Professional Documents

Culture Documents

Government of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur Notification

Government of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur Notification

Uploaded by

jdhamdeep07Copyright:

Available Formats

You might also like

- Active or Passive Voice - All TensesDocument2 pagesActive or Passive Voice - All TensesAldanaVerónicaSpinozzi56% (9)

- Chapter 3-4 QuestionsDocument5 pagesChapter 3-4 QuestionsMya B. Walker0% (1)

- Test Bank Chapter 9Document10 pagesTest Bank Chapter 9Rebecca StephanieNo ratings yet

- SWOT Analysis of PidiliteDocument3 pagesSWOT Analysis of PidiliteparthNo ratings yet

- General CircularsDocument39 pagesGeneral CircularsSubramanya Seeta Ram PrasadNo ratings yet

- Notiied Areas For Agricultural Land in Rural AreaDocument52 pagesNotiied Areas For Agricultural Land in Rural Areaprashanth511100% (1)

- LBT Rates NagpurDocument15 pagesLBT Rates NagpurPankaj GoyenkaNo ratings yet

- Sro 457Document5 pagesSro 457Farhan NazirNo ratings yet

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDocument10 pagesCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatNo ratings yet

- Clarification and Deduction of Tax PDFDocument1 pageClarification and Deduction of Tax PDFusmansidiqiNo ratings yet

- Gujarat Value Added Tax ActDocument7 pagesGujarat Value Added Tax ActvikrantkapadiaNo ratings yet

- Duty Drawback Feb 2020Document192 pagesDuty Drawback Feb 2020AkashAgarwalNo ratings yet

- Sro 154Document5 pagesSro 154msadhanani3922No ratings yet

- Circular CGST 113Document7 pagesCircular CGST 113C DavidNo ratings yet

- HighLights ST FEDocument34 pagesHighLights ST FEShakir MuhammadNo ratings yet

- Maharashtra Value Added Tax ActDocument13 pagesMaharashtra Value Added Tax ActKaran Gandhi0% (1)

- GST - Introduction To GST & Concept of SupplyDocument40 pagesGST - Introduction To GST & Concept of Supplydeepak singhalNo ratings yet

- Value Added TaxDocument1 pageValue Added TaxDurga Prasad VennelakantiNo ratings yet

- Guide On SalesTax ExemptionsDocument16 pagesGuide On SalesTax Exemptionsaal_muhammaddiNo ratings yet

- Submitted To:-Kiran Bala Submitted By: - Sana Noor Roll No.: 16BLW102 Enrolment No.: 16-5220 Semester: 6 Year: 3 / Self FinanceDocument19 pagesSubmitted To:-Kiran Bala Submitted By: - Sana Noor Roll No.: 16BLW102 Enrolment No.: 16-5220 Semester: 6 Year: 3 / Self FinanceSANANo ratings yet

- Non-Levy/Short Levy of Additional DutyDocument5 pagesNon-Levy/Short Levy of Additional Dutybiko137No ratings yet

- Civil Sales Tax Revision Petition Nos. 193 of 2009 194 of 2009Document13 pagesCivil Sales Tax Revision Petition Nos. 193 of 2009 194 of 2009Priyanka NairNo ratings yet

- Tamil Nadu General Sales Tax RuleDocument62 pagesTamil Nadu General Sales Tax RuleBenet RacklandNo ratings yet

- Goods ClassificationDocument23 pagesGoods ClassificationM. WaseemNo ratings yet

- Agricultural Income (C)Document4 pagesAgricultural Income (C)Geetika RajputNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentKrishna Kumar VermaNo ratings yet

- Cottage Industries and VATDocument8 pagesCottage Industries and VATAdib TasnimNo ratings yet

- Comprehensive Manual On 4ad RefundsDocument50 pagesComprehensive Manual On 4ad RefundshaamaNo ratings yet

- Notification No. 95 of 2018 CUSTOMS N.T PDFDocument176 pagesNotification No. 95 of 2018 CUSTOMS N.T PDFARJUNNo ratings yet

- Draft Comprehensive ITC (HS) Export Policy 2019 PDFDocument958 pagesDraft Comprehensive ITC (HS) Export Policy 2019 PDFAnonymous M48MXarNo ratings yet

- Goods & Service Tax (GST) : Presentation By: CA Balakrishnan.SDocument40 pagesGoods & Service Tax (GST) : Presentation By: CA Balakrishnan.SbharatNo ratings yet

