Professional Documents

Culture Documents

Required:: Financial Accounting - Tuck Mary Lou's Case

Required:: Financial Accounting - Tuck Mary Lou's Case

Uploaded by

RC WillenbrockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Required:: Financial Accounting - Tuck Mary Lou's Case

Required:: Financial Accounting - Tuck Mary Lou's Case

Uploaded by

RC WillenbrockCopyright:

Available Formats

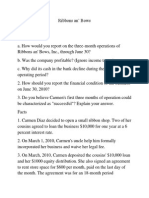

Financial Accounting - Tuck

Mary Lous Case

Required:

Prepare T- accounts to record the transactions Mary Lou's entered into in June 2006.

Present the income statement for Mary Lou's for June 2006.

Present also the balance sheet as of June 30, 2006.

Ignore income taxes.

Mary Lou's Educational Services provides accounting tutoring to companies located in or near Erie,

Pennsylvania. The balance sheet for the firm as of 5/31/2006 is listed below:

ASSETS

Cash

Accounts Receivable

Supplies Inventory

Equipment

Accumulated Dep.

$25,000

86,000

23,000

100,000

(18,000)

$216,000

LIABILITIES AND EQUITIES

Accounts Payable

$9,000

Interest Payable

5,000

Bond Payable

100,000

Common Stock

10,000

Add. Paid in Cap.

60,000

Retained Earnings

32,000

$216,000

_________________________________________________________________________________________________________________________

Tuck School of Business at Dartmouth

Robert J. Resutek

Page 1

Financial Accounting - Tuck

Mary Lous Case

Transactions for the month of June and additional information are as follows:

1.

For new customers, Mary Lou's makes the customer pay in advance for services. For

established customers, the firm allows customers to pay after the services have been

provided (that is, all services rendered to established customers can be viewed as "credit

sales"). In June, Mary Lou's billed established customers for $200,000, all for tutorial

services provided in June. The balance in the Accounts Receivable account shown above

applies to amounts previously billed to established customers. Total payments on account

from established customers were $220,000 in June.

2.

On June 1, Mary Lou's signed a contract to do tutorial work for Cantaloupe Bancorp. of

Erie. The contract stipulated that $98,000 was to be paid for one year's worth of tutoring.

Because Cantaloupe was a new customer, the contract stipulated that Cantaloupe had to pay

for six month's tutoring in advance. Cantaloupe therefore paid $49,000 to Mary Lou's on

June 1. During June, Mary Lou's provided one month's worth of tutoring, per the terms of

the contract.

3.

Salaries earned by Mary Lou's tutors in June were $140,000, of which $23,000 were unpaid

as of June 30th.

4.

Mary Lou's purchased supplies, all on account, during June. Mary Lou's paid suppliers

$63,000 during June. The Accounts Payable account shown above shows the balance due to

suppliers as of June 1. At June 30th, $4,000 was owed to suppliers. A physical count of the

supplies inventory revealed that $22,000 of inventory was on hand.

5.

The balance in the Interest Payable account relates to the Bond Payable shown on the

balance sheet. Interest on the bond is paid each June 30th and December 30th.

6.

The equipment is being depreciated at the rate of $1,000 per month.

7.

Mary Lou's declared a dividend of $5,000 in June. The dividend was to be paid July 10th.

_________________________________________________________________________________________________________________________

Tuck School of Business at Dartmouth

Robert J. Resutek

Page 2

You might also like

- PDF Intermediate Accounting Ifrs Edition Donald E Kieso Ebook Full ChapterDocument53 pagesPDF Intermediate Accounting Ifrs Edition Donald E Kieso Ebook Full Chapterkelly.collett888100% (4)

- Question and Answer - 28Document30 pagesQuestion and Answer - 28acc-expert33% (3)

- Test Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFDocument104 pagesTest Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFKristine Lirose Bordeos100% (1)

- Rational Producer BehaviorDocument4 pagesRational Producer Behaviorleaha17No ratings yet

- CH 11 - Smartbook Accounting 201Document6 pagesCH 11 - Smartbook Accounting 201Gene'sNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDocument3 pagesRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- MCD2010 - T5 SolutionsDocument15 pagesMCD2010 - T5 SolutionsJasonNo ratings yet

- Exercises For Final PDFDocument11 pagesExercises For Final PDFThanh HằngNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFDocument104 pagesTest Bank Accounting 25th Editon Warren Chapter 11 Current Liabili PDFJohn Andrew BordeosNo ratings yet

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- CMA Part 2 Slides PDFDocument80 pagesCMA Part 2 Slides PDFmohamedNo ratings yet

