Professional Documents

Culture Documents

Improving Profitability in A Dynamic Financial Environment: Hedging

Improving Profitability in A Dynamic Financial Environment: Hedging

Uploaded by

Jimmy Lim Teng JiangCopyright:

Available Formats

You might also like

- Case #2 The US Airline - Group 5Document4 pagesCase #2 The US Airline - Group 5Francesco Uzhu50% (2)

- The US Airline Industry Case Study SolutionDocument6 pagesThe US Airline Industry Case Study SolutionGourab Das80% (5)

- Airlines Case StudyDocument2 pagesAirlines Case StudyGiorgi DjagidiNo ratings yet

- Service Sector Management: Airline IndustryDocument15 pagesService Sector Management: Airline IndustryprasalNo ratings yet

- American Airlines' Value PricingDocument19 pagesAmerican Airlines' Value PricingAashish Nag100% (2)

- 2009 H1 CS Q1Document4 pages2009 H1 CS Q1panshanren100% (1)

- Thinking About AirlinesDocument5 pagesThinking About AirlinesChoi MinriNo ratings yet

- Rescuing The Airline Industry - What's The Government's Role - Business LineDocument2 pagesRescuing The Airline Industry - What's The Government's Role - Business Lineswapnil8158No ratings yet

- Southwest InvestorRelations TaoFengDocument20 pagesSouthwest InvestorRelations TaoFengFeng TaoNo ratings yet

- Top 10 Airline Industry ChallengesDocument5 pagesTop 10 Airline Industry Challengessaif ur rehman shahid hussain (aviator)No ratings yet

- Report On Civil AviationDocument14 pagesReport On Civil AviationEr Gaurav Singh SainiNo ratings yet

- PWC Tailwinds Airline Industry Trends Issue 1Document12 pagesPWC Tailwinds Airline Industry Trends Issue 1getoboyNo ratings yet

- Chapter 1 PID - Youssef AliDocument15 pagesChapter 1 PID - Youssef Alianime brandNo ratings yet

- Airline IndustryDocument22 pagesAirline IndustryMohammed AliNo ratings yet

- Air AsiaDocument20 pagesAir AsiaAngela TianNo ratings yet

- Airline IndustryDocument16 pagesAirline Industryben_aizziNo ratings yet

- The Factors Effecting Airline BusinessDocument5 pagesThe Factors Effecting Airline BusinessnajumNo ratings yet

- The USA Airline Industry and Porter's Five ForcesDocument5 pagesThe USA Airline Industry and Porter's Five ForcesSena KuhuNo ratings yet

- Airline Finance and Aviation InsuranceDocument45 pagesAirline Finance and Aviation InsuranceK Manjunath100% (4)

- JetLite PDFDocument27 pagesJetLite PDFAnirudha GoraiNo ratings yet

- Continental Airlines - 2007: A. Case AbstractDocument15 pagesContinental Airlines - 2007: A. Case AbstractbaraasbaihNo ratings yet

- Nicholas A. J. Hastings (Auth.) - Physical Asset Management (2010, Springer London)Document77 pagesNicholas A. J. Hastings (Auth.) - Physical Asset Management (2010, Springer London)Darel Muhammad KamilNo ratings yet

- DVB Overview of Commercial Aircraft 2018 2019Document49 pagesDVB Overview of Commercial Aircraft 2018 2019chand198No ratings yet

- Southwest 5 FORCESDocument11 pagesSouthwest 5 FORCESBvvss RamanjaneyuluNo ratings yet

- Boeing Market Outlook 2005Document39 pagesBoeing Market Outlook 2005mdshoppNo ratings yet

- Case - Southwest AirlinesDocument3 pagesCase - Southwest AirlinesAndrea Montserrat Gonzzalí SánchezNo ratings yet

- Individual Case Analysis For Southwest Airlines 2011Document6 pagesIndividual Case Analysis For Southwest Airlines 2011HilaryChengNo ratings yet

- MKTG 6650 - Individual AssignmentDocument14 pagesMKTG 6650 - Individual AssignmentShehriyar AhmedNo ratings yet

- Failure of KingfisherDocument22 pagesFailure of KingfisherIngit Singh0% (1)

- Crafting & Executing StrategyDocument7 pagesCrafting & Executing StrategyPedro Emilio GarciaNo ratings yet

- The Industry Handbook: The Airline Industry: Printer Friendly Version (PDF Format)Document21 pagesThe Industry Handbook: The Airline Industry: Printer Friendly Version (PDF Format)Gaurav JainNo ratings yet

- Challenges Faced by The Aviation IndustryDocument5 pagesChallenges Faced by The Aviation Industryshiv000291No ratings yet