- Chapter3 How To Obtain Registration Under GSTDocument45 pagesChapter3 How To Obtain Registration Under GSTDR. PREETI JINDALNo ratings yet

- Finance Act2005Document20 pagesFinance Act2005kagronNo ratings yet

- F.No 370142 2016-TI'L Government of Ministry of Finance of Board of Taxes (TPLDocument4 pagesF.No 370142 2016-TI'L Government of Ministry of Finance of Board of Taxes (TPLShariq AltafNo ratings yet

- Topic 2Document5 pagesTopic 2dshikha_singh90No ratings yet

- Chapter 9 - RegistrationDocument20 pagesChapter 9 - Registrationcloudhunter910No ratings yet

- 2008SRO549Document5 pages2008SRO549Aakash RoyNo ratings yet

- Karnatka Vat RulesDocument49 pagesKarnatka Vat RulesshanoboghNo ratings yet

- TRAINING. NOTES Commercial TaxDocument116 pagesTRAINING. NOTES Commercial TaxVipin Thomas100% (1)

- DBK Rate 2018 PDFDocument176 pagesDBK Rate 2018 PDFmahen aryaNo ratings yet

- Agricultural Income and Tax Laws: Basis of TaxationDocument8 pagesAgricultural Income and Tax Laws: Basis of TaxationSarangNo ratings yet

- Caselaw of Balrampur Chini Mills - HCDocument9 pagesCaselaw of Balrampur Chini Mills - HCbmatinvestNo ratings yet

- PRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsDocument6 pagesPRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsSudeep DuttNo ratings yet

- To Be Published in The Gazette of Pakistan Part-IiDocument21 pagesTo Be Published in The Gazette of Pakistan Part-IiQanita ChaudhryNo ratings yet

- Notification No 8 2002Document6 pagesNotification No 8 2002Dhananjay KulkarniNo ratings yet

- Section 109 Land Reforms Act - 1961Document3 pagesSection 109 Land Reforms Act - 1961maheshmrplegalisNo ratings yet

- Indirect Tax NotesDocument61 pagesIndirect Tax NotesSaksham KaushikNo ratings yet

- csnt77-2023 - Applicable 30-Oct-23Document159 pagescsnt77-2023 - Applicable 30-Oct-23Sumit ChhuganiNo ratings yet

- Final TaxDocument18 pagesFinal TaxhayaNo ratings yet

- State Circular 163 19 2021Document8 pagesState Circular 163 19 2021kldengsec123No ratings yet

- Module 6Document19 pagesModule 6ASHISH SINGHNo ratings yet

- GST-Divyastra-Ch-8-Registration-R-2Document12 pagesGST-Divyastra-Ch-8-Registration-R-2djvishaljainNo ratings yet

- Punjab Vat NoteDocument12 pagesPunjab Vat NoteSuraj SinghNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course Group Ii Paper 8: Indirect Tax Laws Maximum Marks: 100 Marks Time Allowed: 3 HoursDocument10 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course Group Ii Paper 8: Indirect Tax Laws Maximum Marks: 100 Marks Time Allowed: 3 HoursANIL JARWALNo ratings yet

- Agricultural IncomeDocument6 pagesAgricultural Incomedhriti_khatri100% (1)

- Circular 52 2018 Customs NewDocument2 pagesCircular 52 2018 Customs NewSteve MclarenNo ratings yet

- KT Entry TaxDocument102 pagesKT Entry Taxvenkatrao_100No ratings yet

- Ghana Customs HS CodeDocument737 pagesGhana Customs HS CodeKWAKU HACKMAN50% (2)

- Agricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksFrom EverandAgricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Memorandum of UnderstandingDocument5 pagesMemorandum of Understandingayusta.ckNo ratings yet

- Chapter 5 DUTYDocument19 pagesChapter 5 DUTYtemedebereNo ratings yet

- Chapter 3 Audit ReportDocument47 pagesChapter 3 Audit Reportwiwi pratiwiNo ratings yet

- ASSIGNMENT KEYNES - pdf-ECONOMICS OFFLINE ASSIGNMENT PDFDocument6 pagesASSIGNMENT KEYNES - pdf-ECONOMICS OFFLINE ASSIGNMENT PDFTashi Lhamu TamangNo ratings yet

