Professional Documents

Culture Documents

Stockquotes 05202016

Stockquotes 05202016

Uploaded by

Radney BallentosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stockquotes 05202016

Stockquotes 05202016

Uploaded by

Radney BallentosCopyright:

Available Formats

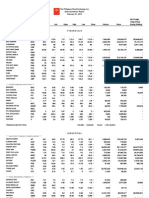

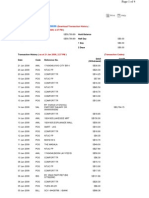

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

MAIN BOARD

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

FINANCIALS

**** BANKS ****

ASIA UNITED

AUB

45.5

45.95

45.95

45.95

45.3

45.95

9,400

428,465

101,090

BDO UNIBANK

BDO

102

102.1

103

104.2

101.9

102

2,039,430

208,794,827

(12,354,318)

BANK PH ISLANDS

BPI

92.2

92.8

92.8

92.8

91.45

92.2

1,494,190

137,604,956.5

(34,296,466.5)

CHINABANK

CHIB

37.9

38

38.25

38.25

37.5

38

66,400

2,514,555

CITYSTATE BANK

EXPORT BANK A

EXPORT BANK B

EAST WEST BANK

CSB

EIBA

EIBB

EW

9.11

16.94

10

17

17.48

17.48

16.84

17

364,600

6,195,106

(2,706,592)

METROBANK

MBT

84.4

84.45

85.5

85.5

83.5

84.4

1,713,010

144,641,558.5

(10,241,181.5)

NEXTGENESIS

PB BANK

NXGEN

PBB

14.8

15.08

14.62

15

14.62

15

10,200

151,822

PBCOM

PBC

23.8

24

24

24.2

24

24

6,000

144,200

PHIL NATL BANK

PNB

50.9

51

51.7

51.95

50.9

51

191,260

9,769,618.5

(1,672,224)

PSBANK

PHILTRUST

PSB

PTC

96.3

437

102.4

479

437

437

437

437

110

48,070

RCBC

RCB

31.5

31.55

31.8

31.8

31.35

31.5

169,700

5,342,845

1,117,825

SECURITY BANK

SECB

191.8

192.6

190

193.2

189.3

192.6

1,852,080

354,664,442

94,013,032

UNION BANK

UBP

64.45

64.5

65.3

65.4

64.5

64.5

84,960

5,514,620

568,957

**** OTHER FINANCIAL INSTITUTIONS ****

AG FINANCE

AGF

3.63

3.7

3.88

3.9

3.42

3.74

1,052,000

3,808,900

35,000

BRIGHT KINDLE

BKR

1.45

1.53

1.44

1.54

1.43

1.54

96,000

143,880

BDO LEASING

BLFI

2.95

3.07

2.95

2.95

38,000

112,150

COL FINANCIAL

COL

14.1

14.3

14.1

14.3

14.1

14.3

11,700

166,090

(25,380)

FIRST ABACUS

FILIPINO FUND

FAF

FFI

0.7

7.18

0.73

7.49

7.21

7.49

7.17

7.49

28,100

202,133

IREMIT

1.85

1.86

1.9

1.9

1.86

1.86

58,000

108,920

MEDCO HLDG

MED

0.55

0.6

0.6

0.6

0.56

0.6

429,000

244,610

MANULIFE

NTL REINSURANCE

PHIL STOCK EXCH

MFC

NRCP

PSE

590

0.96

266

600

0.97

270

600

0.97

270

600

0.97

270

600

0.97

268

600

0.97

268

10

8,000

30

6,000

7,760

8,060

SUN LIFE

VANTAGE

SLF

V

1,375

1.54

1,399

1.58

1,370

-

1,370

-

1,370

-

1,370

-

30

-

41,100

-

FINANCIALS SECTOR TOTAL

VOLUME :

9,722,210

VALUE :

880,664,688.5

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ALSONS CONS

ABOITIZ POWER

ACR

AP

ENERGY DEVT

EDC

FIRST GEN

FGEN

FIRST PHIL HLDG

1.86

45

1.87

45.2

1.86

45.5

1.91

46.05

1.83

44.05

1.87

45.2

8,947,000

1,919,600

16,686,630

87,013,755

5,146,940

(42,723,360)

5.6

5.63

5.72

5.73

5.6

5.6

8,362,300

47,102,178

(31,086,479)

21.2

21.6

21.5

21.6

20.9

21.6

1,205,500

25,544,445

(6,470,560)

FPH

67.05

67.1

69.3

69.45

66

67.1

108,780

7,297,002

(3,130,314)

PHIL H2O

MERALCO

H2O

MER

3.06

321

3.1

321.6

325

325.2

318.6

321.6

441,120

141,476,676

(14,605,952)

MANILA WATER

MWC

27

27.2

27.2

27.5

26.5

27.05

684,100

18,412,060

(2,817,700)

PETRON

PCOR

11.1

11.2

11.4

11.5

11.1

11.1

3,162,400

35,300,194

(6,962,224)

PHX PETROLEUM

PNX

5.39

5.4

5.49

5.5

5.4

5.4

459,100

2,508,724

(5,500)

SPC POWER

TA OIL

SPC

TA

2.49

2.51

2.51

2.51

2.47

2.5

2,003,000

4,997,350

1,246,439.9997

VIVANT

VVT

31.5

32.9

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

3.6

3.72

3.68

3.73

3.22

3.72

1,050,000

3,585,490

(64,900)

