Professional Documents

Culture Documents

Statusandpotentialofenergyandcarbontradinginindia 111121072701 Phpapp01 PDF

Statusandpotentialofenergyandcarbontradinginindia 111121072701 Phpapp01 PDF

Uploaded by

viniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statusandpotentialofenergyandcarbontradinginindia 111121072701 Phpapp01 PDF

Statusandpotentialofenergyandcarbontradinginindia 111121072701 Phpapp01 PDF

Uploaded by

viniCopyright:

Available Formats

Carbon Finance

Faculty: Ashwani Kumar (Asst. Prof, CEPT, Ahmadabad-9)

2011

Status and Potential of Energy and Carbon Trading in India

ABHIK TUSHAR DAS, AJAY CECIL, ANAND SINGH

Executive MBA 2010

Monday, 21 November 2011

www.spm.pdpu.ac.in

11/21/2011

Page 1

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Table of contents:

S No

Topic

Page Number

Executive Summary, Timeline of major Climate Change Events

3 to 5

Why Carbon Markets?

5 to 8

KYOTO plan and its implications

8 to 11

Indian Energy scenario

11 to 14

Fuel substitution

14 to 16

Renewable Energy

16 to 17

Technology Transfer

18 to 19

Project Sustainability

19 to 20

CDM Projects in India

21 to 24

10

The Trading Mechanism

24 to 29

11

Carbon Trading Participants & Platform

30 to 32

12

Post KYOTO?

32 to 33

13

Conclusion

34

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Executive Summary:

Carbon is the major constituent of all GHG which are the root cause of Global Warming. As

the GHGs are transparent to incoming solar radiation, but opaque to outgoing long-wave

radiation, an increase in the levels of GHGs could lead to greater warming, which, in turn,

could have an impact on the world's climate, leading to the phenomenon known as climate

change.

Important greenhouse gases are;

S No. GHG constituent

GWP

%

change*

between 1750

and 2000

31%

151%

17%

-

1

2

3

4

Carbon dioxide (CO2)

1

Methane (CH4)

21

Nitrous oxide (N2O)

310

Hydro-fluorocarbons

140-11700

(HFC)

5

Per-fluoro-carbons

7000-9200

(PFC)

6

Sulphur hexafluoride 23900

(SF6)

*Intergovernmental Panel on Climate Change, IPCC 2001

Atmospheric

Life (Years)

Impact

(%)

5-200

12

114

1.4-260

70-72%

20%

6-7%

-

10,000

50,000+

3200

to -

- Miniscule contribution, not measured

GWP: Global Warming Potential (amount of heat retention ability of the gas as CO2

equivalent)

Atmospheric life: The time the gas stays in the atmosphere

Scientific evidence linking chlorofluorocarbons (CFCs) and other Ozone Depleting

Substances (ODSs) to global ozone depletion led to the initial control of chemicals under the

1987 Montreal Protocol. Emissions of the fluorinated gases (F-gases) (hydro fluorocarbons

(HFCs), per fluorocarbons (PFCs) and SF6) controlled under the Kyoto Protocol grew rapidly

(primarily HFCs) during the 1990s as they replaced ODS. Atmospheric CO2 concentrations

have increased by almost 100 parts-per-million since their pre-industrial level, reaching 379

parts-per-million in 2005, with mean annual growth rates in the 2000-2005 periods higher

than in the 1990s. The total CO2-equivalent (CO2-eq) concentration of all long-lived GHGs is

now about 455 parts-per-million CO2-equivalent.

The World Meteorological Organization (WMO) together with United Nations Environment

Program set up an international multidisciplinary collaborative effort to ensure involvement

of policymakers, general public and environmental scientists towards resolving the

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

contentious issue of Global temperature rise. The Intergovernmental Panel on Climate

Change (IPCC) was divided into three working groups dealing with;

1. Dynamics of climate change

2. Potential impacts of climate change

3. Response to threat of climate change, including adaptation (reduce the vulnerability

of natural and human systems)

The growing pressure on countries to address climate change has given rise to a multimillion dollar international market for buying and selling emissions of greenhouse gases.

Timeline:

1979/ 85/ 87: World Climate Conference's

1988: WMO + UNEP establish IPCC

1990: FAR (First Assessment Report)

1992: UNFCC adopted Earth Summit @ Rio-de-Janerio

1995: COP-1 (Berlin)

1995: SAR (Second Assessment Report)

1996: COP-2 (Switzerland)

1997: COP-3: Kyoto Protocol

1998: COP-4 (Argentina)

1999: Cop-5 (Germany)

2000: COP-6 (Netherland)

2001: TAR (Third Assessment Report)

2001: COP-7 Marrakesh Accord (Morocco)

2002: COP-8 (India)

2003: COP-9 (Italy)

2004: COP-10 (Argentina)

2005: COP-11/ MOP-1 (Canada)

2006: COP-12/ MOP-2 (Kenya)

2007: COP-13/ MOP-3 (Indonesia)

2008: COP-14/ MOP-4 (Poland)

2009: COP-15/ MOP-5 (Denmark)

2010: COP-16/ MOP-6 (Mexico)

2011: COP-17/ MOP-7 (South Africa)

COP: Conference of Parties

MOP: Meeting of the Parties

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

The Greenhouse Effect: The greenhouse effect is a process by which thermal radiation from

a planetary surface is absorbed by atmospheric greenhouse gases, and is re-radiated in all

directions. Since part of this re-radiation is back towards the surface, energy is transferred

to the surface and the lower atmosphere. As a result, the temperature there is higher than

it would be if direct heating by solar radiation were the only warming mechanism. Without

the natural Greenhouse Effect, the average temperature of the earth would be around -18

deg Celsius (-0.4 deg Fahrenheit).

Earths natural greenhouse effect makes life as we know it possible, however, human

activities, primarily the burning of fossil fuels and clearing of forests, have greatly intensified

the natural greenhouse effect, causing global warming.

Impacts of Climate Change:

1.

2.

3.

4.

5.

6.

7.

8.

Temperature rise (5-10 deg F in next 100 years)

Rise in sea levels (SLR), coastal flooding

Melting of Glaciers

Frequent and intense Heat waves, Wildfires

Droughts

Extinction of certain species

Enhanced evaporation from seas leading to heavy (intense) downpours

Melting of Perma-frost in Arctic threatening ecosystems

Why Carbon Markets?

Post KYOTO Protocol, businesses in ANNEX-1/ ANNEX-2 countries need to alter their

business decisions to align with regulations imposed on them in a cost effective way. These

regulations can be mitigated either by investing in cleaner business practices or by

purchasing credits (equivalent to 1 metric tonne of CO2 emission) from another operator

with spare emission allowance. Under International Emissions Trading (IET), countries can

trade in the international carbon credit market to cover their shortfalls in allowances by

three Market based methods;

1. Joint Implementation (article 6 of KYOTO Protocol): A system under which advanced

countries jointly implement a project and the countries that invest in the project can

use the number of emissions reduced by the project to achieve their targets.

2. Clean Development Mechanism (article 12 of KYOTO Protocol): A system under

which a advanced country and a developing country jointly implement a project, the

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

country investing in the project can use the amount of emissions reduced by the

project to achieve its target.

3. Emission trading (article 17 of KYOTO Protocol): A system under which advanced

countries sell and buy emissions to achieve their respective targets.

