Professional Documents

Culture Documents

The MIT Press The Review of Economics and Statistics

The MIT Press The Review of Economics and Statistics

Uploaded by

Sanjana RahmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The MIT Press The Review of Economics and Statistics

The MIT Press The Review of Economics and Statistics

Uploaded by

Sanjana RahmanCopyright:

Available Formats

Mergers and Market Share

Author(s): Dennis C. Mueller

Source: The Review of Economics and Statistics, Vol. 67, No. 2 (May, 1985), pp. 259-267

Published by: The MIT Press

Stable URL: http://www.jstor.org/stable/1924725

Accessed: 24-07-2016 17:59 UTC

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

http://about.jstor.org/terms

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted

digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about

JSTOR, please contact support@jstor.org.

The MIT Press is collaborating with JSTOR to digitize, preserve and extend access to The Review of

Economics and Statistics

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

MERGERS AND MARKET SHARE

Dennis C. Mueller*

Abstract-The impact of mergers on the market shares of

acquired companies is estimated using market share data for

the 1000 largest companies of 1950 and 1972. Market shares

are computed for conglomerate and horizontal acquisitions

between 1950 and 1972. To control for other factors that might

affect market shares, market shares of acquired firms are compared with those of a control sample of unacquired firms drawn

from the same industries. Companies acquired in a conglomerate merger and companies joining in horizontal mergers

are both found to experience substantial losses in market shares

relative to control group companies following the mergers.

M s ERGERS have over the course of the last

century transformed the corporate landscape. A careful examination of the 1,000 largest

manufacturing companies of 1950 revealed that

384 had disappeared through mergers by 1973

(Mueller, 1983, p. 4). Others from this list have

disappeared since. A look at the 100 largest corporations in the United States reveals a mere handful

for which mergers did not figure substantially in

their growth at one time or another. Exxon, United

States Steel, and General Motors were spawned in

the early merger waves. Textron, ITT and Occidental Petroleum are products of recent merger

history. The process of transformation through

merger continues unabated through today.

Despite the venerability of this process and its

profound influence on corporate structure, our

knowledge of the economic effects of mergers is

spotty, and disagreement exists regarding what the

existing evidence shows. Most studies of early

merger activity focussed on the effects of mergers

on the profitability of the merging companies.

Here a fair consensus exists that the mergers of the

first two greater merger waves are more likely to

have lowered than to have increased profitability.'

A similarly mixed picture of the effects of mergers

on the profitability of the merging companies is

presented in studies of post World War II merger

activity in this country and Europe.2

Most recent studies of the effects of mergers

have looked at their impact on the returns on

common shares. Here it appears that the shareholders of acquired companies are unquestionably

better off, but shareholders of acquiring companies

may or may not be better off, and some disagreement exists over whether the net effects of mergers

on stockholder wealth are positive or negative.3

This paper takes a fresh look at the effects of

mergers question, by examining their impact on a

heretofore almost unexplored variable, market

share. Several recent studies have found that

market shares are positively related to profitability

(e.g., Ravenscraft, 1983), and market share is a

frequently cited objective of corporate management. Thus, one might legitimately evaluate the

successfulness of mergers by their impact on

market shares. On the other hand, in certain situations, as for example, in a horizontal merger in an

industry with less than perfect collusion, the combined market share of the merging firms could fall

although their profits rose (see Salant, Switzer and

Reynolds, 1983; Perry and Porter, 1983). Thus, we

shall not attempt to relate our results to the literature on mergers effects on either profitability or

stockholder wealth. We ask instead the more modest question of whether mergers have succeeded in

increasing the market shares of the acquired firms.

The next section describes the data and empirical

tests. Results follow in section II, discussion of the

results and conclusions in sections III and IV.

Received for publication October 26, 1983. Revision accepted

for publication August 21, 1984.

*University of Maryland, College Park and Federal Trade

Commission.

Helpful comments on earlier drafts were obtained from

Ronald Brauetigam, Paul Geroski, David Ravenscraft, and two

referees. My thanks go to Carl Schwinn for his programs

aggregating the CPR data into our economic markets, and to

Paul Bagnoli, John Hamilton and Talat Mahmood for additional computer assistance. The views expressed in this paper

are my own, and should not be assumed to be shared by the

above mentioned gentlemen, any of the FTC staff, or its

commissioners.

1 For surveys of this literature and references to earlier studies

see Markham (1955) and Hogarty (1970).

I. Data and Methodology

Our sample is drawn from Federal Trade Commission surveys for 1950 and 1972 of sales at the

5-digit level for the 1,000 largest companies in

2 For the United States see Weston and Mansinghka (1971);

Melicher and Rush (1974); and Mueller (1980), ch. 9. For

Europe see Meeks (1977); Cowling et al. (1979); and 6 country

studies in Mueller (1980), ch. 3-8.

3For surveys see Steiner (1975), ch. 8; Mueller (1977,1981);

Scherer (1980), pp. 138-141; and Halpern (1982).

[259 1

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

260 THE REVIEW OF ECONOMICS AND STATISTICS

Firm I's market share is assumed to follow a

each year.4 The sample of acquired firms consists

of all companies that were (1) among the 1,000

largest of 1950, and (2) were acquired by a firm

among the 1,000 largest in both 1950 and 1972.

Any company meeting this criterion that was spun

off or sold prior to 1973 was omitted from the

sample. If a company A was acquired by B which

in turn was acquired by C, and A and C met the

criterion, A was included in the sample. When

only a division of a firm was acquired, then this

division was treated as the acquired firm. Using

these criteria a sample of 209 acquired and 123

acquiring companies was constructed.5

Whenever the 5-digit product definition seemed

too disaggregate we aggregated upward until a

more meaningful economic definition of the market

was obtained, placing particular weight on sub-

stitution in production in defining the market.6

Between 1950 and 1972 there were numerous

changes in, SIC product definitions. These changes

required further combining and rearranging of

product lines to match 1950 and 1972 markets.

Fortunately, most industries that could not be

compared had small 1950 sales, so that the percentage of 1950 sales that could not be matched to

1972 markets was only 5.8%, although in some

cases the "match" was admittedly somewhat loose.

