Professional Documents

Culture Documents

12 Month Cash Flow Statement1

12 Month Cash Flow Statement1

Uploaded by

Humaun KabirCopyright:

Available Formats

You might also like

- Types of BraDocument18 pagesTypes of BraHumaun KabirNo ratings yet

- IQ Protocol Pass BoxDocument6 pagesIQ Protocol Pass Boxziauddin bukhari100% (1)

- Cash Flow 12 Months TemplateDocument8 pagesCash Flow 12 Months TemplateFauzan KamalNo ratings yet

- How To Write A Financial PlanDocument6 pagesHow To Write A Financial PlanGokul SoodNo ratings yet

- Projected Cash Flow StatementDocument6 pagesProjected Cash Flow StatementIqtadar AliNo ratings yet

- Australian Professional Standards For TeachersDocument1 pageAustralian Professional Standards For Teachersapi-365080091No ratings yet

- 12 Month Cash FlowDocument2 pages12 Month Cash FlowSubhabrata BanerjeeNo ratings yet

- 12 Month Cash Flow StatementDocument1 page12 Month Cash Flow StatementMircea TeodorescuNo ratings yet

- 12 Month Cash Flow Statement1Document1 page12 Month Cash Flow Statement1talk2vaibsNo ratings yet

- Twelve Month Cash FlowDocument1 pageTwelve Month Cash FlowAbu Bakar Najeeb DarNo ratings yet

- Cash Flow Final 2014Document3 pagesCash Flow Final 2014api-270507542No ratings yet

- Copia de 12 Month Cash Flow Statement1Document3 pagesCopia de 12 Month Cash Flow Statement1Edwin DubónNo ratings yet

- Cash Flow Final 2014Document3 pagesCash Flow Final 2014api-296267783No ratings yet

- 12 Month Cash Flow Statement 1Document1 page12 Month Cash Flow Statement 1oroborous1No ratings yet

- Cash Flow ProjectionDocument8 pagesCash Flow ProjectionSuhailNo ratings yet

- Cash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-19Document3 pagesCash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-19MUHAMMAD -No ratings yet

- Cash Flow Statement - A Free Document Template From Bedin - NoDocument10 pagesCash Flow Statement - A Free Document Template From Bedin - NoAldren Delina RiveraNo ratings yet

- Writing The Business PlanDocument8 pagesWriting The Business PlanIngrid Yaneth SalamancaNo ratings yet

- Financial Plan PerbisDocument9 pagesFinancial Plan PerbisDamas Pandya JanottamaNo ratings yet

- Cash Flow AnalysisDocument14 pagesCash Flow AnalysisReza HaryoNo ratings yet

- The Key Elements of The Financial PlanDocument27 pagesThe Key Elements of The Financial PlanEnp Gus AgostoNo ratings yet

- What Is 'Cash Flow'Document7 pagesWhat Is 'Cash Flow'Selvi VinoseKumarNo ratings yet

- Cash Flow BudgetDocument7 pagesCash Flow BudgetNitin SawadiaNo ratings yet

- Futurpreneur - Ebook - Mentees-June21Document15 pagesFuturpreneur - Ebook - Mentees-June21Jawid WeesaaNo ratings yet

- Cash Flow EstimationDocument10 pagesCash Flow EstimationRohit BajpaiNo ratings yet

- Cash Flow Forecasting & Preparing A Cash Flow: FIRST: Calculate and Plot Your SalesDocument5 pagesCash Flow Forecasting & Preparing A Cash Flow: FIRST: Calculate and Plot Your SalesbitobNo ratings yet

- Three-Year Profit ProjectionsDocument1 pageThree-Year Profit Projectionssurya277No ratings yet

- Cash Flow (12 Months) : Thriftykraftph Fiscal Year Begins:01/28/2021Document3 pagesCash Flow (12 Months) : Thriftykraftph Fiscal Year Begins:01/28/2021arelemancilNo ratings yet

- How To Prepare A Cash Flow StatementDocument8 pagesHow To Prepare A Cash Flow Statementk4kazim100% (8)

