Professional Documents

Culture Documents

Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

You might also like

- JobOrder Dayag MusorDocument29 pagesJobOrder Dayag MusorLaut Bantuas II50% (2)

- S4 HANA Finance - Configuration Guide1Document224 pagesS4 HANA Finance - Configuration Guide1Alberto Mario Delahoz Olaciregui91% (11)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results - Dec 2022Document10 pagesFinancial Results - Dec 2022mehtaarian1No ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- 2008 13 Financial Statements Samsung 2007Document26 pages2008 13 Financial Statements Samsung 2007Wilson Edilber ValenciaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Auditor'S Review ON THE: Independent Quarterly FinancialDocument7 pagesAuditor'S Review ON THE: Independent Quarterly FinancialKarthik KeyanNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Samsung Electronics Co., LTD.: Index December 31, 2009 and 2008Document74 pagesSamsung Electronics Co., LTD.: Index December 31, 2009 and 2008Akshay JainNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Outcome BM TTSL 13112023141556Document11 pagesOutcome BM TTSL 13112023141556Jayanth kumarNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Seminar 4 Internal Control - StudentDocument49 pagesSeminar 4 Internal Control - StudentLIAW ANN YINo ratings yet

- Audit Asignment 1 and 2Document21 pagesAudit Asignment 1 and 2Kurauone MuswereNo ratings yet

- Accounting ManuelDocument1,061 pagesAccounting ManuelthenjhomebuyerNo ratings yet

- Cost Accounting 14th Ed - CARTER - 11 - 50Document58 pagesCost Accounting 14th Ed - CARTER - 11 - 50Wiraswasta MandiriNo ratings yet

- Audit SaadDocument29 pagesAudit SaadsabeehahsanNo ratings yet

- RTP Financial Reporting CapiiiDocument39 pagesRTP Financial Reporting CapiiiManoj ThapaliaNo ratings yet

- Upsa Mba PDFDocument3 pagesUpsa Mba PDFlegendNo ratings yet

- Physical ControlsDocument5 pagesPhysical ControlsRanica VerzosaNo ratings yet

- 3 12Document4 pages3 12Dianne SantiagoNo ratings yet

- Acctg Changes, Error Correction, Prior ErrorDocument3 pagesAcctg Changes, Error Correction, Prior ErrorLayJohn LacadenNo ratings yet

- CMA AssignmentDocument5 pagesCMA AssignmentMaria AkpoduadoNo ratings yet

- STD 11 Book Keeping and AccountancyDocument18 pagesSTD 11 Book Keeping and AccountancyRam IyerNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- Randhil Jinendrasinghe CV DocumentDocument3 pagesRandhil Jinendrasinghe CV Documentapi-537881318No ratings yet

- United States Patent: Tawara Et Al. (45) Date of Patent: Aug. 7, 2007Document25 pagesUnited States Patent: Tawara Et Al. (45) Date of Patent: Aug. 7, 2007SintaDwiSampurnaNo ratings yet

- Afm Mod 2Document4 pagesAfm Mod 2Manas MohapatraNo ratings yet

- Nat & PatDocument36 pagesNat & Patfaith olaNo ratings yet

- 9207 - Faculty Publications Report 2017 02Document104 pages9207 - Faculty Publications Report 2017 02Atta GebrilNo ratings yet

- Cash Flow StatementDocument40 pagesCash Flow StatementOmpriya AcharyaNo ratings yet

- 2 MCQ - Prof Prac of Accty-An OverviewDocument1 page2 MCQ - Prof Prac of Accty-An OverviewRAISA LIDASANNo ratings yet

- Ch13-Testbank RemovedDocument28 pagesCh13-Testbank RemovedMr MDRKHMNo ratings yet

- ACCA104 - Inventory Cost FlowDocument13 pagesACCA104 - Inventory Cost FlowAnaluz Cristine B. CeaNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Chapter 1 Mas Req TrueDocument106 pagesChapter 1 Mas Req TrueRhedeline LugodNo ratings yet