Given the changes in market boundaries and

product definitions between 1950 and 1972, a firm's

market share in 1972 in a given 1972 market might

over- or understate what its market share would be

in a truly comparable market. Overstatement can

occur if a market is too broadly defined and tbit

firm has sales in the erroneously included prod-

ucts, or because the market is too narrowly defined

and a larger fraction of the market's sales are

omitted than of the firm's. Understatement can

occur when the errors run in the opposite direction. In general, we have an errors in observation

problem and our estimated coefficients on market

share variables will be biased toward zero. To

control for these biases to some extent, we estimate the effects of mergers on market shares relative to a control group of companies whose 1950

and 1972 market shares. are defined using the same

market definitions as for the merger sample.

4The 1950 survey has been published (FTC, 1972), the 1972

survey has not been released.

5'The list of merging and control group companies is available

from the author.

6 The market definitions used are given in appendix A-2 of

Mueller (1983).

simple first order Markov process over time:

mi t+Io=amit +? Ill

or

n-I

mit

(1)

j=1

Assuming that the weighted sum of errors in (1)

has the usual mean zero, constant variance property across firms, (1) can be estimated using the

1972 and 1950 market share data as

M,=

ami

Ei

(2)

where lower case letters indicate 1950 values and

upper case letters stand for 1972. To test for the

effects of mergers on market share, we test whether

acquired companies have the same estimated a as

a control group of similar size and industry composition to the acquired firms, but were not

acquired between 1950 and 1972. We do this by

defining a dummy variable, D = 1 if the firm was

acquired, and 0 if it is in the control group, and

estimating (3) across the pooled sample.

M, = ami + bDmi + 'i (3)

If mergers have no effect on market share, b

should equal zero. We treat this prediction as the

null hypothesis.

Two modifications are made to (3) in the empirical work. A constant, c, is added to allow for

some "drift" in market shares because our industry definitions in 1950 and 1972 are not a

perfect match. Second degree terms in m are added to allow for a regression-on-the-mean effect for

larger market share firms.

For each company i acquired in a conglomerate

merger, a weighted market share for 1950 was

constructed using its 1950 sales in each market k,

Sik, as weights

m, (ESik 'mik) si (4)

where si = >kSik is i's total 1950 sales.

Firm i's market share in 1972 is computed over

the K markets in 1972 that match the k markets

in 1950 in which i had sales. In a conglomerate

merger 1950 firm i has become 1972 acquiring

firm I. Using I's 1972 sales in each market k as

weights we have

M, = SIK . MK)I s (5)

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

MERGERS AND MARKET SHARE 261

where S. = EKSIK, and the 72 superscript indi-

cates that 1972 sales weights are used.

and then compute 1950 market shares for the

merging companies using (4).

The use of 1972 sales as weights when comput-

Vertical acquisitions are treated as conglomerate

ing 1972 market shares can in some cases give

acquisitions since both firms are in different in-

misleading results. Consider the following exam-

dustries. The FTC market share data were gathered

ple. Firm i has 1950 sales of 100 in market 1 with

on an establishment basis and include intra-firm

a market share of 0.13 and 200 in market 2 with a

shipments, so the disappearance of acquired com-

market share of 0.10. Its weighted 1950 market

pany shipments into intra-firm transfers following

share is then 0.11 = (0.13 x 100 + 0.10 x

200)/300. In 1972, it has sales of 400 in market I

a vertical acquisition is not a problem.

To measure the effects of mergers on market

shares we selected two control groups of un-

with a market share of 0.12 and zero in market 2.

If its 1972 sales are used as weights to calculate its

1972 market share, one records an increase in

glomerate and horizontal merger samples. To be in

market share from 0.11 to 0.12 = (0.12 x 400 + 0

a control group a company must (1) be in the 1000

x 0)/400, even though the firm lost market share

in both markets. To guard against this bias, we

acquired companies to compare with the con-

largest lists in both 1950 and 1972, and (2) not

have acquired a member of the 1950 list between

also calculate 1972 market shares using 1950 sales

1950 and 1972. The FTC divided the 1950 1000

weights.

largest into the 200 largest, 201-500 largest, and

501-1000 largest. In forming the control groups,

MI = (ESik MIK)S i (6)

While MJ72 in the previous example is 0.12, M150 is

0.04 = (0.12 x 100 + 0 x 200)/300.

The use of these two measures of 1972 market

shares allows us to test the Weston (1970) and

Williamson (1970) hypothesis that conglomerate

mergers improve efficiency by facilitating the redeployment of capital across divisions. Evidence in

favor of this hypothesis would be a significantly

better performance of companies acquired in conglomerate mergers relative to the control group,

when 1972 market shares are calculated using 1972

sales weights (M,72), than when 1950 weights are

used.

We define as horizontal those portions of a

merger in which both the acquiring and acquired

companies had 1950 sales in the same market.7

For horizontal mergers the combined sales of the

two companies in the k markets in which they

both operated in 1950 are compared with the

acquiring firm's sales in the k markets in 1972. Let

q be the acquiring firm, d the acquired company.

For horizontal mergers, we then define i's sales

and market shares as

Sik = Sgk + Sdk, mik = mgk + mdk (7)

companies were chosen at random from the 3 size

categories in the same proportions as exist in the

merger sample. The selection process was con-

tinued until enough firms were drawn so that the

total sales by 2 digit SIC for each control group

roughly equaled those for the merger samples.

There were so many companies acquired from the

pulp and paper industry (SIC 26) that there were

not enough firms left in the 1950 list to bring the

sales of the conglomerate-merger control group up

to the merger sample even when all possible

candidates were included. With this exception, it

was possible to select control group companies

with sales roughly equal to the acquired firms'

sales in 1950. A percentage breakdown of the two

acquired firms' samples and their control groups is

given in table 1.

