Professional Documents

Culture Documents

Washington CAD 2015

Washington CAD 2015

Uploaded by

cutmytaxesCopyright:

Available Formats

You might also like

- ButlerLumberCompany Final ExcelDocument17 pagesButlerLumberCompany Final Excelkaran_w3No ratings yet

- B.C.A Accounting 1st Chapter NotesDocument18 pagesB.C.A Accounting 1st Chapter Notesrakesh87% (23)

- Sample Financial Reports For Livelihood AssociationDocument7 pagesSample Financial Reports For Livelihood AssociationOslec AtenallNo ratings yet

- Jim Chanos ImportantDocument40 pagesJim Chanos Importantkabhijit04No ratings yet

- LVA, FVA, CVA, DVA Impacts On Derivatives ManagementDocument39 pagesLVA, FVA, CVA, DVA Impacts On Derivatives ManagementindisateeshNo ratings yet

- GGATTL16Document65 pagesGGATTL16Tyler DrummondNo ratings yet

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocument3 pagesHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- Lesson 25Document15 pagesLesson 25TUẤN TRẦN MINHNo ratings yet

- 9621-17-7P AID: 1150 - 20/02/2014: S.No. Account Title and Explanation Debit ($) Credit ($)Document3 pages9621-17-7P AID: 1150 - 20/02/2014: S.No. Account Title and Explanation Debit ($) Credit ($)Ekta Saraswat VigNo ratings yet

- Quik Silver Inc 10 Q 31715Document52 pagesQuik Silver Inc 10 Q 31715pakistanNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Financial Statement, Cash Flows and TaxesDocument22 pagesFinancial Statement, Cash Flows and Taxesnumlit1984No ratings yet

- 123 Main Street: (Windsor, ON)Document5 pages123 Main Street: (Windsor, ON)RomanoNo ratings yet

- FFM 9 Im 12Document31 pagesFFM 9 Im 12Mariel CorderoNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- ACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioDocument3 pagesACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioHomeworkhelpbylanceNo ratings yet

- IAS 12: Practice Questions AnswersDocument8 pagesIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNo ratings yet

- Government-Wide Statements & Budgetary Comparison Schedule Part OneDocument5 pagesGovernment-Wide Statements & Budgetary Comparison Schedule Part Onecyics TabNo ratings yet

- LMD Budget SpreadsheetDocument1 pageLMD Budget SpreadsheetScott FranzNo ratings yet

- Tugas 2 Evaluasi Ekonomi Pabrik KimiaDocument9 pagesTugas 2 Evaluasi Ekonomi Pabrik KimiaIllona NathaniaNo ratings yet

- New York City Preliminary Expense Revenue Contract Budget FY2011Document487 pagesNew York City Preliminary Expense Revenue Contract Budget FY2011Aaron MonkNo ratings yet

- FSA Hw2Document13 pagesFSA Hw2Mohammad DaulehNo ratings yet

- Chapter 12 Solutions To The Assigned Exercise ProblemsDocument3 pagesChapter 12 Solutions To The Assigned Exercise ProblemsLuis MenuciNo ratings yet

- 2011-2012 County RevenuesDocument23 pages2011-2012 County RevenuesMichael ToddNo ratings yet

- EB 10 11 Non Departmental - StampedDocument40 pagesEB 10 11 Non Departmental - StampedMatt HampelNo ratings yet

- FinanceDocument12 pagesFinanceJesus Javier Flores RodriguezNo ratings yet

- 2011Q2 Google Earnings SlidesDocument15 pages2011Q2 Google Earnings SlidesAlexia Bonatsos100% (1)

- EconomicsDocument5 pagesEconomicsbrian mochez01No ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Walmart Inc. (WMT) Cash FlowDocument1 pageWalmart Inc. (WMT) Cash FlowinuNo ratings yet

- Financial Management Assignment, HCC, PUDocument12 pagesFinancial Management Assignment, HCC, PUMuhammad MoazNo ratings yet

- 2016 Proposed Budget Presentations 11-17-2015 DRAFTDocument25 pages2016 Proposed Budget Presentations 11-17-2015 DRAFTThe Brookhaven PostNo ratings yet

- 2015Q1 Google Earnings SlidesDocument15 pages2015Q1 Google Earnings SlidesToni HercegNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- City of Miami: Inter-Office MemorandumDocument15 pagesCity of Miami: Inter-Office Memorandumal_crespoNo ratings yet

- 0976 Module 10 RossFCF9ce SM Ch10 FINALDocument21 pages0976 Module 10 RossFCF9ce SM Ch10 FINALYuk SimNo ratings yet

- Department of Public Works (19) : Agency Plan: Mission, Goals and Budget SummaryDocument37 pagesDepartment of Public Works (19) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNo ratings yet

- Lecture Notes Topic 4 Part 2Document34 pagesLecture Notes Topic 4 Part 2sir bookkeeperNo ratings yet

- SolutionCH9 CH11Document9 pagesSolutionCH9 CH11qwerty1234qwer100% (1)

- AESCorporation 10Q 20130808Document86 pagesAESCorporation 10Q 20130808Ashish SinghalNo ratings yet

- 2015 Annual Accomplishment ReportDocument8 pages2015 Annual Accomplishment ReportAngelica Aquino GasmenNo ratings yet

- Taxes and The Statement of Cash FlowsDocument8 pagesTaxes and The Statement of Cash FlowsSaddy ButtNo ratings yet

- Chapter 8Document52 pagesChapter 8raomahinNo ratings yet

- Accounting Seminar 16: Team 6Document64 pagesAccounting Seminar 16: Team 6Jerilynn YeoNo ratings yet

- JAN FEB MAR Projected Amount Total Amount: EarningsDocument2 pagesJAN FEB MAR Projected Amount Total Amount: EarningsSubhankarNo ratings yet

- HD - SCF HD - SCFDocument3 pagesHD - SCF HD - SCFsyedatiqrocketmailcomNo ratings yet

- Chapter Fifteen SolutionsDocument21 pagesChapter Fifteen Solutionsapi-3705855No ratings yet

- T1 - IAS 12 - BT1 - KeyDocument3 pagesT1 - IAS 12 - BT1 - KeyKotoru HanoelNo ratings yet

