Professional Documents

Culture Documents

Form 1: VERSION: E-Gov Ver 4.0.0

Form 1: VERSION: E-Gov Ver 4.0.0

Uploaded by

slbandyopadhyayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 1: VERSION: E-Gov Ver 4.0.0

Form 1: VERSION: E-Gov Ver 4.0.0

Uploaded by

slbandyopadhyayCopyright:

Available Formats

Page 1

Page 2

Page 3

Page 4

e-Gov ver 4.0.0

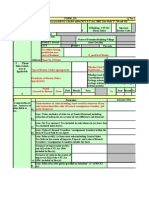

FORM 1

Page 1

[See Rule 8 of the Central Sales Tax (West Bengal) Rules, 1958]

Return of sales Tax Payable under Central Sales Tax Act,1956, for the period form

From:

01/01/2014

To:

31/03/2014

Registration Certificate No.11111111111

Whether original or revised return ? ORIGINAL

VERSION := e-Gov ver 4.0.0

Acknowledgement No.

1. Transfer of goods otherwise than by way of sales as referred to in section 6A the Act

(a) Value of goods transferred to the assessee's place of principal in other States[Details to

be furnished in Annexure A]

0.00

(b) Value of goods transferred to the assessee's agent or principal in other States (Details to

0.00

be furnished in Annexure A )

2. Gross amount payable to the dealer as consideration for the sales of goods made during the above period in respect to

(a) Sales in the course of Inter-State Trade or Commerce including all sales u/s 2(g)

(b) Sales of goods outside the State ( as provided in section 4 of the Act )

(c) Sales of goods in the course of export outside India [ as provided in section 5(1) of the

Act ]

0.00

0.00

0.00

(d) Sales of goods in the course of import into India [ as provided in section 5(2) of the Act

0.00

]

(e) Last sales of goods preceding the sales occasioning the export of those goods outside

India [ as provided in section 5(3) of the Act ] ( Details to be furnished in annexure B )

0.00

(f) Sales of Aviation Turbine Fuel to designated Indian Carriers

[ as provided in section 5(5) of the Act ]

0.00

(g) Sales effected at place inside West Bengal

0.00

Total : 2( (a) + (b) + (c) + (d) + (e) + (f) + (g) )

0.00

3. Gross amount payable to the dealer as consideration for the sales of goods made in the

course of Inter-State Trade or Commerce as per SL. No. 2(a) during the above period

0.00

4. Less :

(a) Cost of freight,delivery or installation separately charged on customers and includend in

0.00

SL. No. 3

(b) Cash discount allowed according to the practice normally prevailing in the trade and

included in SL. No. 3

0.00

(c) Sale price refunded to purchasers in respect of goods returned by them according to

section 8A(1)(b) of the Act.[Statement to be furnished in Annexure Sales Return (CST)]

0.00

Total of 4(a), 4(b) and 4(c) :

0.00

Date:

5. Balance (3-4): total turnover or inter-S tate sales.

0.00

Print All Pages

You might also like

- Form 231Document9 pagesForm 231sanjay jadhav100% (5)

- 201 Oct To Dec 2011Document4 pages201 Oct To Dec 2011Ishan KhandelwalNo ratings yet

- CST Form 1Document6 pagesCST Form 1Sarath Disha80% (5)

- Mvat f231Document5 pagesMvat f231pgotaphoeNo ratings yet

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatparulshinyNo ratings yet

- Section - 80HHC Income-Tax Act 1961 - FA 2022 Deduction in Respect of Profits Retained For Export BusinessDocument6 pagesSection - 80HHC Income-Tax Act 1961 - FA 2022 Deduction in Respect of Profits Retained For Export BusinessPriyank GalaNo ratings yet

- Karnatka Vat RulesDocument49 pagesKarnatka Vat RulesshanoboghNo ratings yet

- FORM 202: Popular EnterpriseDocument4 pagesFORM 202: Popular Enterprisesam3461No ratings yet

- FAQ - Entry Tax West BengalDocument4 pagesFAQ - Entry Tax West BengalAnonymous EAineTizNo ratings yet

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocument4 pagesComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- CST AppealDocument3 pagesCST AppealvnbanjanNo ratings yet

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocument9 pagesForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionNishant GoyalNo ratings yet

- Refunds: S. No. Particulars (')Document9 pagesRefunds: S. No. Particulars (')Rohit KasbeNo ratings yet

- Arunachal Pradesh Goods Tax Rules 2005Document31 pagesArunachal Pradesh Goods Tax Rules 2005Luvjoy ChokerNo ratings yet

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Document12 pages1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanNo ratings yet

- Sales Tax Special Withholding Rules 2010Document9 pagesSales Tax Special Withholding Rules 2010Shayan Ahmad QureshiNo ratings yet

