Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

51 viewsIncome

Income

Uploaded by

vanvunThe document defines key economic terms related to national income and its distribution between the private and public sectors:

- National disposable product (NDP) can be divided into the portion accruing to the private sector and the portion accruing to the government sector.

- Private income is equal to the private sector's portion of NDP plus net income from abroad and transfers, less taxes.

- Personal income is private income less taxes and undistributed corporate profits.

- Personal disposable income is personal income less personal taxes and other deductions.

It then provides examples calculating personal disposable income and other terms using data on components like NDP, transfers, taxes, and undistributed

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- CH-3-Financial Reporting & Analysis-8PDBUA060P PDFDocument428 pagesCH-3-Financial Reporting & Analysis-8PDBUA060P PDFSiravit AriiazNo ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Imperial Beauty Salon: Business PlanDocument12 pagesImperial Beauty Salon: Business PlanALBERT JADE LEGARIANo ratings yet

- Contract Rent Economic Rent +wage+ Interest + Depreciation + ProfitDocument11 pagesContract Rent Economic Rent +wage+ Interest + Depreciation + ProfitvanvunNo ratings yet

- Macro Unsolved Numericals EnglishDocument18 pagesMacro Unsolved Numericals EnglishajeshNo ratings yet

- National Income Related AggregatesDocument4 pagesNational Income Related Aggregatessubs444subs10082002No ratings yet

- National Income-1Document16 pagesNational Income-1Swarnim RamolaNo ratings yet

- National Income-1Document22 pagesNational Income-122babba050No ratings yet

- National-Income - Basic ConceptsDocument11 pagesNational-Income - Basic ConceptsShraddha BansalNo ratings yet

- National Income: Submitted To: - Dr. Hiranmoy RoyDocument30 pagesNational Income: Submitted To: - Dr. Hiranmoy RoyAbhishek ChopraNo ratings yet

- Macro Unsolved Numericals English PDFDocument18 pagesMacro Unsolved Numericals English PDFNindoNo ratings yet

- Home Assignment Summer VactionsDocument3 pagesHome Assignment Summer VactionsLaraNo ratings yet

- National Income Formula and NumericalsDocument17 pagesNational Income Formula and Numericalsbhaskarvishal100% (9)

- National Income Accounting### - 121208Document10 pagesNational Income Accounting### - 121208Innocent escoNo ratings yet

- NCERT Macroeconomics Solutions Class 12 Chapter 2Document9 pagesNCERT Macroeconomics Solutions Class 12 Chapter 2Mahathi AmudhanNo ratings yet

- National Income NumericalsDocument19 pagesNational Income Numericalsyuvrajput1111No ratings yet

- National Income and Related Aggregates: Important FormulaeDocument4 pagesNational Income and Related Aggregates: Important FormulaeRounak BasuNo ratings yet

- National Income 12 ISCDocument58 pagesNational Income 12 ISCAnumedha BharNo ratings yet

- Eco WRITEUPDocument9 pagesEco WRITEUPGaurav MalikNo ratings yet

- Unit 1 Part BDocument20 pagesUnit 1 Part Bvansh.meghawatNo ratings yet

- Assignment IDocument3 pagesAssignment IAparna RajasekharanNo ratings yet

- Delhi Public School, Jammu ASSIGNMENT: National Income Cycle Test-I Class: Xii Sub: EconomicsDocument2 pagesDelhi Public School, Jammu ASSIGNMENT: National Income Cycle Test-I Class: Xii Sub: EconomicsKriti GroverNo ratings yet

- Macrounit 1Document11 pagesMacrounit 1AksshNo ratings yet

- BOP Final ProjectDocument3 pagesBOP Final ProjectßegzNo ratings yet

- Lesson 6 National Income AccountingDocument19 pagesLesson 6 National Income AccountingJet Son100% (1)

- Numericals National Income AccountingDocument22 pagesNumericals National Income AccountingPreeti BajajNo ratings yet

- Ncert Solutions For Class 12 Macroeconomics Chapter 2 National Income AccountingDocument12 pagesNcert Solutions For Class 12 Macroeconomics Chapter 2 National Income AccountingNxirjaonfbsNo ratings yet

- Problem Set 1:: (National Income Accounting)Document12 pagesProblem Set 1:: (National Income Accounting)Sneha Giji SajiNo ratings yet

- Inter Ca: Revision NotesDocument55 pagesInter Ca: Revision NotesRaghavanjNo ratings yet