Joint

Implementation

ERU

CDM

CER

Emission

Trading

AAU/ RMU

Project Based

Carbon Market

Allowance

Based

Voluntary Based

VER

Other greenhouse gasses can also be traded, but are quoted as standard multiples of carbon

dioxide with respect to their global warming potential

The cost of implementing a carbon cap in an Annex-1/ 2 (Developed) countries is

significantly higher than that in a Non-Annex (Developing) country. This is the primary driver

for implementation of Carbon Credit trading mechanism wherein the carbon cap can be

offset by reducing the carbon output of the countries where redundant technology can be

replaced by highly efficient greener technologies with less capital expenditure and negative

impact to the economy.

Carbon Trading Exchanges:

There are six emission trading exchanges which serve to connect the emitter with the Credit

generator

1. Chicago Climate Exchange: The now defunct Chicago Climate Exchange (CCX) was

North Americas only voluntary, legally binding greenhouse gas (GHG) reduction and

trading system for emission sources and offset projects in North America and Brazil.

Trading reached zero monthly volume in February 2010 and remained at zero for the

next 9 months when the decision to close the exchange was announced due to

inactivity in the U.S. carbon markets.

2. European Climate Exchange: ECX / ICE Futures is the most liquid, pan-European

platform for carbon emissions trading, with its futures contract based on the

underlying EU Allowances (EUAs) and Certified Emissions Allowances (CERs)

attracting over 80% of the exchange-traded volume in the European market. ECX

contracts (EUA and CER Futures, options and spot contracts) are standardised

exchange-traded products.

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

3. NASDAQ OMX Commodities Europe (Nord Pool): Nord Pool was the largest power

derivatives exchange and the second largest exchange in European Union emission

allowances (EUAs) and global certified emission reductions (CERs) trading.

4. POWERNEXT: POWERNEXT is a regulated investment firm based in Paris and

operating under the multilateral trading facility status. POWERNEXT designs and

operates electronic trading platforms for spot and derivatives markets in the

European energy sector.

5. Commodity Exchange Bratislava: Formerly BMKB, then BCE, now CEB is a European

commodity exchange made for organising market with commodities according to

adjudication of Ministry of Economy of the Slovak Republic. It is the first exchange

that has started non-stop online trading and clearing.

6. European Energy Exchange: EEX operates market platforms for trading in electric

energy, natural gas, CO2 emission allowances and coal.

Cap-and-trade (originating from the Acid Rain crisis of the US in the 1980s) has been

credited with not only allowing the US to successfully overcome it, but is also finding favour

in addressing the issue of global warming. The offsets created through a baseline and credit

approach, and a carbon tax are all market-based approaches that put a price on carbon and

other greenhouse gases and provide an economic incentive to reduce emissions, beginning

with the lowest-cost opportunities.

The two main types of schemes are;

1. cap and trade scheme: polluter purchases credits

2. baseline and credit scheme: polluter sells credits

The emissions trading program can be called a "cap-and-trade" approach in which an

aggregate cap on all sources is established and these sources are then allowed to trade

amongst themselves to determine which sources actually emit the total pollution load. An

alternative approach with important differences is a baseline and credit program wherein

polluters that are not under an aggregate cap can create credits, usually called offsets, by

reducing their emissions below a baseline level of emissions. Such credits can be purchased

by polluters that do have a regulatory limit.

Emergence of the Carbon Market:

In the late 1990s and early 2000s, some American and Canadian companies had started

undertaking voluntary commitments to limit Greenhouse Gas emissions. Post KYOTO, a

Prototype Carbon Fund (PCF) with participation of 6 Governments and 15 private companies

was formed to pool resources (US$180 million) to purchase emission reduction credits

under the JI and CDM mechanisms. The fund which was established in 1999, was managed

by the World Bank signed the first emission reduction purchase agreement for a CDM

Project in Chile in 2002. The adoption of the Marrakech Accord (2001) led to more number

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

of players in the carbon market, with the Government of the Netherlands floating the first

carbon tender for CDM and JI. Lately Banks and Financial institutions have started investing

in the carbon markets foreseeing huge potential demand from the regulated economies.

The rapid growth in the Carbon Market can directly be attributed to the EU-ETS (emission

trading system) and the KYOTO Protocol.

KYOTO plan and its implications:

The convention established the Conference of Parties (COP) as its supreme body with the

responsibility to oversee the progress towards the aim of the Convention. The protocol also

allows these countries the option of deciding which of the six gases will form part of their

national emission reduction strategy. Some activities in the Land use- Land use changeForestry (LULUCF) sector such as a-forestation and reforestation that absorb CO2 from the

atmosphere are also covered.

KYOTO Parties in Carbon Market:

1. ANNEX-1 (41 countries): countries agreed to reduce their collective greenhouse gas

emissions by 5.2% from the 1990 level

2. ANNEX-2 (23 countries): these countries are expected to provide financial resources

to assist developing countries to comply with their obligations, such as preparing

national reports. Annex II countries are also expected to promote the transfer of

environmentally sound technologies to developing countries.

3. Non-Annex-1: Parties are mostly developing countries, especially vulnerable to the

adverse impacts of climate change and that rely heavily on income from fossil fuel

production and commerce.

Emission Credits (allowance based):

1. AAU: Assigned Amount Units are the emission allowances assigned to the various

countries in the KYOTO Protocol for a commitment period. These allowances depend

upon the emission targets which the countries have to meet during the KYOTO

window period of 2008-12. Total amount of AAUs of an Annex-1 party is calculated

from its base year emissions and emission reduction targets.

2. RMU: Removal Units are emission allowances which are generated in addition to

AAUs as a result of an increase in the National Sink Performance. As sinks do not

contribute to the sustainable CO2 limitations, RMUs expire at the end of the

commitment period. Total RMUs of an Annex-1 party is calculated from the net

removal of GHGs by Afforestation and Reforestation (A/R).

3. ERU: Emission Certificates derive from completion of JI projects between two

industrialized countries are called Emission Reduction Units.

4. CER: Emission Certificates derived from the successful completion of CDM Projects

traded or used by the Project operator.

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

T-CER: A temporary CER certificate issued for CDM projects associated with aforestation and reforestation projects of CDM. Such CERs expire at the end of

commitment period and can be renewed if carbon sequestration is done by

defined methodologies.

L-CER: A long term CER certificate issued for CDM projects associated with aforestation and reforestation projects of CDM. L-CERs therefore differ from

temporary certified emission reductions (t-CERs) in that L-CERs expire at the

end of the crediting period of the project, while t-CERs expire at the end of

the commitment period in which they were issued.

Project participants in a-forestation and reforestation (A/R) may choose

whether to receive t-CERs or L-CERs for emission reductions attributable to

the project.

5. EUA: European Union Allowance are the emission allowances assigned to companies

participating in the European emission trading scheme. These allowances are

assigned to individual companies by each EU Member State.

AAUs

RMUs

ERU+CER

Emission

Trading Units

+/-

Emission Cap of Annex-1 Party

If an Emission cap of an Annex-1 Party is more than its GHG Emissions during the 1 st

commitment period, the surplus can be carried over to the subsequent commitment period.

