Professional Documents

Culture Documents

Financial Results For December 31, 2015 (Result)

Financial Results For December 31, 2015 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results For December 31, 2015 (Result)

Financial Results For December 31, 2015 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

GRAVTTY (rf{DrA) LrMrTEn

Regd. ffice : Gala N0.131 , 1st Floor, Sanjay Bldg. No.5-B, Mittal Estate, Andheri-Kurla Road,

Andheri (East), Mumbai - 400 059. lndia o Phone : 6694 9715 I 16 . Fax : 00-91 -22-2859 5429

Email : gravityindia2T@gmail.com . Website : www.gravityindia.netClN: L17"t 10Mh i

Gil/BSE/os9/20Ls

GPRUlIU

FABRICS

GARMENTS

g87pLCtj42ggg

Date: 12th Februa ry,20LG

To,

Corporate R.elationship Department,

The Bombay Stock Exchange Limited,

Phiroze Jeejeebhoy Towers,

Dalal Street, Fort, Mumbai - 40000L.

Scrip Code: 532015

Sub. : Outcome

of

- GMVITY (INDIA)

Board Meeting held

UMITED

on

12.02.2016

Dear Sir/Madam,

to inform you that the Board of Directors of the Company in their meeting held on L2th February,2016 at

5 p.m. at the Registered Office of the Company transacted the following businesses:

This was

1".

2.

3.

Approved Minutes of the previous meeting of the Board of Directors.

Approved minutes of the previous Committee meeting.

Considered, discussed and approved the Unaudited Financial Statements of the Company for the Quarter

and nine months ended on 3L't December, 2015 and giving authority for publishing the same in

prescribed format pursuant to Regulation 33 & 47 of SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015.

4.

Affirmed the compliance reports of all laws applicable to the Company as per Regulation 17 of

SEBI

(Listi ng Obligations and Disclosure Requirements) Reg ulations, 2015.

Taken on record the CEO and CFO certification regarding truth and fairness of financialstatements forthe

Quarter and nine months ended on 31't December, 201-5.

7.

Affirmed the compliance with the Code of Conduct by Senior Management Personnel of the Company as

per Regulation1-T of SEBI (Listing Obligations and Disclosure Requiremerrts) Regulations, 201-5.

Undertook review of the Risk Assessment and Minimization Procedures as per Regulation 21 of SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 2015.

8.

Taken on record related party transactions, if any;

9.

Taken on record the Shareholding pattern under Regulation 31 of the llisting Obligations and Disclosure

Requirements) Regulations, 2015 for the quarter ended 3L't December,2Ol5 along with a copy attached

of online submission in XBRL format as stated in the SEBI.

10.

Taken on record the Corporate Governance Report under Regulation2T of SEBI (Listing Obligations and

Disclosure Requirements) Regulations, 2015 for the quarter ended 31't Decemb er, 2015.

11.

Taken on record the Statement of Investor Complaints and Grievances Report under Regulation 13 of the

SEBI (t-isting obligations and Disclosure Requirements) Regulations,20L5 for the quarter ended 31st Dec, 20L5.

L2. Took note of the compliances under the SEBl(t-isting obligations and Disctosure Requirements) Regulations, 20L5.

You are requested to please take the same on record, and inform the stakeholders accordingly.

behal f of Gr

I

9<

(fK^,ffi6

auffnf,atna

kar

Managing Director

DIN :00575776

CIN NO : 117110MH1987P1C042899

GRAVITY (INDIA) LIMITET)

GPNUru

Regd. 0ffice : Gala N0.131 , 1st Floor, Sanjay Bldg. No.5-8, Mittal Estate, Andheri-Kurla Road,

Andheri (East), Mumbai - 400 059. lndia . Phone : 6694 9715 I 16 . Fax : 00-91 -22-2859 5429

Email : gravityindia2T@gmail.com . Website : www.gravityindia'net

FABRICS

GARMENTS

CIN: L17110MH 1 gg7pLc'42ggg

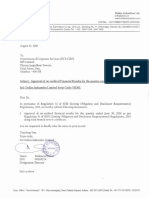

PART-I STATEMENT OF STANDALONE UNAUDITED FINANCIAL RESULT

MONTH ENDEI D 31ST DECEMBER 2015

FOR THE QUARTER AND NINE MONTH

Sr.

No.

