Professional Documents

Culture Documents

Declaration For Vat Advance Payment On Refined Sugar

Declaration For Vat Advance Payment On Refined Sugar

Uploaded by

Janine MesinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration For Vat Advance Payment On Refined Sugar

Declaration For Vat Advance Payment On Refined Sugar

Uploaded by

Janine MesinaCopyright:

Available Formats

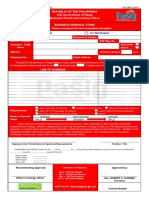

ANNEX "B-1"

BIR Form No.

REPUBLIKA NG PILIPINAS

KAGAWARAN NG PANANALAPI

KAWANIHAN NG RENTAS INTERNAS

2558

April 2008

DECLARATION FOR VAT ADVANCE PAYMENT ON REFINED SUGAR

(Please Accomplish in Quadruplicate)

To the Regional Director/Revenue District Officer

Revenue Region No. 12/Revenue District Office No. ______

Bacolod City

Please issue Payment Order for Advance Payment of Value-Added Tax in the Amount of ____________________

(P__________________) for Sale/Withdrawal of Refined

Sugar Release Order No. _______________.

Printed Name of Sugar Seller/Owner:

TIN: _________________________

Address:

(A)

QUANTITY

No. of Bags

(in 50 kgs.)

( )

1 Refined Sugar

Standard

Premium

( )

2 White Sugar

( )

3 Washed Sugar

Total

(B)

BASE PRICE

Owned by

Owned by

Sugar Refinery

Others

(C)

Amount of Advance

VAT Payment

I declare under the penalties of perjury that the above statement of value-added tax to be paid has been

made in good faith, verified by me and to the best of my knowledge and belief is true and correct pursuant to the

provisions of the National Internal Revenue Code of 1997, as amended, and the Regulations issued under authority

thereof.

DATE:___________________

SIGNATURE:___________________

Printed Name of Officer:___________________________

POSITION:___________________

Name of Sugar Refinery/Mill:______________________

Address of Sugar Refinery/Mill:____________________________________________________________________

Original

: Sugar Refinery/Mill

Duplicate

: Owner/Seller

Triplicate

: Office of the Regional Director

Quadruplicate

: Home RDO of the Seller/Owner

Quintuplicate

: Home RDO of the Sugar Refinery/Mill where it is registered

You might also like

- BIR - Request LetterDocument27 pagesBIR - Request LetterMa. Cristy BroncateNo ratings yet

- Freight Invoice Maersk LineDocument1 pageFreight Invoice Maersk LineAllen JohnsonNo ratings yet

- Sample Supplemental BudgetDocument12 pagesSample Supplemental BudgetTreasurer DJLANo ratings yet

- 70534sample Receipts and Invoices - Annex CDocument11 pages70534sample Receipts and Invoices - Annex CRamon Christopher Ganan0% (1)

- Punzalan v. Dela PenaDocument2 pagesPunzalan v. Dela PenaJanine Mesina100% (1)

- RR13 2008 - Annexes A B, e JDocument26 pagesRR13 2008 - Annexes A B, e JRamon Augusto Melad LacambraNo ratings yet

- Annex "E": (For Buyer of Quedan On Locally Produced Refined Sugar Owned by Tax-Exempt Person)Document1 pageAnnex "E": (For Buyer of Quedan On Locally Produced Refined Sugar Owned by Tax-Exempt Person)Mark Lord Morales BumagatNo ratings yet

- Order of PaymentDocument1 pageOrder of Paymentsena cfoNo ratings yet

- Annex CDocument1 pageAnnex CMerlie BerjaNo ratings yet

- Official Receipt TemplateDocument1 pageOfficial Receipt Templateersalonga8No ratings yet

- Memo Circular On The Guidelines of COVID Related TransactionsDocument1 pageMemo Circular On The Guidelines of COVID Related TransactionsSJ LiminNo ratings yet

- Amount of Advance VAT Paid and Duly Remitted Monthly Report On The Quantity of Refined Sugar Lilled/Produced and TheDocument1 pageAmount of Advance VAT Paid and Duly Remitted Monthly Report On The Quantity of Refined Sugar Lilled/Produced and TheJanine MesinaNo ratings yet

- Debit Note FormatDocument6 pagesDebit Note FormatBhavesh Dinesh GohilNo ratings yet

