Professional Documents

Culture Documents

Congressman Honda's Small Business Resource Guide

Congressman Honda's Small Business Resource Guide

Uploaded by

Mike HondaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Congressman Honda's Small Business Resource Guide

Congressman Honda's Small Business Resource Guide

Uploaded by

Mike HondaCopyright:

Available Formats

Small

Business

Resource Guide

U.S. REPRESENTATIVE MIKE HONDA

Californias 17th Congressional District

March 2016

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 1

Table of Contents

Introduction ............................................................................................................................................................................ 4

Congressman Honda Services for Small Businesses .............................................................................................................. 5

Letters of Support from Congressman Honda .................................................................................................................... 5

Grant Letter Request Form ................................................................................................................................................. 6

Casework ............................................................................................................................................................................. 7

Small Business Resources .................................................................................................................................................... 8

Federal Support ...................................................................................................................................................................... 9

Small Business Loans ........................................................................................................................................................... 9

1)

7(a) Loan Program ................................................................................................................................................... 9

2)

CDC/504 Loan ........................................................................................................................................................ 10

3)

Disaster Loan ......................................................................................................................................................... 10

4)

Export Express Loans ............................................................................................................................................. 11

5)

Export Transaction Financing ................................................................................................................................ 11

6)

International Trade Loans ..................................................................................................................................... 12

7)

Military Reservists Loan ........................................................................................................................................ 12

8)

Patriot Express & Pilot Programs .......................................................................................................................... 13

9)

Microloans ............................................................................................................................................................. 13

Technical Support and Development Programs................................................................................................................ 15

1)

Silicon Valley BusinessSource Centers .................................................................................................................. 15

2)

Small Business Development Centers (SBDCS) ..................................................................................................... 16

3)

Womens Business Centers ................................................................................................................................... 16

4)

Department of Defense Procurement Technical Assistance Program (PTAP) ...................................................... 16

5)

Silicon Valley Service Corps of Retired Executives (SCORE) .................................................................................. 17

Capital Access Programs .................................................................................................................................................... 18

1)

Small Business Administration Programs .............................................................................................................. 18

Tax Incentives .................................................................................................................................................................... 20

1)

Alternative Minimum Tax Exemption ................................................................................................................... 20

2)

Amortization of Business Start-Up Costs .............................................................................................................. 21

3)

Net Operating Losses............................................................................................................................................. 21

4)

Partial Exclusion of Capital Gains on Certain Small Business Stock ...................................................................... 21

5) Losses on Small Business Investment Company Stock Treated as Ordinary Losses without Limitation .............. 22

1 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

6)

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 2

Rollover of Gains into Specialized Small Business Stock ....................................................................................... 22

7)

Uniform Capitalization of Inventory Costs ............................................................................................................ 23

8)

Simplified Dollar-Value LIFO Accounting Method for Small Firms ........................................................................ 23

9)

Tax Credit for Pension Plan Star-Up Costs of Small Firms ..................................................................................... 23

10)

Tax Credit for Cost of Making a Business More Accessible to the Disabled ..................................................... 24

Grant Programs ................................................................................................................................................................. 25

Small Business Administration .......................................................................................................................................... 25

1)

Small Business Innovation Research Awards (SBIR) .............................................................................................. 25

2)

Small Business Technology Transfer (STTR) Awards ............................................................................................. 26

United States Department of Transportation ................................................................................................................... 27

1)

Procurement Assistance Division .......................................................................................................................... 27

Local Funding Opportunities. ............................................................................................................................................... 30

California Small Business Loans ......................................................................................................................................... 30

1)

California Industrial Development Financing Advisory Commission (CIDFAC) Programs ..................................... 30

2)

Industrial Development Revenue Bond (IDB) Program ........................................................................................ 31

3)

Recycling Market Development Zone (RMDZ) Revolving Loan Program .............................................................. 32

4)

Replacement of Underground Storage Tank (RUST) Program Loans ................................................................. 33

5)

California Capital Access Program (CalCAP) .......................................................................................................... 34

6)

Small Business Loan Guarantee Program .............................................................................................................. 34

7)

Small Business Pollution Control Tax-Exempt Bond Financing Program .............................................................. 35

California Technical Support and Development Programs for Small Business ................................................................. 37

1)

California Get Your Business Online ...................................................................................................................... 37

2)

Business Matchmaking .......................................................................................................................................... 37

3)

Silicon Valley Service Core of Retired Executives (SCORE) .................................................................................... 38

4)

Disabled Veteran Business Enterprise (DVBE) and Small Business (SB) Certification Programs .......................... 38

5)

Disadvantaged Business Programs ........................................................................................................................ 39

California Small Business Tax Incentives ........................................................................................................................... 41

1)

Enterprise Zone Program ...................................................................................................................................... 41

2)

Local Agency Military Base Recovery Area (LAMBRA) .......................................................................................... 43

3)

Other Tax Incentives .............................................................................................................................................. 44

California Small Business Grants ....................................................................................................................................... 45

1)

Innovative Clean Air Technologies (ICAT) Program............................................................................................... 45

2 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 3

2) Electric Program Investment Charge (EPIC) .......................................................................................................... 45

3) The Buy California Initiative .................................................................................................................................. 46

4)

Tire Grant Program ................................................................................................................................................ 47

5)

Replacement of Underground Storage Tanks (RUST) Program Grants .............................................................. 48

3 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 4

Introduction

Dear Friend,

Small businesses are the engine of our economy thats why Im proud to support small businesses as your

Member of Congress. As the Lead Democratic Member of the Commerce, Justice, Science Appropriations Subcommittee,

Im working to boost support for the Department of Commerces work to create the conditions for economic growth and

opportunity.

Hitting the ground running on the first week of this Congress, I introduced four bills designed to help start-up and

small businesses create jobs as they work to further expand Silicon Valleys innovation economy. Companies on the brink

of breakthroughs that will improve the lives of millions of people need assistance to stay in business until they can begin

turning a profit on their innovations. The jobs these businesses create will help reduce the income inequality that is hurting

our overall economy.

Additionally, my job is to serve you as a liaison with the federal government often to lesser known resources. My

offices in Santa Clara, CA and Washington, D.C. are both available to assist you, whether it's following up on a pending

visa application, resolving difficulties with shipments in customs, inquiring about federal loans or regulations, or

providing a letter of support when you are seeking a federal grant. My staff can connect you with federal resources and

agencies that assist small businesses and entrepreneurs on a range of issues, including business regulations, financing,

government contracting, export assistance, and overseas investment opportunities.

Case in point: My staff helped Mark, a CA17 resident, after the IRS erroneously levied a $34,000 tax against his

closed company. We worked with the IRS for four months until his entire penalty was abated. We also helped Maria, a

lawful permanent resident, when her sons were still petitioning to become lawful permanent residents. My staff inquired

and Marias sons immediately received employment authorization and were able to start work. You can continue to count

on my services and commitment to legislation to support the entrepreneurial spirit and dynamic economy of Silicon Valley.

