Professional Documents

Culture Documents

Tuition Statement

Tuition Statement

Uploaded by

Anonymous 9FlDK6YrJOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tuition Statement

Tuition Statement

Uploaded by

Anonymous 9FlDK6YrJCopyright:

Available Formats

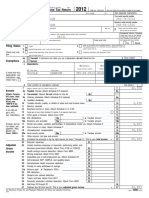

CORRECTED (if checked)

FILERS name, street address, city or town, province or state, ZIP or

foreign postal code, and telephone number

The University of Texas at San Antonio

One UTSA Circle

San Antonio, TX 78249

Payments received for

qualified tuition and related

expenses

OMB No. 1545-1574

Tuition

Statement

Amounts billed for qualified

tuition and related expenses

210.458.8000 / QUESTIONS CALL: 1.877.467.3821

Form 1098-T

$7,770.60

FILER'S Federal identification no.

STUDENT'S social security number

Check if you have changed your reporting method for 2015

***-**-6610

74-1717115

Copy B

For Students

STUDENTS name, street address, city or town, province or state, country,

and ZIP or foreign postal code

Adjustments made for a

prior year

Scholarships or grants

$0.00

Michael Christopher Chapa

8102 W Hausman Rd Apt 1304

San Antonio, TX 78249-3947

Adjustments to Scholarships

or grants for a prior year

$0.00

7

Check this box if the

amount in box 1 or 2

includes amounts for an

academic period

beginning January March 2016

10

Ins. Contract

reimb./refund

This is important

tax information

and is being

furnished to the

Internal Revenue

Service.

$0.00

Service Provider/Account Number

(optional)

QUESTIONS: 1-877-467-3821

Form 1098-T

Check if at least half-time student

Check if a graduate student

(Keep for your records.)

Department of the Treasury - Internal Revenue Service

WHAT IS IRS FORM 1098-T?

IRS Form 1098-T A college or university that received qualified tuition and related expenses on your behalf is required to file Form 1098-T, above, with the Internal Revenue Service (IRS). A

copy of Form 1098-T must be furnished to you. The information being reported to the IRS verifies your enrollment with regard to certain eligibility criteria for the American Opportunity Tax

Credit, the Lifetime Learning Tax Credit and the Higher Education Tuition and Fees Deduction. However, the enrollment information by itself does not establish eligibility for either credit or

deduction.

Box 1. Indicates the total payments received for qualified tuition and related expenses less any related reimbursements or refunds. If an amount is provided in Box 1 then Box 2 is blank.

Box 2. Indicates the total amounts billed for qualified tuition and related expenses less any related reductions in charges. If an amount is provided in Box 2 then Box 1 is blank.

Box 3. Indicates if the school has changed its 1098-T reporting method (amounts billed or amounts paid) for 2015.

Box 4. Indicates any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable

education credit or deduction you may claim for the prior year. See Form 8863, 8917 or Pub. 970 for more information.

Box 5. Indicates the total of all scholarships or grants administered and processed by the eligible educational institution. The amount of scholarships or grants for the calendar year

(including those not reported by the institution) may reduce the amount of any education credit or deduction you may claim for the year. See Form 8863, 8917 for how to report these

amounts.

Box 6. Indicates an adjustment to scholarships or grants for a prior year. This amount may affect the amount of any allowable education credit or deduction you may claim for the prior

year. See Form 8863, 8917 for how to report these amounts.

Box 7. If this Box is checked, the amount in Box 1 or 2 includes amounts for an academic period beginning January-March 2016. See Pub. 970 for how to report these amounts.

Box 8. Indicates whether your school considers you to have carried at least one-half the normal full-time workload for your course of study for an academic term during tax year 2015. If

you were at least a half-time student for at least one academic term during 2015, you meet one of the requirements for the American Opportunity Credit. You do not have to meet the

workload requirement to qualify for the Tuition and Fees Deduction or the Lifetime Learning Credit.

Box 9. Indicates whether your school considers you to have been enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level

educational credential during tax year 2015. If you were enrolled in a graduate program, you are not eligible for the American Opportunity Credit, but you may qualify for the Tuition and Fees

Deduction or the Lifetime Learning Credit.

Box 10. Indicates the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. The amount of reimbursements or refunds for the calendar

year may reduce the amount of any allowable tuition and fees deduction or the education credit you may claim for the year.

