Professional Documents

Culture Documents

7 Comprehensive Examination: Case # 1

7 Comprehensive Examination: Case # 1

Uploaded by

Sajid AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 Comprehensive Examination: Case # 1

7 Comprehensive Examination: Case # 1

Uploaded by

Sajid AliCopyright:

Available Formats

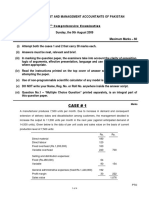

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN

7 t h Comprehensive Examination

Sunday, the 8th February 2009

Time Allowed 2 Hours

Maximum Marks 60

(i) Attempt both the cases 1 and 2 that carry 30 marks each.

(ii) Answers must be neat, relevant and brief.

(iii) In marking the question paper, the examiners take into account the clarity of exposition,

logic of arguments, effective presentation, language and use of clear diagram or chart

where appropriate.

(iv) Read the instructions printed on the top cover of answer script CAREFULLY before

attempting the paper.

(v) Use of non-programmable scientific calculator of any model is allowed.

(v) DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script.

(vi) Question No.1 Multiple Choice Question printed separately, is an integral part of

this question paper.

CASE # 1

Marks

Management of a manufacturing company is reviewing the profitability of its four

products. Several proposals have been considered regarding various product mix and

price changes. Advise the management as to which one of the proposals is most

profitable as given hereunder (show all your workings):

Proposal - 1. Product C is discontinued.

Proposal - 2. Product C is discontinued and a consequent loss of customers results in a

decrease of 200 units in sales of product B.

Proposal - 3. Product C's sales price is increased to Rs.640, and the number of units

sold decreases to 1,500 with no effect on the other products.

Proposal - 4. A new product E is introduced and product C is discontinued with no effect

on the other products.

The total variable cost per unit of product E would be Rs.644, and 1,600

units can be sold at Rs.760 each. The plant in which product C is

produced can be utilized to manufacture product E.

Proposal - 5. The output of product A is reduced to 500 units (to be sold at Rs.960

each) and output of product D is increased to 2,500 units (to be sold at

Rs.840 each).

It may be noted that part of the plant in which product A is produced can

easily be adapted to manufacture product D, but changes in quantities

requires changes in the sales price as suggested.

1 of 3

PTO

Marks

Proposal - 6. The output of product A is increased by 1,000 units to be sold at Rs.800

each by adding a second shift.

In order to achieve the increased production, higher wages must be paid,

thus increasing the variable cost of goods sold per unit to Rs.280 for each

additional unit.

Relevant data for calculating effects of each proposal is as under:

(In Rupees)

Products

Particulars

Sales

Cost of goods sold

Gross profit

Operating expenses

Profit before income tax

Units sold (Nos.)

Sales price per unit (Rs.)

Variable cost of goods sold

per unit (Rs.)

Variable operating

expenses per unit (Rs.)

Total

800,000 1,440,000 1,008,000 1,760,000 5,008,000

380,000

564,480 1,117,440 1,480,000 3,541,920

420,000

875,520 (109,440) 280,000 1,466,080

159,200

238,080

226,080

337,600

960,960

260,800

637,440 (335,520)

(57,600) 505,120

1,000

800

1,200

1,200

1,800

560

2,000

880

200

240

520

480

93.60

100

80

96

The total fixed cost is not expected to fluctuate as a result of changes under

consideration.

30

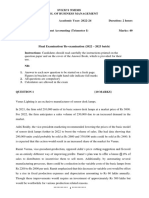

CASE # 2

A company is using a machine for last two (2) years. At the end of second year of its

operation, management of the company felt that increasing market demand could not be

met with due to lesser capacity of existing machine. The management has received a

proposal to purchase similar machine of enhanced production capacity. The particulars of

new proposed machine are given below as compared to existing machine:

Particulars

Purchase price (Rs.)

Estimated life (years)

Salvage value

Annual operating hours

Selling price per unit (Rs.)

Output per hour (units)

Material cost per unit (Rs.)

Labour cost per hour (Rs.)

Consumable stores per year (Rs.)