- City of Miami: Inter-Office MemorandumDocument17 pagesCity of Miami: Inter-Office Memorandumal_crespoNo ratings yet

- Chapter 3 ProFormaDocument15 pagesChapter 3 ProFormaNancy LuciaNo ratings yet

- Irving Staff ARK PresentationDocument17 pagesIrving Staff ARK PresentationAvi SelkNo ratings yet

- ACC1002 Team 8Document11 pagesACC1002 Team 8Yvonne Ng Ming HuiNo ratings yet

- 6-Fac 4 ADocument5 pages6-Fac 4 Anachofr2704No ratings yet

- DRR 1 Sept 19Document6 pagesDRR 1 Sept 19Ilyas SatriaNo ratings yet

- Dipifr Int 2010 Jun ADocument11 pagesDipifr Int 2010 Jun AHellyMyronNo ratings yet

- GSTR9 18acvpa7546a1zk 032022Document8 pagesGSTR9 18acvpa7546a1zk 032022SUBHASH MOURNo ratings yet

- Computation With Dumping Duty (R.A 8752)Document11 pagesComputation With Dumping Duty (R.A 8752)Mariel BoncatoNo ratings yet

- Topic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANDocument18 pagesTopic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANJaved AnwarNo ratings yet

- Ch1-Homework Solutions (A Problems)Document11 pagesCh1-Homework Solutions (A Problems)jmdd555100% (1)

- Constructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmDocument5 pagesConstructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmBhavesh MaruNo ratings yet

- Commercial Property Tax Appeal ServicesDocument7 pagesCommercial Property Tax Appeal ServicescutmytaxesNo ratings yet

- Are Your Property Taxes Too HighDocument8 pagesAre Your Property Taxes Too HighcutmytaxesNo ratings yet

- Property Tax Consultants & Their RulesDocument7 pagesProperty Tax Consultants & Their RulescutmytaxesNo ratings yet

- Texans, Fight Property Tax Increase Amidst COVID 19!Document7 pagesTexans, Fight Property Tax Increase Amidst COVID 19!cutmytaxesNo ratings yet

- What Is Business Personal Property TaxDocument7 pagesWhat Is Business Personal Property TaxcutmytaxesNo ratings yet

- Tips To Win A Property Tax ProtestDocument7 pagesTips To Win A Property Tax ProtestcutmytaxesNo ratings yet

- Udget: H C A DDocument49 pagesUdget: H C A DO'Connor AssociateNo ratings yet

- Top 10 Property Tax TipsDocument7 pagesTop 10 Property Tax TipscutmytaxesNo ratings yet

- Property Appeal Protest ServicesDocument7 pagesProperty Appeal Protest ServicescutmytaxesNo ratings yet

- HFF Investment OverviewDocument4 pagesHFF Investment OverviewcutmytaxesNo ratings yet

- Property Tax in Texas - Research Report 2017Document12 pagesProperty Tax in Texas - Research Report 2017cutmytaxesNo ratings yet

- Property Tax Bills 2017Document16 pagesProperty Tax Bills 2017cutmytaxesNo ratings yet

- Property Tax Deferral Disabled Senior CitizensDocument16 pagesProperty Tax Deferral Disabled Senior CitizenscutmytaxesNo ratings yet

- BREAStrategicPlan PDFDocument16 pagesBREAStrategicPlan PDFcutmytaxesNo ratings yet

- Real Estate Education Course CatalogDocument81 pagesReal Estate Education Course CatalogcutmytaxesNo ratings yet

- Newco Case Study Executive Summary PDFDocument19 pagesNewco Case Study Executive Summary PDFnathan0% (1)

- Working Capital Operating CycleDocument3 pagesWorking Capital Operating CycleRatish NairNo ratings yet

- Black RockDocument3 pagesBlack RockAb CNo ratings yet

- Elearning - Lspr.edu: Master of Arts in Communication: Corporate Communication StudiesDocument36 pagesElearning - Lspr.edu: Master of Arts in Communication: Corporate Communication StudieselearninglsprNo ratings yet

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- Case SPMDocument4 pagesCase SPMainiNo ratings yet

- Profits and MarginsDocument4 pagesProfits and Marginsrishifiib08No ratings yet

- Segment and Interim Reporting: Baker / Lembke / KingDocument34 pagesSegment and Interim Reporting: Baker / Lembke / KingSarah NurainiNo ratings yet

- How To Capitalise On French Retail Investor Appetite For HealthcareDocument4 pagesHow To Capitalise On French Retail Investor Appetite For HealthcareNishant KhatriNo ratings yet

- A Study of Online Shopping Preference With Reference To FlipkartDocument89 pagesA Study of Online Shopping Preference With Reference To Flipkartkumar saurabhNo ratings yet

- Di OutlineDocument81 pagesDi OutlineRobert E. BrannNo ratings yet

- Cloud KitchensDocument6 pagesCloud Kitchenssigitsutoko87650% (1)

- Surname 1Document3 pagesSurname 1Paul NdegNo ratings yet

- General Partnership AgreementDocument5 pagesGeneral Partnership AgreementJay Smith100% (1)

- Classification of PartnersDocument2 pagesClassification of Partnersarnel barawedNo ratings yet

- Clearwater NOTES Ans SWOTDocument8 pagesClearwater NOTES Ans SWOTSuziNo ratings yet

- Cash and Liquidity ManagementDocument21 pagesCash and Liquidity ManagementDivyajyoti SinghNo ratings yet

- Merger and Acquisition Transactions Under Ohada Law: 1. Why Do Companies Enter Into M&A Transactions in Africa?Document6 pagesMerger and Acquisition Transactions Under Ohada Law: 1. Why Do Companies Enter Into M&A Transactions in Africa?Che DivineNo ratings yet

- Professional EnglishDocument10 pagesProfessional EnglishFrancesca Rutti AlvaradoNo ratings yet

- Cfas 19 Pas 41 Biological AssetsDocument3 pagesCfas 19 Pas 41 Biological Assetsnash lastNo ratings yet