BACKGROUND INFORMATION

The Taxpayer Relief Act of 1997 (TRA97) established two education tax credits: the Hope Tax Credit (currently modified as the American Opportunity Credit by

the American Recovery and Reinvestment Act of 2009) for students who are enrolled in one of the first four years of postsecondary education and are carrying at

least a half-time workload while pursuing an undergraduate degree, certificate, or other recognized credential; and the Lifetime Learning Tax Credit for students who

take one or more classes from a college or university to pursue an undergraduate or graduate degree, certificate, other recognized credential, or to acquire or improve

job skills.

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) established a Higher Education Tuition and Fees Deduction for students who have

a modified adjusted gross income that exceeds the defined thresholds for the tax credits.

To claim the American Opportunity (Hope) or Lifetime Learning Tax Credit, use IRS Form 8863, Education Credits. To claim a Higher Education Tuition and Fees

Deduction, use IRS form 8917 but it is not necessary to file an itemized federal income tax return. The deduction is claimed on Line 19 on IRS Form 1040A, or Line 34

on IRS Form 1040. If you are claimed as a dependent by another person [including your parent(s)], you cannot claim the American Opportunity (Hope) Tax Credit,

Lifetime Learning Tax Credit or a Higher Education Tuition and Fees Deduction. However, the person claiming you may be entitled to the credit on his or her tax return.

Resources: For more information see IRS Publication 970: Tax Benefits for Higher Education and IRS Notice 97-60: provides consumer guidance on Education Tax

Incentives. These documents and IRS Form 8863 and 8917 are available at www.irs.gov or by calling the IRS at 1-800-829-1040. For additional 1098-T information and

instructions from your college or university go to www.1098-T.com.

YOUR SCHOOL MAY HAVE PROVIDED ADDITIONAL FINANCIAL INFORMATION ON THE BACK OF THIS FORM, OR YOU MAY USE YOUR

PERSONAL FINANCIAL RECORDS TO ASSIST YOU IN DETERMINING ELIGIBILITY FOR AN EDUCATION TAX CREDIT OR DEDUCTION.

YOUR PERSONAL FINANCIAL RECORDS SERVE AS THE SUPPORTING DOCUMENTATION FOR YOUR FEDERAL INCOME TAX RETURN.

PLEASE SEE THE ENCLOSED INFORMATIONAL BROCHURE OR WWW.1098-T.COM FOR ADDITIONAL INFORMATION REGARDING

ELIGIBILITY AND INCOME LIMITS.

Other Page May Provide More Information - Page 1 of 7

INFORMATION FOR DETERMINING

FEDERAL TAX BENEFITS FOR HIGHER EDUCATION EXPENSES

Michael Christopher Chapa

The University of Texas at San Antonio

YOU MAY BE ABLE TO REDUCE YOUR FEDERAL INCOME TAX LIABILITY

NOTICE TO STUDENT: You may be able to reduce your federal income tax liability by claiming the American Opportunity or Lifetime Learning Education Tax Credit or Higher Education

Tuition and Fees Deduction. These tax benefits apply to the tuition and related expenses (a) paid by you or on your behalf in 2015. The information provided below is a summary of the

information on file at your college or university regarding qualified tuition and related expense payments, as well as any scholarships and grants you received. This information may be of use

to you in calculating the amount of the tax credit or deduction you may be eligible to claim, but your personal financial records serve as the official supporting documentation for your federal

income tax return. Note: To claim the American Opportunity or Lifetime Learning Tax Credit IRS Form 8863 is required. To claim an education deduction IRS Form 8917 is required.

(Additional detail is available at www.1098-T.com.)

If you are claimed as a dependent on another person's tax return (such as your parent's return), please give this notice to that person.

The American Opportunity Tax Credit may be claimed by eligible single tax filers with a maximum modified adjusted gross income (MAGI) of $90,000 or by joint tax filers with a maximum

MAGI of up to $180,000. The Lifetime Learning Tax Credit may be claimed by eligible single tax filers with a maximum modified adjusted gross income (MAGI) of up to $65,000 or by joint

tax filers with a maximum MAGI of up to $130,000. Please visit www.irs.gov for the most recent information regarding current availability, income limits, and documentation applicable to the

Higher Education Tuition and Fees Deduction.

