Professional Documents

Culture Documents

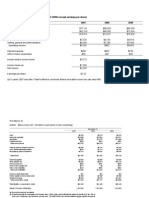

Cash Flow

Cash Flow

Uploaded by

ElenvbOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow

Cash Flow

Uploaded by

ElenvbCopyright:

Available Formats

0.

00%

-2.00%

Japanese

Yen

Czech

Koruna

Swiss

Franc

Euro

Danish

Krone

Swedish

Krona

Taiwanese

$

Hungarian

Forint

Bulgarian

Lev

Kuna

Thai

Baht

BriOsh

Pound

Romanian

Leu

Norwegian

Krone

HK

$

Israeli

Shekel

Polish

Zloty

Canadian

$

Korean

Won

US

$

Singapore

$

Phillipine

Peso

Pakistani

Rupee

Venezuelan

Bolivar

Vietnamese

Dong

Australian

$

Malyasian

Ringgit

Chinese

Yuan

NZ

$

Chilean

Peso

Iceland

Krona

Peruvian

Sol

Mexican

Peso

Colombian

Peso

Indonesian

Rupiah

Indian

Rupee

Turkish

Lira

South

African

Rand

Kenyan

Shilling

Reai

Naira

Russian

Ruble

Risk free Rates in January 2015

98

Riskfree Rates: January 2015

14.00%

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

Risk free Rate

Aswath

Damodaran

98

Measurement of the risk premium

99

The risk premium is the premium that investors

demand for invesOng in an average risk investment,

relaOve to the riskfree rate.

As a general proposiOon, this premium should be

greater than zero

increase with the risk aversion of the investors in that

market

increase

with

the

riskiness

of

the

average

risk

investment

Aswath Damodaran

99

What is your risk premium?

Assume

that

stocks

are

the

only

risky

assets

and

that

you

are

oered

two

investment

opOons:

a riskless investment (say a Government Security), on which you can

make 3%

a mutual fund of all stocks, on which the returns are uncertain

How much of an expected return would you demand to shid

your money from the riskless asset to the mutual fund?

a.

b.

c.

d.

e.

f.

Less

than

3%

Between

3%

-

5%

Between

5%

-

7%

Between

7%

-9%

Between

9%-

11%

More

than

11%

Aswath Damodaran

100

Risk Aversion and Risk Premiums

101

If this were the enOre market, the risk premium

would be a weighted average of the risk premiums

demanded by each and every investor.

The weights will be determined by the wealth that

each investor brings to the market. Thus, Warren

Buegs risk aversion counts more towards

determining the equilibrium premium than yours

and mine.

As investors become more risk averse, you would

expect the equilibrium premium to increase.

Aswath Damodaran

101

Risk Premiums do change..

102

Go back to the previous example. Assume now that

you are making the same choice but that you are

making it in the adermath of a stock market crash (it

has dropped 25% in the last month). Would you

change your answer?

a.

b.

c.

I would demand a larger premium

I would demand a smaller premium

I would demand the same premium

Aswath Damodaran

102

EsOmaOng Risk Premiums in PracOce

103

Survey investors on their desired risk premiums and

use the average premium from these surveys.

Assume that the actual premium delivered over long

Ome periods is equal to the expected premium - i.e.,

use historical data

EsOmate the implied premium in todays asset

prices.

Aswath Damodaran

103

The Survey Approach

104

Surveying all investors in a market place is impracOcal.

However, you can survey a few individuals and use these results. In

pracOce, this translates into surveys of the following:

The limitaOons of this approach are:

There are no constraints on reasonability (the survey could produce

negaOve risk premiums or risk premiums of 50%)

The survey results are more reecOve of the past than the future.

They tend to be short term; even the longest surveys do not go beyond

one year.

Aswath Damodaran

104

The Historical Premium Approach

105

This is the default approach used by most to arrive at the

premium to use in the model

In most cases, this approach does the following

Denes a Ome period for the esOmaOon (1928-Present, last 50 years...)

Calculates average returns on a stock index during the period

Calculates average returns on a riskless security over the period

Calculates the dierence between the two averages and uses it as a

premium looking forward.

