFirst American Bank Case Solutionharleeniitr80% (5)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Notes-Full-Set-Slides Stock Market PDFDocument185 pagesNotes-Full-Set-Slides Stock Market PDFbijayrNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireEhsan Khan100% (2)

- Sample Test 1Document12 pagesSample Test 1Heap Ke XinNo ratings yet

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552No ratings yet

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552No ratings yet

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDocument1 page11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552No ratings yet

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- 6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDDocument1 page6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDapi-25889552No ratings yet

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDocument1 page6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552No ratings yet

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552No ratings yet

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552No ratings yet

- 12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURDocument1 page12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURapi-25889552No ratings yet

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- 14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDDocument1 page14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDapi-25889552No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552No ratings yet

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552No ratings yet

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552No ratings yet

- 7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURDocument1 page7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURapi-25889552No ratings yet

- 95% Capital Protected Autocallable Certificate With MemoryDocument1 page95% Capital Protected Autocallable Certificate With Memoryapi-25889552No ratings yet

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Document1 page153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552No ratings yet

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552No ratings yet

- Capital Protection On EUR/CHF Foreign Exchange RateDocument1 pageCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552No ratings yet

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552No ratings yet

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552No ratings yet

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Document1 page75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552No ratings yet

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552No ratings yet

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDocument1 page2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552No ratings yet

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Document1 page61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552No ratings yet

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocument1 pageCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856No ratings yet

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDocument1 page67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552No ratings yet

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Bonus CertificateDocument7 pagesBonus Certificateaderajew shumetNo ratings yet

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552No ratings yet

- Capital Protected Note TermsheetDocument7 pagesCapital Protected Note Termsheettushar_mittal_2No ratings yet

- 74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010Document1 page74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010api-25889552No ratings yet

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856No ratings yet

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552No ratings yet

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552No ratings yet

- 111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEDocument1 page111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEapi-25889552No ratings yet

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552No ratings yet

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocument1 pageCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552No ratings yet

- 83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010Document1 page83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010api-25889552No ratings yet

- 95% Capital Protection - 100% Participation - 3 Years and 3 Months - Quanto CHFDocument1 page95% Capital Protection - 100% Participation - 3 Years and 3 Months - Quanto CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552No ratings yet

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552No ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552No ratings yet

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552No ratings yet

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552No ratings yet

- Morning News 12 May 2010Document3 pagesMorning News 12 May 2010api-25889552No ratings yet

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552No ratings yet

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552No ratings yet

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552No ratings yet

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDocument1 page62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDocument1 page97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Market Update: EquitiesDocument3 pagesDaily Market Update: Equitiesapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- CG European Income Fund: April 2010Document2 pagesCG European Income Fund: April 2010api-25889552No ratings yet

- Anas Assignment 1Document15 pagesAnas Assignment 1Laiba HassanNo ratings yet

- Mock 19 HL Paper 1 MarkschemeDocument13 pagesMock 19 HL Paper 1 MarkschemesumitaNo ratings yet

- Murali Krishnan - Resume - Boston MADocument2 pagesMurali Krishnan - Resume - Boston MAMurali KrishnanNo ratings yet

- SG 6941 Fx360 Favourite Strategies AW4Document27 pagesSG 6941 Fx360 Favourite Strategies AW4Zac CheahNo ratings yet

- 1979 Letter To Shareholders - Berkshire HathawayDocument9 pages1979 Letter To Shareholders - Berkshire HathawayYashNo ratings yet

- Business Plan Preparation Midterm ExamDocument5 pagesBusiness Plan Preparation Midterm ExamDiane DominiqueNo ratings yet

- App Econ Demand and SupplyDocument8 pagesApp Econ Demand and SupplyRegile Mae To-ongNo ratings yet

- Business IdiomsDocument4 pagesBusiness IdiomshryniaievaNo ratings yet

- Receipt From STC Pay: Transaction ID: 97770838 Amount 16093.23 PKR MTCN 0974782306Document1 pageReceipt From STC Pay: Transaction ID: 97770838 Amount 16093.23 PKR MTCN 0974782306DAWAYA BAKHSHNo ratings yet

- Agile Supply ChainDocument23 pagesAgile Supply ChainHaris MalikNo ratings yet

- Sajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillDocument1 pageSajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillMuzammal HamadNo ratings yet

- Michael Hardt Antonio Negri EmpireDocument496 pagesMichael Hardt Antonio Negri EmpireRomeo ZeffirelliNo ratings yet