Repairs and maintenance per year (Rs.)

Working capital (Rs.)

2 of 3

Existing machine

New machine

480,000

6

Nil

2,000

20

15

4

40

4,000

18,000

50,000

800,000

4

Nil

2,000

20

30

4

80

10,000

12,000

80,000

Marks

The market value of existing machine is assessed at Rs. 200,000 with no salvage

value having remaining useful life of four (4) years.

The company uses the reducing balance method of depreciation @ 25% per annum.

Tax rate of the company is 30%.

Companys required rate of return is 15%.

Required:

Advise the management regarding replacement of the existing machine with new one.

(Show all computations).

30

Present value factors

Year

1

2

3

4

5

6

7

8

9

10

10%

0.909

0.826

0.751

0.683

0.621

0.564

0.513

0.467

0.424

0.386

11%

0.901

0.812

0.731

0.659

0.593

0.535

0.482

0.434

0.391

0.352

12%

0.893

0.797

0.712

0.636

0.567

0.507

0.452

0.404

0.361

0.322

13%

0.885

0.783

0.693

0.613

0.543

0.480

0.425

0.376

0.333

0.295

14%

0.877

0.769

0.675

0.592

0.519

0.456

0.400

0.351

0.308

0.270

15%

0.870

0.756

0.658

0.572

0.497

0.432

0.376

0.327

0.284

0.247

16%

0.862

0.743

0.641

0.552

0.476

0.410

0.354

0.305

0.263

0.227

17%

0.855

0.731

0.624

0.534

0.456

0.390

0.333

0.285

0.243

0.208

18%

0.847

0.718

0.609

0.516

0.437

0.370

0.314

0.266

0.225

0.191

19%

0.840

0.706

0.593

0.499

0.419

0.352

0.296

0.249

0.209

0.176

20%

0.833

0.694

0.579

0.482

0.402

0.335

0.279

0.233

0.194

0.162

18%

0.847

1.566

2.174

2.690

3.127

3.498

3.812

4.078

4.303

4.494

19%

0.840

1.547

2.140

2.639

3.058

3.410

3.706

3.954

4.163

4.339

20%

0.833

1.528

2.106

2.589

2.991

3.326

3.605

3.837

4.031

4.192

Cumulative present value factors

Year

1

2

3

4

5

6

7

8

9

10

10%

0.909

1.736

2.487

3.170

3.791

4.355

4.868

5.335

5.759

6.145

11%

0.901

1.713

2.444

3.102

3.696

4.231

4.712

5.146

5.537

5.889

12%

0.893

1.690

2.402

3.037

3.605

4.111

4.564

4.968

5.328

5.650

13%

0.885

1.668

2.361

2.974

3.517

3.998

4.423

4.799

5.132

5.426

14%

0.877

1.647

2.322

2.914

3.433

3.889

4.288

4.639

4.946

5.216

15%

0.870

1.626

2.283

2.855

3.352

3.784

4.160

4.487

4.772

5.019

THE END

3 of 3

16%

0.862

1.605

2.246

2.798

3.274

3.685

4.039

4.344

4.607

4.833

17%

0.855

1.585

2.210

2.743

3.199

3.589

3.922

4.207

4.451

4.659

You might also like

- Chapter 7 SolutionsDocument9 pagesChapter 7 SolutionsMuhammad Naeem100% (3)

- 820001-Cost and Management AccountingDocument4 pages820001-Cost and Management AccountingsuchjazzNo ratings yet

- Chapter 14 SolutionsDocument10 pagesChapter 14 SolutionsAmanda Ng100% (2)

- Chapter 9 SolutionsDocument11 pagesChapter 9 Solutionssaddam hussain80% (5)

- Chapter 8 Solutions GitmanDocument22 pagesChapter 8 Solutions GitmanCat Valentine100% (3)

- Rev PB SheetDocument10 pagesRev PB SheetPatriqKaruriKimbo100% (1)

- AccountingDocument9 pagesAccountingVaibhav BindrooNo ratings yet

- Chapter 11 SolutionsDocument22 pagesChapter 11 SolutionsChander Santos Monteiro100% (3)

