Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsIndirect Taxes and Profit Margins On MRP

Indirect Taxes and Profit Margins On MRP

Uploaded by

rajibranjan7338This document outlines the various costs that are included in determining the maximum retail price (MRP) of a product, including taxes. It notes that the MRP is calculated as the total of manufacturing costs, marketing and advertising costs, supply chain and logistics costs, taxes, and profits for retailers that can range from 10-50% of all mentioned costs. It then provides details on the various tax rates applied to different cost elements like raw materials, equipment, power, transportation, customs and duties. Profits for manufacturers, dealers and retailers that are subject to income tax are also included.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Fundamentals of Computation of Duties and Taxes For Imported GoodsDocument2 pagesFundamentals of Computation of Duties and Taxes For Imported GoodsZy Depeña89% (9)

- Calculation of Cotton ExportDocument21 pagesCalculation of Cotton Exportcottontrade100% (2)

- Business Financials MRFDocument13 pagesBusiness Financials MRFarshdhirNo ratings yet

- PRICINGDocument1 pagePRICINGSen AquinoNo ratings yet

- Return of Total Income/Statement of Final TaxationDocument1 pageReturn of Total Income/Statement of Final TaxationJazzy BadshahNo ratings yet

- Malaysia GST PresentationDocument15 pagesMalaysia GST PresentationJeffreyNo ratings yet

- Knowledge Series: Measuring GDP: March 2009Document9 pagesKnowledge Series: Measuring GDP: March 2009Shachi SangharajkaNo ratings yet

- CB - Sc.u4cse23215 PQDocument24 pagesCB - Sc.u4cse23215 PQvimal007.xNo ratings yet

- FIFODocument2 pagesFIFOiharoNo ratings yet

- CH - 8 NATIONAL INCOME ACCOUNTING - FINALDocument35 pagesCH - 8 NATIONAL INCOME ACCOUNTING - FINALdeepakNo ratings yet

- Indonesia: in Case of Branches of Foreign Companies, TheDocument2 pagesIndonesia: in Case of Branches of Foreign Companies, TheVioni HanifaNo ratings yet

- Formula SheetDocument9 pagesFormula Sheetrocky2219No ratings yet

- TaxationDocument13 pagesTaxationShaz BurkNo ratings yet

- ExercisesDocument4 pagesExercisesLuân Nguyễn Đình ThànhNo ratings yet

- Physical Plant Cost (PPC) : ServiceDocument4 pagesPhysical Plant Cost (PPC) : ServiceMentari AdindaNo ratings yet

- Advance Tax Vat II Jj2024Document40 pagesAdvance Tax Vat II Jj2024cnarinNo ratings yet

- Export Costing WorksheetDocument2 pagesExport Costing Worksheetkamleshshiva0% (2)

- Custom Duty CalculetorDocument2 pagesCustom Duty CalculetorVelayudham ThiyagarajanNo ratings yet

- Price Build Up Sensitive ProductsDocument1 pagePrice Build Up Sensitive ProductsGaurav SinghNo ratings yet

- Malaysia Tax Guide PDFDocument4 pagesMalaysia Tax Guide PDFChun Zau TohNo ratings yet

- Indore, Chana: Mandi MatrixDocument4 pagesIndore, Chana: Mandi MatrixramNo ratings yet

- To The Presentation: Tax System in BangladeshDocument74 pagesTo The Presentation: Tax System in BangladeshSalahuddin AhmedNo ratings yet

- GDP Calculation TheoryDocument45 pagesGDP Calculation TheoryRakesh JainNo ratings yet

- The Concepts of Macro EconomicsDocument5 pagesThe Concepts of Macro EconomicsRahulNo ratings yet

- Answer Prime Cost Raw Material Purchased + Opening Stock of Raw Materials - Closing Stock of RawDocument2 pagesAnswer Prime Cost Raw Material Purchased + Opening Stock of Raw Materials - Closing Stock of RawVarun ChaitanyaNo ratings yet

- Company Name Company Location Company Started Product Dealt With ParametersDocument20 pagesCompany Name Company Location Company Started Product Dealt With ParametersnidhisanjeetNo ratings yet

- ANGIEDocument1 pageANGIEangieruayaNo ratings yet

- Chapter 13 - Mixed 2013Document9 pagesChapter 13 - Mixed 2013JB RealizaNo ratings yet