The limitaOons of this approach are:

it assumes that the risk aversion of investors has not changed in a

systemaOc way across Ome. (The risk aversion may change from year

to year, but it reverts back to historical averages)

it assumes that the riskiness of the risky porlolio (stock index) has

not changed in a systemaOc way across Ome.

Aswath Damodaran

105

The Historical Risk Premium

Evidence from the United States

106

Arithmetic Average

Geometric Average

Stocks - T. Bills Stocks - T. Bonds Stocks - T. Bills Stocks - T. Bonds

1928-2014

8.00%

6.25%

6.11%

4.60%

2.17%

2.32%

1965-2014

6.19%

4.12%

4.84%

3.14%

2.42%

2.74%

2005-2014

7.94%

4.06%

6.18%

2.73%

6.05%

8.65%

What is the right premium?

Go back as far as you can. Otherwise, the standard error in the esOmate will be

large.

Std Error in estimate =

Annualized Std deviation in Stock prices

)

Number of years of historical data

Be consistent in your use of a riskfree rate.

Use arithmeOc premiums for one-year esOmates of costs of equity and geometric

premiums for esOmates of long term costs of equity.

Aswath Damodaran

106

What about historical premiums for other

markets?

107

Historical data for markets outside the United States

is available for much shorter Ome periods. The

problem is even greater in emerging markets.

The historical premiums that emerge from this data

reects this data problem and there is much greater

error associated with the esOmates of the

premiums.

Aswath Damodaran

107

One soluOon: Bond default spreads as CRP

November 2013

In

November

2013,

the

historical

risk

premium

for

the

US

was

4.20%

(geometric

average,

stocks

over

T.Bonds,

1928-2012)

Arithmetic Average

Geometric Average

Stocks - T. Bills Stocks - T. Bonds Stocks - T. Bills Stocks - T. Bonds

1928-2012

7.65%

5.88%

5.74%

4.20%

2.20%

2.33%

Using

the

default

spread

on

the

sovereign

bond

or

based

upon

the

sovereign

raOng

and

adding

that

spread

to

the

mature

market

premium

(4.20%

for

the

US)

gives

you

a

total

ERP

for

a

country.

Country

India

China

Brazil

RaOng Default Spread (Country Risk Premium)

Baa3

2.25%

Aa3

0.80%

Baa2

2.00%

If you prefer CDS spreads:

Country

India

China

Brazil

US ERP Total ERP for country

4.20%

6.45%

4.20%

5.00%

4.20%

6.20%

Aswath Damodaran

Sovereign CDS Spread

4.20%

1.20%

2.59%

US ERP Total ERP for country

4.20%

8.40%

4.20%

5.40%

4.20%

6.79%

108

Beyond the default spread? EquiOes are

riskier than bonds

While

default

risk

spreads

and

equity

risk

premiums

are

highly

correlated,

one

would

expect

equity

spreads

to

be

higher

than

debt

spreads.

One

approach

to

scaling

up

the

premium

is

to

look

at

the

relaOve

volaOlity

of

equiOes

to

bonds

and

to

scale

up

the

default

spread

to

reect

this:

Brazil:

The

annualized

standard

deviaOon

in

the

Brazilian

equity

index

over

the

previous

year

is

21

percent,

whereas

the

annualized

standard

deviaOon

in

the

Brazilian

C-bond

is

14

percent.

! 21% $

Brazil's Total Risk Premium = 4.20% + 2.00%#

& = 7.20%

" 14% %

Using the same approach for China and India:

! 24% $

Equity Risk PremiumIndia = 4.20% + 2.25%#

& = 7.80%

" 17% %

! 18% $

Equity Risk PremiumChina = 4.20% + 0.80%#

& = 5.64%

" 10% %

Aswath Damodaran

109

Implied ERP in November 2013: Watch

what I pay, not what I say..

If you can observe what investors are willing to pay

for stocks, you can back out an expected return from

that price and an implied equity risk premium.