II. The Results

A. Conglomerate Mergers

All market shares must fall between zero and

one and there is a heavy concentration of market

shares below 0.1, the mean for the acquired firms

is 0.067 in the conglomerate merger sample. This

heavy concentration of observations near the origin

7 Note that an acquired company having some sales in markets

in which the acquiring company had sales, and some in markets

where it did not, appeared in both the conglomerate and

horizontal merger samples. Its market share in each was calculated by aggregating over the j markets appropriate to each

definition.

raises the possibility that a few outliers swing the

regression lines in one direction or another. To

avoid this, we weighted all observations by 1950

sales. The sales weighted equations also yield more

meaningful economic estimates. A 10 percentage

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

262 THE REVIEW OF ECONOMICS AND STATISTICS

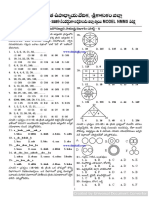

TABLE 1.-PERCENTAGE BREAKDOWN OF SAMPLE COMPANIES' 1950 SALES BY 2-DIGIT INDUSTRY

Industry Major Conglomerate Conglomerate Horizontal Horizontal

SIC Industry Merger Merger Merger Merger

Code Group Sample Control Group Sample Control Group

20 Food & Kindred Products .180 .203 .093

21 Tobacco Manufactures .009 .009

22 Textile Mill Products .063 .073 .242

23 Apparel & Related Products .007 .013 .012

24 Lumber & Wood Products .013 .016 .026

25 Furniture & Fixtures .009 .015 .004

.095

0 0

.220

.006

.019

.002

26 Pulp & Paper Products .134 .068 .128 .098

27 Printing & Publishing .006 .004 0 .001

28 Chemicals & Related Products .147 .149 .019 .029

29 Petroleum & Coal Products .008 .008 .128 .113

30 Rubber Products .004 .005 .007 .007

31 Leather & Leather Products 0 0 .013 .023

32

Stone,

Clay

&

Glass

Products

.020

.021

.001

33 Primary Metal Products .062 .056 .113 .097

34 Fabricated Metal Products .042 .062 .016 .035

35 Machinery, Except Electrical .125 .128 .049 .046

36 Electrical Machinery .063 .072 .008 .017

37 Transportation Equipment .080 .128 .140 .188

38 Instruments & Related Products .013 .015 0 .009

39

Miscellaneous

Manufactures

point increase in market share for a company with

$300,000,000 in sales has greater economic significance than the same change for a firm with $30,000

in sales. All reported estimates are for sales

weighted regressions. Results of a similar qualitative nature were obtained from unweighted regres-

.014

.016

.001

declines in market shares of the acquired compa-

nies took place before they were acquired, and that

their post-acquisition performance was no worse

or even better than that of the control group. This

observation would be consistent with the failing

firm hypothesis (Dewey, 1961), or with the hy-

sions, however.

pothesis that takeovers occur to replace poor

The first two equations in table 2 present results

for the basic linear equation including a constant

term to capture market share drift.8 The coefficient

on the m term indicates a high retention of market

share even after 23 years has elapsed for companies in the top 1000 in 1950, which were not

acquired. The coefficient on the Dm term indicates

that companies that were acquired between 1950

and 1972 retained a significantly smaller percentage of their 1950 shares. For example, while

an unacquired firm retained 88.5% of its 1950

market share in 1972 using 1972 sales as weights,

an acquired firm retains but 18% of its 1950 market

managers (Manne, 1965). To test for this alterna-

tive possibility, D was redefined as D (73 YR)/23, where YR is year of acquisition, YR =

50,72. A merger occurring relatively early in the

1950-72 interval receives a heavier weight in the

merger vector than a merger occurring late in the

interval. Control group firms continue to have

D = 0. If the decline in market shares preceded

the acquisitions, this alternative weighting of observations in the Dm vector should reverse the

sign, or at least raise the coefficient of this term.

But it lowers it still further. The coefficients on

Dm are negative and larger in absolute value than

when D is a 0,1 dummy. The relative deteriora-

share.

The mergers in the sample took place throughout

tion in market shares for acquired companies is

the period 1950-72.9 It could be that the relative

more severe, the earlier they occur. Indeed, equa-

tion 3 (4) implies that a firm acquired before 1956

8 Closely analogous results to those reported were obtained

when the intercepts were suppressed.

9 Because our reference point in selecting a sample is firms in

existence and relatively large in 1950, a far smaller percentage

of our mergers took place in the late 1960s than is true for the

population of all firms in existence at each point in time. The

(unweighted) mean year for a merger in the sample is 1961,

virtually the middle of the time period.

(1952) is predicted to have a negative market share

in 1972 when 1950 (1972) sales are used as weights.

It is impossible for a firm to have a negative

market share, and the latter implication of equa-

tions 3 and 4 suggests nonlinearity. When both m2

and DM2 were added to the equation, multicollin-

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

MERGERS AND MARKET SHARE 263

TABLE 2.-CONGLOMERATE MERGERS

Dependent

Equation Variable c m Dm Dm2 D n R

1 MSO 0.009 0.691 -0.527 1,0 313 .922

2.34 39.23 16.77

2 M72 0.011 0.885 -0.705 1,0 313 .940

2.61 45.02 20.09

3 M5O -0.003 0.727 -0.779 73 - YR 313 .929

0.78 43.49 18.30 23

4 M72 - 0.005 0.933 -1.02 73 - YR 313 .944

1.30 49.24 21.08 23

5 M5O - 0.012 0.750 -2.00 1,0 313 .901

3.31 37.84 12.34

6 M72 -0.017 0.964 -2.77 1,0 313 .920

3.97 42.62 14.93

7 M5O - 0.009 0.753 -4.43 73 - YR 313 .930

3.01 45.35 18.63 23

8 M72 -0.014 0.968 -5.83 73 - YR 313 .946

3.91 52.16 21.95 23

Notes: t-values are under coefficients. All variables and constant weighted by 1950 sales.

earity was present. The best-fit equation for D =

(73 - YR)/23 was one in which a linear relationship between m and M was assumed for the

allow for the downward bias in standard error

estimate without overturning the conclusion that

mergers have resulted in a relative deterioration in

control group firms, but a nonlinear relationship is

the acquired firms' market shares.

assumed for the acquired firms (see equations 7

and 8). The larger an acquired firm's 1950 market

share was, the larger was the percentage loss in its

market share between 1950 and 1972. The same

equations are presented with D defined as a 0,1

dummy in equations 5 and 6. The nonlinear

specification when D is zero or one is inferior, as

judged by R2, to the linear. A comparison of

equations 5 and 6 with 7 and 8 reveals again a

lower coefficient on the D terms when D weights

earlier acquisitions more heavily, however. The

implication from equations 5-8 as from 1-4 is

that the decline in market shares acquired firms

experience relative to the unacquired control group

firms occurred after their acquisition.

Heteroscedasticity was present in both the sales

weighted results reported and the reported, unweighted results based on Gleijser's test (1969).

