Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

94 viewsFinman Advance Assignment

Finman Advance Assignment

Uploaded by

Jam BigaranThe document contains suggested advance questions for students on several case studies, including:

- Krispy Kreme: Questions focus on analyzing financial statements and ratios to assess financial health over time and reasons for a recent share price decline.

- FedEx vs UPS: Questions compare the two companies' strategies, performance based on financials/ratios/stock prices, and assess which has attained sustainable competitive advantage.

- Star River Electronics: Questions involve forecasting financials, assessing financial health, identifying key drivers of performance, estimating weighted average cost of capital, and analyzing a potential investment.

- Nike: Questions focus on calculating and justifying weighted average cost of capital, costs of equity, and recommending an

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- BofA 1 15 Statement PDFDocument4 pagesBofA 1 15 Statement PDFPrincespragti Patil75% (12)

- Nike Case AnalysisDocument9 pagesNike Case AnalysisUyen Thao Dang96% (54)

- Questions - SI Cases' Questions - All PDFDocument4 pagesQuestions - SI Cases' Questions - All PDFAnish DalmiaNo ratings yet

- Strategy Papers and Cases QuestionsDocument9 pagesStrategy Papers and Cases QuestionsMuhammad Ahmed0% (1)

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- SOAP PLANT Project Report CompleteDocument8 pagesSOAP PLANT Project Report CompleteER. INDERAMAR SINGH52% (25)

- Cases Qs MBA 6003Document5 pagesCases Qs MBA 6003Faria CHNo ratings yet

- Questions For Cases Winter 2011Document2 pagesQuestions For Cases Winter 2011AhmedMalikNo ratings yet

- Case 06 NotesDocument4 pagesCase 06 NotesUmair Mushtaq SyedNo ratings yet

- Case Studies in Working Capital Management and ShortDocument13 pagesCase Studies in Working Capital Management and ShortNguyễn Thế Long100% (1)

- Case QuestionsDocument5 pagesCase Questionsaditi_sharma_65No ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisRizka HendrawanNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysistimbulmanaluNo ratings yet

- Case 24 Star River Electronics LTD QuestionsDocument1 pageCase 24 Star River Electronics LTD QuestionsdewimachfudNo ratings yet

- Loccitane QuestionsDocument2 pagesLoccitane QuestionsMarat SafarliNo ratings yet

- Case Student QuestionsDocument5 pagesCase Student QuestionsSolmaz Hashemi25% (4)

- Questions For Case AnalysisDocument3 pagesQuestions For Case AnalysisDwinanda SeptiadhiNo ratings yet

- Suggested Quey4uujjrstions For Advance Assignment To StudentsDocument3 pagesSuggested Quey4uujjrstions For Advance Assignment To StudentsDendy FebrianNo ratings yet

- Business Strategy Kramer SPRING 2007 Case Discussion Assignment QuestionsDocument8 pagesBusiness Strategy Kramer SPRING 2007 Case Discussion Assignment Questionsmt8383No ratings yet

- Case Study - QuestionsDocument2 pagesCase Study - Questionsfarahhr0% (1)

- STRATACC 1st Term 2017-2018 Case Guide QuestionsDocument4 pagesSTRATACC 1st Term 2017-2018 Case Guide QuestionsWihl Mathew ZalatarNo ratings yet

- Marketing of Services Case Study QuestionsDocument4 pagesMarketing of Services Case Study QuestionsdreamagiczNo ratings yet

- Case QuestDocument6 pagesCase QuestAbdul Kodir0% (1)

- Suraj Lums Edu PKDocument9 pagesSuraj Lums Edu PKalice123h21No ratings yet

- 7 F 93 CB 558 CDocument20 pages7 F 93 CB 558 CPabloCaicedoArellanoNo ratings yet

- FINA 6092 Case QuestionsDocument7 pagesFINA 6092 Case QuestionsKenny HoNo ratings yet

- Case Assignment Questions - Mejik Before UTSDocument6 pagesCase Assignment Questions - Mejik Before UTSRinaNo ratings yet