- Quiz Chapter 21 & 24Document13 pagesQuiz Chapter 21 & 24mzvette234No ratings yet

- Break Even AnalysisDocument13 pagesBreak Even Analysissuchipatel100% (2)

- Warming Up Khurshed Pastakia 7 Dec 141Document41 pagesWarming Up Khurshed Pastakia 7 Dec 141vnewatiaNo ratings yet

- 5038 - Assignment 2 Brief - Updated (With Numbers)Document7 pages5038 - Assignment 2 Brief - Updated (With Numbers)Minh Thu Nguyen TranNo ratings yet

Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

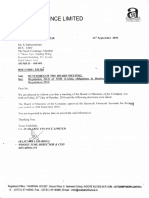

Picturehouse Medio Limited

May 23, 2016

To

The BSE Ltd.

Phiroze Jeejeebhoy Towers

Dalal Street Fort,

Mumbai - 400 001

Dear Sir(s)/M adam (s),

Sub: Outcome ofthe Meeting of Board of Directors - Regarding

Ref: Regulation 30 & 33 of the SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015

Scrip Code: BSE - 532355;

With reference to the subject matter cited above, we would like to inform you that the Board

of Directors of the Company at its Meeting held on Monday,May 23,2016, have inter-alio,

1.

2.

3.

Approved the Standalone & Consolidated Audited Financial Results of the Company for

the quarter and financial year ended March 31, 2016.

Approved the Standalone & Consolidated Audit Report submitted by the Statutory

Auditors for the financial Vear ended March 31, 2016.

Standalone & Consolidated Form A for financial year ended March 3L, 2016.

Further, please find enclosed copy ofthe Standalone & Consolidated Audited Financial Results

and a copy of the Standalone & Consolidated Audit Report along with Standalone &

Consolidated Form A for the vear ended March 31, 2016.

Kindly take the above information on records.

Thanking you.

Yours sincerelV,

Prasad V. Potluri

Managing Director

Enclosed: a/a

Pi.turehouse

l edio

Lilr|ited.

Corp. Oftice! Ploi No. 83 & 84 4th Floor punnoioh ptozd Rood No.

Bonioro Hills Hyderobod - 500 034 l: +91 1O 673O 9999

F: +91 40 6730 9988

{p

Regd. Officer KRM Centre 9th Floor No.

Horringron Rood Cherpet

Chennoi-60003l n +91 4430285570 F:+91 413O2B 5571

info@pvpglobol.com I pvpcinemo.com

CIN:

192 I 9lTN2OO0PLC0,{,{O77

Piclurehouse Medio [.imifecl

Pictuehouse Media Limited

Registe.ed Offjce: KRM Cent.e,9th Floor, Door No.2, Hrnington Road, Chetpet, Chennai6oo031 webj wwt!.pvp.inenD.conr

CIN: l92t91T\:QOoPtC0{4077

ffiffi%

Standalone Finan.iak

Incorc rrotu Operalions

(a) N.r Sares/ri.onc

Iotil ii.onr

1,25r 26

from opcr.&rns (ne0

indc.6c/dd.s.

(a)

(b) Consunrthon or

G)

r.or oFratiof

2r2.1(,

9,508.2{

1,975.39

l2,9.12ltl

1,975.39

72,942.83

lt

9.601.8i

5,161..10

Other oFerating nr.on,.