Base year cash flow (last 12 mths)

Dividends (TTM):

33.22

+ Buybacks (TTM):

49.02

= Cash to investors (TTM): 82.35

Earnings in TTM:

E(Cash to investors)

Expected growth in next 5 years

Top down analyst estimate of

earnings growth for S&P 500 with

stable payout: 5.59%

91.82

86.96

S&P 500 on 11/1/13=

1756.54

1756.54 =

96.95

102.38

108.10

86.96 91.82 96.95 102.38 108.10

110.86

+

+

+

+

+

2

3

4

5

(1+ r) (1+ r) (1+ r) (1+ r) (1+ r) (r .0255)(1+ r)5

Beyond year 5

Expected growth rate =

Riskfree rate = 2.55%

Expected CF in year 6 =

108.1(1.0255)

r = Implied Expected Return on Stocks = 8.04%

Minus

Risk free rate = T.Bond rate on 1/1/14=2.55%

Equals

Aswath Damodaran

Implied Equity Risk Premium (1/1/14) = 8.04% - 2.55% = 5.49%

110

The bogom line on Equity Risk Premiums

in November 2013

Mature

Markets:

In

November

2013,

the

number

that

we

chose

to

use

as

the

equity

risk

premium

for

all

mature

markets

was

5.5%.

This

was

set

equal

to

the

implied

premium

at

that

point

in

Ome

and

it

was

much

higher

than

the

historical

risk

premium

of

4.20%

prevailing

then

(1928-2012

period).

Arithmetic Average

Geometric Average

Stocks - T. Bills Stocks - T. Bonds Stocks - T. Bills Stocks - T. Bonds

1928-2012

7.65%

5.88%

5.74%

4.20%

2.20%

2.33%

1962-2012

5.93%

3.91%

4.60%

2.93%

2.38%

2.66%

2002-2012

7.06%

3.08%

5.38%

1.71%

5.82%

8.11%

For

emerging

markets,

we

will

use

the

melded

default

spread

approach

(where

default

spreads

are

scaled

up

to

reect

addiOonal

equity

risk)

to

come

up

with

the

addiOonal

risk

premium

that

we

will

add

to

the

mature

market

premium.

Thus,

markets

in

countries

with

lower

sovereign

raOngs

will

have

higher

risk

premiums

that

5.5%.

Emerging

Market

ERP

=

5.5%

+

Aswath Damodaran

!

$

Equity

&& !

Country Default Spread*##

" Country Bond %

111

A Composite way of esOmaOng ERP for

countries

Step 1: EsOmate an equity risk premium for a mature market. If your

preference is for a forward looking, updated number, you can

esOmate an implied equity risk premium for the US (assuming that

you buy into the contenOon that it is a mature market)

My esOmate: In November 2013, my esOmate for the implied premium in

the US was 5.5%. That will also be my esOmate for a mature market ERP.

Step 2: Come up with a generic and measurable deniOon of a mature

market.

My esOmate: Any AAA rated country is mature.

Step

3:

EsOmate

the

addiOonal

risk

premium

that

you

will

charge

for

markets

that

are

not

mature.

You

have

two

choices:

The

default

spread

for

the

country,

esOmated

based

either

on

sovereign

raOngs

or

the

CDS

market.

A

scaled

up

default

spread,

where

you

adjust

the

default

spread

upwards

for

the

addiOonal

risk

in

equity

markets.

