Professional Documents

Culture Documents

Case 16 Citibank Indonesia

Case 16 Citibank Indonesia

Uploaded by

shielamae0 ratings0% found this document useful (0 votes)

41 views1 pageCitibank

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCitibank

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

41 views1 pageCase 16 Citibank Indonesia

Case 16 Citibank Indonesia

Uploaded by

shielamaeCitibank

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

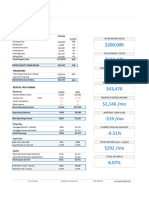

Case 16: Citibank Indonesia

Castillo, Kristine H. (9)

Point of View. Third party analyst.

Problem. Given the current outlook in Indonesia, how would Mr. Mistri manage Citibank

Indonesia to meet the corporate goal set by the home country?

Analysis. Mr. Mistri is faced with a dilemma on the more aggressive strategy of the home country

against his already aggressive budget while Indonesias short term outlook is pessimistic. His

alternatives include eliminating its participation in loans to government and private sectors as

this provide low returns and may pose damage in its relationship with the host country. Another

option is to increase the total money lent to Indonesia, however this will expose the bank to

higher risk. To add to this, he also have internal problems with the increasing employee turnover

rate, and the potential impact of the increase in budget with his performance evaluation and

incentive compensation. Although the corporate is controlling international branches based on

sovereign risk limits and budgeting, Mr. Mistri is operating below the sovereign risk limit and it

can be inferred that the budget he submitted is moderately aggressive. This may be due to his

personal interest of exceeding his budget for the incentive compensation. For financial services

firm, their main business is accepting higher risk for a greater reward. Mr. Mistri may not be

taking in too much risk as he is considering the companys exposure in times of pessimistic

outlook, as well as its impact on his evaluation and compensation. The corporate, on the other

hand, should consider the economic outlook of the country as the currency they are operating in

evaluating its managers.

Recommendation. Mr. Mistri should accept the increase in the budget and should take on both

alternative of decreasing, and nit completely eliminating the loan to government and private

institutions and to increase commercial loans. He should maximize the risk based on the

sovereign limit assigned to Indonesia. The real GDP growth is still at a positive level although the

short term outlook is negative. But, if they take on higher risk in relation to Indonesian economy,

they may achieve growth in profit if the country indeed performed well. The corporate should

also evaluate its incentive compensation plan that would encourage managers to maximize its

profitability by taking in risk as they are in a financial service sector. The compensation should at

least target a growth similar to the GDP growth of the host country, and reward managers for

performing in excess of this goal.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Aggregate Demand WorksheetDocument6 pagesAggregate Demand WorksheetDanaNo ratings yet

- Mohit Sachdeva RATIO ANALYSIS at PRISM CEMENTDocument68 pagesMohit Sachdeva RATIO ANALYSIS at PRISM CEMENTvickram jainNo ratings yet

- Pelican Instrument IncDocument2 pagesPelican Instrument Incshielamae0% (4)

- Winwood Performance Plus: An Experiential Exercise On Chapter 5 - Foundations of PlanningDocument9 pagesWinwood Performance Plus: An Experiential Exercise On Chapter 5 - Foundations of PlanningshielamaeNo ratings yet

- Winwood PerformanceDocument2 pagesWinwood PerformanceshielamaeNo ratings yet

- Nagornov Arundel CaseDocument12 pagesNagornov Arundel CaseJean-Simon CayerNo ratings yet

- Case 6 - Top SecretDocument7 pagesCase 6 - Top SecretshielamaeNo ratings yet

- DeluxeDocument4 pagesDeluxeshielamaeNo ratings yet

- Papa John'sDocument12 pagesPapa John'sshielamae100% (1)

- Ben SantosDocument10 pagesBen SantosshielamaeNo ratings yet

- Case 2 - Vershire Company (Version 2.1)Document3 pagesCase 2 - Vershire Company (Version 2.1)shielamaeNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (34)

- Topic 2 - Financial Statements For Decisions (STU)Document42 pagesTopic 2 - Financial Statements For Decisions (STU)thiennnannn45No ratings yet

- Financial and Business Risk Management 1 PDFDocument75 pagesFinancial and Business Risk Management 1 PDFrochelleandgelloNo ratings yet

- Loma 357 C1Document13 pagesLoma 357 C1May ThirteenthNo ratings yet

- DMMR CVP MathDocument2 pagesDMMR CVP MathSabbir ZamanNo ratings yet

- Sunlife Proposal Bianca OseraDocument2 pagesSunlife Proposal Bianca OseraBianca Joy OseraNo ratings yet

- Purchasing Power Parity Theory and ExchaDocument24 pagesPurchasing Power Parity Theory and ExchaTharshiNo ratings yet

- Bank Final AccountDocument11 pagesBank Final AccountKadam KartikeshNo ratings yet

- Financial DerivativesDocument25 pagesFinancial DerivativesnarutomoogrNo ratings yet

- Tax Planning Tips For Property Investors Financial Year EndDocument1 pageTax Planning Tips For Property Investors Financial Year EndAdrianNo ratings yet

- New India Mediclaim Policy Premium Chart-1Document2 pagesNew India Mediclaim Policy Premium Chart-1saiNo ratings yet

- Quick Tests Unit 1 and Unit 2Document47 pagesQuick Tests Unit 1 and Unit 2junjun100% (2)

- 10 Funds Flow StatementDocument13 pages10 Funds Flow Statementankush sardanaNo ratings yet

- Chapter 2Document4 pagesChapter 2Muhammad ImranNo ratings yet

- Course Planner: GC University FaisalabadDocument3 pagesCourse Planner: GC University Faisalabadgoharmahmood203No ratings yet

- Laptop InvoiceDocument1 pageLaptop InvoicePranjal ThakurNo ratings yet

- STRM 01Document19 pagesSTRM 01Professor Dr. Md. Atiqur RahmanNo ratings yet

- Lec12 - Ratio AnalysisDocument85 pagesLec12 - Ratio AnalysisDylan Rabin Pereira100% (1)

- Partnership Dissolution ProblemsDocument9 pagesPartnership Dissolution ProblemsKristel DayritNo ratings yet

- 19Document3 pages19Kristine Arsolon100% (2)

- Answer Scheme TUTORIAL CHAPTER 4Document13 pagesAnswer Scheme TUTORIAL CHAPTER 4niklynNo ratings yet

- World Bank Finance Details For TanescoDocument115 pagesWorld Bank Finance Details For TanescoAmani KeenjaNo ratings yet

- Chola MsDocument98 pagesChola MsDhaval224No ratings yet

- IAS08Document29 pagesIAS08Shah KamalNo ratings yet

- FIN 456 International Financial Management: The Market For Foreign ExchangeDocument35 pagesFIN 456 International Financial Management: The Market For Foreign ExchangeHiếu Nguyễn Minh HoàngNo ratings yet

- Rental Investment ReportDocument5 pagesRental Investment ReportTuba TunaNo ratings yet

- Cost Production Ethyl AcetateDocument14 pagesCost Production Ethyl Acetateshalmiaida50% (2)