- Drewry Ship Operating Cost Index (Annual % Change) : Image Credits: Drewry - Co.ukDocument2 pagesDrewry Ship Operating Cost Index (Annual % Change) : Image Credits: Drewry - Co.uksellappanNo ratings yet

- SSRN Id2025282Document27 pagesSSRN Id2025282Rajita NairNo ratings yet

- Global FLeet and MRO Market Forecast 2021-2031Document58 pagesGlobal FLeet and MRO Market Forecast 2021-2031rachid mouchaouche100% (1)

- TL Potential Winners of Low Oil Part1Document11 pagesTL Potential Winners of Low Oil Part1dpbasicNo ratings yet

- Airline 2013 - JCR ReportDocument4 pagesAirline 2013 - JCR ReportnchaudhryNo ratings yet

- Privatisation in Indian AviationDocument14 pagesPrivatisation in Indian AviationMohit Bhatt67% (3)

- Southwest AirlinesDocument28 pagesSouthwest AirlinesHansen SantosoNo ratings yet

- Analysis of The Jet Fuel Price Risk Exposure and ODocument6 pagesAnalysis of The Jet Fuel Price Risk Exposure and OLutherOldaNo ratings yet

- Coping Up of Local Commercial Airlines in Fuel Cost: A StudyDocument6 pagesCoping Up of Local Commercial Airlines in Fuel Cost: A StudyAngel ValdezNo ratings yet

- Aviation Industry in IndiaDocument2 pagesAviation Industry in Indiameeti89No ratings yet

- BusinessEconomics AssignmentDocument6 pagesBusinessEconomics AssignmentHillda MmNo ratings yet

- Spice JetDocument37 pagesSpice JetPreeti DahiyaNo ratings yet

- Effect of Inflation & Deflation On Aviation SectorDocument19 pagesEffect of Inflation & Deflation On Aviation SectorKVJ50% (2)

- 41,17 Harish Akshay Space LawDocument25 pages41,17 Harish Akshay Space LawMunna TripathiNo ratings yet

- Paper 1 Tic PrelimsDocument15 pagesPaper 1 Tic PrelimsdavidbohNo ratings yet

- Aviation Quater Info UncompletedDocument6 pagesAviation Quater Info Uncompletedsheru006No ratings yet

- Airline IndustryDocument8 pagesAirline IndustryKrishnaPranayNo ratings yet

- PEST AnalysisDocument3 pagesPEST AnalysisAbhishek KundanNo ratings yet

- FY2020-40 FAA Aerospace ForecastDocument119 pagesFY2020-40 FAA Aerospace ForecastAnup KelkarNo ratings yet

- AMTE 324 Topic 2Document25 pagesAMTE 324 Topic 2Kim RioverosNo ratings yet

- Effects of Decreasing in Oil Prices On Global and Saudia Arab EconomyDocument48 pagesEffects of Decreasing in Oil Prices On Global and Saudia Arab EconomyMomal TanveerNo ratings yet

- 2015 Aviation TrendsDocument5 pages2015 Aviation TrendsTran Viet HaNo ratings yet

- Spicejet: Credit Rating AnalysisDocument9 pagesSpicejet: Credit Rating Analysissatyakidutta007No ratings yet

- Paper 1 QuestionDocument8 pagesPaper 1 QuestiondavidbohNo ratings yet

- FX Impacts On Airlines (Dec 2015)Document5 pagesFX Impacts On Airlines (Dec 2015)Anonymous BVbNj7RXNo ratings yet

- Fuel Hedging and Risk Management: Strategies for Airlines, Shippers and Other ConsumersFrom EverandFuel Hedging and Risk Management: Strategies for Airlines, Shippers and Other ConsumersNo ratings yet

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityFrom EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityNo ratings yet

Improving Profitability in A Dynamic Financial Environment: Hedging

Improving Profitability in A Dynamic Financial Environment: Hedging

Uploaded by

Jimmy Lim Teng JiangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Improving Profitability in A Dynamic Financial Environment: Hedging

Improving Profitability in A Dynamic Financial Environment: Hedging

Uploaded by

Jimmy Lim Teng JiangCopyright:

Available Formats

Improving profitability in a dynamic

financial environment

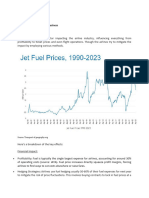

Strong demand, efficiency initiatives, and falling oil prices in the fourth quarter helped

airlines nearly double industry net profit to US$20 billion in 2014 over 2013, while

achieving the highest industry net margin in more than three decades. Airline financials

are expected to continue on this trend as airlines continue to focus on reducing costs

and boosting revenues. Over the past decade, the airline industry has achieved seven

percent compound annual revenue growth, which is more than double that of global

economic growth. On the cost side, the sharp decline in oil prices is a significant nearterm tailwind, with fuel averaging 25 percent of airline cost structures. In addition, lower

oil prices provide a stimulant to consumer incomes, and thus create an opportunity to

open additional routes and frequencies that might not have been profitable at higher oil

price levels.