- TDS NotificationDocument24 pagesTDS NotificationSeemaNaikNo ratings yet

- Costing Vs PricingDocument6 pagesCosting Vs PricingArif NasimNo ratings yet

- BBA (2013 Pattern) 1 PDFDocument52 pagesBBA (2013 Pattern) 1 PDFRushiraj DhamaleNo ratings yet

- Chapter 3: Directors and Their RolesDocument8 pagesChapter 3: Directors and Their RolesMehedul Islam SabujNo ratings yet

- Budget Analysis-2012 - T.P Ostwal & AssociatesDocument115 pagesBudget Analysis-2012 - T.P Ostwal & AssociatesvaidheiNo ratings yet

- Compound InterestDocument10 pagesCompound InterestgetphotojobNo ratings yet

Washington CAD 2015

Washington CAD 2015

Uploaded by

cutmytaxesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Washington CAD 2015

Washington CAD 2015

Uploaded by

cutmytaxesCopyright:

Available Formats

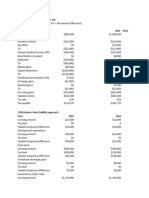

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

C01 - City Of Brenham

Number of Properties: 8394

Land Totals

Land - Homesite

(+)

$86,939,821

Land - Non Homesite

(+)

$115,336,921

Land - Ag Market

(+)

$25,040,043

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$227,316,785

Improvements - Homesite

(+)

$542,848,358

Improvements - Non Homesite

(+)

$268,691,102

Total Improvements

(=)

(+)

$227,316,785

$811,539,460

(+)

$811,539,460

Personal Property (1319)

$130,524,456

(+)

$130,524,456

Minerals (303)

$239,148,700

(+)

$239,148,700

$0

(+)

$0

(=)

$1,408,529,401

Improvement Totals

Other Totals

Autos (0)

Total Market Value

$1,408,529,401

Total Homestead Cap Adjustment (1721)

(-)

$10,427,927

Total Exempt Property (373)

(-)

$100,535,270

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$25,040,043

Ag Use (93)

(-)

$175,742

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$24,864,301

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (2922)

(+)

$0

(HS) Homestead State (2922)

(+)

$0

(O65) Over 65 Local (1343)

(+)

$31,395,820

(O65) Over 65 State (1343)

(+)

$0

(DP) Disabled Persons Local (62)

(+)

$0

(DP) Disabled Persons State (62)

(+)

$0

(DV) Disabled Vet (95)

(+)

$1,044,120

(DVX/MAS) Disabled Vet 100% (25)

(+)

$3,195,708

(PRO) Prorated Exempt Property (1)

(+)

$12,350

(AUTO) Lease Vehicles Ex (19)

(+)

$1,957,075

(PC) Pollution Control (2)

(+)

$1,304,120

(AUTO2) PERSONAL USE/BUSINESS USE (6)

(+)

$73,805

(EXPT) PARTIAL EXEMPT PROPERTY (1)

(+)

$2,893,566

(PRCX) Primarly Charitable Exemption (5)

(+)

$377,080

(HB366) House Bill 366 (127)

(+)

$24,535

(AB) Abatement (19)

(+)

$41,681,487

Total Exemptions

(=)

$83,959,666

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

(-)

$24,864,301

(=)

$1,272,701,903

418,853,044 )

(-)

$83,959,666

(=)

$1,188,742,237

Page 1 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

C02 - City Of Burton

Number of Properties: 360

Land Totals

Land - Homesite

(+)

$1,911,271

Land - Non Homesite

(+)

$1,473,740

Land - Ag Market

(+)

$3,115,861

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$6,500,872

Improvements - Homesite

(+)

$17,454,581

Improvements - Non Homesite

(+)

$4,432,946

Total Improvements

(=)

(+)

$6,500,872

$21,887,527

(+)

$21,887,527

Personal Property (40)

$331,660

(+)

$331,660

Minerals (4)

$212,800

(+)

$212,800

$0

(+)

$0

(=)

$28,932,859

Improvement Totals

Other Totals

Autos (0)

Total Market Value

$28,932,859

Total Homestead Cap Adjustment (50)

(-)

$251,111

Total Exempt Property (30)

(-)

$2,886,330

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$3,115,861

Ag Use (30)

(-)

$33,851

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$3,082,010

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (78)

(+)

$0

(HS) Homestead State (78)

(+)

$0

(O65) Over 65 Local (51)

(+)

$0

(O65) Over 65 State (51)

(+)

$0

(DP) Disabled Persons Local (1)

(+)

$0

(DP) Disabled Persons State (1)

(+)

$0

(DV) Disabled Vet (5)

(+)

$60,000

(DVX/MAS) Disabled Vet 100% (1)

(+)

$107,272

(PRO) Prorated Exempt Property (1)

(+)

$43,054

(AUTO2) PERSONAL USE/BUSINESS USE (1)

(+)

$13,640

(HB366) House Bill 366 (5)

(+)

$1,215

Total Exemptions

(=)

$225,181

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

(-)

$3,082,010

(=)

$22,713,408

10,129,944 )

(-)

$225,181

(=)

$22,488,227

Page 2 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

**** O65 Freeze Totals

Freeze Assessed

$6,445,398

Freeze Taxable

$6,407,538

Freeze Ceiling (50)

$22,430.89

**** O65 Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

(=)

$16,080,689

(=)

$16,057,616

*** DP Freeze Totals

Freeze Assessed

$23,073

Freeze Taxable

$23,073

Freeze Ceiling (1)

$58.05

*** DP Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

Printed on 07/27/2015 at 8:27 AM

Page 3 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

G01 - Washington County

Number of Properties: 35509

Land Totals

Land - Homesite

(+)

$254,045,907

Land - Non Homesite

(+)

$322,188,425

Land - Ag Market

(+)

$2,534,309,733

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$3,110,544,065

Improvements - Homesite

(+)

$1,652,592,692

Improvements - Non Homesite

(+)

$488,403,487

Total Improvements

(=)

(+)

$3,110,544,065

$2,140,996,179

(+)

$2,140,996,179

Personal Property (2352)

$182,206,420

(+)

$182,206,420

Minerals (10751)

$516,004,900

(+)

$516,004,900

$0

(+)

$0

(=)

$5,949,751,564

Improvement Totals

Other Totals

Autos (0)

Total Market Value

$5,949,751,564

Total Homestead Cap Adjustment (4188)