- ACI 2016 Connectivity ReportDocument68 pagesACI 2016 Connectivity ReportTatianaNo ratings yet

- Using Quickbooks Accountant 2012 For Accounting 11th Edition Glenn Owen Solutions ManualDocument26 pagesUsing Quickbooks Accountant 2012 For Accounting 11th Edition Glenn Owen Solutions ManualMaryJohnsonsmni100% (38)

- B2B Is Still Dead. Long Live Human Relevance.: Thursday, January 12th, 2012Document5 pagesB2B Is Still Dead. Long Live Human Relevance.: Thursday, January 12th, 2012Faisal Ahmad JafriNo ratings yet

- Transportation, Transshipment and Assignment ProblemsDocument103 pagesTransportation, Transshipment and Assignment ProblemsPratik Minj50% (2)

- Insema Sunly Engineering - Company ProfileDocument22 pagesInsema Sunly Engineering - Company ProfileG-SamNo ratings yet

- Break EvenDocument46 pagesBreak EvenRaj TripathiNo ratings yet

- Sun Tzi AORDocument11 pagesSun Tzi AORSkyoda SoonNo ratings yet

- MDRT10 JanDocument4 pagesMDRT10 JanNur TakafulNo ratings yet

- Assignment 2a - Costa Concordia ResponseDocument5 pagesAssignment 2a - Costa Concordia ResponsenlewissmNo ratings yet

- Social Entrepreneurship Definition MatrixDocument9 pagesSocial Entrepreneurship Definition Matrixxmergnc100% (11)

- Problems and Strategies in Service Marketing PDFDocument15 pagesProblems and Strategies in Service Marketing PDFNihat ÇeşmeciNo ratings yet

- Women of Lockerbie PresentationDocument17 pagesWomen of Lockerbie Presentationapi-253786771No ratings yet

- Results and DiscussionDocument7 pagesResults and DiscussionTamara AllejeNo ratings yet

- World Countries - Country Capitals and Currency PDFDocument6 pagesWorld Countries - Country Capitals and Currency PDFAbhi RamNo ratings yet

- English - Irregular VerbsDocument14 pagesEnglish - Irregular Verbsdungdaejoo2No ratings yet

- ZFP Ebook LP NFZ 2011 inDocument470 pagesZFP Ebook LP NFZ 2011 inOswald Schbaltz100% (2)

- College Accounting A Career Approach 12th Edition Scott Solutions ManualDocument97 pagesCollege Accounting A Career Approach 12th Edition Scott Solutions Manualrobertnelsonxrofbtjpmi100% (13)

- Katrina Kaif & Varun Dhawan Are The New Faces of FBBDocument2 pagesKatrina Kaif & Varun Dhawan Are The New Faces of FBBSujith KumarNo ratings yet

- Indian Railways (.) Is An Indian: History of Rail Transport in IndiaDocument3 pagesIndian Railways (.) Is An Indian: History of Rail Transport in IndiaKapil BajajNo ratings yet

- Case Study On Two Wheeler's ForecastingDocument5 pagesCase Study On Two Wheeler's Forecastingkrunalpunjani07No ratings yet

- Hospital SuppliesDocument9 pagesHospital SuppliesGaurav MadanpuriNo ratings yet

- Faith Disas International College: Class: SubjectDocument9 pagesFaith Disas International College: Class: SubjectLyndsey TamatchoNo ratings yet

Government of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur Notification

Government of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur Notification

Uploaded by

jdhamdeep07Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur Notification

Government of Chhattisgarh Finance and Planning Department (Commercial Tax Department) Mantralaya Dau Kalyan Singh Bhawan, Raipur Notification

Uploaded by

jdhamdeep07Copyright:

Available Formats

Government of Chhattisgarh

Finance and Planning Department

(Commercial Tax Department)

Mantralaya

Dau Kalyan Singh Bhawan, Raipur

NOTIFICATION

Raipur, Dated 02/04/2007

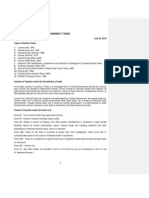

No. F-10/ 33 / 2007/CT/V ( 24 ) - In exercise of the powers conferred by Section 10 of the

Chhattisgarh Sthaniya Kshetra Me Mal Ke Pravesh Par Kar Adhiniyam, 1976 (No. 52 of 1976), the

State Government hereby exempt the class of goods specified in column (2) of the schedule below

from payment of tax to the extent specified in column (3) from 01.04.2007 to 31.03.2008, subject to

the restrictions and conditions specified in column (4) of the schedule:SCHEDULE

S.