- Chapter 12 SolutionsDocument13 pagesChapter 12 SolutionsCindy Lee75% (4)

- Chapter 15Document6 pagesChapter 15Rayhan Atunu100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali67% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali50% (2)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- Study Guide CH 7 MicroDocument35 pagesStudy Guide CH 7 MicroIoana StanciuNo ratings yet

- Comp Exam1 05082k8Document2 pagesComp Exam1 05082k8Shoaib AliNo ratings yet

- Tutorial 4Document6 pagesTutorial 4FEI FEINo ratings yet

- 9 Comprehensive Examination: Case # 1Document4 pages9 Comprehensive Examination: Case # 1Sajid AliNo ratings yet

- 5 - CostDocument34 pages5 - CostAarogyaBharadwajNo ratings yet

- Lecture 1Document7 pagesLecture 1HarusiNo ratings yet

- Comp Exam25 QP 25052k13Document3 pagesComp Exam25 QP 25052k13Sajid AliNo ratings yet

- Advanced Management Accounting PDFDocument4 pagesAdvanced Management Accounting PDFSmag SmagNo ratings yet

- 16 Af 601 Sma - 3Document4 pages16 Af 601 Sma - 3umargee123No ratings yet

- BhaDocument25 pagesBharishu jainNo ratings yet

- Introduction To Marginal CostingDocument29 pagesIntroduction To Marginal CostingUdaya ChoudaryNo ratings yet

- Case # 1: Institute of Cost and Management Accountants of PakistanDocument2 pagesCase # 1: Institute of Cost and Management Accountants of PakistanSajid AliNo ratings yet

- 8508 Managerial AccountingDocument10 pages8508 Managerial AccountingHassan Malik100% (1)

- Standard Cost (RS.)Document13 pagesStandard Cost (RS.)Anushree GuptaNo ratings yet

- QP MBA FINANCIAL AND MANAGEMENT ACCOUNTING 803FI0C002 Trimester I Cjj8nC4tr8Document5 pagesQP MBA FINANCIAL AND MANAGEMENT ACCOUNTING 803FI0C002 Trimester I Cjj8nC4tr8Rushil JoshiNo ratings yet

- Accounting Techniques For Decision MakingDocument24 pagesAccounting Techniques For Decision MakingRima PrajapatiNo ratings yet

- 2 Comprehensive Examination: Case # 1Document3 pages2 Comprehensive Examination: Case # 1Sajid AliNo ratings yet

- Elements of Cost Variable Cost Portion Fixed CostDocument65 pagesElements of Cost Variable Cost Portion Fixed CostDipen AdhikariNo ratings yet

- p1 Question June 2018Document5 pagesp1 Question June 2018S.M.A AwalNo ratings yet

- Pakistan: Marks Q. 1 Excellent Engineering Limited Is A Medium Sized, Well Established Company, Producing HighDocument6 pagesPakistan: Marks Q. 1 Excellent Engineering Limited Is A Medium Sized, Well Established Company, Producing HighAbdul BasitNo ratings yet

- Cagayan State University - AndrewsDocument4 pagesCagayan State University - AndrewsWynie AreolaNo ratings yet

- CUACM 413 Tutorial QuestionsDocument31 pagesCUACM 413 Tutorial Questionstmash3017No ratings yet

- Capacity PlanningDocument12 pagesCapacity PlanningHafiz AbirNo ratings yet

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- BUSI 354 - CHDocument4 pagesBUSI 354 - CHBarbara SlavovNo ratings yet

- ARM - CMA Mock March 2024 With SolutionDocument17 pagesARM - CMA Mock March 2024 With SolutionTooba MaqboolNo ratings yet

- Paper - 4: Cost Accounting and Financial ManagementDocument20 pagesPaper - 4: Cost Accounting and Financial ManagementdhilonjimyNo ratings yet

- Advanced Management Accounting For CA Final-Parag GuptaDocument236 pagesAdvanced Management Accounting For CA Final-Parag GuptaPrasenjit Dey100% (1)