Efforts to remove heteroscedasticity by reweighting each observation did not yield a choice of

weight that gave homoscedastic residuals for all

obvious choices of scale variable. Although heteroscedasticity is troublesome, coefficients remain unbiased estimates of the true parameters, and inefficiency does not seem so serious a problem,

given that we have 313 observations. Moreover,

the key coefficients on the Dm and DM2 terms are

12 to 22 times their standard errors. Thus, a several

fold expansion of the standard errors is possible to

B. Horizontal Mergers

The first 4 equations in table 3 reproduce results

for the horizontal merger sample and its control

group that parallel those for the conglomerate

mergers reported in table 2. The coefficient on m

indicates that nonacquired companies in the industries in which horizontal mergers occurred were

less successful at retaining their 1950 market shares

through 1972, retaining little more than 50%. But

they were considerably more successful than the

firms engaging in horizontal mergers. A comparison of equations 1 and 2 with 3 and 4 again

reveals that placing heavier weight on earlier

mergers worsens the relative performance of merging firms. A firm acquired in 1950 is projected to

lose all of its market share by 1972 using 1972

sales-weights to calculate M, all but 4% of its 1950

market share using 1950 sales-weights. The earlier

a merger occurred, the worse the relative loss of

market share.

When m2 and DM2 terms were added to the

basic linear equation for the horizontal mergers'

sample, multicollinearity did not appear to be a

problem, although the two coefficients were of

opposite signs. Equations 5 and 6 imply that the

M - m curve for nonacquired companies is concave from below, the curve for merging firms is

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

264 THE REVIEW OF ECONOMICS AND STATISTICS

TABLE 3.-HORIZONTAL MERGERS

n = 176

Dependent

Equation Variable c m Dm m2 Dm2 D R2

1 M50 0.024 0.511 -0.346 1,0 .832

9.57 17.77 7.86

M72

0.027

0.547

-0.403

1,0

.818

9.48 16.94 8.15

3

4

M5O

M72

0.024

0.513

-0.472

73

9.83 18.29 8.57

0.027 0.549 -0.553 73 9.80

17.54

8.99

YR

.840

23

YR .829

23

5 M5O 0.015 0.825 -0.604 -0.936 1.21 1,0 .862

4.65 12.09 9.84 5.38 5.18

6 M72 0.015 0.962 -0.710 -1.22 1.43 1,0 .859

4.07 12.92 10.59 6.44 5.58

7 M5O 0.015 0.826 -0.784 -0.931 1.52 73 - YR .869

4.57 12.44 10.46 5.49 5.22 23

8 M72 0.014 0.966 -0.932 -1.23 1.83 73 - YR .870

4.02 13.51 11.55 6.72 5.82 23

Notes: t-values are under coefficients. All variables and constant weighted by 1950 sales.

convex. The two curves cross at a 1950 market

largest, the other not, the 1972 market share re-

share of around 0.5. Only one pair of companies

flects the contribution of both acquired firms, while

we attribute all of the sales to the one acquired

firm in our sample. The estimate of the merger's

impact on the acquired firm's market share is

biased upward, and this bias could be considerable. For example, St. Regis Paper acquired 3

firms from the 1950-1000 largest list between 1950

and 1972, each is an observation in the sample.

But, the 1973 Moody's Industrial Manual lists

some 53 companies as having been acquired by St.

Regis between 1953 and 1972 alone, and the bulk

involved in a horizontal merger has their combined 1950 market share greater than 0.5. Thus,

equations 5 and 6 predict a decline in market

share for a pair of firms in a horizontal merger

between 1950 and 1972 relative to a nonmerging

firm with the same market share in 1950 as the

combined market share of the merging firms, for

every pair of merging companies save one.

The results for equations 7 and 8 parallel 5 and

6 except that D has been redefined once again to

place heavier weight on the earlier observations.

Both D-coefficients are larger in absolute value.

of these appear to be in the lumber and paper

industries. Our comparison of 1950 and 1972

Thus, this reweighting of observations exaggerates

market shares ignoring these 50 + additional

the curvature of each relationship. The convex

mergers must certainly overestimate any increase

curves in equations 7 and 8 lie beneath their

or underestimate any decline in St. Regis' market

respective curves in 5 and 6 for all 1950 market

shares that occurred.

shares less than 0.56. For all mergers in the sample

The most important biases are for firms like St.

but one, the reweighted curves in 7 and 8 predict

Regis that made numerous acquisitions in the same

relatively lower market shares for merging firms

industries. Numerous mergers in the same industry

are more likely for horizontal mergers. Thus, the

than for nonmerging firms the earlier the merger

occurs.

C. Biases and Caveats

Before drawing conclusions, a few possible bi-

estimates for horizontal acquisitions are more likely

to be biased in favor of finding a positive effect of

mergers on market share than are the conglomerate mergers' estimates. It is important to

recall that for horizontal mergers, 1950 market

ases in the results must be reviewed. The most

shares are defined as the sum of the acquiring and

important of these is that we have data on only

acquired firms' market shares. The nonlinear re-

those acquired companies that were in the top

sults in equations 5-8 of table 3 imply that there

was a smaller loss in market share for merging

firms relative to the control group when the com-

1000 of 1950. If a company acquired two firms

with sales in the same market, one in the 1950-1000

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

MERGERS AND MARKET SHARE 265

bined market share of the merging firms in 1950

acquired company before 1973 were excluded from

was large. Large 1950 market shares in horizontal

the sample, information allowing an adjustment

mergers tend to be due to the large market shares

for partial acquisitions was lacking. While the

of the acquiring companies. The unrecorded

control group firms also undertook unrecorded

acquisitions of these firms are also likely to be

spinoffs, it is reasonable to assume that spinoffs of

greater in number.

assets acquired through merger are more common

We define as conglomerate any acquisition, or

than internally generated assets. If a bias from

part thereof, where the two firms did not sell in the

ignoring unreported spinoffs were significant, one

same market in 1950. Often the acquiring firm had

would expect acquired firms to perform much

sales in a market neighboring the acquired com-

better when their market shares are measured using

pany's markets, and made several acquisitions in

1972 sales as weights than when 1950 sales are

these besides the one in our sample. In these

used, since the 1972 sales weights allow for the

market-extension conglomerate mergers, a consid-

spinoffs. But the deterioration in market shares for

erable upward bias in our estimates of the benefi-

acquired firms is, if anything, greater when one

cial effects of mergers on market shares is also

uses 1972 sales as weights so that whatever bias

possible. Nevertheless, the greater upward bias is

exists is more than offset by other factors.

probably in the horizontal merger results.