For more information on how I can help your business,

please visit http://honda.house.gov/services/business-assistance

Sincerely,

Mike Honda

U.S. House of Representatives

4 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 5

Congressman Honda Services for Small Businesses

Letters of Support from Congressman Honda

While Congressman Honda does NOT decide which organizations are awarded grants or other federal funding, there

are instances in which it is appropriate for the Congressman to write a letter of support for an application. If you wish

to request a letter of support for your application, you must supply Congressman Honda with the following:

1.

2.

3.

4.

A description of your organization,

A summary of the application,

A description of what the money will be used for, and

A draft letter of support

Please send this information via the form on page 6 (Grant Letter Request Form) to Honda.district@mail.house.gov

or by mail to either our district office or our office located in Washington, DC:

Washington, DC Office

1713 Longworth House Office Building

Washington, DC 20515

Phone: 202-225-2631

Fax: (202) 225-2699

District Office

900 Lafayette Street, Suite 206

Santa Clara, CA 95050

Phone: (408) 436-2720

Fax: (408) 436-2721

5 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

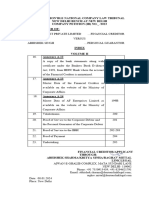

GRANT LETTER REQUEST FORM

P a g e | 6

Requests will be reviewed within two business days.

If approved, grant support letters are typically available within 5 business days

You MUST provide a draft grant support letter at the time of the request.

Grant Applicant Information

Organization/Agency:

Contact Person/Title:

Address:

Telephone:

Fax:

Email:

Grantor Information

Organization/Agency:

Contact Person/Title:

Address:

Telephone:

Fax:

Email:

Grant Information

Title of Grant:

Title of Project/Program:

Amount Requested:

Brief Description of Project/Program:

Target Community (Who will be served?):

Mailing Instructions

Send letter to: Grantor

Grantee

Method:

US Mail

Fax

Email (scanned) Pickup Other

Address (if different than above):

Grant Application Deadline:

Grant Letter Receipt Deadline:

Additional Information

6 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 7

Casework

If you have encountered a problem involving a federal government agency or federally subsidized benefit that you have

not been able to successfully resolve, Congressman Hondas staff of constituent liaisons may be able to assist you in the

following areas:

Employment Issues: including assistance with disability benefits, employer-provided health care plans and COBRA,

Family Medical Leave Act (FMLA) benefits, pensions, unemployment benefits, Federal and State Workers Compensation

claims and retirement-related issues.

Consumer Affairs: including assistance obtaining a home loan modification under the Making Home Affordable Program,

insurance claims, dissatisfaction with consumer products or services, environmental regulations and concerns regarding

air quality, water or land contamination.

Immigration Issues: including issues with visitor visas, family and employment based visas, lawful permanent resident

status, naturalization, international adoptions, detention, passports, customs and border issues and assistance to

American Citizens in crisis abroad.

Veteran Issues: including issues with VA pension and disability benefits, education benefits, veteran burial or funeral

issues and issues regarding the VA medical centers.

IRS Issues: including connecting constituents with the Taxpayer Advocate Service to address federal tax issues including

lost or delayed tax refunds, penalty abatements, payment installation plans, tax credits, referrals to IRS Low Income Tax

Clinics and paper tax forms.

Military Issues: including issues pertaining to the Department of Defense, Army, Navy, Marine Corps, Air Force, Coast

Guard, Reserves and California National Guard, as well as obtaining military records, medals and academy nominations.

Health Care Issues: including issues with Medicare and Medicaid, health insurance, insurance providers, nursing homes,

hospitals, and prescription drugs.

Social Security: including issues with Supplemental Security Income, Social Security Disability, survivors benefits, and

retirement benefits.

Social Services: including issues with food stamps, HEAP (low-income heating program), FEMA and disaster relief, and

issues related to federally subsidized housing.

Please visit the Services section of www.honda.house.gov or call (408) 436-2720 for further information. Please

note that if you are seeking assistance with a case that involves a lawsuit or litigation, House Rules prohibit the Office

of Congressman Honda from giving legal advice or intervening in the proceeding.

7 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 8

Small Business Resources

1. For Small Business resources specific to California, including information on starting or expanding business, please

visit: http://business.ca.gov/Programs/SmallBusiness.aspx

2. For more information on federal small business loans, please visit: https://www.sba.gov/content/what-sbaoffers-help-small-businesses-grow

3. For veterans looking for business assistance, please visit the Veterans Business Outreach Center at:

http://www.vbocix.org/

8 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 9

Federal Support

Small Business Loans

1) 7(a) Loan Program

The 7(a) Loan Program is SBAs primary program to help start-up and existing small businesses obtain

financing when they might not be eligible for business loans through normal lending channels. The name

comes from section 7(a) of the Small Business Act, which authorizes SBA to provide business loans to

American small businesses. SBA itself does not make loans, but rather guarantees a portion of loans made

and administered by commercial lending institutions.

Additional Information:

7(a) loans are the most basic and most commonly used type of loans. They are also the most flexible, since

financing can be guaranteed for a variety of general business proposals, including working capital,

machinery and equipment, furniture and fixtures, land and building (including purchase, renovation and new

construction), leasehold improvements, and debt refinancing (under special conditions).

All 7(a) loans are provided by lenders who are called participants because they participate with SBA in the

7(a) program. Not all lenders choose to participate, but most American banks do. There are also some non-

bank lenders who participate with SBA in the 7(a) program, which expands the availability of lenders making

loans under SBA guidelines.

Eligibility:

The eligibility requirements are designed to be as broad as possible in order for this lending program to

accommodate the most diverse variety of small business financing needs. All businesses that are considered

for financing under SBAs 7(a) loan program must: meet SBA size standards, be for-profit, not already have

the internal resources (business or personal) to provide the financing and be able to demonstrate

repayment.

Eligibility factors for all 7(a) loans include: size, type of business, use of proceeds and the availability of funds

from other sources.

Contact Information:

For more information, please visit: https://www.sba.gov/loans-grants/see-what-sba-offers/sba-loanprograms/7a-loan-program

9 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 10

2) CDC/504 Loan

The CDC/504 Loan program is a long-term financing tool for economic development within a community.

The 504 Program provides growing businesses with long-term, fixed-rate financing for major fixed assets,

such as land and buildings. A Certified Development Company (CDC) is a nonprofit corporation set up to

contribute to the economic development of its community. CDCs work with the SBA and private-sector

lenders to provide financing to small businesses. There are about 270 CDCs nationwide, with each covering a

specific geographic area.

Additional Information:

Proceeds from 504 loans must be used for fixed asset projects such as: purchasing land and improvements,

including existing buildings, grading, street improvements, utilities, parking lots and landscaping;

construction of new facilities, or modernizing, renovating or converting existing facilities; or purchasing long-

term machinery and equipment. The 504 Program cannot be used for working capital or inventory,

consolidating or repaying debt, or refinancing.