- E Business Website: A Case Study of ASOSDocument4 pagesE Business Website: A Case Study of ASOSPatty NutnichaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Candy AvinashNo ratings yet

- Fardapaper Exploring The Effect of Starbucks Green Marketing On Consumers Purchase Decisions From Consumers' PerspectiveDocument14 pagesFardapaper Exploring The Effect of Starbucks Green Marketing On Consumers Purchase Decisions From Consumers' PerspectiveAsora Yasmin snehaNo ratings yet

- S&P 500 Index Fund ComparisonDocument3 pagesS&P 500 Index Fund Comparisonstevenacarpenter50% (2)

- 80 Trading Stategies For ForexDocument16 pages80 Trading Stategies For Forexnornart100% (1)

- T A T I: Investing Cycle Learning ObjectivesDocument15 pagesT A T I: Investing Cycle Learning ObjectivesAngelo PayawalNo ratings yet

- 1 Business Studies - XI (Subhash Dey)Document44 pages1 Business Studies - XI (Subhash Dey)priya tiwari100% (1)

- TD SequentialDocument8 pagesTD SequentialOxford Capital Strategies LtdNo ratings yet

- Appendix B, Profitability AnalysisDocument97 pagesAppendix B, Profitability AnalysisIlya Yasnorina IlyasNo ratings yet

- Competition Act 2002, IndiaDocument41 pagesCompetition Act 2002, Indiasuchitracool1No ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- ManipulationDocument13 pagesManipulationKevin Smith100% (2)

- ABC Costing Allied Office ProductsDocument13 pagesABC Costing Allied Office ProductsProfessorAsim Kumar Mishra100% (1)

- Unit 1 - IAPMDocument17 pagesUnit 1 - IAPMAmish QwertyNo ratings yet

6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EUR

6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EUR

Uploaded by

api-25889552Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EUR

6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EUR

Uploaded by

api-25889552Copyright:

Available Formats

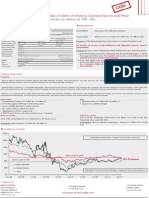

Autocall Certificate with Memory Effect on DJ EURO STOXX 50

6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EUR

Details Redemption

Issuer EFG Financial Products On 20.04.2010 Client pays EUR 1000 (Denomination)

Guarantor EFG International

Rating: Fitch A Each Month, from with N being the number of Months since the last Coupon (since inception if

Underlying DJ EURO STOXX 50 € Pr Month 1 to Month 11: no Coupon has been paid so far)

Bbg Ticker SX5E Index

Strike Level EUR 2983.17 If the Underlying closes above the Coupon Trigger Level:

Autocall Level (100%) EUR 2983.17 The Investor will receive a (N x 0.5%) Coupon

Coupon Trigger (70%) EUR 2088.22

Barrier Level (70%) EUR 2088.22 On top of the Coupon, if the Underlying closes above the Autocall Trigger Level:

Initial Fixing Level 20.04.2010 The product is early redeemed and the Investor receives a Cash Settlement in EUR equal to:

Payment Date 27.04.2010 Denomination. The product expires

Valuation Date 20.04.2011

Maturity 27.04.2011 On 20.04.2011 Client receives (if the product has not been early redeemed):

Details Cash Settlement

Monthly Autocall and Coupon Observation a. If the Underlying closes above the Barrier Level on the Valuation date:

ISIN CH0112094492 The Investor will receive a Cash Settlement in EUR equal to: Denomination x (1 + N x 0.5%)

Valoren 11209449

SIX Symbol not listed b. If the Underlying closes at or below the Barrier Level on the Valuation date:

The Investor will receive a Cash settlement in EUR equal to:

Denomination x Final Fixing Level of the Underlying / Strike Level

Characteristics

Underlying_____________________________________________________________________________________________________________________________________________________________________________________________

- The EURO STOXX 50 (Price) Index is a free-float market capitalization-weighted index of 50 European blue-chip stocks from those countries participating in the EMU. Each component's weight is capped at 10% of the

index's total free float market capitalization. The index was developed with a base value of 1000 as of December 31, 1991.

Opportunities______________________________________________________________________ Risks______________________________________________________________________________________________

1. Monthly opportunity to receive a 0.5% Coupon, with Memory effect feature 1. I f on the Valuation Date, the Underlying closes at or below the Barrier Level, the Investor will

2. Your capital is protected against a decrease of 30% at maturity suffer a loss reflecting the negative performance of the Underlying

3. Secondary market as liquid as equity markets

Best case scenario_________________________________________________________________ Worst case scenario_______________________________________________________________________________

The Underlying closes between the Coupon Trigger Level and the Autocall Level on The Underlying has never closed above the Coupon Trigger Level on each Observation Dates,

each Observation Date, and closes above the Coupon Trigger Lev el on the and it closes below the Barrier Level on the Valuation Date.