This bias in estimating the impact of mergers is

A bias in favor of a positive effect of mergers on

market shares is introduced by omitting entirely

offset to the extent control group firms also made

all acquisitions in which full spinoffs subsequently

acquisitions during the period in the industries in

occurred. Few firms buy a company, improve its

which they were selling in 1950. While they did, a

performance, and then sell it. A spinoff of an

comparison of the merger histories of the acquir-

acquired firm is, or at least was in the 1950s and

ing and control group companies reveals the former

1960s, an admission of failure. A hint of the

to be far more active in the market for corporate

validity of this conjecture is apparent in the few

control. This finding is not surprising. Any com-

instances in which data on both purchase and sales

pany that was among the 1000 largest in 1950, and

prices of acquired and later spunoff companies are

made many acquisitions over the next 22 years, is

available (see table 4). Taking into account infla-

likely to have acquired at least one other company

tion and the normal growth in asset values that

in the 1950 top 1000, and thus appear in the

occurred in the years between purchase and sale it

merger sample. Whatever bias exists from not

is hard to believe the operating efficiency of these

having data on premerger market shares of

companies improved following their acquisition.

acquired firms not in the 1950-1000 largest group

We expect the same is true of the 9 other spinoffs

leads toward an overestimate of the positive effects

for which no sales price is reported. Were it possi-

of mergers on market share.

ble to calculate market shares for these companies

An opposite bias could be introduced by our

in 1972 and include them in the sample we expect

neglect of spinoffs. Although all acquisitions in

they would reinforce the negative findings regard-

which the acquiring firm sold the previously

ing the effects of mergers.

TABLE 4.-PURCHASE AND SALES PRICES OF SPINOFFS OF 1000 LARGEST AcQuISITIONS

Acquiring Acquired Year Year Purchase Price Sales Price

Firm Firm Acquired Sold $'000 $ '000

Murray

Easy

1955,

57

1963

9,400

770

(Wallace- Washer

Murray)

National Godchaux 1956 1961 14,000 9,600

Sugar Sugar

Kennecott Okonite 1957 1966 31,300 31,700

Copper

Heublin Theo Hamm 1965 1973 62,006 6,000

Source: Moody's Industrial Manual, 1973.

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

266 THE REVIEW OF ECONOMICS AND STATISTICS

The matching of 1950 and 1972 markets is of

varying degrees of accuracy. To the extent these

markets are not fully comparable, errors in

observation are introduced in the market share

data, and regression coefficients are biased toward

zero. The same market definitions have been used

for the merging firms and the control group com-

panies, so that this bias should be removed or

reduced for the variables measuring the impact of

the mergers, the D variables.

III. Discussion

Only one other study has examined the effect of

mergers on market shares. Goldberg (1973)

IV. Conclusion

The results of this paper would seem to require

the rejection or at least reinterpretation of several

leading hypotheses regarding mergers. No support

was found for the hypothesis that mergers improve

efficiency by consolidating the sales of the acquired

companies on their most efficient product lines.

The relative loss in market shares when 1972 sales

are used as weights to calculate 1972 market shares

are about the same or slightly greater than when

M50 is the dependent variable. Acquired firms

perform no better if not worse than nonacquired

companies in those markets in which each chose to

concentrate its sales.

examined a sample of 44 companies acquired in

Smiley (1976) and Mandelker (1974) found that

the fifties and sixties and found no significant

acquired firms had below average stock market

change in market shares or growth rates following

performance prior to their acquisition. These be-

the mergers. The longest time span following a

low average stock market returns may signal the

merger in Goldberg's sample was eleven years, the

declines in market shares we record following a

mean was 3-1/2 (p. 146). The sample used in this

company's acquisition. But if they do, and if it is

paper contains 209 acquired companies with an

bad management that precipitated the acquisi-

average post-acquisition time period of 11 years

tions, then the new management does not appear

and a maximum of 22. Moreover, Goldberg's sam-

to have done much better than the old at improv-

ple was heavily concentrated in advertising-inten-

ing company performance, as measured by com-

sive industries while ours spans all manufacturing.

paring its market share to otherwise similar but

In one important dimension, Goldberg's data

nonacquired companies.

base was richer than ours, however. He was able to

Dewey (1961) expressed the view that mergers

compute growth rates for the acquired firms in the

take place to rescue "falling firms" from bank-

years immediately preceding and following the

ruptcy. Firms acquired between 1950 and 1972 fell

mergers. Our data observations are limited to two

a long way relative to otherwise similar non-

points in time, 1950 and 1972. Goldberg's data

acquired firms. As in all merger studies, we can

allowed him to test for a change in growth rate

never truly test the counterfactual. Perhaps these

following the mergers. He found no significant

companies would have suffered similar or even

change. We were forced to attempt to infer whether

greater market share declines had they not been

observed changes in market shares between 1950

acquired. Assuming this interpretation were cor-

and 1972 preceded or followed the mergers by

rect, our results imply an important modification

reweighting the sample observations by their point

to the "falling firm" hypothesis. At best, mergers

in time.

cushion a company's fall, they do not alter its

In a previous study of 133 mergers between

trajectory. Our results also offer an alternative to

1962 and 1972, I found a significant decline in the

the falling firm hypothesis, namely, the hypothesis

growth rate of the acquiring companies in the five

that the acquired company's fall begins after its

years following the mergers compared with both a

acquisition and that it is the acquisition that causes

matched control group sample, and their industries

the fall in market share.

(1980, pp. 289-291). These results are consistent

As noted in the introduction, however, our re-

with those of the present investigation. Taken to-

gether, Goldberg's study and the two by myself

sults with respect to mergers' effects on market

shares cannot be interpreted as implying anything

strongly imply that mergers in the United States in

directly about mergers' effects on profitability or

the fifties and sixties did not increase the market

shareholder returns. Nevertheless, the relative loss

shares of acquired companies or their growth rates.

in market shares for acquired companies seems

The present study suggests a significant decline in

sufficiently large that it is difficult to believe that

rates of return on assets or sales did not also

market shares.

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

MERGERS AND MARKET SHARE 267

decline for these companies, relative to the control

group firms. Thus, our results seem in line with

those that find that mergers reduce the profitability of the merging companies (e.g., Meeks, 1977).

