Professional Documents

Culture Documents

VE Daily 100427

VE Daily 100427

Uploaded by

ValuEngine.comOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VE Daily 100427

VE Daily 100427

Uploaded by

ValuEngine.comCopyright:

Available Formats

ATTENTION Investors and Finance Professionals:

If you are reading this you should sign up for ValuEngine's award-winning stock

valuation and forecast service at the low price of $19.95/month!

NO OBLIGATION, 30 Day FREE TRIAL!

CLICK HERE

April 27, 2010

VALUATION WATCH: Our models find that overvaluation is approaching

levels typically seen when a market correction is imminent. Overvalued

stocks now make up over 61% of our universe and more than 31% of the

universe is calculated to be overvalued by 20% or more. All sectors are

now calculated to be overvalued.

Diamonds are Forever

ValuEngine Models Rate Harry Winston a Buy

ValuEngine has issued a BUY recommendation for HARRY WINSTON DIAMOND

CORP (HWD). Based on the information we have gathered and our resulting research, we

feel that HARRY WINSTON DIAMOND CORP has the probability to OUTPERFORM average

market performance for the next year. The company exhibits ATTRACTIVE market valuation,

momentum and expected EPS growth.

Harry Winston Diamond Corporation engages in mining and retailing diamonds.

The company supplies rough diamonds worldwide. It has a 40% ownership interest in the

Diavik Diamond Mine located in the Northwest Territories, Canada. The company, through its

subsidiary, Harry Winston Inc., engages in fine jewelry and watch retailing under the Harry

Winston brand. Harry Winston Diamond Corporation also serves customers through a

network of distributors internationally. It was formerly known as Aber Diamond Corporation

and changed its name to Harry Winston Diamond Corporation in 2007. The company was

founded in 1980 and is headquartered in Toronto, Canada.

When compared to our universe of more than 4000 stocks trading on US exchanges,

HWD ranks near the top for short and long-term forecast returns as well as valuation,

momentum, and one-year chance of gain.

Subscribers can check out the latest figures on HWD HERE.

Not a ValuEngine Premium Website member? Then please consider signing up for our

no obligation, 30 Day free trial today.

To Sign Up for a 30 Day FREE TRIAL, Please Click the Logo Below

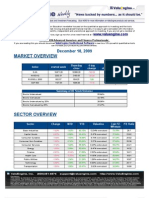

MARKET OVERVIEW

Summary of VE Stock Universe

Stocks Undervalued 39.68%

Stocks Overvalued 60.32%

Stocks Undervalued by 20% 18.76%

Stocks Overvalued by 20% 31.34%

SECTOR OVERVIEW

Last 12- P/E

Sector Change MTD YTD Valuation

MReturn Ratio

Basic Industries 1.01% 6.13% 19.44% 15.00% overvalued 90.14% 27.61

Capital Goods 1.37% 7.18% 19.22% 19.15% overvalued 64.65% 23.61

Consumer Durables 0.92% 7.29% 15.00% 22.96% overvalued 87.57% 24.67

Consumer Non-Durables 0.15% 4.21% 12.23% 8.14% overvalued 74.70% 19.8

Consumer Services 1.25% 8.25% 20.96% 11.19% overvalued 75.41% 24.12

Energy 0.52% 4.00% 6.08% 13.88% overvalued 75.72% 22.37

Finance 0.74% 6.15% 15.91% 12.90% overvalued 43.49% 19.91

Health Care -0.09% 4.15% 12.13% 2.23% overvalued 64.78% 22.48

Public Utilities 0.16% 1.81% 2.85% 5.37% overvalued 45.16% 16.58

Technology 0.65% 6.10% 14.68% 3.86% overvalued 75.27% 29.31

Transportation 1.37% 6.24% 14.94% 11.78% overvalued 59.07% 22.3

You might also like

- LLQP StudyNotesDocument8 pagesLLQP StudyNotesikawoako100% (2)

- Note Acc406 Chapter 1,2,3,4,5Document10 pagesNote Acc406 Chapter 1,2,3,4,5Sha Abdullah II100% (3)

- April 26, 2010: Valuengine Models Predict Strong Returns For Citigroup SharesDocument2 pagesApril 26, 2010: Valuengine Models Predict Strong Returns For Citigroup SharesValuEngine.comNo ratings yet

- CrossroadsDocument2 pagesCrossroadsValuEngine.comNo ratings yet

- VE Daily 100406Document2 pagesVE Daily 100406ValuEngine.comNo ratings yet

- Too LiveDocument2 pagesToo LiveValuEngine.comNo ratings yet

- Food Additive Manufacturer Senomyx (SNMX,$SNMX) Leads ValuEngine - Com Forecast ScreenDocument2 pagesFood Additive Manufacturer Senomyx (SNMX,$SNMX) Leads ValuEngine - Com Forecast ScreenValuEngine.comNo ratings yet

- ValuEngine Market Valuation Figures Inch Into The Danger Zone (Again... )Document4 pagesValuEngine Market Valuation Figures Inch Into The Danger Zone (Again... )ValuEngine.comNo ratings yet