BOGO MEDELLIN

BMM

56

63.9

60

63.9

55.1

55.6

380

22,601

CNTRL AZUCARERA

CENTURY FOOD

CAT

CNPF

190

21.25

205

21.3

21.75

21.75

20.65

21.3

2,304,600

49,051,375

13,826,500

DEL MONTE

DMPL

10.74

10.76

10.76

10.8

10.72

10.76

28,800

309,552

DNL INDUS

DNL

9.65

9.7

9.72

9.74

9.5

9.7

3,441,400

33,123,921

27,056,251

EMPERADOR

EMP

7.32

7.4

7.3

7.46

7.29

7.4

399,700

2,954,406

557,199

ALLIANCE SELECT

FOOD

0.89

0.91

0.88

0.93

0.88

0.91

123,000

109,660

(1,780)

GINEBRA

GSMI

12.6

12.64

13

13

12.64

12.64

28,200

364,188

(34,128)

JOLLIBEE

JFC

235

235.8

233.6

237

233

235

708,500

167,079,832

39,430,692

LIBERTY FLOUR

MACAY HLDG

LFM

MACAY

34

37.6

40.95

39.8

37.5

39.9

37.5

39.9

700

26,730

MAXS GROUP

MAXS

23.55

24

24.1

24.1

23.5

24

319,900

7,642,935

MG HLDG

PUREFOODS

MG

PF

0.275

217

0.29

218

0.29

217

0.305

217

0.275

216.4

0.29

217

1,060,000

6,010

300,600

1,301,422

188,676

PEPSI COLA

PIP

3.41

3.55

3.45

3.45

3.4

3.41

906,000

3,090,390

2,595,240

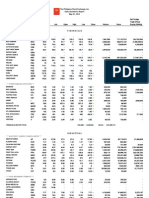

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

ROXAS AND CO

RCI

2.3

2.59

2.3

2.3

2.3

2.3

1,000

2,300

RFM CORP

ROXAS HLDG

SWIFT FOODS

RFM

ROX

SFI

4.25

4.55

0.153

4.27

4.7

0.155

4.3

0.156

4.32

0.156

4.25

0.154

4.25

0.155

1,677,000

2,330,000

7,131,470

361,550

(94,750)

-

UNIV ROBINA

URC

202.6

203.2

202.8

205

201

202.6

2,091,280

423,945,024

(107,468,188)

VITARICH

VITA

0.88

0.9

0.88

0.9

0.87

0.88

8,380,000

7,375,660

68,050

VICTORIAS

VMC

4.6

4.8

4.6

4.6

4.6

4.6

5,000

23,000

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

13.8

14

14.8

15

13.62

14

5,900

80,950

CONCRETE A

CA

195

201

200

200

193

195

1,040

203,950

CONCRETE B

DAVINCI CAPITAL

CAB

DAVIN

15

4.62

4.64

4.62

4.64

4.62

4.62

119,000

549,860

388,080

EEI CORP

EEI

1,139,370

HOLCIM

HLCM

MEGAWIDE

MWIDE

PHINMA

PHN

PNCC

SUPERCITY

TKC METALS

PNC

SRDC

T

VULCAN INDL

7.45

7.46

7.45

7.5

7.4

7.45

353,000

2,628,449

15.08

15.1

15.34

15.4

15.1

15.1

37,100

565,442

6.7

6.73

6.55

6.85

6.55

6.73

1,123,200

7,614,645

(1,459,220)

11.54

11.62

11.6

11.62

11.6

11.62

700

8,124

1.2

2.08

2.09

2.24

2.08

7,280,000

15,224,560

(83,050)

VUL

1.3

1.33

1.3

1.3

1.3

1.3

18,000

23,400

110

2.2

150

2.21

2.19

2.21

2.19

2.21

179,000

393,050

(66,000)

EUROMED

LMG CHEMICALS

CIP

CROW

N

EURO

LMG

1.7

1.84

1.82

2.16

1.7

2.16

1.7

2.16

1.7

2.16

1.7

2.16

2,000

5,000

3,400

10,800

MABUHAY VINYL

MVC

3.36

3.49

3.35

3.5

3.35

3.35

18,000

61,280

PRYCE CORP

PPC

2.68

2.74

2.71

2.75

2.67

2.74

174,000

469,880

**** CHEMICALS ****

CHEMPHIL

CROWN ASIA

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CONCEPCION

CIC

45.5

46.45

46.45

46.45

46

46

12,100

556,690

(547,400)

GREENERGY

INTEGRATED MICR

IONICS

GREEN

IMI

ION

5.6

2.29

5.7

2.3

5.6

2.3

5.74

2.35

5.6

2.23

5.6

2.3

734,900

1,193,000

4,128,952

2,721,460

3,584,460

-

PANASONIC

PHX SEMICNDCTR

PMPC

PSPC

4.14

1.79

4.6

1.8

1.85

1.87

1.7

1.79

2,799,000

4,957,460

(55,610)

CIRTEK HLDG

TECH

17.82

18

17.82

18

17.6

18

244,500

4,383,088

8,850

FILSYN A

FILSYN B

PICOP RES

SPLASH CORP

FYN

FYNB

PCP

SPH

2.5

2.52

2.51

2.53

2.49

2.5

309,000

773,630

STENIEL

STN

16,580,000

7,287,050

57,800

(48,290,370)

**** OTHER INDUSTRIALS ****

INDUSTRIAL SECTOR TOTAL

VOLUME :

66,771,800

VALUE :