- Differences Between Private Income and Personal Income Are As FollowsDocument2 pagesDifferences Between Private Income and Personal Income Are As Followsveronica_rachnaNo ratings yet

- Theory - National Income and Related AggregatesDocument11 pagesTheory - National Income and Related AggregatesTanuj ChaudharyNo ratings yet

- MACROECONOMICS Chap. 2Document3 pagesMACROECONOMICS Chap. 2ASTA ACHIEVERS TUITIONSNo ratings yet

- GUR008 File PPT 210 PPT National IncomeDocument34 pagesGUR008 File PPT 210 PPT National IncomerizkiNo ratings yet

- Winter Vacation HomeworkDocument15 pagesWinter Vacation HomeworkHadya HassNo ratings yet

- Chapter 6 (Part 1) Measuring Domestic Output, National Income and The Price LevelDocument31 pagesChapter 6 (Part 1) Measuring Domestic Output, National Income and The Price Levelchuojx-jb23No ratings yet

- JK Shah Economics Revisionery NotesDocument54 pagesJK Shah Economics Revisionery Notesकनक नामदेवNo ratings yet

- Economic Analysis For Business Unit IVDocument35 pagesEconomic Analysis For Business Unit IVGOPI DEVARAJINo ratings yet

- Macro CIA Mera Hi HaiDocument3 pagesMacro CIA Mera Hi Haidishydashy88No ratings yet

- Ncert Sol Class 12 Macro Economics Chapter 2Document11 pagesNcert Sol Class 12 Macro Economics Chapter 2Satyam RajNo ratings yet

- National Income FINALDocument23 pagesNational Income FINALSanchit GargNo ratings yet

- Assignment 04 Economics GAGANDocument7 pagesAssignment 04 Economics GAGANDisha SharmaNo ratings yet

- Class XII National Income WorksheetDocument2 pagesClass XII National Income WorksheetNidhi AroraNo ratings yet

- Eco Assgn SolnDocument8 pagesEco Assgn SolnlulughoshNo ratings yet

- Chapter 8Document35 pagesChapter 8Danial NorazmanNo ratings yet

- Numerical Problems Ni AccountingDocument7 pagesNumerical Problems Ni AccountingKenil ShahNo ratings yet

- Economics PPT Mid TermDocument9 pagesEconomics PPT Mid TermTanishkaNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BRanzNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BAnand_Agrawal19No ratings yet

- Under Section Id) : Unit 4 Exempted IncomesDocument8 pagesUnder Section Id) : Unit 4 Exempted IncomesAmritNo ratings yet

- Economicsquestionbank2022 23Document33 pagesEconomicsquestionbank2022 23imtidrago artsNo ratings yet

- Chapter 3 - National Income and Related AggregatesDocument11 pagesChapter 3 - National Income and Related Aggregatesishika.khandelwal2007No ratings yet

- Important Questions For CBSE Class 12 Macro Economics Chapter 2 PDFDocument8 pagesImportant Questions For CBSE Class 12 Macro Economics Chapter 2 PDFAlans TechnicalNo ratings yet

- Economic - Analysis For - Business - Unit - IVDocument35 pagesEconomic - Analysis For - Business - Unit - IVViswanath ViswaNo ratings yet

- Class Xii Economics Unit 1 Study Material 2021-22Document32 pagesClass Xii Economics Unit 1 Study Material 2021-22MOHAMMAD SYED AEJAZNo ratings yet

- National - Income (1) - Circular FlowDocument6 pagesNational - Income (1) - Circular Flowaparnah_83No ratings yet

- EconomicsDocument66 pagesEconomicsSangeeta YadavNo ratings yet

- Measurement of N.I. (Expenditure Method)Document26 pagesMeasurement of N.I. (Expenditure Method)ankitNo ratings yet

- Economics For Managers - Session 16Document8 pagesEconomics For Managers - Session 16Abimanyu NNNo ratings yet

- Economics 12 2023-1Document31 pagesEconomics 12 2023-1aryantejpal2605No ratings yet

- National Income AccountingDocument37 pagesNational Income Accountingnavya.cogni21No ratings yet

- Macroeconomics TutorialDocument18 pagesMacroeconomics Tutorialfamin87No ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Nature and Context of Research 2Document2 pagesNature and Context of Research 2vanvunNo ratings yet