(-)

$27,709,180

Total Exempt Property (718)

(-)

$153,305,295

(-)

$2,503,323,152

(=)

$3,265,413,937

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$2,534,309,733

Ag Use (7353)

(-)

$30,986,581

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$2,503,323,152

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (7967)

(+)

$0

(HS) Homestead State (7967)

(+)

$0

(O65) Over 65 Local (3647)

(+)

$42,539,515

(O65) Over 65 State (3647)

(+)

$0

(DP) Disabled Persons Local (170)

(+)

$1,895,530

(DP) Disabled Persons State (170)

(+)

$0

(DV) Disabled Vet (229)

(+)

$2,426,165

(DVX/MAS) Disabled Vet 100% (63)

(+)

$10,105,343

(PRO) Prorated Exempt Property (2)

(+)

$55,404

(PC) Pollution Control (4)

(+)

$1,701,510

(AUTO) Lease Vehicles Ex (41)

(+)

$4,324,035

(EXPT) PARTIAL EXEMPT PROPERTY (1)

(+)

$2,893,566

(PRCX) Primarly Charitable Exemption (9)

(+)

$626,240

(AUTO2) PERSONAL USE/BUSINESS USE (24)

(+)

$348,340

(HB366) House Bill 366 (2265)

(+)

$423,870

(AB) Abatement (19)

(+)

$41,681,487

Total Exemptions

(=)

$109,021,005

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

1,278,440,773 )

(-)

$109,021,005

(=)

$3,156,392,932

Page 4 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

**** O65 Freeze Totals

Freeze Assessed

$562,051,208

Freeze Taxable

$514,997,553

Freeze Ceiling (3439)

$1,266,079.24

**** O65 Transfer Totals

Transfer Assessed

$3,780,330

Transfer Taxable

$3,564,330

Post-Percent Taxable

$2,574,017

Transfer Adjustment (18)

$990,313

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

(=)

$2,640,405,066

(=)

$2,625,248,866

*** DP Freeze Totals

Freeze Assessed

$17,789,804

Freeze Taxable

$15,156,200

Freeze Ceiling (157)

$41,869.63

*** DP Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

Printed on 07/27/2015 at 8:27 AM

Page 5 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

JC1 - Blinn College

Number of Properties: 35507

Land Totals

Land - Homesite

(+)

$254,045,907

Land - Non Homesite

(+)

$322,188,425

Land - Ag Market

(+)

$2,534,309,733

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$3,110,544,065

Improvements - Homesite

(+)

$1,652,592,692

Improvements - Non Homesite

(+)

$488,403,487

Total Improvements

(=)

(+)

$3,110,544,065

$2,140,996,179

(+)

$2,140,996,179

Personal Property (2350)

$177,996,830

(+)

$177,996,830

Minerals (10751)

$516,004,900

(+)

$516,004,900

$0

(+)

$0

(=)

$5,945,541,974

Improvement Totals

Other Totals

Autos (0)

Total Market Value

$5,945,541,974

Total Homestead Cap Adjustment (4188)

(-)

$27,709,180

Total Exempt Property (718)

(-)

$153,305,295

(-)

$2,503,323,152

(=)

$3,261,204,347

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$2,534,309,733

Ag Use (7353)

(-)

$30,986,581

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$2,503,323,152

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (7967)

(+)

$0

(HS) Homestead State (7967)

(+)

$0

(O65) Over 65 Local (3647)

(+)

$42,539,515

(O65) Over 65 State (3647)

(+)

$0

(DP) Disabled Persons Local (170)

(+)

$1,895,530

(DP) Disabled Persons State (170)

(+)

$0

(DV) Disabled Vet (229)

(+)

$2,426,165

(DVX/MAS) Disabled Vet 100% (63)

(+)

$10,105,343

(PRO) Prorated Exempt Property (2)

(+)

$55,404

(PC) Pollution Control (4)

(+)

$1,701,510

(AUTO) Lease Vehicles Ex (41)

(+)

$4,324,035

(EXPT) PARTIAL EXEMPT PROPERTY (1)

(+)

$2,893,566

(PRCX) Primarly Charitable Exemption (9)

(+)

$626,240

(AUTO2) PERSONAL USE/BUSINESS USE (24)

(+)

$348,340

(HB366) House Bill 366 (2265)

(+)

$423,870

Total Exemptions

(=)

$67,339,518

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

1,278,440,773 )

(-)

$67,339,518

(=)

$3,193,864,829

Page 6 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

**** O65 Freeze Totals

Freeze Assessed

$562,051,208

Freeze Taxable

$514,997,553

Freeze Ceiling (3439)

$232,042.33

**** O65 Transfer Totals

Transfer Assessed

$3,780,330

Transfer Taxable

$3,564,330

Post-Percent Taxable

$2,974,161

Transfer Adjustment (18)

$590,169

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

(=)

$2,678,277,107

(=)

$2,663,120,907

*** DP Freeze Totals

Freeze Assessed

$17,789,804

Freeze Taxable

$15,156,200

Freeze Ceiling (157)

$7,478.33

*** DP Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

Printed on 07/27/2015 at 8:27 AM

Page 7 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

RD1 - Washington Co Fm

Number of Properties: 35509

Land Totals

Land - Homesite

(+)

$254,045,907

Land - Non Homesite

(+)

$322,188,425

Land - Ag Market

(+)

$2,534,309,733

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$3,110,544,065

Improvements - Homesite

(+)

$1,652,592,692

Improvements - Non Homesite

(+)

$488,403,487

Total Improvements

(=)

(+)

$3,110,544,065

$2,140,996,179

(+)

$2,140,996,179

Personal Property (2352)

$182,206,420

(+)

$182,206,420

Minerals (10751)

$516,004,900

(+)

$516,004,900

$0

(+)

$0

(=)

$5,949,751,564

Improvement Totals

Other Totals

Autos (0)

Total Market Value

$5,949,751,564

Total Homestead Cap Adjustment (4188)

(-)

$27,709,180

Total Exempt Property (718)

(-)

$153,305,295

(-)

$2,503,323,152

(=)

$3,265,413,937

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$2,534,309,733

Ag Use (7353)

(-)

$30,986,581

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$2,503,323,152

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (7967)