- Value Added Tax (Vat)Document40 pagesValue Added Tax (Vat)Phuong TrangNo ratings yet

- CENVAT Credit Rules, 2004Document8 pagesCENVAT Credit Rules, 2004Keval KotechaNo ratings yet

- After-Tax Economic Analysis: Engineering EconomyDocument16 pagesAfter-Tax Economic Analysis: Engineering EconomyTUẤN TRẦN MINHNo ratings yet

- General Costing - Cop7777yDocument1 pageGeneral Costing - Cop7777yNaman HumaneNo ratings yet

- All Formulas For Eco Till 4.8Document2 pagesAll Formulas For Eco Till 4.8Riana KapoorNo ratings yet

- 2 Cost SheetDocument3 pages2 Cost SheetAnurag Agarwal100% (1)

- Multinational Enterprises: Practical IssuesDocument45 pagesMultinational Enterprises: Practical IssuesShiv PrasadNo ratings yet

- Costing: Cost Is The Amount of Expenditure (Actual or Notional) Incurred On or Attributable To, A Given ThingDocument7 pagesCosting: Cost Is The Amount of Expenditure (Actual or Notional) Incurred On or Attributable To, A Given Thingbhupendra SinghNo ratings yet

- Chapter 14 - Percentage Taxes2013Document11 pagesChapter 14 - Percentage Taxes2013JB RealizaNo ratings yet

- Price Calculation: Total Expense 1,388.10Document1 pagePrice Calculation: Total Expense 1,388.10Karan KumarNo ratings yet

- Calculation of Custom ValueDocument22 pagesCalculation of Custom ValueTanzila SiddiquiNo ratings yet

- Cin Kss SessionDocument71 pagesCin Kss SessionAjay DayalNo ratings yet

- Chapter 14 - Percentage Taxes2013Document10 pagesChapter 14 - Percentage Taxes2013ljane100% (2)

- Price List of Comfort Ip Pos ProductsDocument1 pagePrice List of Comfort Ip Pos ProductsDurban Chamber of Commerce and IndustryNo ratings yet

- By Ken Woo: Ca (M), Acca (Uk), BSC (First Hons)Document166 pagesBy Ken Woo: Ca (M), Acca (Uk), BSC (First Hons)kotisanampudiNo ratings yet

- Planning Tool - : Please Complete The Yellow Fields Only! All Blue Fields Will Be Completed AutomaticallyDocument13 pagesPlanning Tool - : Please Complete The Yellow Fields Only! All Blue Fields Will Be Completed AutomaticallyStoica NicolaeNo ratings yet

- Income Statement1Document1 pageIncome Statement1James HohoasiNo ratings yet

- How To Calculate Custom Duty: Compiled by DR Renu AggarwalDocument6 pagesHow To Calculate Custom Duty: Compiled by DR Renu AggarwalJibran SakharkarNo ratings yet

- TAX SOLUTIONS (2) Corrected 2aaDocument12 pagesTAX SOLUTIONS (2) Corrected 2aaketty sambaNo ratings yet

- Import ClearanceDocument26 pagesImport ClearanceSamNo ratings yet

- Modül Business Decisions and EconomicsDocument60 pagesModül Business Decisions and Economicsmuhendis_8900No ratings yet

- Details (RM) MillionDocument8 pagesDetails (RM) MillionJones ChongNo ratings yet

- Income Statement: Less Sales Returns and AllowancesDocument1 pageIncome Statement: Less Sales Returns and AllowancesAnyone AnywhereNo ratings yet

- Computation Formulae For Imported GoodsDocument1 pageComputation Formulae For Imported GoodsMohamed AfkarNo ratings yet

- Pricing Process and Strategy, Cost and Price Calculations For ExportDocument7 pagesPricing Process and Strategy, Cost and Price Calculations For ExportsanjayttmNo ratings yet

- Calculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageDocument3 pagesCalculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageAccounts Pivot Engg67% (3)

- Pertemuan 07 Rancangan Pabrik (18 November 2015)Document21 pagesPertemuan 07 Rancangan Pabrik (18 November 2015)Sania Daniati ArifinNo ratings yet

- Cash Incentives For Export Promotion in NepalDocument30 pagesCash Incentives For Export Promotion in NepalChandan Sapkota100% (2)