- Palmobile Web - e 000 800001000559955 - 07oct2023Document1 pagePalmobile Web - e 000 800001000559955 - 07oct2023jamihjeromeNo ratings yet

- Fuel Bioethanol Account (Credit) : Official Register BookDocument1 pageFuel Bioethanol Account (Credit) : Official Register BookJanine MesinaNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 22-2008 Issued On June 10, 2008 PrescribesDocument1 pageREVENUE MEMORANDUM ORDER NO. 22-2008 Issued On June 10, 2008 PrescribesGedan TanNo ratings yet

- BLGF Change Request 1 - Correction of Reports For Ave LRGDocument1 pageBLGF Change Request 1 - Correction of Reports For Ave LRGRosalie T. Orbon-TamondongNo ratings yet

- KastamDocument8 pagesKastamruthechavariaNo ratings yet

- PC22036Document899 pagesPC22036Muhawat AliNo ratings yet

- New Microsoft Office Word DocumentDocument15 pagesNew Microsoft Office Word Documentabdulkhaderjeelani14No ratings yet

- Annex A-RR22-2020NOD V03Document2 pagesAnnex A-RR22-2020NOD V03Fo LetNo ratings yet

- Ca Copy Center & Printing Press & Gen. Merchandise: in Settlement of The FollowingDocument1 pageCa Copy Center & Printing Press & Gen. Merchandise: in Settlement of The FollowingJunpyo ArkinNo ratings yet

- (25 Marks) : Table 1Document7 pages(25 Marks) : Table 1Atashi ChakrabortyNo ratings yet

- Tax Remittance Advice: Bureau of Internal RevenueDocument1 pageTax Remittance Advice: Bureau of Internal RevenueJi Aub TakNo ratings yet

- Sample Only: Barangay Budget Accountability Form No. 1 Quarterly Report of Actual IncomeDocument2 pagesSample Only: Barangay Budget Accountability Form No. 1 Quarterly Report of Actual IncomeBonifacio Gepiga100% (1)

- Submission of Sworn Declaration of Inventory by All Gasoline StationsDocument1 pageSubmission of Sworn Declaration of Inventory by All Gasoline Stationsarnelo sarmientoNo ratings yet

- BLGF Memorandum Re Change Request Forms (CRFS) For The FY 2022 SGLG AssessmentDocument6 pagesBLGF Memorandum Re Change Request Forms (CRFS) For The FY 2022 SGLG AssessmentMTO San Antonio, Zambales100% (1)

- Business Permit License Office Renewal FormDocument1 pageBusiness Permit License Office Renewal FormAdrian Joseph GarciaNo ratings yet

- E Receipt For State Bank Collect PaymentDocument1 pageE Receipt For State Bank Collect PaymentabhishekNo ratings yet

- Bassett - Mulhall Homestead Fraud ComplaintDocument116 pagesBassett - Mulhall Homestead Fraud Complaintreef_galNo ratings yet

- BRF Revised - xlsx201919 19315Document1 pageBRF Revised - xlsx201919 19315Jane CMNo ratings yet

- DTRE ApplicationDocument1 pageDTRE ApplicationHabibullah MemonNo ratings yet

- Book ReceiptDocument1 pageBook ReceiptAl RxNo ratings yet

- Request Letter For Tax ClearanceDocument1 pageRequest Letter For Tax ClearanceFrintz De la TorreNo ratings yet

- Rmo No. 4-2015Document1 pageRmo No. 4-2015ChaNo ratings yet

- La Union 9 SamplesDocument9 pagesLa Union 9 SamplesHanten gokuNo ratings yet

- Statement of Account: Bandartila BranchDocument1 pageStatement of Account: Bandartila BranchMarrieXuanaNo ratings yet

- Notice 138Document13 pagesNotice 138Farhan AliNo ratings yet

- Product Replenishment Debit Memo: BIR Form No.Document2 pagesProduct Replenishment Debit Memo: BIR Form No.Jon JamoraNo ratings yet

- WTEI or Inventory ListingDocument1 pageWTEI or Inventory ListingAnabelleNo ratings yet

- Office of The Municipal AccountantDocument2 pagesOffice of The Municipal AccountantInternal Audit UnitNo ratings yet

- Credit Note - Fleet: Tayag Ayla Mariz Alcebar, Zarcon Gasoline Service StatioDocument1 pageCredit Note - Fleet: Tayag Ayla Mariz Alcebar, Zarcon Gasoline Service Statiomariz alcebarNo ratings yet