Class of goods

Extent of

Restrictions and conditions

No.

exemption

(1)

(2)

(3)

(4)

Whole of

1. Coconut

tax

Whole

tax

2.

Sewing machine

3.

Atta, maida, suji and wheat

bran

Goods manufactured by

any industries situated in

Chhattisgarh State, except

coal and iron ore

4.

5.

Goods

specified

Schedule-II and III.

6.

Petrol, diesel oil, aviation

spirit and aviation turbine

fuel.

Petrol, diesel oil, furnace

oil, aviation spirit, aviation

turbine fuel and fire bricks.

7.

8.

9.

10.

in

of

Whole of

tax

Whole of When entered into a local area by a small

tax

enterprise, where the investment in plant and

machinery does not exceed one crore rupees, for

consumption or use as raw material in the process

of manufacture.

Whole of When entered into a local area for use or

tax

consumption as raw material in the manufacture

of agarbatti.

Whole of When entered into a local area by a dealer

tax

registered under the Chhattisgarh Value Added

Tax Act, 2005 for sale.

Whole of When purchased by a dealer registered under the

tax

Chhattisgarh Value Added Tax Act, 2005 from

another registered dealer under the said Act for

consumption or use in a local area.

Whole of

tax

Whole of

tax

Computer, computer parts

and accessories.

Readymade

garments,

readymade cotton hosiery,

cotton knitted garments

and readymade nylon

hosiery.

All kinds of motor vehicles Whole of When entered into a local area by a dealer

tax

registered under the Chhattisgarh Value Added

Tax Act, 2005 for sale.

11.

All varieties of cloth as Partly so as

specified in entry 8 of to reduce

the rate of

Schedule-II

12.

Cane basket, drill rod and Partly

PVC casing pipe

as

reduce

rate of

to 1%

Fly-ash

Whole

tax

tax to 1%

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

so

to

the

tax

When purchased by a dealer registered under the

Chhattisgarh Value Added Tax Act, 2005 from

another registered dealer under the said Act for

consumption or use in a local area.

of When entered into a local area by a dealer

registered under the Chhattisgarh Value Added

Tax Act, 2005 from any local area within

Chhattisgarh State.

Paddy and rice

Whole of When entered into a local area from any local

tax

area within Chhattisgarh State.

Hessian cloth

Whole of

tax

Raw wool

Whole of When entered into a local area by a dealer

tax

registered under the Chhattisgarh Value Added

Tax Act, 2005 for use or consumption in the

manufacture of goods for sale in the State of

Chhattisgarh or in the course of inter-state trade

or commerce or in the course of export out of the

territory of India.

Tyres, tubes and flaps of Whole of

motor vehicles of all kinds, tax

of tractor and trailers and

of animal drawn vehicles.

Spare parts of all kinds of Whole of

motor vehicle including tax

tractor.

Maize, broken rice, fish, Whole of When entered into a local area by poultry farmers

de-oiled rice bran, shell tax

for use as raw material in the manufacture of

grid, feed supplements

poultry feed for consumption in their poultry

(medicines) and de-oiled

farm.

cake.

Lubricants

Whole of

tax

Rice

Whole of When entered into a local area by Food

tax

Corporation of India for sale under public

distribution system.

Loose tea

Whole of

tax

Hydrogenated vegetable oil Partly so

not manufactured in India

as

to

reduce the

rate of tax

to 0.5%

Jute as specified in clause Whole of When entered into a local area for consumption

(v) of section 14 of the tax

or use as raw material in the process of

Central Sales Tax Act,

manufacture.

1956 (No. 74 of 1956)

25.

Vegetable and edible oil

26.

Kirana goods

27.

Babool seed

28.

Lakh

29.

30.

Hydrogenated vegetable oil

and Ghee

Jaggery

31.

Rice bran

32.

Goods

specified

Schedule-II and III

33.

Un-processed

cloth

manufactured in powerloom

34.

Silk yarn upto 22.00

deniers

Cotton and woolen khadi

cloth

News print

35.

36.

in

37.

Raw material used in the

manufacture of cookedfood

38.

Articles of gold and silver

including coins, bullion

and specie

39.

Television

Whole of

tax

Whole of

tax

Whole of When entered into a local area for consumption

tax

or use as raw material in the process of

manufacture.