- STR 581 Capstone Final Exam All Part 1-2-3Document7 pagesSTR 581 Capstone Final Exam All Part 1-2-3johnNo ratings yet

- Krispy Kreme Doughnuts-Suggested QuestionsDocument1 pageKrispy Kreme Doughnuts-Suggested QuestionsMohammed AlmusaiNo ratings yet

- Case Assignment Questions ALL PDFDocument26 pagesCase Assignment Questions ALL PDFMiscue JoNo ratings yet

- Discounted Cashflow Valuation Problems and SolutionDocument54 pagesDiscounted Cashflow Valuation Problems and SolutionJang haewonNo ratings yet

- Case Discussion QuestionsDocument3 pagesCase Discussion QuestionsAninda DuttaNo ratings yet

- Strategic Planning Process 2 - External Environment AnalysisDocument51 pagesStrategic Planning Process 2 - External Environment Analysiskamasuke hegdeNo ratings yet

- The Term Paper FIN 408, Course Title: Corporate Finance Answer The Following Questions From The Annual Reports of One of The Listed Companies in DSEDocument2 pagesThe Term Paper FIN 408, Course Title: Corporate Finance Answer The Following Questions From The Annual Reports of One of The Listed Companies in DSEAntora HoqueNo ratings yet

- Case Study KLM PDFDocument32 pagesCase Study KLM PDFManmit SinghNo ratings yet

- Case 04 NotesDocument5 pagesCase 04 Noteswjk4261936No ratings yet

- 1103 CaseDocument8 pages1103 Casezmm45x7sjtNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Case Study Sustainable Finance McDonaldsDocument28 pagesCase Study Sustainable Finance McDonaldsSweet tripathiNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisFami FamzNo ratings yet

- Introduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFDocument36 pagesIntroduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFbarbara.wilkerson397100% (15)

- Introduction To Corporate Finance 4th Edition Booth Test Bank 1Document49 pagesIntroduction To Corporate Finance 4th Edition Booth Test Bank 1glen100% (53)

- Nike Case AnalysisDocument9 pagesNike Case AnalysisNic AurthurNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisOktoNo ratings yet

- Nike Case Analysis PDFDocument9 pagesNike Case Analysis PDFSrishti PandeyNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case Analysisshamayita sahaNo ratings yet

- 1900cccc74252345 Nike Case AnalysisDocument9 pages1900cccc74252345 Nike Case AnalysistimbulmanaluNo ratings yet

- Nike Case Solution PDFDocument9 pagesNike Case Solution PDFKunal KumarNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisKwame Obeng SikaNo ratings yet

- Case Questions - EssentialsDocument9 pagesCase Questions - EssentialsHarry KingNo ratings yet

- Financial Ratio Analysis ThesisDocument8 pagesFinancial Ratio Analysis Thesismichellebojorqueznorwalk100% (1)

- Assignments 24 March - March 31 2015Document2 pagesAssignments 24 March - March 31 2015Alex HuesingNo ratings yet

- FIN 571 GENIUS Expect Success Fin571geniusdotcomDocument40 pagesFIN 571 GENIUS Expect Success Fin571geniusdotcomwillam52No ratings yet

- Select A Company Listed On An InternationallyDocument4 pagesSelect A Company Listed On An InternationallyTalha chNo ratings yet

- The Concept of StrategyDocument8 pagesThe Concept of StrategyAmit GandhiNo ratings yet

- Common Questions (30 Marks Each)Document3 pagesCommon Questions (30 Marks Each)RahulNo ratings yet

- BU481 2023F Case Preparation Questions - All CasesDocument3 pagesBU481 2023F Case Preparation Questions - All CasesAryan KhanNo ratings yet

- The Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationFrom EverandThe Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationNo ratings yet

- Life Sciences Sales Incentive Compensation: Sales Incentive CompensationFrom EverandLife Sciences Sales Incentive Compensation: Sales Incentive CompensationNo ratings yet

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- ReportHistory 732xxxDocument8 pagesReportHistory 732xxxdandy119No ratings yet