Conversely, if the GHG emission during the 1st commitment period of an Annex-1 Party is

more than its emission cap, the Annex-1 party will be deemed to be non-compliance of the

KYOTO Protocol and would be levied a penalty in the form of deduction of allowance from

the 2nd commitment period for an amount equal to 1.3 times the number of tonnes of

excess emissions.

www.spm.pdpu.ac.in

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

International Emission Trading Schematic:

With EMISSION TRADING

Emission Cap (Before Trading) (units)

Trading of Units (units)

Emission Cap (After Trading) (units)

GHG Emissions (units)

Required emission reductions (units)

Unit Cost of reduction (US$)

Total Cost of Reduction (US$)

Trading Cost (US$)

Total Cost of compliance (US$)

Unit: 1 Metric Tonne of CO2 equivalent

Party-X

10

1

11

12

1

200

200

150

350

Party-Y

8

-1

7

10

3

100

300

-150

150

Total

18

0

18

22

4

500

0

500

Party-X

10

NA

10

12

2

200

400

NA

400

Party-Y

8

NA

8

10

2

100

200

NA

200

Total

18

NA

18

22

4

600

NA

600

Unit cost = US$150

WITHOUT EMISSION TRADING

Emission Cap (Before Trading) (units)

Trading of Units (units)

Emission Cap (After Trading) (units)

GHG Emissions (units)

Required emission reductions (units)

Unit Cost of reduction (US$)

Total Cost of Reduction (US$)

Trading Cost (US$)

Total Cost of compliance (US$)

Unit: 1 Metric Tonne of CO2 equivalent

Emission Credits (voluntary based):

Emission offset mechanism outside the KYOTO Protocol is known as the VER (Voluntary

Emission Reduction) which are not standardized commodity and hence fetch a discounted

price as compared to the allowance based units. The VER market is characterized by the

following set of objectives;

To make a quantifiable contribution towards reducing emissions

Enhance public relations

Generate goodwill by entering the Carbon Market

Manage Corporate Social Responsibilities (CSR)

Become Carbon neutral

VER can vary largely with their quality (actual emission reduction achieved for each unit of

standard value 1 Metric Tonne of CO2 claimed) depending on the supplier and buyer.

Parties involved in such transactions should make proper due diligence before making

www.spm.pdpu.ac.in

10

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

purchasing decisions. VCS (Voluntary Carbon Standard) are being recognized to promote

sustainable development alongside greenhouse gas emission reduction objectives. VERs if

standardized and generated through UN approved processes and issued through a

internationally recognized body, would demand a similar price as compared to the CER/

AAU.

Gold Standard VERs:

The rigorous Gold Standard certification (backed by World Wide Fund for Nature- WWF)

process ensures genuine quality, and like all high end products, Gold Standard carbon

offsets carry a price premium. The Gold Standard approach delivers not only better quality

projects but also more commercially viable investments.

1. The Gold Standard is the benchmark global carbon standard

2. Gold Standard certified carbon credits sell at a price premium due to their high

quality, robustness and sustainable development benefits

3. The Gold Standard has nearly a decade of expertise and great market recognition

4. There is high end-buyer demand

5. Projects are more likely to be eligible for future compliance schemes

6. Reduced reputational risk, endorsed and supported by more than 80 NGOs

worldwide

7. UN accredited auditors, supplemented by GS in-house experts

Indian Energy scenario:

The GOI (Government of India) plans to achieve a GDP (gross domestic product) growth rate

of 10% in the Eleventh Five Year Plan and maintain an average growth rate of about 8% in

the next 15 years (Planning Commission 2002). Given the plans for rapid economic growth,

it is evident that the countrys requirements for energy and supporting infrastructure would

increase rapidly as well.

Total Energy consumption % in India;

1.

2.

3.

4.

5.

6.

7.

Combustible Renewable and Waste: 27.2%

Hydro: 1.8%

Oil: 23.7%

Nuclear: 0.8%

Coal/Peat: 40.8%

Natural gas: 5.6%

Other Renewable: 0.2%

www.spm.pdpu.ac.in

11

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

As is evident, the primary energy source fir India is dominated by Coal consumption which

drives the economy. Coal has high carbon content (Commercial coal has a carbon content of

at least 70%) and hence is a major pollutant in terms of GHG emissions. Because the atomic

weight of carbon is 12 and that of oxygen is 16, the atomic weight of carbon dioxide is 44.

Based on that ratio, and assuming complete combustion, 1 pound of carbon combines with

2.667 pounds of oxygen to produce 3.667 pounds of carbon dioxide. For example, coal with

a carbon content of 78 percent and a heating value of 14,000 Btu per pound emits about

204.3 pounds of carbon dioxide per million Btu when completely burned.

www.spm.pdpu.ac.in

12

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

India set a voluntary target to cut its carbon intensity, or the amount of carbon dioxide

released per unit of GDP, by as much as 25 percent by 2020 from 2005 levels. No additional

measures will be offered to reduce CO2, the main greenhouse gas scientists blame for

climate change. If India has to reduce its carbon emissions, it would mean a major

reorientation of her energy strategy, especially if that warranted a shift from its current

coal-based to a oil and gas based energy system. A 30% CO2 reduction over a period of 30

years using annual emissions reduction targets leads to a fall in GDP of 4% and raises the

number of poor by 17.5% in the 30th year.

It can be seen that the bottom 50% of rural people emitted in 1990 a mere 54 kg of carbon

per person per year. The richest 10% of urban people emitted 12 times as much at 656 kg of

Carbon per person per year, which is still way below the world average of 1.1 tonne and

much below the average emission in developed countries.

Government initiatives in reducing Carbon Emissions:

Emphasis on energy conservation: Promotion of use of CFL lamps, mandatory BEE

certification

Promotion of renewable energy sources: JNNSM,

Abatement of air pollution:

Afforestation and wasteland development.

Economic reforms, subsidy removal and joint ventures in capital goods.

Fuel substitution policies.

www.spm.pdpu.ac.in

13

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Population

Carbon

intensity

Energy

intensity of

GDP

GDP per

Capita

CARBON EMISSIONS

The Carbon Emission basket can be reduced by controlling one of the four parameters;

1. Carbon intensity: The amount of carbon by weight emitted per unit of energy

consumed.

2. Energy intensity of GDP: Energy intensity is a measure of the energy efficiency of a

nation's economy (energy per unit of GDP).

3. GDP per capita: A measure of the total output of a country that takes the gross

domestic product (GDP) and divides it by the number of people in the country.

4. Population: The entire pool of people contributing to the GDP of a country.

Fuel substitution:

Coal was initially the mainstay of commercial energy and use of oil and gas was not allowed

for some sectors. More recently, many sectors have switched to the use of fuels other than

coal. For example, the power sector is permitted to use natural gas. Coal-based fertilizer

plants no longer function and coal use in railways is almost phased out. Consumers

preferences for clean and easily available fuel, oil is preferred in part because the

distribution infrastructure for petroleum is better. Natural gas emits 60% less carbon dioxide

than coal and 42% less than oil for a comparable unit of consumption, although it does emit

other non-carbon greenhouse gases. Gas is an efficient fuel and saves up to 30% of energy

in most applications. Unlike nuclear energy, natural gas do not pose waste disposal or safety

problems. And it is available in abundance. If any single factor can substantially lower

www.spm.pdpu.ac.in

14

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

carbon intensity in the global economy, it is inter-fuel substitution or replacement of

conventional fuels such as coal and oil by natural gas.

