Professional Documents

Culture Documents

Financial Results, Limited Review Report For December 31, 2015 (Result)

Financial Results, Limited Review Report For December 31, 2015 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results, Limited Review Report For December 31, 2015 (Result)

Financial Results, Limited Review Report For December 31, 2015 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

SPECTRUM FOODS LIMITED

{Fonmerly Known A,s Spectium Leasing & Finance Limited}

L-5, B-il, KRISHNA MARG, C-SCHEME, JAIPUR, RAJASTHAN {tNDtA}

FHCNE:9'! -'!41-5191000,2379483,23?:946 FAX:91 - 141-2365888, E-n':ail :.lobs@s,-:ryasalt.cor:

Cll{ }'l*: L"t 54 99RJ1 994PLC0080'! 6

Cl N

: 115499RJ 1994P1C008016

Date: 12.02.2016

Ref: SFtflPR|2OL6/06

To,

The Manager,

Department of corporate services

Bombay Stock Exchange

25th Floor, Phiroze Jeejeebhoy Towers,

Dalal Street, Kaia Ghoda, Fort,

M umbai, Maharashtra-400001

Reg.: Outcome of Board Meeting

Ref: Scrip code 531982

Dear Sir,

With reference to above, we hereby intimate you regarding the Board Meeting of Spectrum

Foods Limited held on l-2th February 201,6 at its registered office at 12:OO am to transact the

following businesses:-

L Approval of un-audited financial results of the Company for the third quarter ended

on

31st December 2015.

2. Approval and to take on record the Limited Review Report received from the Statutory

Auditors of the Company.

We are enclosing the un-audited financial results of the Company for the third quarter ended

on 3l-st December 2015 along with Limited Review Report from the Statutory Auditors of the

Company. Kindly take the same on record.

Thanking You

Yours Faithfully

IT.

I(ATT.8I^*. & ASSOGIATES

710, Paris Point,

CHARTERED ACCOUNTANTS

Collectorate Circle

Ba

P

nipark, Jaipur(Raj.)

h.: 2207 082, 9828037 060

limited Review Report on Quarterly Unaudited Financiat Results pursuant to Regulation 33 of

the SEBI (Listing Obligations and Disclosure Requirements) Regutations, 2015

Review Report to,

The Board of Directors of M/s Spectrum Foods Limited.

We have reviewed the accompanying statement of unaudited financial results of M/s

Spectrum Foods Limited for the period ended 31't December, 2O15.This statement is the

responsibility of the Company's Management and has been approved by the Board of

Directors. Our responsibility is to issue a report on these financial statements based on our

review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

Engagements to Review Financial Statements issued by the lnstitute of Chartered Accountants

of India. This standard requires that we plan and perform the review to obtain moderate

assurance as to whether the financial statements are free of material misstatement. A review

is limited primarily to inquiries of company personnel and analytical procedures applied to

financial data and thus provide less assurance than an audit. We have not performed an audit

and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come

to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in

accordance with applicable accounting standards and other recognized accounting practices

and policies has not disclosed the information required to be disclosed in terms of Regulation

33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 including

the manner in which it is to be disclosed, or that it contains any material misstatement.

For N.K Kataria and

Chartered

Membership No. O79O48

Place : Jaipur

Date: 12.02.2OLG

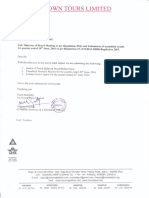

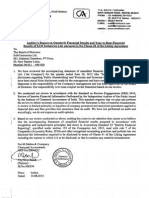

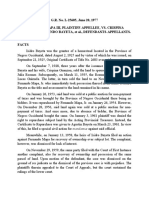

SPECTRUM FOODS LTD.

Regd. Office: Surya House, L-5. B-ll, Krishna Marg, C-Scheme, JAIPUR - 302001 (RAJ) INDIA

Ph : (o) +91-141-2379483,5'191000 Fax. +91'141-2365888

RS In

@dI

:.::Y,gqr,to

'.: r

Sr.

i;:::;:;=

Client 3 months

No.

Qiiddd:3Ji12.2015

(Refer Notes Below)

lncome from ODerations

r) Net Salesllncome from Operations (Net of excise duty)

l) lncome from Windmill

fotal lncome from Ooerations

2

:,!$cadilg:r3..

mohths

tlnarrdited

andd

=PrerrlOqSr:,i.

ConeopOnding 3

mohths ended"

30.09.2015

'.,' 31:i2,2014,:...

Unaudited

l-.Jnaudited

date

lgaiiaa$f:,,

:,Yeartoiate.