Regardless of how these mergers line up along

other lines of merger success, the acquired com-

panies investigated in this paper were unsuccessful

in one important dimension of market competition, their ability to gain and retain customers.

Moreover, their failures in this competition appear

to have come after they were acquired. These

findings, if sustained in future research, raise inter-

esting questions about the motives behind mergers,

and public policy toward them.

REFERENCES

Cowling, Keith, Paul Stoneman, John Cubbin, John Cable,

Graham Hall, Simon Domberger and Pat Dutton,

Mergers and Economic Performance (Cambridge: Cambridge University Press, 1979).

Dewey, Donald, "Mergers and Cartels: Some Reservations

about Policy," American Economic Review 51 (May

Control," Journal of Political Economy 73 (Apr. 1965),

110-120.

Markham, Jesse W., "Survey of the Evidence and Findings on

Mergers," in Business Concentration and Public Policy

(New York: NBER, 1955).

Meeks, Geoffrey, Disappointing Marriage: A Study of the Gains

from Merger (Cambridge: Cambridge University Press,

1977).

Melicher, Ronald W. and David F. Rush, "Evidence on the

Acquisition-Related Performance of Conglomerate

Firms," Journal of Finance 29 (Mar. 1974), 1941-1949.

Mueller, Dennis C., "The Effects of Conglomerate Mergers: A

Survey of the Empirical Evidence," Journal of Banking

Finance 1 (4) (Dec. 1977), 315-347.

(ed), The Determinants and Effects of Mergers: An

International Comparison (Cambridge: Oelgeschlager,

Gunn, & Hain, 1980).

______ "The Case against Conglomerate Mergers," in Roger

D. Blair and Robert F. Lanzillotti (eds.), The Conglomerate Corporation (Cambridge: Oelgeschlager,

Gunn, & Hain, 1981), 71-95.

, The Determinants of Persistent Profits (Washington,

D.C.: Federal Trade Commission, 1983).

Perry, Martin K., and Robert H. Porter, "Oligopoly and the

Incentive for Horizontal Merger," mimeo, Bell Laboratories, 1983.

Ravenscraft, David J., "Structure-Profit Relationships at the

Line of Business Level," this REVIEw 65 (Feb. 1983),

22-31.

1961), 255-262.

Federal Trade Commission, Values of Shipments Data by Product Class for the 1,000 Largest Manufacturing Companies

of 1950 (Washington, D.C., 1972).

______ Statistical Report on Mergers and Acquisitions 1978

(Washington, D.C., 1980).

Gleijser, Herbert, "A New Test for Heteroscedasticity," Journal of the American Statistical Association 64 (Mar.

Salant, Stephen W., Sheldon Switzer, and Robert J. Reynolds,

"Losses from Horizontal Merger: The Effects of an

Exogenous Change in Industry Structure on CoumotNash Equilibrium," Quarterly Journal of Economics 98

(May 1983), 185-199.

Scherer, Frederic M., Industrial Market Structure and Economic

Performance, second edition (Chicago: Rand McNally,

1980).

1969), 316-323.

Goldberg, Lawrence G., "The Effect of Conglomerate Mergers

on Competition," Journal of Law and Economics 16

(Apr. 1973), 137-158.

Halpem, Paul, "Corporate Acquisitions: A Theory of Special

Cases?" mimeo, University of Toronto, 1982.

Hogarty, Thomas F., "Profits from Merger: The Evidence of

Fifty Years," St. Johns Law Review 44 (Spec. Ed.)

(Spring 1970), 378-391.

Judge, George G., William E. Griffiths, R. Carter Hill, and

Tsoung-Chao Lee, The Theory and Practice of Econometrics (New York: Wiley, 1980).

Mandelker, Gershon, "Risk and Return: The Case of Merging

Firms," Journal of Financial Econometrics 1 (Dec. 1974),

303-335.

Manne, Henry G., "Mergers and the Market for Corporate

Smiley, Robert, "Tender Offers, Transactions Costs and the

Firm," this REVIEw 58 (Feb. 1976), 22-32.

Steiner, Peter O., Mergers: Motives Effects, Policies (Ann

Arbor: University of Michigan Press, 1975).

Weston, J. Fred, " The Nature and Significance of Conglomerate Firms," St. John's Law Review 44 (Spec. Ed.)

(Spring 1970), 66-80.

Weston, J. Fred, and Surendra K. Mansinghka, "Tests of the

Efficiency Performance in Conglomerate Firms," Journal of Finance 26 (Sept. 1971), 919-936.

Williamson, Oliver E., Corporate Control and Business Behav-

ior: An Inquiry into the Effects of Organization Form on

Enterprise Behavior (Englewood Cliffs, N.J.: PrenticeHall, 1970).

This content downloaded from 86.164.156.132 on Sun, 24 Jul 2016 17:59:14 UTC

All use subject to http://about.jstor.org/terms

You might also like

- Badrtalei J. Bates D. L PDFDocument16 pagesBadrtalei J. Bates D. L PDFIsye Shintya RahmawatiNo ratings yet

- Manuel de Pilotage Helicoptere Alat PDFDocument231 pagesManuel de Pilotage Helicoptere Alat PDFHichem PrinceNo ratings yet

- Case Digests For FinalsDocument40 pagesCase Digests For FinalsJayson YuzonNo ratings yet

- 1924725Document10 pages1924725Daniyal AghaNo ratings yet

- New Evidence and Perspectives On Mergers: Gregor Andrade, Mark Mitchell, and Erik StaffordDocument18 pagesNew Evidence and Perspectives On Mergers: Gregor Andrade, Mark Mitchell, and Erik StaffordarschlochwichserhureNo ratings yet

- Klepper SimonsDocument33 pagesKlepper SimonsartkoblitzNo ratings yet

- This Content Downloaded From 150.140.137.45 On Tue, 30 Nov 2021 10:36:03 UTCDocument17 pagesThis Content Downloaded From 150.140.137.45 On Tue, 30 Nov 2021 10:36:03 UTCh priovolosNo ratings yet

- 1985 - Rohades - HeggestadDocument23 pages1985 - Rohades - HeggestadJuan Manuel González SánchezNo ratings yet

- 9d6e PDFDocument48 pages9d6e PDFHarika KollatiNo ratings yet

- MIT Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Review of Economics and StatisticsDocument6 pagesMIT Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Review of Economics and StatisticsElok HendionoNo ratings yet