The school listed above and the Tax Credit Reporting Service (TCRS) are unable to provide individual income tax advice. Please contact the Internal Revenue Service at 1-800829-1040 or your personal tax advisor for further information relating to your eligibility for and/or calculation of these tax benefits.

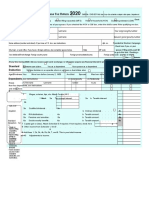

TAX YEAR 2015 AMOUNTS

Part 1: Charges to Your Account

Part 2: Credits to Your Account

Tuition (a)

Fees (a)

Future Tuition (a)

Future Fees (a)

$2,335.50 Financial Aid (Out-of-Pocket)

$1,587.30 Refunds

$2,335.50

$1,512.30

Qualified Expenses Total for Jan 1 Dec 31, 2015 (a)

$7,770.60 Gift Aid Total for Jan 1 Dec 31, 2015 (b)

$15,829.00

$8,053.40

$0.00

TAX YEAR 2015 ADJUSTMENTS TO PRIOR TAX YEAR AMOUNTS (c)

Part 3: Adjustments Made for a Prior Year to

Qualified Tuition and Related Expenses

Part 4: Adjustments Made for a Prior Year to

Scholarships or Grants

NOT APPLICABLE

NOT APPLICABLE

(a) "Qualified Tuition and Related Expenses": The expenses reported on this form must be required by and paid to the institution for enrollment purposes. They include tuition and

certain fees; they do not include books, room and board, athletics (unless part of the students degree program), insurance, equipment, transportation, or other similar personal living

expenses. As a result, the amount of Qualified Tuition and Related Expenses listed above will likely be less than the total amount of money you have paid to the school providing this notice.

Additional detail may be available at www.1098-T.com. Prepaid Qualified Tuition and Related Expenses are payments received for qualified tuition and related expenses in 2015 that relate to

the academic period January through March 2016.

(b) Important information regarding "Scholarships and Grants": Some portion of your Scholarships and Grants may be subject to income tax. Please consult with the IRS or your tax

advisor to determine the taxability of your Scholarships and Grants and how such amounts may affect the amount of your education tax credit or deduction. For additional information on

these issues, please reference IRS Notice 97-60: Consumer Guidance on Education Tax Incentives and IRS Publication 970: Tax Benefits for Higher Education. These documents, as well

copies of IRS Forms 8863 and 8917, can be obtained at the IRS web site, www.irs.gov, or by calling the IRS at 1-800-829-1040. Forms 8863 and 8917 are also available at www.1098T.com.

(c) "Adjustments to Prior Tax Year Amounts" represent transactions processed in Tax Year 2015 that may affect your transactions for a prior tax year. If amounts are shown in these

sections, and if the American Opportunity or Lifetime Learning Tax Credit was claimed by you or on your behalf for a prior tax year, please refer to the Instructions for IRS Form 8863 or IRS

Publication 970 regarding how such amounts must be accounted for on your current year tax return. If no amounts appear in Parts 3 and 4 and you believe you have adjustments to charges

and/or credits, please go to www.1098-T.com and view the detailed transactions for the amounts shown in Parts 1 and 2 on this form.

For more detailed information pertaining to the amounts listed above, visit the Tax Credit Reporting Service (TCRS) web site at www.1098-T.com.

Other Page May Provide More Information - Page 2 of 7

INFORMATION FOR DETERMINING

FEDERAL TAX BENEFITS FOR HIGHER EDUCATION EXPENSES

Michael Christopher Chapa

The University of Texas at San Antonio

Part 1: Charges to Your Account

Financial Detail: Tuition (01)

Transaction

Date

Program

Name

Financial

Type

Financial

Sub-Type

Academic

Term

Academic

Year

Financial

Description

$1,435.50

Amount

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

G002 Tuition-Designated Funds

Grad

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

T001 Tuition - Texas Resident

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

T001 Tuition - Texas Resident

$450.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

G002 Tuition-Designated Funds

Grad

$478.50

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

GIT1 Tuition-Graduate

Incremental

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

T001 Tuition - Texas Resident

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

G002 Tuition-Designated Funds

Grad

-$478.50

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

GIT1 Tuition-Graduate

Incremental

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

T001 Tuition - Texas Resident

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

G002 Tuition-Designated Funds

Grad

-$478.50

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

GIT1 Tuition-Graduate

Incremental

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

T001 Tuition - Texas Resident

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

G002 Tuition-Designated Funds

Grad

$478.50

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

GIT1 Tuition-Graduate

Incremental

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Tuition (01)