(+)

$0

(HS) Homestead State (7967)

(+)

$12,387,420

(O65) Over 65 Local (3647)

(+)

$42,539,515

(O65) Over 65 State (3647)

(+)

$0

(DP) Disabled Persons Local (170)

(+)

$1,895,530

(DP) Disabled Persons State (170)

(+)

$0

(DV) Disabled Vet (229)

(+)

$2,426,165

(DVX/MAS) Disabled Vet 100% (63)

(+)

$10,064,932

(PRO) Prorated Exempt Property (2)

(+)

$55,404

(PC) Pollution Control (4)

(+)

$1,701,510

(AUTO) Lease Vehicles Ex (41)

(+)

$4,324,035

(EXPT) PARTIAL EXEMPT PROPERTY (1)

(+)

$2,893,566

(PRCX) Primarly Charitable Exemption (9)

(+)

$626,240

(AUTO2) PERSONAL USE/BUSINESS USE (24)

(+)

$348,340

(HB366) House Bill 366 (2265)

(+)

$423,870

(AB) Abatement (19)

(+)

$41,681,487

Total Exemptions

(=)

$121,368,014

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

1,278,440,773 )

(-)

$121,368,014

(=)

$3,144,045,923

Page 8 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

**** O65 Freeze Totals

Freeze Assessed

$562,051,208

Freeze Taxable

$514,997,553

Freeze Ceiling (3439)

$594,990.45

**** O65 Transfer Totals

Transfer Assessed

$3,780,330

Transfer Taxable

$3,564,330

Post-Percent Taxable

$3,275,679

Transfer Adjustment (18)

$288,651

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

(=)

$2,628,759,719

(=)

$2,613,603,519

*** DP Freeze Totals

Freeze Assessed

$17,789,804

Freeze Taxable

$15,156,200

Freeze Ceiling (157)

$18,704.48

*** DP Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

Printed on 07/27/2015 at 8:27 AM

Page 9 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

S01 - Brenham ISD

Number of Properties: 25674

Land Totals

Land - Homesite

(+)

$224,350,496

Land - Non Homesite

(+)

$257,788,503

Land - Ag Market

(+)

$1,944,508,886

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$2,426,647,885

Improvements - Homesite

(+)

$1,437,321,233

Improvements - Non Homesite

(+)

$443,207,824

Total Improvements

(=)

(+)

$2,426,647,885

$1,880,529,057

(+)

$1,880,529,057

Personal Property (2132)

$170,672,615

(+)

$170,672,615

Minerals (5000)

$386,470,760

(+)

$386,470,760

$0

(+)

$0

(=)

$4,864,320,317

Improvement Totals

Other Totals

Autos (0)

Total Market Value

$4,864,320,317

Total Homestead Cap Adjustment (3737)

(-)

$25,065,652

Total Exempt Property (625)

(-)

$129,221,225

(-)

$1,921,110,463

(=)

$2,788,922,977

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$1,944,508,886

Ag Use (5631)

(-)

$23,398,423

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$1,921,110,463

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (7025)

(+)

$0

(HS) Homestead State (7025)

(+)

$170,337,283

(O65) Over 65 Local (3164)

(+)

$14,700,547

(O65) Over 65 State (3164)

(+)

$30,195,977

(DP) Disabled Persons Local (147)

(+)

$0

(DP) Disabled Persons State (147)

(+)

$1,291,836

(DV) Disabled Vet (195)

(+)

$2,008,859

(DVX/MAS) Disabled Vet 100% (55)

(+)

$6,768,172

(PRO) Prorated Exempt Property (1)

(+)

$12,350

(PC) Pollution Control (4)

(+)

$1,701,510

(AUTO) Lease Vehicles Ex (36)

(+)

$4,121,170

(EXPT) PARTIAL EXEMPT PROPERTY (1)

(+)

$2,893,566

(PRCX) Primarly Charitable Exemption (7)

(+)

$494,310

(AUTO2) PERSONAL USE/BUSINESS USE (19)

(+)

$285,840

(HB366) House Bill 366 (1574)

(+)

$293,245

Total Exemptions

(=)

$235,104,665

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

1,142,323,935 )

(-)

$235,104,665

(=)

$2,553,818,312

Page 10 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

**** O65 Freeze Totals

Freeze Assessed

$492,823,856

Freeze Taxable

$372,770,826

Freeze Ceiling (2978)

$2,926,602.64

**** O65 Transfer Totals

Transfer Assessed

$10,045,260

Transfer Taxable

$8,248,260

Post-Percent Taxable

$6,421,912

Transfer Adjustment (49)

$1,826,348

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

(=)

$2,179,221,138

(=)

$2,168,289,835

*** DP Freeze Totals

Freeze Assessed

$16,007,778

Freeze Taxable

$10,922,658

Freeze Ceiling (136)

$112,085.67

*** DP Transfer Totals

Transfer Assessed

$78,300

Transfer Taxable

$43,300

Post-Percent Taxable

$34,655

Transfer Adjustment (1)

$8,645

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

Printed on 07/27/2015 at 8:27 AM

Page 11 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

S02 - Burton ISD

Number of Properties: 9449

Land Totals

Land - Homesite

(+)

$27,433,531

Land - Non Homesite

(+)

$61,602,582

Land - Ag Market

(+)

$579,029,347

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$668,065,460

Improvements - Homesite

(+)

$209,052,039

Improvements - Non Homesite

(+)

$44,752,663

Total Improvements

(=)

(+)

$668,065,460

$253,804,702

(+)

$253,804,702

$7,319,605

(+)

$7,319,605

$120,982,080

(+)

$120,982,080

$0

(+)

$0

(=)

$1,050,171,847

Improvement Totals

Other Totals

Personal Property (214)

Minerals (5535)

Autos (0)

Total Market Value

$1,050,171,847

Total Homestead Cap Adjustment (439)

(-)

$2,582,941

Total Exempt Property (90)

(-)

$24,072,560

(-)

$571,626,939

(=)

$451,889,407

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$579,029,347

Ag Use (1678)

(-)

$7,402,408

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$571,626,939

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (893)

(+)

$0

(HS) Homestead State (893)

(+)

$21,192,335

(O65) Over 65 Local (456)