In addition to dealing with more volatile oil prices, airlines are also accounting for a

recent significant strengthening of the US dollar due to the varying economic prospects

previously discussed. In some regions, this currency volatility will temper the near-term

benefit of lower fuel prices as fuel, airplane financing, and other costs are often paid in

US dollars. Depending on an airline's network structure, large movements in foreign

exchange rates can also affect international volumes and revenues owing to changes in

traveler purchasing power. Although increased financial market volatility will be a

headwind for some airlines, many have hedging tactics in place to smooth the effects,

and the overall airline profit outlook remains strong owing to solid demand fundamentals

and lower fuel prices.

You might also like

- Case #2 The US Airline - Group 5Document4 pagesCase #2 The US Airline - Group 5Francesco Uzhu50% (2)

- The US Airline Industry Case Study SolutionDocument6 pagesThe US Airline Industry Case Study SolutionGourab Das80% (5)

- Airlines Case StudyDocument2 pagesAirlines Case StudyGiorgi DjagidiNo ratings yet

- Service Sector Management: Airline IndustryDocument15 pagesService Sector Management: Airline IndustryprasalNo ratings yet

- American Airlines' Value PricingDocument19 pagesAmerican Airlines' Value PricingAashish Nag100% (2)

- 2009 H1 CS Q1Document4 pages2009 H1 CS Q1panshanren100% (1)

- Thinking About AirlinesDocument5 pagesThinking About AirlinesChoi MinriNo ratings yet

- Rescuing The Airline Industry - What's The Government's Role - Business LineDocument2 pagesRescuing The Airline Industry - What's The Government's Role - Business Lineswapnil8158No ratings yet

- Southwest InvestorRelations TaoFengDocument20 pagesSouthwest InvestorRelations TaoFengFeng TaoNo ratings yet

- Top 10 Airline Industry ChallengesDocument5 pagesTop 10 Airline Industry Challengessaif ur rehman shahid hussain (aviator)No ratings yet

- Report On Civil AviationDocument14 pagesReport On Civil AviationEr Gaurav Singh SainiNo ratings yet

- PWC Tailwinds Airline Industry Trends Issue 1Document12 pagesPWC Tailwinds Airline Industry Trends Issue 1getoboyNo ratings yet

- Chapter 1 PID - Youssef AliDocument15 pagesChapter 1 PID - Youssef Alianime brandNo ratings yet

- Airline IndustryDocument22 pagesAirline IndustryMohammed AliNo ratings yet

- Air AsiaDocument20 pagesAir AsiaAngela TianNo ratings yet

- Airline IndustryDocument16 pagesAirline Industryben_aizziNo ratings yet

- The Factors Effecting Airline BusinessDocument5 pagesThe Factors Effecting Airline BusinessnajumNo ratings yet

- The USA Airline Industry and Porter's Five ForcesDocument5 pagesThe USA Airline Industry and Porter's Five ForcesSena KuhuNo ratings yet

- Airline Finance and Aviation InsuranceDocument45 pagesAirline Finance and Aviation InsuranceK Manjunath100% (4)

- JetLite PDFDocument27 pagesJetLite PDFAnirudha GoraiNo ratings yet

- Continental Airlines - 2007: A. Case AbstractDocument15 pagesContinental Airlines - 2007: A. Case AbstractbaraasbaihNo ratings yet

- Nicholas A. J. Hastings (Auth.) - Physical Asset Management (2010, Springer London)Document77 pagesNicholas A. J. Hastings (Auth.) - Physical Asset Management (2010, Springer London)Darel Muhammad KamilNo ratings yet

- DVB Overview of Commercial Aircraft 2018 2019Document49 pagesDVB Overview of Commercial Aircraft 2018 2019chand198No ratings yet

- Southwest 5 FORCESDocument11 pagesSouthwest 5 FORCESBvvss RamanjaneyuluNo ratings yet

- Boeing Market Outlook 2005Document39 pagesBoeing Market Outlook 2005mdshoppNo ratings yet

- Case - Southwest AirlinesDocument3 pagesCase - Southwest AirlinesAndrea Montserrat Gonzzalí SánchezNo ratings yet