(LJ)

Iloric

n' stock in lrade and

7,963.63

horl ri

292.Jb

l)rogrss

n$

mateiials

rroductioi Eipentes

(t tFSil ind pror$ionil dD,8.s

7,636.41r

1,956.61

J2.J.l

1,1.72

(120.05)

169.39

r5.70

26.01

61,05

67.15

22.11

il.ll

6.81

9,591,

5.20

1.6-18

216

,i.74

5l

61.9i

91.12

25.50

,u.55

2,089.76

ProfiV(Lo$) lron otcratiDrs belore dlncrnnone, fnDn.ecosts and exceplnrnnl

ilcDN ll-2)

1838.50)

I

5

l2

6a

,7.35

.1.81

Profiv(Lots)iroD ordnrary a(tn ilics }cforo ftrdn(e.osLs and.t(plional itens

lls.05

55_0r

229.12

270.01

,184.05

10,3,12.65

2,611,98

2,600.18

2 811.42

1619.72)

t9.r{

1\.17

513 80

19.!1

t187,49)

{833.66)

(3+4)

costs btrt bfore

(rcefriotr.l

lir ilio\ bciorr

rJ

| 005.17

.185.71

(1,635.r5)

t573,23)

(i2t.q:i)

0,268.3J)

104.6it

1s73.23)

(r-r2.06)

(2:t?)

(12:.37)

40.5rJ

{1,268.3'1)

104.6,1

(1,1j55,86)

'10.58

(r,26314)

104.64

(r,655.86)

(r.268.J4)

104.64

(1,655,ri6)

1225.00

ti,22500

i,225.00

(20 r1)

r l7-8i

tr(I-oss)

fron Ordnrary l.dvnics ifter

tax

(t10)

t,ll

t 29

781,30

(20.r1)

t0

N.t trofi

l,l{1.5t

139.41

1{14.64

60,61)

(20.t

r'nri|/(L^.) rio'n Ondindry.\!

.131.68

(1,268.1t)

158 00

Prcfiy(ro$) rroN ordtuiry actiritics dJterfinancc

(96:1.43)

1l

I3

1l

Net lJiori V(l-o$) for the penod (11-12)

jharc ot Proril/ ( r-o$) of iso.ial!

290.57

tj70.ql

ll

Net

lrofiv(Los) aftcr tar.s,,nn,ority intorcshnd

share

ofProfiv(Lo$) of

updluitr sharecaprral (ri.c vilueof Rs l0eaih)

lle*i\es er.lu.ling Fvaluation fese^,es is per lialdn. shiri oi

P,rid

l5

5,225.00

pre\ ious

(.rBisi. ind djluren EPS betor. [\traoi.linn'r iteors ror th. pcrorl, lor lh. \ err t.

.lattnnd tor thc pre\rous lear(rotto bennnualiz.d)

(b) lt.tsic.nd diluted [tS dfrcr [\traordiniN itc.15 for the t)eriod, for rh. ) edr lo

lale nnd lor tle Dreyious vedrlnotto lrnnnuali2pdJ

(6r8.01)

(9s.43)

290.57

5,225 00

t22j00

5,225.00

r,017.81

1,396.10

2,819.8:

la.t7)

(2.11)

0.20

(1.

r/l

3i)

056

(165)

0.56

(1

(r.09)

(q\

-I\ //.7

4'

(b6/s,

Pi(turehouse l/ledio Limited,

Corp. Office: Plot l.lo. 83 & 84 4th Floor Punnoioh Ptozo Rood No.

Bonloro Hills Hyderobod , 500 034 I: +91 40 673O 9999

F: +91 40 6730 9988

Regd. Office: KRM Centre 9th tloor No. 2 Ho(insion Rood Cherper

Chennoi - 600 031 I: +91 44 3O2a 557a F: +91 44 3o2B 5s7t

info@pvpgloboi.com pvpcinemo.corn

CIN: L92l 9lTN2000PtC044077

!!re

!!!J! !!!!!!!! r!_t!!!