(+)

$0

(O65) Over 65 State (456)

(+)

$4,017,196

(DP) Disabled Persons Local (23)

(+)

$0

(DP) Disabled Persons State (23)

(+)

$176,087

(DV) Disabled Vet (28)

(+)

$315,390

(DVX/MAS) Disabled Vet 100% (8)

(+)

$1,353,234

(PRO) Prorated Exempt Property (1)

(+)

$43,054

(AUTO) Lease Vehicles Ex (5)

(+)

$202,865

(AUTO2) PERSONAL USE/BUSINESS USE (5)

(+)

$62,500

(PRCX) Primarly Charitable Exemption (2)

(+)

$131,930

(HB366) House Bill 366 (766)

(+)

$143,225

Total Exemptions

(=)

$27,637,816

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

131,103,405 )

(-)

$27,637,816

(=)

$424,251,591

Page 12 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

**** O65 Freeze Totals

Freeze Assessed

$66,023,896

Freeze Taxable

$51,153,909

Freeze Ceiling (436)

$429,678.26

**** O65 Transfer Totals

Transfer Assessed

$774,080

Transfer Taxable

$669,080

Post-Percent Taxable

$622,259

Transfer Adjustment (3)

$46,821

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

(=)

$373,050,861

(=)

$371,953,290

*** DP Freeze Totals

Freeze Assessed

$1,782,026

Freeze Taxable

$1,097,571

Freeze Ceiling (21)

$11,657.33

*** DP Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

Printed on 07/27/2015 at 8:27 AM

Page 13 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

S03 - Giddings I S D

Number of Properties: 473

Land Totals

Land - Homesite

(+)

$2,261,880

Land - Non Homesite

(+)

$2,797,340

Land - Ag Market

(+)

$10,771,500

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$15,830,720

Improvements - Homesite

(+)

$6,214,650

Improvements - Non Homesite

(+)

$443,000

Total Improvements

(=)

(+)

$15,830,720

$6,657,650

(+)

$6,657,650

$4,110

(+)

$4,110

$8,756,260

(+)

$8,756,260

$0

(+)

$0

(=)

$31,248,740

Improvement Totals

Other Totals

Personal Property (3)

Minerals (307)

Autos (0)

Total Market Value

$31,248,740

Total Homestead Cap Adjustment (12)

(-)

$60,587

Total Exempt Property (4)

(-)

$11,510

(-)

$10,585,750

(=)

$20,590,893

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$10,771,500

Ag Use (44)

(-)

$185,750

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$10,585,750

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (49)

(+)

$490,083

(HS) Homestead State (49)

(+)

$1,122,580

(O65) Over 65 Local (27)

(+)

$75,000

(O65) Over 65 State (27)

(+)

$250,000

(DV) Disabled Vet (2)

(+)

$24,000

(HB366) House Bill 366 (34)

(+)

$8,185

Total Exemptions

(=)

$1,969,848

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

5,013,433 )

(-)

$1,969,848

(=)

$18,621,045

Page 14 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

**** O65 Freeze Totals

Freeze Assessed

$2,979,536

Freeze Taxable

$1,763,391

Freeze Ceiling (24)

$17,204.94

**** O65 Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

(=)

$16,857,654

(=)

$16,857,654

*** DP Freeze Totals

Freeze Assessed

$0

Freeze Taxable

$0

Freeze Ceiling (0)

$0.00

*** DP Transfer Totals

Transfer Assessed

$0

Transfer Taxable

$0

Post-Percent Taxable

$0

Transfer Adjustment (0)

$0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment)

Printed on 07/27/2015 at 8:27 AM

Page 15 of 16

WASHINGTON PRODUCTION SITE

Assessment Roll Grand Totals Report

Tax Year: 2015

As of: Certification

W01 - Oak Hill W/d

Number of Properties: 192

Land Totals

Land - Homesite

(+)

$4,485,460

Land - Non Homesite

(+)

$789,280

Land - Ag Market

(+)

$982,742

Land - Timber Market

(+)

$0

Land - Exempt Ag/Timber Market

(+)

$0

Total Land Market Value

(=)

$6,257,482

Improvements - Homesite

(+)

$29,429,750

Improvements - Non Homesite

(+)

$1,586,482

Total Improvements

(=)

(+)

$6,257,482

$31,016,232

(+)

$31,016,232

$580,954

(+)

$580,954

$56,950

(+)

$56,950

$0

(+)

$0

(=)

$37,911,618

Improvement Totals

Other Totals

Personal Property (22)

Minerals (3)

Autos (0)

Total Market Value

$37,911,618

Total Homestead Cap Adjustment (56)

(-)

$386,134

Total Exempt Property (4)

(-)

$278,360

Productivity Totals

Total Productivity Market (Non Exempt)

(+)

$982,742

Ag Use (6)

(-)

$11,431

Timber Use (0)

(-)

$0

Total Productivity Loss

(=)

$971,311

Total Assessed

Exemptions

(HS Assd

(HS) Homestead Local (124)

(+)

$0

(HS) Homestead State (124)

(+)

$0

(O65) Over 65 Local (54)

(+)

$0

(O65) Over 65 State (54)

(+)

$0

(DP) Disabled Persons Local (3)

(+)

$0

(DP) Disabled Persons State (3)

(+)

$0

(DV) Disabled Vet (3)

(+)

$32,000

(DVX/MAS) Disabled Vet 100% (1)

(+)

$328,020

(HB366) House Bill 366 (4)

(+)

$1,209

Total Exemptions

(=)

$361,229

Net Taxable (Before Freeze)

Printed on 07/27/2015 at 8:27 AM

(-)

$971,311

(=)

$36,275,813

30,097,416 )

(-)

$361,229

(=)

$35,914,584

Page 16 of 16

You might also like

- ButlerLumberCompany Final ExcelDocument17 pagesButlerLumberCompany Final Excelkaran_w3No ratings yet

- B.C.A Accounting 1st Chapter NotesDocument18 pagesB.C.A Accounting 1st Chapter Notesrakesh87% (23)

- Sample Financial Reports For Livelihood AssociationDocument7 pagesSample Financial Reports For Livelihood AssociationOslec AtenallNo ratings yet