Redemption: Denomination + 12 Coupons of 0.5 (total return: 6%) Redemption: Denomination x Final Fixing Level of the Underlying / Strike Level

Historical Chart

4000

importer depuis la deuxieme feuille Observation date scenario

N Months since last Coupon

3500

Early Redemption:

Denomination

3000 Autocall Level at 100%

(N x 0.5% ) Coupon is paid

2500

30% Protection

Coupon Trigger and Barrier Levels at 70%

2000

On the Maturity Date: Negative

Performance of the Underlying

1500

Mar-08 Jul-08 Nov-08 Mar-09 Jul-09 Nov-09 Mar-10

Contacts

Filippo Colombo Christophe Spanier Nathanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

Stanislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publication serves only fo r information purposes and is not research; it constitutes neither a recommendation for the purchase of financial instruments nor an offer or an invitation for an offer. No responsibility is taken for the correctness of this info rmation. The financial instruments mentioned in this document are derivative instruments.

They do not qualify as units of a collective investment scheme pursuant to art. 7 et seqq. of the Swiss Federal Act on Collective Investment Schemes (CISA ) and are therefore neither registered nor supervised by the Swiss Financial M arket Supervisory A uthority FINM A. Investors bear the credit risk of the issuer/guarantor. Before investing in

derivative instruments, Investors are highly recommended to ask their financial advisor for advice specifically focused o n the Investor´s financial situation; the information contained in this document does no t substitute such advice. This publication do es not constitute a simplified pro spectus pursuant to art. 5 CISA , or a listing prospectus

pursuant to art. 652a or 1156 of the Swiss Code of Obligations. The relevant product documentatio n can be obtained directly at EFG Financial P roducts AG: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, or via e-mail: termsheet@efgfp.com. Selling restrictions apply for Europe, Hong Kong, Singapore, the USA, US persons, and the United Kingdom (t

law). The Underlyings´ performance in the past does not constitute a guarantee for their future performance. The financial products' value is subject to market fluctuation, what can lead to a partial or total loss of the invested capital. The purchase of the financial products triggers costs and fees. EFG Financial Products AG and/or another

related co mpany may operate as market maker for the financial products, may trade as principal, and may conclude hedging transactions. Such activity may influence the market price, the price movement, or the liquidity of the financial products. © EFG Financial P roducts A G A ll rights reserved.

You might also like

- First American Bank Case SolutionDocument13 pagesFirst American Bank Case Solutionharleeniitr80% (5)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Notes-Full-Set-Slides Stock Market PDFDocument185 pagesNotes-Full-Set-Slides Stock Market PDFbijayrNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireEhsan Khan100% (2)

- Sample Test 1Document12 pagesSample Test 1Heap Ke XinNo ratings yet

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552No ratings yet

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552No ratings yet

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDocument1 page11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552No ratings yet

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- 6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDDocument1 page6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDapi-25889552No ratings yet

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDocument1 page6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552No ratings yet

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552No ratings yet

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552No ratings yet

- 12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURDocument1 page12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURapi-25889552No ratings yet

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- 14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDDocument1 page14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDapi-25889552No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552No ratings yet

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552No ratings yet

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552No ratings yet

- 7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURDocument1 page7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURapi-25889552No ratings yet

- 95% Capital Protected Autocallable Certificate With MemoryDocument1 page95% Capital Protected Autocallable Certificate With Memoryapi-25889552No ratings yet

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Document1 page153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552No ratings yet

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552No ratings yet

- Capital Protection On EUR/CHF Foreign Exchange RateDocument1 pageCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552No ratings yet

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552No ratings yet

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552No ratings yet

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Document1 page75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552No ratings yet

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552No ratings yet

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDocument1 page2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552No ratings yet

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Document1 page61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552No ratings yet

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocument1 pageCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856No ratings yet

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDocument1 page67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552No ratings yet

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Bonus CertificateDocument7 pagesBonus Certificateaderajew shumetNo ratings yet

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552No ratings yet

- Capital Protected Note TermsheetDocument7 pagesCapital Protected Note Termsheettushar_mittal_2No ratings yet

- 74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010Document1 page74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010api-25889552No ratings yet