Fall

2015

GIT1 Tuition-Graduate

Incremental

$450.00

Academic

Year

Financial

Description

$20.00

Financial Detail: Fees (02)

Transaction

Date

Program

Name

Financial

Type

Financial

Sub-Type

Academic

Term

Amount

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

CA01 Automated Services

Charge

$225.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GES1 Green/Environmental Svc

Fee

$5.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

IE01 International Education Fee

$2.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

LM01 Library Resource Charge

$126.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

MS01 Medical Services Fee

$32.70

Other Page May Provide More Information - Page 3 of 7

INFORMATION FOR DETERMINING

FEDERAL TAX BENEFITS FOR HIGHER EDUCATION EXPENSES

Michael Christopher Chapa

The University of Texas at San Antonio

Financial Detail: Fees (02)

Transaction

Date

Program

Name

Financial

Type

Financial

Sub-Type

Academic

Term

Academic

Year

Financial

Description

Amount

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

RF01 Recreation Center Fee

$120.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

RP01 Student Data Management

Fee

$10.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

S001 Student Services Fee

$138.60

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

SATH Athletics Fee

$180.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

SP01 Publication Charge

$5.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

TEAM Teaching & Learning Ctr

Charge

$5.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

TF01 Transportation Fee

$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

U001 University Center Fee

$90.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

YID1 ID Card Fee

$3.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

CA01 Automated Services

Charge

$75.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

LM01 Library Resource Charge

$42.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

S001 Student Services Fee

$46.20

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

SATH Athletics Fee

$60.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

U001 University Center Fee

$30.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

-$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

-$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

CA01 Automated Services

Charge

-$75.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

LM01 Library Resource Charge

-$42.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

S001 Student Services Fee

-$46.20

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

SATH Athletics Fee

-$60.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

U001 University Center Fee

-$30.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

-$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

-$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

CA01 Automated Services

Charge

-$75.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

LM01 Library Resource Charge

-$42.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

S001 Student Services Fee

-$46.20

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

SATH Athletics Fee

-$60.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

U001 University Center Fee

-$30.00

Other Page May Provide More Information - Page 4 of 7

INFORMATION FOR DETERMINING

FEDERAL TAX BENEFITS FOR HIGHER EDUCATION EXPENSES

Michael Christopher Chapa

The University of Texas at San Antonio

Financial Detail: Fees (02)

Transaction

Date

Program

Name

Financial

Type

Financial

Sub-Type

Academic

Term

Academic

Year

Financial

Description

-$20.00

Amount

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

-$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

CA01 Automated Services

Charge

$75.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

DL01 Digital Learning Fee

$75.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

LM01 Library Resource Charge

$42.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

S001 Student Services Fee

$46.20

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

SATH Athletics Fee

$60.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

U001 University Center Fee

$30.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BISP Global Business Skills

Charge

-$20.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

BTSI COB Technical Serv & Inst

Supp

-$15.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GB01 COB Graduate Services

Chrg

-$150.00

08/01/2015

Main Campus

Qualified Charge to Account (C)

Fees (02)

Fall

2015

GES1 Green/Environmental Svc

Fee

-$5.00

Transaction

Date

Program

Name

Financial

Type

Academic

Year

Financial

Description

$150.00

Financial Detail: Future Tuition (79)

Financial

Sub-Type

Academic

Term

Amount

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

GIT1 Tuition-Graduate

Incremental

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

G002 Tuition-Designated Funds

Grad

$478.50

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

T001 Tuition - Texas Resident

$150.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

T001 Tuition - Texas Resident

$150.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

G002 Tuition-Designated Funds

Grad

$478.50

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

G002 Tuition-Designated Funds

Grad

$478.50

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

T001 Tuition - Texas Resident

$150.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

GIT1 Tuition-Graduate

Incremental

$150.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Tuition (79)