- Nature and Context of Research 1Document16 pagesNature and Context of Research 1vanvunNo ratings yet

- GK For Class TestDocument3 pagesGK For Class TestvanvunNo ratings yet

- Logical ReasoningDocument3 pagesLogical ReasoningvanvunNo ratings yet

- Multiple Choice Questions On Ratio and ProportionDocument1 pageMultiple Choice Questions On Ratio and Proportionvanvun100% (3)

- Costing and Cost AccountingDocument1 pageCosting and Cost AccountingvanvunNo ratings yet

- Notes For Students Amalgamation 2Document4 pagesNotes For Students Amalgamation 2vanvunNo ratings yet

- Liquidity Management in BanksDocument28 pagesLiquidity Management in BanksvanvunNo ratings yet

- Interdependence Between Micro and Macro EconomicsDocument1 pageInterdependence Between Micro and Macro Economicsvanvun50% (2)

- Implications of Baumol's Sales Revenue Maximization ModelDocument1 pageImplications of Baumol's Sales Revenue Maximization ModelvanvunNo ratings yet

- Concept of Commercial Banks of Nepa1Document8 pagesConcept of Commercial Banks of Nepa1vanvunNo ratings yet

- Notes For Students Amalgamation 1Document3 pagesNotes For Students Amalgamation 1vanvunNo ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- Concept of Commercial Banks of NepalDocument2 pagesConcept of Commercial Banks of Nepalvanvun100% (1)

- Importance of OBDocument3 pagesImportance of OBvanvunNo ratings yet

- Banking: Meaning of BankDocument8 pagesBanking: Meaning of BankvanvunNo ratings yet

- Teacher Vacant Announcement 1Document2 pagesTeacher Vacant Announcement 1vanvunNo ratings yet

- SDX?SF) KL/DF) FLS/) F 1 DKLQSF) X:TFGT/) F: Quantifiaciton of Amounts (Sec. 27)Document1 pageSDX?SF) KL/DF) FLS/) F 1 DKLQSF) X:TFGT/) F: Quantifiaciton of Amounts (Sec. 27)vanvunNo ratings yet

- Relation Between TPDocument7 pagesRelation Between TPvanvunNo ratings yet

- Networking Basic Components: Merge and Burst Events: It Is Necessary For An Event To Be The Ending Event of Only OneDocument7 pagesNetworking Basic Components: Merge and Burst Events: It Is Necessary For An Event To Be The Ending Event of Only OnevanvunNo ratings yet

- Career Paths Accounting SB-17Document1 pageCareer Paths Accounting SB-17YanetNo ratings yet

- MeleseDocument40 pagesMeleseዳግማዊ ጌታነህ ግዛው ባይህNo ratings yet

- Income Statement To The NetDocument26 pagesIncome Statement To The NetOman SherNo ratings yet

- ABM FABM 2 Q1 Course Guide PDFDocument58 pagesABM FABM 2 Q1 Course Guide PDFEarl Christian BonaobraNo ratings yet

- Unit 2Document15 pagesUnit 2Maithra DNo ratings yet

- Chapter 2 - PartnershipDocument20 pagesChapter 2 - PartnershipNgNo ratings yet

- Fashion Business Plan Example - Clothes Business PlanDocument16 pagesFashion Business Plan Example - Clothes Business Planfakhour nabil100% (1)

- Acct 301 WorksheetDocument3 pagesAcct 301 Worksheetapi-355720477No ratings yet

- Quiz 2Document21 pagesQuiz 2Drey StudyingNo ratings yet

- Shariah Stock Screening Final ReportDocument16 pagesShariah Stock Screening Final ReportOsama Ali RizwanNo ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- Financial Analysis ReviewerDocument15 pagesFinancial Analysis ReviewerPrincess Corine BurgosNo ratings yet

- Income Taxation True or False SummaryDocument2 pagesIncome Taxation True or False SummaryFranklin JungcoNo ratings yet

- Absorption CostingDocument76 pagesAbsorption CostingMustafa KamalNo ratings yet

- Closing Journal Entries-Sole ProprietorshipDocument1 pageClosing Journal Entries-Sole ProprietorshipMary100% (3)

- Group 08 Financial Feasibility Excel 2Document8 pagesGroup 08 Financial Feasibility Excel 2Slindokuhle ThandoNo ratings yet