Gas is regarded as a regional resource, more than two-thirds of proven gas reserves in the

world are clustered in and around two oil-rich regions; Russia and the Persian Gulf, notably

Iran and Saudi Arabia-and significant gas reserves are found in Algeria, Indonesia, Trinidad

and Tobago and Turkmenistan. China and India, which together account for a third of global

incremental energy demand, have only modest gas deposits. Other major energy importers

such as the United States, Europe, Japan and South Korea have either modest gas deposits

or none at all. Technological breakthroughs in combined cycle gas turbines have rendered

gas-fuelled generation highly efficient. Plants with such turbines can be set up in a short

time and require much less initial capital investment than hydroelectricity or coal fired

power generation plants. India, with its focus on food security, consumes 40% of its gas in

the fertilizer sector. The UNFCC and Kyoto Protocol are perceived to have key roles in

facilitating the switch to cleaner gas.

According to the National Communication submitted by India to the Kyoto Secretariat, coal

based power generation contributes to half of the countrys carbon emissions.

Transportation accounted for 10% of carbon emissions a decade ago, but considering the

growth of cars on Indian roads, that figure must have gone up substantially since then. From

the perspective of a cleaner environment, inter-fuel substitution should ideally target

sectors with maximum emissions, namely, power generation and transportation.

Inter-fuel substitution away from polluting coal/ oil and towards clean gas is seriously

constrained by the prevailing price of gas, availability of transport fuel substitutes like

subsidised diesel and the poor distribution infrastructure.

For countries committed to Kyoto commitments to reduce carbon, nuclear energy will

provide an attractive alternative to gas. Among the technologies which could deliver a

contribution to emission reduction, nuclear power generation plays a crucial role. However

there are a lot of alternative energy sources, the costs of renewable sources are falling

rapidly: in the last 10 years the cost per kWh of electricity from wind turbines fell by 50%,

and that from photovoltaic cells fell by 30%. The costs of nuclear power are rising, despite

the fact that nuclear power has been hugely subsidized over the last half century and many

serious problems associated with nuclear power that have existed since its introduction and

www.spm.pdpu.ac.in

15

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

are still not resolved (decay time of nuclear waste, concerns over safety, health risks due to

exposure to radiation). One of the by-products of most nuclear reactors is plutonium-239,

which can be used in nuclear weapons. Nuclear installations could also become targets for

terrorist attacks and radioactive material could be used by terrorists to make "dirty bombs".

Renewable energy sources have multiple benefits. They are free from greenhouse gas

emissions and can also increase diversity in the energy market. They can provide long-term

sustainability of our energy supply and can be used in rural areas of less developed

countries that are not connected to gas and electricity networks.

Renewable Energy:

Renewable energy source to meet growing energy needs can be capitalised to acquire

carbon credits. These carbon credits are sold on international markets generating income

for the owner of the credits. Carbon credits, which are issued to organizations based on

their efforts to limit climate change, and renewable energy projects are intricately linked in

India.

A carbon credit represents the removal of one ton of carbon dioxide or its green-house gas

(GHG) equivalent from the environment. Firms in the European Union and the OECD

member countries are buying carbon credits called CER (Certified Emission Reductions) from

firms in India. CER are registered and issued by the Executive Board of the Clean

Development Mechanism (CDM) of United Nations Framework Convention on Climate

Change. CER are used to meet a part of the obligations in the EU and OECD countries to

reduce GHG emissions; obligations that were agreed upon in the Kyoto Protocol and are

now mandated by national governments.

The World Bank estimates that in 2006 approximately US $5 billion worth of CER were sold.

The European Climate Exchange added CER Futures for trading in March 2008, followed by

CER Options in May 2008. The CER for December 2008 delivery was trading at about US $30

(EU 21) on September 1 on the European Climate Exchange.

Financing of renewable energy projects via carbon credits is a relatively new activity in India.

It requires simple and innovative models that are easy to implement, manage and finance.

Renewable energy firms like C-TRADE are working to help develop renewable energy

projects through carbon financing. C-TRADE develops renewable energy projects in

developing countries and finances them partly by having the rights to the carbon credits

that the project will generate. Its biogas renewable energy projects turn waste manure from

farms into electricity that the farmers use. The projects are completed on a Build-OperateTransfer (BOT) basis, transferring the asset to the farmer at the end of the agreement

period. C-Trade finances the entire operation. Because many of the renewable energy

projects in India tend to be on the smaller scale, innovative business models have made

aggregation of investments possible in these projects. Developers of these projects are

starting to use the growing market for carbon credits to finance a part of their project costs.

www.spm.pdpu.ac.in

16

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

In recent years, the wind energy market has grown significantly and much of this growth can

be attributed to supportive governmental policies and innovations in management and

financing. A 6.5-megawatt (MW) wind energy project in the state of Madhya Pradesh was

issued 10,413 CER for offsetting green house gas emissions over a 13-month period. With 5

wind turbines, the wind farm is owned by a consortium of 5 companies but operated and

maintained by the supplier.

Wind turbines in another 9.6-MW project being developed by a hotel firm are also operated

and maintained by their supplier. This project is expected to generate 15,245 CER annually

for 10 years. At the CER price of US $30, the project could generate about US $457,000

annually, which is equivalent to about US $47 worth of CER per KW of installed capacity.

In India, an additional 70,000 MW of electricity generation capacity is expected to be built

between 2007 and 2012 and about 21% of this addition is expected to come from

renewable sources. Small Hydro potential in India is estimated to be 15,000 MW and as of

March 2008 about 2,000 MW projects have already been installed. Small hydro electric

projects of various sizes are taking advantage of carbon credit financing.

The mountainous state of UTTARAKHAND has an active list of hydro electric projects of

various sizes under development and at the proposal stage. Many potential project sites

have been identified in the state for development of hydro-electric projects. These include a

large number of run-of-river projects ranging from 0.4 MW to 230 MW, and also a few large

projects (between 25 and 100 MW) based on water storage. The four small hydro projects

for which project design documents have been prepared for CDM are expected to generate

160,000 carbon credits valued at US $1.6 million per year

Note: This is based on a CER priced at US $10, not the current price of US $30 the value at

current CER price will be three times this amount.

In the past sugar mills in India have been able to generate energy for their use from bagasse

(sugarcane pulp) however, the mills were unable to supply the surplus power to the grid,

and had little incentive to use efficient technologies. Some of the CDM projects are changing

this. One bagasse based renewable energy project at a sugar factory in India is expected to

offset 42,446 tons of carbon dioxide annually for ten years. This 9-MW biomass renewable

project was issued 33,434 CER between May 2006 and March 2007. It supplies electricity to

the state electricity grid, replacing the need to build more fossil-fuel based power plants.

In the past few years a large number of renewable energy projects have benefited from

carbon financing, meeting the energy security needs, and preventing the release of green

house gases into the atmosphere. Still, many dispersed and disaggregated renewable

energy activities have not yet been able to tap markets for carbon credits. With the

development of the carbon credit market and new approaches to renewable energy

businesses and policy this may change in the future.

www.spm.pdpu.ac.in

17

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Technology Transfer:

The role of technology is critical in achieving any carbon targets and there is a need for

complementary policies and cooperation to support technology development and diffusion.