- Rumor Mill and Merger Waves: Analysis of Aggregate Market ActivityDocument22 pagesRumor Mill and Merger Waves: Analysis of Aggregate Market ActivityIgor SemenenkoNo ratings yet

- Market PowerDocument44 pagesMarket PowerAlexandre AutranNo ratings yet

- Entry Deterrence in The Ready-To-Eat Breakfast Cereal IndustryDocument24 pagesEntry Deterrence in The Ready-To-Eat Breakfast Cereal IndustryLuis TandazoNo ratings yet

- The Impact of Industry Shocks On Takeover and Restructuring ActivityDocument37 pagesThe Impact of Industry Shocks On Takeover and Restructuring ActivityDeepankar SharmaNo ratings yet

- The Dynamics of Mergers and Acquisitions in Oligopolistic IndustriesDocument41 pagesThe Dynamics of Mergers and Acquisitions in Oligopolistic IndustriesafledvinaNo ratings yet

- Profitability of Momentum Strategies An Evaluation of Alternative Explanations 2001Document23 pagesProfitability of Momentum Strategies An Evaluation of Alternative Explanations 2001profkaplanNo ratings yet

- McHahan & Porter (1997) How Much Does Industry MatterDocument16 pagesMcHahan & Porter (1997) How Much Does Industry MatterPKNo ratings yet

- Emerging MarketDocument13 pagesEmerging MarketAaron WenedyNo ratings yet

- Cause and Effect of Mergers & AcquisitionsDocument8 pagesCause and Effect of Mergers & AcquisitionsRamlah Idris100% (4)

- Pestel Analysis of British AirwaysDocument11 pagesPestel Analysis of British Airwaysaudioslave8778No ratings yet

- Merger MarketValueMDE2018AcceptedDocument39 pagesMerger MarketValueMDE2018AcceptedDaniyal AghaNo ratings yet

- The Impact of Entrepreneurship On Economic Growth: M.A. Carree, and A.R. ThurikDocument28 pagesThe Impact of Entrepreneurship On Economic Growth: M.A. Carree, and A.R. ThuriknapestershineNo ratings yet

- 2001.andrade Et Al. New Evidence and Prespectives On MergersDocument91 pages2001.andrade Et Al. New Evidence and Prespectives On MergersValentinNo ratings yet

- Andrade, Mitchell, Stafford - 2001 - New Evidence and Perspectives On MergersDocument18 pagesAndrade, Mitchell, Stafford - 2001 - New Evidence and Perspectives On MergersGokulNo ratings yet

- Do Bad Bidders Become Good Targets_1990Document28 pagesDo Bad Bidders Become Good Targets_1990farid.ilishkinNo ratings yet

- Exchange Rate Movements and The Profitability of U.S. MultinationalsDocument18 pagesExchange Rate Movements and The Profitability of U.S. MultinationalsEric TawandaNo ratings yet

- Li XiangDocument10 pagesLi XiangjamilkhannNo ratings yet

- How Much Does Industry Matter ReallyDocument16 pagesHow Much Does Industry Matter ReallyOno JoksimNo ratings yet

- Employment Responses To International Liberalization in ChileDocument24 pagesEmployment Responses To International Liberalization in ChileerydmardhatillahNo ratings yet

- Development of Prediction Models For Horizontal and Vertical MergersDocument13 pagesDevelopment of Prediction Models For Horizontal and Vertical MergersEnaNukovićNo ratings yet

- Organizatonal DynamicsDocument40 pagesOrganizatonal DynamicsCj MabintaNo ratings yet

- Competitive Strategy of Private EquityDocument48 pagesCompetitive Strategy of Private Equityapritul3539No ratings yet

- Department of Economics Working Paper SeriesDocument36 pagesDepartment of Economics Working Paper Seriesvan7911No ratings yet

- A Fresh Look PDFDocument8 pagesA Fresh Look PDFceojiNo ratings yet

- Jacoby - The Conglomerate CorporationDocument13 pagesJacoby - The Conglomerate CorporationPal SaruzNo ratings yet

- Growth Impact of Privatization at Micro and Macro Level in Developing CountriesDocument31 pagesGrowth Impact of Privatization at Micro and Macro Level in Developing Countrieskashif aliNo ratings yet

- Tests of The Efficiency Performance of Conglomerate FirmsDocument15 pagesTests of The Efficiency Performance of Conglomerate FirmsCẩm Anh ĐỗNo ratings yet

- Theory of Mergers and AcqusitionDocument31 pagesTheory of Mergers and AcqusitionPolite ManNo ratings yet

- Product Proliferation and Preemption Strategy SupplementsDocument22 pagesProduct Proliferation and Preemption Strategy SupplementstantanwyNo ratings yet

- The Role of Diversification Strategies in Global Companies: - Research ResultsDocument8 pagesThe Role of Diversification Strategies in Global Companies: - Research ResultscuribenNo ratings yet

- Corporate Mergers in A Developing Country: An Empirical Analysis of The Merger ProbabilityDocument30 pagesCorporate Mergers in A Developing Country: An Empirical Analysis of The Merger ProbabilitySavithri RvNo ratings yet

- External Analysis: ©scott Gallagher 2006Document5 pagesExternal Analysis: ©scott Gallagher 2006Paras VyasNo ratings yet

- The Impact of Entrepreneurship On Economic GrowthDocument29 pagesThe Impact of Entrepreneurship On Economic GrowthSurabhi SrivastavaNo ratings yet

- Wiley RAND CorporationDocument15 pagesWiley RAND CorporationAndreu Caio CastoNo ratings yet

- AL Malkawi 2007Document28 pagesAL Malkawi 2007Yolla Monica Angelia ThenuNo ratings yet

- A Comparison of Industry Classification Schemes For Capital Market ResearchDocument10 pagesA Comparison of Industry Classification Schemes For Capital Market ResearchseemaNo ratings yet

- Drivers Global Strategy Organization: Industry of andDocument28 pagesDrivers Global Strategy Organization: Industry of andjorgel_alvaNo ratings yet

- Uniuersity of Paris X-Nanterre, 92001 Nanterre, FranceDocument13 pagesUniuersity of Paris X-Nanterre, 92001 Nanterre, Franceluminita vlongaNo ratings yet

- Exposure, Legitimacy, and Social Disclosure: Dennis M. PattenDocument12 pagesExposure, Legitimacy, and Social Disclosure: Dennis M. PattenEka Meilawati RaharjoNo ratings yet