1,140,350,164

HOLDING FIRMS

**** HOLDING FIRMS ****

ASIA AMLGMATED

ABACORE CAPITAL

AAA

ABA

0.425

0.43

AYALA CORP

ABOITIZ EQUITY

0.425

0.465

0.415

0.43

AC

794

AEV

71.9

796

807

72

71.2

819.5

790

794

382,330

305,229,995

73.5

71.15

72

4,734,720

341,612,218

ALLIANCE GLOBAL

AGI

14.2

14.22

14.56

169,859,869

14.56

14.04

14.22

4,571,400

64,863,378

(21,689,728)

ANSCOR

ANS

5.98

6.1

6.1

ANGLO PHIL HLDG

ATN HLDG A

APO

ATN

1.19

0.34

1.25

0.345

1.19

0.37

1.22

0.385

1.19

0.33

1.22

0.34

9,800

58,810

144,000

21,200,000

171,890

7,401,550

ATN HLDG B

ATNB

0.335

0.36

0.355

0.38

0.33

0.335

BHI HLDG

COSCO CAPITAL

BH

COSCO

409

7.68

949.5

7.69

7.77

7.77

7.67

7.69

1,390,000

482,800

73,800

574,600

4,435,430

1,088,605

DMCI HLDG

DMC

12.94

12.96

12.88

12.98

12.88

FILINVEST DEV

FDC

6.2

6.28

6.2

6.28

6.17

12.96

9,606,700

124,280,974

(23,458,320)

6.28

506,000

3,171,814

FJ PRINCE A

FJP

5.04

5.26

5.05

5.05

5.04

5.04

6,100

30,747

FJ PRINCE B

FORUM PACIFIC

GT CAPITAL

FJPB

FPI

GTCAP

5.01

0.25

1,373

5.9

0.265

1,380

0.25

1,410

0.27

1,421

0.248

1,380

0.265

1,380

150,000

91,795

38,120

127,496,120

(25,548,040)

HOUSE OF INV

HI

6.3

6.4

6.2

6.39

6.2

6.3

31,400

198,656

JG SUMMIT

JGS

92.5

92.55

93

93.25

92.55

92.55

3,807,160

353,600,739.5

64,684,691

JOLLIVILLE HLDG

KEPPEL HLDG A

JOH

KPH

4.01

5.2

5.39

5.99

5.34

5.34

5.2

5.2

4,800

25,250

KEPPEL HLDG B

LODESTAR

LOPEZ HLDG

KPHB

LIHC

LPZ

5.35

0.69

7.63

5.79

0.71

7.65

5.35

0.69

7.82

5.35

0.71

7.82

5.35

0.69

7.63

5.35

0.69

7.65

5,900

85,000

1,329,300

31,565

58,690

10,174,702

308,324

LT GROUP

LTG

13.7

13.9

13.7

13.9

13.68

13.9

2,909,700

40,421,756

33,347,072

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

METRO GLOBAL

MABUHAY HLDG

MJC INVESTMENTS

METRO PAC INV

MGH

MHC

MJIC

MPI

0.48

2.87

5.89

0.52

3.57

5.9

6.1

6.1

5.9

5.9

27,504,400

163,407,905

(5,379,674)

PACIFICA

PRIME ORION

PA

POPI

0.032

1.78

0.033

1.8

0.032

1.84

0.033

1.84

0.032

1.78

0.032

1.78

60,700,000

495,000

1,943,400

881,320

1,382,400

-

PRIME MEDIA

PRIM

1.32

1.49

1.38

1.38

1.32

1.32

31,000

41,370

REPUBLIC GLASS

REG

2.62

2.7

2.62

2.62

2.62

2.62

15,000

39,300

SOLID GROUP

SGI

1.16

1.2

1.2

1.2

1.16

1.2

91,000

106,630

SYNERGY GRID

SM INVESTMENTS

SGP

SM

190

955

215

960

190

985

190

985

190

950

190

955

70

13,300

488,910

467,381,155

(140,665,020)

SAN MIGUEL CORP

SMC

71

73.4

72

73.4

71

73.4

85,840

6,178,145

(150,542.5)

SOC RESOURCES

SOC

0.87

0.91

0.93

0.93

0.85

0.91

259,000

224,790

SEAFRONT RES

SPM

2.14

2.22

2.22

2.22

2.22

2.22

1,000

2,220

TOP FRONTIER

TFHI

157.9

158

152.1

158

152

158

4,950

769,463

UNIOIL HLDG

WELLEX INDUS

UNI

WIN

0.315

0.21

0.33

0.213

0.32

0.216

0.33

0.227

0.31

0.21

0.32

0.214

7,260,000

2,285,950

47,250

3,480,000

741,990

ZEUS HLDG

ZHI

0.33

0.345

0.35

0.35

0.33

0.345

11,650,000

3,928,250

HOLDING FIRMS SECTOR TOTAL

VOLUME :

180,466,215

VALUE :

2,061,716,468

PROPERTY

**** PROPERTY ****

ARTHALAND CORP

ALCO

0.26

0.27

0.265

0.265

0.26

0.26

20,000

5,250

ANCHOR LAND

AYALA LAND

ALHI

ALI

7.12

34.9

7.91

34.95

35.3

35.9

34.85

34.9

12,668,800

443,388,300

(45,169,500)