- Does Corporate Tax Avoidance Explain Firm Performance? Evidence From An Emerging EconomyDocument18 pagesDoes Corporate Tax Avoidance Explain Firm Performance? Evidence From An Emerging EconomyReynardo GosalNo ratings yet

- Financial Accounting Theory 3Rd Edition Deegan Test Bank Full Chapter PDFDocument38 pagesFinancial Accounting Theory 3Rd Edition Deegan Test Bank Full Chapter PDFchristinecohenceyamrgpkj100% (11)

- ecolex2ke សទ្ទានុក្រមសេដ្ឋកិច្ចDocument119 pagesecolex2ke សទ្ទានុក្រមសេដ្ឋកិច្ចKhmerNo ratings yet

- IT Card SaneepDocument4 pagesIT Card Saneephajabarala2008No ratings yet

- 商业预算规划Document10 pages商业预算规划upelpmwlfNo ratings yet

- Master File - Business PlanDocument14 pagesMaster File - Business PlanInfant JinNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- Financial Statement AnalysisDocument23 pagesFinancial Statement AnalysisHinata UzumakiNo ratings yet

- AccDocument8 pagesAccCavin Jhon Mamites CabarloNo ratings yet

- CA Tax NotesDocument616 pagesCA Tax NotesvijayNo ratings yet

- DR Jones Case AnalysisDocument7 pagesDR Jones Case AnalysisPROJECT ACCOUNTANTS MEGAWIDENo ratings yet

Income

Income

Uploaded by

vanvun0 ratings0% found this document useful (0 votes)

51 views4 pagesThe document defines key economic terms related to national income and its distribution between the private and public sectors:

- National disposable product (NDP) can be divided into the portion accruing to the private sector and the portion accruing to the government sector.

- Private income is equal to the private sector's portion of NDP plus net income from abroad and transfers, less taxes.

- Personal income is private income less taxes and undistributed corporate profits.

- Personal disposable income is personal income less personal taxes and other deductions.

It then provides examples calculating personal disposable income and other terms using data on components like NDP, transfers, taxes, and undistributed

Original Description:

Private Income

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines key economic terms related to national income and its distribution between the private and public sectors:

- National disposable product (NDP) can be divided into the portion accruing to the private sector and the portion accruing to the government sector.

- Private income is equal to the private sector's portion of NDP plus net income from abroad and transfers, less taxes.

- Personal income is private income less taxes and undistributed corporate profits.

- Personal disposable income is personal income less personal taxes and other deductions.

It then provides examples calculating personal disposable income and other terms using data on components like NDP, transfers, taxes, and undistributed

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

51 views4 pagesIncome

Income

Uploaded by

vanvunThe document defines key economic terms related to national income and its distribution between the private and public sectors:

- National disposable product (NDP) can be divided into the portion accruing to the private sector and the portion accruing to the government sector.

- Private income is equal to the private sector's portion of NDP plus net income from abroad and transfers, less taxes.

- Personal income is private income less taxes and undistributed corporate profits.

- Personal disposable income is personal income less personal taxes and other deductions.

It then provides examples calculating personal disposable income and other terms using data on components like NDP, transfers, taxes, and undistributed

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

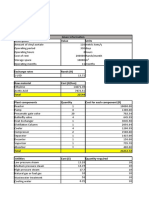

5.

Concept of Private Income,

Personal Income and Personal

Disposable Income.

NDPfc can be divided in to two parts :- Part of NDPfc accruing to Private sector

and Part of NDPfc accruing to Government Sector.

2. NDPfc = Part of NDPfc accruing to Private sector + Part of NDPfc accruing to

Government Sector.

3. Part of NDPfc accruing to Government Sector = Savings of Non Departmental

enterprises + Income of Government from Property and Entrepreneurship

4. Part of NDPfc accruing to Private sector = NDPfc - Part of NDPfc accruing to

Government Sector.