Whole of When entered into a local area for consumption

tax

or use as raw material in the process of

manufacture.

Whole of

tax

Whole of

tax

Whole of When the goods specified in column (2) is

tax

produced in Chhattisgarh State.

Whole of When entered into a local area by a dealer

tax

registered under the Chhattisgarh Value Added

Tax Act, 2005, for use in the manufacture of

Ferro Alloys.

Whole of When manufactured by a dealer registered under

tax

the Chhattisgarh Value Added Tax Act, 2005 in a

local area and subsequently entered into another

local area for processing so as to obtain processed

cloth.

Whole of

tax

Whole of

tax

Whole of

tax

Whole of When entered into a local area by a registered

tax

dealer under the Chhattisgarh Value Added Tax

Act, 2005 who has been granted permission for

composition of tax under sub-section (2) of

section 10 of the said Act.

Whole of When entered into a local area by a registered

tax

dealer under the Chhattisgarh Value Added Tax

Act, 2005 for conversion into articles of gold and

silver including coins, bullion and specie.

Whole of

tax

By order and in the name of the Governor of Chhattisgarh,

(K.R. Misra)

Joint Secretary

You might also like

- Active or Passive Voice - All TensesDocument2 pagesActive or Passive Voice - All TensesAldanaVerónicaSpinozzi56% (9)

- Chapter 3-4 QuestionsDocument5 pagesChapter 3-4 QuestionsMya B. Walker0% (1)

- Test Bank Chapter 9Document10 pagesTest Bank Chapter 9Rebecca StephanieNo ratings yet

- SWOT Analysis of PidiliteDocument3 pagesSWOT Analysis of PidiliteparthNo ratings yet

- General CircularsDocument39 pagesGeneral CircularsSubramanya Seeta Ram PrasadNo ratings yet

- Notiied Areas For Agricultural Land in Rural AreaDocument52 pagesNotiied Areas For Agricultural Land in Rural Areaprashanth511100% (1)

- LBT Rates NagpurDocument15 pagesLBT Rates NagpurPankaj GoyenkaNo ratings yet

- Sro 457Document5 pagesSro 457Farhan NazirNo ratings yet

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDocument10 pagesCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatNo ratings yet

- Clarification and Deduction of Tax PDFDocument1 pageClarification and Deduction of Tax PDFusmansidiqiNo ratings yet

- Gujarat Value Added Tax ActDocument7 pagesGujarat Value Added Tax ActvikrantkapadiaNo ratings yet

- Duty Drawback Feb 2020Document192 pagesDuty Drawback Feb 2020AkashAgarwalNo ratings yet

- Sro 154Document5 pagesSro 154msadhanani3922No ratings yet

- Circular CGST 113Document7 pagesCircular CGST 113C DavidNo ratings yet

- HighLights ST FEDocument34 pagesHighLights ST FEShakir MuhammadNo ratings yet

- Maharashtra Value Added Tax ActDocument13 pagesMaharashtra Value Added Tax ActKaran Gandhi0% (1)

- GST - Introduction To GST & Concept of SupplyDocument40 pagesGST - Introduction To GST & Concept of Supplydeepak singhalNo ratings yet

- Value Added TaxDocument1 pageValue Added TaxDurga Prasad VennelakantiNo ratings yet

- Guide On SalesTax ExemptionsDocument16 pagesGuide On SalesTax Exemptionsaal_muhammaddiNo ratings yet

- Submitted To:-Kiran Bala Submitted By: - Sana Noor Roll No.: 16BLW102 Enrolment No.: 16-5220 Semester: 6 Year: 3 / Self FinanceDocument19 pagesSubmitted To:-Kiran Bala Submitted By: - Sana Noor Roll No.: 16BLW102 Enrolment No.: 16-5220 Semester: 6 Year: 3 / Self FinanceSANANo ratings yet

- Non-Levy/Short Levy of Additional DutyDocument5 pagesNon-Levy/Short Levy of Additional Dutybiko137No ratings yet

- Civil Sales Tax Revision Petition Nos. 193 of 2009 194 of 2009Document13 pagesCivil Sales Tax Revision Petition Nos. 193 of 2009 194 of 2009Priyanka NairNo ratings yet

- Tamil Nadu General Sales Tax RuleDocument62 pagesTamil Nadu General Sales Tax RuleBenet RacklandNo ratings yet