- Individual Case Analysis For Southwest Airlines 2011Document6 pagesIndividual Case Analysis For Southwest Airlines 2011HilaryChengNo ratings yet

- MKTG 6650 - Individual AssignmentDocument14 pagesMKTG 6650 - Individual AssignmentShehriyar AhmedNo ratings yet

- Failure of KingfisherDocument22 pagesFailure of KingfisherIngit Singh0% (1)

- Crafting & Executing StrategyDocument7 pagesCrafting & Executing StrategyPedro Emilio GarciaNo ratings yet

- The Industry Handbook: The Airline Industry: Printer Friendly Version (PDF Format)Document21 pagesThe Industry Handbook: The Airline Industry: Printer Friendly Version (PDF Format)Gaurav JainNo ratings yet

- Challenges Faced by The Aviation IndustryDocument5 pagesChallenges Faced by The Aviation Industryshiv000291No ratings yet

- Drewry Ship Operating Cost Index (Annual % Change) : Image Credits: Drewry - Co.ukDocument2 pagesDrewry Ship Operating Cost Index (Annual % Change) : Image Credits: Drewry - Co.uksellappanNo ratings yet

- SSRN Id2025282Document27 pagesSSRN Id2025282Rajita NairNo ratings yet

- Global FLeet and MRO Market Forecast 2021-2031Document58 pagesGlobal FLeet and MRO Market Forecast 2021-2031rachid mouchaouche100% (1)

- TL Potential Winners of Low Oil Part1Document11 pagesTL Potential Winners of Low Oil Part1dpbasicNo ratings yet

- Airline 2013 - JCR ReportDocument4 pagesAirline 2013 - JCR ReportnchaudhryNo ratings yet

- Privatisation in Indian AviationDocument14 pagesPrivatisation in Indian AviationMohit Bhatt67% (3)

- Southwest AirlinesDocument28 pagesSouthwest AirlinesHansen SantosoNo ratings yet

- Analysis of The Jet Fuel Price Risk Exposure and ODocument6 pagesAnalysis of The Jet Fuel Price Risk Exposure and OLutherOldaNo ratings yet

- Coping Up of Local Commercial Airlines in Fuel Cost: A StudyDocument6 pagesCoping Up of Local Commercial Airlines in Fuel Cost: A StudyAngel ValdezNo ratings yet

- Aviation Industry in IndiaDocument2 pagesAviation Industry in Indiameeti89No ratings yet

- BusinessEconomics AssignmentDocument6 pagesBusinessEconomics AssignmentHillda MmNo ratings yet

- Spice JetDocument37 pagesSpice JetPreeti DahiyaNo ratings yet

- Effect of Inflation & Deflation On Aviation SectorDocument19 pagesEffect of Inflation & Deflation On Aviation SectorKVJ50% (2)

- 41,17 Harish Akshay Space LawDocument25 pages41,17 Harish Akshay Space LawMunna TripathiNo ratings yet

- Paper 1 Tic PrelimsDocument15 pagesPaper 1 Tic PrelimsdavidbohNo ratings yet

- Aviation Quater Info UncompletedDocument6 pagesAviation Quater Info Uncompletedsheru006No ratings yet

- Airline IndustryDocument8 pagesAirline IndustryKrishnaPranayNo ratings yet

- PEST AnalysisDocument3 pagesPEST AnalysisAbhishek KundanNo ratings yet

- FY2020-40 FAA Aerospace ForecastDocument119 pagesFY2020-40 FAA Aerospace ForecastAnup KelkarNo ratings yet

- AMTE 324 Topic 2Document25 pagesAMTE 324 Topic 2Kim RioverosNo ratings yet

- Effects of Decreasing in Oil Prices On Global and Saudia Arab EconomyDocument48 pagesEffects of Decreasing in Oil Prices On Global and Saudia Arab EconomyMomal TanveerNo ratings yet

- 2015 Aviation TrendsDocument5 pages2015 Aviation TrendsTran Viet HaNo ratings yet

- Spicejet: Credit Rating AnalysisDocument9 pagesSpicejet: Credit Rating Analysissatyakidutta007No ratings yet

- Paper 1 QuestionDocument8 pagesPaper 1 QuestiondavidbohNo ratings yet

- FX Impacts On Airlines (Dec 2015)Document5 pagesFX Impacts On Airlines (Dec 2015)Anonymous BVbNj7RXNo ratings yet

- Fuel Hedging and Risk Management: Strategies for Airlines, Shippers and Other ConsumersFrom EverandFuel Hedging and Risk Management: Strategies for Airlines, Shippers and Other ConsumersNo ratings yet

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityFrom EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityNo ratings yet