- Chap1 Marginal Costing & Decision MakingDocument31 pagesChap1 Marginal Costing & Decision Makingrajsingh15No ratings yet

- Intermediate Group II Test Papers (Revised July 2009)Document55 pagesIntermediate Group II Test Papers (Revised July 2009)Sumit AroraNo ratings yet

- Relevant Costing and Differential AnalysisDocument32 pagesRelevant Costing and Differential AnalysisEj BalbzNo ratings yet

- Cost Sheet: Particulars Job 101 Job 102Document12 pagesCost Sheet: Particulars Job 101 Job 102vishal soniNo ratings yet

- Question No.1 Is Compulsory. Answer Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument8 pagesQuestion No.1 Is Compulsory. Answer Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKv kNo ratings yet

- P2 Sep 2013Document16 pagesP2 Sep 2013Ashraf ValappilNo ratings yet

- 4 Af 201 Ca PDFDocument4 pages4 Af 201 Ca PDFSyed Ali GilaniNo ratings yet

- ME323 Assignment 1Document2 pagesME323 Assignment 1sbsharma5190No ratings yet

- Year I Year II Year IIIDocument4 pagesYear I Year II Year IIIvNo ratings yet

- SCMPE 2 Question PaperDocument8 pagesSCMPE 2 Question Paperneha manglaniNo ratings yet

- 8 Comprehensive Examination: Case # 1Document3 pages8 Comprehensive Examination: Case # 1Sajid AliNo ratings yet

- F5 2013 Dec Q PDFDocument7 pagesF5 2013 Dec Q PDFcatcat1122No ratings yet

- Problems On Transfer PricingDocument4 pagesProblems On Transfer Pricingdjgavli11210No ratings yet

- 10 Comprehensive Examination: Case # 1Document2 pages10 Comprehensive Examination: Case # 1Sajid AliNo ratings yet

- Revalidation Test Paper Intermediate Group II: Revised Syllabus 2008Document6 pagesRevalidation Test Paper Intermediate Group II: Revised Syllabus 2008sureka1234No ratings yet

- 305 Final Exam Cram Question PackageDocument14 pages305 Final Exam Cram Question PackageGloriana FokNo ratings yet

- IPCC CostingDocument1 pageIPCC CostingEsukapalli Siva ReddyNo ratings yet

- Capacity Planning, Facility Location & LayoutDocument56 pagesCapacity Planning, Facility Location & LayoutFekadu100% (1)

- Budget Numerical PDFDocument5 pagesBudget Numerical PDFDilip BhusalNo ratings yet

- BBA F 0A PRODUCT LIFE CYCLE COSTING QuestionsDocument1 pageBBA F 0A PRODUCT LIFE CYCLE COSTING QuestionsDIMPI 2122069No ratings yet

- FM 02Document3 pagesFM 02Sudhan RNo ratings yet

- Shree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementDocument6 pagesShree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementVeerraju RyaliNo ratings yet

- Strategic Cost Management Performance Evaluation Full Test 1 May 2023 Scheduled Solution 1674105536Document34 pagesStrategic Cost Management Performance Evaluation Full Test 1 May 2023 Scheduled Solution 1674105536Kunal BhatnagarNo ratings yet

- The Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Document9 pagesThe Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Amal VinothNo ratings yet

- Disposable SyringeDocument5 pagesDisposable SyringePrabhu KoppalNo ratings yet

- Advanced Cost and Management AccountingDocument5 pagesAdvanced Cost and Management AccountingAivin JosephNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsAhmed Rawy100% (1)

- Chapter 13 Solutions MKDocument26 pagesChapter 13 Solutions MKCindy Kirana17% (6)

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Chapter 16Document11 pagesChapter 16Aarti J50% (2)

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- Chapter 1 SolutionsDocument3 pagesChapter 1 SolutionsChadwick PohNo ratings yet