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856No ratings yet

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552No ratings yet

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552No ratings yet

- 111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEDocument1 page111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEapi-25889552No ratings yet

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552No ratings yet

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocument1 pageCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552No ratings yet

- 83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010Document1 page83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010api-25889552No ratings yet

- 95% Capital Protection - 100% Participation - 3 Years and 3 Months - Quanto CHFDocument1 page95% Capital Protection - 100% Participation - 3 Years and 3 Months - Quanto CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552No ratings yet

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552No ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552No ratings yet

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552No ratings yet

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552No ratings yet

- Morning News 12 May 2010Document3 pagesMorning News 12 May 2010api-25889552No ratings yet

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552No ratings yet

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552No ratings yet

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552No ratings yet

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDocument1 page62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDocument1 page97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Market Update: EquitiesDocument3 pagesDaily Market Update: Equitiesapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- CG European Income Fund: April 2010Document2 pagesCG European Income Fund: April 2010api-25889552No ratings yet

- Anas Assignment 1Document15 pagesAnas Assignment 1Laiba HassanNo ratings yet

- Mock 19 HL Paper 1 MarkschemeDocument13 pagesMock 19 HL Paper 1 MarkschemesumitaNo ratings yet

- Murali Krishnan - Resume - Boston MADocument2 pagesMurali Krishnan - Resume - Boston MAMurali KrishnanNo ratings yet

- SG 6941 Fx360 Favourite Strategies AW4Document27 pagesSG 6941 Fx360 Favourite Strategies AW4Zac CheahNo ratings yet

- 1979 Letter To Shareholders - Berkshire HathawayDocument9 pages1979 Letter To Shareholders - Berkshire HathawayYashNo ratings yet

- Business Plan Preparation Midterm ExamDocument5 pagesBusiness Plan Preparation Midterm ExamDiane DominiqueNo ratings yet

- App Econ Demand and SupplyDocument8 pagesApp Econ Demand and SupplyRegile Mae To-ongNo ratings yet

- Business IdiomsDocument4 pagesBusiness IdiomshryniaievaNo ratings yet

- Receipt From STC Pay: Transaction ID: 97770838 Amount 16093.23 PKR MTCN 0974782306Document1 pageReceipt From STC Pay: Transaction ID: 97770838 Amount 16093.23 PKR MTCN 0974782306DAWAYA BAKHSHNo ratings yet

- Agile Supply ChainDocument23 pagesAgile Supply ChainHaris MalikNo ratings yet

- Sajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillDocument1 pageSajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillMuzammal HamadNo ratings yet

- Michael Hardt Antonio Negri EmpireDocument496 pagesMichael Hardt Antonio Negri EmpireRomeo ZeffirelliNo ratings yet

- E Business Website: A Case Study of ASOSDocument4 pagesE Business Website: A Case Study of ASOSPatty NutnichaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Candy AvinashNo ratings yet

- Fardapaper Exploring The Effect of Starbucks Green Marketing On Consumers Purchase Decisions From Consumers' PerspectiveDocument14 pagesFardapaper Exploring The Effect of Starbucks Green Marketing On Consumers Purchase Decisions From Consumers' PerspectiveAsora Yasmin snehaNo ratings yet

- S&P 500 Index Fund ComparisonDocument3 pagesS&P 500 Index Fund Comparisonstevenacarpenter50% (2)

- 80 Trading Stategies For ForexDocument16 pages80 Trading Stategies For Forexnornart100% (1)

- T A T I: Investing Cycle Learning ObjectivesDocument15 pagesT A T I: Investing Cycle Learning ObjectivesAngelo PayawalNo ratings yet

- 1 Business Studies - XI (Subhash Dey)Document44 pages1 Business Studies - XI (Subhash Dey)priya tiwari100% (1)

- TD SequentialDocument8 pagesTD SequentialOxford Capital Strategies LtdNo ratings yet

- Appendix B, Profitability AnalysisDocument97 pagesAppendix B, Profitability AnalysisIlya Yasnorina IlyasNo ratings yet

- Competition Act 2002, IndiaDocument41 pagesCompetition Act 2002, Indiasuchitracool1No ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- ManipulationDocument13 pagesManipulationKevin Smith100% (2)

- ABC Costing Allied Office ProductsDocument13 pagesABC Costing Allied Office ProductsProfessorAsim Kumar Mishra100% (1)

- Unit 1 - IAPMDocument17 pagesUnit 1 - IAPMAmish QwertyNo ratings yet