Professional Documents

Culture Documents

Coupon 10% P.A. - American Barrier at 80% - 3 Months - USD

Coupon 10% P.A. - American Barrier at 80% - 3 Months - USD

Uploaded by

api-25889552Copyright:

Available Formats

You might also like

- Micro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full ChapterDocument67 pagesMicro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full Chapterchristine.parsons231100% (6)

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCDocument1 pageCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552No ratings yet

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856No ratings yet

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDocument1 pageCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552No ratings yet

- Coupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCDocument1 pageCoupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCapi-25889552No ratings yet

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552No ratings yet

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552No ratings yet

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856No ratings yet

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocument1 pageCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552No ratings yet

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552No ratings yet

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDocument1 pageCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552No ratings yet

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocument1 pageCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552No ratings yet

- Single Barrier Reverse Convertible On GERDAU SADocument1 pageSingle Barrier Reverse Convertible On GERDAU SAapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552No ratings yet

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPDocument1 pageCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552No ratings yet

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552No ratings yet

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552No ratings yet

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDDocument1 pageCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552No ratings yet

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552No ratings yet

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552No ratings yet

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552No ratings yet

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQDocument1 pageCoupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQapi-25889552No ratings yet

- Coupon 18% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 18% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552No ratings yet

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552No ratings yet

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552No ratings yet

- Coupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNDocument1 pageCoupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNapi-25889552No ratings yet

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552No ratings yet

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDocument1 page11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552No ratings yet

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552No ratings yet

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDocument1 page2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552No ratings yet

- Coupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFDocument1 pageCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552No ratings yet

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocument1 pageCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856No ratings yet

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDocument1 page67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552No ratings yet

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552No ratings yet

- 260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onDocument1 page260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onapi-25889552No ratings yet

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552No ratings yet

- 83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010Document1 page83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010api-25889552No ratings yet

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552No ratings yet

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552No ratings yet

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Document1 page61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552No ratings yet

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- WSP Fulcrum Security Exercises VFDocument4 pagesWSP Fulcrum Security Exercises VFManeeshNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552No ratings yet

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552No ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552No ratings yet

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552No ratings yet

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552No ratings yet

- Morning News 12 May 2010Document3 pagesMorning News 12 May 2010api-25889552No ratings yet

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552No ratings yet

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552No ratings yet

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552No ratings yet

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDocument1 page62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDocument1 page97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Market Update: EquitiesDocument3 pagesDaily Market Update: Equitiesapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- CG European Income Fund: April 2010Document2 pagesCG European Income Fund: April 2010api-25889552No ratings yet

- Lenovo G460 G560 User GuideDocument130 pagesLenovo G460 G560 User GuidejoreyvilNo ratings yet

- 20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4Document2 pages20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4SerenaNo ratings yet

- 2014-01-15 US (Szymoniak) V American Doc 241-1 Memo MTD JPMCDocument23 pages2014-01-15 US (Szymoniak) V American Doc 241-1 Memo MTD JPMClarry-612445No ratings yet

- Electrical Testing ProeduresDocument9 pagesElectrical Testing ProeduresUdhayakumar VenkataramanNo ratings yet

- Sema V COMELEC DigestDocument5 pagesSema V COMELEC DigestTrizia VeluyaNo ratings yet

- PayslipDocument2 pagesPaysliprajdeep singhNo ratings yet

- Nicole Elyse NelsonDocument3 pagesNicole Elyse Nelsonapi-331206184No ratings yet

- Pulsar: Pulse Burst RadarDocument8 pagesPulsar: Pulse Burst RadartungluongNo ratings yet

- 003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English HDocument33 pages003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English Hcricketprediction8271No ratings yet

- V 12 - Schedule of Important Labor Laws - 22.02.2023Document6 pagesV 12 - Schedule of Important Labor Laws - 22.02.2023haris hafeezNo ratings yet

- Indian Ports Community SystemDocument6 pagesIndian Ports Community Systempatil sNo ratings yet

- Government of Madhya Pradesh Public Health Engineering DepartmentDocument63 pagesGovernment of Madhya Pradesh Public Health Engineering DepartmentShreyansh SharmaNo ratings yet

- Specification of ZXDC02 HP400Document2 pagesSpecification of ZXDC02 HP400huynhphucthoNo ratings yet

- Omml 0416 19Document14 pagesOmml 0416 19ahmed nasserNo ratings yet

- JVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Document81 pagesJVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Сержант БойкоNo ratings yet

- 2-3 Tree PDFDocument8 pages2-3 Tree PDFHitesh GuptaNo ratings yet

- Percentage Increase and DecreaseDocument3 pagesPercentage Increase and DecreaseLai Kee KongNo ratings yet

- Gripping, Prying and TwistingDocument8 pagesGripping, Prying and TwistingLeslie Joy Anastacio VizcarraNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Ponzi Scheme - EditedDocument4 pagesPonzi Scheme - EditedGifted MaggieNo ratings yet

- Casing Collar LocatorDocument4 pagesCasing Collar LocatorHammad ShouketNo ratings yet

- Hanspaul Automechs LTD Vs Rsa LTD Civil Appli No.126 of 2018 Hon - Kitusi, J.ADocument11 pagesHanspaul Automechs LTD Vs Rsa LTD Civil Appli No.126 of 2018 Hon - Kitusi, J.AJoyce MasweNo ratings yet

- Flyback ConverterDocument18 pagesFlyback Converter25Krishnapriya S SNo ratings yet

- Anexa 2. Eon 25Document11 pagesAnexa 2. Eon 25Alexandra AntonNo ratings yet

- SL-53625 Rev02 07-08Document111 pagesSL-53625 Rev02 07-08Abdul Aziz ShawnNo ratings yet

- L Uk SulphDocument24 pagesL Uk SulphypyeeNo ratings yet

- Adams, Clark - 2009 - Landfill Bio DegradationDocument17 pagesAdams, Clark - 2009 - Landfill Bio Degradationfguasta100% (1)

- Auction News Journal 3.1.14Document15 pagesAuction News Journal 3.1.14Etrans 1No ratings yet

- Data Sheet - Proofpoint Enterprise PrivacyDocument4 pagesData Sheet - Proofpoint Enterprise PrivacyJoseNo ratings yet

Coupon 10% P.A. - American Barrier at 80% - 3 Months - USD

Coupon 10% P.A. - American Barrier at 80% - 3 Months - USD

Uploaded by

api-25889552Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coupon 10% P.A. - American Barrier at 80% - 3 Months - USD

Coupon 10% P.A. - American Barrier at 80% - 3 Months - USD

Uploaded by

api-25889552Copyright:

Available Formats

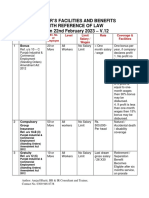

Single Barrier Reverse Convertible on AMERICAN INTERNATIONAL GROUP

Coupon 10% p.a. - American Barrier at 80% - 3 Months - USD

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 06.05.2010 Client pays USD 1000 (Denomination)

Rating: Fitch A

Underlying AMERICAN INTERNATIONAL GROUP On 06.08.2010 Client receiv es 2.5% in fine (10% p.a.) Coupon

Bbg Ticker AIG US Equity

Payment Date 06.05.10 PLUS

Valuation Date 30.07.10

Maturity 06.08.10 Scenario 1: if the Underlying has never traded at or below the Barrier level

Strike Level USD 41.6 (100%)

The Investor will receive a Cash Settlement equal to the Denomination

Barrier Level USD 33.28 (80%)

EU Saving Tax Option Premium Component 2.42% (9.68% p.a.)

Scenario 2: if the Underlying traded at least once at or below the Barrier level

Interest Component 0.08% (0.32% p.a.)

Details Physical Settlement American Barrier a. If the Final Fixing Level is at or below the Strike Level, the Investor will

Conversion Ratio 24.04 receive a predefined round number (i.e. Conversion Ratio) of the

ISIN CH0112499550 Underlying per Denomination.

Valoren 11249955

b. If the Final Fixing Level is above the Strike Level, the Investor will receive a

SIX Symbol not listed

Cash Settlement in the Settlement Currency equal to: Denomination

Characteristics

Underlying_______________________________________________________________________________________________________________________________________________________

American International Group, Inc. is a holding company which, through its subsidiaries provides a varied range of insurance and insurance-related

activities in the United States and abroad. The Company's main activities include both general insurance and life insurance & retirement services operations

as well as financial services and asset management.

Opportunities______________________________________________________________ Risks__________________________________________________________________________

1. A guaranteed Coupon of 2.5% in fine (10% p.a.) 1. Maximum yield is limited to 2.5% in fine (10% p.a.)

2. Protection against 20% drop in Underlying's price 2. Exposure to v olatility changes

3. Low er v olatility than direct equity exposure

4. Secondary market as liquid as a share

5. Optimization of EU Tax components

Best case scenario_________________________________________________________ Worst case scenario___________________________________________________________

The Underlying has nev er traded below the Barrier Lev el The Underlying traded below the Barrier Lev el and on the Final Fixing Date

closes under the Barrier Lev el

Redemption: Denomination + Coupon of 2.5% in fine (10% p.a.) Redemption: Underlying + Coupon of 2.5% in fine (10% p.a.)

Historical Chart

50 importer depuis la deuxieme feuille Redemption: 100% and a Coupon of

2.5% in fine (10% p.a.)

45

Strike: USD 41.6 (100% of Spot Reference)

40

20% Protection

35

Barrier: USD 33.28 (80% of Strike Level)

30

Redemption: 24.04 shares and a

Coupon of 2.5% in fine (10% p.a.)

25

20

Aug-09 Nov-09 Feb-10

Contacts

Filippo Colombo Christ ophe Spanier Nat hanael Gabay

Bruno Frat eschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cut uri Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly for info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n for an offer. No respo nsibility is taken fo r the co rrectness o f this information. The financial

instruments mentio ned in this do cument are derivative instruments. They do no t qualify as units o f a collective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct on Co llective Investment Schemes (CISA ) and are therefore neither registered nor supervised by

the Swiss Financial M arket Superviso ry A utho rity FINM A . Investo rs bear the credit risk o f the issuer/guarantor. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial advisor fo r advice specifically fo cused o n the Investo r´s financial

situatio n; the information co ntained in this do cument do es no t substitute such advice. This publicatio n do es no t co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de of Obligatio ns. The relevant product

do cumentatio n can be o btained directly at EFG Financial P ro ducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, or via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Kong, Singapo re, the USA , US perso ns, and the United Kingdo m (the issuance is subje

law). The Underlyings´ perfo rmance in the past do es not co nstitute a guarantee for their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial or total lo ss o f the invested capital. The purchase o f the financial pro ducts triggers

co sts and fees. EFG Financial P ro ducts A G and/or ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity

o f the financial pro ducts. © EFG Financial P ro ducts A G A ll rights reserved.

You might also like

- Micro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full ChapterDocument67 pagesMicro Econ 6 Principles of Microeconomics 6Th Edition William A Mceachern Full Chapterchristine.parsons231100% (6)

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCDocument1 pageCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552No ratings yet

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856No ratings yet

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDocument1 pageCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552No ratings yet

- Coupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCDocument1 pageCoupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCapi-25889552No ratings yet

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552No ratings yet

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552No ratings yet

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856No ratings yet

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocument1 pageCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552No ratings yet

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552No ratings yet

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDocument1 pageCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552No ratings yet

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocument1 pageCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552No ratings yet

- Single Barrier Reverse Convertible On GERDAU SADocument1 pageSingle Barrier Reverse Convertible On GERDAU SAapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552No ratings yet

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPDocument1 pageCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552No ratings yet

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552No ratings yet

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552No ratings yet

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDDocument1 pageCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552No ratings yet

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552No ratings yet

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552No ratings yet

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552No ratings yet

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQDocument1 pageCoupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQapi-25889552No ratings yet

- Coupon 18% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 18% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552No ratings yet

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552No ratings yet

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552No ratings yet

- Coupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNDocument1 pageCoupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNapi-25889552No ratings yet

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552No ratings yet

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDocument1 page11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552No ratings yet

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552No ratings yet

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDocument1 page2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552No ratings yet

- Coupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFDocument1 pageCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552No ratings yet

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocument1 pageCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856No ratings yet

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDocument1 page67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552No ratings yet

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552No ratings yet

- 260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onDocument1 page260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onapi-25889552No ratings yet

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552No ratings yet

- 83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010Document1 page83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010api-25889552No ratings yet

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552No ratings yet

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552No ratings yet

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Document1 page61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552No ratings yet