;

r;cllr,g!'!t Pgriad

'

ended

:3rll2:2015

Unaudited

figu.re

forihe

prev,ious ygar

tnoto"'

""',zl.1i2ni4

"'

I

Previous

yeat ended

31;03.201 5

lnarrdited

150 46

33.62

0.00

182.41

113 24

84.15

000

141.19

60.80

64.57

125.37

33.62

266.56

113.24

21.54

15.92

0.00

37 46

000

0.00

0.00

000

0.00

U.UU

0.08

288 13

(11 41)

15 10

18.65

369

79.82

(1s4 rj2

9.65

50 65

4.75

14 40

859

121 61

'19.58

43 65

194

11

:net) {a}+(b)

ExDenses

a) Cost of material consumed

l) Purchase of stock-in{rade

c) Changes in inventories of finished goods, work-in-progress and

stock-in-trade

d) Employee benefits expenses

e) Depriciation and amortisation expense

1 0% of the total expenses

relatinq to operations to be shown separately)

22.7t

6t

46.98

32.16

191 .48

516

116 84

88.95

F) Other expenses (Any item exceeding

17.07

105.50

275 23

94.63

96.85

40.f,o

28.52

1.46

75.08

/ bb

1.01

0.58

000

'1.59

0.05

Profit / loss from ordinary activities before finance costs and

exceptional items (3+4)

47.57

29.10

146

76.67

7.73

(5a qt'i

Finance Costs

44 96

35.20

0.00

80.16

0.90

5A.1?-

Total Expenses (a)+(b)+(c)+(cl)+(e)+(f

Profiu (loss) from operations before other income, finance

:osts and exceptional items (1-2)

4

LaCS

fther lncome

(81 12t

26'i

Profit / loss from ordinary activitise after finance cost sbut

before execeptional items (5-6)

z.o

(6.10)

1.46

(3 49

Exceptional ltems

0.00

0.00

0.00

0.00

0.00

Profiu loss from ordinary activities before tax (7+8)

261

(6 10)

1.46

(3 49

6.83

0.00

000

0.00

000

z.o

(6 10)

146

0.00

(3 4e)

000

11

Tax Expense

Net Profit / Loss from ordinary activities after tax (9-10)

6.83

(104 53)

't2

Extraordinary itmes (net of tax expense

000

0.00

0.00

000

0.00

IJ

lssociates and minority interest

2.61

(6 10

1.46

3 491

b d.1

14

Share of profit / loss of asscociates

0.00

0.00

000

0.00

0.00

000

vlinoritv lnterest

000

0.00

0.00

000

0.00

000

tn

Net Profit/ Loss for the period (13t14+15)

zot

(0.1 0l

1.46

(3.49

683

Paid-up equity share capital (Face value of the Share shall be

indicated)

teserre *chJding Revaluation Reserues (as per balance shet of previous

484 84

4A4 84

17

18

rccounhnq vear)

170.O1

58 71

9

10

Rs.-)

{eiEofiI7[osafeti taxes bur before share of profit / loss os

(1

Earning Per Share (EPS)

of Face Value Rs.'101 each)

+12)

1ees1

(of Face Value Rs. 1o/- each)

(1

04 53

000

(1

(1

04 53

04 53

444.44

484.84

444 A4

40.41

37.80

170.01

40.26

0.05

0.05

0.00

0.00

0.03

0.03

005

0.03

0.03

000

0.05

0.05

0.00

0.03

0.03

005

o05

0.03

0.03

000

( not annualised):

000

share

(betore extraorolanry

2C

ifmesl

20

ii. Book value eer Strare latter extraordinary itmes) (of face Value Rs'

101 eachl:

000

of Face Value Rs.10/- each):

^u

0.00

(after extraordinary items)

(al Basic

i. Book Vatue per

04 53

484.84

( not annualised):

b) Diluted

:b) Diluted

(1

(before extraordinary items)

ii Earning eer Snare

1!

:.

Wdr^,ii

'.'"\

j_

*''

.,t..,.,

-:!,_

'::

i'.'.'. ' ,'-i;

10.83

10.78

10.83

10.78

11 21

10 83

27.17

10.83

27.17

1121

Ended 31.12.2015

(31.12.20'.t41

a) Pledged / Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of promoter

and promoter group)

- Percentage ofshares (as a % ofthe total share capatil ofthe

2054411

Percentage of shares (as a % of the total shareholding of the

Percentage of shares (as a % of the total share capital of the

3 months ended

B

Particulars

NVESTOR COMPLAINTS

)endinq at the beqinninq of the quarter

Received durinq the quarter

lisnosed of durino the ouarter

Remaininq unsolved at the end of the quartet

r/*"a"".