- Mandolin ChordsDocument3 pagesMandolin Chordsrajibranjan7338100% (1)

- Digital Booklet - Songs of Innocent 1Document29 pagesDigital Booklet - Songs of Innocent 1rajibranjan7338No ratings yet

- SQL TipsDocument94 pagesSQL Tipsrajibranjan7338100% (1)

- Selenium Is An Open Source Web Application Test Automation ToolDocument5 pagesSelenium Is An Open Source Web Application Test Automation Toolrajibranjan7338No ratings yet

- Yamaha PSR E423 EnglishDocument28 pagesYamaha PSR E423 Englishrajibranjan7338No ratings yet

Indirect Taxes and Profit Margins On MRP

Indirect Taxes and Profit Margins On MRP

Uploaded by

rajibranjan73380 ratings0% found this document useful (0 votes)

9 views2 pagesThis document outlines the various costs that are included in determining the maximum retail price (MRP) of a product, including taxes. It notes that the MRP is calculated as the total of manufacturing costs, marketing and advertising costs, supply chain and logistics costs, taxes, and profits for retailers that can range from 10-50% of all mentioned costs. It then provides details on the various tax rates applied to different cost elements like raw materials, equipment, power, transportation, customs and duties. Profits for manufacturers, dealers and retailers that are subject to income tax are also included.

Original Description:

Indirect taxation and how it affects the retail prices

Original Title

Indirect Taxes and Profit Margins on Mrp

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the various costs that are included in determining the maximum retail price (MRP) of a product, including taxes. It notes that the MRP is calculated as the total of manufacturing costs, marketing and advertising costs, supply chain and logistics costs, taxes, and profits for retailers that can range from 10-50% of all mentioned costs. It then provides details on the various tax rates applied to different cost elements like raw materials, equipment, power, transportation, customs and duties. Profits for manufacturers, dealers and retailers that are subject to income tax are also included.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views2 pagesIndirect Taxes and Profit Margins On MRP

Indirect Taxes and Profit Margins On MRP

Uploaded by

rajibranjan7338This document outlines the various costs that are included in determining the maximum retail price (MRP) of a product, including taxes. It notes that the MRP is calculated as the total of manufacturing costs, marketing and advertising costs, supply chain and logistics costs, taxes, and profits for retailers that can range from 10-50% of all mentioned costs. It then provides details on the various tax rates applied to different cost elements like raw materials, equipment, power, transportation, customs and duties. Profits for manufacturers, dealers and retailers that are subject to income tax are also included.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

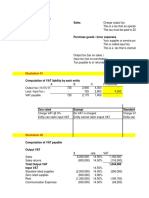

INDIRECT TAXES NAD PROFIT MARGINS ON MRP

MRP= Total Manufacturing cost + marketing &advertising cost+ supply

chain & logistic cost+ Taxes+profit for retailer+10-50 % (all mentioned cost )

But it depend on the segment.

Manufacturing cost = [Cost of Raw material (Taxed)+Cost of equipments

(Taxed)+ Power ( Taxed) + Manpower Cost (Taxed )+ Consultancy (Taxed) +

Before Production Transportation (Taxed)]

Marketing and advertising cost = 7 to 10 % of total budget ( Upto 14.5 %

Service tax on outsourced marketing and advertising, accepted as an input

cost to company)

Shipping cost:- (Packing & Forwaring = 3 % , Freight = 3% ( 14.5% Service tax

on 30% of transportation charges if transported through Railway or

Transporting agency) )

Customs & Duties :- At Manufacturing Location =Import Duty (Taxed) +

Excise Duty Including Cess (12.36 %) + Tariffs + Export duty (taxed)

At Dealers location:- Central Sales tax (If there is an interstate sale (14.5% on

basic cost+ED+ P&F) + Assam Govt. Entry Tax (2% of total value including

transportation)

At Retailers location :- VAT (14 % for Assam) Risk expenditure :- Transit

insurance (Taxed) + Warrantee & Guarantee Cost (Taxed) + Quality Assurance

cost ( Outsourced activities come under service tax @ 14.5% ) + Minimum

Safety Stock cost

Overhead Cost:- Exchange rates + travel expenses (taxed),

Profits- Manufacturers profit (Approx 3%)+ Dealers margin (Approx 5 %

Average) + Retailers margin (Approx 10 % average) - All come under income

tax

You might also like

- Fundamentals of Computation of Duties and Taxes For Imported GoodsDocument2 pagesFundamentals of Computation of Duties and Taxes For Imported GoodsZy Depeña89% (9)