- Chapter 3Document8 pagesChapter 3Jamie Catherine Go100% (1)

- Expenses - Accounting TheoryDocument30 pagesExpenses - Accounting Theorybonny99100% (1)

- Accounting 1 Final Study Guide Version 1Document12 pagesAccounting 1 Final Study Guide Version 1johannaNo ratings yet

- 1 Accounting-Week-2assignmentsDocument4 pages1 Accounting-Week-2assignmentsTim Thiru0% (1)

- AkaunDocument4 pagesAkaunaisyah100% (1)

- P7.3 (Lo 3)Document3 pagesP7.3 (Lo 3)RiyanNo ratings yet

- AccountingDocument2 pagesAccountingLouie CraneNo ratings yet

- Fin. Acc. Chapter-2 Tabular AnalysisDocument2 pagesFin. Acc. Chapter-2 Tabular AnalysisFayez AmanNo ratings yet

- Chapter 3 Practice QuestionsDocument6 pagesChapter 3 Practice QuestionsRishi KamalNo ratings yet

- BU8101 Sem3 - Group 11Document63 pagesBU8101 Sem3 - Group 11Shweta SridharNo ratings yet

- For Analysis Basis of Carmen Diaz CaseDocument9 pagesFor Analysis Basis of Carmen Diaz CaseShielarien DonguilaNo ratings yet

- Chapter 3 QuestionDocument2 pagesChapter 3 Questionjugnu0% (1)

- Spring '21 North South University Hhq1 School of Business, BbaDocument4 pagesSpring '21 North South University Hhq1 School of Business, BbaMushfiqur RahmanNo ratings yet

- Latihan Soal Akm 1Document2 pagesLatihan Soal Akm 1hamidah candradewiNo ratings yet

- EQuestionsDocument11 pagesEQuestionsLala BoraNo ratings yet

- CH 01Document2 pagesCH 01Sandeep Kumar PalNo ratings yet

- Quest 1Document7 pagesQuest 1btetarbeNo ratings yet

- Week 3 Individual AssignmentDocument3 pagesWeek 3 Individual Assignmentkenny938No ratings yet

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- Chapter 3Document26 pagesChapter 3Susmita BashirNo ratings yet

- Week #4 Practice Problems: Problem #1Document6 pagesWeek #4 Practice Problems: Problem #1Joseph GuzmanNo ratings yet

- Acct 200 FinalDocument6 pagesAcct 200 FinalLương Thế CườngNo ratings yet

- ACC300 Principles of AccountingDocument11 pagesACC300 Principles of AccountingG JhaNo ratings yet

- Chapter 1 and 2Document5 pagesChapter 1 and 2Kei HanzuNo ratings yet

- Assignment On AccountingDocument9 pagesAssignment On AccountingAaryaAustNo ratings yet

- 2009-04-17 160040 KellyDocument17 pages2009-04-17 160040 KellyKaran NaikNo ratings yet

- ch4 Completing The Accounting Cycle Facebook PDFDocument20 pagesch4 Completing The Accounting Cycle Facebook PDFYaman AlsaadiNo ratings yet

- JPIA Financial Accounting 1 (Prelims)Document20 pagesJPIA Financial Accounting 1 (Prelims)Kristienalyn De AsisNo ratings yet

- Wise Company Completes These Transactions During April of The Current Year Journals Ledgers Receivable A+ AnswerDocument2 pagesWise Company Completes These Transactions During April of The Current Year Journals Ledgers Receivable A+ AnswerMike Russell40% (5)

- Final Mock Test BBUSDocument19 pagesFinal Mock Test BBUSGia LâmNo ratings yet

- Exam #2Document5 pagesExam #2Anonymous AMfLQKpjklNo ratings yet

- Chapter 3-Adjusting The AccountsDocument26 pagesChapter 3-Adjusting The Accountsbebybey100% (1)

- Adjusting and Corporation Quiz 1Document13 pagesAdjusting and Corporation Quiz 1JEFFERSON CUTENo ratings yet

- Accounting Questions 22Document3 pagesAccounting Questions 22rln0518No ratings yet

- Dao Vang CPA Was Retained by Universal Cable To Prepare: Unlock Answers Here Solutiondone - OnlineDocument1 pageDao Vang CPA Was Retained by Universal Cable To Prepare: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- FSA-Tutorial 1-Fall 2022Document4 pagesFSA-Tutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Acct 2600 Exam 1 Study SheetDocument8 pagesAcct 2600 Exam 1 Study Sheetapi-236442317No ratings yet

- Quiz ch1 2Document5 pagesQuiz ch1 2loveshareNo ratings yet

- Special ExamDocument3 pagesSpecial ExamAdoree Ramos50% (2)