- Vat Relief Bir Transmittal Form Annex A 1Document1 pageVat Relief Bir Transmittal Form Annex A 1Ma Pamela Corales CastilloNo ratings yet

- PMS 028 - Waste Management - Garbage&SlopsDocument1 pagePMS 028 - Waste Management - Garbage&SlopsMr TibsNo ratings yet

- Greater Hyderabad Municipal CorporationDocument4 pagesGreater Hyderabad Municipal CorporationDasharath TallapallyNo ratings yet

- Nur Hazwani BT Che Arif: QTY Price NO Description TAX Code Price/Unit (RM) (RM)Document1 pageNur Hazwani BT Che Arif: QTY Price NO Description TAX Code Price/Unit (RM) (RM)aqem222No ratings yet

- RTGS Payment DTD .07.01.2020Document1 pageRTGS Payment DTD .07.01.2020Chakradhar GaikwadNo ratings yet

- Second Division January 25, 2017 G.R. No. 205045 Commissioner of Internal Revenue, Petitioner San Miguel Corporation, RespondentDocument32 pagesSecond Division January 25, 2017 G.R. No. 205045 Commissioner of Internal Revenue, Petitioner San Miguel Corporation, RespondentLouella TuraNo ratings yet

- Source Code: Govt. ServantDocument6 pagesSource Code: Govt. ServantmujebaliNo ratings yet

- Session 4. PAGSASANAY SA PAGGAWA NG MGA TALA NG PANANALAPIDocument37 pagesSession 4. PAGSASANAY SA PAGGAWA NG MGA TALA NG PANANALAPIEJ David BeltranNo ratings yet

- Format For ENADocument11 pagesFormat For ENAMartin BishwasNo ratings yet

- Invoice: IMPORTANT: Please Note Our New Bank DetailsDocument2 pagesInvoice: IMPORTANT: Please Note Our New Bank DetailsMDEISY MAYA CHALANo ratings yet

- Model ReferatDocument1 pageModel ReferatMaria RoxanaNo ratings yet

- Report On Availment of Abatement Under Revenue Regulations No. 9-2010Document2 pagesReport On Availment of Abatement Under Revenue Regulations No. 9-2010EupraxiaNo ratings yet

- Liquor License RenewalDocument4 pagesLiquor License RenewalVinayak Vamanrao Kulkarni 19DMLAW043No ratings yet

- Office of The Additional Commissioner Inland Enforcement & Collection Zone-I, 357-Khanewal Road, MultanDocument1 pageOffice of The Additional Commissioner Inland Enforcement & Collection Zone-I, 357-Khanewal Road, Multanwrite2hannanNo ratings yet

- Turnover Declaration Form - TemplateDocument1 pageTurnover Declaration Form - TemplatepradyumnagaliNo ratings yet

- Vat 213Document2 pagesVat 213Sridhar EluvakaNo ratings yet

- MSLA1a: Master Securities Lending Agreement Registration FormDocument1 pageMSLA1a: Master Securities Lending Agreement Registration FormJanine MesinaNo ratings yet

- Amount of Advance VAT Paid and Duly Remitted Monthly Report On The Quantity of Refined Sugar Lilled/Produced and TheDocument1 pageAmount of Advance VAT Paid and Duly Remitted Monthly Report On The Quantity of Refined Sugar Lilled/Produced and TheJanine MesinaNo ratings yet

- Bioethanol-Blended Gasoline (E-Gasoline) : Official Register BookDocument1 pageBioethanol-Blended Gasoline (E-Gasoline) : Official Register BookJanine MesinaNo ratings yet

- Rayo vs. CFI of Bulacan, 110 SCRA 460Document1 pageRayo vs. CFI of Bulacan, 110 SCRA 460Neil bryan MoninioNo ratings yet

- Fuel Bioethanol Account (Credit) : Official Register BookDocument1 pageFuel Bioethanol Account (Credit) : Official Register BookJanine MesinaNo ratings yet

- Civ Reviewer (Part 1)Document175 pagesCiv Reviewer (Part 1)Janine Mesina100% (1)

- List of Cases For Constitutional Law Under Atty. Jimenez SY 2013-2014Document15 pagesList of Cases For Constitutional Law Under Atty. Jimenez SY 2013-2014Erika C. DizonNo ratings yet