ARANETA PROP

ARA

2.15

2.17

2.12

2.2

2.1

2.15

422,000

897,450

10,650

BELLE CORP

BEL

3.07

3.14

3.08

3.14

3.05

3.14

650,000

2,026,510

1,104,250

A BROWN

CITYLAND DEVT

CROWN EQUITIES

BRN

CDC

CEI

1.22

0.98

0.13

1.23

1

0.132

1.29

0.134

1.3

0.136

1.18

0.13

1.23

0.131

3,085,000

-

3,809,560

-

37,780

-

6,510,000

857,610

CEBU HLDG

CHI

5.15

5.2

5.15

5.2

5.15

5.15

26,600

137,540

CENTURY PROP

CPG

0.52

0.53

0.53

0.53

0.52

0.52

1,819,000

952,220

CEBU PROP A

CEBU PROP B

CYBER BAY

CPV

CPVB

CYBR

5.68

5.68

0.5

5.98

6.39

0.51

0.51

0.52

0.5

0.5

7,110,000

3,568,950

32,320

DOUBLEDRAGON

DD

48.5

49

48.8

49

47.5

49

930,000

44,994,420

10,520,050

EMPIRE EAST

ELI

0.81

0.83

0.81

0.81

0.81

0.81

1,000

810

EVER GOTESCO

EVER

0.152

0.16

0.16

0.16

0.16

0.16

10,000

1,600

FILINVEST LAND

FLI

1.89

1.94

1.95

1.95

1.86

1.94

16,674,000

31,766,290

(10,580,680)

GLOBAL ESTATE

8990 HLDG

GERI

HOUSE

0.97

7.54

0.98

7.55

1

7.5

1

7.6

0.97

7.5

0.98

7.55

1,171,000

289,700

1,146,510

2,187,697

1,000

(1,145,851)

IRC PROP

IRC

1.25

1.27

1.28

1.28

1.28

1.28

150,000

192,000

(120,320)

KEPPEL PROP

CITY AND LAND

MEGAWORLD

KEP

LAND

MEG

4.4

0.95

4.1

4.7

1.05

4.11

4.7

4.25

4.7

4.3

4.7

4.11

4.7

4.11

2,000

38,147,000

9,400

158,338,260

(5,475,410)

MRC ALLIED

MRC

0.09

0.092

0.092

0.092

0.09

0.092

480,000

43,840

PHIL ESTATES

PHES

0.265

0.27

0.26

0.3

0.26

0.27

150,000

40,900

PRIMETOWN PROP

PRIMEX CORP

ROBINSONS LAND

PMT

PRMX

RLC

8.56

28.1

8.59

28.2

28.5

28.65

27.85

28.2

2,479,700

69,898,260

(41,296,195)

PHIL REALTY

RLT

0.46

0.47

0.485

0.485

0.46

0.46

300,000

141,350

ROCKWELL

ROCK

1.51

1.59

1.6

1.6

1.55

1.59

394,000

621,830

200,530

SHANG PROP

STA LUCIA LAND

SM PRIME HLDG

SHNG

SLI

SMPH

3.08

0.88

23.5

3.1

0.9

23.55

0.93

24

0.93

24

0.88

23.05

0.9

23.5

831,000

21,912,300

738,820

513,313,175

(7,200)

(209,898,615)

STARMALLS

SUNTRUST HOME

PTFC REDEV CORP

STR

SUN

TFC

5.95

1.02

35.1

6.65

1.03

40

1.01

53.5

1.07

53.5

1.01

30

1.04

42

443,000

5,300

457,020

205,445

(153,000)

-

UNIWIDE HLDG

VISTA LAND

UW

VLL

5.03

5.04

5.1

5.16

5.02

5.04

5,921,100

29,977,868

(2,942,119)

PROPERTY SECTOR TOTAL

VOLUME :

122,602,500

VALUE :

1,309,718,885

SERVICES

**** MEDIA ****

ABS CBN

ABS

52

52.1

52.5

52.5

51.9

52.1

59,780

3,114,126

GMA NETWORK

GMA7

6.56

6.58

6.64

6.64

6.55

6.58

120,900

796,868

MANILA BULLETIN

MB

0.58

0.6

0.59

0.59

0.58

0.58

200,000

116,360

MLA BRDCASTING

MBC

19.22

20.1

20.1

20.1

19.2

20

6,800

135,322

2,160

2,168

2,226

2,226

2,160

2,160

31,705

68,933,390

(36,012,390)

4.14

4.17

4.27

4.3

4.1

4.17

210,000

875,450

**** TELECOMMUNICATIONS ****

GLOBE TELECOM

GLO

LIBERTY TELECOM

LIB

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

Name

PTT CORP

PLDT

Symbol

PTT

TEL

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

1,658

1,660

1,698

1,698

1,650

1,660

191,535

319,111,260

(152,976,640)

6.95

16.7

7

16.9

6.99

17.9

7

18.88

6.93

16.1

6.95

16.7

108,500

96,000

756,886

1,656,608

65,330

-

**** INFORMATION TECHNOLOGY ****

DFNN INC

IMPERIAL A

DFNN

IMP

IMPERIAL B

IMPB

169

190

195

240

169

198

1,550

294,026

(6,300)

ISLAND INFO

IS

0.34

0.345

0.36

0.365

0.335

0.34

31,500,000

10,956,550

51,000

ISM COMM

ISM

1.69

1.7

1.8

1.8

1.63

1.69

6,979,000

11,836,370

68,300

JACKSTONES

NOW CORP

JAS

NOW

2.4

2.96

2.5

2.99

2.56

3.1

2.75

3.17

2.26

2.9

2.5

2.96

308,000

794,550

(13,000)

17,756,000

54,378,710

(93,300)

TRANSPACIFIC BR

PHILWEB

YEHEY CORP

TBGI

WEB

YEHEY

1.86

23.5

6.92

1.9

23.85

7

23.85

7.22

23.85

7.22

23.65

6.9

23.85

7

21,000

102,600

500,815

714,762

(4,735)

