Professional Documents

Culture Documents

Web of Debt - Thinking Outside The Box: How A Bankrupt Germany Solved Its Infrastructure Problems

Web of Debt - Thinking Outside The Box: How A Bankrupt Germany Solved Its Infrastructure Problems

Uploaded by

superdude663Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Web of Debt - Thinking Outside The Box: How A Bankrupt Germany Solved Its Infrastructure Problems

Web of Debt - Thinking Outside The Box: How A Bankrupt Germany Solved Its Infrastructure Problems

Uploaded by

superdude663Copyright:

Available Formats

Web of Debt - Thinking Outside The Box: How A Bankrupt G...

Home

Order Here

Blog

Public Banking Institute

http://www.webofdebt.com/articles/bankrupt-germany.php

Articles by Author

Interviews

Model-Economy Wiki

THINKING OUTSIDE THE BOX:

HOW A BANKRUPT GERMANY SOLVED ITS

INFRASTRUCTURE PROBLEMS

Ellen Brown, August 9th, 2007

http://www.webofdebt.com/articles/bankrupt-germany.php

Post your comments here

"We were not foolish enough to try to make a currency [backed by] gold of which we had none, but for

every mark that was issued we required the equivalent of a mark's worth of work done or goods

produced. . . .we laugh at the time our national financiers held the view that the value of a currency is

regulated by the gold and securities lying in the vaults of a state bank."

- Adolf Hitler, quoted in "Hitler's Monetary System," www.rense.com, citing C. C. Veith,

Citadels of

Chaos (Meador, 1949)

Guernsey wasn't the only government to solve its infrastructure problems by issuing its own money. (See E. Brown,

"Waking Up on a Minnesota Bridge," www.webofdebt.com/articles/infrastructure-crisis.php, August 4, 2007.) A

more notorious model is found in post-World War I Germany. When Hitler came to power, the country was

completely, hopelessly broke. The Treaty of Versailles had imposed crushing reparations payments on the German

people, who were expected to reimburse the costs of the war for all participants costs totaling three times the

value of all the property in the country. Speculation in the German mark had caused it to plummet, precipitating one

of the worst runaway inflations in modern times. At its peak, a wheelbarrow full of 100 billion-mark banknotes

could not buy a loaf of bread. The national treasury was empty, and huge numbers of homes and farms had been lost

to the banks and speculators. People were living in hovels and starving. Nothing quite like it had ever happened

before - the total destruction of the national currency, wiping out people's savings, their businesses, and the economy

generally. Making matters worse, at the end of the decade global depression hit. Germany had no choice but to

succumb to debt slavery to international lenders.

Or so it seemed. Hitler and the National Socialists, who came to power in 1933, thwarted the international banking

cartel by issuing their own money. In this they took their cue from Abraham Lincoln, who funded the American

Civil War with government-issued paper money called "Greenbacks." Hitler began his national credit program by

devising a plan of public works. Projects earmarked for funding included flood control, repair of public buildings

and private residences, and construction of new buildings, roads, bridges, canals, and port facilities. The projected

cost of the various programs was fixed at one billion units of the national currency. One billion non-inflationary bills

of exchange, called Labor Treasury Certificates, were then issued against this cost. Millions of people were put to

work on these projects, and the workers were paid with the Treasury Certificates. This government-issued money

wasn't backed by gold, but it was backed by something of real value. It was essentially a receipt for labor and

materials delivered to the government. Hitler said, "for every mark that was issued we required the equivalent of a

1 of 4

13-11-16 11:29 AM

Web of Debt - Thinking Outside The Box: How A Bankrupt G...

http://www.webofdebt.com/articles/bankrupt-germany.php

mark's worth of work done or goods produced." The workers then spent the Certificates on other goods and services,

creating more jobs for more people.

Within two years, the unemployment problem had been solved and the country was back on its feet. It had a solid,

stable currency, no debt, and no inflation, at a time when millions of people in the United States and other Western

countries were still out of work and living on welfare. Germany even managed to restore foreign trade, although it

was denied foreign credit and was faced with an economic boycott abroad. It did this by using a barter system:

equipment and commodities were exchanged directly with other countries, circumventing the international banks.

This system of direct exchange occurred without debt and without trade deficits. Germany's economic experiment,

like Lincoln's, was short-lived; but it left some lasting monuments to its success, including the famous Autobahn, the

world's first extensive superhighway.1

Hjalmar Schacht, who was then head of the German central bank, is quoted in a bit of wit that sums up the German

version of the "Greenback" miracle. An American banker had commented, "Dr. Schacht, you should come to

America. We've lots of money and that's real banking." Schacht replied, "You should come to Berlin. We don't have

money. That's real banking."2

Although Hitler has rightfully gone down in infamy in the history books, he was quite popular with the German

people, at least for a time. Stephen Zarlenga suggests in The Lost Science of Money that this was because he

temporarily rescued Germany from English economic theory the theory that money must be borrowed against the

gold reserves of a private banking cartel rather than issued outright by the government.3 According to Canadian

researcher Dr. Henry Makow, this may have been a chief reason Hitler had to be stopped: he had sidestepped the

international bankers and created his own money. Makow quotes from the 1938 interrogation of C. G. Rakovsky, one

of the founders of Soviet Bolsevism and a Trotsky intimate, who was tried in show trials in the USSR under Stalin.

According to Rakovsky, Hitler had actually been funded by the international bankers, through their agent Hjalmar

Schacht, in order to control Stalin, who had usurped power from their agent Trotsky. But Hitler had become an even

bigger threat than Stalin when he had taken the bold step of printing his own money. Rakovsky said:

[Hitler] took over for himself the privilege of manufacturing money and not only physical moneys, but

also financial ones; he took over the untouched machinery of falsification and put it to work for the

benefit of the state . . . . Are you capable of imagining what would have come . . . if it had infected a

number of other states . . . . If you can, then imagine its counterrevolutionary functions.4

Economist Henry C K Liu writes of Germany's remarkable transformation:

The Nazis came to power in Germany in 1933, at a time when its economy was in total collapse, with

ruinous war-reparation obligations and zero prospects for foreign investment or credit. Yet through an

independent monetary policy of sovereign credit and a full-employment public-works program, the

Third Reich was able to turn a bankrupt Germany, stripped of overseas colonies it could exploit, into the

strongest economy in Europe within four years, even before armament spending began.5

In Billions for the Bankers, Debts for the People (1984), Sheldon Emry commented:

Germany issued debt-free and interest-free money from 1935 and on, accounting for its startling rise

from the depression to a world power in 5 years. Germany financed its entire government and war

operation from 1935 to 1945 without gold and without debt, and it took the whole Capitalist and

Communist world to destroy the German power over Europe and bring Europe back under the heel of

the Bankers. Such history of money does not even appear in the textbooks of public (government)

schools today.

Another Look at the Weimar Hyperinflation

What does appear in modern textbooks is the disastrous runaway inflation suffered in 1923 by the Weimar Republic

2 of 4

13-11-16 11:29 AM

Web of Debt - Thinking Outside The Box: How A Bankrupt G...

http://www.webofdebt.com/articles/bankrupt-germany.php

(the common name for the republic that governed Germany from 1919 to 1933). The radical devaluation of the

German mark is cited as the textbook example of what can go wrong when governments are given the unfettered

power to print money. That is what it is cited for; but in the complex world of economics, things are not always as

they seem. The Weimar financial crisis began with the impossible reparations payments imposed at the Treaty of

Versailles. Schacht, who was currency commissioner for the Republic, complained:

The Treaty of Versailles is a model of ingenious measures for the economic destruction of Germany. . . .

[T]he Reich could not find any way of holding its head above the water other than by the inflationary

expedient of printing bank notes.

That is what he said at first. But Zarlenga writes that Schacht proceeded in his 1967 book The Magic of Money "to

let the cat out of the bag, writing in German, with some truly remarkable admissions that shatter the 'accepted

wisdom' the financial community has promulgated on the German hyperinflation."6 Schacht revealed that it was the

privately-owned Reichsbank, not the German government, that was pumping new currency into the economy. Like

the U.S. Federal Reserve, the Reichsbank was overseen by appointed government officials but was operated for

private gain. What drove the wartime inflation into hyperinflation was speculation by foreign investors, who would

sell the mark short, betting on its decreasing value. In the manipulative device known as the short sale, speculators

borrow something they don't own, sell it, then "cover" by buying it back at the lower price. Speculation in the

German mark was made possible because the Reichsbank made massive amounts of currency available for

borrowing, marks that were created with accounting entries on the bank's books and lent at a profitable interest.

When the Reichsbank could not keep up with the voracious demand for marks, other private banks were allowed to

create them out of nothing and lend them at interest as well.7

According to Schacht, then, not only did the government not cause the Weimar hyperinflation, but it was the

government that got it under control. The Reichsbank was put under strict government regulation, and prompt

corrective measures were taken to eliminate foreign speculation, by eliminating easy access to loans of bank-created

money. Hitler then got the country back on its feet with his Treasury Certificates issued Greenback-style by the

government.

Schacht actually disapproved of this government fiat money, and wound up getting fired as head of the Reichsbank

when he refused to issue it (something that may have saved him at the Nuremberg trials). But he acknowledged in

his later memoirs that allowing the government to issue the money it needed had not produced the price inflation

predicted by classical economic theory. He surmised that this was because factories were sitting idle and people were

unemployed. In this he agreed with John Maynard Keynes: when the resources were available to increase

productivity, adding new money to the economy did not increase prices; it increased goods and services. Supply and

demand increased together, leaving prices unaffected.

___________________

1

Matt Koehl, "The Good Society?", www.rense.com (January 13, 2005); Stephen Zarlenga, The Lost Science

of Money (Valatie, New York: American Monetary Institute, 2002), pages 590-600.

3 of 4

John Weitz, Hitler's Banker (Great Britain: Warner Books, 1999).

S. Zarlenga, op. cit.

Henry Makow, "Hitler Did Not Want War," www.savethemales.com (March 21, 2004).

Henry C. K. Liu, "Nazism and the German Economic Miracle," Asia Times (May 24, 2005).

Stephen Zarlenga, "Germany's 1923 Hyperinflation: A 'Private' Affair," Barnes Review (July-August 1999);

David Kidd, "How Money Is Created in Australia," http://dkd.net/davekidd/politics/money.html (2001).

13-11-16 11:29 AM

Web of Debt - Thinking Outside The Box: How A Bankrupt G...

http://www.webofdebt.com/articles/bankrupt-germany.php

S. Zarlenga, "Germany's 1923 Hyperinflation," op. cit.

Ellen Brown, J.D., developed her research skills as an attorney practicing civil litigation in Los Angeles. In Web of

Debt, her latest book, she turns those skills to an analysis of the Federal Reserve and "the money trust." She shows

how this private cartel has usurped the power to create money from the people themselves, and how we the people

can get it back. Brown's eleven books include the bestselling Nature's Pharmacy, co-authored with Dr. Lynne

Walker, which has sold 285,000 copies.

Home | Also by Ellen Brown | Links | Contact Us | Order Now

Select Language

Powered by

Translate

Site by Phoenix Development.

Copyright 2007 Ellen Brown. All Rights Reserved.

4 of 4

13-11-16 11:29 AM

You might also like

- Corporate Finance A Focused Approach 6th Edition Ehrhardt Solutions Manual DownloadDocument38 pagesCorporate Finance A Focused Approach 6th Edition Ehrhardt Solutions Manual DownloadAndrea Howard100% (23)

- Hubbart Formula Approach - Problem SumDocument2 pagesHubbart Formula Approach - Problem SumGulzar Ahmed0% (1)

- Propaganda From Thucydides To ThatcherDocument13 pagesPropaganda From Thucydides To Thatcherbruceybruce100% (1)

- Nazi Monetary PolicyDocument5 pagesNazi Monetary Policyapi-268107541No ratings yet

- Ernst Zundel Full Trial OverviewDocument86 pagesErnst Zundel Full Trial OverviewfruitfuckNo ratings yet

- Treason in AmericaDocument334 pagesTreason in Americavigilancio153100% (3)

- Lobster 19Document129 pagesLobster 19belga197100% (3)

- Population Control in India - Prologue To The Emergency PeriodDocument40 pagesPopulation Control in India - Prologue To The Emergency PeriodTatiana L. Carrera100% (1)

- Millegan CreekDocument4 pagesMillegan Creekashwinmkumar25% (4)

- How Hitler Defied The BankersDocument4 pagesHow Hitler Defied The BankersMd Redhwan Sidd KhanNo ratings yet

- In Short, I Was A Racketeer, A Gangster For (Monopoly) Capitalism (TS)Document1 pageIn Short, I Was A Racketeer, A Gangster For (Monopoly) Capitalism (TS)foro35No ratings yet

- How Hitler Defied The BankersDocument4 pagesHow Hitler Defied The BankersElianMNo ratings yet

- Global Power and DivideDocument2 pagesGlobal Power and DivideMIKAELA BEATRICE LOPEZ100% (1)

- The Universalist HolocaustDocument5 pagesThe Universalist HolocaustVienna1683No ratings yet

- Bernard Von Bothmer - Understanding The HolocaustDocument26 pagesBernard Von Bothmer - Understanding The HolocaustBernard von BothmerNo ratings yet

- Irrefutable Evidence Against The HolocaustDocument5 pagesIrrefutable Evidence Against The HolocaustRené D. Monkey100% (1)

- Whiteford. .Sir Uncle Sam, Knight of The British Empire. (1940)Document8 pagesWhiteford. .Sir Uncle Sam, Knight of The British Empire. (1940)Joseph ScottNo ratings yet

- Imani vs. Federal Reserve BankDocument163 pagesImani vs. Federal Reserve BankaminalogaiNo ratings yet

- Enemies of The People by Paul CudenecDocument113 pagesEnemies of The People by Paul CudenecormrNo ratings yet

- Louis T McFaddenDocument18 pagesLouis T McFaddenanon-718138100% (1)

- Banking and Currency and The Money Trust by Minesota Congressman Charles A Lindbergh SRDocument114 pagesBanking and Currency and The Money Trust by Minesota Congressman Charles A Lindbergh SRMudassar NawazNo ratings yet

- Ezra Pound, America Roosevelt and The Causes of The Present WarDocument33 pagesEzra Pound, America Roosevelt and The Causes of The Present WarCaimito de GuayabalNo ratings yet

- About The Emotional Basis of Political PowerDocument12 pagesAbout The Emotional Basis of Political PowerLorus GaineyNo ratings yet

- Bukovsky - Is The European Union The New Soviet Union Transcript) (R)Document4 pagesBukovsky - Is The European Union The New Soviet Union Transcript) (R)pillulful100% (2)

- They Run America by Gary Allen - American OpinionDocument18 pagesThey Run America by Gary Allen - American OpinionKeith KnightNo ratings yet

- DidSixMillionReallyDie RichardHarwoodDocument47 pagesDidSixMillionReallyDie RichardHarwoodshemsaNo ratings yet

- EXPOSED: An Examination of The Anti-Defamation LeagueDocument24 pagesEXPOSED: An Examination of The Anti-Defamation LeagueKristin SzremskiNo ratings yet

- By Robert Henry GoldsboroughDocument30 pagesBy Robert Henry GoldsboroughJelani FletcherNo ratings yet

- Pujo Committee Explained Explained - Today-2Document2 pagesPujo Committee Explained Explained - Today-2Keith KnightNo ratings yet

- 5 22 11 Banksters Pranksters Hell HolesDocument6 pages5 22 11 Banksters Pranksters Hell HolesMarilyn MacGruder BarnewallNo ratings yet

- Sept. 5, 1969, Issue of LIFE MagazineDocument7 pagesSept. 5, 1969, Issue of LIFE MagazineDoghouse ReillyNo ratings yet

- Israel and The MocksDocument131 pagesIsrael and The MocksFree d MuslimNo ratings yet

- The Pseudoscience of EconomicsDocument30 pagesThe Pseudoscience of EconomicsPeter LapsanskyNo ratings yet

- Tyson - Target America - The Influence of Communist Propaganda On The US Media (1983) PDFDocument143 pagesTyson - Target America - The Influence of Communist Propaganda On The US Media (1983) PDFarge_deianira100% (1)

- A Financial War Against RothschildsDocument4 pagesA Financial War Against Rothschildsduong1989No ratings yet

- The Power Elite Playbook by Deanna Spingola 1Document49 pagesThe Power Elite Playbook by Deanna Spingola 1Eddie Hudzinski100% (1)

- Committee 300 WikiDocument2 pagesCommittee 300 Wikiiwan45604No ratings yet

- JewishWarOfSurvival - Arnold LeeseDocument69 pagesJewishWarOfSurvival - Arnold Leeseperegrine200200No ratings yet

- Interview With Professor Robert Faurisson-tehranDecember132006Document23 pagesInterview With Professor Robert Faurisson-tehranDecember132006928371No ratings yet

- Foundations As Syndicates of Control - Rockefellers - Foundations As Control-16Document16 pagesFoundations As Syndicates of Control - Rockefellers - Foundations As Control-16Keith KnightNo ratings yet

- Where Does Money Come From?Document4 pagesWhere Does Money Come From?api-127658921No ratings yet

- Confrontation With The Banking CartelTwitter3.23.19Document24 pagesConfrontation With The Banking CartelTwitter3.23.19karen hudes100% (1)

- The Opal File - A Secret History of Australia and New ZealandDocument19 pagesThe Opal File - A Secret History of Australia and New Zealandkitty katNo ratings yet

- Rothschild Family's Net Worth ExplainedDocument4 pagesRothschild Family's Net Worth ExplainedclonazzyoNo ratings yet

- Against Jews, Judaism and ZionismDocument10 pagesAgainst Jews, Judaism and ZionismRoy BorrillNo ratings yet

- David Hoggan - The Myth of The Six MillionDocument62 pagesDavid Hoggan - The Myth of The Six Milliongibmedat67% (3)

- Wall Street and The Bolshevik RevolutionDocument2 pagesWall Street and The Bolshevik Revolutionyoutube watcherNo ratings yet

- Carlos Whitlock-Porter - Made in Russia The HolocaustDocument428 pagesCarlos Whitlock-Porter - Made in Russia The Holocaustfredodeep76No ratings yet

- Research Paper Holocaust OverviewDocument12 pagesResearch Paper Holocaust OverviewErin SullivanNo ratings yet

- Jews Chamisn Beginning Israel2Document39 pagesJews Chamisn Beginning Israel2karen hudes100% (1)

- The Secrets of The Federal ReserveDocument6 pagesThe Secrets of The Federal Reserveapi-12303031No ratings yet

- Fractional Reserve Banking - Myrray Rothbard Short EssayDocument5 pagesFractional Reserve Banking - Myrray Rothbard Short EssaySUPPRESS THISNo ratings yet

- For Fear of The Jews Compress 231126 194258Document268 pagesFor Fear of The Jews Compress 231126 194258Eugene VenterNo ratings yet

- The Collectivism of American Neo-Nazis After 1945Document38 pagesThe Collectivism of American Neo-Nazis After 1945Nevin GussackNo ratings yet

- The New World Order and Our Current Administration (Public) Version 1.0Document110 pagesThe New World Order and Our Current Administration (Public) Version 1.0zeon deikun100% (5)

- The History of a Lie: "The Protocols of the Wise Men of Zion"From EverandThe History of a Lie: "The Protocols of the Wise Men of Zion"No ratings yet

- How Hitler Defied The BankersDocument9 pagesHow Hitler Defied The Bankerskoroga100% (1)

- Manifesto for the Abolition of Enslavement to Interest on MoneyFrom EverandManifesto for the Abolition of Enslavement to Interest on MoneyRating: 4.5 out of 5 stars4.5/5 (3)

- 1929 - The Crash ExplainedDocument3 pages1929 - The Crash Explainedfrederic9866No ratings yet

- Wilberg - National BolshevismDocument15 pagesWilberg - National BolshevismThigpen FockspaceNo ratings yet

- Hyperinflation in Germany, 1914-1923: (This Article Is Excerpted From The Book .)Document10 pagesHyperinflation in Germany, 1914-1923: (This Article Is Excerpted From The Book .)hipsterzNo ratings yet

- Du An 2 - EnglishDocument2 pagesDu An 2 - English6fxg774ggfNo ratings yet

- Public Finance 8th Ed SolutionDocument92 pagesPublic Finance 8th Ed SolutionChan ZacharyNo ratings yet

- Market Segmentation and Targeting With BMWDocument21 pagesMarket Segmentation and Targeting With BMWPankaj Chauhan100% (1)

- 149 - Strategic Management 10 TH EditionDocument454 pages149 - Strategic Management 10 TH Editionaram323No ratings yet

- 2019 IndiaDocument29 pages2019 Indiasudhanshballal2442No ratings yet

- Economy Mcqs 2Document3 pagesEconomy Mcqs 2Dj-Kanaan AsifNo ratings yet

- Bmbe RRLDocument6 pagesBmbe RRLCarla ZanteNo ratings yet

- Me (Monopoly) PPT Rohit Valse 713190Document12 pagesMe (Monopoly) PPT Rohit Valse 713190RohitNo ratings yet

- IKEA Expands Into India: ResearchDocument45 pagesIKEA Expands Into India: ResearchZafar Ibn KaderNo ratings yet

- Sales ProcessDocument8 pagesSales ProcessMohit JohriNo ratings yet

- Adam Smith Father of EconomicsDocument3 pagesAdam Smith Father of EconomicsGleizuly VaughnNo ratings yet

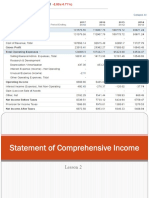

- Lesson 2 Statement of Comprehensive IncomeDocument23 pagesLesson 2 Statement of Comprehensive IncomePaulette Sarno80% (5)

- Simplified 6th Edition of PBDs For The Procurement of Infrastructure ProjectsDocument38 pagesSimplified 6th Edition of PBDs For The Procurement of Infrastructure ProjectsAnton_Young_1962No ratings yet

- KMV ModelDocument5 pagesKMV ModelVijay BehraNo ratings yet

- Decimals Answer KeyDocument3 pagesDecimals Answer KeyKathleen EstilloreNo ratings yet

- Hedging Strategies Using FuturesDocument23 pagesHedging Strategies Using FuturesBiswajit SarmaNo ratings yet

- Questions For Competitive Markets Type I: True/False Question (Give A Brief Explanation)Document3 pagesQuestions For Competitive Markets Type I: True/False Question (Give A Brief Explanation)Hạnh Đỗ Thị ThanhNo ratings yet

- Econ 100.2 THC - Problem Set 3Document4 pagesEcon 100.2 THC - Problem Set 3TiffanyUyNo ratings yet

- CMA CAF-8 Important TheoryDocument14 pagesCMA CAF-8 Important TheoryShehrozSTNo ratings yet

- დავალება 1Document8 pagesდავალება 1Makuna NatsvlishviliNo ratings yet

- Ch07 Learning CurvesDocument24 pagesCh07 Learning Curvessubash1111@gmail.com100% (1)

- 428799Document365 pages428799maba424No ratings yet

- Letter To The Editor of The Newspaper On Noise PollutionDocument3 pagesLetter To The Editor of The Newspaper On Noise PollutionAimanNo ratings yet

- Bombay DyeingDocument12 pagesBombay DyeingAVINASH TOPNONo ratings yet

- MICROECONOMIA Y MACROECONOMÍA - Est2018 - 1 PDFDocument2 pagesMICROECONOMIA Y MACROECONOMÍA - Est2018 - 1 PDFVanessa MayorgaNo ratings yet