- Facebook IPODocument4 pagesFacebook IPOvaibhavNo ratings yet

- Cases in Guaranty and SuretyshipDocument51 pagesCases in Guaranty and SuretyshipErxha Lado0% (1)

- CARSONDocument2 pagesCARSONShubhangi AgrawalNo ratings yet

- Hybrid and Derivative Securities (Lembar Jawaban)Document4 pagesHybrid and Derivative Securities (Lembar Jawaban)Radinne Fakhri Al WafaNo ratings yet

- IGCSE and O Level Economics: Mid-Course Assessment (Units 1.1 To 4.4)Document3 pagesIGCSE and O Level Economics: Mid-Course Assessment (Units 1.1 To 4.4)Sylwia SdiriNo ratings yet

- Shedule of ChargessDocument13 pagesShedule of ChargessalirezaNo ratings yet

- Central Bank Digital Currencies: Preliminary Legal ObservationsDocument30 pagesCentral Bank Digital Currencies: Preliminary Legal Observationsprabin ghimireNo ratings yet

- Stockmock PPT Sasmira PGDGFM2206Document9 pagesStockmock PPT Sasmira PGDGFM2206Sasmira BhonkarNo ratings yet

- Notice of Rescission or NullificationDocument3 pagesNotice of Rescission or Nullificationresearcher3100% (4)

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- Uxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21Document2 pagesUxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21JayCharleysNo ratings yet

- Teoría y Política Monetaria: ITAM 201Document22 pagesTeoría y Política Monetaria: ITAM 201dafreeNo ratings yet

- Capital Market Regulations (LW 4411)Document9 pagesCapital Market Regulations (LW 4411)Aayushi PriyaNo ratings yet

- Service Sector in Indian EconomyDocument10 pagesService Sector in Indian EconomyKunal SainiNo ratings yet

- Hogy Fy2012 ArDocument42 pagesHogy Fy2012 ArJerry ThngNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- LL IFAD Inclusive Rural and Agricultural Finance Experiments in West and Central Africa During The Last Decade 2009 2020 1Document56 pagesLL IFAD Inclusive Rural and Agricultural Finance Experiments in West and Central Africa During The Last Decade 2009 2020 1amir mahmudNo ratings yet

- Performance Management System Questions PapersDocument24 pagesPerformance Management System Questions PapersLAVANYANo ratings yet

- Building Blocks of Finance-1Document38 pagesBuilding Blocks of Finance-1Anggari SaputraNo ratings yet

- School of Economics, Finance and Business: Module Code: Econ 41215 MODULE NAME: Advanced Financial TheoryDocument8 pagesSchool of Economics, Finance and Business: Module Code: Econ 41215 MODULE NAME: Advanced Financial TheoryalexgideiNo ratings yet

- Tes DesDocument12 pagesTes DesSarah SarcheNo ratings yet

- General Income Tax and Benefit Guide: Canada Revenue AgencyDocument63 pagesGeneral Income Tax and Benefit Guide: Canada Revenue AgencyvolvoproNo ratings yet

- Crossing of Cheques BLDocument27 pagesCrossing of Cheques BLVikash kumarNo ratings yet

- List SMS Headers 16062020 1Document494 pagesList SMS Headers 16062020 1Uday kumarNo ratings yet

- Mode of Defining Existence of PartnershipDocument12 pagesMode of Defining Existence of PartnershipTanvi23780% (5)

- Consulting Demystified 2007-08Document15 pagesConsulting Demystified 2007-08Ayan JanaNo ratings yet

Finman Advance Assignment

Finman Advance Assignment

Uploaded by

Jam Bigaran0 ratings0% found this document useful (0 votes)

94 views3 pagesThe document contains suggested advance questions for students on several case studies, including:

- Krispy Kreme: Questions focus on analyzing financial statements and ratios to assess financial health over time and reasons for a recent share price decline.

- FedEx vs UPS: Questions compare the two companies' strategies, performance based on financials/ratios/stock prices, and assess which has attained sustainable competitive advantage.

- Star River Electronics: Questions involve forecasting financials, assessing financial health, identifying key drivers of performance, estimating weighted average cost of capital, and analyzing a potential investment.