Aswath Damodaran

112

ERP : Nov 2013

Andorra

Austria

Belgium

Cyprus

Denmark

Finland

France

Germany

Greece

Iceland

Ireland

Italy

Canada

United States of America

North America

7.45%

5.50%

6.70%

22.00%

5.50%

5.50%

5.95%

5.50%

15.63%

8.88%

9.63%

8.50%

5.50%

5.50%

5.50%

1.95%

Liechtenstein

5.50%

0.00%

Albania

0.00%

Luxembourg

5.50%

0.00%

Armenia

1.20%

Malta

7.45%

1.95%

Azerbaijan

16.50%

Netherlands

5.50%

0.00%

Belarus

0.00%

Norway

5.50%

0.00%

Bosnia

0.00%

Portugal

10.90%

5.40%

Bulgaria

0.45%

Spain

8.88%

3.38%

CroaOa

Czech

Republic

0.00%

Sweden

5.50%

0.00%

Estonia

10.13%

Switzerland

5.50%

0.00%

Georgia

3.38%

Turkey

8.88%

3.38%

Hungary

4.13%

United

Kingdom

5.95%

0.45%

Kazakhstan

3.00%

Western

Europe

6.72%

1.22%

Latvia

0.00%

0.00%

0.00%

ArgenOna

15.63%

10.13%

Belize

19.75%

14.25%

Bolivia

10.90%

5.40%

Brazil

8.50%

3.00%

Chile

6.70%

1.20%

Colombia

8.88%

3.38%

Costa

Rica

8.88%

3.38%

Ecuador

17.50%

12.00%

El

Salvador

10.90%

5.40%

Guatemala

9.63%

4.13%

Honduras

13.75%

8.25%

Mexico

8.05%

2.55%

Nicaragua

15.63%

10.13%

Panama

8.50%

3.00%

Paraguay

10.90%

5.40%

Peru

8.50%

3.00%

Suriname

10.90%

5.40%

Uruguay

8.88%

3.38%

Aswath Damodaran

Venezuela

12.25%

6.75%

La;n

America

9.44%

3.94%

Country

Angola

Benin

Botswana

Burkina

Faso

Cameroon

Cape

Verde

Egypt

Gabon

Ghana

Kenya

Morocco

Mozambique

Namibia

Nigeria

Rwanda

Senegal

South

Africa

Tunisia

Uganda

Zambia

Africa

TRP

CRP

10.90%

5.40%

13.75%

8.25%

7.15%

1.65%

13.75%

8.25%

13.75%

8.25%

12.25%

6.75%

17.50%

12.00%

10.90%

5.40%

12.25%

6.75%

12.25%

6.75%

9.63%

4.13%

12.25%

6.75%

8.88%

3.38%

10.90%

5.40%

13.75%

8.25%

12.25%

6.75%

8.05%

2.55%

10.23%

4.73%

12.25%

6.75%

12.25%

6.75%

11.22%

5.82%

12.25%

10.23%

8.88%

15.63%

15.63%

8.50%

9.63%

6.93%

6.93%

10.90%

9.63%

8.50%

8.50%

Lithuania

8.05%

Macedonia

10.90%

Moldova

15.63%

Montenegro

10.90%

Poland

7.15%

Romania

8.88%

Russia

8.05%

Serbia

10.90%

Slovakia

7.15%

Slovenia

9.63%

Ukraine

15.63%

E.