In part, a sufficiently long horizon for the price of carbon should provide a stimulus, but the

Copenhagen discussions will also consider the extent to which multilateral co-operation can

be effective in transferring technology to developing countries and how this should link with

other areas such as foreign assistance programs and trade policy

India has announced that it will endeavor to reduce emissions intensity of GDP by 20 to 25

percent in comparison to the 2005 level by 2020. Government has launched National Action

Plan on Climate Change that includes National Solar Mission and National Mission on

Enhanced Energy Efficiency which aim at reducing emissions intensity of GDP.

The Indian Government follows the policy of sustainable development through a range of

programs aimed at;

Energy Conservation

Improved Energy Efficiency in various sectors

Promoting use of Renewable Energy

Power Sector Reforms

Use of Cleaner and Lesser Carbon Intensive fuel for transport

Fuel Switching to Cleaner Energy

Forestation and Conservation of Forests

Promotion of Clean Coal Technologies

Encouraging Mass Rapid Transport systems

The centrality of the technology question comes from the realisation that a reduction of

emissions consistent with the objective of the European Union, which is to keep global

warming under 2 C higher than pre-industrial levels, would entail developed countries

having to reduce their emissions in the range of 2540% by 2020 and 8095% by 2050,

whereas developing countries would need to limit the rise in their greenhouse gas emissions

(GHG) by 1530% below those of 1990 by 2020. To reach such an ambitious goal a

significant scale-up of public and private research and development (R&D) programs as well

as enhanced deployment and diffusion programs, together with private-sector investment

flows for mitigation technologies are necessary in both developed and developing countries.

As developing countries often lack the capacity to develop and finance critical climate

technologies, developed countries will have to increase the pace and extent of the current

technology transfer. This process involves not only the supply and shipment of hardware but

also requires developing processes covering the flows of know-how, experience and

equipment and the capacity of developing countries to understand, utilize and replicate the

www.spm.pdpu.ac.in

18

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

technology, to adapt it to local conditions and integrate it with indigenous technologies. The

latter is critical as only the acquisition of domestic capacities to master the received

knowledge and to innovate from it will allow developing countries to sustain a low-carbon

path.

In response to increasing awareness of the pressing need to boost technology transfer, in

2001 the COP set up a comprehensive technology transfer framework, which led to the

establishment of a web-based portal for technology-related information, the conduct of

capacity building programs and the elaboration of so called technology needs assessments

(TNAs). The COP moreover supported efforts to improve policy and market conditions with

the aim of accelerating the uptake of technologies by developing countries. Finally, it

created an Expert Group on Technology Transfer (EGTT) whose function is to identify ways

to facilitate the development and transfer of technology activities.

Project Sustainability:

A range of activities can generate greenhouse gas reductions while advancing sustainable

development. The carbon offsets market holds substantial promise as a source of catalytic

funding, but barriers often impede market access for small and medium sized enterprises,

local government bodies, and development organizations. Green Markets' carbon market

information program provides information and links to resources to increase knowledge

about the greenhouse gas reduction market so that it can become more broadly inclusive,

with the goal of helping to enable carbon market access for small-scale activities and for

initiatives conceived and implemented by stakeholders who might otherwise be left out.

Sustainable Energy Acceleration:

Under the sustainable energy acceleration program, Green Markets has worked to enhance

understanding about the climate protection attributes of renewable energy and energy

efficiency applications, and to build knowledge about innovative financial mechanisms for

small-scale sustainable energy technologies. Areas of focus have included:

Solar Water Heating

With support from the Renewable Energy and Energy Efficiency Partnership, Blue Moon

Fund, and Oak Foundation, Green Markets worked to boost the use of solar water heating

systems for climate protection and economic development through the Innovative

Financing to Accelerate Solar Water Heating initiative.

Solar water heaters are often cost effective, locally manufactured

in many countries, and can contribute substantially to climate

protection and economic development. Yet solar water heater

markets have remained small in many locations, even where

conditions for market growth appear quite promising. Barriers

related to the lack of available arrangements to address the high

www.spm.pdpu.ac.in

19

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

up-front cost of the technology are commonly among the main impediments to market

growth for solar water heating. Innovative business structures such as fee-for-service and

ESCO operations and financial mechanisms such as carbon trading can help to surmount

financial barriers and support growth in solar water heating markets.

PV Solar Home Systems

Photovoltaic solar home systems (SHS) have proven their ability to

supply modern energy to rural areas of the developing world while

directly reducing greenhouse gas emissions by replacing kerosene

lamps and candles with solar powered electric lights. Carbon

abatement per system is very small, yet PV SHS installations achieve

perhaps the highest level of carbon abatement per Watt peak of PV.

SHS projects also typically have substantial social benefits, increasing

the quality of life for rural households.

Building on prior work examining the role for SHS in climate protection and development,

developing standardized procedures for baseline setting and other aspects of carbon market

participation, and helping to create and support rural PV energy enterprises and consumer

financing programs, Green Markets has worked to accelerate PV SHS dissemination by

facilitating access to carbon finance and through other strategies.

Renewable Hybrid Mini-Grids

Diesel generators commonly supply power for isolated communities and productive

applications in off-grid areas across much of the world. Revenue from the sale of verified or

certified emission reductions can improve project economics and potentially catalyze diesel

fuel replacement with renewable energy in mini-grid systems.

Green Markets has worked to build knowledge about renewable

energy options and carbon finance for diesel replacement in minigrids, and to facilitate access to carbon finance and other

environmental market programs for diesel replacement projects.

www.spm.pdpu.ac.in

20

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

CDM Projects in India:

Under the Clean Development Mechanism (CDM) of the United Nations Framework

Convention on Climate Change (UNFCCC), carbon credits are earned by project proponents

that develop and implement projects as per CDM modalities and procedures and are

registered by the CDM Executive Board. National Governments recommend such CDM

projects for registration with the Executive Board as contribute to sustainable development.

As on Aug 2010, India has 520 registered CDM projects, out of the total 2313 projects

registered by the CDM Executive Board of the UNFCCC, Ministry of State for Environment

and Forests. These projects have the potential to generate 43 million Certified Emission

Reduction Units (CERs) per annum which amount to approximately 12% of the total annual

CERs generated by registered CDM projects globally.

As on date 79 million CERs have been issued to Indian projects and assuming a conservative

price of $10 per CER, the value of actual CER issued to Indian projects amounts to US$ 790

million

Annex I countries that have ratified the Kyoto Protocol can invest in projects that both

reduce GHGs and contribute to sustainable development in non-Annex I countries. A CDM

project provides certified emissions reductions (CERs) to Annex I countries, which they can

use to meet their GHG reduction commitments under the Kyoto Protocol. Article 12 of the

Kyoto Protocol sets out three goals for the CDM:

1. To help mitigate climate change

2. To assist Annex I countries attain their emission reduction commitments

3. To assist developing countries in achieving sustainable development

As stated below the Clean Development Mechanism was introduced to combine the

interests of the Annex I and non-Annex I countries. In addition to this there are clear

benefits for Project Developers in using the CDM as it can be a driver for getting

environmentally benign technologies more economically viable and overcome barriers that

would otherwise prevent the project from being realized. Thus the CDM can widen the

market opportunity for suppliers of equipment. For project developers in developing

countries, the CDM can be used to modify planned or projected investments into projects

with lower emissions of greenhouse gasses. Together this makes a win-win situation for all

parties. An important facet of the CDM is that a project activity starting as of the year 2000

shall be eligible for validation and registration as a CDM project, if registered before 31

December 2005. This means that CERs are bankable from the inception of the CDM and can

thus be generated prior to 2008, which is a significant difference from ERUs generated from

Joint Implementation projects. This might create a strong incentive for those in a position to

act now to engage in CDM projects as early as possible.

www.spm.pdpu.ac.in

21

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Type of projects, which are being applied for CDM and which can be of valuable potential,

are:

1. Energy efficiency projects:

Increasing building efficiency (Concept of Green Building/LEED Rating), eg.