- Calculation of Cotton ExportDocument21 pagesCalculation of Cotton Exportcottontrade100% (2)

- Business Financials MRFDocument13 pagesBusiness Financials MRFarshdhirNo ratings yet

- PRICINGDocument1 pagePRICINGSen AquinoNo ratings yet

- Return of Total Income/Statement of Final TaxationDocument1 pageReturn of Total Income/Statement of Final TaxationJazzy BadshahNo ratings yet

- Malaysia GST PresentationDocument15 pagesMalaysia GST PresentationJeffreyNo ratings yet

- Knowledge Series: Measuring GDP: March 2009Document9 pagesKnowledge Series: Measuring GDP: March 2009Shachi SangharajkaNo ratings yet

- CB - Sc.u4cse23215 PQDocument24 pagesCB - Sc.u4cse23215 PQvimal007.xNo ratings yet

- FIFODocument2 pagesFIFOiharoNo ratings yet

- CH - 8 NATIONAL INCOME ACCOUNTING - FINALDocument35 pagesCH - 8 NATIONAL INCOME ACCOUNTING - FINALdeepakNo ratings yet

- Indonesia: in Case of Branches of Foreign Companies, TheDocument2 pagesIndonesia: in Case of Branches of Foreign Companies, TheVioni HanifaNo ratings yet

- Formula SheetDocument9 pagesFormula Sheetrocky2219No ratings yet

- TaxationDocument13 pagesTaxationShaz BurkNo ratings yet

- ExercisesDocument4 pagesExercisesLuân Nguyễn Đình ThànhNo ratings yet

- Physical Plant Cost (PPC) : ServiceDocument4 pagesPhysical Plant Cost (PPC) : ServiceMentari AdindaNo ratings yet

- Advance Tax Vat II Jj2024Document40 pagesAdvance Tax Vat II Jj2024cnarinNo ratings yet

- Export Costing WorksheetDocument2 pagesExport Costing Worksheetkamleshshiva0% (2)

- Custom Duty CalculetorDocument2 pagesCustom Duty CalculetorVelayudham ThiyagarajanNo ratings yet

- Price Build Up Sensitive ProductsDocument1 pagePrice Build Up Sensitive ProductsGaurav SinghNo ratings yet

- Malaysia Tax Guide PDFDocument4 pagesMalaysia Tax Guide PDFChun Zau TohNo ratings yet

- Indore, Chana: Mandi MatrixDocument4 pagesIndore, Chana: Mandi MatrixramNo ratings yet

- To The Presentation: Tax System in BangladeshDocument74 pagesTo The Presentation: Tax System in BangladeshSalahuddin AhmedNo ratings yet

- GDP Calculation TheoryDocument45 pagesGDP Calculation TheoryRakesh JainNo ratings yet

- The Concepts of Macro EconomicsDocument5 pagesThe Concepts of Macro EconomicsRahulNo ratings yet

- Answer Prime Cost Raw Material Purchased + Opening Stock of Raw Materials - Closing Stock of RawDocument2 pagesAnswer Prime Cost Raw Material Purchased + Opening Stock of Raw Materials - Closing Stock of RawVarun ChaitanyaNo ratings yet

- Company Name Company Location Company Started Product Dealt With ParametersDocument20 pagesCompany Name Company Location Company Started Product Dealt With ParametersnidhisanjeetNo ratings yet

- ANGIEDocument1 pageANGIEangieruayaNo ratings yet

- Chapter 13 - Mixed 2013Document9 pagesChapter 13 - Mixed 2013JB RealizaNo ratings yet

- Value Added Tax (Vat)Document40 pagesValue Added Tax (Vat)Phuong TrangNo ratings yet

- CENVAT Credit Rules, 2004Document8 pagesCENVAT Credit Rules, 2004Keval KotechaNo ratings yet

- After-Tax Economic Analysis: Engineering EconomyDocument16 pagesAfter-Tax Economic Analysis: Engineering EconomyTUẤN TRẦN MINHNo ratings yet

- General Costing - Cop7777yDocument1 pageGeneral Costing - Cop7777yNaman HumaneNo ratings yet