- Business TOOL RequirementDocument10 pagesBusiness TOOL RequirementIftekhar IfteeNo ratings yet

- Accounting - Basic Accounting: General LedgerDocument10 pagesAccounting - Basic Accounting: General LedgerEstelarisNo ratings yet

- Assignment CMDocument4 pagesAssignment CMSyed Rauf HaiderNo ratings yet

- Basic Accounting TermsDocument3 pagesBasic Accounting TermsAllyza VillapandoNo ratings yet

- Chapter 1tgDocument32 pagesChapter 1tgThimme Gowda RGNo ratings yet

- The Essentials of Cash FlowDocument5 pagesThe Essentials of Cash FlowDaniel GarciaNo ratings yet

- Cash Flow Statement AnalysisDocument36 pagesCash Flow Statement Analysisthilaganadar100% (5)

- Free Cash FlowDocument6 pagesFree Cash FlowAnh KietNo ratings yet

- Tally - ERP 9: Billwise Details For Non-Trading Accounts in Tally - ERP 9Document5 pagesTally - ERP 9: Billwise Details For Non-Trading Accounts in Tally - ERP 9MANI KNo ratings yet

- Cash Flow Pushpa MamDocument73 pagesCash Flow Pushpa Mamdhaypule deepaNo ratings yet

- Group 2Document33 pagesGroup 2psychowriterrrrrNo ratings yet

- Research Paper On Cash Flow StatementDocument8 pagesResearch Paper On Cash Flow Statementgz9fk0td100% (1)

- Chapter 2 Statements and Cash FlowDocument7 pagesChapter 2 Statements and Cash FlowBqsauceNo ratings yet

- Cash Flow Note (19743)Document10 pagesCash Flow Note (19743)Abhimanyu Singh RaghavNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Financial AssumptionsDocument29 pagesFinancial AssumptionsHưng Đặng QuốcNo ratings yet

- TEMPLATE Financial Projections WorkbookDocument22 pagesTEMPLATE Financial Projections WorkbookFrancois ChampenoisNo ratings yet

- Working Capital and Cashflows Assignment BECDocument8 pagesWorking Capital and Cashflows Assignment BECWalter tawanda MusosaNo ratings yet

- What Is A Cash Flow Forecast?Document3 pagesWhat Is A Cash Flow Forecast?kanika_0711No ratings yet

- Free Business TemplatesDocument3 pagesFree Business Templateshowieg43100% (9)

- FinanceDocument32 pagesFinanceAkriti SinghNo ratings yet

- Cash Flow Forecast Notes 2023Document5 pagesCash Flow Forecast Notes 2023shaadzali3No ratings yet

- Financial Appraisals 12-1-2012Document5 pagesFinancial Appraisals 12-1-2012Muhammad ShakirNo ratings yet

- Financial Projecti TemplatesDocument27 pagesFinancial Projecti Templatesbarakkat72No ratings yet

- Financial Plan For BusinessDocument4 pagesFinancial Plan For Businesschandralekhakodavali100% (1)

- Analyze Cash Flow The Easy WayDocument2 pagesAnalyze Cash Flow The Easy Wayanilnair88No ratings yet

- ADFIN MGT Lala2Document3 pagesADFIN MGT Lala2Lala OliverosNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- Cash Management ExplanationDocument6 pagesCash Management ExplanationtacangbadetteNo ratings yet

- What Is Working CapitalDocument3 pagesWhat Is Working CapitalparthNo ratings yet

- JKWCPA Accounting 101 For Small Businesses EGuideDocument13 pagesJKWCPA Accounting 101 For Small Businesses EGuideAlthaf CassimNo ratings yet

- Fundamentals 02 Accounting Interview QuestionsDocument37 pagesFundamentals 02 Accounting Interview Questionsnatalia.velianoskiNo ratings yet

- Executive Certificate in Microfinance & Entrepreneurship: Cash Flow Projection PresentationDocument17 pagesExecutive Certificate in Microfinance & Entrepreneurship: Cash Flow Projection PresentationSabeloNo ratings yet