- VE Bulletin Pick Scores BigDocument2 pagesVE Bulletin Pick Scores BigValuEngine.comNo ratings yet

- Fly The American SkiesDocument2 pagesFly The American SkiesValuEngine.comNo ratings yet

- SnapshotDocument2 pagesSnapshotValuEngine.comNo ratings yet

- Forecast Model Pick Melco Crown Entertainment (MPEL,$MPEL) Up 20% in 19 DaysDocument2 pagesForecast Model Pick Melco Crown Entertainment (MPEL,$MPEL) Up 20% in 19 DaysValuEngine.comNo ratings yet

- Vonage Back From The DeadDocument2 pagesVonage Back From The DeadValuEngine.comNo ratings yet

- ValuEngine Weekly NewsletterDocument14 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- InhospitableDocument2 pagesInhospitableValuEngine.comNo ratings yet

- Still Flying High On The Friendly SkiesDocument3 pagesStill Flying High On The Friendly SkiesValuEngine.comNo ratings yet

- Positive News From Airlines Leads To Gains For ValuEngine Forecast 22 Newsletter Picks AMR and LCCDocument2 pagesPositive News From Airlines Leads To Gains For ValuEngine Forecast 22 Newsletter Picks AMR and LCCValuEngine.comNo ratings yet

- Kelly Services Gets A BuyDocument2 pagesKelly Services Gets A BuyValuEngine.comNo ratings yet

- Goldman Sachs (GS,$GS) Beats Expectations But Profits Down Due To Dividend, ValuEngine Models Remain Neutral On The Finance GiantDocument2 pagesGoldman Sachs (GS,$GS) Beats Expectations But Profits Down Due To Dividend, ValuEngine Models Remain Neutral On The Finance GiantValuEngine.comNo ratings yet

- VE Weekly 100326Document9 pagesVE Weekly 100326ValuEngine.comNo ratings yet

- Peet's Coffee and Tea (Peet, $peet) Breaks Out, Provides Big Gain For VE Market Neutral PortfolioDocument3 pagesPeet's Coffee and Tea (Peet, $peet) Breaks Out, Provides Big Gain For VE Market Neutral PortfolioValuEngine.comNo ratings yet

- ValuEngine Weekly November 5, 2010Document10 pagesValuEngine Weekly November 5, 2010ValuEngine.comNo ratings yet

- Stock UpDocument2 pagesStock UpValuEngine.comNo ratings yet

- Pier Number One!Document3 pagesPier Number One!ValuEngine.comNo ratings yet

- Black GoldDocument2 pagesBlack GoldValuEngine.comNo ratings yet

- February 19, 2010: Bonus For ReadersDocument7 pagesFebruary 19, 2010: Bonus For ReadersValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter March 30, 2010Document15 pagesValuEngine Weekly Newsletter March 30, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter August 13, 2010Document9 pagesValuEngine Weekly Newsletter August 13, 2010ValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument9 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor EducationDocument11 pagesThe ValuEngine Weekly Is An Investor EducationValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter July 9, 2010Document13 pagesValuEngine Weekly Newsletter July 9, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter July 30, 2010Document16 pagesValuEngine Weekly Newsletter July 30, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly NewsletterDocument12 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- VE Weekly 101119Document8 pagesVE Weekly 101119ValuEngine.comNo ratings yet

- Market Overview: September 4, 2009Document11 pagesMarket Overview: September 4, 2009ValuEngine.comNo ratings yet

- January 29, 2010: Market OverviewDocument9 pagesJanuary 29, 2010: Market OverviewValuEngine.comNo ratings yet

- VE Weekly 101126Document6 pagesVE Weekly 101126ValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter February 12, 2010Document12 pagesValuEngine Weekly Newsletter February 12, 2010ValuEngine.comNo ratings yet

- Exxon-Mobil (XOM,$XOM) Reports Major Gulf Discovery, ValuEngine - Com Rates Energy Giant A BuyDocument2 pagesExxon-Mobil (XOM,$XOM) Reports Major Gulf Discovery, ValuEngine - Com Rates Energy Giant A BuyValuEngine.comNo ratings yet

- Bonus For Readers: February 26, 2010Document10 pagesBonus For Readers: February 26, 2010ValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument11 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument12 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- ValuEngine Weekly NewsletterDocument13 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter February 18, 2011Document10 pagesValuEngine Weekly Newsletter February 18, 2011ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter April 1, 2010Document9 pagesValuEngine Weekly Newsletter April 1, 2010ValuEngine.comNo ratings yet

- VE Weekly 090911Document8 pagesVE Weekly 090911ValuEngine.comNo ratings yet

- Chambal Fertilizers and Chemicals LimitedDocument9 pagesChambal Fertilizers and Chemicals LimitedSoumalya GhoshNo ratings yet

- Ratio Analysis-Overview Ratios:: CaveatsDocument18 pagesRatio Analysis-Overview Ratios:: CaveatsabguyNo ratings yet