3Utzt20Ls

(a) Net Sales

b

c

d

e

Quarter

ended

Nine Month

Nine Month

Year

ended

ended

ended

30to9t2(Jt5 3Llt2l20t4

3ttlzt20LS

lttt2t2.l1.a

11,tolt2'l1\

Unaudited

Unaudited

Quarter

ended

Particulars

Incomes from operations

Quarter

ended

Unaudited

Unaudited

Unaudited

324.88

296.07

296.O7

1036.08

1210.1

2063.72

2798.22

1036.O8

1210.10

2063.72

2798.22

(93.98)

76.M

0.00

7957.52

111.75

39.0s

196.39

0.00

2765.64

L44.85

52.07

2876.26

Total Income [ 1

Expenditure

Increase(-)/Decrease(+) in stock in TR.& VVIP

Raw material purchase

Purchase of Traded Goods

Staff/Worker Cost

Depreciation

Other Expenditure

324.84

Total

413.19

(22.90)

0.00

311.07

44.28

7.57

27.31

t2I

Profit From Operations before Other Income,Interest and

Exceptional ltems [1-2 I

Other Income

(Rs.In lacs)

50.76

0.00

290.94

37.04

76.60

0.00

1039.62

Ll.5 t

t2.62

32.62

24.81

0.00

1003.62

110.02

32.72

Rq 8?

322.41

1056.O5

1330.r6

9) 7)

2LL4.60

(120.0s)

(s0.88)

ss.60

(26.34)

L.2t

(19.97)

4.69

Profit Before lnterest & Exceptional ltems [3+4t

Interest

(83.61)

(2s.13)

(17.3s)

0.00

(0.16)

(0.02)

0.00

1.80

7

8

Profit After Int. but before Exceptional ltems [5-6]

(83.61)

(24.97)

(17.33)

(112.s6)

(41.9s)

Net Profit (+)

10

Tax Expenses

0.95

2.55

11

Net Profit (+)/Loss G) after tax [9-101

(84.s6)

(27.s2)

t2

Extraordinarv items (net of tax expense Rs. )

Net Profit (+) / Loss G) for the period ( 11-12 )

0.00

0.00

13

(84.s6)

(27.s2)

L4

Paid-up Equity Share Capital ( Face Value of Rs.10/- Each )

(88.31)

Exceptional ltems

0.00

Loss (-) fr. Ordinary Activities after tax ( 7+8 )

Reserves excluding Revaluation Reserve as per balance sheet

15

0.00

(83.61)

of

(24.e71

2.62

0.00

(17.33)

7.5t

(24.84)

0.00

(24.84)

7.09

Audited

1,10.09

(78.04)

10.73

(112.96)

13.L2

(64.e2)

(40.15)

0.00

r..86

(66.78)

0.00

(112.95)

0.00

(41.9s)

3.49

(66.78)

(3.22)

1.1".51

(116.46)

(s3.46)

0.00

(116.46)

(63.s6)

o00

ooo

(s3.46)

(63.s6)

900.20

900.20

900.20

900.20

900.20

900.20

9001950

9001950

90019s0

9001950

90019s0

9001950

N.A

N.A

N.A

N.A

N.A

234.31

orevious accountino vr.

Earning Per Share (EPS

):-

a) Basic

& Diluted

EPS before

Extraordinary items for the period, for the year to date & for the

previous year (Not to be annualised )

16

b) Basic & diluted

EPS

(L.24',

(0.31

(0.28

(1.2s)

(0.s9)

(0.74)

0.24]

(0.31)

(0.281

0..291

(0.5g',)

o.74

7074989

7074989

7t06062

7086451.00

78.59

7L06062

78.94

7074989

78.59

78.59

78.94

78.72

0.00

0.00

0.00

0.00

0.00

0.00

0.0(

0.0c

0.0(

0.0c

after Extraordinary items for the period, for

the year to date & for the previous year (not to be annualised

PART.II

A

L

PARTICU LARS OF SHAREHOLDING

Public Shareholding :

Number of Shares

Percentaoe of shareholdino

Promoters & Promoter group Shareholding **

al Pledged/Encumbered : - Number of shares

- Percentage of Shares ( as a % of the total sh.Holding of promotor &

0.00

0.00

promoter group)

b)Non-encumbered

- Percentage of Sh.(as

:-

a7o

NumberofShares

of the total Sh.holding of

1926961

promoter group)

- Percentaqe of Sh. (as a %of the total Sh.Cap.of the co.)

B

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

1895888

L92696t

1895888

100

100

100

100

100

2t.4L

21.41.

21.06

27.4L

2L.06

191s499

100

21,.28o/o

SLlL2lzOLs

Nit

Received during the quarter

NIL

Disposed of during the quarter

NIL

NII

Remaininq unresolved at the end of the quarter

1926961

promoter &

Notes: 1l

2)

3l

4l

The above Financial Results as reviewed by Audit Committee, have been taken on

records at the meeting of the Board Of Directors of the Company held on Feb 12,2016.