Europe

&

Russia

8.60%

6.75%

4.73%

3.38%

10.13%

10.13%

3.00%

4.13%

1.43%

1.43%

5.40%

4.13%

3.00%

3.00%

2.55%

5.40%

10.13%

5.40%

1.65%

3.38%

2.55%

5.40%

1.65%

4.13%

10.13%

3.10%

Bangladesh

Cambodia

China

Fiji

Hong

Kong

India

Indonesia

Japan

Korea

Macao

Malaysia

MauriOus

Mongolia

Pakistan

Papua

NG

Philippines

Singapore

Sri

Lanka

Taiwan

Thailand

Vietnam

Asia

10.90%

13.75%

6.94%

12.25%

5.95%

9.10%

8.88%

6.70%

6.70%

6.70%

7.45%

8.05%

12.25%

17.50%

12.25%

9.63%

5.50%

12.25%

6.70%

8.05%

13.75%

7.27%

5.40%

8.25%

1.44%

6.75%

0.45%

3.60%

3.38%

1.20%

1.20%

1.20%

1.95%

2.55%

6.75%

12.00%

6.75%

4.13%

0.00%

6.75%

1.20%

2.55%

8.25%

1.77%

Bahrain

8.05%

2.55%

5.50%

0.00%

Israel

6.93%

1.43%

Australia

12.25%

6.75%

Jordan

12.25%

6.75%

Cook

Islands

5.50%

0.00%

Kuwait

6.40%

0.90%

New

Zealand

Lebanon

12.25%

6.75%

Australia

&

NZ

5.50%

0.00%

Oman

6.93%

1.43%

Qatar

6.40%

0.90%

Saudi

Arabia

6.70%

1.20%

United

Arab

Emirates

6.40%

0.90%

Black #: Total ERP

Middle

East

6.88%

1.38%

Red #: Country risk premium

AVG: GDP weighted average

EsOmaOng ERP for Disney: November 2013

IncorporaOon: The convenOonal pracOce on equity risk premiums is to

esOmate an ERP based upon where a company is incorporated. Thus, the

cost of equity for Disney would be computed based on the US equity risk

premium, because it is a US company, and the Brazilian ERP would be

used for Vale, because it is a Brazilian company.

OperaOons: The more sensible pracOce on equity risk premium is to

esOmate an ERP based upon where a company operates. For Disney in

2013:

Region/ Country

US& Canada

Europe

Asia-Pacic

LaOn America

Disney

Aswath Damodaran

Proportion of Disneys

Revenues

82.01%

11.64%

6.02%

0.33%

100.00%

ERP

5.50%

6.72%

7.27%

9.44%

5.76%

114

ERP for Companies: November 2013

Company

Bookscape

Vale

In November 2013,

the mature market

premium used was

5.5%

Tata Motors

Baidu

Deutsche Bank

Aswath Damodaran

Region/ Country

United States

US & Canada

Brazil

Rest of Latin

America

China

Japan

Rest of Asia

Europe

Rest of World

Company

India

China

UK

United States

Mainland Europe

Rest of World

Company

China

Germany

North America

Rest of Europe

Asia-Pacific

South America

Company

Weight

100%

4.90%

16.90%

ERP

5.50%

5.50%

8.50%

1.70%

10.09%

37.00%

10.30%

8.50%

17.20%

3.50%

100.00%

23.90%

23.60%

11.90%

10.00%

11.70%

18.90%

100.00%

100%

35.93%

24.72%

28.67%

10.68%

0.00%

100.00%

6.94%

6.70%

8.61%

6.72%

10.06%

7.38%

9.10%

6.94%

5.95%

5.50%

6.85%

6.98%

7.19%

6.94%

5.50%

5.50%

7.02%

7.27%

9.44%

6.12%

115

The Anatomy of a Crisis: Implied ERP from

September 12, 2008 to January 1, 2009

116

Aswath Damodaran

116

An Updated Equity Risk Premium: January

2015

Base year cash flow (last 12 mths)

Dividends (TTM):

38.57

+ Buybacks (TTM):

61.92

= Cash to investors (TTM): 100.50

Earnings in TTM:

114.74

E(Cash to investors)

100.5 growing @

5.58% a year

112.01

106.10

S&P 500 on 1/1/15=

2058.90

2058.90 =

Expected growth in next 5 years

Top down analyst estimate of earnings

growth for S&P 500 with stable

payout: 5.58%

118.26

124.85

131.81

106.10 112.91 118.26 124.85 131.81 131.81(1.0217)

+

+

+

+

+

(1+ r) (1+ r)2 (1+ r)3 (1+ r)4 (1+ r)5 (r .0217)(1+ r)5

Beyond year 5

Expected growth rate =

Riskfree rate = 2.17%

Expected CF in year 6 =

131.81(1.0217)

r = Implied Expected Return on Stocks = 7.95%

Minus

Risk free rate = T.Bond rate on 1/1/15= 2.17%

Equals

Implied Equity Risk Premium (1/1/15) = 7.95% - 2.17% = 5.78%

Aswath Damodaran

117

4.00%

3.00%

Implied Premium

Implied Premiums in the US: 1960-2014

118

Implied Premium for US Equity Market: 1960-2014

7.00%

6.00%

5.00%

2.00%

1.00%

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

1994

1993

1992

1991

1990

1989

1988

1987

1986

1985

1984

1983

1982

1981

1980

1979

1978

1977

1976

1975

1974

1973

1972

1971

1970

1969

1968

1967

1966

1965

1964

1963

1962

1961

1960

0.00%

Year

118

Aswath

Damodaran

You might also like

- Beroni Group Case Group 3 Private EquityDocument6 pagesBeroni Group Case Group 3 Private EquityFer Garcia De Rojas67% (3)