Interest rates on 504 loans are pegged to an increment above the current market rate for five-year and 10-

year U.S. Treasury issues. Maturities of 10 and 20 years are available. Fees total approximately three (3)

percent of the debenture and may be financed with the loan.

Eligibility:

To be eligible, the business must be operated for profit and fall within the size standards set by the SBA.

Under the 504 Program, the business qualifies as small if it does not have a tangible net worth in excess of

$7.5 million and does not have an average net income in excess of $2.5 million after taxes for the preceding

two years. Loans cannot be made to businesses engaged in speculation or investment in rental real estate.

Contact Information:

For more information, please visit: https://www.sba.gov/loans-grants/see-what-sba-offers/sba-loanprograms/cdc-504

Telephone: (800) 827-5722

3) Disaster Loan

If you are in a declared disaster area and are the victim of a disaster, you may be eligible for financial

assistance from the U.S. Small Business Administration (SBA)- even if you don't own a business. As a

homeowner, renter and/or personal-property owner, you may apply to the SBA for a loan to help you

recover from a disaster.

Additional Information:

Personal Property Loan: This loan can provide a homeowner or renter with up to $40,000 to help repair or

replace personal property, such as clothing, furniture, automobiles, etc., lost in the disaster. As a rule of

thumb, personal property is anything that is not considered real estate or a part of the actual structure. This

loan may not be used to replace extraordinarily expensive or irreplaceable items, such as antiques,

collections, pleasure boats, recreational vehicles, fur coats, etc.

Real Property Loan: A homeowner may apply for a loan of up to $200,000 to repair or restore their primary

home to its pre-disaster condition. The loan may not be used to upgrade the home or make additions to it.

If, however, city or county building codes require structural improvements, the loan may be used to meet

these requirements. Loans may be increased by as much as 20 percent to protect the damaged real property

from possible future disasters of the same kind.

Contact Information:

10 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 11

For more information please visit: https://www.sba.gov/loans-grants/see-what-sba-offers/sba-loanprograms/disaster

Telephone: (800) 827-5722

4) Export Express Loans

The SBA Export Express program provides exporters and lenders a streamlined method to obtain SBA backed

financing for loans and lines of credit up to $250,000. Lenders use their own credit decision process and loan

documentation; exporters get access to their funds faster. The SBA provides an expedited eligibility review

and provides a response in less than 24 hours.

Additional Information:

SBA Export Express loans are available to businesses that meet the normal requirements for an SBA business

loan guaranty. Financing is available for manufacturers, wholesalers, export trading companies and service

exporters. Loan applicants must demonstrate that the loan proceeds will enable them to enter a new export

market or expand an existing export market. Applicants must have been in business, though not necessarily

in exporting, for at least 12 months.

The SBA does not establish or subsidize interest rates on loans. Interest rates are negotiated between the

borrower and the lender, but may never exceed SBA interest rate caps. Rates can either be fixed or variable,

and are tied to the prime rate as published in The Wall Street Journal.

Contact Information:

San Francisco (Territory: Northern California)

Jeff Deiss

International Trade Finance Manger, Western US

Office of International Trade, SBA

U.S. Small Business Administration

50 Fremont Street, Suite 2450

San Francisco, CA 94105

Tel: 415-744-7730 Fax: 202-292-3534

Email: jeff.deiss@sba.gov

More Information: https://www.sba.gov/content/export-express-loan-program

5) Export Transaction Financing

SBAs Export Working Capital Program (EWCP) loans are targeted for businesses that are able to generate

export sales and need additional working capital to support these sales. SBAs aim for the EWCP program is

to ensure that qualified small business exporters do not lose viable export sales due to a lack of working

capital.

Additional Information:

Application is made directly to lenders. Interested businesses are encouraged to contact the SBA staff at a

U.S. Export Assistance Center (USEAC) to discuss whether they are eligible for the EWCP program and

whether it is the appropriate tool to meet their export financing needs. The participating lenders review /

approve the applications and submit the request to the SBA staff at the USEAC location servicing the

exporters geographical territory.

11 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 12

The maximum EWCP line of credit/loan amount is $2 million. Participating banks receive a 90% SBA guaranty

provided that the total SBA guaranteed portion to the borrower does not exceed $1.5 million. In those

instances where the SBA guaranteed portion reaches the $1.5 million cap, banks can still get a 90% guaranty

thanks to a co-guaranty program between SBA and the Export-Import Bank of the United States (EXIM).

The SBA does not establish or subsidize interest rates on loans. The interest rate can be fixed or variable and

is negotiated between the borrower and the participant lender.

Contact Information:

Phone: (800) 827-5722

Email: answerdesk@sba.gov

6) International Trade Loans

The SBA International Trade Loan program is a term loan designed for businesses that plan to start/continue

exporting or those that that have been adversely affected by competition from imports. The proceeds of the

Loan must enable the borrower to be in a better position to compete.

Additional Information:

Eligible Businesses

Small businesses that are in a position to expand existing export markets/develop new export markets or

small businesses that have been adversely affected by international trade and can demonstrate that the

Loan proceeds will improve their competitive position are eligible for International Trade Loans

Loan Amount

The maximum gross amount ($2 million) and SBA-guaranteed amount ($1.5 million) for an International

Trade Loan is the same as a regular 7(a) loan. However, there is an exception to the maximum SBA 7(a)

guaranty amount to one borrower. When there is an International Trade loan and a separate working capital

loan, the maximum SBA guaranty on the combined loans can be up to $1.75 million as long as the SBA

guaranty on the working capital loan does not exceed $1,250,000.

Interest Rate

The SBA does not establish or subsidize interest rates on loans. Interest rates are negotiated between the

borrower and the lender, subject to SBA caps. Rates can either be fixed or variable, and are tied to the prime

rate as published in The Wall Street Journal. For loans greater than $50,000 and maturity in excess of 7

years, lenders may charge up to 2.75 percent over prime rate.

Contact Information:

For more information, please visit: https://www.sba.gov/content/international-trade-loan

Phone: (800) 827-5722

7) Military Reservists Loan

The purpose of the Military Reservist Economic Injury Disaster Loan program (MREIDL) is to provide funds to

an eligible small business to meet its ordinary and necessary operating expenses that it could have met, but

is unable to meet, because an essential employee was "called-up" to active duty in their role as a military

reservist.

These loans are intended only to provide the amount of working capital needed by a small business to pay

its necessary obligations as they mature until operations return to normal after the essential employee is

released from active military duty. The purpose of these loans is not to cover lost income or lost profits.

MREIDL funds cannot be used to take the place of regular commercial debt, to refinance long-term debt or

to expand the business.

12 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 13

Federal law requires SBA to determine whether credit in an amount needed to accomplish full recovery is

available from non-government sources without creating an undue financial hardship to the applicant. The

law calls this credit available elsewhere. Generally, SBA determines that over 90% of disaster loan applicants

do not have sufficient financial resources to recover without the assistance of the Federal government.