Star dalone

Consolidated

Yrar ended

31-Mar-16

31'Mar-15

PARTICULARS

EQUITY AND LIABILITIES

31'Mar-16

31-Mar-15

Auditd

Audited

Audited

Audited

Shareholders' Funds:

(a) Share Capital

(b) Reserves and SLrrptus

5,225.0A

Share applicarion

noney pending

3,225.00

3,225.00

5,225.00

1,037.82

1,896.40

2,859.85

4,606.96

!'%r!2

7,121.40

8,084.85

6,138.i2

1,767.99

8,285.89

7,942.30

,a.u,

39.9.2

,u.0,

$]le_

8,370.92

&010.54

12,917.73

(618 04)

(c) Money received againstshare s,arranrs

otmenr

Non-.urrent Iiabitiries:

(a) Long-term borrowings

(b) Deferred tax liabiiities (Nci)

(c) Othr Long+erm liabilities

(d) Long-ieh provisions

6.11

6,192.20

luhent liabiliries:

(a) Short-term

borrowhgs

(b) Trade payabtes

(c) Other currenr liabilities

(d) Shorrierh provisjons

Total

,ssETS:

(i) Tangibte assets

(ji) Intangibte assets

(iii) Capjtal work_in progfess

(iv) Intangibte assets under development

(b) Non-cu!rent invcstmenls

(c) Deferrd tax assrs (Nt)

(d) Long-tern loans and actvances

(e) Other non-currnt assets

6.41

5,103.33

3,006.srt

75,219.39

64.94

226.09

34.3{i

770.7ti

77.t2

39.56

311..11

1.14_09

70.72

0.94

434.27

.137.55

1409.08

3;152,62

\6,442.78

13J68.33

16,208,24

14229.76

31,934.50

29,663.72

185.03

226.12

185.14

,,rorru

z,sai.n

13.00

38.06

31.56

38.05

z,zso.z7

,.ra

3.92

2,a24.86

270.13

306.49

7,777.26

9,650.76

43.00

rodwill on consolidation

(a)

Curenr investmenis

(b) Invenioris

(d, (

dshdnJ.d\hcqujvJte Ls

/e' chJ-L-tPrm lodn\ dnd

(4 other current

ddv.,n.t.

assers

roul

1

700.00

9,650.76

nrr.aderPLer\able\

250.15

250.15

7].25

214.9A

3,206.4r

3,288_81

239.40

183.85

13,417.97

l't,404.90

____t:l!!jl_L

14,229.76

82.83

cuoi,ur r-'a

".a

ri..."i*;;;;;;:,:;;:T:-:"t

t*'ompanv and

Lhorlv o{'ned subsi.iades

3 Tne ligures oftast quafter endcd Marcir

31,2016 are the balancing figures between

audite.

31'2016 and the pubiisrred

veu' ro date ri8;res upto th;a q,**.|iii".""".i;;ffi;j"|il:::l'

4 Previous period figures have

ie

20,$6 3a

s't,654,38

29,357.23

31,9U.50

29.663.72

228.46

|

The above results are reviwed bv th

Audit cornrnittee and approvecl by the

Board of Directors rn rheir meeting herd

2 The Consolidared financiat resutts

include the

21,,rl0.38

on 23rd Mav

2016.

rvlls pvp cinema |rivate Lt.r. M/s pvp

*Pect ol the rul

rinanciar vear ended Nrarch

been regroupeo, wnerever necessary,

for itre purpos ofcomparison.

5 The Company operates in Media

ard relaed segments, hence segment reporiing

is not applicable.

6 Thase resLrlts are also avaitabte at

the wabsiie or ihe Contpany at ws,w.pvpcincnu.com.

lgl

PRASAD V. POTLURI

Managing Dirccior

Date:

May2t

2016

al

(b=

CNGSN & ASSOCIATES LLP

S, NEELAKANTAN

Dr. C.N. GANGADARAN

B Com , FC;A

B.Com, FCA,

R. THIRUMALMARUGAN

G. CHELLA KRISHNA

M Com , FCA

N,.Com., FCA, PGPM

lv8ll/

(Lond ). Ph d

B. RAMAKRISHNAN

CHARTERED ACCOUNTANTS

D. KALAIALAGAN

B.Com., Grad. CWA, FCA

B.Com.. FCA

No.43, (Old No.22), Swathi Court, Flat No. C & D,

V. VIVEK ANAND

B Com., FCA

NYAPATHY SRILATHA

K. PARTHASARATHY

B.Com FCA

E,K. SRIVATSAN

Vijayaraghava Road, T. Nagar, Chennai - 600 017.

Iel +91-44-4554 1480 i 81, Fax . +91-44-4554 1482

Web . www.cngsn.com ;Email :info@cngsn.com

lM.Com., FCA, PGDFM

B.Com . ACA

INDEPENDENT AUDITOR,S REPORT

To the Board of Directors

of picturehouse

Media Limited, Chennai

1

We have audited the accompal]nng statements of Standalone Financial

picturehouse Media Limited (the company) for

Results

the

_(the statement) of

year ended March 31, 2016, being submitted by the Company pu;su;t

to the

requirement of Regulation 33 of the sEBI (Lisiing obligalions-and Disclosure

Requirements) Regulations, 2015. This statement;hich"is the responsib ity

oi

the Company's Management ald approved by the Board of Directors, has been

prepared on the basis of the related financiar statements which are in

accorda'ce with the Accounting standards prescribed under section 133 of ttre

Companies Act, 2013, as applicable and other accounting principles generally

accepted in India. our responsibility is to express an opinion on the stalement.

2.a. we conducted our audit in accordance with the Standards on AudiLing

rssued by the Institute of chartered Accountants of India. Those StandardS

require that we comply with the ethical requirements and plan and perform the

audit to obtain reasonable assurance about whether the statements are free

from material misstatemenrs.

2.b.

An audit involves performing procedures to obtain audit evidence about

the amounts and the disclosure in the statements. These procedures serected

depend on the auditor's judgment, including the assessment of the risk of

material misstatement of the statements, whether due to fraud or error. In

making those risk assessments, the auditor considers internal finalcial control

relevant to the Company's preparation of t-he statements that give a true a'd

fair view in order to design audit procedures that are appropriate in the

clrcumstarces. An audit also includes evaluating the appropriateness of the

accounting policies used a''d the reasonableness of the -accounting estimates

made by the Management, as weli as evaluating the overall presentation of the

statements.

2.c. We believe that the audit

evidence obtained by us is suffrcient and

approprlate to provide a basis for our audit opinion or: the statements.

CNGSN & Associates LLP, a Limiled Liability partnership with LLp ldenlitv No AAC S4O2

Regd Otfice : Agaslyar Manor, No.2O, Raja Street. T Nagar. Chenna, - OOO Ot Z

puducherry

Oftices

Chennai

Veltore

Hvderabad

at .

2.d.

Emphrrsis of Matters

In our Independent Audit Report to tLrc members, attention i.s d.rant_tn

to the notes

to the financial statements uith regard. to the roans and od.uance

for Qtm Tnin e

and Film under-production expenses (wlq. rhe management is 6y

tne

these items are consid.<zred good and reari.z,able ii the ordiiary uilut that

iJ

business. Ho,teuer tuere unoble to d.etermine whether ong ad.justments"our""

to

thesl

carrying amounts are necessary and prouision

for d.iminuiion,-if ong, to be mad.e

dep7ryds on the future euents. Our opinion ii respect of thise

iatters b not

modifted.

3.

In our opinion arrd to the best of our information and according to tJle

explanations given to us, the Statement:

i)

is presented in accordance with the requirements of Reguration 33 of

the

SEBI (Listing Obligations and Disclosure Requiirements) Regulations,

2O1S;

and

ir)

give a true ald fair vlery in conformity with the accounting principles

generally accepted in India, of tlre Loss, and other financial

information of the

Company for the year ended March 37,2i:O76.

4.

The Statement includes the results for tlle euarter ended March 3 I

,

2016 being the balancing flgure between audited figures

rn respect of the full

frnancial yeg and the pubrished ear to date figures"up to the tlird quarter

of

the current financia.l vear.

for M/s CNGSN & ASSOCIATES LLp

Camp: Hyderabad

Date : 23.d May, 2076

CHARTERED ACCOUNTANTS

Firm Registration No: 0O4915S

iI

cle ;r''u't ,;"

R. Thirumalmarugan

Partner

Membership No:

2OO1O2

S. NEELAKANTAN

Dr. C.N. GANGADARAN

B Corn., FCA

B.Com., FCA, iVBllV (Lond

R. THIRUMALMARUGAN

G. CHELLA KRISHNA

lvl

CNGSN & ASSOCIATES LLP

Com., FCA

Ph d

N4.Com., FCA, PGPN4

B. RAMAKRISHNAN

D. KALAIALAGAN

CHARTERED ACCOUNTANTS

B.Com., Grad. CWA, FCA

B.Com., FCA

No.43, (Old No.22), Swathi Court, Flat No. C & D,

Vijayaraghava Road, T. Nagar, Chennai - 600 017.

Tel: +91-44-4554 1480 181; Fax +91-44-4554 1482

Web : www.cngsn.com ; Email : info@cngsn.com

V. VIVEK ANAND

NYAPATHY SRILATHA

B.Com., FCA

M.Com., FCA, PGDFIM

K. PARTHASARATHY

B.Com FCA

E.K. SRIVATSAN

B.Com.. ACA

INDEPENDENT AUDITOR,S REPORT

To the Board of Directors

of picturehouse

Media Limlted, Chennai

1

We have audited th^e accompanying statements

of Consolidated Finalcial

Results (the statement) of pictureiroul. 'na"at"

i#,.d

(th" H;dr";;"-i#"r

and its. sub-sidiaries (the Holding company

uni-it"-",

o"rorarles together referred

to as the Group) for the year ended March zt,borc,

being

company pursuarrt. to- the requirem"ni oi n"grrutionsub-mittei;;';;

|gtalns

33 of the SEBI

(Listing Obligations and Discto.sur. i.t;;;;;s)

Regutations,

2015. This

statement which is the responsibility of ihe

Holding Company,s Ur-"g"-.",

a''d approved by the Board of Directirs, hu" ;;;;;."pared

on the basis of the

related consolidated frnancial statements which are

in

accordance

with the

Accounting Standards prescribed under section.iSS

of

the

Compalies

Act,

2013, as applicable and other accounting p.-;i;i;" g"""rally

accepted

in India.

Our responsibility is to express al opiniJn-on the

Statement.

2.a.

We conducted our audit in accordance wittr

the Staldards on Auditing

rssued by the Institute of Chartered Accountants

of

India. Tho".a;;;;:

requrre that we comply with the ethical requirements

and plan and perform the

audit to obtain reasonable assura'ce about whether ttre

statements are free

from materia_l misstatemenrs.

involves performing

1l

*T audit

the amounts

and the disclosure

procedures to obtarn audit evidence about

in the statements. These procedures

depend on tl.e auditor's judgment, incruaing iile

ot the""r."i.i

risk of

material misstatement of the statements, wliether assessment

due

to

fraud

.;

;.;;;. h

making those

risk assessments, the auditor considers rnterna] financial

control

Holding Company's preparation of the statements

.the.

that

give a

true and fair view in order to. design audit procedures that

a-re

in

the circumstances. An audit also in-crudes

"pp.op.fut"

trr.

appropriateness

of the

accountlng policies used and the reasonableness

"t'"r""irrgo"f the iccounting

made by the Ma'agement, as werl as eva-luating

""tr-"i."

ihe overa. presentation

of the

statements.

relevant, to

2.c. We believe that the audit evidence obtaineri by us is

sufficient arrd

appropriate to provide a basis for our audit opirrion

o., the statements.

CNGSN & Associates LLe a Limited Liabjtity partnership with LLp tdentitv No.AAC-9402

Regd. Office : Agastyar Manor, No_20. Reja Stfeet, T.Nagar, Chenna;- 600 017

puducherrv

Oftices

Chennai

Vellore

Hvderabad

at .

2.d.

Emphasis of Matters

In our Independent Audit Report to the members, attentton i,s dranun

to the notes

to the fi.nancial statements uith regard to the locLns and

ad.uonce for fitm Tnince

a,nd FiIm under-production expenses (wlp). The management

is o7 tie uiew that

these items are considered. good. and 'reatizable ti tn oraiiorg"

business Howeuer uere unable b determine tuhether ana ad.justments;;;;';f

to these

carrying amounts are necessary and. prouision

diminulion,"if ang, to be mii.e

for

dep9.ryds on the fuh'tre euents. atr ipinion ii respect

of thise iatters is iit

modified.

2.e.

Other Matter

we did not audit the financial statements of two subsidiaries, whose

finarrcia_t

statements reflect totar assets (net) of Rs.rg224.g3 lakhs

as at 3i* March.

Tf

9;,,^.1{ revenues of Rs.3434.60 lakhs and net cash ows amounrins to {lr(s +v 64 lar-h s lor the vear then ended. as considered in the consoli"dated

frnancial statements. These financiar statements have been audited

by other

auditors

whose reports have been furnished to us by the Managemer_rt

urra orri

opinion on the statements, in so far as it relates to the arnounts

and disclosures

respect of these subsidiaries is based solely on the reports

of the

11:1:d"d.1l

olner audltors_

3.

In our opinion and to the best of our information and according to

the

explanations given to us, the Statement:

r)

includes the results of the followine entities

PVP Cinemas plt Ltd

PVP Capital Ltd

Picturehouse Media private Ltd, Singapore

i)

is presented in accordance with the requirements of Regulation

33 of the

strBI (Listing obligations and Disciosure Requirements) Regura'tions,

20rs; anJ

i1) give a true and fair vi9i1 in conformity with the accounLing principles

generally accepted in India, of the Loss, and other financial

informition of the

Group for the year ended March 3I,2016.

for M/s CNGSN & ASSOCIATES LLp

Camp: Hyderabad

Date : 23.d May,2O16

CHARTERED ACCOUNTANTS

OO49 15S

Firm Registration No:

\-.--

R. Thirumalmarugan

Partner

Membership No: 200102

Form A

{for audit

1

2

)rt with unmodified opil

Name of the company

Annual f inancial statements for

the year ended

Pictu rehouse Media Lin

Tvpe of Audit observation

Frequency of observation

To be signed by-

Un Modif ied

Not Applicable

Managing Director

nI

ted

31st March, 2016

G -4

Mr. Prasad V Potluri

cFo

;,

LLP

)4915S)

Auditor of the company

L---=t--_

Mr. Thirumalmarugan

Partner. M. No.: 200101

K\-;;

Audit Committee Chairman

Mr.

Nagaraja n

Form A

with unmodified opinion)

(for audit

Name of the com

Annual fina ncia I statements

the year ended

Pictu rehouse Media Limited

for

9l 49!, t 9!!!rv91icl

ue ncy of observation

IJpe_

F

req

31st March, 2016

Un Modif ied

Not Aoolica ble

To be signed by-

d

Managing Director

Mr. Prasad V. Potluri

,RJ"-"

For CNGSN & Associates, LLP

rtered Accou ntants

(Firm Registration No.004915S)

Cha

Auditor of the company

Mr. Thirumalmarugan

Partner. M. No.: 200102

Audit Committee Chairman

You might also like

- JobOrder Dayag MusorDocument29 pagesJobOrder Dayag MusorLaut Bantuas II50% (2)

- S4 HANA Finance - Configuration Guide1Document224 pagesS4 HANA Finance - Configuration Guide1Alberto Mario Delahoz Olaciregui91% (11)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results - Dec 2022Document10 pagesFinancial Results - Dec 2022mehtaarian1No ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- 2008 13 Financial Statements Samsung 2007Document26 pages2008 13 Financial Statements Samsung 2007Wilson Edilber ValenciaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Auditor'S Review ON THE: Independent Quarterly FinancialDocument7 pagesAuditor'S Review ON THE: Independent Quarterly FinancialKarthik KeyanNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Samsung Electronics Co., LTD.: Index December 31, 2009 and 2008Document74 pagesSamsung Electronics Co., LTD.: Index December 31, 2009 and 2008Akshay JainNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Outcome BM TTSL 13112023141556Document11 pagesOutcome BM TTSL 13112023141556Jayanth kumarNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Seminar 4 Internal Control - StudentDocument49 pagesSeminar 4 Internal Control - StudentLIAW ANN YINo ratings yet

- Audit Asignment 1 and 2Document21 pagesAudit Asignment 1 and 2Kurauone MuswereNo ratings yet

- Accounting ManuelDocument1,061 pagesAccounting ManuelthenjhomebuyerNo ratings yet

- Cost Accounting 14th Ed - CARTER - 11 - 50Document58 pagesCost Accounting 14th Ed - CARTER - 11 - 50Wiraswasta MandiriNo ratings yet

- Audit SaadDocument29 pagesAudit SaadsabeehahsanNo ratings yet

- RTP Financial Reporting CapiiiDocument39 pagesRTP Financial Reporting CapiiiManoj ThapaliaNo ratings yet

- Upsa Mba PDFDocument3 pagesUpsa Mba PDFlegendNo ratings yet

- Physical ControlsDocument5 pagesPhysical ControlsRanica VerzosaNo ratings yet

- 3 12Document4 pages3 12Dianne SantiagoNo ratings yet

- Acctg Changes, Error Correction, Prior ErrorDocument3 pagesAcctg Changes, Error Correction, Prior ErrorLayJohn LacadenNo ratings yet

- CMA AssignmentDocument5 pagesCMA AssignmentMaria AkpoduadoNo ratings yet

- STD 11 Book Keeping and AccountancyDocument18 pagesSTD 11 Book Keeping and AccountancyRam IyerNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- Randhil Jinendrasinghe CV DocumentDocument3 pagesRandhil Jinendrasinghe CV Documentapi-537881318No ratings yet

- United States Patent: Tawara Et Al. (45) Date of Patent: Aug. 7, 2007Document25 pagesUnited States Patent: Tawara Et Al. (45) Date of Patent: Aug. 7, 2007SintaDwiSampurnaNo ratings yet

- Afm Mod 2Document4 pagesAfm Mod 2Manas MohapatraNo ratings yet

- Nat & PatDocument36 pagesNat & Patfaith olaNo ratings yet

- 9207 - Faculty Publications Report 2017 02Document104 pages9207 - Faculty Publications Report 2017 02Atta GebrilNo ratings yet

- Cash Flow StatementDocument40 pagesCash Flow StatementOmpriya AcharyaNo ratings yet

- 2 MCQ - Prof Prac of Accty-An OverviewDocument1 page2 MCQ - Prof Prac of Accty-An OverviewRAISA LIDASANNo ratings yet

- Ch13-Testbank RemovedDocument28 pagesCh13-Testbank RemovedMr MDRKHMNo ratings yet

- ACCA104 - Inventory Cost FlowDocument13 pagesACCA104 - Inventory Cost FlowAnaluz Cristine B. CeaNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Chapter 1 Mas Req TrueDocument106 pagesChapter 1 Mas Req TrueRhedeline LugodNo ratings yet

- Quiz Chapter 21 & 24Document13 pagesQuiz Chapter 21 & 24mzvette234No ratings yet

- Break Even AnalysisDocument13 pagesBreak Even Analysissuchipatel100% (2)

- Warming Up Khurshed Pastakia 7 Dec 141Document41 pagesWarming Up Khurshed Pastakia 7 Dec 141vnewatiaNo ratings yet

- 5038 - Assignment 2 Brief - Updated (With Numbers)Document7 pages5038 - Assignment 2 Brief - Updated (With Numbers)Minh Thu Nguyen TranNo ratings yet