5. Part of NDPfc accruing to Private sector = NDPfc (Savings of Non

Departmental enterprises + Income of government from Property and

Entrepreneurship)

6. Private Income= Part of NDPfc accruing to private sector + Net factor Income

from Abroad + Current Transfer from Government + Net Current Transfer from

Rest of World + Interest on Public Debt

7. Private Income= (NDPfc - Part of NDPfc accruing to Government) + Net factor

Income from Abroad + Current Transfer from Government + Net Current Transfer

from Rest of World + Interest on Public Debt

8. Private Income= NDPfc (Savings of Non Departmental enterprises + Income

of government from Property and Entrepreneurship) + Net factor Income from

Abroad + Current Transfer from Government + Net Current Transfer from Rest of

World + Interest on Public Debt

9. Personal Income = Private Income Corporation Tax Undistributed Profits

10. Undistributed Profits may be given as Net retained earnings of private sector

enterprises or savings of private sector enterprises or corporate savings

11.Personal disposable Income = Personal Income- Direct tax paid by households

Miscellaneous receipts of Government administrative undertakings

12. Direct tax paid by household may be given as personal direct tax.

1. Calculate personal disposable income from the given data: ITEMS

(Rs. in

crores )

i. Net current transfered from rest of

3

the world.

ii. Private income

200

iii. Personal taxes

30

National debt interest

Corporate profit tax

20

Undistributed profit of corporation

10

Ans. Rs. 140 Crores

2. Calculate personal disposable income from the given data: ITEMS

i. Net current transferred from rest of the

world.

ii. Net domestic product accruing to private

sector.

iii. Net factor income from abroad.

iv. National debt interest

v. Corporate profit tax

vi. Undistributed profit of corporation

vii. Net current transferred from rest of the

world.

Ans. Rs. 485 Crores

(Rs. in

crores )

15

500

(-)10

40

55

20

15

3. Calculate personal income from the given data: ITEMS

i. Net current transferred from rest of the

world.

ii. Net domestic product accruing to private

sector.

iii. Net factor income from abroad.

iv. National debt interest

v. Corporate profit tax

vi. Undistributed profit of corporation

vii. Net current transferred from rest of the

world.

(Rs. in

crores )

25

600

(-)10

50

65

20

15

4. Calculate ' Personal income from the following data: ITEMS

(Rs. IN

LAKHS)

i. Retained earning of private

20

corporation.

ii. Miscellaneous receipts of

50

government.

iii. Personal disposable income.

200

iv. Personal taxes

30

v. corporate profit tax

10

Ans. Rs. 280 Crores.

5. Calculate Gross National Disposable income and Personal income; ITEMS

(Rs. IN

Crores)

i. Net factor income from abroad.

(-)50

ii. Net indirect taxes

110

iii. Current Transferred by the

government

iv. Corporate taxes

v. Net domestic product at market price

vi. National debt interest

vii. NCT from abroad.

viii. Consumption of fixed capital

ix. Domestic product accruing to govt.

x. Retain earning of private corporation.

Ans. GNDI Rs. 900 Croresd. PI = 720 RS.

6. From the following data, Calculate

a. National Income

b. Personal disposable income

ITEMS

i. Compensation of employee

ii. Rent.

iii. Profit

iv. CFC

v. M I

Vi. Private income

vii. NFIA

viii. Net retained earnings of private

enterprises.

ix. Interest

x. N I T

xi. Net Export.

xii. Direct txes

Xiii. Corporation tax.

40

60

800

80

10

50

70

10

(Rs. IN

Crores)

1200

400

800

300

1000

3600

-50

200

250

350

-60

150

100

Ans. NI Rs. 3600

Crores PI = 3150 RS.

7. Calculate Gross National Disposable income and Personal income; ITEMS

(Rs. IN Crores)

i. Net factor income from abroad.

(-) 10

ii. Net indirect taxes

120

iii. Current Transferred by the

30

government

iv. Corporate taxes

20

v. National income

900

vi. National debt interest

50

vii. NCT to abroad.

20

viii. Personal tax

40

ix. Domestic product accruing to govt.

90

x. Retain earning of private corporation.

10

Ans. NNDI Rs. 1050 Crores. PDI =680 RS.

You might also like

- CH-3-Financial Reporting & Analysis-8PDBUA060P PDFDocument428 pagesCH-3-Financial Reporting & Analysis-8PDBUA060P PDFSiravit AriiazNo ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Imperial Beauty Salon: Business PlanDocument12 pagesImperial Beauty Salon: Business PlanALBERT JADE LEGARIANo ratings yet

- Contract Rent Economic Rent +wage+ Interest + Depreciation + ProfitDocument11 pagesContract Rent Economic Rent +wage+ Interest + Depreciation + ProfitvanvunNo ratings yet

- Macro Unsolved Numericals EnglishDocument18 pagesMacro Unsolved Numericals EnglishajeshNo ratings yet

- National Income Related AggregatesDocument4 pagesNational Income Related Aggregatessubs444subs10082002No ratings yet