Because the Military Reservist economic injury loans are taxpayer subsidized, Congress intended that

applicants with the financial capacity to fund their own recovery should do so and therefore are not eligible

for MREIDL assistance.

Additional Information:

The law authorizes loan terms up to a maximum of 30 years. SBA determines the term of each loan in

accordance with the borrower's ability to repay. Based on the financial circumstances of each borrower, SBA

determines an appropriate installment payment amount, which in turn determines the actual term.

Loan Amount Limit - $2,000,000: The actual amount of each loan, up to this maximum, is limited to the

actual economic injury as calculated by SBA, not compensated by business interruption insurance or

otherwise, and beyond the ability of the business and/or its owners to provide. If a business is a major

source of employment, SBA has authority to waive the $2,000,000 statutory limit.

Contact Information:

Phone: (800)827-5722

Email: answerdesk@sba.gov

More Information: https://www.sba.gov/content/military-reservists-economic-injury-loans

8) SBA Express Program

The SBAExpress loan is offered by SBAs network of participating lenders nationwide and features their

fastest turnaround time for loan approvalsabout 36 hours. Loans are available up to $350,000 and

qualify for SBAs maximum guaranty of up to 50 percent for loans of $150,000 or less.

Additional Information:

The SBA and its resource partners are focusing additional efforts on counseling and training to augment this

loan initiative.

Eligible Applicants:

Loans made under this program generally follow SBAs standards for the 7(a) Loan Program

Contact Information:

More Information: https://www.sba.gov/content/sba-express

9) Microloans

The Microloan Program provides small, short-term loans to start-up, newly established, or growing small

business concerns. Under this program, SBA makes funds available to nonprofit community-based lenders

(intermediaries) which, in turn, make loans to eligible borrowers in amounts up to a maximum of $50,000.

The average loan size is about $13,000. Applications are submitted to the local intermediary and all credit

decisions are made on the local level.

13 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 14

Additional Information:

The maximum term allowed for a microloan is six years. However, loan terms vary according to the size of

the loan, the planned use of funds, the requirements of the intermediary lender, and the needs of the small

business borrower.

Contact Information:

More Information: https://www.sba.gov/offices/headquarters/ofa/resources/11432

14 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 15

Technical Support and Development Programs

1) Small Business Development Centers (SBDC)

SBDCs provide free or low-cost assistance to small businesses using programs customized to local

conditions. The SBDC also focuses on projects that advance the job development, investment and economic

growth priorities of California, with an emphasis on manufacturers, exporters and technology-oriented

firms.

Additional Information:

SBDCs support small business in marketing and business strategy, finance, technology transfer, government

contracting, management, manufacturing, engineering, sales, accounting, exporting, and other topics. SBDCs

are funded by grants from the SBA and matching funds. There are more than 1,100 SBDCs with at least one

in every state and territory.

Contact Information:

Silicon Valley SBDC at Enterprise Foundation

480 North 1st Street, Suite 210

San Jose, CA

Telephone: (408) 248-4800

Fax: (408) 385-9156

Website: http://svsbdc.org

SBA Telephone: (800) 732-7232

More Information: https://www.sba.gov/tools/local-assistance/sbdc

Alameda County SBDC at Offices of OBDC

2101 Webster Street, Suite 1200

Oakland, CA 94612

Telephone: (510) 208-0410

Website: http://acsbdc.org/

SBDC Hispanic Satellite at Enterprise Foundation

480 North 1st Street, Suite 210

San Jose, CA

Telephone: (408) 248-4800

Fax: (408) 385-9156

Website: http://sbdchc.org/

15 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 16

2) SBA Womens Business Centers

The SBA Womens Business Center (WBC) is dedicated to training and assisting women in business or those who

want to startup a business. This Center provides a variety of business skills and ongoing technical assistance to

women in thirty-four counties. WBCs are similar to Small Business Development Centers, except they concentrate

on assisting women entrepreneurs. Programs include micro enterprise development and asset building, financial

literacy, loans and credit, one-on-one technical assistance, and Business Action Circles.

Contact Information:

AnewAmerica

210 N 4th Street, Suite 205

San Jose, CA 95112

Phone: 408-326-2669

Fax: 408-645-5972

Janet Garcia

Administrative Assistant

Phone: 408-326-2669

jgarcia@anewamerica.org

3) Department of Defense Procurement Technical Assistance Program (PTAP)

Procurement Technical Assistance Centers are a local resource, available at no or nominal cost, that can

provide assistance to businesses in marketing products and services to the Federal, state and local

governments.

Contact Information:

California CFDC PTAC

1792 Tribute Road, Suite 270

Sacramento, CA 95815

Telephone: 916-442-1729

Website:

http://www.cacapital.org/

16 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 17

4) Service Corps of Retired Executives (SCORE)

The Service Corps of Retired Executives (SCORE) uses over 11,000 volunteers to bring practical experience to

start-up small business and to those thinking about starting a new small business. SCORE provides

mentoring and workshops.

Contact Information:

Silicon Valley SCORE

234 East Gish Road, Suite 100

San Jose, CA 95112

Telephone: (408) 453-6237

More Information: http://www.svscore.org/

5) Minority Business Development Agency

San Jose MBDA Business Center is a federally funded project by The U.S. Department of Commerces

Minority Business Development Agency (MBDA), and ASIAN, Inc. of San Francisco.

The San Jose MBDA Business Center is an entrepreneurially-focused program; Their primary objective is to

assist the integration and participation of the minority-owned business community in the nations economic

growth. Understanding that this is a task that requires synergies beyond the efforts of a single organization,

we have established a private/public, multi-industry-sector network of buyers, suppliers and service

providers that results in a holistic, added value business service to our partners and clients.

Contact Information:

San Jose MBDA Business Center

3031 Tischway, Suite 80

San Jose, CA 95128

Telephone: (408) 998-8058

More Information: http://www.mbda.gov/businesscenters/sanjose

17 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 18

Capital Access Programs

1) Small Business Administration Programs

Small Business Investment Companies (SBICs)

SBICs are privately owned companies that are licensed by the SBA to provide debt and equity capital to

small businesses. They can obtain loans from the SBA to supplement their own capital.

For the SBIC program, a small business is a business with net worth of $18 million or less and an average

after-tax income for the two preceding years of $6 million or less. There are alternative size standards in

some industries. The SBIC sells a debenture to the SBA, which guarantees repayment and creates a pool of

these debentures for resale on the secondary market. SBICs can borrow three times their private capital, up

to a maximum of $113 million.

New Market Venture Capital

New Market Venture Capital is a program that encourages equity investments in small businesses in low-

income areas that meet specific statistical criteria established by regulation. A tax credit is available on a

competitive basis.

