Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

21 viewsI Cahn Proposal

I Cahn Proposal

Uploaded by

Jan Eduard SanchesASd asd a sdasd as as d

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Csqa Paper 3 With AnswersDocument7 pagesCsqa Paper 3 With AnswersMurthy PasumarthyNo ratings yet

- Exam Format Score Multiple Choice Questions (60 Score)Document14 pagesExam Format Score Multiple Choice Questions (60 Score)Muhammad Irfan100% (5)

- FABM 2 Module 5 FS AnalysisDocument9 pagesFABM 2 Module 5 FS AnalysisJOHN PAUL LAGAO100% (4)

- Dba7302 PDFDocument10 pagesDba7302 PDFvick lolNo ratings yet

- Bản Cắt (Jochen Wirts - Christopher Lovelock - Service Marketing-People, Technology, Strategy 9th Edition)Document8 pagesBản Cắt (Jochen Wirts - Christopher Lovelock - Service Marketing-People, Technology, Strategy 9th Edition)thuphuongvttp2003No ratings yet

- Internal Auditor - Micro Fibre Group - BdjobsDocument2 pagesInternal Auditor - Micro Fibre Group - BdjobsTitas KhanNo ratings yet

- Gul Ahmed - PresenatationDocument27 pagesGul Ahmed - Presenatationzubair_ahmed_imports0% (1)

- DXN Marketing India Private Limited: Direct Seller Application & Agreement FormDocument5 pagesDXN Marketing India Private Limited: Direct Seller Application & Agreement FormJuka Vegueta Kalizaya MirandaNo ratings yet

- Solution Aud589 - Dec 2015Document7 pagesSolution Aud589 - Dec 2015LANGITBIRUNo ratings yet

- Team Prtc Fpb Oct 2023 - Tax (q)Document8 pagesTeam Prtc Fpb Oct 2023 - Tax (q)Daphne PerezNo ratings yet

- Option SellingDocument5 pagesOption SellingSathishNo ratings yet

- Final Flowers or Grapes Case ReportDocument4 pagesFinal Flowers or Grapes Case ReportScribdTranslationsNo ratings yet

- A Workaholic EconomyDocument2 pagesA Workaholic Economybabyu1No ratings yet

- SaffolaDocument35 pagesSaffolaAmberChelaniNo ratings yet

- Strategic Management 3e - Chapter 6Document35 pagesStrategic Management 3e - Chapter 6Lerato MphutiNo ratings yet

- Effect of Job Enlargement On Employee Performance at The RifDocument62 pagesEffect of Job Enlargement On Employee Performance at The RifUmair AkramNo ratings yet

- PWC CII Pharma Summit Report 22novDocument64 pagesPWC CII Pharma Summit Report 22novManuj KhuranaNo ratings yet

- EOS Accounts and Budget Support Level IIIDocument91 pagesEOS Accounts and Budget Support Level IIIJB MANNo ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)Ali RazaNo ratings yet

- CV Arie Akbar 2022Document1 pageCV Arie Akbar 2022Abay ImamNo ratings yet

- Notes 2 CORPORATIONDocument4 pagesNotes 2 CORPORATIONVictor Angelo AlejandroNo ratings yet

- 21HI0139 Bid DocsDocument121 pages21HI0139 Bid DocsMaeNo ratings yet

- Smu Mba FinanceDocument1 pageSmu Mba FinanceAbhi ChawlaNo ratings yet

- Review of Related LiteratureDocument6 pagesReview of Related LiteratureJoseph Deo Cañete100% (2)

- Big Data Insurance Case Study PDFDocument2 pagesBig Data Insurance Case Study PDFVivek SaahilNo ratings yet

- CV 2018 PDFDocument6 pagesCV 2018 PDFArtakNo ratings yet

- Vadivel 29.01.2018Document2 pagesVadivel 29.01.2018suganthiNo ratings yet

- I LRD 3 L HF 78 W9 NBDWDocument3 pagesI LRD 3 L HF 78 W9 NBDWBIKRAM KUMAR BEHERANo ratings yet

- Bom PresentationDocument27 pagesBom PresentationprashantNo ratings yet

- Sustainable Supply Chain Practice and PerformanceDocument21 pagesSustainable Supply Chain Practice and PerformanceMuzzammil SyedNo ratings yet

I Cahn Proposal

I Cahn Proposal

Uploaded by

Jan Eduard Sanches0 ratings0% found this document useful (0 votes)

21 views1 pageASd asd a sdasd as as d

Original Title

i Cahn Proposal

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentASd asd a sdasd as as d

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views1 pageI Cahn Proposal

I Cahn Proposal

Uploaded by

Jan Eduard SanchesASd asd a sdasd as as d

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Dividend

Recapitalization: Is Icahn right on Dell?

Dell is in the midst of a fight between three investor groups. One is led by Michael

Dell and funded by a private equity partner. The second is the Blackstone counter

offer for the firm. The third is a bid by Carl Icahn. All three groups are pushing for

more debt in the firm, but the Icahn bid is different on two dimensions: one is that it

wants to keep the firm public (while the other two plan to take it private) and it

wants Dell to pay much of the new debt out as a special dividend (rather than try to

restructure the firm).