- Nike: Questions focus on calculating and justifying weighted average cost of capital, costs of equity, and recommending an

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains suggested advance questions for students on several case studies, including:

- Krispy Kreme: Questions focus on analyzing financial statements and ratios to assess financial health over time and reasons for a recent share price decline.

- FedEx vs UPS: Questions compare the two companies' strategies, performance based on financials/ratios/stock prices, and assess which has attained sustainable competitive advantage.

- Star River Electronics: Questions involve forecasting financials, assessing financial health, identifying key drivers of performance, estimating weighted average cost of capital, and analyzing a potential investment.

- Nike: Questions focus on calculating and justifying weighted average cost of capital, costs of equity, and recommending an

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

94 views3 pagesFinman Advance Assignment

Finman Advance Assignment

Uploaded by

Jam BigaranThe document contains suggested advance questions for students on several case studies, including:

- Krispy Kreme: Questions focus on analyzing financial statements and ratios to assess financial health over time and reasons for a recent share price decline.

- FedEx vs UPS: Questions compare the two companies' strategies, performance based on financials/ratios/stock prices, and assess which has attained sustainable competitive advantage.

- Star River Electronics: Questions involve forecasting financials, assessing financial health, identifying key drivers of performance, estimating weighted average cost of capital, and analyzing a potential investment.

- Nike: Questions focus on calculating and justifying weighted average cost of capital, costs of equity, and recommending an

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

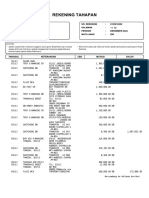

KRISPY KREME

Suggested Questions for Advance Assignment to Students

1. What can the historical income statements (case Exhibit 1) and balance sheets (case

Exhibit 2) tell you about the financial health and current condition of Krispy Kreme

Doughnuts, Inc.?

2. How can financial ratios extend your understanding of financial statements? What

questions do the time series of ratios in case Exhibit 7 raise? What questions do the ratios

on peer firms in case Exhibits 8 and 9 raise?

3. Is Krispy Kreme financially healthy at year-end 2004?

4. In light of your answer to question 3, what accounts for the firms recent share price

decline?

5. What is the source of intrinsic investment value in this company? Does this source appear

on the financial statements?

FEDEX VS UPS

Suggested Questions for Advance Assignment to Students

1. Prepare to describe in class the competition in the overnight package delivery industry,

and the strategies by which those two firms are meeting the competition. What are the

enabling and inhibiting factors facing the two firms as they pursue their goals? Do you

think that either firm can attain a sustainable competitive advantage in this business?

2. Why did FedExs stock price outstrip UPSs during the initiation of talks over liberalized

air cargo routes between the U.S. and China? Assuming a perfectly efficient stock

market, how might one interpret a 14% increase in FedExs market value of equity?

3. How have FedEx and UPS performed since the early 1990s? Which firm is doing better?

In class, prepare to discuss the insights you derived from the two firms financial

statements, financial ratios, stock-price performance, and economic profit (economic

value added or EVA). Also, prepare to describe how EVA is estimated, and its strengths

and weaknesses as a measure of performance.

4. If you had to identify one of those companies as excellent, which company would you

choose? On what basis did you make your decision? More generally, what is excellence

in business?

STAR RIVER ELECTRONICS

Advance Assignment to Students

1. Assess the current financial health and recent financial performance of the company.

What strengths and/or weaknesses would you highlight to Adeline Koh?

2. Forecast the firms financial statements for 2002 and 2003. What will be the external

financing requirements of the firm in those years? Can the firm repay its loan within a

reasonable period?

3. What are the key driver assumptions of the firms future financial performance? What are

the managerial implications of those key drivers? That is, what aspects of the firms

activities should Koh focus on especially?

4. What is Star Rivers weighted-average cost of capital (WACC)? What methods did you

use to estimate WACC? What are the key assumptions that especially influence WACC?

5. What are the free cash flows of the packaging machine investment? Should Koh approve

the investment?