Spring

2016

GIT1 Tuition-Graduate

Incremental

$150.00

Other Page May Provide More Information - Page 5 of 7

INFORMATION FOR DETERMINING

FEDERAL TAX BENEFITS FOR HIGHER EDUCATION EXPENSES

Michael Christopher Chapa

The University of Texas at San Antonio

Financial Detail: Future Fees (80)

Transaction

Date

Program

Name

Financial

Type

Financial

Sub-Type

Academic

Term

Academic

Year

Financial

Description

Amount

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

SATH Athletics Fee

$60.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

SP01 Publication Charge

$5.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

TEAM Teaching & Learning Ctr

Charge

$5.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

TF01 Transportation Fee

$20.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

U001 University Center Fee

$40.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

YID1 ID Card Fee

$3.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

BISP Global Business Skills

Charge

$20.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

BTSI COB Technical Serv & Inst

Supp

$15.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

CA01 Automated Services

Charge

$50.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

GB01 COB Graduate Services

Chrg

$150.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

LM01 Library Resource Charge

$42.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

S001 Student Services Fee

$46.20

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

SATH Athletics Fee

$60.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

U001 University Center Fee

$20.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

BISP Global Business Skills

Charge

$20.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

BTSI COB Technical Serv & Inst

Supp

$15.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

CA01 Automated Services

Charge

$75.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

GB01 COB Graduate Services

Chrg

$150.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

LM01 Library Resource Charge

$42.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

S001 Student Services Fee

$46.20

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

SATH Athletics Fee

$60.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

U001 University Center Fee

$30.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

S001 Student Services Fee

$46.20

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

RP01 Student Data Management

Fee

$10.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

RF01 Recreation Center Fee

$120.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

MS01 Medical Services Fee

$32.70

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

LM01 Library Resource Charge

$42.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

IE01 International Education Fee

$2.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

GB01 COB Graduate Services

Chrg

$150.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

CA01 Automated Services

Charge

$100.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

BISP Global Business Skills

Charge

$20.00

12/01/2015

Main Campus

Qualified Charge to Account (C)

Future Fees (80)

Spring

2016

BTSI COB Technical Serv & Inst

Supp

$15.00

Other Page May Provide More Information - Page 6 of 7

INFORMATION FOR DETERMINING

FEDERAL TAX BENEFITS FOR HIGHER EDUCATION EXPENSES

Michael Christopher Chapa

The University of Texas at San Antonio

Part 2: Credits to Your Account

Financial Detail: Financial Aid (Out-of-Pocket) (01)

Transaction

Date

Program

Name

Financial

Type

Financial

Sub-Type

Academic

Term

Academic

Year

Financial

Description

Spring

2015

F453 Direct Fed Unsub Stafford

Loan

$7,420.00

Amount

01/02/2015

Main Campus

Payments to Account (P)

Financial Aid (Out-of-Pocket)

(01)

08/08/2015

Main Campus

Payments to Account (P)

Financial Aid (Out-of-Pocket)

(01)

Fall

2015

F453 Direct Fed Unsub Stafford

Loan

$6,925.00

09/21/2015

Main Campus

Payments to Account (P)

Financial Aid (Out-of-Pocket)

(01)

Fall

2015

F453 Direct Fed Unsub Stafford

Loan

$1,484.00

Financial Detail: Refunds (01)

Transaction

Date

Program

Name

Financial

Type

Financial

Sub-Type

Academic

Term

Academic

Year

Financial

Description

Amount

01/03/2015

Main Campus

Refunds (S)

Refunds (01)

Spring

2015

REFD General Refund Account

$3,567.20

08/08/2015

Main Campus

Refunds (S)

Refunds (01)

Fall

2015

REFD General Refund Account

$3,002.20

09/22/2015

Main Campus

Refunds (S)

Refunds (01)

Fall

2015

REFD General Refund Account

$1,484.00

Other Page May Provide More Information - Page 7 of 7

You might also like

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Paula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Document2 pagesPaula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Natural Beauty LaserNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Federal TexasDocument22 pagesFederal TexasPaola V. MartinezNo ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- Julian Saud 1095a 2022Document8 pagesJulian Saud 1095a 2022Neyda LarroqueNo ratings yet

- App A - Enlistment or Appointment ApplicationDocument9 pagesApp A - Enlistment or Appointment ApplicationMark CheneyNo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatuspeachyNo ratings yet