Contact Information:

Bay Area

o Alpine Investors IV SBIC, LP

Contact: Tara Genstil

Two Embarcadero Center,

Suite 2320

San Francisco, CA 94111

Telephone: (415) 392-9100

Fax: (415) 392-9101

Email: backoffice@alpine-investors.com

Website: http://www.alpine-investors.com

18 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

o Champlain Capital Partners II, L.P.

Contact: Dennis M. Leary

One Post Street

Suite 925

San Francisco, CA 94104

Phone: (415) 228-4181

Fax: (415) 362-3211

Email: dleary@champlaincapital.com

Website: http://www.champlaincapital.com

o Hercules Technology II, L.P.

Contact: Andrew Olson

400 Hamilton Avenue,

Suite 310

Palo Alto, CA 94301

Phone: (650) 289-3072

Fax: (650) 473-9194

Email: aolson@htgc.com

Website: www.htgc.com

o Norwest Strategic Capital, L.P.

Promod Haque

525 University Avenue, Suite 800

Palo Alto, CA 94301

Phone: (850)321-8000

Email: promod.haque@nvp.com

Website: http://www.nvp.com

o Tregaron Opportunity Fund I, L.P.

Contact: Todd Collins

300 Hamilton Avenue, 4th Floor

Palo Alto, CA 94301

Phone: (650)403-2084

Fax: (650)618-2550

Email: collins@tregaroncapital.com

Website: http://www.tregaroncapital.com

o Rembrandt Venture Partners II, L.P.

Contact: Gerald S. Casilil

600 Montogomery Street

44th Floor

San Francisco, CA 94111-2819

Phone: (650)326-7070

Email: jcasilil@rembrandtvc.com

Website: http://www.rembrandtvc.com

Washington, DC

o Telephone: (202) 205-6510 E-mail: askSBIC@sba.gov

Website: https://www.sba.gov/content/sbic-directory

P a g e | 19

19 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 20

Tax Incentives

Disclaimer: The information provided is not offered as legal or tax advice. Examples of tax benefits are based on the stated

IRS Guidelines and on other assumptions which may not apply to your personal situation. You should seek the advice of

your tax advisor, attorney, and/or financial planner. All material is presented solely as educational information.

1) Alternative Minimum Tax Exemption

As a result of the Taxpayer Relief Act of 1997 (P.L. 105-34), certain small corporations have been exempt

from the AMT since 1998. If a corporation loses its eligibility, it becomes subject to the AMT in the first tax

year when it no longer qualifies for the exemption and in every tax year thereafter, regardless of the

amount of its gross receipts.

Additional Information:

There is reason to believe that this exemption gives some eligible small corporations what amounts to a

slight competitive advantage over comparable firms paying the AMT. A 1997 study estimated that firms that

invested heavily in machinery and equipment and intangible assets like research and development (R&D),

financed the bulk of their investments through debt, and paid the AMT for five or more successive years had

a higher cost of capital than comparable firms that paid the regular income tax only in the same period.

The exemption also provides owners of small firms with an incentive to incorporate, since the taxable

income of pass through entities is subject to the individual AMT through the tax returns filed by individual

owners.

Eligibility:

Eligibility is determined by a corporations average annual gross receipts in the previous three tax years. All

corporations formed after 1998 are exempt from the AMT in their first year with taxable income, regardless

of the size of their gross receipts.

They remain exempt as long as their average annual gross receipts do not exceed $5 million in their first

three tax years, and as long as their average annual gross receipts do not exceed $7.5 million in each

succeeding three-year period (e.g., 1999-2001, 2000-2002, etc.).

Contact Information:

More information: http://www.irs.gov/taxtopics/tc556.html

20 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 21

2) Amortization of Business Start-Up Costs

Under IRC Section 195 (as amended by P.L. 108-357), business taxpayers who incur business start-up and

organizational costs after October 22, 2004, are allowed to deduct up to $5,000 of those costs in the year

when the new trade or business begins. This maximum deduction is reduced (but not below zero) by the

amount by which eligible expenditures exceed $50,000.

Additional Information:

Business taxpayers who incurred or paid business start-up and organizational costs and then entered a trade

or business on or before October 22, 2004, could amortize (or deduct in equal annual amounts) those

expenditures over not less than five years, beginning in the month when the new trade or business

commenced.

To qualify for the current deduction, the start-up and organizational costs must meet two requirements.

They must be paid or incurred as part of an investigation into creating or acquiring an active trade or

business, as part of starting a new trade or business, or as part of an activity done to produce income or

profit before starting a trade or business with the aim of converting the activity into an active trade or

business.

Any eligible expenditure that cannot be deducted may be amortized over 15 years, beginning in the month

when the new trade or business begins to earn income. In order to claim the $5,000 deduction, a taxpayer

must have an equity interest in the new trade or business and actively participate in its management.

Contact Information:

More information: http://www.irs.gov/publications/p535/ch08.html

3) Net Operating Losses

A firm incurs a net operating loss (NOL) for tax purposes when its deductions exceed its gross income. As a

result, it has no income tax liability in an NOL year. An NOL may be used to obtain a refund of taxes paid in

previous years or to reduce or offset future tax liabilities. Under IRC Section 172(b), a business taxpayer is

permitted to carry an NOL back to each of the two tax years preceding the NOL year and forward to each of

the 20 tax years following that year.

Additional Information:

A provision of the American Recovery and Reinvestment Act of 2009 extended the carry back period for

NOLs to five years for eligible firms that incurred an NOL in 2008. Only firms with average annual gross

receipts of $15 million or less in the NOL year and the two previous tax years may take advantage of the

extension. The provision is intended to bolster the cash flow of small firms that have experienced a

significant loss of revenue in the current recession.

Contact Information:

For more information, please visit:

https://www.irs.gov/publications/p334/ch09.html

4) Partial Exclusion of Capital Gains on Certain Small Business Stock

Two important considerations in determining an individuals income tax liability are the recognition of

income as ordinary or capital and the distinction between long-term and short-term capital gains or losses.

Additional Information:

Under IRC Section 1202, non-corporate taxpayers (including partnerships, LLCs, and S corporations) may

exclude 50% of any gain from the sale or exchange of qualified small business stock (QSBS) that has been

21 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 22

held for over five years. The exclusion rises to 60% if the QSBS has been issued by a qualified corporation

based in an empowerment zone. And under a provision of the ARRA, it becomes 75% for QSBS acquired

from February 18, 2009, through December 31, 2010, and held for five years.

There is a cumulative limit on the gain from stock issued by a single qualified corporation that may be

excluded: in a single tax year, the gain is limited to the greater of 10 times the taxpayers adjusted basis of

all QSBS issued by the firm and sold or exchanged during the year, or $10 millionreduced by any gains

excluded by the taxpayer in previous years. The remaining gain is taxed at a fixed rate of 28%. As a result,

the marginal effective tax rate on capital gains from the sale or exchange of QSBS held longer than five years

is 14%: 0.5 x 0.28.