- Jvi RPT 23062k16Document23 pagesJvi RPT 23062k16Sajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document13 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document14 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document15 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- Notice Transitional ArrangementDocument1 pageNotice Transitional ArrangementSajid AliNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- Chapter 6 Common Stock FundamentalsDocument6 pagesChapter 6 Common Stock FundamentalsbibekNo ratings yet

- Macro Quiz 1 SP 2023Document7 pagesMacro Quiz 1 SP 2023Nguyễn Đỗ Thu Hương K17-HLNo ratings yet

- App Econ 12 - MidtermDocument2 pagesApp Econ 12 - MidtermGermano GambolNo ratings yet

- Gillette CompanyDocument5 pagesGillette CompanyImran HassanNo ratings yet

- Balance of Payments - NotesDocument6 pagesBalance of Payments - NotesJay-an CastillonNo ratings yet

- Porters Forces For UniversityDocument4 pagesPorters Forces For UniversityCraig MooreNo ratings yet

- Sinking Fund ScheduleDocument8 pagesSinking Fund ScheduleThomasaquinos msigala JrNo ratings yet

- Advantages of The Product Life CycleDocument5 pagesAdvantages of The Product Life CycleMunotidaishe TaziwaNo ratings yet

- Crime Rates Cause of UnemplDocument18 pagesCrime Rates Cause of UnemplSofia BougioukouNo ratings yet

- Textile and Apparel Retailing Whitepaper - KSA TechnopakDocument16 pagesTextile and Apparel Retailing Whitepaper - KSA TechnopakNift MfmNo ratings yet

- CDI-2 Traffic InvestigationDocument8 pagesCDI-2 Traffic InvestigationTfig Fo EcaepNo ratings yet

- Word Doc... On InflationDocument9 pagesWord Doc... On InflationTanya VermaNo ratings yet

- Solved The Demand For Good X Is Given by QDX 1200Document1 pageSolved The Demand For Good X Is Given by QDX 1200M Bilal SaleemNo ratings yet

- Management ReportDocument22 pagesManagement ReportJohn Adam Cayanan DesuasidoNo ratings yet

- Macroeconomic Assignment 1mba059 Ma Pann Myat PhyuDocument2 pagesMacroeconomic Assignment 1mba059 Ma Pann Myat PhyuCWHNo ratings yet

- EC1101E: Introduction To Economic AnalysisDocument79 pagesEC1101E: Introduction To Economic AnalysisdineshNo ratings yet

- Financial Derivatives - Module 1Document18 pagesFinancial Derivatives - Module 1Ravneet KaurNo ratings yet

- 10 1 1 649 8329Document300 pages10 1 1 649 8329akash deepNo ratings yet

- TBCH 12Document16 pagesTBCH 12bernandaz123100% (1)

- Chapter 1 PPT (Lecture)Document20 pagesChapter 1 PPT (Lecture)Ana Krann100% (2)

- Lemonsexperiment PDFDocument28 pagesLemonsexperiment PDFRyan Dave Agaton BironNo ratings yet

- Cost Accounting Manual (2nd Edition)Document177 pagesCost Accounting Manual (2nd Edition)Bilal Farooq100% (1)

- BUS3310Document83 pagesBUS3310valero506No ratings yet

- FM&I - Practice Problems Guidelines For RevisionDocument2 pagesFM&I - Practice Problems Guidelines For RevisionHà PhạmNo ratings yet

- Ma CH 10 Measuring A Nations IncomeDocument28 pagesMa CH 10 Measuring A Nations IncomeLarissa CarletNo ratings yet

- 3 - Cho Et Al 2015Document17 pages3 - Cho Et Al 2015HelloNo ratings yet

- Macroeconomics in Modules 3rd Edition Krugman Solutions Manual 1Document36 pagesMacroeconomics in Modules 3rd Edition Krugman Solutions Manual 1charlessalasnekqjrfzyxNo ratings yet

- Scott Sedam Margin GapDocument33 pagesScott Sedam Margin GapMark LynchNo ratings yet

- RES Essay Competition 2014 Judges Report & Winning EssaysDocument38 pagesRES Essay Competition 2014 Judges Report & Winning EssaysAxelNo ratings yet