- Jim Chanos ImportantDocument40 pagesJim Chanos Importantkabhijit04No ratings yet

- LVA, FVA, CVA, DVA Impacts On Derivatives ManagementDocument39 pagesLVA, FVA, CVA, DVA Impacts On Derivatives ManagementindisateeshNo ratings yet

- GGATTL16Document65 pagesGGATTL16Tyler DrummondNo ratings yet

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocument3 pagesHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- Lesson 25Document15 pagesLesson 25TUẤN TRẦN MINHNo ratings yet

- 9621-17-7P AID: 1150 - 20/02/2014: S.No. Account Title and Explanation Debit ($) Credit ($)Document3 pages9621-17-7P AID: 1150 - 20/02/2014: S.No. Account Title and Explanation Debit ($) Credit ($)Ekta Saraswat VigNo ratings yet

- Quik Silver Inc 10 Q 31715Document52 pagesQuik Silver Inc 10 Q 31715pakistanNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Financial Statement, Cash Flows and TaxesDocument22 pagesFinancial Statement, Cash Flows and Taxesnumlit1984No ratings yet

- 123 Main Street: (Windsor, ON)Document5 pages123 Main Street: (Windsor, ON)RomanoNo ratings yet

- FFM 9 Im 12Document31 pagesFFM 9 Im 12Mariel CorderoNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- ACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioDocument3 pagesACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioHomeworkhelpbylanceNo ratings yet

- IAS 12: Practice Questions AnswersDocument8 pagesIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNo ratings yet

- Government-Wide Statements & Budgetary Comparison Schedule Part OneDocument5 pagesGovernment-Wide Statements & Budgetary Comparison Schedule Part Onecyics TabNo ratings yet

- LMD Budget SpreadsheetDocument1 pageLMD Budget SpreadsheetScott FranzNo ratings yet

- Tugas 2 Evaluasi Ekonomi Pabrik KimiaDocument9 pagesTugas 2 Evaluasi Ekonomi Pabrik KimiaIllona NathaniaNo ratings yet

- New York City Preliminary Expense Revenue Contract Budget FY2011Document487 pagesNew York City Preliminary Expense Revenue Contract Budget FY2011Aaron MonkNo ratings yet

- FSA Hw2Document13 pagesFSA Hw2Mohammad DaulehNo ratings yet

- Chapter 12 Solutions To The Assigned Exercise ProblemsDocument3 pagesChapter 12 Solutions To The Assigned Exercise ProblemsLuis MenuciNo ratings yet

- 2011-2012 County RevenuesDocument23 pages2011-2012 County RevenuesMichael ToddNo ratings yet

- EB 10 11 Non Departmental - StampedDocument40 pagesEB 10 11 Non Departmental - StampedMatt HampelNo ratings yet

- FinanceDocument12 pagesFinanceJesus Javier Flores RodriguezNo ratings yet

- 2011Q2 Google Earnings SlidesDocument15 pages2011Q2 Google Earnings SlidesAlexia Bonatsos100% (1)

- EconomicsDocument5 pagesEconomicsbrian mochez01No ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Walmart Inc. (WMT) Cash FlowDocument1 pageWalmart Inc. (WMT) Cash FlowinuNo ratings yet

- Financial Management Assignment, HCC, PUDocument12 pagesFinancial Management Assignment, HCC, PUMuhammad MoazNo ratings yet

- 2016 Proposed Budget Presentations 11-17-2015 DRAFTDocument25 pages2016 Proposed Budget Presentations 11-17-2015 DRAFTThe Brookhaven PostNo ratings yet

- 2015Q1 Google Earnings SlidesDocument15 pages2015Q1 Google Earnings SlidesToni HercegNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- City of Miami: Inter-Office MemorandumDocument15 pagesCity of Miami: Inter-Office Memorandumal_crespoNo ratings yet

- 0976 Module 10 RossFCF9ce SM Ch10 FINALDocument21 pages0976 Module 10 RossFCF9ce SM Ch10 FINALYuk SimNo ratings yet

- Department of Public Works (19) : Agency Plan: Mission, Goals and Budget SummaryDocument37 pagesDepartment of Public Works (19) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNo ratings yet

- Lecture Notes Topic 4 Part 2Document34 pagesLecture Notes Topic 4 Part 2sir bookkeeperNo ratings yet

- SolutionCH9 CH11Document9 pagesSolutionCH9 CH11qwerty1234qwer100% (1)

- AESCorporation 10Q 20130808Document86 pagesAESCorporation 10Q 20130808Ashish SinghalNo ratings yet

- 2015 Annual Accomplishment ReportDocument8 pages2015 Annual Accomplishment ReportAngelica Aquino GasmenNo ratings yet

- Taxes and The Statement of Cash FlowsDocument8 pagesTaxes and The Statement of Cash FlowsSaddy ButtNo ratings yet

- Chapter 8Document52 pagesChapter 8raomahinNo ratings yet

- Accounting Seminar 16: Team 6Document64 pagesAccounting Seminar 16: Team 6Jerilynn YeoNo ratings yet

- JAN FEB MAR Projected Amount Total Amount: EarningsDocument2 pagesJAN FEB MAR Projected Amount Total Amount: EarningsSubhankarNo ratings yet

- HD - SCF HD - SCFDocument3 pagesHD - SCF HD - SCFsyedatiqrocketmailcomNo ratings yet

- Chapter Fifteen SolutionsDocument21 pagesChapter Fifteen Solutionsapi-3705855No ratings yet

- T1 - IAS 12 - BT1 - KeyDocument3 pagesT1 - IAS 12 - BT1 - KeyKotoru HanoelNo ratings yet

- City of Miami: Inter-Office MemorandumDocument17 pagesCity of Miami: Inter-Office Memorandumal_crespoNo ratings yet

- Chapter 3 ProFormaDocument15 pagesChapter 3 ProFormaNancy LuciaNo ratings yet

- Irving Staff ARK PresentationDocument17 pagesIrving Staff ARK PresentationAvi SelkNo ratings yet