For individuals subject to the AMT, a portion of the excluded gain is treated as an individual AMT preference

item, which means that it must be included in the calculation of AMT taxable income. The portion was 42%

for QSBS acquired on or before December 31, 2000 and disposed of by May 6, 2003; 28% for QSBS acquired

after December 31, 2000 and disposed of by May 6, 2003; and 7% for QSBS acquired after May 6, 2003 and

disposed of by December 31, 2008.

To qualify for the partial exclusion, small business stock must satisfy certain requirements. First, it must be

issued after August 10, 1993 and must be acquired by the taxpayer at its original issue, either directly or

through an underwriter, in exchange for money, property, or as compensation for services rendered to the

issuing corporation. Second, the stock must be issued by a domestic corporation whose gross assets do not

exceed $50 million before and immediately after the stock is issued. Third, at least 80% of the corporations

assets must be tied to the active conduct of one or more qualified trades or businesses during substantially

all of the requisite five-year holding period.

5) Losses on Small Business Investment Company Stock Treated as Ordinary Losses

without Limitation

Under IRC Section 1242, individuals who invest in small business investment companies (SBICs) are

permitted to deduct from ordinary income all losses from the sale or exchange or worthlessness of stock in

these companies. This treatment is intended to foster equity investment in these companies by lowering the

after-tax loss on an investment in an SBIC, relative to after-tax losses on similar investments.

Additional Information:

SBICs are private regulated investment corporations that are licensed under the Small Business Investment

Act of 1958 to provide equity capital, long-term loans, and managerial guidance to firms with a net worth of

less than $18 million and less than $6 million in average net income over the previous two years.

They use their own capital and funds borrowed at favorable rates through SBA loan guarantees to make

equity and debt investments in qualified firms. For tax purposes, most SBICs are treated as C corporations.

There are no known estimates of the revenue loss associated with this small business tax benefit.

Contact Information:

More information: http://www.irs.gov/publications/p550/ch04.html

6) Rollover of Gains into Specialized Small Business Stock

Individual and corporate taxpayers who satisfy certain conditions are allowed to roll over, free of tax, any

capital gains on the sale of publicly traded securities. The proceeds from the sale must be used to purchase

common stock or partnership interests in specialized small business investment companies (SSBICs) licensed

under the Small Business Investment Act of 1958 within 60 days of the sale.

SSBICs are similar to SBICs except that SSBICs are required to invest in small firms owned by individuals who

are considered socially or economically disadvantagedmainly members of minority groups.

22 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 23

Additional Information:

If the proceeds from the sale exceed the cost of the SSBIC stock or partnership interest, the excess is

recognized as a capital gain and taxed accordingly. The taxpayers basis in the SSBIC stock or partnership

interest is reduced by the amount of any gain from the sale of securities that are rolled over.

The maximum gain an individual can roll over in a single tax year is the lesser of $50,000 or $500,000 less

any gains previously rolled over under this provision. For corporations, the maximum deferral in a tax year is

the lesser of $250,000 or $1 million less any previously deferred gains.

7) Uniform Capitalization of Inventory Costs

IRC Section 1244 allows taxpayers to deduct any loss from the sale, exchange, or worthlessness of qualified

small business stock as an ordinary loss, rather than a capital loss. For business taxpayers, ordinary losses

are treated as business losses in computing a net operating loss.

Additional Information:

To qualify for this treatment, the stock must meet four requirements. First, it must be issued by a domestic

corporation after November 6, 1978.

Second, the stock must be acquired by an individual investor or a partnership in exchange for money or

other property, but not stock or securities.

Third, the stock must be issued by a small business corporation, which the statute defines as a corporation

whose total amount of money and property received as a contribution to capital and paid-in surplus totals

less than $1 million when it issues the stock.

Finally, during the five tax years before a loss on the stock is recognized, the firm must have derived more

than 50% of its gross receipts from sources other than royalties, rents, dividends, interest, annuities, and

stock or security transactions. The maximum amount that may be deducted as an ordinary loss in a tax year

is $50,000 (or $100,000 for a couple filing jointly).

8) Simplified Dollar-Value LIFO Accounting Method for Small Firms

LIFO operates on the assumption that the most recently acquired goods are sold before all other goods.

Consequently, LIFO assigns the newest unit costs to the cost of goods sold and the oldest unit costs to the

ending inventory. The method can be advantageous when the cost of many inventory items is rising,

because it yields a lower taxable income and inventory valuation than other methods. There are various

ways to apply LIFO. A widely used application is known as the dollar-value method. Under this method, a

taxpayer accounts for its inventories on the basis of a pool of dollars rather than specific items.

Additional Information:

IRC Section 474, which was added to the tax code by the Tax Reform Act of 1986, allows eligible small firms

to use a simplified dollar-value LIFO method. It differs from the regular dollar-value method in the way in

which inventory items are pooled and the technique for estimating the base-year value of the pools. A firm

is eligible to use the simplified method if its average annual gross receipts were $5 million or less in the

three previous tax years.

9) Tax Credit for Pension Plan Start-Up Costs of Small Firms

Under IRC Section 45E, qualified small firms may claim a non-refundable tax credit for a portion of the start-

up costs they incur in setting up new retirement plans for employees. The credit, which was enacted as part

of the Economic Growth and Tax Relief Reconciliation Act of 2001, began in 2002 and originally was

scheduled to disappear (or sunset) after 2010. But a provision of the Pension Protection Act of 2006

permanently extended the credit. It is a component of the general business credit and thus subject to its

limitations and rules for carryover.

23 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 24

Additional Information:

The credit is equal to 50% of the first $1,000 in eligible costs incurred in each of the first three years a

qualified pension is operative. Eligible costs are defined as the ordinary and necessary expenses incurred in

administering the plan and informing employees about the plans benefits and requirements. Qualified plans

consist of new defined benefit plans, defined contribution plans, savings incentive match plans for

employees, and simplified employee pension plans.

Eligibility:

The credit gives owners of small firms an incentive to establish pension plans for employees by lowering the

after-tax cost of setting up and administering these plans in their first three years.

Firms with fewer than 100 employees, each of whom received at least $5,000 in compensation in the

previous year, are eligible to claim the credit

10)

Tax Credit for Cost of Making a Business More Accessible to the Disabled

Under IRC Section 44, an eligible small firm may claim a non-refundable credit for expenses it incurs to make

its business more accessible to disabled individuals. The credit is equal to 50% of the amount of eligible

expenditures in a tax year over $250 but not greater than $10,250. In the case of a partnership, this upper

limit applies separately at the partnership level and at the partner or individual level; the same distinction

holds in the case of a subchapter S corporation. The disabled access credit is a component of the general

business credit under IRC Section 38 and thus subject to its limitations.

Additional Information:

To qualify for the credit, a firm must satisfy one of two requirements: its gross receipts (less any returns and

allowances) in the previous tax year totaled no more than $1 million, or it employed no more than 30

persons on a full-time basis during that year. A worker is considered a full-time employee if he or she works

at least 30 hours a week for 20 or more weeks in a calendar year.