- Goods ClassificationDocument23 pagesGoods ClassificationM. WaseemNo ratings yet

- Agricultural Income (C)Document4 pagesAgricultural Income (C)Geetika RajputNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentKrishna Kumar VermaNo ratings yet

- Cottage Industries and VATDocument8 pagesCottage Industries and VATAdib TasnimNo ratings yet

- Comprehensive Manual On 4ad RefundsDocument50 pagesComprehensive Manual On 4ad RefundshaamaNo ratings yet

- Notification No. 95 of 2018 CUSTOMS N.T PDFDocument176 pagesNotification No. 95 of 2018 CUSTOMS N.T PDFARJUNNo ratings yet

- Draft Comprehensive ITC (HS) Export Policy 2019 PDFDocument958 pagesDraft Comprehensive ITC (HS) Export Policy 2019 PDFAnonymous M48MXarNo ratings yet

- Goods & Service Tax (GST) : Presentation By: CA Balakrishnan.SDocument40 pagesGoods & Service Tax (GST) : Presentation By: CA Balakrishnan.SbharatNo ratings yet

- Chapter3 How To Obtain Registration Under GSTDocument45 pagesChapter3 How To Obtain Registration Under GSTDR. PREETI JINDALNo ratings yet

- Finance Act2005Document20 pagesFinance Act2005kagronNo ratings yet

- F.No 370142 2016-TI'L Government of Ministry of Finance of Board of Taxes (TPLDocument4 pagesF.No 370142 2016-TI'L Government of Ministry of Finance of Board of Taxes (TPLShariq AltafNo ratings yet

- Topic 2Document5 pagesTopic 2dshikha_singh90No ratings yet

- Chapter 9 - RegistrationDocument20 pagesChapter 9 - Registrationcloudhunter910No ratings yet

- 2008SRO549Document5 pages2008SRO549Aakash RoyNo ratings yet

- Karnatka Vat RulesDocument49 pagesKarnatka Vat RulesshanoboghNo ratings yet

- TRAINING. NOTES Commercial TaxDocument116 pagesTRAINING. NOTES Commercial TaxVipin Thomas100% (1)

- DBK Rate 2018 PDFDocument176 pagesDBK Rate 2018 PDFmahen aryaNo ratings yet

- Agricultural Income and Tax Laws: Basis of TaxationDocument8 pagesAgricultural Income and Tax Laws: Basis of TaxationSarangNo ratings yet

- Caselaw of Balrampur Chini Mills - HCDocument9 pagesCaselaw of Balrampur Chini Mills - HCbmatinvestNo ratings yet

- PRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsDocument6 pagesPRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsSudeep DuttNo ratings yet

- To Be Published in The Gazette of Pakistan Part-IiDocument21 pagesTo Be Published in The Gazette of Pakistan Part-IiQanita ChaudhryNo ratings yet

- Notification No 8 2002Document6 pagesNotification No 8 2002Dhananjay KulkarniNo ratings yet

- Section 109 Land Reforms Act - 1961Document3 pagesSection 109 Land Reforms Act - 1961maheshmrplegalisNo ratings yet

- Indirect Tax NotesDocument61 pagesIndirect Tax NotesSaksham KaushikNo ratings yet

- csnt77-2023 - Applicable 30-Oct-23Document159 pagescsnt77-2023 - Applicable 30-Oct-23Sumit ChhuganiNo ratings yet

- Final TaxDocument18 pagesFinal TaxhayaNo ratings yet

- State Circular 163 19 2021Document8 pagesState Circular 163 19 2021kldengsec123No ratings yet

- Module 6Document19 pagesModule 6ASHISH SINGHNo ratings yet

- GST-Divyastra-Ch-8-Registration-R-2Document12 pagesGST-Divyastra-Ch-8-Registration-R-2djvishaljainNo ratings yet

- Punjab Vat NoteDocument12 pagesPunjab Vat NoteSuraj SinghNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course Group Ii Paper 8: Indirect Tax Laws Maximum Marks: 100 Marks Time Allowed: 3 HoursDocument10 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course Group Ii Paper 8: Indirect Tax Laws Maximum Marks: 100 Marks Time Allowed: 3 HoursANIL JARWALNo ratings yet

- Agricultural IncomeDocument6 pagesAgricultural Incomedhriti_khatri100% (1)