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- WSP Fulcrum Security Exercises VFDocument4 pagesWSP Fulcrum Security Exercises VFManeeshNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552No ratings yet

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552No ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552No ratings yet

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552No ratings yet

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552No ratings yet

- Morning News 12 May 2010Document3 pagesMorning News 12 May 2010api-25889552No ratings yet

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552No ratings yet

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552No ratings yet

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552No ratings yet

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDocument1 page62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDocument1 page97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Market Update: EquitiesDocument3 pagesDaily Market Update: Equitiesapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- CG European Income Fund: April 2010Document2 pagesCG European Income Fund: April 2010api-25889552No ratings yet

- Lenovo G460 G560 User GuideDocument130 pagesLenovo G460 G560 User GuidejoreyvilNo ratings yet

- 20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4Document2 pages20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4SerenaNo ratings yet

- 2014-01-15 US (Szymoniak) V American Doc 241-1 Memo MTD JPMCDocument23 pages2014-01-15 US (Szymoniak) V American Doc 241-1 Memo MTD JPMClarry-612445No ratings yet

- Electrical Testing ProeduresDocument9 pagesElectrical Testing ProeduresUdhayakumar VenkataramanNo ratings yet

- Sema V COMELEC DigestDocument5 pagesSema V COMELEC DigestTrizia VeluyaNo ratings yet

- PayslipDocument2 pagesPaysliprajdeep singhNo ratings yet

- Nicole Elyse NelsonDocument3 pagesNicole Elyse Nelsonapi-331206184No ratings yet

- Pulsar: Pulse Burst RadarDocument8 pagesPulsar: Pulse Burst RadartungluongNo ratings yet

- 003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English HDocument33 pages003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English Hcricketprediction8271No ratings yet

- V 12 - Schedule of Important Labor Laws - 22.02.2023Document6 pagesV 12 - Schedule of Important Labor Laws - 22.02.2023haris hafeezNo ratings yet

- Indian Ports Community SystemDocument6 pagesIndian Ports Community Systempatil sNo ratings yet

- Government of Madhya Pradesh Public Health Engineering DepartmentDocument63 pagesGovernment of Madhya Pradesh Public Health Engineering DepartmentShreyansh SharmaNo ratings yet

- Specification of ZXDC02 HP400Document2 pagesSpecification of ZXDC02 HP400huynhphucthoNo ratings yet

- Omml 0416 19Document14 pagesOmml 0416 19ahmed nasserNo ratings yet

- JVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Document81 pagesJVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Сержант БойкоNo ratings yet

- 2-3 Tree PDFDocument8 pages2-3 Tree PDFHitesh GuptaNo ratings yet

- Percentage Increase and DecreaseDocument3 pagesPercentage Increase and DecreaseLai Kee KongNo ratings yet

- Gripping, Prying and TwistingDocument8 pagesGripping, Prying and TwistingLeslie Joy Anastacio VizcarraNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Ponzi Scheme - EditedDocument4 pagesPonzi Scheme - EditedGifted MaggieNo ratings yet

- Casing Collar LocatorDocument4 pagesCasing Collar LocatorHammad ShouketNo ratings yet

- Hanspaul Automechs LTD Vs Rsa LTD Civil Appli No.126 of 2018 Hon - Kitusi, J.ADocument11 pagesHanspaul Automechs LTD Vs Rsa LTD Civil Appli No.126 of 2018 Hon - Kitusi, J.AJoyce MasweNo ratings yet

- Flyback ConverterDocument18 pagesFlyback Converter25Krishnapriya S SNo ratings yet

- Anexa 2. Eon 25Document11 pagesAnexa 2. Eon 25Alexandra AntonNo ratings yet

- SL-53625 Rev02 07-08Document111 pagesSL-53625 Rev02 07-08Abdul Aziz ShawnNo ratings yet

- L Uk SulphDocument24 pagesL Uk SulphypyeeNo ratings yet

- Adams, Clark - 2009 - Landfill Bio DegradationDocument17 pagesAdams, Clark - 2009 - Landfill Bio Degradationfguasta100% (1)

- Auction News Journal 3.1.14Document15 pagesAuction News Journal 3.1.14Etrans 1No ratings yet

- Data Sheet - Proofpoint Enterprise PrivacyDocument4 pagesData Sheet - Proofpoint Enterprise PrivacyJoseNo ratings yet