Eligibility:

Qualified expenses are defined as the amounts an eligible small firm pays or incurs to bring its business into

compliance with the Americans With Disabilities Act of 1990 (ADA). They must be reasonable in amount and

necessary in light of legal requirements. Eligible expenses include those related to removing architectural,

communication, transportation, or physical barriers to making a business accessible to or usable by disabled

individuals; providing interpreters or other effective methods of making materials understandable to

hearing-impaired individuals; and supplying qualified readers, taped texts, and other effective methods of

making materials understandable to visually impaired individuals.

24 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

P a g e | 25

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

Grant Programs

Small Business Administration

1) Small Business Innovation Research Awards (SBIR)

SBIR awards are competitive grants to small businesses (500 or fewer employees) to research and develop

new ideas for selected government agencies. Government agencies with the largest research budgets fund

the SBIR program. The SBA coordinates and oversees the SBIR program but does not provide funding for the

awards.

Additional Information:

Phase I grants allow a company to determine if an idea has scientific and technical merit and is feasible.

Phase II evaluates the ideas commercial potential.

Phase III is private sector development of the idea.

Contact Information:

US SBA Region IX

330 N. Brand Blvd., #1200

Glendale, CA 91203

Telephone: (818) 552-3436

For more information:

https://www.sba.gov/office

s/regional/ix

US SBA Office of Technology

409 Third Street, SW

Washington, DC 20416

Telephone: (202) 205-6450

For more information: http://www.sbir.gov/

25 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 26

2) Small Business Technology Transfer (STTR) Awards

The STTR program is similar to the SBIR program, but it requires the small business to work with a nonprofit

research institute. The SBA coordinates and oversees the STTR program but does not provide funding for the

awards.

Additional Information:

Following submission of proposals, agencies make STTR awards based on small business/nonprofit research

institution qualification, degree of innovation, and future market potential. Small businesses that receive

awards then begin a three-phase program.

o Phase I is the startup phase. Awards of up to $100,000 for approximately one year fund the exploration

of the scientific, technical, and commercial feasibility of an idea or technology.

o Phase II awards of up to $750,000, for as long as two years, expand Phase I results. During this period,

the R&D work is performed and the developer begins to consider commercial potential. Only Phase I

award winners are considered for Phase II.

o Phase III is the period during which Phase II innovation moves from the laboratory into the marketplace.

No STTR funds support this phase. The small business must find funding in the private sector or other

non-STTR federal agency funding.

Contact Information:

Washington, DC

o US Small Business Administration

Office of Technology

409 Third Street, SW

Washington, DC 20416

Telephone: (202) 205-6450

For more information: http://www.sbir.gov/

26 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 27

United States Department of Transportation

1) Procurement Assistance Division

The Procurement Assistance Division is responsible for working closely with each of the Operating

Administrations' Small Business specialists to ensure that adequate procurement opportunities are made

available to small businesses. Below is a listing of Small Business specialists in each OA whose primary role is

to serve as advocates to small businesses.

Contact Information:

Federal Aviation Administration (FAA)

o Fred Dendy

800 Independence Avenue, SW

Room 715

Washington, DC 20591

Phone: (202) 267-7454

Email: fred.dendy@faa.gov

Federal Highway Administration (FHWA)

o Frank Waltos

1200 New Jersey Avenue, SE

Washington, DC 20590

Phone: (202) 366-4205

Email: frank.waltos@dot.gov

Federal Motor Carrier Safety Administration (FMCSA)

o Nathan Watters

1200 New Jersey Avenue, SE

Suite W66-499

Washington, DC 20560

Phone: (202) 366-3036

Fax: (202) 385-2335

Email: Nathan.Watters@dot.gov

Federal Railroad Administration (FRA)

o Dana L. Hicks

Contract Specialist

Federal Railroad Administration

1200 New Jersey Avenue, SE

Washington, DC 20590

Phone: (202) 493-6131

Fax: (202) 493-6171

Email: Dana.hicks@dot.gov

Federal Transit Administration (FTA)

o Robyn Jones

FTA Office of Acquisition Management

1200 New Jersey Avenue, SE

27 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

Washington, DC 20590

Phone: (202) 366-0943

Email: robyn.jones@dot.gov

Maritime Administration

o Rita C. Thomas

1200 New Jersey Avenue, SE

Washington, DC 20590

Phone: (202) 366-2802

Email: rita.thomas@dot.gov

National Highway Transportation Safety Administration

o Lloyd S. Blackwell

1200 New Jersey Avenue, SE

Washington, DC 20590

Phone: (202) 366-9564

Email: lloyd.blackwell@nhtsa.dot.gov

Office of the Secretary (OST)

o Ames Owens

Office of the Secretary

Acquisition Services Division

1200 New Jersey Avenue, SE

Washington, DC 20590

Phone: (202) 366-9614

Email: ames.owens@dot.gov

Pipeline and Hazardous Materials Safety Administration (PHMSA)

o Jackie Naranjo

Contract Specialist

Office of Acquisition Services, PHA-30

1200 New Jersey Avenue, SE

East Building, Second Floor

Washington, DC 20590

Phone: (202) 366-4429

Email: jackie.naranjo@dot.gov

Research and Innovative Technology Administration (RITA)

o Phaedra Johnson

Office of the Secretary

Acquisition Services Division

1200 New Jersey Avenue, SE

Washington, DC 20590

Phone: (202) 366-0742

Email: phaedra.johnson@dot.gov

RITA-VOLPE

o Peter Kontakos

Small Business Specialist

28 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

P a g e | 28

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

US DOT/RITA/Volpe Center

Office of Acquisitions, RVP-31

55 Broadway

Cambridge, MA 02142

Phone: (617) 494-2602

Fax: (617) 494-3024

Email: peter.kontakos@dot.gov

Saint Lawrence Seaway Development Corporation (SLSDC)

o Patricia White

Contracting Officer

Chief, Procurement & Supply Division

U.S. Department of Transportation

Saint Lawrence Seaway Development Corporation

PO Box 520

180 Andrews Street

Massena, NY 13662

Phone: (315) 764-3236

Email: patricia.white@dot.gov

P a g e | 29

29 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 30

Local Funding Opportunities

California Small Business Loans

1) California Industrial Development Financing Advisory Commission (CIDFAC) Programs

Agency:

California Industrial Development Financing Advisory Commission (CIDFAC), located in the State Treasurers

Office.

Purpose of Program:

The California Industrial Development Financing Advisory Commission (CIDFAC) administers a number of

programs to assist California manufacturing businesses in funding capital expenditures for business

acquisitions or expansions. The programs allow businesses to borrow funds at competitive rates through

the issuance of tax-exempt bonds enhanced by a letter of credit.

Type of Funding:

Capital generated from the issuance of tax-exempt industrial development bonds used to finance capital

expenditures.