NIKE

Suggested Advance Study Questions

1. What is the WACC and why is it important to estimate a firms cost of capital? Do you

agree with Joanna Cohens WACC calculation? Why or why not?

2. If you do not agree with Cohens analysis, calculate your own WACC for Nike and be

prepared to justify your assumptions.

3. Calculate the costs of equity using CAPM, the dividend discount model, and the earnings

capitalization ratio. What are the advantages and disadvantages of each method?

4. What should Kimi Ford recommend regarding an investment in Nike?

CALIFORNIA PIZZA KITCHEN

Suggestion for Advance Assignment to Students

1. In what ways can Susan Collyns facilitate the success of CPK?

2. Using the scenarios in case Exhibit 9, what role does leverage play in affecting the return

on equity (ROE) for CPK? What about the cost of capital? In assessing the effect of

leverage on the cost of capital, you may assume that a firms CAPM beta can be modeled

in the following manner: L = U[1 + (1 T)D/E], where U is the firms beta without

leverage, T is the corporate income tax rate, D is the market value of debt, and E is the

market value of equity.

3. Based on the analysis in case Exhibit 9, what is the anticipated CPK share price under

each scenario? How many shares will CPK be likely to repurchase under each scenario?

What role does the tax deductibility of interest play in encouraging debt financing at

CPK?

4. What capital structure policy would you recommend for CPK?

You might also like

- BofA 1 15 Statement PDFDocument4 pagesBofA 1 15 Statement PDFPrincespragti Patil75% (12)

- Nike Case AnalysisDocument9 pagesNike Case AnalysisUyen Thao Dang96% (54)

- Questions - SI Cases' Questions - All PDFDocument4 pagesQuestions - SI Cases' Questions - All PDFAnish DalmiaNo ratings yet

- Strategy Papers and Cases QuestionsDocument9 pagesStrategy Papers and Cases QuestionsMuhammad Ahmed0% (1)

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- SOAP PLANT Project Report CompleteDocument8 pagesSOAP PLANT Project Report CompleteER. INDERAMAR SINGH52% (25)

- Cases Qs MBA 6003Document5 pagesCases Qs MBA 6003Faria CHNo ratings yet

- Questions For Cases Winter 2011Document2 pagesQuestions For Cases Winter 2011AhmedMalikNo ratings yet

- Case 06 NotesDocument4 pagesCase 06 NotesUmair Mushtaq SyedNo ratings yet

- Case Studies in Working Capital Management and ShortDocument13 pagesCase Studies in Working Capital Management and ShortNguyễn Thế Long100% (1)

- Case QuestionsDocument5 pagesCase Questionsaditi_sharma_65No ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisRizka HendrawanNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysistimbulmanaluNo ratings yet

- Case 24 Star River Electronics LTD QuestionsDocument1 pageCase 24 Star River Electronics LTD QuestionsdewimachfudNo ratings yet

- Loccitane QuestionsDocument2 pagesLoccitane QuestionsMarat SafarliNo ratings yet

- Case Student QuestionsDocument5 pagesCase Student QuestionsSolmaz Hashemi25% (4)

- Questions For Case AnalysisDocument3 pagesQuestions For Case AnalysisDwinanda SeptiadhiNo ratings yet

- Suggested Quey4uujjrstions For Advance Assignment To StudentsDocument3 pagesSuggested Quey4uujjrstions For Advance Assignment To StudentsDendy FebrianNo ratings yet

- Business Strategy Kramer SPRING 2007 Case Discussion Assignment QuestionsDocument8 pagesBusiness Strategy Kramer SPRING 2007 Case Discussion Assignment Questionsmt8383No ratings yet

- Case Study - QuestionsDocument2 pagesCase Study - Questionsfarahhr0% (1)

- STRATACC 1st Term 2017-2018 Case Guide QuestionsDocument4 pagesSTRATACC 1st Term 2017-2018 Case Guide QuestionsWihl Mathew ZalatarNo ratings yet

- Marketing of Services Case Study QuestionsDocument4 pagesMarketing of Services Case Study QuestionsdreamagiczNo ratings yet