- Tnvat Form WW Fy 15-16Document30 pagesTnvat Form WW Fy 15-16samaadhuNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- Tax UpdatesDocument19 pagesTax UpdatesYeoh MaeNo ratings yet

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatTarifNo ratings yet

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocument4 pagesForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424No ratings yet

- Service Tax Refund - RansaDocument1 pageService Tax Refund - RansaservervcnewNo ratings yet

- Notification No. 52/2011-Service Tax: ProvidedDocument12 pagesNotification No. 52/2011-Service Tax: Providedsatish kumarNo ratings yet

- Form Jvat 409Document2 pagesForm Jvat 409Suzanne BradyNo ratings yet

- Vat R2 2016 - 2017Document4 pagesVat R2 2016 - 2017Hotel sapphireNo ratings yet

- S.I. 11 of 2022 Customs and Excise General Amendment Regulations 2022Document4 pagesS.I. 11 of 2022 Customs and Excise General Amendment Regulations 2022Jeremiah MatongotiNo ratings yet

- SCH 3Document8 pagesSCH 3suniljaithwarNo ratings yet

- Punjab Vat NoteDocument12 pagesPunjab Vat NoteSuraj SinghNo ratings yet

- Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - XxivDocument11 pagesDepartment of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxivpradeepji392No ratings yet

- VAT RefundDocument45 pagesVAT RefundPatrick Tan100% (1)

- Gujarat Vat Audit FinalDocument36 pagesGujarat Vat Audit FinalAbhay DesaiNo ratings yet

- DGFT Notification No.08/2015-2020 Dated 4th June, 2015Document5 pagesDGFT Notification No.08/2015-2020 Dated 4th June, 2015stephin k jNo ratings yet

- Guidelines RMO9 2000Document14 pagesGuidelines RMO9 2000Rizza TagleNo ratings yet

- Final Focus Notes Sec 106Document8 pagesFinal Focus Notes Sec 106KattNo ratings yet

- All About Form 3CEB Specified Domestic Transaction + International TransactionDocument3 pagesAll About Form 3CEB Specified Domestic Transaction + International TransactionKirti SanghaviNo ratings yet

- Payments To Non-ResidentsDocument8 pagesPayments To Non-Residentssmyns.bwNo ratings yet

- 'RULE+9Document6 pages'RULE+9chinum1No ratings yet

- Audit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NoDocument12 pagesAudit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NosuniljaithwarNo ratings yet

- Report Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961Document2 pagesReport Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961kinnari bhutaNo ratings yet

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraNo ratings yet

- Input Tax CreditDocument12 pagesInput Tax CreditAwesome AngelNo ratings yet

- Clarification and Deduction of Tax PDFDocument1 pageClarification and Deduction of Tax PDFusmansidiqiNo ratings yet

- Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - XxivDocument11 pagesDepartment of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxivrajiv29No ratings yet

- Social Security Contribution LevyDocument5 pagesSocial Security Contribution LevyNews CutterNo ratings yet

- GST Expense Breakup in Tax Audit Report - Taxguru - inDocument3 pagesGST Expense Breakup in Tax Audit Report - Taxguru - inmanoj shahNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- Goa VAT LawDocument23 pagesGoa VAT LawSiddesh ChimulkerNo ratings yet

- GST Audit Vis A Vis Annual ReturnDocument30 pagesGST Audit Vis A Vis Annual ReturnchariNo ratings yet

- FORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1Document26 pagesFORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1S Kumar SharmaNo ratings yet

- Compliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.Document4 pagesCompliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.shakiraNo ratings yet

- The Uttarakhand Value Added Tax Act, 2005Document4 pagesThe Uttarakhand Value Added Tax Act, 2005sandeeep mauryaNo ratings yet

- 4-GST Special Commercial Terms and Conditions RevisedDocument7 pages4-GST Special Commercial Terms and Conditions Revisedvishal.nithamNo ratings yet

- Tax Laws Updates For December 2013Document72 pagesTax Laws Updates For December 2013Archana ThirunagariNo ratings yet

- 10 42 Vat at GlanceDocument19 pages10 42 Vat at Glanceemmanuel JohnyNo ratings yet

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- (The Second Schdule) : (See Section 4 (B) ) Computation of Gross ProfitsDocument11 pages(The Second Schdule) : (See Section 4 (B) ) Computation of Gross ProfitsYoga GuruNo ratings yet

- Application For Refund of Tax, Interest, Penalty, Fees or Any Other AmountDocument15 pagesApplication For Refund of Tax, Interest, Penalty, Fees or Any Other Amountdhaval bhalodiaNo ratings yet

- TRAINING. NOTES Commercial TaxDocument116 pagesTRAINING. NOTES Commercial TaxVipin Thomas100% (1)