Eligibility:

Industrial Development Bonds can be used to finance capital expenditures in agriculture, forestry, or mining.

The bonds finance the expansion or acquisition of facilities and equipment for product assembly, fabrication,

manufacturing, or processing. Businesses that process or manufacture recycled or reused products and

materials may also qualify. Eligibility is governed by a detailed set of criteria pursuant to federal and state

law.

30 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 31

Contact Information:

Deanna Hamelin, Manager

915 Capitol Mall, Room 457

Sacramento, CA 95814

Telephone: (916) 653-3843

Fax: (916) 653-3241

Email: cidfac@treasurer.ca.gov

Website: http://www.treasurer.ca.gov/cidfac/

2) Industrial Development Revenue Bond (IDB) Program

Agency:

IDBs can be issued by the California Infrastructure and Economic Development Bank (I-Bank), by local

Industrial Development Authorities, or by Joint Powers Authorities. The mission of the I-Bank is to finance

public infrastructure and private investments that promote economic growth, revitalize communities, and

enhance the quality of life throughout California. The I-Bank is located within the Business, Transportation,

and Housing Agency. IDBs are tax-exempt securities issued up to $10 million by a governmental entity to

provide money for the acquisition, construction, rehabilitation and equipping of manufacturing and

processing facilities for private companies. IDBs can be issued by the I-Bank, local Industrial Development

Authorities, or by Joint Powers Authorities.

Purpose of Program:

The IDB Program provides tax-exempt financing to qualified manufacturing and processing companies for

the construction or acquisition of facilities and equipment. IDBs allow private companies to borrow at low

interest rates normally reserved for state and local governmental entities.

Type of Funding:

Funds from tax-exempt securities issued by a governmental entity.

Eligibility:

Manufacturing and processing companies are eligible. The project financed by the bonds must be a facility

used for the manufacture, production, or processing of tangible property. At least 95% of the bond proceeds

must be spent on qualifying costs. Qualifying costs are capital expenditures such as land, buildings,

equipment, and other depreciable property, and can also include capitalized interest during construction.

Contact Information:

Applications are accepted on a continuous basis. The I-Bank Board of Directors normally meets each month

to consider approval of complete applications received at least 20 working days prior to the meeting date.

For additional information, Contact Information:

o Teveia Barnes, Executive Director

980 9th Street, 9th floor

Sacramento, CA 95814

E-mail: Ruben.Rojas@ibank.ca.gov

Telephone: (916) 539-4408

Fax: (916) 322-6314

http://ibank.ca.gov/

31 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 32

3) Recycling Market Development Zone (RMDZ) Revolving Loan Program

Agency:

California Integrated Waste Management Board.

Purpose of Program:

The program provides direct loans to eligible businesses and nonprofit organizations within Recycling

Market Development Zones that manufacture recycled raw materials, produce new recycled products, or

reduce the waste resulting from the manufacture of a product. These loans promote market development

for post-consumer and secondary waste materials.

Type of Funding:

The program makes loans to acquire equipment, make leasehold improvements, purchase recycled raw

materials and inventory, or acquire real estate with a maximum value of $500,000.

Eligibility:

Business applicants must be located in one of the designated Recycling Market Development Zones and

divert waste from non-hazardous California landfills. The program will end on July 1, 2011 unless later

enacted by the Legislature.

Contact Information:

State RMDZ Office

o Jim LaTanner, Supervisor

RMDZ Loan Program (Mail Stop #11)

P.O. Box 4025

Sacramento, CA 95812-4025

(916) 341-6534

loans@ciwmb.ca.gov

http://www.calrecycle.ca.gov/RMDZ/

Regional Silicon Valley RMDZ Offices:

o Anne Hansen

Environmental

Services Specialist

200 E Santa Clara St

San Jose, CA

Phone: (408) 975-2574

Fax: (408) 292-6211

Email: anne.hansen@sanjoseca.gov

o Steve Lautze

Green Business

Specialist

250 Frank H Ogawa Pl.

Oakland, CA 94612

Phone: (510) 238-4973

Fax: (510) 238-2226

32 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 33

4) Replacement of Underground Storage Tank (RUST) Program Loans

Agency:

State Water Resources Control Board.

Purpose of Program:

The program helps owners and operators of small independent underground storage tanks comply with

legislative mandates enacted in 1999 (SB 989) to enhance underground tanks and monitoring systems.

Type of Funding:

Typically, loans are provided to facilitate any of the following: plans, permits, drawings; excavation and

removal of tanks, lines, and dispensers; installation of new tanks, lines, dispensers, under-dispenser

containments, electronic monitoring systems, and enhanced vapor recovery systems. Also, funding is

offered to water boards and other regulatory agencies in the event of an emergency situation, or to clean up

a site that poses a health or safety threat.

Eligibility:

Small business owners or operators of underground petroleum storage tanks are eligible. Applicants must

provide evidence that their site(s) will be in state compliance once funds are applied to the project. Other

eligibility can be found in Health & Safety Code section 25299.102.

Contact Information:

Janice Clemons

Division of Clean Water Programs

(916) 341-5857

UST Cleanup Fund

P.O. Box 944212

Sacramento, CA 94244-2120

janice.clemons@waterboards.ca.gov

http://www.waterboards.ca.gov/water_issues/programs/ustcf/rust.shtml

33 | P a g e

S m a l l B u s i n e s s R e s o u r c e G u i d e

T h e O f f i c e o f C o n g r e s s m a n M i k e H o n d a

P a g e | 34

5) California Capital Access Program (CalCAP)

Agency:

California Pollution Control Financing Authority.

Purpose of Program:

This program provides incentives for lenders to make loans to small businesses that may otherwise have

difficulty obtaining financing. This is accomplished through a loss reserve account that provides up to 100%

coverage for the lender on certain loan defaults.

Type of Funding:

The program provides loans with variable rates and terms. The borrower works directly with a CalCAP

lender.

Eligibility:

The borrower's business must be in one of the industries listed in the qualified Standard Industry

Classification codes list. The business is not required to engage in activities that affect the environment.

The borrower's primary business and 50% of its employees, business income, sales, or payroll must be in

California.

The business activity resulting from the bank's loan must be created and retained in California.

The business must be classified as a small business under U.S. Small Business Administration guidelines (Title

13 of the Code of Federal Regulations) or have fewer than 500 employees.

Contact Information:

915 Capitol Mall, Room 457

Sacramento, CA 95814

Telephone: (916) 654-5610

Fax: (916) 657-4821

E-mail: SSBCIquestions@treasury.gov

http://www.treasurer.ca.gov/cpcfa/calcap/

6) Small Business Loan Guarantee Program

Agency:

Business, Transportation and Housing Agency. The program is administered through contracts between the

agency and nonprofit financial development corporations located throughout the state.

Purpose of Program:

This program helps businesses become eligible for loans they might not otherwise obtain. It also creates the

opportunity for businesses to establish a favorable credit history for future loan needs.

Type of Funding: