Professional Documents

Culture Documents

Order in Respect of Mr. Vinay Talwar in The Matter of Vital Communications Limited

Order in Respect of Mr. Vinay Talwar in The Matter of Vital Communications Limited

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Order in Respect of Mr. Vinay Talwar in The Matter of Vital Communications Limited

Order in Respect of Mr. Vinay Talwar in The Matter of Vital Communications Limited

Uploaded by

Shyam SunderCopyright:

Available Formats

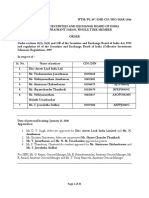

WTM/RKA/EFD-DRA-I /62/2016

SECURITIES AND EXCHANGE BOARD OF INDIA

ORDER

IN THE MATTER OF VITAL COMMUNICATIONS LTD.

In respect of Mr Vinay Talwar

_________________________________________________________________________

1. SEBI had passed an order dated July 31, 2014 in respect of 24 entities including one Mr.

Vinay Talwar. Mr. Vinay Talwar was found to have contravened the provisions of regulation

3, 4, 5 and 6 of the SEBI (Prohibition of fraudulent and Unfair Trade Practices relating to

Securities Market) Regulations, 1995 read with regulations 3 and 4 of the SEBI (Prohibition

of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 and

was accordingly restrained from accessing the securities market and was further prohibited

from buying, selling or otherwise dealing in securities, directly or indirectly, or being

associated with the securities market in any manner, whatsoever, for a period of three yearsin

terms of the said order.

2. Aggrieved by the said order, Mr. Vinay Talwarand Mr. J. P. Madaan preferred appeals before

Honble Securities Appellate Tribunal(SAT) which were disposed of byHonble SAT vide

order dated April 28, 2016 with following directions:

3. In view of the fact that the appellants are not contesting the impugned decision on merits but

are only interested in getting the debarment period reduced, we deem it proper to dispose of the

appeals by passing the following order:

(a) Appellants are at liberty to make a representation to SEBI seeking reduction of the

debarment for a period lesser than three years, within a period of two weeks from today.

(b) If such a representation is made within a period of two weeks from today, then SEBI shall

consider the same on its own merits and pass appropriate order as it deems fit within a period of

four weeks from the date of receiving the representation.

3. Mr. Vinay Talwar filed a representation vide letter dated May 5, 2016received by SEBI on

May 9, 2016.In addition, he has also relied upon his submissions in the appeal before the

Honble SAT. He has, inter alia,made following submissions:

(a) Show cause notice in question is related to the period of 1999-2002 which is more than

12 to 14 years old. Theshow cause notice in January 28, 2014 is issued almost after six

years after the show cause notice dated September 17, 2007.The delay defeats justice

Order in respect of Mr. Vinay Talwar

1 of 4

and that the inordinate delay caused in order to initiate separate investigation has

rendered the impugned award bad and illegal;

(b) The matter pertains to the year 2002 whereas Mr. Vinay Talwar was forcefully removed

as the director of the company on September 6, 2000 by Mr. Vijay Jhindal, Chairman of

the companywas already been removed from the post of director;The company has

provided the information and replies to SEBI in 2002 onwards which is subsequent to

the removal of Mr. Vinay Talwar from the company;

(c) SEBI vide order dated February 20, 2008 had noted that there is no cogent evidence

pointing to the involvement of Mr. Vinay Talwar in the matter;

(d) It is evident that all activities that are alleged to have been carried out in as alleged in the

SCN were carried out by Mr. Vijay Jindal and his associates for their personal benefit on

account of the alleged dealings and Mr. Vinay Talwar had nothing to do with any of it;

(e) It is apparent from the material on record that Mr. Vinay Talwar did not obtain any

pecuniary benefit on account of the alleged dealings;

(f) The order of debarment of three years against Mr. Vinay Talwar is contrary to the

principles of parity as the main culprit Mr. Vijay Jindal was also awarded the same

period of debarment whereas the role of Mr. Vinay Talwar is negligible in comparison

to the role of Mr. Vijay Jhindal;

(g) In the order lenient view was taken against Ms. Shubha Jhindal wife of Mr. Vijay Jhindal

and she was debarred only for one year keeping in mind the dates when she joined and

when the event that resulted in pecuniary benefit took place;

(h) Because SEBIs order dated February 20, 2008 referred to a separate proceeding, but the

records of the matter clearly reflect that even in the second proceeding no new facts

against Mr. Vinay Talwar came to the surface in the order of Ld. Whole time Member

to reach a different conclusion vide order dated July 31, 2014.

4. In this case, after the order dated July 31, 2014 was passed, Mr. Vinay Talwar had a remedy

provided by law by filing appeal under section 15T of the SEBI Act before the Hon'ble SAT.

In terms of said section 15T, any person aggrieved by an order of the Boardmay prefer an

appeal to the Hon'ble SAT. In terms of section 15T(4) of the SEBI Act, Hon'ble SAT may

confirm, modify or set aside the order appealed against. In this case, as observed by Hon'ble

SAT in its order dated April 28, 2016, while availing this remedy Mr. Vinay Talwar has not

contested the order dated July 31, 2014 on merits and he was only interested in reduction of

the debarment period. In terms of the said order of Hon'ble SAT, the only question that

Order in respect of Mr. Vinay Talwar

2 of 4

remains to be examined is whether the debarment period of three years imposed upon

Mr.Vinay Talwar should be reduced in view of the submissions made by him in his

representation.

5. I note that in his representation, Mr. Vinay Talwar has made the same submissions which he

had made during the proceedings that have culminated in the order dated July 31, 2014. All

those submissions have already been dealt within detail in the order dated July 31, 2014. His

role in the entire scheme has been clearly brought out in the order dated July 31, 2014. In

para. 22 of the order clear findings were given that he did not play any role in the

advertisement issued during May, June 2002. However, he was director of the company at

the time of the preferential allotment of 72, 00,000 shares to 15 entities on December 14,

1999. It has been established in the said order that the whole scheme of the company, its

promoters/directors and the preferential allottees was a ploy to defraud the investors in the

securities market. The facts and circumstances particularly those summarised in para. 32 of

the said order have led to the finding that the whole scheme of things pertaining to

preferential allotment during December 1999to 15 entities which were connected to the

company, its promoters/directors including Mr. Vinay Talwar and subsequent sale were

carried out as a device to enable fraudulent gains to the promoters and directors. Mr. Vinay

Talwar has been found to be party to the fraudulent preferential allotment which was to

cheat the investors. He had knowingly indulged in such fraudulent activities. He had not

contested any of these findings. Mr. Vinay Talwar's role has been more particularly described

in para. 32 (a) and (h), para. 33, para. 34 read with para. 22 of the order dated July 31, 2014

and I do not consider it necessary to burden this order with same findings again.

6. It is also relevant to mention that the order dated February 20, 2008 had been set aside by

Hon'ble SAT vide its order dated August 28, 2008 in the appeals filed by Mr. J. P. Madaan,

Mr. Vijay Jhindal and Ms. Shubha Jhindal. While disposing of the said appeals, Hon'ble SAT

had not accepted the prayer of those appellants, rather expressed its unhappiness with the

SEBI order dated February 20, 2008 and remanded the matter back to SEBI to issue fresh

show cause notice(s).

7. Thus, it is noted that all the facts and circumstances submitted in the representation of Mr.

Vinay Tawar has already been considered in the order dated July 31, 2014 and none of the

findings on merits have been contested or disputed.

8. The only new contention which Mr. Vinay Talwar has put forward in his representation is

that the period of debarment against him is contrary to the principles of parity as,according

to him,the main culprit Mr. Vijay Jhindal was also awarded same period of debarment and

lenient view was taken against his wife, Ms. Shubha Jhindal. In the order dated July 31,2014

entire facts and circumstances including the delay in disposing of the SCNs as contested by

Order in respect of Mr. Vinay Talwar

3 of 4

Mr. Vinay Talwar have been taken into account in the order dated July 31, 2014 while

awarding the debarment. Further, the period of debarment have been awarded considering

the role and involvement of respective entities as mentioned in para. 37 ofthe order dated

July 31, 2014. It is undisputed fact that during the period of preferential allotment in

question, funding thereof by the company, inconsistent and misleading disclosures, etc. Mr.

Vinay Talwar was Chairman cum Managing Director of the company. This apart, he was

actively involved in the fraudulent scheme as has been detailed in the said order. I, therefore,

do not agree with this contention of Mr. Vinay Talwar.

9. The representations of Mr. Vinay Talwar are disposed of accordingly.

th

DATE: JUNE8 , 2016

PLACE: MUMBAI

-SdRAJEEV KUMAR AGARWAL

WHOLE TIME MEMBER

SECURITIES AND EXCHANGE BOARD OF INDIA

Order in respect of Mr. Vinay Talwar

4 of 4

You might also like

- Morgan Stanley Mutual Fund Vs Kartrik DasDocument15 pagesMorgan Stanley Mutual Fund Vs Kartrik DasChaitanya Sharma100% (1)

- Ivan Kodeh..appli VS Sardinius..respo Civil Appli No.1 of 2015 Hon - Mziray, J.ADocument21 pagesIvan Kodeh..appli VS Sardinius..respo Civil Appli No.1 of 2015 Hon - Mziray, J.AOmar SaidNo ratings yet

- Order in The Matter of Disc Assets Lead India LTDDocument25 pagesOrder in The Matter of Disc Assets Lead India LTDShyam SunderNo ratings yet

- Corporate Frauds in India PDFDocument32 pagesCorporate Frauds in India PDFSwarnajeet Gaekwad100% (3)

- Indian Financial SystemDocument107 pagesIndian Financial SystemAkram Hasan89% (9)

- Order in Respect of Jalaj Batra - in The Matter of Vijay Textiles LimitedDocument3 pagesOrder in Respect of Jalaj Batra - in The Matter of Vijay Textiles LimitedShyam SunderNo ratings yet

- Order in The Matter of M/s Nicer Green Housing and Infrastructure LimitedDocument20 pagesOrder in The Matter of M/s Nicer Green Housing and Infrastructure LimitedShyam SunderNo ratings yet

- Adjudication Order Against Shri Vinod Kumar in The Matter of CDI International LimitedDocument7 pagesAdjudication Order Against Shri Vinod Kumar in The Matter of CDI International LimitedShyam Sunder100% (1)

- SEBI ORDER - Apte Amalgamations LTDDocument14 pagesSEBI ORDER - Apte Amalgamations LTDFuson1234No ratings yet

- In The Matter of Pancard Clubs LimitedDocument33 pagesIn The Matter of Pancard Clubs LimitedShyam SunderNo ratings yet

- Adjudication Order in respect of Shri Vijay Jamnadas Vora, Ms. Hina Vijaykumar Vora, Shri Chetan Dogra, M/s. Chetan Dogra HUF, Ms. Minoti Dhawan and Shri Manojbhai Rameshchandra Shah. in the matter of M/s. Sky Industries LimitedDocument76 pagesAdjudication Order in respect of Shri Vijay Jamnadas Vora, Ms. Hina Vijaykumar Vora, Shri Chetan Dogra, M/s. Chetan Dogra HUF, Ms. Minoti Dhawan and Shri Manojbhai Rameshchandra Shah. in the matter of M/s. Sky Industries LimitedShyam SunderNo ratings yet

- Morgan Stanley Mutual Fund V Kartick Das 1994 SCW 2801Document12 pagesMorgan Stanley Mutual Fund V Kartick Das 1994 SCW 2801Chaitanya SharmaNo ratings yet

- Savitiri DeviDocument4 pagesSavitiri DevivedaprakashmNo ratings yet

- Order in The Matter of Sankalp Projects LimitedDocument21 pagesOrder in The Matter of Sankalp Projects LimitedShyam SunderNo ratings yet

- Assignment ON Laws On Securities and Financial Markets: TopicDocument7 pagesAssignment ON Laws On Securities and Financial Markets: TopicSiddharth DasNo ratings yet

- Adjudication Order Against Ms Rashmee Seengal in The Matter of CDI International LimitedDocument9 pagesAdjudication Order Against Ms Rashmee Seengal in The Matter of CDI International LimitedShyam SunderNo ratings yet

- Zyblat - Solicitors Regulation Authority TribunalDocument4 pagesZyblat - Solicitors Regulation Authority TribunalhyenadogNo ratings yet

- Civil Case 46 of 2015Document16 pagesCivil Case 46 of 2015wanyamaNo ratings yet

- Equiv Alent Citation: (2001) 45C La48 (Ap), (2002) 112C Ompc As211 (Ap), (2001) 5C Omplj45 (Ap)Document16 pagesEquiv Alent Citation: (2001) 45C La48 (Ap), (2002) 112C Ompc As211 (Ap), (2001) 5C Omplj45 (Ap)Krishna KumarNo ratings yet

- Adjudication Order in Respect of Mr. Madhukar Chimanlal Sheth in The Matter of M/s.Fact Enterprise Ltd.Document20 pagesAdjudication Order in Respect of Mr. Madhukar Chimanlal Sheth in The Matter of M/s.Fact Enterprise Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of Shri Mahendra P Rathod in The Matter of SEL Manufacturing Co Ltd.Document7 pagesAdjudication Order in Respect of Shri Mahendra P Rathod in The Matter of SEL Manufacturing Co Ltd.Shyam SunderNo ratings yet

- Order in The Matter of SPNJ Land Projects and Developers India LimitedDocument15 pagesOrder in The Matter of SPNJ Land Projects and Developers India LimitedShyam SunderNo ratings yet

- Agency and Partnership CasesDocument560 pagesAgency and Partnership Caseseka1992No ratings yet

- Remedial Law Case - EIZMENDI JR. VS. FERNANDEZDocument2 pagesRemedial Law Case - EIZMENDI JR. VS. FERNANDEZUPDkathNo ratings yet

- Eizmendi V. FernandezDocument10 pagesEizmendi V. FernandezMartin Franco SisonNo ratings yet

- Francisco Eizmendi, Jr. vs. Teodorico Fernandez, G.R. No. 215280, 05 September 2018Document13 pagesFrancisco Eizmendi, Jr. vs. Teodorico Fernandez, G.R. No. 215280, 05 September 2018Regienald BryantNo ratings yet

- Stay ShanthiDocument6 pagesStay Shanthibala premNo ratings yet

- Civil Application 55 of 2020Document6 pagesCivil Application 55 of 2020elisha sogomoNo ratings yet

- Order-In The Matter of PAFL Industries LimitedDocument19 pagesOrder-In The Matter of PAFL Industries LimitedShyam SunderNo ratings yet

- Adjudication Order Against Shri Suresh Kumar in The Matter of CDI International LimitedDocument8 pagesAdjudication Order Against Shri Suresh Kumar in The Matter of CDI International LimitedShyam SunderNo ratings yet

- National Company Law Appellate Tribunal (From New Delhi) (F.B.)Document5 pagesNational Company Law Appellate Tribunal (From New Delhi) (F.B.)ashutosh srivastavaNo ratings yet

- HH 188-23Document40 pagesHH 188-23hazelNo ratings yet

- Item 22Document3 pagesItem 22maandilraj1No ratings yet

- Adjudication Order in The Matter of Grauer & Weil India Limited in Respect of Non Redressal of Investor GrievancesDocument7 pagesAdjudication Order in The Matter of Grauer & Weil India Limited in Respect of Non Redressal of Investor GrievancesShyam SunderNo ratings yet

- Adjudication Order in Respect of Vinod Shares Ltd. in The Matter of Maharashtra Polybutenes Ltd.Document17 pagesAdjudication Order in Respect of Vinod Shares Ltd. in The Matter of Maharashtra Polybutenes Ltd.Shyam SunderNo ratings yet

- Ali Vs Atty BubongDocument8 pagesAli Vs Atty BubongNievesAlarconNo ratings yet

- Sy Vs CaDocument9 pagesSy Vs CaCarol JacintoNo ratings yet

- Maruti Udyog Employees Union ... Vs State of Haryana On 15 December, 2000 PDFDocument17 pagesMaruti Udyog Employees Union ... Vs State of Haryana On 15 December, 2000 PDFDithhi BhattacharyaNo ratings yet

- Miscellaneous Application - Delay CondonationDocument5 pagesMiscellaneous Application - Delay CondonationGeet ShikharNo ratings yet

- UntitledDocument29 pagesUntitledRiddhi TalrejaNo ratings yet

- Order in The Matter of Vaibhav Pariwar India Projects LimitedDocument19 pagesOrder in The Matter of Vaibhav Pariwar India Projects LimitedShyam SunderNo ratings yet

- 2022 135 Taxmann Com 252 SC 2022 171 SCL 413 SC 2022 232 COMP CASE 136 SC 18 02 2022Document59 pages2022 135 Taxmann Com 252 SC 2022 171 SCL 413 SC 2022 232 COMP CASE 136 SC 18 02 2022Shashwat SinghNo ratings yet

- Order in The Matter of G. N. Dairies LimitedDocument10 pagesOrder in The Matter of G. N. Dairies LimitedShyam SunderNo ratings yet

- Narinder Batra Vs Union of India UOI 02032009 DELD090392COM416685Document78 pagesNarinder Batra Vs Union of India UOI 02032009 DELD090392COM416685Priya singhNo ratings yet

- Failure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSDocument4 pagesFailure To Detect and Report The Scams That Took Place Involving IL&FS and Its 21 Entities When They Were The Auditors of The IL&FSJay NirupamNo ratings yet

- Estafa MisappropriationDocument16 pagesEstafa MisappropriationMadeleine Bayani-De MesaNo ratings yet

- Interim Order in The Matter of Neesa Technologies LimitedDocument14 pagesInterim Order in The Matter of Neesa Technologies LimitedShyam SunderNo ratings yet

- OMAR P. ALI, Complainant, vs. ATTY. MOSIB A. BUBONG, RespondentDocument10 pagesOMAR P. ALI, Complainant, vs. ATTY. MOSIB A. BUBONG, RespondentbchiefulNo ratings yet

- Settlement Order - United SpiritsDocument5 pagesSettlement Order - United SpiritsrupalNo ratings yet

- Order in The Matter of Pancard Clubs LimitedDocument84 pagesOrder in The Matter of Pancard Clubs LimitedShyam SunderNo ratings yet

- Bail Application Bhanuprasad TrivediDocument9 pagesBail Application Bhanuprasad TrivediRajdeep MukherjeeNo ratings yet

- Shirin Moosajee Vs Juzer Zakiuddin Mohamedali 2 Others (Commercial Application 2 of 2021) 2022 TZHCComD 155 (2 June 2022)Document12 pagesShirin Moosajee Vs Juzer Zakiuddin Mohamedali 2 Others (Commercial Application 2 of 2021) 2022 TZHCComD 155 (2 June 2022)nubitse94No ratings yet

- Interim Order in The Matter of Mass Infra Realty LimitedDocument17 pagesInterim Order in The Matter of Mass Infra Realty LimitedShyam Sunder0% (1)

- text1.pdfDocument6 pagestext1.pdfSherullah MemonNo ratings yet

- Susela Padmavathy Amma V Bharti Airtel Limitedwatermark 1600371Document21 pagesSusela Padmavathy Amma V Bharti Airtel Limitedwatermark 1600371Vivek TiwariNo ratings yet

- 2023 17 1501 48447 Judgement 20-Nov-2023Document24 pages2023 17 1501 48447 Judgement 20-Nov-2023Sanjay SrivastavaNo ratings yet

- Order in Respect of Just-Reliable Projects India LimitedDocument23 pagesOrder in Respect of Just-Reliable Projects India LimitedShyam SunderNo ratings yet

- Case Digest LaborDocument32 pagesCase Digest LaborEsp BsbNo ratings yet

- Ho HupDocument25 pagesHo Hupcacamarba20036236No ratings yet

- Rajeev Saumitra Vs Neetu SinghDocument46 pagesRajeev Saumitra Vs Neetu Singhsorien panditNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Gktoday Mcqs May 19Document81 pagesGktoday Mcqs May 19JibanNo ratings yet

- Risk Management PolicyDocument10 pagesRisk Management Policymahak guptaNo ratings yet

- Postal Ballot NoticeDocument6 pagesPostal Ballot NoticeFeby SamNo ratings yet

- Annual Reports Epleo9 PDFDocument213 pagesAnnual Reports Epleo9 PDFpinky gargNo ratings yet

- Investor Protection: by Vinay BabbarDocument7 pagesInvestor Protection: by Vinay BabbarasdNo ratings yet

- FAQs BASL MembershipDocument4 pagesFAQs BASL MembershipPranoti PatilNo ratings yet

- Adjudication Order Against Kothari Global Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Kothari Global Limited in The Matter of SCORESShyam SunderNo ratings yet

- Voltas24aprfut Ra 01042024104036Document6 pagesVoltas24aprfut Ra 01042024104036Mukesh SainiNo ratings yet

- SingerDocument2 pagesSingernaresh kayadNo ratings yet

- Securities Laws Coloured Notes CS Executive CS Vikas Vohra YESDocument352 pagesSecurities Laws Coloured Notes CS Executive CS Vikas Vohra YESpkkavithaaNo ratings yet

- 123Document373 pages123Roshanlal123No ratings yet

- Im - Infra Series IVDocument89 pagesIm - Infra Series IVdroy21No ratings yet

- Adani Green Energy Limited - Information Memorandum PDFDocument379 pagesAdani Green Energy Limited - Information Memorandum PDFRAKESH BABUNo ratings yet

- Date: 19 October 2021: Shilpa Medicare LimitedDocument30 pagesDate: 19 October 2021: Shilpa Medicare LimitedSangram KendreNo ratings yet

- Scheme & Scope of Power of SEBIDocument22 pagesScheme & Scope of Power of SEBIKanchan Ks SamantNo ratings yet

- Morning India 20210323 Mosl Motilal OswalDocument8 pagesMorning India 20210323 Mosl Motilal Oswalvikalp123123No ratings yet

- I S C I: Appeal No. /2019Document39 pagesI S C I: Appeal No. /2019RUDRAKSH KARNIKNo ratings yet

- Only Banking Monthly Banking Awareness PDF AugustDocument117 pagesOnly Banking Monthly Banking Awareness PDF AugustMadhumita kumariNo ratings yet

- Foreign Direct Investment in IndiaDocument30 pagesForeign Direct Investment in Indiadevesh bhattNo ratings yet

- Settlement Order in Respect of Mr. Nalin PasrichaDocument5 pagesSettlement Order in Respect of Mr. Nalin PasrichaShyam SunderNo ratings yet

- A Study On Competency Mapping of The Employees of Reliance Mutual Fund"Document117 pagesA Study On Competency Mapping of The Employees of Reliance Mutual Fund"nishamanghani190067% (3)

- Order in The Matter of M/s.Peers Allied Corporation LTDDocument28 pagesOrder in The Matter of M/s.Peers Allied Corporation LTDShyam SunderNo ratings yet

- Settlement Order in Respect of Vishal K Mahadevia in The Matter of M/s Tak Machinery and Leasing Limited (Now Known As "M/s Mangal Credit & Fincorp Limited")Document4 pagesSettlement Order in Respect of Vishal K Mahadevia in The Matter of M/s Tak Machinery and Leasing Limited (Now Known As "M/s Mangal Credit & Fincorp Limited")Shyam SunderNo ratings yet

- SEBI Meaning: Securities Mutual FundsDocument13 pagesSEBI Meaning: Securities Mutual FundsVipra VashishthaNo ratings yet

- Regulation by SEBI, Takeover CodeDocument28 pagesRegulation by SEBI, Takeover CodemonuNo ratings yet

- Filed DRHP - 20200825121338Document436 pagesFiled DRHP - 20200825121338SubscriptionNo ratings yet

- Annualreportwithaddendumnotice PDFDocument280 pagesAnnualreportwithaddendumnotice PDFRakesh KNo ratings yet

- PDFDocument364 pagesPDFSmita mohantyNo ratings yet