- National Income-1Document16 pagesNational Income-1Swarnim RamolaNo ratings yet

- National Income-1Document22 pagesNational Income-122babba050No ratings yet

- National-Income - Basic ConceptsDocument11 pagesNational-Income - Basic ConceptsShraddha BansalNo ratings yet

- National Income: Submitted To: - Dr. Hiranmoy RoyDocument30 pagesNational Income: Submitted To: - Dr. Hiranmoy RoyAbhishek ChopraNo ratings yet

- Macro Unsolved Numericals English PDFDocument18 pagesMacro Unsolved Numericals English PDFNindoNo ratings yet

- Home Assignment Summer VactionsDocument3 pagesHome Assignment Summer VactionsLaraNo ratings yet

- National Income Formula and NumericalsDocument17 pagesNational Income Formula and Numericalsbhaskarvishal100% (9)

- National Income Accounting### - 121208Document10 pagesNational Income Accounting### - 121208Innocent escoNo ratings yet

- NCERT Macroeconomics Solutions Class 12 Chapter 2Document9 pagesNCERT Macroeconomics Solutions Class 12 Chapter 2Mahathi AmudhanNo ratings yet

- National Income NumericalsDocument19 pagesNational Income Numericalsyuvrajput1111No ratings yet

- National Income and Related Aggregates: Important FormulaeDocument4 pagesNational Income and Related Aggregates: Important FormulaeRounak BasuNo ratings yet

- National Income 12 ISCDocument58 pagesNational Income 12 ISCAnumedha BharNo ratings yet

- Eco WRITEUPDocument9 pagesEco WRITEUPGaurav MalikNo ratings yet

- Unit 1 Part BDocument20 pagesUnit 1 Part Bvansh.meghawatNo ratings yet

- Assignment IDocument3 pagesAssignment IAparna RajasekharanNo ratings yet

- Delhi Public School, Jammu ASSIGNMENT: National Income Cycle Test-I Class: Xii Sub: EconomicsDocument2 pagesDelhi Public School, Jammu ASSIGNMENT: National Income Cycle Test-I Class: Xii Sub: EconomicsKriti GroverNo ratings yet

- Macrounit 1Document11 pagesMacrounit 1AksshNo ratings yet

- BOP Final ProjectDocument3 pagesBOP Final ProjectßegzNo ratings yet

- Lesson 6 National Income AccountingDocument19 pagesLesson 6 National Income AccountingJet Son100% (1)

- Numericals National Income AccountingDocument22 pagesNumericals National Income AccountingPreeti BajajNo ratings yet

- Ncert Solutions For Class 12 Macroeconomics Chapter 2 National Income AccountingDocument12 pagesNcert Solutions For Class 12 Macroeconomics Chapter 2 National Income AccountingNxirjaonfbsNo ratings yet

- Problem Set 1:: (National Income Accounting)Document12 pagesProblem Set 1:: (National Income Accounting)Sneha Giji SajiNo ratings yet

- Inter Ca: Revision NotesDocument55 pagesInter Ca: Revision NotesRaghavanjNo ratings yet

- Differences Between Private Income and Personal Income Are As FollowsDocument2 pagesDifferences Between Private Income and Personal Income Are As Followsveronica_rachnaNo ratings yet

- Theory - National Income and Related AggregatesDocument11 pagesTheory - National Income and Related AggregatesTanuj ChaudharyNo ratings yet

- MACROECONOMICS Chap. 2Document3 pagesMACROECONOMICS Chap. 2ASTA ACHIEVERS TUITIONSNo ratings yet

- GUR008 File PPT 210 PPT National IncomeDocument34 pagesGUR008 File PPT 210 PPT National IncomerizkiNo ratings yet

- Winter Vacation HomeworkDocument15 pagesWinter Vacation HomeworkHadya HassNo ratings yet

- Chapter 6 (Part 1) Measuring Domestic Output, National Income and The Price LevelDocument31 pagesChapter 6 (Part 1) Measuring Domestic Output, National Income and The Price Levelchuojx-jb23No ratings yet

- JK Shah Economics Revisionery NotesDocument54 pagesJK Shah Economics Revisionery Notesकनक नामदेवNo ratings yet

- Economic Analysis For Business Unit IVDocument35 pagesEconomic Analysis For Business Unit IVGOPI DEVARAJINo ratings yet