(31.12.2015\

\IL

NIL

NIL

NIL

1178239

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Ncnda+Imfpa en Blanco 3333.auDocument9 pagesNcnda+Imfpa en Blanco 3333.auflint1967100% (1)

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Taxmann Companies Act 2013: Taxmann Companies Act 2013From EverandTaxmann Companies Act 2013: Taxmann Companies Act 2013Rating: 4.5 out of 5 stars4.5/5 (7)

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Motion To QuashDocument6 pagesMotion To QuashMichael_Lee_RobertsNo ratings yet

- Intellectual Property RightsDocument19 pagesIntellectual Property RightsSanjeevani Sanguri100% (1)

- G.R. No. 93833.ramirez v. Court of AppealsDocument5 pagesG.R. No. 93833.ramirez v. Court of Appealselian mckensiNo ratings yet

- State of Maryland v. Baltimore & Ohio Railroad Co., 44 U.S. 534 (1845)Document20 pagesState of Maryland v. Baltimore & Ohio Railroad Co., 44 U.S. 534 (1845)Scribd Government DocsNo ratings yet

- Mapa III vs. Guanzon, 77 SCRADocument17 pagesMapa III vs. Guanzon, 77 SCRAJohn CruzNo ratings yet

- Rodillas Vs SandiganbayanDocument4 pagesRodillas Vs SandiganbayanJasielle Leigh UlangkayaNo ratings yet

- Moot ArguementsDocument11 pagesMoot ArguementsAseemNo ratings yet

- Pd1067 PrimerDocument18 pagesPd1067 PrimerRobert RamirezNo ratings yet

- Iprs For KenyaDocument15 pagesIprs For KenyaPeter Asan100% (1)

- Joaquin Vs NavarroDocument9 pagesJoaquin Vs NavarroKarlNo ratings yet

- Report: Sex Trafficking in HawaiiDocument17 pagesReport: Sex Trafficking in HawaiiHonolulu Star-AdvertiserNo ratings yet

- Fire Accident in RMG Industry in BangladeshDocument14 pagesFire Accident in RMG Industry in BangladeshdevilbondhonNo ratings yet

- Rule Against InalienabilityDocument3 pagesRule Against Inalienability100No ratings yet

- Shreya Singhal Vs Union of IndiaDocument4 pagesShreya Singhal Vs Union of IndiaParul NayakNo ratings yet

- ANSYS CFD-Post User's GuideDocument372 pagesANSYS CFD-Post User's GuideAdrian DavidNo ratings yet

- Volume 44, Issue 8 - February 22, 2013Document40 pagesVolume 44, Issue 8 - February 22, 2013BladeNo ratings yet

- Alcira vs. NLRCDocument3 pagesAlcira vs. NLRCOliver Reidsil M. RojalesNo ratings yet

- A.M. No. Mtj-11-1792 by TampariaDocument2 pagesA.M. No. Mtj-11-1792 by TampariaCelver Joy Gaviola TampariaNo ratings yet

- LLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsDocument133 pagesLLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsTahaNo ratings yet

- State of Michigan Constitution - 1963Document57 pagesState of Michigan Constitution - 1963Cory FerribyNo ratings yet

- Disclosure To Promote The Right To Information: IS 1341 (1992) : Steel Butt Hinges - (CED 15: Builder Hardware)Document11 pagesDisclosure To Promote The Right To Information: IS 1341 (1992) : Steel Butt Hinges - (CED 15: Builder Hardware)Sriram SubramanianNo ratings yet

- bnk601s120221 Tutorial 9 SolutionDocument3 pagesbnk601s120221 Tutorial 9 SolutionNatasha NadanNo ratings yet

- Law and Definition of Estafa by MisappropriationDocument2 pagesLaw and Definition of Estafa by MisappropriationVirgilio VolosoNo ratings yet

- Inter PipeDocument6 pagesInter PipeChristelle GalecioNo ratings yet

- Thermal Terms & Conditions of SaleDocument1 pageThermal Terms & Conditions of SalethermaltechnologiesNo ratings yet

- Manila Trading Vs Philippine Union LaborDocument5 pagesManila Trading Vs Philippine Union LaborJae Tuffie KatneesNo ratings yet

- Mir Kamal PashaDocument3 pagesMir Kamal PashakamalNo ratings yet

- Inquest ProceedingsDocument4 pagesInquest ProceedingsNonoy Dioneda DukaNo ratings yet

- Comparative Tort Law Cases, Materials, and Exercises (Thomas Kadner Graziano, Andrew Tettenborn Etc.) (Z-Library)Document650 pagesComparative Tort Law Cases, Materials, and Exercises (Thomas Kadner Graziano, Andrew Tettenborn Etc.) (Z-Library)Nico LagosNo ratings yet