- CE On ReceivablesDocument5 pagesCE On ReceivablesChesterTVNo ratings yet

- CH 11Document3 pagesCH 11vivienNo ratings yet

- Assignment 2Document2 pagesAssignment 2Sidharth ChughNo ratings yet

- ACC 255 08 OutlineDocument9 pagesACC 255 08 Outlineadi zilbrshtiinNo ratings yet

- INVENTORYDocument8 pagesINVENTORYKevin Klein RamosNo ratings yet

- CH 1 ProblemsDocument8 pagesCH 1 Problemsbangun7770% (1)

- Accounting 2 - MCQs (Revison) - AnswerDocument8 pagesAccounting 2 - MCQs (Revison) - Answernemoyassin4No ratings yet

- Accounting Textbook Solutions - 19Document19 pagesAccounting Textbook Solutions - 19acc-expertNo ratings yet

- Mock Test 1Document20 pagesMock Test 1Quỳnh'ss Đắc'ssNo ratings yet

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Task 1Document1 pageTask 1Robin ScherbatskyNo ratings yet

- Supply Chain Management Dan Ekonomi Di Indonesia: Kuliah Umum Mata Kuliah Ekonomi KesehatanDocument16 pagesSupply Chain Management Dan Ekonomi Di Indonesia: Kuliah Umum Mata Kuliah Ekonomi KesehatanresimartaNo ratings yet

- Unit 3: Trial Balance: Learning OutcomesDocument12 pagesUnit 3: Trial Balance: Learning OutcomesRaja NarayananNo ratings yet

- IND AS 7 Cash Flow Statement by Rahul MalkanDocument13 pagesIND AS 7 Cash Flow Statement by Rahul Malkanvishwas jagrawalNo ratings yet

- May 2018 and 2017 SolutionsDocument43 pagesMay 2018 and 2017 SolutionsgNo ratings yet

- Review QuestionairesDocument18 pagesReview QuestionairesAngelica DuarteNo ratings yet

- Presentación Situacion Fiscal Municipio Aguadilla 2022Document13 pagesPresentación Situacion Fiscal Municipio Aguadilla 2022La Isla OesteNo ratings yet

- Principles of Acct - Chapter-5Document54 pagesPrinciples of Acct - Chapter-5Yonas N IsayasNo ratings yet

- Activity: Depreciation DEADLINE: December 2, 2021 at 11:59AM Problem 1Document4 pagesActivity: Depreciation DEADLINE: December 2, 2021 at 11:59AM Problem 1Gee Lysa Pascua VilbarNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: FinalDocument8 pagesFundamentals of Accountancy, Business and Management 2: FinalBryanNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument8 pagesFinancial Statements For Jollibee Foods CorporationJ U D YNo ratings yet

- CH 9 Cost of Capital Book QuestionsDocument8 pagesCH 9 Cost of Capital Book QuestionsSavy DhillonNo ratings yet

- ALİ, Jan, Sharif - 2015 - Effect of Dividend Policy On Stock PricesDocument32 pagesALİ, Jan, Sharif - 2015 - Effect of Dividend Policy On Stock Pricesmuhammad sami ullah khanNo ratings yet

- Ch17 InvestmentsDocument37 pagesCh17 InvestmentsBabi Dimaano Navarez0% (1)

- Ch03 Predetermined Overhead RatesDocument48 pagesCh03 Predetermined Overhead Ratesバツ きNo ratings yet

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document12 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica ParasNo ratings yet

- Exercise Financial Model IndividualDocument5 pagesExercise Financial Model IndividualHaziq SuhairiNo ratings yet

- Chapter TwoDocument33 pagesChapter TwoTerefe DubeNo ratings yet

- AccountancyDocument11 pagesAccountancypraveentyagiNo ratings yet

- ACCTG11 FINANCIAL ACCTG AND REPORTING BSA Coursse OutlineDocument9 pagesACCTG11 FINANCIAL ACCTG AND REPORTING BSA Coursse OutlineJaya RamirezNo ratings yet

- Module 1 - Accounting and BusinessDocument16 pagesModule 1 - Accounting and BusinessNiña Sharie Cardenas100% (1)

- Sensitivity Analysis BondsDocument5 pagesSensitivity Analysis BondsZhenyi ZhuNo ratings yet

- Audit of IntangiblesDocument7 pagesAudit of IntangiblesAireese33% (3)

- ASE20104 - Examiner Report - April 2019Document14 pagesASE20104 - Examiner Report - April 2019Aung Zaw Htwe100% (1)