- Market Risk Questions PDFDocument16 pagesMarket Risk Questions PDFbabubhagoud1983No ratings yet

- Sample Exam Part IDocument3 pagesSample Exam Part ISw00per100% (1)

- FNCE 4040 Spring 2012 Midterm 2 With AnswersDocument6 pagesFNCE 4040 Spring 2012 Midterm 2 With AnswersAustin LindseyNo ratings yet

- Corporate Finance MCQsDocument0 pagesCorporate Finance MCQsonlyjaded4655100% (1)

- Hurdle Rates Iii: Estimating Equity Risk Premiums Part IDocument12 pagesHurdle Rates Iii: Estimating Equity Risk Premiums Part IAnshik BansalNo ratings yet

- Sharpe RatioDocument5 pagesSharpe RatioAlicia WhiteNo ratings yet

- Investment Is A Lifetime Learning Process (No Short Cut)Document41 pagesInvestment Is A Lifetime Learning Process (No Short Cut)Hiu Yin YuenNo ratings yet

- Value at RiskDocument18 pagesValue at RiskSameer Kumar100% (1)

- Fundamentals of Financial ManagementDocument107 pagesFundamentals of Financial ManagementBharat GujarNo ratings yet

- I (N S C) : Nvestment Is A Lifetime Learning Process O Hort UTDocument40 pagesI (N S C) : Nvestment Is A Lifetime Learning Process O Hort UTKoon Sing ChanNo ratings yet

- Risk PremiumDocument29 pagesRisk PremiumNabilah Usman100% (1)

- Session 3: Discount Rate Basics The Risk Free Rate: Aswath DamodaranDocument12 pagesSession 3: Discount Rate Basics The Risk Free Rate: Aswath DamodaranmargottupioNo ratings yet

- Chapter 6Document53 pagesChapter 6Naeemullah baigNo ratings yet

- III. Estimating Growth: DCF ValuationDocument48 pagesIII. Estimating Growth: DCF Valuationiqrajawed11No ratings yet

- Cash Flow InvestmentsDocument17 pagesCash Flow Investmentskuky6549369No ratings yet

- Risk Tolerance QuestionaireDocument4 pagesRisk Tolerance QuestionaireATL3809100% (1)

- Estimating Business GrowthDocument34 pagesEstimating Business GrowthDele AwosileNo ratings yet

- Clase VI - Discount Rates (Equity Risk Premium)Document25 pagesClase VI - Discount Rates (Equity Risk Premium)Miguel Vega OtinianoNo ratings yet

- Capital Market and Portfolio - AssignmentDocument7 pagesCapital Market and Portfolio - AssignmentAdrija ChakrabortyNo ratings yet

- Chapter 5: Introduction To Risk, Return, and The Historical RecordDocument7 pagesChapter 5: Introduction To Risk, Return, and The Historical RecordBiloni KadakiaNo ratings yet

- Corporate Valuation Session 5: Shobhit Aggarwal 16 July 2021 IIM UdaipurDocument27 pagesCorporate Valuation Session 5: Shobhit Aggarwal 16 July 2021 IIM UdaipurRohan LunawatNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- 1Document5 pages1mkc2044No ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingToufiq AitNo ratings yet

- Analysis of Mean & STD DevDocument6 pagesAnalysis of Mean & STD DevsunithanitwNo ratings yet

- Chapter 08 Slides MHKB - FIN101Document33 pagesChapter 08 Slides MHKB - FIN101MumuNo ratings yet

- Risk ToleranceDocument8 pagesRisk Toleranceapi-173610472No ratings yet

- All About Value at Risk (Var)Document3 pagesAll About Value at Risk (Var)Azra AmidžićNo ratings yet