The company has only one business segment ofTextiles.

The above Results are subject to review by the statutory Auditors.

Figures for the previous year are regrouped and re-arranged wherever necessary

Place: - Mumbai

Date: - 12.02.2016

I,For

Gravity

Ltd.

le

i Rasiklal D.

lcn't

Thakkar

& Managing Director

You might also like

- Strategic ManagementDocument13 pagesStrategic Managementca_karthik_moorthy80% (5)

- Econ Macro Ia Ib SampleDocument6 pagesEcon Macro Ia Ib SampleAditya ShahNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- KFC Franchisee BusinessDocument21 pagesKFC Franchisee BusinessLi Pan100% (1)

- FCCdocswmDocument613 pagesFCCdocswmKy Henderson100% (1)

- D076201Document21 pagesD076201ridazNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesConsolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document2 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document13 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document8 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document2 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- FordMotorCompany 10Q 20110805Document102 pagesFordMotorCompany 10Q 20110805Lee LoganNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document9 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Reliance Industries: From Wikipedia, The Free Encyclopedia Not To Be Confused With - Reliance Industries LimitedDocument4 pagesReliance Industries: From Wikipedia, The Free Encyclopedia Not To Be Confused With - Reliance Industries LimitedflowermatrixNo ratings yet

- Chartering and OperationDocument35 pagesChartering and Operationmarines0587% (15)

- MB0045 Financial Management Answer KeyDocument21 pagesMB0045 Financial Management Answer Keysureshganji06No ratings yet

- Greg Watson: Career ExperienceDocument2 pagesGreg Watson: Career ExperienceCameron WalkerNo ratings yet

- Investment StartegyDocument87 pagesInvestment StartegySudhir NahakNo ratings yet

- Bajaj Finserv Ltd. Investor Presentation - Q3 FY2017-18Document32 pagesBajaj Finserv Ltd. Investor Presentation - Q3 FY2017-18Mayank SharmaNo ratings yet

- FDP Reading MaterialDocument135 pagesFDP Reading MaterialSyam MohanNo ratings yet

- PFRS 13Document3 pagesPFRS 13Annie JuliaNo ratings yet

- Sapm Unit 3Document13 pagesSapm Unit 3pm2640047No ratings yet

- Corporate Governance and Corporate Social ResponsibilityDocument10 pagesCorporate Governance and Corporate Social ResponsibilityrichaNo ratings yet

- Ambev Presentation Dec.19Document22 pagesAmbev Presentation Dec.19arthurNo ratings yet

- B.inggris N Kel.2Document34 pagesB.inggris N Kel.2Putra RakhmadaniNo ratings yet

- What Is Yield To Maturity (YTM) ?Document5 pagesWhat Is Yield To Maturity (YTM) ?Niño Rey LopezNo ratings yet

- Chapter 2 Corporate ValuationDocument12 pagesChapter 2 Corporate ValuationCaptain Rs -pubg mobileNo ratings yet

- Algo TradingDocument982 pagesAlgo Tradingyogesh kannaNo ratings yet

- Essentials of Federal Taxation Chapyter5-8Document16 pagesEssentials of Federal Taxation Chapyter5-8Amanda_CChenNo ratings yet

- LIFT Impact Report 2012Document32 pagesLIFT Impact Report 2012LIFTcommunitiesNo ratings yet

- Scrutinizer's Report (Company Update)Document7 pagesScrutinizer's Report (Company Update)Shyam SunderNo ratings yet

- AMHQLXTT01 EnglishDocument13 pagesAMHQLXTT01 EnglishJ. BangjakNo ratings yet

- David Corporate AssignmentDocument13 pagesDavid Corporate Assignmentsamuel debebeNo ratings yet

- Global Standard in Financial Engineering: Quantitative FinanceDocument23 pagesGlobal Standard in Financial Engineering: Quantitative FinanceNorbert DurandNo ratings yet

- Chapter 5 (Properties of Stock Options) - Lecture FileDocument14 pagesChapter 5 (Properties of Stock Options) - Lecture FileKobir HossainNo ratings yet

- The Future of FinTech Paradigm Shift Small Business Finance Report 2015Document36 pagesThe Future of FinTech Paradigm Shift Small Business Finance Report 2015Jibran100% (3)

- Key Performance Indicators: Oil & Gas Industry: BY A.GokulakrishnaDocument36 pagesKey Performance Indicators: Oil & Gas Industry: BY A.GokulakrishnaMOON KINGNo ratings yet

- Expenditure Method For Measurement of National IncomeDocument4 pagesExpenditure Method For Measurement of National Incomeakashsoni1995No ratings yet