- Dit 602Document1 pageDit 602Humaun KabirNo ratings yet

- Q.C. Measurements: 12 GG S - XXL, Base Size: MDocument1 pageQ.C. Measurements: 12 GG S - XXL, Base Size: MHumaun KabirNo ratings yet

- Industrial Sewing Machine ClassificationsDocument3 pagesIndustrial Sewing Machine ClassificationsHumaun KabirNo ratings yet

- Inter LiningDocument2 pagesInter LiningHumaun Kabir100% (1)

- Sample ObDocument6 pagesSample ObHumaun KabirNo ratings yet

- Top 10 Yarn QuestionsDocument3 pagesTop 10 Yarn QuestionsHumaun KabirNo ratings yet

- Textile Yarn:: Types of Yarn - Characteristics of YarnDocument8 pagesTextile Yarn:: Types of Yarn - Characteristics of YarnHumaun Kabir100% (1)

- Preparatory Section: A. WarpingDocument30 pagesPreparatory Section: A. WarpingHumaun KabirNo ratings yet

- What Is InterliningDocument9 pagesWhat Is InterliningHumaun KabirNo ratings yet

- What Is Gauge in The Sweater WorldDocument2 pagesWhat Is Gauge in The Sweater WorldHumaun KabirNo ratings yet

- What Is Lab DipDocument7 pagesWhat Is Lab DipHumaun KabirNo ratings yet

- Yarn Consumption SheetDocument4 pagesYarn Consumption SheetHumaun KabirNo ratings yet

- What Is Garment Wash? - Types of Garment Washing - Procedure of Garment WashingDocument5 pagesWhat Is Garment Wash? - Types of Garment Washing - Procedure of Garment WashingHumaun KabirNo ratings yet

- R1600H Sistema ImplementosDocument31 pagesR1600H Sistema ImplementosLuis Angel Pablo Juan de Dios100% (1)

- Ongc V Saw PipesDocument9 pagesOngc V Saw PipesManisha SinghNo ratings yet

- Associated Labor Union v. BorromeoDocument2 pagesAssociated Labor Union v. BorromeoJaneen ZamudioNo ratings yet

- FSM 2000Document52 pagesFSM 2000aram_hNo ratings yet

- Resident Medical Officer KAmL4W116erDocument4 pagesResident Medical Officer KAmL4W116erAman TyagiNo ratings yet

- 3dea2029ed9eb115091e9ea026cbba8fDocument3 pages3dea2029ed9eb115091e9ea026cbba8fJamie Cea100% (1)

- C&I in Water Treatment PlantsDocument28 pagesC&I in Water Treatment PlantsSunil PanchalNo ratings yet

- 2003 Nissan Maxima NaviDocument167 pages2003 Nissan Maxima NaviMarco OchoaNo ratings yet

- BSBCMM511 Simulation PackDocument4 pagesBSBCMM511 Simulation PackmiraNo ratings yet

- Debug Tacacs CiscoDocument5 pagesDebug Tacacs CiscodeztrocxeNo ratings yet

- Employee Behaviour in Organization Under Work Moral: Project OnDocument26 pagesEmployee Behaviour in Organization Under Work Moral: Project OnDhanvanth ReddyNo ratings yet

- HT Motors Data SheetDocument3 pagesHT Motors Data SheetSE ESTNo ratings yet

- Updating Your Application From The RCM3365 To The RCM3900: 022-0131 Rev. DDocument5 pagesUpdating Your Application From The RCM3365 To The RCM3900: 022-0131 Rev. Droberto carlos anguloNo ratings yet

- Huawei AirEngine 5760-51 Access Point DatasheetDocument16 pagesHuawei AirEngine 5760-51 Access Point DatasheetJsdfrweporiNo ratings yet

- Product Environmental Profile: Canalis KNA 40A To 160ADocument7 pagesProduct Environmental Profile: Canalis KNA 40A To 160AJavier LazoNo ratings yet