- Shared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputDocument1 pageShared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputBlessing Nel GuillaumeNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Document42 pages2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Document1 pageCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn StarnesjpneebNo ratings yet

- Form W-4 (2018) : Specific InstructionsDocument4 pagesForm W-4 (2018) : Specific InstructionsRony MartinezNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- State District of ColumbiaDocument20 pagesState District of ColumbiaRoger federerNo ratings yet

- Ahtasham Ahmed Case - CompressedDocument19 pagesAhtasham Ahmed Case - CompressedarsssyNo ratings yet

- Zax11 Stockbridge Ga 9061Document4 pagesZax11 Stockbridge Ga 9061Frank ValenzuelaNo ratings yet

- Claimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Document1 pageClaimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Jimmy BurtNo ratings yet

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- 5.tax Interview Questions Virtual Interview FiverrDocument4 pages5.tax Interview Questions Virtual Interview Fiverrfrantzloppe05No ratings yet

- 2007 Federal ReturnDocument2 pages2007 Federal ReturnbradybunnellNo ratings yet

- New Hire Paperwork 2021aDocument27 pagesNew Hire Paperwork 2021aTom BondalicNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchNo ratings yet

- 1481546265426Document3 pages1481546265426api-370784582No ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- Form1095a 2017 PDFDocument8 pagesForm1095a 2017 PDFTina Reyes100% (1)

- LG FFDocument1 pageLG FFfeem743No ratings yet

- Advanced Scenario 6: Samantha Rollins (2017)Document9 pagesAdvanced Scenario 6: Samantha Rollins (2017)Center for Economic Progress0% (1)

- 2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)Document7 pages2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)atul0070No ratings yet

- Fairmount Heights - Documents 1 PDFDocument88 pagesFairmount Heights - Documents 1 PDFAri AsheNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramLoriNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusRobert M Hamil.No ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- Mart1552 21i FCDocument23 pagesMart1552 21i FCOlga M.No ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- Tax Certificate 2022-2023Document1 pageTax Certificate 2022-2023marco.kozilekgoweNo ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- Electronic Filing Instructions For Your 2008 Federal Tax ReturnDocument14 pagesElectronic Filing Instructions For Your 2008 Federal Tax ReturnjakeNo ratings yet

- City Agenda April 16, 2014Document267 pagesCity Agenda April 16, 2014Brian DaviesNo ratings yet

- 1040es Estimated Tax 2014 For IndividualsDocument12 pages1040es Estimated Tax 2014 For IndividualsClaudia MaldonadoNo ratings yet

- Lesson Plan Prepare An Individual Income Tax Return - 0Document5 pagesLesson Plan Prepare An Individual Income Tax Return - 0Clary AgustinNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- f1098t PDFDocument6 pagesf1098t PDFashley valdiviaNo ratings yet

- US Internal Revenue Service: I1098et 06Document3 pagesUS Internal Revenue Service: I1098et 06IRSNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- 1098 T UWM 2017 PDFDocument2 pages1098 T UWM 2017 PDFsolrak9113No ratings yet

- SSF SS 1098T PDFDocument1 pageSSF SS 1098T PDFJoseph FabreNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementJonathan EllisNo ratings yet

- Banner Accounts Receivable 8.5.2 TRA 1098-T Reporting HandbookDocument51 pagesBanner Accounts Receivable 8.5.2 TRA 1098-T Reporting HandbookAmjad AliNo ratings yet

- f1098t 2021Document6 pagesf1098t 2021Batman Arkham Kinght™️No ratings yet

- Education Benefits Self-Study Course: (2 Tax Law CE Hours)Document34 pagesEducation Benefits Self-Study Course: (2 Tax Law CE Hours)John MikeNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementVampire LadyNo ratings yet

- Student's 1098T Form PDFDocument1 pageStudent's 1098T Form PDFVexel 22No ratings yet

- Tuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceDocument4 pagesTuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceGeozzzyNo ratings yet

- Tax Notification Account Billing Information Tab PDFDocument2 pagesTax Notification Account Billing Information Tab PDFIbrahiem MohammadNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- Tax Return 2020Document27 pagesTax Return 2020Sadman Sakib Tazwar100% (1)

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition Statemented redfNo ratings yet