TECHNOPOLIS Building Kolkata

Increasing commercial/industrial energy efficiency (Renovation & Modernization of

old power plants)

Fuel switching from more carbon intensive fuels to less carbon intensive fuels

Also includes re-powering, upgrading instrumentation, controls, and/or equipment

2. Transport:

Improvements in vehicle fuel efficiency by the introduction of new technologies

Changes in vehicles and/or fuel type, for example, switch to electric cars or fuel cell

vehicles (CNG/Bio fuels)

Switch of transport mode, e.g. changing to less carbon intensive means of transport

like trains (Metro in Delhi)

Reducing the frequency of the transport activity

3. Methane recovery:

4.

Animal waste methane recovery & utilization

Installing an anaerobic digester & utilizing methane to produce energy

Coal mine methane recovery

Collection & utilization of fugitive methane from coal mining

Capture of biogas

Landfill methane recovery and utilization

Capture & utilization of fugitive gas from gas pipelines

Methane collection and utilization from sewage/industrial waste treatment facilities

Industrial process changes

Any industrial process change resulting in the reduction of any category greenhouse

gas emissions

5. Cogeneration:

Use of waste heat from electric generation, such as exhaust from gas turbines, for

industrial purposes or heating (e.g. Distillery-Molasses/ bagasse)

6. Agricultural sector:

Energy efficiency improvements or switching to less carbon intensive energy sources

for water pumps (irrigation)

Methane reductions in rice cultivation

Reducing animal waste or using produced animal waste for energy generation (see

also under methane recovery) and

Any other changes in an agricultural practices resulting in reduction of any category

of greenhouse gas emission

www.spm.pdpu.ac.in

22

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Example of CDM project in India:

M/s. SIDDHESHWARI PAPER UDYOG LTD (hereafter referred to as SPUL) is into the business

of paper manufacturing. Currently SPUL is importing the electricity from the grid and

generating steam using the in-house coal1 based boiler. However, the grid electricity is not

continuous and of good quality, SPUL has planned to install a rice husk based captive

cogeneration unit (6 MW Biomass Cogeneration plant).

Purpose of captive power plant: The purpose of the project activity is to utilize rice husk

available in the region for effective generation of electricity and steam for in-house

consumption. The project activity is the 6 MW rice husk based cogeneration power plant

generating electricity (extraction condensing turbine set) and steam for captive

consumption. The project activity is helping in conservation of natural resources like coal.

Present (pre- project) Scenario

Presently the electricity is imported from the electricity grid and no user of project activity

steam exists (the steam will be used in proposed chemical recovery plant). The existing

contract demand of the project activity is 2500 KVA which is expected to grow to 3200 KVA.

Project Scenario

The project activity, which is a carbon neutral fuel based cogeneration plant, generates

electricity in addition to steam to meet SPULs captive electricity requirement. Te additional

electricity from the project activity will be exported to adjacent sister paper plant i.e.

SIDDHARTH papers limited. Therefore project activity displaces the use of fossil fuels like

coal which would have been used in absence of the project activity.

www.spm.pdpu.ac.in

23

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

CDM timeline:

The CDM established a way in which countries can meet their emissions reduction targets

by investing in low-emitting projects, whilst at the same time contributing to sustainable

development in the host country. In practice, there are three different trading models under

which CERs from a CDM project can be developed.

These include:

1. Unilateral trading model This represents a project that is designed, financed and

implemented without an investor from an Annex-I Party. In this scenario the non-Annex I

host Party bears all risks associated with the preparation and sale of CERs. On the other

hand, it allows CDM host Parties and/or project proponents to sell CERs at a premium when

the demand is higher, and enables countries to use the proceeds for development purposes,

in line with the objectives of the CDM. The permission to carry out unilateral CDM projects

was granted at the COP-6 in The Hague, which allowed developing economies to implement

CDM projects without a partner from an Annex-I country. Unilateral CERs are also subject to

the requirements set by the CDM Executive Board and the COP. The unilateral model has

already been applied in Costa Rica;

2. Bilateral trading model under this model a project proponent develops a project in a

non-Annex-I country in partnership with a country subjected to GHG emission reduction

obligations (an Annex-I Party). The goal of such a partnership for the Annex-I country is to

receive the credits realized from the project, either via an emission reduction purchase

agreement (ERPA), or as a result of some other form of financial consideration. Under most

ERPA agreements, credits purchases are committed in advance of issuance but not paid

until the CERs are delivered.

3. Multilateral model - a variation of the bilateral model is the multilateral model. Under

this model CERs are sold to a fund, which oversees a portfolio of projects. The fund is

traditionally made up of investors of Annex-I countries. The advantage of this model is that

a fund spreads the risk of investment and issuance across a range of projects. Furthermore,

the investor country spreads their risk by investing in several different funds. An example of

a multilateral fund is the Prototype Carbon Fund from the World Bank (see section 2.4.1

below). To date, the majority of the buyers of credits are relying on the multilateral model.

The Trading Mechanism:

Entities with potential GHG liabilities can reduce such liabilities by either implementing

internal emissions reductions programs, or by participating in international emissions

trading markets

Emissions trading is an administrative approach used to control pollution by providing

economic incentives for achieving reductions in the emissions of pollutants. The

www.spm.pdpu.ac.in

24

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

development of a carbon project that provides a reduction in Greenhouse Gas emissions is a

way by which participating entities may generate tradable carbon credits. Say a company in

India can prove it has prevented the emission of x-Metric Tonnes of carbon, it can sell this

much amount of points (or carbon credits) to a company in say, the US which has been

emitting carbons. The World Bank has built itself a role in this market as a referee, broker

and macro-manager of international fund flows.

A central authority (in our case CDM India, an authority under the Ministry of Environment

and Forests) sets a limit or cap on the amount of a pollutant that can be emitted in a

country. Companies or other groups that emit the pollutant are given credits (CERs

Certified Emission Reductions) or allowances which represent the right to emit a specific

amount. The total amount of credits cannot exceed the cap, limiting total emissions to that

level. Companies that pollute beyond their allowances must buy credits from those who

pollute less than their allowances or face heavy penalties. This transfer is referred to as a

trade. In effect, the buyer is being fined for polluting, while the seller is being rewarded for

having reduced emissions. Thus companies that can easily reduce emissions will do so and

those for which it is harder will buy credits which reduce greenhouse gasses at the lowest

possible cost to society. Countries which have companies having higher credits will enable

them to sell the credits in the international market.

There are a number of international markets most notably the EU, with its European Union

Greenhouse Gas Emission Trading Scheme (EU ETS) that began its operations on 1 January

2005. Companies which accumulate CERs sell them there in this market to interested

buyers. The international market for CERs has crossed the US$30 billion mark in 2006,

largely driven by the trading of EUA (European Union Allowances). EUA are the equivalent of

CERs (Certified Emission Reductions).