- Damodaran ERP2013Document35 pagesDamodaran ERP2013Aparajita SharmaNo ratings yet

- Bond Risks and Yield Curve AnalysisDocument33 pagesBond Risks and Yield Curve Analysisarmando.chappell1005No ratings yet

- Chapter 7: Risk and ReturnDocument21 pagesChapter 7: Risk and ReturnNITIN SINGHNo ratings yet

- BKM9e Answers Chap005Document6 pagesBKM9e Answers Chap005soul1971No ratings yet

- Chapter 5: Introduction To Risk, Return, and The Historical RecordDocument7 pagesChapter 5: Introduction To Risk, Return, and The Historical RecordQingyu MaiNo ratings yet

- Many Shall Be Restored That Now Are Fallen, and Many Shall Fall That Now Are in Honor.Document21 pagesMany Shall Be Restored That Now Are Fallen, and Many Shall Fall That Now Are in Honor.Lukas SavickasNo ratings yet

- Discounted Cash Flow ValuationDocument26 pagesDiscounted Cash Flow ValuationSantosh Kumar100% (1)

- Presentación Riesgos de LiquidezDocument21 pagesPresentación Riesgos de LiquidezPiero Martin LeónNo ratings yet

- Value at Risk (VaR) Lec. 4Document22 pagesValue at Risk (VaR) Lec. 4palaiphilip23No ratings yet

- Agile Portfolio 2Document9 pagesAgile Portfolio 2quantextNo ratings yet

- RiskProfilingQ EngDocument4 pagesRiskProfilingQ EngcharlestvmNo ratings yet

- What Are The Different Types of Risks?: Macro Risk LevelsDocument7 pagesWhat Are The Different Types of Risks?: Macro Risk Levelsعباس ناناNo ratings yet

- CH 5 History of Interest Rates and Risk PremiumsDocument5 pagesCH 5 History of Interest Rates and Risk PremiumsdivyangvyasNo ratings yet

- Chapter 7 Intro To Risk and Return - UpdatedDocument64 pagesChapter 7 Intro To Risk and Return - UpdatedJec AlmarzaNo ratings yet

- Seminar 5 Risk and ReturnDocument66 pagesSeminar 5 Risk and ReturnPoun GerrNo ratings yet

- Risk and ReturnDocument70 pagesRisk and Returnmiss_hazel85No ratings yet

- Model Building ApproachDocument7 pagesModel Building ApproachJessuel Larn-epsNo ratings yet

- Presentation On Value at RiskDocument22 pagesPresentation On Value at RiskRomaMakhijaNo ratings yet

- Risk and ReturnDocument15 pagesRisk and ReturnShimanta EasinNo ratings yet

- Session 6 TestDocument3 pagesSession 6 TestAnshik BansalNo ratings yet

- Risk Profile QuestionnaireDocument5 pagesRisk Profile QuestionnaireSanaullah BughioNo ratings yet

- Estimating Growth: Growth Can Be Good, Bad or NeutralDocument39 pagesEstimating Growth: Growth Can Be Good, Bad or NeutralDaniella SpizzirriNo ratings yet

- Empirical Security ReturnsDocument20 pagesEmpirical Security ReturnsHussain ZahidNo ratings yet

- CH 01 Investment Setting SolutionsDocument7 pagesCH 01 Investment Setting Solutionsdwm1855No ratings yet

- Exercicios - Chapter5e6 - IPM - BKM - Cópia - CópiaDocument12 pagesExercicios - Chapter5e6 - IPM - BKM - Cópia - CópiaLuis CarneiroNo ratings yet

- Gerald Rehn - The Power of Diversified InvestingDocument48 pagesGerald Rehn - The Power of Diversified InvestingKiril YordanovNo ratings yet

- Investment ch-3Document12 pagesInvestment ch-3Robsan AfdalNo ratings yet

- Tutorial Questions Weesadk 5. - Risk UncertainDocument3 pagesTutorial Questions Weesadk 5. - Risk UncertainMinh VănNo ratings yet

- Points To Remember #Document69 pagesPoints To Remember #Ryan DixonNo ratings yet