- Macro CIA Mera Hi HaiDocument3 pagesMacro CIA Mera Hi Haidishydashy88No ratings yet

- Ncert Sol Class 12 Macro Economics Chapter 2Document11 pagesNcert Sol Class 12 Macro Economics Chapter 2Satyam RajNo ratings yet

- National Income FINALDocument23 pagesNational Income FINALSanchit GargNo ratings yet

- Assignment 04 Economics GAGANDocument7 pagesAssignment 04 Economics GAGANDisha SharmaNo ratings yet

- Class XII National Income WorksheetDocument2 pagesClass XII National Income WorksheetNidhi AroraNo ratings yet

- Eco Assgn SolnDocument8 pagesEco Assgn SolnlulughoshNo ratings yet

- Chapter 8Document35 pagesChapter 8Danial NorazmanNo ratings yet

- Numerical Problems Ni AccountingDocument7 pagesNumerical Problems Ni AccountingKenil ShahNo ratings yet

- Economics PPT Mid TermDocument9 pagesEconomics PPT Mid TermTanishkaNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BRanzNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BAnand_Agrawal19No ratings yet

- Under Section Id) : Unit 4 Exempted IncomesDocument8 pagesUnder Section Id) : Unit 4 Exempted IncomesAmritNo ratings yet

- Economicsquestionbank2022 23Document33 pagesEconomicsquestionbank2022 23imtidrago artsNo ratings yet

- Chapter 3 - National Income and Related AggregatesDocument11 pagesChapter 3 - National Income and Related Aggregatesishika.khandelwal2007No ratings yet

- Important Questions For CBSE Class 12 Macro Economics Chapter 2 PDFDocument8 pagesImportant Questions For CBSE Class 12 Macro Economics Chapter 2 PDFAlans TechnicalNo ratings yet

- Economic - Analysis For - Business - Unit - IVDocument35 pagesEconomic - Analysis For - Business - Unit - IVViswanath ViswaNo ratings yet

- Class Xii Economics Unit 1 Study Material 2021-22Document32 pagesClass Xii Economics Unit 1 Study Material 2021-22MOHAMMAD SYED AEJAZNo ratings yet

- National - Income (1) - Circular FlowDocument6 pagesNational - Income (1) - Circular Flowaparnah_83No ratings yet

- EconomicsDocument66 pagesEconomicsSangeeta YadavNo ratings yet

- Measurement of N.I. (Expenditure Method)Document26 pagesMeasurement of N.I. (Expenditure Method)ankitNo ratings yet

- Economics For Managers - Session 16Document8 pagesEconomics For Managers - Session 16Abimanyu NNNo ratings yet

- Economics 12 2023-1Document31 pagesEconomics 12 2023-1aryantejpal2605No ratings yet

- National Income AccountingDocument37 pagesNational Income Accountingnavya.cogni21No ratings yet

- Macroeconomics TutorialDocument18 pagesMacroeconomics Tutorialfamin87No ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Nature and Context of Research 2Document2 pagesNature and Context of Research 2vanvunNo ratings yet

- Nature and Context of Research 1Document16 pagesNature and Context of Research 1vanvunNo ratings yet

- GK For Class TestDocument3 pagesGK For Class TestvanvunNo ratings yet

- Logical ReasoningDocument3 pagesLogical ReasoningvanvunNo ratings yet

- Multiple Choice Questions On Ratio and ProportionDocument1 pageMultiple Choice Questions On Ratio and Proportionvanvun100% (3)

- Costing and Cost AccountingDocument1 pageCosting and Cost AccountingvanvunNo ratings yet

- Notes For Students Amalgamation 2Document4 pagesNotes For Students Amalgamation 2vanvunNo ratings yet

- Liquidity Management in BanksDocument28 pagesLiquidity Management in BanksvanvunNo ratings yet

- Interdependence Between Micro and Macro EconomicsDocument1 pageInterdependence Between Micro and Macro Economicsvanvun50% (2)

- Implications of Baumol's Sales Revenue Maximization ModelDocument1 pageImplications of Baumol's Sales Revenue Maximization ModelvanvunNo ratings yet

- Concept of Commercial Banks of Nepa1Document8 pagesConcept of Commercial Banks of Nepa1vanvunNo ratings yet

- Notes For Students Amalgamation 1Document3 pagesNotes For Students Amalgamation 1vanvunNo ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- Concept of Commercial Banks of NepalDocument2 pagesConcept of Commercial Banks of Nepalvanvun100% (1)