Background - The objectives of Buyers:

There are different buyers in the marketplace with a variety of diverse objectives. In

general, these objectives can be summarized as follows:

1. Purchase of low-cost emission reductions: Most of the buyers in the market have a

degree of sensitivity to the cost of emission reductions. Current market prices for

emission reductions are quite low in comparison to forecasted prices under many

market studies. Buyers who purchase at a low cost today can also potentially sell at a

much higher price in the future.

2. Minimization of future risk is a primary determinant of buyer behavior. Buyers are

concerned about the potentially large liabilities associated with not being compliant

in the future.

3. Risk-diversification. Many buyers are purchasing different types of credits under all

of the trading mechanism so that they can spread their risk among a portfolio.

4. Learning by doing. Buyers are willing to undergo early-stage learning-by doing by

engaging in comprehensive project documentation, external verification and

certification

www.spm.pdpu.ac.in

25

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Current emission buyers:

The carbon credit market, which includes the CDM, is currently characterized by having

relatively few buyers, who have a range of motives for participation. The vast majority of

the publicly known capital for purchasing emission reductions comes from various funds and

multilateral buyers. As of March 2003, the major institutional buyers include;

1. The World Bank Prototype Carbon Fund (US$180M)

2. Carboncredits.nl, Dutch ERUPT/CERUPT (US$250M)

3. The Netherlands Carbon Development Fund (US$140M)

4. International Finance Corporation (US$40M)

5. The Andean Development Bank (US$40M)

6. Community Development Carbon Fund (US$100M - target)

7. World Bank Bio-Carbon Fund (US$100M - target)

8. The Asian Development Bank (US$60M - unconfirmed)

9. The Finnish small scale tender (US$3M)

10. CDC IXIS Carbon Fund (US$30M under development)

Market pricing of Carbon emission reduction units:

CER prices are quoted in EUROS () or U.S. dollars (US$) for sale on the global market.

Pricing structures offered are typically 'Fixed', 'Floating', or a combination of the two:

Fixed price: This is an agreed price per CERs which will not change if the EUA

allowance market moves against the Seller. This structure is often preferred by those

requiring more certainty of the revenue stream for future budgeting plans, rather

than being exposed to market fluctuations. A fixed price may also be preferable to

lock-in current market conditions if perceived to be advantageous to both parties.

Usually a fixed price will be lower than the equivalent Floating price, because the

Buyer is taking all market risk.

Floating price: This is a percentage of the average EUA price over an agreed number

of days. A floating price allows Sellers exposure to potential gains in the EUA market,

but also to potential loses should the market fall. This structure generally only works

for European Buyers who have an exposure to the EUA market Japanese Buyers

who are not involved in the EU ETS tend not to link CER prices to the EUA market.

Combination of Fixed and Floating: Buyers and Sellers may choose to specify a price

based on fixed and floating components, in order to reduce exposure to either

structure. For example, 50% of the agreed CERs may be at a fixed price, while the

other 50% may be at a floating price. Or, a Fixed minimum price may be agreed, with

an additional Floating payment

www.spm.pdpu.ac.in

26

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Factors affecting CER prices include:

EUA market price: For many Buyers, the value of CERs is benchmarked to the EUA

price, the most established trading system for emissions.

Volatility in EUA prices is typically reflected in the CER market. It is therefore

important to have a strong understanding of the underlying market dynamics of

EUAs.

Other Market pricing factors

www.spm.pdpu.ac.in

27

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

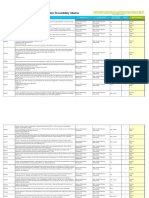

Major international exchanges trading carbon:

www.spm.pdpu.ac.in

28

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Softwares for carbon trading:

POMAX is a seasoned carbon trading software

CARBONFLOWs architecture is cloud-based, featuring highly scalable

Contract Specification for CER on MCX:

www.spm.pdpu.ac.in

29

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Carbon Trading Participants & Platform:

India now has two Commodity exchanges trading in Carbon Credits. This means that Indian

Companies can now get a better trading platform and price for CERs generated.

1. Multi Commodity Exchange (MCX), Indias largest commodity exchange, has

launched futures trading in carbon credits. The initiative makes it Asia's first-ever

commodity exchange and among the select few along with the Chicago Climate

Exchange (CCE) and the European Climate Exchange to offer trades in carbon credits.

The Indian exchange also expects its tie-up with CCX which will enable Indian firms to

get better prices for their carbon credits and better integrate the Indian market with

the global markets to foster best practices in emissions trading.

2. On 11th April 2008, National Commodity and Derivatives Exchange (NCDEX) also has

started futures contract in Carbon Trading for delivery in December 2008.

MCX is the futures exchange. People here are getting price signals for the carbon for the

delivery in next five years. The exchange is only for Indians and Indian companies. Every

year, in the month of December, the contract expires and at that time people who have

bought or sold carbon will have to give or take delivery. They can fulfill the deal prior to

December too, but most people will wait until December because that is the time to meet

the norms in Europe. If the Indian buyer thinks that the current price is low for him he will

wait before selling his credits. The Indian government has not fixed any norms nor has it

made it compulsory to reduce carbon emissions to a certain level. So, people who are

coming to buy from Indians who are actually financial investors. They are thinking that if the

Europeans are unable to meet their target of reducing the emission levels by 2009, 2010 or

2012, then the demand for the carbon will increase and then they may make more money.

So investors are willing to buy now to sell later. There is a huge requirement of carbon

credits in Europe before 2012. Only those Indian companies that meet the UNFCCC norms

and take up new technologies will be entitled to sell carbon credits. There are parameters

set and detailed audit is done before you get the entitlement to sell the credit.

MCX keen to play a major role on the emission front by extending its platform to add carbon

credits to its existing basket of commodities with regard to commodities futures trading, the

existing and potential suppliers of carbon credits in India have geared up to generate more

carbon credits from their existing and ongoing projects to be sold in the international

markets. With India supposed to be a major supplier of carbon credits, the tie-up between

the two exchanges is expected to ensure better price discovery of carbon credits, besides

covering risks associated with buying and selling.

www.spm.pdpu.ac.in

30

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

With growing concerns among nations to curb pollution levels while maintaining the growth

in their economic activities, the emission trading (ET) industry has come to life. And, with

the increasing ratification of Kyoto Protocol (KP) by countries and rising social accountability

of polluting industries in the developed nations, the carbon emissions trading is likely to

emerge as a multibillion-dollar market in global emissions trading. The recent surge in

carbon credits trading activities in Europe is an indication of how the emissions trading

industry is going to pan out in the years to come.

Potential participants in carbon credits trading are as below:

1.

2.

3.

1.

2.

1.

2.

3.