- ACC1002 Team 8Document11 pagesACC1002 Team 8Yvonne Ng Ming HuiNo ratings yet

- 6-Fac 4 ADocument5 pages6-Fac 4 Anachofr2704No ratings yet

- DRR 1 Sept 19Document6 pagesDRR 1 Sept 19Ilyas SatriaNo ratings yet

- Dipifr Int 2010 Jun ADocument11 pagesDipifr Int 2010 Jun AHellyMyronNo ratings yet

- GSTR9 18acvpa7546a1zk 032022Document8 pagesGSTR9 18acvpa7546a1zk 032022SUBHASH MOURNo ratings yet

- Computation With Dumping Duty (R.A 8752)Document11 pagesComputation With Dumping Duty (R.A 8752)Mariel BoncatoNo ratings yet

- Topic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANDocument18 pagesTopic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANJaved AnwarNo ratings yet

- Ch1-Homework Solutions (A Problems)Document11 pagesCh1-Homework Solutions (A Problems)jmdd555100% (1)

- Constructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmDocument5 pagesConstructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmBhavesh MaruNo ratings yet

- Commercial Property Tax Appeal ServicesDocument7 pagesCommercial Property Tax Appeal ServicescutmytaxesNo ratings yet

- Are Your Property Taxes Too HighDocument8 pagesAre Your Property Taxes Too HighcutmytaxesNo ratings yet

- Property Tax Consultants & Their RulesDocument7 pagesProperty Tax Consultants & Their RulescutmytaxesNo ratings yet

- Texans, Fight Property Tax Increase Amidst COVID 19!Document7 pagesTexans, Fight Property Tax Increase Amidst COVID 19!cutmytaxesNo ratings yet

- What Is Business Personal Property TaxDocument7 pagesWhat Is Business Personal Property TaxcutmytaxesNo ratings yet

- Tips To Win A Property Tax ProtestDocument7 pagesTips To Win A Property Tax ProtestcutmytaxesNo ratings yet

- Udget: H C A DDocument49 pagesUdget: H C A DO'Connor AssociateNo ratings yet

- Top 10 Property Tax TipsDocument7 pagesTop 10 Property Tax TipscutmytaxesNo ratings yet

- Property Appeal Protest ServicesDocument7 pagesProperty Appeal Protest ServicescutmytaxesNo ratings yet

- HFF Investment OverviewDocument4 pagesHFF Investment OverviewcutmytaxesNo ratings yet

- Property Tax in Texas - Research Report 2017Document12 pagesProperty Tax in Texas - Research Report 2017cutmytaxesNo ratings yet

- Property Tax Bills 2017Document16 pagesProperty Tax Bills 2017cutmytaxesNo ratings yet

- Property Tax Deferral Disabled Senior CitizensDocument16 pagesProperty Tax Deferral Disabled Senior CitizenscutmytaxesNo ratings yet

- BREAStrategicPlan PDFDocument16 pagesBREAStrategicPlan PDFcutmytaxesNo ratings yet

- Real Estate Education Course CatalogDocument81 pagesReal Estate Education Course CatalogcutmytaxesNo ratings yet

- Newco Case Study Executive Summary PDFDocument19 pagesNewco Case Study Executive Summary PDFnathan0% (1)

- Working Capital Operating CycleDocument3 pagesWorking Capital Operating CycleRatish NairNo ratings yet

- Black RockDocument3 pagesBlack RockAb CNo ratings yet

- Elearning - Lspr.edu: Master of Arts in Communication: Corporate Communication StudiesDocument36 pagesElearning - Lspr.edu: Master of Arts in Communication: Corporate Communication StudieselearninglsprNo ratings yet

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- Case SPMDocument4 pagesCase SPMainiNo ratings yet

- Profits and MarginsDocument4 pagesProfits and Marginsrishifiib08No ratings yet

- Segment and Interim Reporting: Baker / Lembke / KingDocument34 pagesSegment and Interim Reporting: Baker / Lembke / KingSarah NurainiNo ratings yet

- How To Capitalise On French Retail Investor Appetite For HealthcareDocument4 pagesHow To Capitalise On French Retail Investor Appetite For HealthcareNishant KhatriNo ratings yet

- A Study of Online Shopping Preference With Reference To FlipkartDocument89 pagesA Study of Online Shopping Preference With Reference To Flipkartkumar saurabhNo ratings yet

- Di OutlineDocument81 pagesDi OutlineRobert E. BrannNo ratings yet

- Cloud KitchensDocument6 pagesCloud Kitchenssigitsutoko87650% (1)

- Surname 1Document3 pagesSurname 1Paul NdegNo ratings yet

- General Partnership AgreementDocument5 pagesGeneral Partnership AgreementJay Smith100% (1)

- Classification of PartnersDocument2 pagesClassification of Partnersarnel barawedNo ratings yet

- Clearwater NOTES Ans SWOTDocument8 pagesClearwater NOTES Ans SWOTSuziNo ratings yet

- Cash and Liquidity ManagementDocument21 pagesCash and Liquidity ManagementDivyajyoti SinghNo ratings yet

- Merger and Acquisition Transactions Under Ohada Law: 1. Why Do Companies Enter Into M&A Transactions in Africa?Document6 pagesMerger and Acquisition Transactions Under Ohada Law: 1. Why Do Companies Enter Into M&A Transactions in Africa?Che DivineNo ratings yet

- Professional EnglishDocument10 pagesProfessional EnglishFrancesca Rutti AlvaradoNo ratings yet

- Cfas 19 Pas 41 Biological AssetsDocument3 pagesCfas 19 Pas 41 Biological Assetsnash lastNo ratings yet

- TDS NotificationDocument24 pagesTDS NotificationSeemaNaikNo ratings yet

- Costing Vs PricingDocument6 pagesCosting Vs PricingArif NasimNo ratings yet

- BBA (2013 Pattern) 1 PDFDocument52 pagesBBA (2013 Pattern) 1 PDFRushiraj DhamaleNo ratings yet

- Chapter 3: Directors and Their RolesDocument8 pagesChapter 3: Directors and Their RolesMehedul Islam SabujNo ratings yet

- Budget Analysis-2012 - T.P Ostwal & AssociatesDocument115 pagesBudget Analysis-2012 - T.P Ostwal & AssociatesvaidheiNo ratings yet

- Compound InterestDocument10 pagesCompound InterestgetphotojobNo ratings yet