Professional Documents

Culture Documents

Q1. Enter The Following Transactions in The Two-Column Journal Provided For Marc's Detailing. You May Omit Explanations

Q1. Enter The Following Transactions in The Two-Column Journal Provided For Marc's Detailing. You May Omit Explanations

Uploaded by

Valeed ChOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q1. Enter The Following Transactions in The Two-Column Journal Provided For Marc's Detailing. You May Omit Explanations

Q1. Enter The Following Transactions in The Two-Column Journal Provided For Marc's Detailing. You May Omit Explanations

Uploaded by

Valeed ChCopyright:

Available Formats

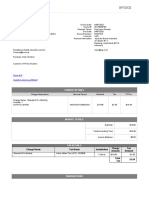

Q1. Enter the following transactions in the two-column journal provided for Marcs Detailing.

You may omit explanations.

Mar. 2

purchased auto cleaning supplies from Sung Suppliers for $400 on account.

4

Collected an account receivable of $360 from a customer, Dee-Lux Limousines.

5

Paid $175 in partial payment of an account payable to Modern Co for equipment purchased in February.

7

Issued capital stock in exchange for $3,500 cash.

9

Purchased office equipment from Wallys Warehouse for $4,200; paid $2,000 cash and issued a note payable due

in 90 days for the balance.

Q2. The accountant for All-Around Consulting prepared the following adjusted trial balance at December 31, 2005, after one

year of operations prepare closing enteries and the post closing trial balance.

Debit

Credit

Cash..................................................................................................

$ 5,400

Accounts Receivable.........................................................................

4,200

Unexpired Insurance.........................................................................

1,800

Office Equipment..............................................................................

18,000

Accumulated Depreciation: Office Equipment..................................

$ 300

Unearned Consulting Fees................................................................

3,000

Capital Stock.....................................................................................

15,000

Retained Earnings, January 1, 2005..................................................

2,400

Dividends..........................................................................................

800

Consulting Fees Earned.....................................................................

20,000

Salaries Expense...............................................................................

6,300

Utilities Expense...............................................................................

1,500

Rent Expense....................................................................................

2,400

Depreciation Expense........................................................................

300

______

$40,700

$40,700

Q3. At the end of the month the unadjusted trial balance of Three Star Company included the following accounts:

Debit

Credit

Sales (75% represent credit sales).........................................................

$1,380,000

Accounts Receivable ...........................................................................

$975,000

Allowance for Doubtful Accounts........................................................

11,750

1

Refer to the above data. If the income statement method of estimating uncollectible accounts expense is

followed, and uncollectible accounts expense is estimated to be 2% of net credit sales, the net realizable value

of Three Stars accounts receivable at the end of the month is?

2

Refer to the above data. If Three Star uses the balance sheet approach in estimating uncollectible accounts, and

aging the accounts receivable indicates the estimated uncollectible portion to be $24,000, the uncollectible

accounts expense for the month is?

Q4. Shown below is a partially completed bank reconciliation for Ruby Transport at August 31, as well as additional data necessary to

answer the questions that follow.

RUBY TRANSPORT

Bank Reconciliation

August 31, 20__

Balance per bank statement

$25,650

Balance per depositors records

$20,631

Additional information

a

Outstanding checks: no. 729, $1,790; no. 747, $350; no. 752, $1,115.

b

Check no. 742 (for repairs) was written for $568 but erroneously recorded in Rubys records as $865.

c

Deposits in transit, $3,220.

d

Note collected by the bank and credited to Rubys account, $6,900.

e

NSF check of C. Craig, one of Rubys customers, $2,178.

f

Bank service charge for August, $35.

Q1.

2004

Mar 2

Supplies

430

Accounts Payable

430

Bought supplies from Sung Supplies.*

Cash

360

Accounts Receivable

360

Collected from Dee-Lux Limousines.*

Accounts Payable

175

Cash

175

Partial

Co.* payment on amount due to Modern

7

Cash

3,500

Capital Stock

3,500

Issued stock.

Office Equipment

4,200

Cash

2,000

Notes Payable

2,200

Purchased office equipment from Wallys

Warehouse; note due in 90 days.*

Q2.

DR

Consulting Fees Earned.................................................

Income Summary

CR

20,000

20,000

Income Summary

10,500

Salaries Expense...........................................

6,300

Utilities Expense..........................................

1,500

Rent Expense................................................

2,400

Depreciation Expense...................................

300

Income Summary...........................................................

9,500

Retained Earnings........................................

9,500

Retained Earnings..........................................................

800

Dividends.....................................................

Q3.

800

At the end of the month the unadjusted trial balance of Three Star Company

included the following accounts:

Debit

Sales (75% represent credit sales)..................

Credit

$1,380,000

Accounts Receivable ...................................... $975,000

Allowance for Doubtful Accounts.....................

Refer to the above data. If the income statement method of

estimating uncollectible accounts expense is followed, and uncollectible

accounts expense is estimated to be 2% of net credit sales, the net

realizable value of Three Stars accounts receivable at the end of the

month is:

a

11,750

$1,359,300. b

$20,700.

$32,450.

$942,550.

Refer to the above data. If Three Star uses the balance sheet

approach in estimating uncollectible accounts, and aging the accounts

receivable indicates the estimated uncollectible portion to be $24,000,

the uncollectible accounts expense for the month is:

a

$24,000.

$12,250.

$35,750.

$11,750.

Q4.

Shown below is a partially completed bank reconciliation for Ruby Transport at

August 31, as well as additional data necessary to answer the questions that

follow.

RUBY TRANSPORT

Bank Reconciliation

August 31, 20__

Balance per bank statement

$25,650

Add:

(1)

Deduct:

(2)

Adjusted cash balance

Balance per depositors records

$20,631

Add:

(3)

Deduct:

(4)

Adjusted cash balance

Additional information

a

Outstanding checks: no. 729, $1,790; no. 747, $350; no. 752, $1,115.

Check no. 742 (for repairs) was written for $568 but erroneously

recorded in Rubys records as $865.

Deposits in transit, $3,220.

Note collected by the bank and credited to Rubys account, $6,900.

NSF check of C. Craig, one of Rubys customers, $2,178.

Bank service charge for August, $35.

In Rubys completed bank reconciliation at August 31, what dollar

amount should be deducted from the balance per bank statement

(indicated by 2 above)?

a

$3,255.

$2,213.

$3,552.

$3,220.

$3,255.

$7,197.

$6,603.

In Rubys completed bank reconciliation at August 31, what dollar

amount should be deducted from the balance per depositors records

(indicated by 4 above)?

a

In Rubys completed bank reconciliation at August 31, what dollar

amount should be added to the balance per depositors records

(indicated by 3 above)?

a

$2,510.

$1,846.

$3,255.

$2,510.

$2,213.

Ruby Transport keeps $500 cash on hand in addition to this checking

account and has no other bank accounts or cash equivalents. What

amount should appear as Cash in Rubys August 31 balance sheet?

a

$26,115.

$20,631.

$25,650.

Some other amount.

The necessary adjustment to Ruby Transports accounting records as of

August 31 includes a net:

a

Increase to Cash of $4,390. c

Increase to Cash of $4,984.

Increase to Cash of $1,916. d

Decrease to Cash of $35

You might also like

- Understanding Business and Personal Law - 2305Document879 pagesUnderstanding Business and Personal Law - 2305Valeed Ch100% (1)

- Financial Accounting and Reporting Fundamentals 2nd Edition Zeus Vernon MillanDocument603 pagesFinancial Accounting and Reporting Fundamentals 2nd Edition Zeus Vernon MillanJamie Rose Aragones100% (1)

- Mastering Correction of Accounting Errors TestbankDocument9 pagesMastering Correction of Accounting Errors TestbankLade Palkan67% (3)

- Latihan Acca v02Document17 pagesLatihan Acca v02Indriyanti KrisdianaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Xls259 Xls EngDocument3 pagesXls259 Xls EngValeed ChNo ratings yet

- Ayesha FinalDocument91 pagesAyesha FinalValeed ChNo ratings yet

- Written QuestionsDocument33 pagesWritten QuestionsLet it beNo ratings yet

- On Corporate Governance Under Companies ActDocument14 pagesOn Corporate Governance Under Companies ActPawan Kmuar Yadav100% (1)

- Chapter 7 Question Review PDFDocument12 pagesChapter 7 Question Review PDFChit ComisoNo ratings yet

- ACC17-FAR Take Home Activities 1 and 2: Test IDocument19 pagesACC17-FAR Take Home Activities 1 and 2: Test IJustine Cruz67% (3)

- Tutorial Before UTS Peng Akun 1Document11 pagesTutorial Before UTS Peng Akun 1Fanji AriefNo ratings yet

- Chapter 7 Question Review 11th EdDocument12 pagesChapter 7 Question Review 11th EdKryzzel Anne JonNo ratings yet

- Intermidate AssignmentDocument6 pagesIntermidate AssignmentTahir DestaNo ratings yet

- Audit of Cash and Cash EquivalentsDocument4 pagesAudit of Cash and Cash EquivalentsstillwinmsNo ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- Intermediate Accounting 1Document14 pagesIntermediate Accounting 1cpacpacpa100% (1)

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Long Quiz 1 Acc 205Document6 pagesLong Quiz 1 Acc 205Philip LarozaNo ratings yet

- Acc 106 Quiz BR and Ar NoakDocument8 pagesAcc 106 Quiz BR and Ar Noakhoneyjoy salapantanNo ratings yet

- F CFAS-EXAM - Docx 143874436Document48 pagesF CFAS-EXAM - Docx 143874436Athena AthenaNo ratings yet

- Accounting Cash Internal ControlsDocument14 pagesAccounting Cash Internal ControlsDave A ValcarcelNo ratings yet

- A. What Are Necessary Document To Support Settlement Travel Advance?Document3 pagesA. What Are Necessary Document To Support Settlement Travel Advance?Vermuda VermudaNo ratings yet

- Accounting Questions 22Document3 pagesAccounting Questions 22rln0518No ratings yet

- Assignment For 2nd Yr Eco. StudentsDocument3 pagesAssignment For 2nd Yr Eco. StudentsMan SanchoNo ratings yet

- Mid Term POA - Test 01Document8 pagesMid Term POA - Test 01Trang Ca CaNo ratings yet

- Audit of CashDocument6 pagesAudit of CashMark Lord Morales Bumagat100% (2)

- Prelim ExamDocument7 pagesPrelim ExamHoney Grace TangarurangNo ratings yet

- Bank Reconciliation RevisionDocument4 pagesBank Reconciliation RevisionFadzir AmirNo ratings yet

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuNo ratings yet

- ACC101 Chapter6newxcxDocument18 pagesACC101 Chapter6newxcxAhmed RawyNo ratings yet

- Tutorial 6Document3 pagesTutorial 6Wan LinNo ratings yet

- Multiple ChoicesDocument5 pagesMultiple ChoicesAdlan AfnanNo ratings yet

- Financial Accounting Final AssessmentDocument17 pagesFinancial Accounting Final AssessmentroydkaswekaNo ratings yet

- C02 Sample Questions Feb 2013Document20 pagesC02 Sample Questions Feb 2013Elizabeth Fernandez100% (1)

- Audit 2 - Topic1PdfDocument20 pagesAudit 2 - Topic1PdfKenata FauziNo ratings yet

- Test 3 QuestionsDocument8 pagesTest 3 QuestionsArt and Fashion galleryNo ratings yet

- Self-Test 1Document8 pagesSelf-Test 1Dymphna Ann CalumpianoNo ratings yet

- PA Sample MCQs 2Document15 pagesPA Sample MCQs 2ANH PHẠM QUỲNHNo ratings yet

- Revision Questions 2Document14 pagesRevision Questions 2najihah AnualNo ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewNayan SahaNo ratings yet

- Bahria University, Islamabad Campus: C. Line ManagersDocument4 pagesBahria University, Islamabad Campus: C. Line ManagersIfrah BashirNo ratings yet

- Intaudp - Mem02Document2 pagesIntaudp - Mem02Cal PedreroNo ratings yet

- Revision 2Document3 pagesRevision 2Jerlin PreethiNo ratings yet

- SuspenseDocument2 pagesSuspenseDipankar MallickNo ratings yet

- AP Quiz 1 (B46)Document19 pagesAP Quiz 1 (B46)Jacqueline OrtegaNo ratings yet

- T3 2004 - Dec - QDocument8 pagesT3 2004 - Dec - QVinh Ngo NhuNo ratings yet

- Week.2. Completing Accounting Cyscel - Ss-2020 Review and ExerciseDocument2 pagesWeek.2. Completing Accounting Cyscel - Ss-2020 Review and ExerciseAngela ThrisanandaNo ratings yet

- Problems Inter Acc1Document10 pagesProblems Inter Acc1Chau NguyenNo ratings yet

- Quizzer (Cash To Inventory Valuation) KeyDocument10 pagesQuizzer (Cash To Inventory Valuation) KeyLouie Miguel DulguimeNo ratings yet

- Auditing Quiz - Cash and Cash Equivalents Auditing Quiz - Cash and Cash EquivalentsDocument3 pagesAuditing Quiz - Cash and Cash Equivalents Auditing Quiz - Cash and Cash EquivalentsLawrence YusiNo ratings yet

- Bank Reconciliation: Everett Community College Tutoring CenterDocument3 pagesBank Reconciliation: Everett Community College Tutoring Centerehab_ghazallaNo ratings yet

- Chapter 5Document5 pagesChapter 5Abrha636No ratings yet

- Accounting Assignment 05A 207Document11 pagesAccounting Assignment 05A 207Aniyah's RanticsNo ratings yet

- Exercises 1Document8 pagesExercises 1Altaf HussainNo ratings yet

- 28 Days Accounts Challenge-1Document13 pages28 Days Accounts Challenge-1krishnaeatpute777No ratings yet

- 28 Days Accounts Challenge-1Document20 pages28 Days Accounts Challenge-1selvammsmaniNo ratings yet

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- Introductory Financial Accounting - Mock PaperDocument12 pagesIntroductory Financial Accounting - Mock PaperSuyash DixitNo ratings yet

- Financial Accounting Test One (01) James MejaDocument21 pagesFinancial Accounting Test One (01) James MejaroydkaswekaNo ratings yet

- Accounting For Cash and ReceivableDocument7 pagesAccounting For Cash and ReceivableAbrha GidayNo ratings yet

- ACFrOgCou4wKTauTkea Z6 FCVPWeJGqSpgleXqjesbx28oB34Ab yimjiedN0OQAAWExpJ4Z0URQ7cHjvLbb CYn8WgHpdz3wnDavUewUjSa5IyXyAVaWRvKApm-huNKA9kPdyoMBVMyYs5WehlDocument2 pagesACFrOgCou4wKTauTkea Z6 FCVPWeJGqSpgleXqjesbx28oB34Ab yimjiedN0OQAAWExpJ4Z0URQ7cHjvLbb CYn8WgHpdz3wnDavUewUjSa5IyXyAVaWRvKApm-huNKA9kPdyoMBVMyYs5Wehl有钱的啵啵No ratings yet

- Acc SampleexamDocument12 pagesAcc SampleexamAmber AJNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Marketing Strategy of Nestle: BBA LLL Ali Raza 14-Arid-4830Document42 pagesMarketing Strategy of Nestle: BBA LLL Ali Raza 14-Arid-4830Valeed ChNo ratings yet

- Mid Term Datesheet Spring 2017Document4 pagesMid Term Datesheet Spring 2017Valeed ChNo ratings yet

- Spring 2017 Time TableDocument13 pagesSpring 2017 Time TableValeed ChNo ratings yet

- Career Drive Feedback Form: Scale: (Completely Disagree) 1 - 5 (Completely Agree)Document1 pageCareer Drive Feedback Form: Scale: (Completely Disagree) 1 - 5 (Completely Agree)Valeed ChNo ratings yet

- MKT624 - Final Term Quiz Master File SolvedDocument72 pagesMKT624 - Final Term Quiz Master File SolvedSaad Ul HasanNo ratings yet

- Chapter 08Document34 pagesChapter 08Valeed ChNo ratings yet

- The Ritz Carlton Hotel Company: Case Analysis of Organizational CultureDocument17 pagesThe Ritz Carlton Hotel Company: Case Analysis of Organizational CultureValeed ChNo ratings yet

- Subcultures of Consumption - An Ethnography of The New BikersDocument20 pagesSubcultures of Consumption - An Ethnography of The New BikersValeed ChNo ratings yet

- Big-B Versus Big-O For MBAs of OBLDocument17 pagesBig-B Versus Big-O For MBAs of OBLValeed ChNo ratings yet

- Assumptions:: Related To Lecture 13 and 14: What-If Game With The Five Year Fin PlanDocument6 pagesAssumptions:: Related To Lecture 13 and 14: What-If Game With The Five Year Fin PlanValeed ChNo ratings yet

- Defining Research ProblemDocument13 pagesDefining Research ProblemValeed ChNo ratings yet

- Chapter 7 Consumer Learning: Consumer Behavior, 10e (Schiffman/Kanuk)Document34 pagesChapter 7 Consumer Learning: Consumer Behavior, 10e (Schiffman/Kanuk)Valeed Ch100% (1)

- Mbaiseca: Financial Statement Analysis: Dr. Kumail Abbas Rizvi Human Resource Management: Prof. F.A. FareedyDocument1 pageMbaiseca: Financial Statement Analysis: Dr. Kumail Abbas Rizvi Human Resource Management: Prof. F.A. FareedyValeed ChNo ratings yet

- SFM 10e TB Chap 3Document22 pagesSFM 10e TB Chap 3Valeed ChNo ratings yet

- Organization Studies 2014 Brown 0170840614559259Document13 pagesOrganization Studies 2014 Brown 0170840614559259Valeed ChNo ratings yet

- Marble IndustryDocument17 pagesMarble IndustryValeed ChNo ratings yet

- Schiffman01 9ed TBDocument22 pagesSchiffman01 9ed TBValeed ChNo ratings yet

- Periodic TableDocument36 pagesPeriodic TableValeed ChNo ratings yet

- Strategies and Tactics For Distributive BargainingDocument24 pagesStrategies and Tactics For Distributive BargainingValeed ChNo ratings yet

- Key Operating and Financial DataDocument1 pageKey Operating and Financial DataValeed ChNo ratings yet

- Seminarski Rad 2014-15 FPSP ModelDocument7 pagesSeminarski Rad 2014-15 FPSP ModelAleksandar TomićNo ratings yet

- Abacus SmartPrice CueCardDocument2 pagesAbacus SmartPrice CueCardfmfarazmalikNo ratings yet

- Invoice: Zoom W-9 Question About Your Billing?Document2 pagesInvoice: Zoom W-9 Question About Your Billing?Ardhan FadhlurrahmanNo ratings yet

- Final Examination Principles of Finance (DPF 24153)Document9 pagesFinal Examination Principles of Finance (DPF 24153)USHA PERUMALNo ratings yet

- Foreclosed Property BidDocument14 pagesForeclosed Property BidJessah JaliqueNo ratings yet

- Relationship Manager or Sales ManagerDocument2 pagesRelationship Manager or Sales Managerapi-121421428No ratings yet

- Federal Income Tax OutlineDocument62 pagesFederal Income Tax OutlineLiz ElidrissiNo ratings yet

- Corporate Finance 1st Edition Booth Test BankDocument31 pagesCorporate Finance 1st Edition Booth Test Banka430138385No ratings yet

- Loan ProposalsDocument14 pagesLoan ProposalsEisen Slouchy0% (1)

- Introductio1 AmitDocument11 pagesIntroductio1 AmitKaranPatilNo ratings yet

- UPSCPORTAL Magazine Civil Services 2009 Pre SpecialDocument113 pagesUPSCPORTAL Magazine Civil Services 2009 Pre SpecialJaya Ram M100% (1)

- Statement of Profit or Loss and Other Comprehensive IncomeDocument3 pagesStatement of Profit or Loss and Other Comprehensive IncomePatricia San Pablo100% (1)

- Cash Flow Statements - Pas 7Document1 pageCash Flow Statements - Pas 7JyNo ratings yet

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNo ratings yet

- FinMan Module 5 Time Value of MoneyDocument9 pagesFinMan Module 5 Time Value of Moneyerickson hernanNo ratings yet

- Jimma University Jimma Institute of Technology Mechanical Engineering DepartmentDocument30 pagesJimma University Jimma Institute of Technology Mechanical Engineering Departmentzetseat100% (1)

- Fundamental Analysis of INFOSYSDocument25 pagesFundamental Analysis of INFOSYSsohelrangrej21No ratings yet

- Sukanya Samriddhi Yojana PDFDocument1 pageSukanya Samriddhi Yojana PDFSai SrinivasNo ratings yet

- LAW485Document35 pagesLAW485Roxana Iskandar100% (1)

- Gala vs. ElliceDocument18 pagesGala vs. ElliceRaymarc Elizer AsuncionNo ratings yet

- Alerus Beneficiary FormDocument3 pagesAlerus Beneficiary Formambasyapare1No ratings yet

- Swift Messaging Factsheet Corporateactions56104Document4 pagesSwift Messaging Factsheet Corporateactions56104kartikb60No ratings yet

- 2023 Killara High School - S2 - TrialDocument63 pages2023 Killara High School - S2 - TrialretroreinactNo ratings yet

- Income StatementDocument24 pagesIncome StatementFarheen AkramNo ratings yet

- Saving, Capital Accumulation, and OutputDocument37 pagesSaving, Capital Accumulation, and OutputbenimadimkemalNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptRaghavendra KumarNo ratings yet

- Raise Money - WS PDFDocument24 pagesRaise Money - WS PDFxZeep DNo ratings yet