- Kci Fi001261149Document9 pagesKci Fi001261149minjokcsy99No ratings yet

- Experiment 7: Investigating The Change of Volume in The Change of Temperature (Document2 pagesExperiment 7: Investigating The Change of Volume in The Change of Temperature (EDWIN SIMBARASHE MASUNUNGURENo ratings yet

- Experiments in Art and Technology A Brief History and Summary of Major Projects 1966 - 1998Document12 pagesExperiments in Art and Technology A Brief History and Summary of Major Projects 1966 - 1998mate maricNo ratings yet

- Analyzing Factual Report Text "ROSE"Document9 pagesAnalyzing Factual Report Text "ROSE"Muhammad Taufiq GunawanNo ratings yet

- TC-42X1 Part 1Document50 pagesTC-42X1 Part 1Pedro SandovalNo ratings yet

- Experiment No. 2: Aim: A) D Flip-Flop: Synchronous VHDL CodeDocument6 pagesExperiment No. 2: Aim: A) D Flip-Flop: Synchronous VHDL CodeRahul MishraNo ratings yet

- CT CalculationDocument2 pagesCT CalculationTheresia AndinaNo ratings yet

- 04.02.20 BCTDA MTG Public CommentsDocument85 pages04.02.20 BCTDA MTG Public CommentsDaniel WaltonNo ratings yet

- Dressmaking 10 - 1st PT - TOS - Key To Correction 2Document8 pagesDressmaking 10 - 1st PT - TOS - Key To Correction 2Sonia CanaNo ratings yet

- AnycubicSlicer - Usage Instructions - V1.0 - ENDocument16 pagesAnycubicSlicer - Usage Instructions - V1.0 - ENkokiNo ratings yet

- Birla Power - MBA ProjectDocument23 pagesBirla Power - MBA ProjectBibhu Prasad SahooNo ratings yet

- Cyber CrimeDocument366 pagesCyber CrimeRufino Gerard MorenoNo ratings yet

- 1 Heena - Front End UI ResumeDocument5 pages1 Heena - Front End UI ResumeharshNo ratings yet

12 Month Cash Flow Statement1

12 Month Cash Flow Statement1

Uploaded by

Humaun KabirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Month Cash Flow Statement1

12 Month Cash Flow Statement1

Uploaded by

Humaun KabirCopyright:

Available Formats

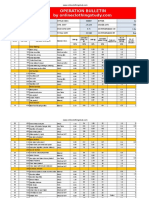

Twelve-month cash flow

Pre-Startup

EST

Cash on Hand (beginning of

month)

Enter Company Name Here

Jan-05

Feb-05

0

Mar-05

0

Apr-05

0

May-05

0

Jun-05

0

Fiscal Year Begins:

Jul-05

0

Notes on Preparation

Aug-05

0

Sep-05

0

Oct-05

0

Nov-05

0

Dec-05

0

Jan-05

Total Item

EST

Note: You may want to print this information to use as reference later. To

CASH RECEIPTS

delete these instructions, click the border of this text box and then press the

DELETE key.

Cash Sales

Collections fm CR accounts

Loan/ other cash inj.

TOTAL CASH RECEIPTS

Total Cash Available (before

cash out)

CASH PAID OUT

Purchases (merchandise)

Purchases (specify)

Purchases (specify)

Refer back to your Profit & Loss Projection. Line-by-line ask yourself when

you should expect cash to come and go. You have already done a sales

projection, now you must predict when you will actually collect from

customers.

side,

0

0 On the expense

0

0 you have

0 previously

0 projected

0 expenses;

0

now predict when you will actually have to write the check to pay those bills.

Most items will be the same as on the Profit & Loss Projection. Rent and utility

0

0

0

0

0

0

0

0

bills, for instance, are usually paid in the month they are incurred. Other items

will differ from the Profit & Loss view. Insurance and some types of taxes, for

example, may actually be payable quarterly or semiannually, even though you

recognize them as monthly expenses. Just try to make the Cash Flow as

realistic as you can line by line. The payoff for you will be an ability to manage

and forecast working capital needs. Change the category labels in the left

column as needed to fit your accounting system.

Note that lines for 'Loan principal payment' through 'Owners' Withdrawal' are

for items that always are different on the Cash Flow than on the Profit & Loss.

Loan Principal Payment, Capital Purchases, and Owner's Draw simply do not,

by the rules of accounting, show up on the Profit & Loss Projection. They do,

however, definitely take cash out of the business, and so need to be included

in your Cash plan. On the other hand, you will not find Depreciation on the

Cash Flow because you never write a check for Depreciation. Cash from

Loans Received and Owners' Injections go in the "Loan/ other cash inj." row.

The "Pre-Startup" column is for cash outlays prior to the time covered by the

Cash Flow. It is intended primarily for new business startups or major

expansion projects where a great deal of cash must go out before operations

commence. The bottom section, "ESSENTIAL OPERATING DATA", is not

actually part of the Cash model, but it allows you to track items which have a

heavy impact on cash. The Cash Flow Projection is the best way to forecast

working capital needs. Begin with the amount of Cash on Hand you expect to

have. Project all the Receipts and Paid Outs for the year. If CASH POSITION

gets dangerously low or negative, you will need to pump in more cash to keep

the operation afloat. Many profitable businesses have gone under because

they could not pay the bills while waiting for money to flow in. Your creditors

do not care about profit; they want to be paid with cash. Cash is the financial

lifeblood of your business.

Gross wages (exact withdrawal)

Payroll expenses (taxes, etc.)

Outside services

Supplies (office & oper.)

Repairs & maintenance

Advertising

Car, delivery & travel

Accounting & legal

Rent

Telephone

Utilities

Insurance

Taxes (real estate, etc.)

Interest

Other expenses (specify)

Other (specify)

Other (specify)

Miscellaneous

SUBTOTAL

TOTAL CASH PAID OUT

Cash Position (end of month)

Loan principal payment

Capital purchase (specify)

Other startup costs

Reserve and/or Escrow

Owners' Withdrawal

ESSENTIAL OPERATING DATA (non cash flow information)

Sales Volume (dollars)

Accounts Receivable

Bad Debt (end of month)

Inventory on hand (eom)

Accounts Payable (eom)

Depreciation

You might also like

- Types of BraDocument18 pagesTypes of BraHumaun KabirNo ratings yet

- IQ Protocol Pass BoxDocument6 pagesIQ Protocol Pass Boxziauddin bukhari100% (1)

- Cash Flow 12 Months TemplateDocument8 pagesCash Flow 12 Months TemplateFauzan KamalNo ratings yet

- How To Write A Financial PlanDocument6 pagesHow To Write A Financial PlanGokul SoodNo ratings yet

- Projected Cash Flow StatementDocument6 pagesProjected Cash Flow StatementIqtadar AliNo ratings yet

- Australian Professional Standards For TeachersDocument1 pageAustralian Professional Standards For Teachersapi-365080091No ratings yet

- 12 Month Cash FlowDocument2 pages12 Month Cash FlowSubhabrata BanerjeeNo ratings yet

- 12 Month Cash Flow StatementDocument1 page12 Month Cash Flow StatementMircea TeodorescuNo ratings yet

- 12 Month Cash Flow Statement1Document1 page12 Month Cash Flow Statement1talk2vaibsNo ratings yet

- Twelve Month Cash FlowDocument1 pageTwelve Month Cash FlowAbu Bakar Najeeb DarNo ratings yet

- Cash Flow Final 2014Document3 pagesCash Flow Final 2014api-270507542No ratings yet

- Copia de 12 Month Cash Flow Statement1Document3 pagesCopia de 12 Month Cash Flow Statement1Edwin DubónNo ratings yet

- Cash Flow Final 2014Document3 pagesCash Flow Final 2014api-296267783No ratings yet

- 12 Month Cash Flow Statement 1Document1 page12 Month Cash Flow Statement 1oroborous1No ratings yet

- Cash Flow ProjectionDocument8 pagesCash Flow ProjectionSuhailNo ratings yet

- Cash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-19Document3 pagesCash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-19MUHAMMAD -No ratings yet

- Cash Flow Statement - A Free Document Template From Bedin - NoDocument10 pagesCash Flow Statement - A Free Document Template From Bedin - NoAldren Delina RiveraNo ratings yet

- Writing The Business PlanDocument8 pagesWriting The Business PlanIngrid Yaneth SalamancaNo ratings yet

- Financial Plan PerbisDocument9 pagesFinancial Plan PerbisDamas Pandya JanottamaNo ratings yet

- Cash Flow AnalysisDocument14 pagesCash Flow AnalysisReza HaryoNo ratings yet

- The Key Elements of The Financial PlanDocument27 pagesThe Key Elements of The Financial PlanEnp Gus AgostoNo ratings yet

- What Is 'Cash Flow'Document7 pagesWhat Is 'Cash Flow'Selvi VinoseKumarNo ratings yet

- Cash Flow BudgetDocument7 pagesCash Flow BudgetNitin SawadiaNo ratings yet

- Futurpreneur - Ebook - Mentees-June21Document15 pagesFuturpreneur - Ebook - Mentees-June21Jawid WeesaaNo ratings yet

- Cash Flow EstimationDocument10 pagesCash Flow EstimationRohit BajpaiNo ratings yet

- Cash Flow Forecasting & Preparing A Cash Flow: FIRST: Calculate and Plot Your SalesDocument5 pagesCash Flow Forecasting & Preparing A Cash Flow: FIRST: Calculate and Plot Your SalesbitobNo ratings yet

- Three-Year Profit ProjectionsDocument1 pageThree-Year Profit Projectionssurya277No ratings yet

- Cash Flow (12 Months) : Thriftykraftph Fiscal Year Begins:01/28/2021Document3 pagesCash Flow (12 Months) : Thriftykraftph Fiscal Year Begins:01/28/2021arelemancilNo ratings yet

- How To Prepare A Cash Flow StatementDocument8 pagesHow To Prepare A Cash Flow Statementk4kazim100% (8)

- Business TOOL RequirementDocument10 pagesBusiness TOOL RequirementIftekhar IfteeNo ratings yet

- Accounting - Basic Accounting: General LedgerDocument10 pagesAccounting - Basic Accounting: General LedgerEstelarisNo ratings yet

- Assignment CMDocument4 pagesAssignment CMSyed Rauf HaiderNo ratings yet

- Basic Accounting TermsDocument3 pagesBasic Accounting TermsAllyza VillapandoNo ratings yet

- Chapter 1tgDocument32 pagesChapter 1tgThimme Gowda RGNo ratings yet

- The Essentials of Cash FlowDocument5 pagesThe Essentials of Cash FlowDaniel GarciaNo ratings yet

- Cash Flow Statement AnalysisDocument36 pagesCash Flow Statement Analysisthilaganadar100% (5)

- Free Cash FlowDocument6 pagesFree Cash FlowAnh KietNo ratings yet

- Tally - ERP 9: Billwise Details For Non-Trading Accounts in Tally - ERP 9Document5 pagesTally - ERP 9: Billwise Details For Non-Trading Accounts in Tally - ERP 9MANI KNo ratings yet

- Cash Flow Pushpa MamDocument73 pagesCash Flow Pushpa Mamdhaypule deepaNo ratings yet

- Group 2Document33 pagesGroup 2psychowriterrrrrNo ratings yet

- Research Paper On Cash Flow StatementDocument8 pagesResearch Paper On Cash Flow Statementgz9fk0td100% (1)

- Chapter 2 Statements and Cash FlowDocument7 pagesChapter 2 Statements and Cash FlowBqsauceNo ratings yet

- Cash Flow Note (19743)Document10 pagesCash Flow Note (19743)Abhimanyu Singh RaghavNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Financial AssumptionsDocument29 pagesFinancial AssumptionsHưng Đặng QuốcNo ratings yet

- TEMPLATE Financial Projections WorkbookDocument22 pagesTEMPLATE Financial Projections WorkbookFrancois ChampenoisNo ratings yet

- Working Capital and Cashflows Assignment BECDocument8 pagesWorking Capital and Cashflows Assignment BECWalter tawanda MusosaNo ratings yet

- What Is A Cash Flow Forecast?Document3 pagesWhat Is A Cash Flow Forecast?kanika_0711No ratings yet

- Free Business TemplatesDocument3 pagesFree Business Templateshowieg43100% (9)

- FinanceDocument32 pagesFinanceAkriti SinghNo ratings yet

- Cash Flow Forecast Notes 2023Document5 pagesCash Flow Forecast Notes 2023shaadzali3No ratings yet

- Financial Appraisals 12-1-2012Document5 pagesFinancial Appraisals 12-1-2012Muhammad ShakirNo ratings yet

- Financial Projecti TemplatesDocument27 pagesFinancial Projecti Templatesbarakkat72No ratings yet

- Financial Plan For BusinessDocument4 pagesFinancial Plan For Businesschandralekhakodavali100% (1)

- Analyze Cash Flow The Easy WayDocument2 pagesAnalyze Cash Flow The Easy Wayanilnair88No ratings yet

- ADFIN MGT Lala2Document3 pagesADFIN MGT Lala2Lala OliverosNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- Cash Management ExplanationDocument6 pagesCash Management ExplanationtacangbadetteNo ratings yet

- What Is Working CapitalDocument3 pagesWhat Is Working CapitalparthNo ratings yet

- JKWCPA Accounting 101 For Small Businesses EGuideDocument13 pagesJKWCPA Accounting 101 For Small Businesses EGuideAlthaf CassimNo ratings yet

- Fundamentals 02 Accounting Interview QuestionsDocument37 pagesFundamentals 02 Accounting Interview Questionsnatalia.velianoskiNo ratings yet

- Executive Certificate in Microfinance & Entrepreneurship: Cash Flow Projection PresentationDocument17 pagesExecutive Certificate in Microfinance & Entrepreneurship: Cash Flow Projection PresentationSabeloNo ratings yet

- Dit 602Document1 pageDit 602Humaun KabirNo ratings yet

- Q.C. Measurements: 12 GG S - XXL, Base Size: MDocument1 pageQ.C. Measurements: 12 GG S - XXL, Base Size: MHumaun KabirNo ratings yet

- Industrial Sewing Machine ClassificationsDocument3 pagesIndustrial Sewing Machine ClassificationsHumaun KabirNo ratings yet

- Inter LiningDocument2 pagesInter LiningHumaun Kabir100% (1)

- Sample ObDocument6 pagesSample ObHumaun KabirNo ratings yet

- Top 10 Yarn QuestionsDocument3 pagesTop 10 Yarn QuestionsHumaun KabirNo ratings yet

- Textile Yarn:: Types of Yarn - Characteristics of YarnDocument8 pagesTextile Yarn:: Types of Yarn - Characteristics of YarnHumaun Kabir100% (1)

- Preparatory Section: A. WarpingDocument30 pagesPreparatory Section: A. WarpingHumaun KabirNo ratings yet

- What Is InterliningDocument9 pagesWhat Is InterliningHumaun KabirNo ratings yet

- What Is Gauge in The Sweater WorldDocument2 pagesWhat Is Gauge in The Sweater WorldHumaun KabirNo ratings yet

- What Is Lab DipDocument7 pagesWhat Is Lab DipHumaun KabirNo ratings yet

- Yarn Consumption SheetDocument4 pagesYarn Consumption SheetHumaun KabirNo ratings yet

- What Is Garment Wash? - Types of Garment Washing - Procedure of Garment WashingDocument5 pagesWhat Is Garment Wash? - Types of Garment Washing - Procedure of Garment WashingHumaun KabirNo ratings yet

- R1600H Sistema ImplementosDocument31 pagesR1600H Sistema ImplementosLuis Angel Pablo Juan de Dios100% (1)

- Ongc V Saw PipesDocument9 pagesOngc V Saw PipesManisha SinghNo ratings yet

- Associated Labor Union v. BorromeoDocument2 pagesAssociated Labor Union v. BorromeoJaneen ZamudioNo ratings yet

- FSM 2000Document52 pagesFSM 2000aram_hNo ratings yet

- Resident Medical Officer KAmL4W116erDocument4 pagesResident Medical Officer KAmL4W116erAman TyagiNo ratings yet

- 3dea2029ed9eb115091e9ea026cbba8fDocument3 pages3dea2029ed9eb115091e9ea026cbba8fJamie Cea100% (1)

- C&I in Water Treatment PlantsDocument28 pagesC&I in Water Treatment PlantsSunil PanchalNo ratings yet

- 2003 Nissan Maxima NaviDocument167 pages2003 Nissan Maxima NaviMarco OchoaNo ratings yet

- BSBCMM511 Simulation PackDocument4 pagesBSBCMM511 Simulation PackmiraNo ratings yet

- Debug Tacacs CiscoDocument5 pagesDebug Tacacs CiscodeztrocxeNo ratings yet

- Employee Behaviour in Organization Under Work Moral: Project OnDocument26 pagesEmployee Behaviour in Organization Under Work Moral: Project OnDhanvanth ReddyNo ratings yet

- HT Motors Data SheetDocument3 pagesHT Motors Data SheetSE ESTNo ratings yet

- Updating Your Application From The RCM3365 To The RCM3900: 022-0131 Rev. DDocument5 pagesUpdating Your Application From The RCM3365 To The RCM3900: 022-0131 Rev. Droberto carlos anguloNo ratings yet

- Huawei AirEngine 5760-51 Access Point DatasheetDocument16 pagesHuawei AirEngine 5760-51 Access Point DatasheetJsdfrweporiNo ratings yet

- Product Environmental Profile: Canalis KNA 40A To 160ADocument7 pagesProduct Environmental Profile: Canalis KNA 40A To 160AJavier LazoNo ratings yet

- Kci Fi001261149Document9 pagesKci Fi001261149minjokcsy99No ratings yet

- Experiment 7: Investigating The Change of Volume in The Change of Temperature (Document2 pagesExperiment 7: Investigating The Change of Volume in The Change of Temperature (EDWIN SIMBARASHE MASUNUNGURENo ratings yet

- Experiments in Art and Technology A Brief History and Summary of Major Projects 1966 - 1998Document12 pagesExperiments in Art and Technology A Brief History and Summary of Major Projects 1966 - 1998mate maricNo ratings yet

- Analyzing Factual Report Text "ROSE"Document9 pagesAnalyzing Factual Report Text "ROSE"Muhammad Taufiq GunawanNo ratings yet

- TC-42X1 Part 1Document50 pagesTC-42X1 Part 1Pedro SandovalNo ratings yet

- Experiment No. 2: Aim: A) D Flip-Flop: Synchronous VHDL CodeDocument6 pagesExperiment No. 2: Aim: A) D Flip-Flop: Synchronous VHDL CodeRahul MishraNo ratings yet

- CT CalculationDocument2 pagesCT CalculationTheresia AndinaNo ratings yet

- 04.02.20 BCTDA MTG Public CommentsDocument85 pages04.02.20 BCTDA MTG Public CommentsDaniel WaltonNo ratings yet

- Dressmaking 10 - 1st PT - TOS - Key To Correction 2Document8 pagesDressmaking 10 - 1st PT - TOS - Key To Correction 2Sonia CanaNo ratings yet

- AnycubicSlicer - Usage Instructions - V1.0 - ENDocument16 pagesAnycubicSlicer - Usage Instructions - V1.0 - ENkokiNo ratings yet

- Birla Power - MBA ProjectDocument23 pagesBirla Power - MBA ProjectBibhu Prasad SahooNo ratings yet

- Cyber CrimeDocument366 pagesCyber CrimeRufino Gerard MorenoNo ratings yet

- 1 Heena - Front End UI ResumeDocument5 pages1 Heena - Front End UI ResumeharshNo ratings yet