- Dominant Designs and The Survival of FirmsDocument4 pagesDominant Designs and The Survival of FirmsMaria GraciaNo ratings yet

- The Aggregate Implications of Mergers and AcquisitionsDocument52 pagesThe Aggregate Implications of Mergers and AcquisitionsLove IslamNo ratings yet

- Rent Seeking, Market Structure and GrowthDocument34 pagesRent Seeking, Market Structure and GrowthFavian Arsyi SuhardoyoNo ratings yet

- Financiarizacion Empresas UKDocument25 pagesFinanciarizacion Empresas UKArturo Martínez BareaNo ratings yet

- Wealth Effect Due To M&ADocument21 pagesWealth Effect Due To M&AMuhammad Ashraf100% (1)

- Dierkens 1991Document20 pagesDierkens 1991thaiNo ratings yet

- Gains From Trade When Firms Matter: Marc J. Melitz and Daniel Trefl ErDocument28 pagesGains From Trade When Firms Matter: Marc J. Melitz and Daniel Trefl Ermiller120No ratings yet

- Hugh D. ShermanDocument25 pagesHugh D. Shermanfisayobabs11No ratings yet

- 4 (Paper) - Golubov, Petmezas, Travlos - 2013 - Empirical Mergers and Acquisitions Research A Review of Methods, Evidence and Managerial ImplicationDocument47 pages4 (Paper) - Golubov, Petmezas, Travlos - 2013 - Empirical Mergers and Acquisitions Research A Review of Methods, Evidence and Managerial ImplicationGokulNo ratings yet

- DuhaDocument26 pagesDuhaKhánh LyNo ratings yet

- Concentration and Price-Cost Margins in Manufacturing IndustriesFrom EverandConcentration and Price-Cost Margins in Manufacturing IndustriesNo ratings yet

- The What, The Why, The How: Mergers and AcquisitionsFrom EverandThe What, The Why, The How: Mergers and AcquisitionsRating: 2 out of 5 stars2/5 (1)

- Mahatma Gandhi BiographyDocument5 pagesMahatma Gandhi BiographyGian LuceroNo ratings yet

- TravelDocument18 pagesTravelAnna Marie De JuanNo ratings yet

- Form 3 Accounting June 2023Document9 pagesForm 3 Accounting June 2023Bonolo RamofoloNo ratings yet

- Saica Handbook Auditing - CompressDocument8 pagesSaica Handbook Auditing - Compresscykfkkxgs7No ratings yet

- BOE MCQ'sDocument43 pagesBOE MCQ'sAnchal LuthraNo ratings yet

- N-23-05 Republic V EquitableDocument1 pageN-23-05 Republic V EquitableAndrew GallardoNo ratings yet

- Private International LawDocument16 pagesPrivate International LawMelvin PernezNo ratings yet

- Kaal ChakraDocument99 pagesKaal ChakraLordgrg GhotaneNo ratings yet

- Narrative 1Document6 pagesNarrative 1Babiejoy Beltran AceloNo ratings yet

- RWS Reviewer Finals 2SDocument3 pagesRWS Reviewer Finals 2SJillary BalmoriNo ratings yet

- IGCSE HISTORY Topic 5 - Who Was To Blame For The Cold WarDocument11 pagesIGCSE HISTORY Topic 5 - Who Was To Blame For The Cold WarAbby IuNo ratings yet

- Novelas Cortas, by Pedro Antonio de AlarconDocument229 pagesNovelas Cortas, by Pedro Antonio de Alarconme meNo ratings yet

- DT Ratcfull Sig 55 Sce MetaDocument3 pagesDT Ratcfull Sig 55 Sce MetaPrashant JumanalNo ratings yet

- Unit 5a - VocabularyDocument1 pageUnit 5a - VocabularyCarlos ManriqueNo ratings yet

- Singapore Airlines v. CA DigestDocument1 pageSingapore Airlines v. CA DigestMa Gabriellen Quijada-TabuñagNo ratings yet

- Essays On Contemporary Issues in AfricanDocument19 pagesEssays On Contemporary Issues in AfricanDickson Omukuba JuniorNo ratings yet

- Teacher'S Weekly Learning PlanDocument3 pagesTeacher'S Weekly Learning PlanMA. CHONA APOLENo ratings yet

- Baker HughesDocument92 pagesBaker HughesItalo Venegas100% (1)

- Ancestors: Optional Rules For Legend of The 5 Rings Third EditionDocument5 pagesAncestors: Optional Rules For Legend of The 5 Rings Third EditionGerrit DeikeNo ratings yet

- Tlm4all@NMMS 2019 Model Grand Test-1 (EM) by APMF SrikakulamDocument8 pagesTlm4all@NMMS 2019 Model Grand Test-1 (EM) by APMF SrikakulamThirupathaiahNo ratings yet

- Datuk Seri Anwar Bin Ibrahim V Utusan Melayu (M) BHD & AnorDocument82 pagesDatuk Seri Anwar Bin Ibrahim V Utusan Melayu (M) BHD & AnorAnonymous YessNo ratings yet

- TestDocument1 pageTestDinis VieiraNo ratings yet

- Individual Movie Review (The Lady (2011) )Document7 pagesIndividual Movie Review (The Lady (2011) )Firdaus AdamNo ratings yet

- Sociological Factors May Contribute To Rent-Seeking Behavior. An Index of Ethno-LinguisticDocument4 pagesSociological Factors May Contribute To Rent-Seeking Behavior. An Index of Ethno-LinguisticMuhammad SaadNo ratings yet

- Ammonite WorksheetDocument2 pagesAmmonite WorksheetDerrick Scott FullerNo ratings yet

- Teaching Note Archer Daniels Midland Company: Case OverviewDocument7 pagesTeaching Note Archer Daniels Midland Company: Case OverviewRoyAlexanderWujatsonNo ratings yet

- Vax Cert PHDocument1 pageVax Cert PHRulen CataloNo ratings yet

- Towards A Sustainable Transportation Environment. The Case of Pedicabs and Cycling in The Philippines Brian GOZUN Marie Danielle GUILLENDocument8 pagesTowards A Sustainable Transportation Environment. The Case of Pedicabs and Cycling in The Philippines Brian GOZUN Marie Danielle GUILLENChristian VenusNo ratings yet