- Importance of OBDocument3 pagesImportance of OBvanvunNo ratings yet

- Banking: Meaning of BankDocument8 pagesBanking: Meaning of BankvanvunNo ratings yet

- Teacher Vacant Announcement 1Document2 pagesTeacher Vacant Announcement 1vanvunNo ratings yet

- SDX?SF) KL/DF) FLS/) F 1 DKLQSF) X:TFGT/) F: Quantifiaciton of Amounts (Sec. 27)Document1 pageSDX?SF) KL/DF) FLS/) F 1 DKLQSF) X:TFGT/) F: Quantifiaciton of Amounts (Sec. 27)vanvunNo ratings yet

- Relation Between TPDocument7 pagesRelation Between TPvanvunNo ratings yet

- Networking Basic Components: Merge and Burst Events: It Is Necessary For An Event To Be The Ending Event of Only OneDocument7 pagesNetworking Basic Components: Merge and Burst Events: It Is Necessary For An Event To Be The Ending Event of Only OnevanvunNo ratings yet

- Career Paths Accounting SB-17Document1 pageCareer Paths Accounting SB-17YanetNo ratings yet

- MeleseDocument40 pagesMeleseዳግማዊ ጌታነህ ግዛው ባይህNo ratings yet

- Income Statement To The NetDocument26 pagesIncome Statement To The NetOman SherNo ratings yet

- ABM FABM 2 Q1 Course Guide PDFDocument58 pagesABM FABM 2 Q1 Course Guide PDFEarl Christian BonaobraNo ratings yet

- Unit 2Document15 pagesUnit 2Maithra DNo ratings yet

- Chapter 2 - PartnershipDocument20 pagesChapter 2 - PartnershipNgNo ratings yet

- Fashion Business Plan Example - Clothes Business PlanDocument16 pagesFashion Business Plan Example - Clothes Business Planfakhour nabil100% (1)

- Acct 301 WorksheetDocument3 pagesAcct 301 Worksheetapi-355720477No ratings yet

- Quiz 2Document21 pagesQuiz 2Drey StudyingNo ratings yet

- Shariah Stock Screening Final ReportDocument16 pagesShariah Stock Screening Final ReportOsama Ali RizwanNo ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- Financial Analysis ReviewerDocument15 pagesFinancial Analysis ReviewerPrincess Corine BurgosNo ratings yet

- Income Taxation True or False SummaryDocument2 pagesIncome Taxation True or False SummaryFranklin JungcoNo ratings yet

- Absorption CostingDocument76 pagesAbsorption CostingMustafa KamalNo ratings yet

- Closing Journal Entries-Sole ProprietorshipDocument1 pageClosing Journal Entries-Sole ProprietorshipMary100% (3)

- Group 08 Financial Feasibility Excel 2Document8 pagesGroup 08 Financial Feasibility Excel 2Slindokuhle ThandoNo ratings yet

- Does Corporate Tax Avoidance Explain Firm Performance? Evidence From An Emerging EconomyDocument18 pagesDoes Corporate Tax Avoidance Explain Firm Performance? Evidence From An Emerging EconomyReynardo GosalNo ratings yet

- Financial Accounting Theory 3Rd Edition Deegan Test Bank Full Chapter PDFDocument38 pagesFinancial Accounting Theory 3Rd Edition Deegan Test Bank Full Chapter PDFchristinecohenceyamrgpkj100% (11)

- ecolex2ke សទ្ទានុក្រមសេដ្ឋកិច្ចDocument119 pagesecolex2ke សទ្ទានុក្រមសេដ្ឋកិច្ចKhmerNo ratings yet

- IT Card SaneepDocument4 pagesIT Card Saneephajabarala2008No ratings yet

- 商业预算规划Document10 pages商业预算规划upelpmwlfNo ratings yet

- Master File - Business PlanDocument14 pagesMaster File - Business PlanInfant JinNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- Financial Statement AnalysisDocument23 pagesFinancial Statement AnalysisHinata UzumakiNo ratings yet

- AccDocument8 pagesAccCavin Jhon Mamites CabarloNo ratings yet

- CA Tax NotesDocument616 pagesCA Tax NotesvijayNo ratings yet

- DR Jones Case AnalysisDocument7 pagesDR Jones Case AnalysisPROJECT ACCOUNTANTS MEGAWIDENo ratings yet