- All Formulas For Eco Till 4.8Document2 pagesAll Formulas For Eco Till 4.8Riana KapoorNo ratings yet

- 2 Cost SheetDocument3 pages2 Cost SheetAnurag Agarwal100% (1)

- Multinational Enterprises: Practical IssuesDocument45 pagesMultinational Enterprises: Practical IssuesShiv PrasadNo ratings yet

- Costing: Cost Is The Amount of Expenditure (Actual or Notional) Incurred On or Attributable To, A Given ThingDocument7 pagesCosting: Cost Is The Amount of Expenditure (Actual or Notional) Incurred On or Attributable To, A Given Thingbhupendra SinghNo ratings yet

- Chapter 14 - Percentage Taxes2013Document11 pagesChapter 14 - Percentage Taxes2013JB RealizaNo ratings yet

- Price Calculation: Total Expense 1,388.10Document1 pagePrice Calculation: Total Expense 1,388.10Karan KumarNo ratings yet

- Calculation of Custom ValueDocument22 pagesCalculation of Custom ValueTanzila SiddiquiNo ratings yet

- Cin Kss SessionDocument71 pagesCin Kss SessionAjay DayalNo ratings yet

- Chapter 14 - Percentage Taxes2013Document10 pagesChapter 14 - Percentage Taxes2013ljane100% (2)

- Price List of Comfort Ip Pos ProductsDocument1 pagePrice List of Comfort Ip Pos ProductsDurban Chamber of Commerce and IndustryNo ratings yet

- By Ken Woo: Ca (M), Acca (Uk), BSC (First Hons)Document166 pagesBy Ken Woo: Ca (M), Acca (Uk), BSC (First Hons)kotisanampudiNo ratings yet

- Planning Tool - : Please Complete The Yellow Fields Only! All Blue Fields Will Be Completed AutomaticallyDocument13 pagesPlanning Tool - : Please Complete The Yellow Fields Only! All Blue Fields Will Be Completed AutomaticallyStoica NicolaeNo ratings yet

- Income Statement1Document1 pageIncome Statement1James HohoasiNo ratings yet

- How To Calculate Custom Duty: Compiled by DR Renu AggarwalDocument6 pagesHow To Calculate Custom Duty: Compiled by DR Renu AggarwalJibran SakharkarNo ratings yet

- TAX SOLUTIONS (2) Corrected 2aaDocument12 pagesTAX SOLUTIONS (2) Corrected 2aaketty sambaNo ratings yet

- Import ClearanceDocument26 pagesImport ClearanceSamNo ratings yet

- Modül Business Decisions and EconomicsDocument60 pagesModül Business Decisions and Economicsmuhendis_8900No ratings yet

- Details (RM) MillionDocument8 pagesDetails (RM) MillionJones ChongNo ratings yet

- Income Statement: Less Sales Returns and AllowancesDocument1 pageIncome Statement: Less Sales Returns and AllowancesAnyone AnywhereNo ratings yet

- Computation Formulae For Imported GoodsDocument1 pageComputation Formulae For Imported GoodsMohamed AfkarNo ratings yet

- Pricing Process and Strategy, Cost and Price Calculations For ExportDocument7 pagesPricing Process and Strategy, Cost and Price Calculations For ExportsanjayttmNo ratings yet

- Calculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageDocument3 pagesCalculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageAccounts Pivot Engg67% (3)

- Pertemuan 07 Rancangan Pabrik (18 November 2015)Document21 pagesPertemuan 07 Rancangan Pabrik (18 November 2015)Sania Daniati ArifinNo ratings yet

- Cash Incentives For Export Promotion in NepalDocument30 pagesCash Incentives For Export Promotion in NepalChandan Sapkota100% (2)

- Mandolin ChordsDocument3 pagesMandolin Chordsrajibranjan7338100% (1)

- Digital Booklet - Songs of Innocent 1Document29 pagesDigital Booklet - Songs of Innocent 1rajibranjan7338No ratings yet

- SQL TipsDocument94 pagesSQL Tipsrajibranjan7338100% (1)

- Selenium Is An Open Source Web Application Test Automation ToolDocument5 pagesSelenium Is An Open Source Web Application Test Automation Toolrajibranjan7338No ratings yet

- Yamaha PSR E423 EnglishDocument28 pagesYamaha PSR E423 Englishrajibranjan7338No ratings yet