- The Investment Principle: Risk and Return Models: You Cannot Swing Upon A Rope That Is Attached Only To Your Own BeltDocument23 pagesThe Investment Principle: Risk and Return Models: You Cannot Swing Upon A Rope That Is Attached Only To Your Own Beltdjmona9No ratings yet

- Lezione 4Document16 pagesLezione 4PaoloPasoZuccaroNo ratings yet

- Beating the Market, 3 Months at a Time (Review and Analysis of the Appels' Book)From EverandBeating the Market, 3 Months at a Time (Review and Analysis of the Appels' Book)No ratings yet

- Foreign NPVDocument21 pagesForeign NPVThe lost bikerNo ratings yet

- 9602 in Fin SolveDocument86 pages9602 in Fin SolveCharles MK Chan0% (1)

- Vocabulary Related To The World of WorkDocument8 pagesVocabulary Related To The World of WorkAnii MamaniNo ratings yet

- International Business 2007Document384 pagesInternational Business 2007swaroopceNo ratings yet

- Managing Economic Exposure PDFDocument24 pagesManaging Economic Exposure PDFNilesh MandlikNo ratings yet

- Financial Planning and Analysis: The Master BudgetDocument57 pagesFinancial Planning and Analysis: The Master BudgetBig D100% (2)

- Informe Deoleo PDFDocument13 pagesInforme Deoleo PDFEneida6736No ratings yet

- Cross Cultural Report of Italy and Saudi ArabiaDocument13 pagesCross Cultural Report of Italy and Saudi ArabiaumarzNo ratings yet

- International Business Etiquette PaperDocument5 pagesInternational Business Etiquette Paperakpoole123No ratings yet

- CAO Director Global Real Estate in New York City Resume Robert CapuaDocument2 pagesCAO Director Global Real Estate in New York City Resume Robert CapuaRobertCapuaNo ratings yet

- Chapter 4Document14 pagesChapter 4Selena JungNo ratings yet

- CV Europass November Darko StilinovicDocument12 pagesCV Europass November Darko StilinovicSascha DenicNo ratings yet

- TCodeDocument12 pagesTCodeSudhakar RaiNo ratings yet

- Phillip Nova 2H2023 Market OutlookDocument29 pagesPhillip Nova 2H2023 Market OutlookSteven TimNo ratings yet

- No$GBADocument8 pagesNo$GBAHenraNo ratings yet

- Jawaban Uas B.ingDocument3 pagesJawaban Uas B.ingAndry WigunaNo ratings yet

- Four Steps First FX Trade CADocument7 pagesFour Steps First FX Trade CAKevin MonksNo ratings yet

- iPAY International S.A. 2014Document20 pagesiPAY International S.A. 2014LuxembourgAtaGlanceNo ratings yet

- 1 EUR To GEL - Euros To Georgian Lari Exchange RateDocument1 page1 EUR To GEL - Euros To Georgian Lari Exchange RateJustina GedminėNo ratings yet

- Flash Memory Inc Student Spreadsheet SupplementDocument5 pagesFlash Memory Inc Student Spreadsheet Supplementjamn1979No ratings yet

- Debabrata Mohanty, M.com, Sec A, (B.F), Regd - No-13351019 (Pondicherry University)Document12 pagesDebabrata Mohanty, M.com, Sec A, (B.F), Regd - No-13351019 (Pondicherry University)Andrew TaylorNo ratings yet

- Euro Fractal Trading System PDFDocument2 pagesEuro Fractal Trading System PDFAndre0% (1)

- Market Watch Malaysia Construction Industry 2011Document13 pagesMarket Watch Malaysia Construction Industry 2011earnestgoh3635No ratings yet

- Lectura ObligatoriaDocument9 pagesLectura ObligatoriaSamir GalanNo ratings yet

- Arrieta V NaricDocument6 pagesArrieta V NaricEcnerolAicnelavNo ratings yet

- Môi trường kinh doanh quốc tếDocument66 pagesMôi trường kinh doanh quốc tếThanh ThảoNo ratings yet