- Case QuestDocument6 pagesCase QuestAbdul Kodir0% (1)

- Suraj Lums Edu PKDocument9 pagesSuraj Lums Edu PKalice123h21No ratings yet

- 7 F 93 CB 558 CDocument20 pages7 F 93 CB 558 CPabloCaicedoArellanoNo ratings yet

- FINA 6092 Case QuestionsDocument7 pagesFINA 6092 Case QuestionsKenny HoNo ratings yet

- Case Assignment Questions - Mejik Before UTSDocument6 pagesCase Assignment Questions - Mejik Before UTSRinaNo ratings yet

- STR 581 Capstone Final Exam All Part 1-2-3Document7 pagesSTR 581 Capstone Final Exam All Part 1-2-3johnNo ratings yet

- Krispy Kreme Doughnuts-Suggested QuestionsDocument1 pageKrispy Kreme Doughnuts-Suggested QuestionsMohammed AlmusaiNo ratings yet

- Case Assignment Questions ALL PDFDocument26 pagesCase Assignment Questions ALL PDFMiscue JoNo ratings yet

- Discounted Cashflow Valuation Problems and SolutionDocument54 pagesDiscounted Cashflow Valuation Problems and SolutionJang haewonNo ratings yet

- Case Discussion QuestionsDocument3 pagesCase Discussion QuestionsAninda DuttaNo ratings yet

- Strategic Planning Process 2 - External Environment AnalysisDocument51 pagesStrategic Planning Process 2 - External Environment Analysiskamasuke hegdeNo ratings yet

- The Term Paper FIN 408, Course Title: Corporate Finance Answer The Following Questions From The Annual Reports of One of The Listed Companies in DSEDocument2 pagesThe Term Paper FIN 408, Course Title: Corporate Finance Answer The Following Questions From The Annual Reports of One of The Listed Companies in DSEAntora HoqueNo ratings yet

- Case Study KLM PDFDocument32 pagesCase Study KLM PDFManmit SinghNo ratings yet

- Case 04 NotesDocument5 pagesCase 04 Noteswjk4261936No ratings yet

- 1103 CaseDocument8 pages1103 Casezmm45x7sjtNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Case Study Sustainable Finance McDonaldsDocument28 pagesCase Study Sustainable Finance McDonaldsSweet tripathiNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisFami FamzNo ratings yet

- Introduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFDocument36 pagesIntroduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFbarbara.wilkerson397100% (15)

- Introduction To Corporate Finance 4th Edition Booth Test Bank 1Document49 pagesIntroduction To Corporate Finance 4th Edition Booth Test Bank 1glen100% (53)

- Nike Case AnalysisDocument9 pagesNike Case AnalysisNic AurthurNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisOktoNo ratings yet

- Nike Case Analysis PDFDocument9 pagesNike Case Analysis PDFSrishti PandeyNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case Analysisshamayita sahaNo ratings yet

- 1900cccc74252345 Nike Case AnalysisDocument9 pages1900cccc74252345 Nike Case AnalysistimbulmanaluNo ratings yet

- Nike Case Solution PDFDocument9 pagesNike Case Solution PDFKunal KumarNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisKwame Obeng SikaNo ratings yet

- Case Questions - EssentialsDocument9 pagesCase Questions - EssentialsHarry KingNo ratings yet

- Financial Ratio Analysis ThesisDocument8 pagesFinancial Ratio Analysis Thesismichellebojorqueznorwalk100% (1)

- Assignments 24 March - March 31 2015Document2 pagesAssignments 24 March - March 31 2015Alex HuesingNo ratings yet

- FIN 571 GENIUS Expect Success Fin571geniusdotcomDocument40 pagesFIN 571 GENIUS Expect Success Fin571geniusdotcomwillam52No ratings yet

- Select A Company Listed On An InternationallyDocument4 pagesSelect A Company Listed On An InternationallyTalha chNo ratings yet

- The Concept of StrategyDocument8 pagesThe Concept of StrategyAmit GandhiNo ratings yet

- Common Questions (30 Marks Each)Document3 pagesCommon Questions (30 Marks Each)RahulNo ratings yet