-

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

7.31

7.35

7.41

7.41

7.3

7.35

66,400

487,104

ASIAN TERMINALS

ATI

11.1

11.42

11.1

11.1

11.1

11.1

100

1,110

1,110

CEBU AIR

CEB

92.6

92.65

92.95

92.95

92.2

92.65

505,620

46,810,547

30,952,023

INTL CONTAINER

ICT

62.2

62.55

63.1

63.2

62

62.3

1,130,550

70,419,412

(27,627,425)

LBC EXPRESS

LBC

10.32

10.68

10.4

10.68

10.3

10.68

54,800

564,986

LORENZO SHIPPNG

MACROASIA

METROALLIANCE A

METROALLIANCE B

PAL HLDG

GLOBALPORT

HARBOR STAR

LSC

MAC

MAH

MAHB

PAL

PORT

TUGS

1.16

2.62

4.9

1.14

1.25

2.75

5

1.18

4.9

1.18

4.9

1.18

4.9

1.12

4.9

1.18

6,000

157,000

29,400

180,000

**** HOTEL & LEISURE ****

ACESITE HOTEL

BOULEVARD HLDG

ACE

BHI

1.3

0.055

1.37

0.056

0.058

0.058

0.055

0.055

59,640,000

3,293,570

DISCOVERY WORLD

DWC

1.75

1.88

1.84

1.95

1.84

1.88

14,000

26,390

GRAND PLAZA

GPH

21.1

24

21.2

21.2

21.2

21.2

100

2,120

WATERFRONT

WPI

0.35

0.365

0.37

0.385

0.35

0.35

290,000

106,850

51,100

CENTRO ESCOLAR

FAR EASTERN U

CEU

FEU

9.15

940

9.55

1,000

9.55

970

9.55

970

9.55

970

9.55

970

100

500

955

485,000

IPEOPLE

IPO

11.54

12.48

11.54

11.54

11.5

11.54

83,600

964,096

STI HLDG

STI

0.58

0.59

0.6

0.6

0.58

0.58

7,119,000

4,140,000

11,800

BERJAYA

BLOOMBERRY

BCOR

BLOOM

22.4

4.23

28.4

4.25

4.39

4.39

4.2

4.25

3,082,000

13,285,460

(2,226,700)

IP EGAME

EG

0.0098

0.011

0.01

0.011

0.0099

0.011

24,200,000

241,900

PACIFIC ONLINE

LOTO

17.02

17.4

17.1

17.1

17.1

17.1

250,500

4,283,550

LEISURE AND RES

LR

7.56

7.68

7.74

7.74

7.68

7.68

1,100

8,482

3,870

MELCO CROWN

MCP

2.22

2.23

2.29

2.31

2.2

2.23

7,106,000

15,853,810

(2,220,010)

MANILA JOCKEY

MJC

1.98

2.02

1.98

1.98

84,000

167,120

(89,520)

PREMIUM LEISURE

PLC

0.87

0.88

0.9

0.9

0.87

0.88

2,462,000

2,175,500

209,590

PHIL RACING

TRAVELLERS

PRC

RWM

8.66

3.37

8.99

3.38

3.38

3.4

3.36

3.37

702,000

2,367,820

1,160,350

CALATA CORP

CAL

3.06

3.08

3.12

3.14

3.08

878,000

2,680,040

9,240

METRO RETAIL

MRSGI

3.9

3.94

3.86

3.95

3.86

3.93

261,000

1,019,650

(3,870)

PUREGOLD

PGOLD

41.65

41.7

41.85

41.9

41.65

41.7

910,600

37,991,555

19,805,055

ROBINSONS RTL

RRHI

77.55

77.65

78.95

78.95

77.55

77.65

349,730

27,154,566.5

(7,570,869.5)

PHIL SEVEN CORP

SEVN

108.1

114

115

115

109

114.9

370

41,110

11,490

SSI GROUP

SSI

2.83

2.84

2.79

2.89

2.78

2.84

3,503,000

9,927,920

(882,000)

APC GROUP

EASYCALL

APC

ECP

0.63

2.8

0.64

3.37

0.63

2.81

0.65

2.81

0.62

2.8

0.63

2.8

1,715,000

5,000

1,080,540

14,030

IPM HLDG

IPM

9.6

9.69

9.55

9.69

9.53

9.69

711,200

6,888,538

4,843,510

PAXYS

PRMIERE HORIZON

PAX

PHA

2.41

0.395

2.56

0.415

2.41

0.42

2.41

0.42

2.41

0.395

2.41

0.395

2,000

3,820,000

4,820

1,524,550

PHILCOMSAT

SBS PHIL CORP

PHC

SBS

6.52

6.58

6.16

6.68

6.11

6.58

5,457,200

35,695,452

(671,279)

**** EDUCATION ****

**** CASINOS & GAMING ****

**** RETAIL ****

**** OTHER SERVICES ****

SERVICES SECTOR TOTAL

VOLUME :

185,222,420

MINING & OIL

VALUE :

894,199,763.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

Name

ATOK

APEX MINING

ABRA MINING

Symbol

AB

APX

AR

Bid

12.4

2.38

0.0042

Ask

13.88

2.45

0.0043

Open

12.02

2.44

0.0043

High

13.88

2.45

0.0044

Low

12.02

2.35

0.0042

Close

13.88

2.44

0.0042

Volume

700

1,253,000

295,000,000

Value, Php

9,168

2,997,280

1,282,300

Net Foreign

Buying/(Selling),

Php

(243,500)

(26,960)

ATLAS MINING

AT

4.53

4.57

4.56

4.56

4.3

4.53

199,000

881,620

BENGUET A

BC

7.7

7.7

7.64

26,000

200,582

BENGUET B

BCB

8.5

7.65

7.75

7.64

7.65

30,600

235,009

(153,931)

COAL ASIA HLDG

COAL

0.52

0.53

0.53

0.53

0.51

0.53

884,000

454,690

CENTURY PEAK

DIZON MINES

FERRONICKEL

CPM

DIZ

FNI

8.6

0.89

9

0.9

9

0.9

9.3

0.91

9

0.88

9

0.89

7,600

15,575,000

68,430

13,857,160

903,400

GEOGRACE

GEO

0.295

0.305

0.32

0.32

0.295

0.295

2,470,000

732,100

LEPANTO A

LC

0.285

0.29

0.28

0.285

0.27

0.285

36,610,000

10,233,800

LEPANTO B

LCB

0.29

0.295

0.28

0.295

0.28

0.295

1,800,000

514,500

MANILA MINING A

MANILA MINING B

MA

MAB

0.015

0.016

0.016

0.017

0.016

0.016

0.016

0.016

0.015

0.016

0.016

0.016

356,900,000

38,100,000

5,367,900

609,600

48,000

MARCVENTURES

MARC

1.94

1.95

1.95

1.97

1.93

1.95

557,000

1,083,130

NIHAO

NICKEL ASIA

NI

NIKL

2.55

4.89

2.6

4.93

2.69

5.05

2.69

5.05

2.55

4.85

2.6

4.89

128,000

4,474,000

329,560

21,887,010

(11,873,720)

OMICO CORP

ORNTL PENINSULA

OM

ORE

0.61

1.35

0.62

1.36

1.4

1.4

1.32

1.35

387,000

524,130

PX MINING

PX

7.48

7.49

7.2

7.48

6.97

7.48

4,767,600

34,949,395

(1,025,944)

SEMIRARA MINING

SCC

126.9

127

127.5

127.7

126.5

127

1,370,380

173,615,696

(5,161,235)

UNITED PARAGON

UPM

0.013

0.014

0.014

0.014

0.013

0.013

156,300,000

2,046,900

BASIC ENERGY

BSC

0.24

0.247

0.24

0.24

0.24

0.24

130,000

31,200

ORNTL PETROL A

ORNTL PETROL B

PHILODRILL

PETROENERGY

OPM

OPMB

OV

PERC

0.01

0.0097

0.013

3.91

0.011

0.011

0.014

4

0.01

0.014

3.91

0.011

0.014

4

0.01

0.012

3.91

0.011

0.014

3.91

25,400,000

181,100,000

90,000

254,100

2,351,600

352,040

PX PETROLEUM

PXP

4.13

4.15

4.12

4.35

3.93

4.13

9,670,000

40,294,460

254,690

TA PETROLEUM

TAPET

3.88

3.9

4.09

4.2

3.82

3.9

2,177,000

8,591,180

(39,200)

VOLUME :

1,135,406,880

**** OIL ****

MINING & OIL SECTOR TOTAL

VALUE :

323,754,540

PREFERRED

ABC PREF

AC PREF A

AC PREF B1

AC PREF B2

BC PREF A

DMC PREF

FGEN PREF F

FGEN PREF G

FPH PREF

FPH PREF C

GLO PREF A

GLO PREF P

LR PREF

ABC

ACPA

ACPB1

ACPB2

BCP

DMCP

FGENF

FGENG

FPHP

FPHPC

GLOPA

GLOPP

LRP

525

535

15.02

702

109.1

117.2

460

518

1.1

535

540

33.4

116.4

118

535

1.12

525

535

1.11

525

535

1.11

525

535

1.1

525

535

1.1

3,000

10

341,000

1,575,000

5,350

377,310

MWIDE PREF

MWP

108.9

111

110.9

110.9

108.6

108.6

2,670

291,503

PF PREF

PF PREF 2

PNX PREF 3A

PFP

PFP2

PNX3A

1,020

103.8

1,025

107

1,020

106

1,020

106

1,020

106

1,020

106

100

3,000

102,000

318,000

(102,000)

-

PNX PREF 3B

PNX3B

106.3

112.4

106.1

106.1

106.1

106.1

110

11,671

PHOENIX PREF

PCOR PREF 2A

PCOR PREF 2B

PNXP

PRF2A

PRF2B

62

1,033

1,051

1,077

1,070

1,070

1,070

1,050

1,050

110

115,700

SFI PREF

SFIP

3.6

3.7

3.7

3.7

3.7

3,000

11,100

SMC PREF 2A

SMC PREF 2B

SMC PREF 2C

SMC2A

SMC2B

SMC2C

78

81

79.85

81.4

80.3

81

80.3

81

48,770

3,935,642

SMC PREF 2D

SMC PREF 2E

SMC PREF 2F

SMC2D

SMC2E

SMC2F

76.1

77.5

77.3

79

78

77.5

76.5

77.3

77.5

77.3

76.5

77.3

77.5

77.3

1,410

2,000

109,245

154,600

SMC PREF 2G

SMC PREF 2H

SMC2G

SMC2H

76.5

75.4

77.8

75.5

75.4

75.5

75.4

75.5

206,690

15,596,745.5

2,184,583.5

SMC PREF 2I

SMC2I

75.5

75.8

75.8

75.8

75.7

75.8

17,460

1,322,443

SMC PREF 1

PLDT II

TEL PREF JJ

SMCP1

TLII

TLJJ

37

-

PREFERRED TOTAL

VOLUME :

629,330

PHIL. DEPOSITARY RECEIPTS

VALUE :

23,926,309.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

Name

ABS HLDG PDR

GMA HLDG PDR

Symbol

ABSP

GMAP

Bid

51.6

6.26

Ask

51.95

6.49

Open

52

6.21

PHIL. DEPOSIT RECEIPTS TOTAL

High

52

6.26

VOLUME :

Low

51.45

6.2

Close

51.6

6.26

2,522,580

Volume

2,488,880

33,700

VALUE :

Value, Php

128,440,625

210,422

Net Foreign

Buying/(Selling),

Php

76,322,865.5

(73,238)

281,400

128,651,047

WARRANTS

LR WARRANT

LRW

2.88

2.9

2.98

WARRANTS TOTAL

2.98

2.88

VOLUME :

2.88

97,000

97,000

VALUE :

281,400

SMALL, MEDIUM & EMERGING

ALTERRA CAPITAL

ALT

4.03

4.04

7.4

7.8

3.71

4.03

48,467,800

223,026,552

1,810,948

ITALPINAS

IDC

3.01

3.05

3.05

3.01

28,000

84,360

MAKATI FINANCE

MFIN

3.57

3.94

3.61

3.94

3.6

3.94

9,000

33,770

XURPAS

17.34

17.38

17.22

17.7

17.2

17.38

704,100

12,250,252

(5,195,218)

1,024,681

SMALL, MEDIUM & EMERGING TOTAL

VOLUME :

49,208,900

VALUE :

235,394,934

EXCHANGE TRADED FUNDS

FIRST METRO ETF

FMETF

EXCHANGE TRADED FUNDS TOTAL

TOTAL MAIN BOARD

119.8

120.3

121.8

121.8

VOLUME :

VOLUME :

119.5

8,510

1,749,409,435

119.8

8,510

VALUE :

VALUE :

1,024,681

6,846,824,124

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

Name

Symbol

Bid

NO. OF ADVANCES:

NO. OF DECLINES:

NO. OF UNCHANGED:

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

56

140

42

NO. OF TRADED ISSUES:

NO. OF TRADES:

238

82,269

ODDLOT VOLUME:

ODDLOT VALUE:

71,860

207,007.47

BLOCK SALE VOLUME:

BLOCK SALE VALUE:

2,253,044

360,085,738.51

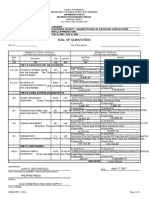

BLOCK SALES

SECURITY

PRICE

URC

201.6000

SCC

127.8576

TEL

1,703.3860

BDO

104.9000

VOLUME

975,884

303,980

14,010

959,170

VALUE

196,738,214.40

38,866,153.25

23,864,437.86

100,616,933.00

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining & Oil

SME

ETF

PSEi

All Shares

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,672.05

11,756.3

7,476.68

3,095.55

1,469.9

11,426.36

1,672.05

11,775.19

7,495.71

3,106.84

1,470.21

11,458.35

1,658.7

11,665.11

7,365.15

3,029.62

1,443.54

11,229.19

1,662.33

11,710.79

7,374.92

3,048.89

1,443.55

11,458.35

(1.23)

(0.76)

(1.53)

(2.68)

(1.83)

0.13

(20.82)

(90.14)

(115.06)

(84.1)

(27.04)

15.89

10,683,259

67,750,909

180,507,670

122,606,088

185,246,941

1,135,721,887

49,209,075

8,510

981,308,125.00

1,337,120,458.67

2,061,764,476.26

1,309,743,012.77

918,102,427.84

362,657,990.70

235,395,697.75

1,024,681.00

7,390.91

4,408.4

7,395.6

4,410.74

7,295.28

4,355.24

7,299.03

4,385.98

(1.72)

(0.85)

(128.3)

(37.79)

1,751,734,339

7,207,116,869.99

GRAND TOTAL

Note: Sectoral and Grand Total include Main Board, Oddlot, and Block Sale transactions.

FOREIGN BUYING:

FOREIGN SELLING:

NET FOREIGN BUYING/(SELLING):

TOTAL FOREIGN:

Php 3,810,175,952.67

Php 4,312,825,067.27

Php (502,649,114.60)

Php 8,123,001,019.94

Securities Under Suspension by the Exchange as of May 20 , 2016

ASIA AMLGMATED

ABC PREF

AC PREF A

CENTURY PEAK

EXPORT BANK A

EXPORT BANK B

FPH PREF

FILSYN A

FILSYN B

GREENERGY

METROALLIANCE A

METROALLIANCE B

METRO GLOBAL

NEXTGENESIS

PICOP RES

PF PREF

PHILCOMSAT

PRIMETOWN PROP

PNCC

GLOBALPORT

PTT CORP

SMC PREF 2A

SPC POWER

STENIEL

AAA

ABC

ACPA

CPM

EIBA

EIBB

FPHP

FYN

FYNB

GREEN

MAH

MAHB

MGH

NXGEN

PCP

PFP

PHC

PMT

PNC

PORT

PTT

SMC2A

SPC

STN

The Philippine Stock Exchange, Inc

Daily Quotations Report

May 20 , 2016

Name

PLDT II

UNIWIDE HLDG

Symbol

Bid

TLII

UW

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

You might also like

- Listing Eft 2022Document22 pagesListing Eft 2022Farhan AimanNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016J CervNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Melissa BaileyNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 05, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 05, 2016craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015RafaelAndreiLaMadridNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Chris DeNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 18, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 18, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014nadonecNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014John Paul Samuel ChuaNo ratings yet

- The Art of Better Retail Banking: Supportable Predictions on the Future of Retail BankingFrom EverandThe Art of Better Retail Banking: Supportable Predictions on the Future of Retail BankingNo ratings yet

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesFrom EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo ratings yet

- Kase on Technical Analysis Workbook: Trading and ForecastingFrom EverandKase on Technical Analysis Workbook: Trading and ForecastingNo ratings yet

- Improving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentFrom EverandImproving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentRating: 5 out of 5 stars5/5 (1)

- The Hunt for Unicorns: How Sovereign Funds Are Reshaping Investment in the Digital EconomyFrom EverandThe Hunt for Unicorns: How Sovereign Funds Are Reshaping Investment in the Digital EconomyNo ratings yet

- Imo SN Circ244 Ais UnlocodeDocument4 pagesImo SN Circ244 Ais UnlocodeRadney BallentosNo ratings yet

- RADAR Maneuvering BoardDocument1 pageRADAR Maneuvering BoardRadney Ballentos100% (1)

- Squat ComputationDocument15 pagesSquat ComputationRadney BallentosNo ratings yet

- 7surveyor Inverse Draft Survey Marine Surveyor InformationDocument9 pages7surveyor Inverse Draft Survey Marine Surveyor InformationRadney BallentosNo ratings yet

- Shareholding Statistics: Share Capital and Voting RightsDocument2 pagesShareholding Statistics: Share Capital and Voting RightsTheng RogerNo ratings yet

- Precios SNIIM (Estándar México), C16, Midwest (Crudo y Refinado EE - UU.), C11 y C5 (Crudo y Refinado Mundial)Document0 pagesPrecios SNIIM (Estándar México), C16, Midwest (Crudo y Refinado EE - UU.), C11 y C5 (Crudo y Refinado Mundial)api-127357347No ratings yet

- Smart MiningDocument12 pagesSmart MiningAmura FXNo ratings yet

- Review Jurnal Moneter BismillahDocument5 pagesReview Jurnal Moneter BismillahGalang IhsanNo ratings yet

- April 2023Document68 pagesApril 2023Daniel Pratama SimbolonNo ratings yet

- 17FG0045 BoqDocument2 pages17FG0045 BoqrrpenolioNo ratings yet

- Philippine Stock Exchange Financials IndexDocument3 pagesPhilippine Stock Exchange Financials IndexGen GaveriaNo ratings yet

- Write The Value of Money in WordsDocument1 pageWrite The Value of Money in WordsmayjeeteeNo ratings yet

- Presentation HUT KRPRIDocument25 pagesPresentation HUT KRPRIAdeCitoTiyastonoNo ratings yet

- Pt. Crompton Prima Switchgear Indonesia: Agreement of Borrowing CB Pole 150 KVDocument1 pagePt. Crompton Prima Switchgear Indonesia: Agreement of Borrowing CB Pole 150 KVRiyan RifandiNo ratings yet

- DBSDocument4 pagesDBSSilvia DewiyantiNo ratings yet

- Rsia. Puri Betik Hati Billing Statement SummaryDocument39 pagesRsia. Puri Betik Hati Billing Statement Summaryyayang indah100% (1)

- Salesman: S018 AccountDocument3 pagesSalesman: S018 Accountandry hardianNo ratings yet

- Travel Order LandbankDocument12 pagesTravel Order LandbankJonel TorresNo ratings yet

- Tugas Rul Fungsi Kppu Dalam Merge Di Tinjau Dari UndangDocument7 pagesTugas Rul Fungsi Kppu Dalam Merge Di Tinjau Dari UndangLa Ode Muhamad Hazarul AzwaniNo ratings yet

- Data Tamu Ota 2023Document11 pagesData Tamu Ota 2023FaizinNo ratings yet

- Assigned Cases in Civ Rev II (1 Batch)Document4 pagesAssigned Cases in Civ Rev II (1 Batch)Rebuild BoholNo ratings yet

- Domestic Summer February 20 2018 PDFDocument5 pagesDomestic Summer February 20 2018 PDFSantos JanNo ratings yet

- Program Jaminan Sosial Ketenagakerjaan: Ial eDocument2 pagesProgram Jaminan Sosial Ketenagakerjaan: Ial eyizzzzNo ratings yet

- Nurul Aryani - AKL1 - QUIZ 4 - SOAL 2.Document1 pageNurul Aryani - AKL1 - QUIZ 4 - SOAL 2.Nurul AryaniNo ratings yet

- Lifekicks Sales Target, Budget Promo & Timeline (3 Months Timeline) DescriptionDocument1 pageLifekicks Sales Target, Budget Promo & Timeline (3 Months Timeline) DescriptionPutra SoetotoNo ratings yet

- Tunggakan 23 Oktober 2023Document64 pagesTunggakan 23 Oktober 2023Kornelius SokinNo ratings yet

- HISTORI TRANSAKSI Nov - 22Document3 pagesHISTORI TRANSAKSI Nov - 22Wawan WijayaNo ratings yet

- MALACAÑANDocument83 pagesMALACAÑANBryan NadimpallyNo ratings yet

- Grade 1 Performance Tasks (1st Quarter) MathematicsDocument4 pagesGrade 1 Performance Tasks (1st Quarter) Mathematicsmanuela.aragoNo ratings yet

- List Site TBG Dan Tagihan 2021 7 Mei Update 2Document83 pagesList Site TBG Dan Tagihan 2021 7 Mei Update 2reva rosilawatiNo ratings yet

- Summary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Disclosures Submitted As of 30 September 2021Document2 pagesSummary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Disclosures Submitted As of 30 September 2021Rosaly Tonelada TabaqueroNo ratings yet

- Performa Invoice PoDocument72 pagesPerforma Invoice PoBana TourNo ratings yet

- Sub-Agency-Mango 2Document56 pagesSub-Agency-Mango 2Yudhi LatuyNo ratings yet