- Circular 52 2018 Customs NewDocument2 pagesCircular 52 2018 Customs NewSteve MclarenNo ratings yet

- KT Entry TaxDocument102 pagesKT Entry Taxvenkatrao_100No ratings yet

- Ghana Customs HS CodeDocument737 pagesGhana Customs HS CodeKWAKU HACKMAN50% (2)

- Agricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksFrom EverandAgricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Memorandum of UnderstandingDocument5 pagesMemorandum of Understandingayusta.ckNo ratings yet

- Chapter 5 DUTYDocument19 pagesChapter 5 DUTYtemedebereNo ratings yet

- Chapter 3 Audit ReportDocument47 pagesChapter 3 Audit Reportwiwi pratiwiNo ratings yet

- ASSIGNMENT KEYNES - pdf-ECONOMICS OFFLINE ASSIGNMENT PDFDocument6 pagesASSIGNMENT KEYNES - pdf-ECONOMICS OFFLINE ASSIGNMENT PDFTashi Lhamu TamangNo ratings yet

- ACI 2016 Connectivity ReportDocument68 pagesACI 2016 Connectivity ReportTatianaNo ratings yet

- Using Quickbooks Accountant 2012 For Accounting 11th Edition Glenn Owen Solutions ManualDocument26 pagesUsing Quickbooks Accountant 2012 For Accounting 11th Edition Glenn Owen Solutions ManualMaryJohnsonsmni100% (38)

- B2B Is Still Dead. Long Live Human Relevance.: Thursday, January 12th, 2012Document5 pagesB2B Is Still Dead. Long Live Human Relevance.: Thursday, January 12th, 2012Faisal Ahmad JafriNo ratings yet

- Transportation, Transshipment and Assignment ProblemsDocument103 pagesTransportation, Transshipment and Assignment ProblemsPratik Minj50% (2)

- Insema Sunly Engineering - Company ProfileDocument22 pagesInsema Sunly Engineering - Company ProfileG-SamNo ratings yet

- Break EvenDocument46 pagesBreak EvenRaj TripathiNo ratings yet

- Sun Tzi AORDocument11 pagesSun Tzi AORSkyoda SoonNo ratings yet

- MDRT10 JanDocument4 pagesMDRT10 JanNur TakafulNo ratings yet

- Assignment 2a - Costa Concordia ResponseDocument5 pagesAssignment 2a - Costa Concordia ResponsenlewissmNo ratings yet

- Social Entrepreneurship Definition MatrixDocument9 pagesSocial Entrepreneurship Definition Matrixxmergnc100% (11)

- Problems and Strategies in Service Marketing PDFDocument15 pagesProblems and Strategies in Service Marketing PDFNihat ÇeşmeciNo ratings yet

- Women of Lockerbie PresentationDocument17 pagesWomen of Lockerbie Presentationapi-253786771No ratings yet

- Results and DiscussionDocument7 pagesResults and DiscussionTamara AllejeNo ratings yet

- World Countries - Country Capitals and Currency PDFDocument6 pagesWorld Countries - Country Capitals and Currency PDFAbhi RamNo ratings yet

- English - Irregular VerbsDocument14 pagesEnglish - Irregular Verbsdungdaejoo2No ratings yet

- ZFP Ebook LP NFZ 2011 inDocument470 pagesZFP Ebook LP NFZ 2011 inOswald Schbaltz100% (2)

- College Accounting A Career Approach 12th Edition Scott Solutions ManualDocument97 pagesCollege Accounting A Career Approach 12th Edition Scott Solutions Manualrobertnelsonxrofbtjpmi100% (13)

- Katrina Kaif & Varun Dhawan Are The New Faces of FBBDocument2 pagesKatrina Kaif & Varun Dhawan Are The New Faces of FBBSujith KumarNo ratings yet

- Indian Railways (.) Is An Indian: History of Rail Transport in IndiaDocument3 pagesIndian Railways (.) Is An Indian: History of Rail Transport in IndiaKapil BajajNo ratings yet

- Case Study On Two Wheeler's ForecastingDocument5 pagesCase Study On Two Wheeler's Forecastingkrunalpunjani07No ratings yet

- Hospital SuppliesDocument9 pagesHospital SuppliesGaurav MadanpuriNo ratings yet

- Faith Disas International College: Class: SubjectDocument9 pagesFaith Disas International College: Class: SubjectLyndsey TamatchoNo ratings yet