Hedgers:

Producers: Reliance Energy, Tata Steel, Dwarikesh Sugar, DLF ltd

Intermediaries in spot markets

Green land carbon trading, Verve consulting, X-change carbon,

Ultimate buyers:

Investors:

Arbitragers

Portfolio managers

Diverse participants with wide participation objectives:

Commodity financers

Funding agencies

Corporate having risk exposure in energy products

Advantages of an MCX carbon contract:

In India, currently only bilateral deals and trading through intermediaries are widely

prevalent leading to sellers being denied fair prices for their carbon credits. Advantages

that the MCX platform offers are:

1. Sellers and intermediaries can hedge against price risk

2. Advance selling could help projects generate liquidity and thereby, reduce costs

of implementation

3. There is no counterparty risk as the Exchange guarantees the trade

4. The price discovery on the Exchange platform ensures a fair price for both the

buyer and the seller

5. Players are brought to a single platform, thus, eliminating the laborious process

of identifying either buyers or sellers with enough credibility

6. The MCX futures floor gives an immediate reference price. At present, there is

no transparency related to prices in the Indian carbon credit market, which has

kept sellers at the receiving end with no bargaining power.

www.spm.pdpu.ac.in

31

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Other participants and initiatives:

1. Carbon Credits projects requires huge capital investment. Realizing the importance

of carbon credits in India

2. The World Bank has entered into an agreement with Infrastructure Development

Finance Company (IDFC), wherein IDFC will handle carbon finance operations in the

country for various carbon finance facilities

3. The agreement initially earmarks a $10-million aid in World Bank-managed carbon

finance to IDFC-financed projects that meet all the required eligibility and due

diligence standards

4. IDBI has set up a dedicated Carbon Credit desk, which provides all the services in the

area of Clean Development Mechanism/Carbon Credit (CDM). In order to achieve

this objective, IDBI has entered into formal arrangements with multi-lateral agencies

and buyers of carbon credits like IFC, Washington, KFW, Germany and Sumitomo

Corporation, Japan and reputed domestic technical experts like MITCON

5. HDFC Bank has signed an agreement with Cantor CO2E India Pvt Ltd and MITCON

Consultancy Services Limited (MITCON) for providing carbon credit services. As part

of the agreement, HDFC Bank will work with the two companies on awareness

building, identifying and registering Clean Development Mechanism (CDM) and

facilitating the buy or sell of carbon credits in the global market.

Post KYOTO:

The existing accord to reduce carbon emissions is up for review in 2012, beyond which it is

uncertain. The last global conference on the subject, at Copenhagen, was not able to

provide any clarity on the post-2012 period. Finding buyers for post-2012/Post-Kyoto

carbon credits has been a challenge. POINTCARBON reported that carbon brokers said that

such deal would likely reflect a price of 6-9 EUROS per ton CO2e. The current price for

CERs under the Clean Development Mechanism would be about 14 EUROS. The discount for

post-Kyoto credits would thus be 5-8 EUROS, a significant reduction reflecting the

uncertainty of the negotiations at Copenhagen and at UNFCC meetings thereafter. If a

treaty is not finalized until next December, these low prices may continue until then.

Under Kyoto, developed countries are allowed to establish domestic and internationally

linked emissions trading schemes and purchase emissions reductions in developing

countries and count them as their own. But on December 31 next year (eight months before

the next federal election) Kyoto will expire without a successor agreement. Since the 2007

Bali summit countries have been in a negotiating deadlock over different paths for a postKyoto agreement. Developing countries want a second Kyoto emissions reduction period

because it puts the entire onus on developed countries.

www.spm.pdpu.ac.in

32

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Non-European developed countries want a new non-binding agreement that brings all the

leading emitters into the tent. European countries want a mix of both. The failure to agree

over what was being negotiated, let alone the detail, led to the eruption at the 2009

Copenhagen summit, modestly repeated in Cancun last December. To have an unbroken

period between Kyoto and a successor, agreement countries would need to conclude

negotiations at this year's Durban summit which is extremely unlikely.

A recent survey by the World Bank's Carbon Finance Unit found that less than 20 per cent of

carbon market participants questioned was optimistic that a new Kyoto-style, legally binding

emissions reduction framework would be negotiated by 2020. Optimism dropped further to

a few per cent when they were offered a 2015 deadline. There is no global carbon market;

there is only a European one.

According to the same World Bank report, 84 per cent of the US$142 billion global carbon

market is made up of emissions permits sourced from within the European Union. Europe's

reach extends to 97 per cent when its purchased emission reductions in developing

countries are included. With the government allowing half of all permits to be purchased

offshore, Australia's floating carbon price could be heavily influenced by European policy.

Europe's dominance is set to be the status quo until a post-Kyoto framework is established

that could possibly bring China, India and the US into the fold.

Australia's scheme, covering the emissions of 22 million people, is also likely to be eclipsed

by the size of a scheme for hundreds of millions Europeans and their centralized decisionmaking based on European policy and economic priorities and interests. While Australia

goes headfirst to introduce a market-based scheme, other countries aren't following our

lead: Japan and South Korea have effectively shelved their trading schemes until a postKyoto framework is established; New Zealand is watering down its scheme; participant

states in regional US emissions trading schemes are withdrawing; and China has flagged the

possibility of trialing a scheme, but to date its carbon pricing experience has been to profit,

having secured 42 per cent of Europe's offshore emissions reduction projects

The World Bank has launched a 68m (57m) pot of funding aimed at enabling carboncutting projects to keep selling UN-backed offsets after the first phase of the Kyoto Protocol

expires in 2012.

The absence of a global framework undermines the political and policy case for prioritizing

emissions cuts. It's a message that has not been lost on international carbon markets.

www.spm.pdpu.ac.in

33

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India

School Of Petroleum Management, Gandhinagar, Gujarat, India

Conclusion:

Carbon trading is a nascent concept which is a strong tool for mitigating the emission risks

the globe is facing. Though some major pollutants are signatories to the KYOTO Protocol, it

would take efforts of other nations in building up a mechanism that ensures the

temperature rise due to the GHG emissions being restricted to the envisaged 2 deg level.

Though the KYOTO Protocol was mandated for a window of 2008 to 2012, the Durban talks

as scheduled in December 2011 is expected to come up with concrete plans to make

sustainable developments in the field of Emission Trading. The flow of investments/

technology from developed countries to developing ones is aided by the unprecedented

economic growth as witnessed in Asia. Such rapid growth at the cost of the environment

would put the future generations in jeopardy. Hence developing nations like India and China

are better off accepting Voluntary Emission cuts which would ensure their readiness to face

compulsory cuts as and when they are imposed on them.

Carbon emissions trading has been steadily increasing in recent years. According to the

World Bank's Carbon Finance Unit, 374 million metric tonnes of carbon dioxide equivalent

(tCO2e) were exchanged through projects in 2005, a 240% increase relative to 2004 (110

mtCO2e)[26] which was itself a 41% increase relative to 2003 (78 mtCO2e).

One criticism of carbon trading is that it is a form of colonialism, where rich countries

maintain their levels of consumption while getting credit for carbon savings in inefficient

industrial projects. Nations that have fewer financial resources may find that they cannot

afford the permits necessary for developing an industrial infrastructure, thus inhibiting

these countries economic development. Most developing nations feel that instead of

adjusting their lifestyle and energy efficiency, developed nations are passing the buck of

Global Warming on developing nations who have very low per capita energy consumption.

Thus Emission Trading can be seen as a powerful tool in the hands of powerful nations to

maintain economic superiority and make poor countries accountable for their inefficiencies

which leads to a disparity in the concept of Emission Trading.

www.spm.pdpu.ac.in

34

Executive MBA 2010

Status and Potential of Energy and Carbon Trading in India