- Group 1 - FRA Assignment - HUL - Term1Document8 pagesGroup 1 - FRA Assignment - HUL - Term1satyam pandeyNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument7 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter August 27 2010Document11 pagesValuEngine Weekly Newsletter August 27 2010ValuEngine.comNo ratings yet

- PGHH 2022 UpdateDocument11 pagesPGHH 2022 Updatename100% (1)

- Mutual FundsDocument4 pagesMutual FundsSujesh SasiNo ratings yet

- CH CFDocument10 pagesCH CFSyed OsamaNo ratings yet

- Financial Statement Analysis FIN3111Document9 pagesFinancial Statement Analysis FIN3111Zile MoazzamNo ratings yet

- Free Weekly Newsletter June 18, 2010Document12 pagesFree Weekly Newsletter June 18, 2010ValuEngine.comNo ratings yet

- Tapping the Markets: Opportunities for Domestic Investments in Water and Sanitation for the PoorFrom EverandTapping the Markets: Opportunities for Domestic Investments in Water and Sanitation for the PoorNo ratings yet

- Universal Circuits, IncDocument5 pagesUniversal Circuits, IncRatish Mayank25% (4)

- Sale and Lease Back Transactions in Terms of VATDocument4 pagesSale and Lease Back Transactions in Terms of VATAccaceNo ratings yet

- Business Finance (Soft Copy of Chapter 7 Managing Personal Finance)Document7 pagesBusiness Finance (Soft Copy of Chapter 7 Managing Personal Finance)KOUJI N. MARQUEZNo ratings yet

- Afr AssignmentDocument5 pagesAfr Assignmentshahid sjNo ratings yet

- Eclectica Absolute Macro Fund: Manager CommentDocument3 pagesEclectica Absolute Macro Fund: Manager Commentfreemind3682No ratings yet

- Islamic Finance and Ethiacal InvestmentDocument23 pagesIslamic Finance and Ethiacal InvestmentAntony Juniar ElfarishiNo ratings yet

- DP & Trading ModificationDocument1 pageDP & Trading ModificationBhalani VijayNo ratings yet

- Es070617 1Document3 pagesEs070617 1RICARDO100% (1)

- Principle of LendingDocument29 pagesPrinciple of Lendingsonal yadavNo ratings yet

- DangoteCementPlc 2018 AnnualReportDocument225 pagesDangoteCementPlc 2018 AnnualReportVaibhav KhodakeNo ratings yet

- Non-Banking Financial CompanyDocument36 pagesNon-Banking Financial CompanyDipak MahalikNo ratings yet

- 139 Bonnevie v. HernandezDocument3 pages139 Bonnevie v. HernandezKevin Hernandez100% (1)

- Behavioral Finance LectureDocument13 pagesBehavioral Finance LectureshadykittenNo ratings yet

- Project Dissertation: Submitted in The Partial Fullfilment of MBADocument50 pagesProject Dissertation: Submitted in The Partial Fullfilment of MBAAshish BaniwalNo ratings yet

- Corporate Social Responsibility and Tax Avoidance: Evidence From The 2018 Tax Reform in TaiwanDocument34 pagesCorporate Social Responsibility and Tax Avoidance: Evidence From The 2018 Tax Reform in Taiwan22nNo ratings yet

- Lecture 5 InterestRateFutures (Part1)Document36 pagesLecture 5 InterestRateFutures (Part1)efflux 1990No ratings yet

- Financial Analysis Example Excel TemplateDocument3 pagesFinancial Analysis Example Excel TemplateRosa LindaNo ratings yet

- Bloomberg FunctionsDocument1 pageBloomberg Functionschandra_kumarbrNo ratings yet

- BDD Redevelopment - EnggDocument13 pagesBDD Redevelopment - Enggbalaeee123No ratings yet

- ADX CompaniesGuide2011Document151 pagesADX CompaniesGuide2011joNo ratings yet

- Apple Q3 FY19 Consolidated Financial StatementsDocument3 pagesApple Q3 FY19 Consolidated Financial StatementsJack PurcherNo ratings yet

- PINKYS WORLD ... SECTION-1-POWER-OF-ATTORNEY Gos From Strawman To The RealDocument3 pagesPINKYS WORLD ... SECTION-1-POWER-OF-ATTORNEY Gos From Strawman To The RealStephanie's World100% (2)

- Direct Housing FinanceDocument3 pagesDirect Housing Financesagar1089No ratings yet

- Keisya Allysa Rakhman - 6082101100 - Tugas Week12Document28 pagesKeisya Allysa Rakhman - 6082101100 - Tugas Week12KEISYA ALLYSA RAKHMANNo ratings yet

- Syndicated Loan Agreement: PartiesDocument10 pagesSyndicated Loan Agreement: PartiesAleezah Gertrude RaymundoNo ratings yet

- NOTICE ChecklistDocument2 pagesNOTICE ChecklistAdrian50% (2)

- Accounting Sample ResumeDocument2 pagesAccounting Sample ResumeegrandeventuresNo ratings yet