- BU481 2023F Case Preparation Questions - All CasesDocument3 pagesBU481 2023F Case Preparation Questions - All CasesAryan KhanNo ratings yet

- The Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationFrom EverandThe Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationNo ratings yet

- Life Sciences Sales Incentive Compensation: Sales Incentive CompensationFrom EverandLife Sciences Sales Incentive Compensation: Sales Incentive CompensationNo ratings yet

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- ReportHistory 732xxxDocument8 pagesReportHistory 732xxxdandy119No ratings yet

- Facebook IPODocument4 pagesFacebook IPOvaibhavNo ratings yet

- Cases in Guaranty and SuretyshipDocument51 pagesCases in Guaranty and SuretyshipErxha Lado0% (1)

- CARSONDocument2 pagesCARSONShubhangi AgrawalNo ratings yet

- Hybrid and Derivative Securities (Lembar Jawaban)Document4 pagesHybrid and Derivative Securities (Lembar Jawaban)Radinne Fakhri Al WafaNo ratings yet

- IGCSE and O Level Economics: Mid-Course Assessment (Units 1.1 To 4.4)Document3 pagesIGCSE and O Level Economics: Mid-Course Assessment (Units 1.1 To 4.4)Sylwia SdiriNo ratings yet

- Shedule of ChargessDocument13 pagesShedule of ChargessalirezaNo ratings yet

- Central Bank Digital Currencies: Preliminary Legal ObservationsDocument30 pagesCentral Bank Digital Currencies: Preliminary Legal Observationsprabin ghimireNo ratings yet

- Stockmock PPT Sasmira PGDGFM2206Document9 pagesStockmock PPT Sasmira PGDGFM2206Sasmira BhonkarNo ratings yet

- Notice of Rescission or NullificationDocument3 pagesNotice of Rescission or Nullificationresearcher3100% (4)

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- Uxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21Document2 pagesUxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21JayCharleysNo ratings yet

- Teoría y Política Monetaria: ITAM 201Document22 pagesTeoría y Política Monetaria: ITAM 201dafreeNo ratings yet

- Capital Market Regulations (LW 4411)Document9 pagesCapital Market Regulations (LW 4411)Aayushi PriyaNo ratings yet

- Service Sector in Indian EconomyDocument10 pagesService Sector in Indian EconomyKunal SainiNo ratings yet

- Hogy Fy2012 ArDocument42 pagesHogy Fy2012 ArJerry ThngNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- LL IFAD Inclusive Rural and Agricultural Finance Experiments in West and Central Africa During The Last Decade 2009 2020 1Document56 pagesLL IFAD Inclusive Rural and Agricultural Finance Experiments in West and Central Africa During The Last Decade 2009 2020 1amir mahmudNo ratings yet

- Performance Management System Questions PapersDocument24 pagesPerformance Management System Questions PapersLAVANYANo ratings yet

- Building Blocks of Finance-1Document38 pagesBuilding Blocks of Finance-1Anggari SaputraNo ratings yet

- School of Economics, Finance and Business: Module Code: Econ 41215 MODULE NAME: Advanced Financial TheoryDocument8 pagesSchool of Economics, Finance and Business: Module Code: Econ 41215 MODULE NAME: Advanced Financial TheoryalexgideiNo ratings yet

- Tes DesDocument12 pagesTes DesSarah SarcheNo ratings yet

- General Income Tax and Benefit Guide: Canada Revenue AgencyDocument63 pagesGeneral Income Tax and Benefit Guide: Canada Revenue AgencyvolvoproNo ratings yet

- Crossing of Cheques BLDocument27 pagesCrossing of Cheques BLVikash kumarNo ratings yet

- List SMS Headers 16062020 1Document494 pagesList SMS Headers 16062020 1Uday kumarNo ratings yet

- Mode of Defining Existence of PartnershipDocument12 pagesMode of Defining Existence of PartnershipTanvi23780% (5)

- Consulting Demystified 2007-08Document15 pagesConsulting Demystified 2007-08Ayan JanaNo ratings yet