I have two articles attached to this weekly puzzle. One is on the Dell dividend recap

proposal by Icahn and the other is on a surge in dividend recaps in Europe,

primarily in companies that have been taken private by PE firms.

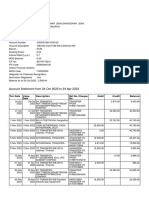

I have also attached the financial summary page for Dell and my assessment of the

optimal capital structure for Dell. Based on the operating income that Dell reported

in the last twelve months, the optimal debt to capital ratio I come up with 50%. Note

that the debt ratio for Dell, based on the plans of all three groups, will be in the 60%-

70% range.

1. Do you think that Dell is a good candidate for an increase in financial

leverage? If yes, why? If not, why not?

2. Which of the three groups proposals is closest in spirit and practice to what

we assume in the optimal capital structure spreadsheet (about what the firm

does with the new debt)?

3. If you believe that value will increase by increasing debt, what is driving the

increase in value? (I know that you are tempted to say the lower cost of

capital but what is causing the cost of capital to be lower?)

4. If you were a potential lender to Dell on this deal, why would you lend

money? And assuming that you lend money, how would you try to protect

yourself?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Csqa Paper 3 With AnswersDocument7 pagesCsqa Paper 3 With AnswersMurthy PasumarthyNo ratings yet

- Exam Format Score Multiple Choice Questions (60 Score)Document14 pagesExam Format Score Multiple Choice Questions (60 Score)Muhammad Irfan100% (5)

- FABM 2 Module 5 FS AnalysisDocument9 pagesFABM 2 Module 5 FS AnalysisJOHN PAUL LAGAO100% (4)

- Dba7302 PDFDocument10 pagesDba7302 PDFvick lolNo ratings yet

- Bản Cắt (Jochen Wirts - Christopher Lovelock - Service Marketing-People, Technology, Strategy 9th Edition)Document8 pagesBản Cắt (Jochen Wirts - Christopher Lovelock - Service Marketing-People, Technology, Strategy 9th Edition)thuphuongvttp2003No ratings yet

- Internal Auditor - Micro Fibre Group - BdjobsDocument2 pagesInternal Auditor - Micro Fibre Group - BdjobsTitas KhanNo ratings yet

- Gul Ahmed - PresenatationDocument27 pagesGul Ahmed - Presenatationzubair_ahmed_imports0% (1)

- DXN Marketing India Private Limited: Direct Seller Application & Agreement FormDocument5 pagesDXN Marketing India Private Limited: Direct Seller Application & Agreement FormJuka Vegueta Kalizaya MirandaNo ratings yet

- Solution Aud589 - Dec 2015Document7 pagesSolution Aud589 - Dec 2015LANGITBIRUNo ratings yet

- Team Prtc Fpb Oct 2023 - Tax (q)Document8 pagesTeam Prtc Fpb Oct 2023 - Tax (q)Daphne PerezNo ratings yet

- Option SellingDocument5 pagesOption SellingSathishNo ratings yet

- Final Flowers or Grapes Case ReportDocument4 pagesFinal Flowers or Grapes Case ReportScribdTranslationsNo ratings yet

- A Workaholic EconomyDocument2 pagesA Workaholic Economybabyu1No ratings yet

- SaffolaDocument35 pagesSaffolaAmberChelaniNo ratings yet

- Strategic Management 3e - Chapter 6Document35 pagesStrategic Management 3e - Chapter 6Lerato MphutiNo ratings yet

- Effect of Job Enlargement On Employee Performance at The RifDocument62 pagesEffect of Job Enlargement On Employee Performance at The RifUmair AkramNo ratings yet

- PWC CII Pharma Summit Report 22novDocument64 pagesPWC CII Pharma Summit Report 22novManuj KhuranaNo ratings yet

- EOS Accounts and Budget Support Level IIIDocument91 pagesEOS Accounts and Budget Support Level IIIJB MANNo ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)Ali RazaNo ratings yet

- CV Arie Akbar 2022Document1 pageCV Arie Akbar 2022Abay ImamNo ratings yet

- Notes 2 CORPORATIONDocument4 pagesNotes 2 CORPORATIONVictor Angelo AlejandroNo ratings yet

- 21HI0139 Bid DocsDocument121 pages21HI0139 Bid DocsMaeNo ratings yet

- Smu Mba FinanceDocument1 pageSmu Mba FinanceAbhi ChawlaNo ratings yet

- Review of Related LiteratureDocument6 pagesReview of Related LiteratureJoseph Deo Cañete100% (2)

- Big Data Insurance Case Study PDFDocument2 pagesBig Data Insurance Case Study PDFVivek SaahilNo ratings yet

- CV 2018 PDFDocument6 pagesCV 2018 PDFArtakNo ratings yet

- Vadivel 29.01.2018Document2 pagesVadivel 29.01.2018suganthiNo ratings yet

- I LRD 3 L HF 78 W9 NBDWDocument3 pagesI LRD 3 L HF 78 W9 NBDWBIKRAM KUMAR BEHERANo ratings yet

- Bom PresentationDocument27 pagesBom PresentationprashantNo ratings yet

- Sustainable Supply Chain Practice and PerformanceDocument21 pagesSustainable Supply Chain Practice and PerformanceMuzzammil SyedNo ratings yet