Professional Documents

Culture Documents

Cfupm8774e 2016-17

Cfupm8774e 2016-17

Uploaded by

Sukanta ParidaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cfupm8774e 2016-17

Cfupm8774e 2016-17

Uploaded by

Sukanta ParidaCopyright:

Available Formats

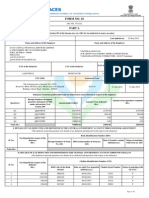

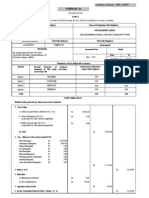

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. FDUELYJ

Last updated on

Name and address of the Employer

18-May-2016

Name and address of the Employee

POWER GRID CORPORATION OF INDIA LTD

CF 17, POWERGRID CORPORATION, ACTION AREA 1C,

NEW TOWN RAJARHAT, KOLKATA - 700156

West Bengal

+(91)33-23242857

ER2SALARY@POWERGRID.CO.IN

ABHISHEK MANOHAR

196 RAIGARO KA MOHALLA, BADHAL, PHULERA, JAIPUR 303602 Rajasthan

PAN of the Deductor

TAN of the Deductor

AAACP0252G

CALP06393C

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

CFUPM8774E

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

7th Floor, Middleton Row Kolkata - 700071

2016-17

Period with the Employer

From

To

01-Apr-2015

31-Mar-2016

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q1

QRHDWBJF

217213.05

18327.00

18327.00

Q2

QRKQEESB

223943.16

20097.00

20097.00

Q3

QROJNGGE

228075.93

21899.00

21899.00

Q4

QRUSOCDG

250369.42

9308.00

9308.00

919601.56

69631.00

69631.00

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

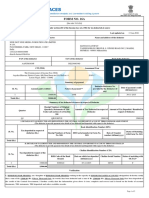

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

6173.00

0004329

06-05-2015

56267

6077.00

0013283

05-06-2015

00830

6077.00

0004329

04-07-2015

13591

6546.00

0004329

06-08-2015

07940

Page 1 of 2

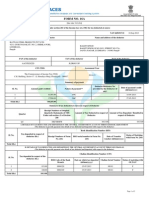

Certificate Number: FDUELYJ

Sl. No.

TAN of Employer: CALP06393C

Tax Deposited in respect of the

deductee

(Rs.)

PAN of Employee: CFUPM8774E

Assessment Year: 2016-17

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

6768.00

0004329

06-09-2015

05590

6783.00

0004329

06-10-2015

51881

7300.00

0013283

04-11-2015

00996

7299.00

0013283

04-12-2015

04408

7300.00

0004329

05-01-2016

17914

10

9308.00

0004329

05-02-2016

33521

11

0.00

05-03-2016

12

0.00

05-04-2016

Total (Rs.)

69631.00

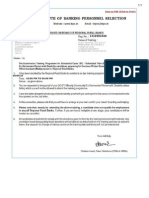

Verification

I, BHIMSEN ROUT, son / daughter of PARI ROUT working in the capacity of CHIEF MANAGER (designation) do hereby certify that a sum of Rs. 69631.00 [Rs. Sixty

Nine Thousand Six Hundred and Thirty One Only (in words)] has been deducted and a sum of Rs. 69631.00 [Rs. Sixty Nine Thousand Six Hundred and Thirty One

Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the

books of account, documents, TDS statements, TDS deposited and other available records.

Place

KOLKATA

Date

27-May-2016

Designation: CHIEF MANAGER

(Signature of person responsible for deduction of Tax)

Full Name:BHIMSEN ROUT

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Digitally signed by

BHIMASEN ROUT

Date: 2016.05.27 09:47:14

IST

Page 2 of 2

You might also like

- GLCA DA MS Excel HBFC Project Modified-1Document3 pagesGLCA DA MS Excel HBFC Project Modified-1Subhan Ahmad KhanNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- Form 16Document2 pagesForm 16SIVA100% (1)

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Draft STATCOM Maintenance Schedule (FINAL)Document36 pagesDraft STATCOM Maintenance Schedule (FINAL)Sukanta Parida100% (2)

- Report On Summer Training at Hero Cycles LTDDocument28 pagesReport On Summer Training at Hero Cycles LTDmohitshukla80% (5)

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- Sungf9tIqDhAO64RjsPj Form16 PartADocument2 pagesSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHINo ratings yet

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110No ratings yet

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978No ratings yet

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- LetterDocument2 pagesLetterShiv Kiran SademNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryNo ratings yet

- AbpDocument2 pagesAbpJinendraabhiNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Form 16: Jakson Engineers LimitedDocument5 pagesForm 16: Jakson Engineers LimitedAnit SinghNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

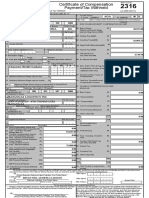

- Bir 2013Document1 pageBir 2013karlycoreNo ratings yet

- 2316 JAKEDocument1 page2316 JAKEJM HernandezNo ratings yet

- Income Tax Payment Challan: PSID #: 20391652Document1 pageIncome Tax Payment Challan: PSID #: 20391652Tanvir AhmedNo ratings yet

- Gadiano 2316Document2 pagesGadiano 2316Jypy Torrejos100% (1)

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- TdsDocument4 pagesTdsSahil SheikhNo ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- 103497Document5 pages103497Ashok PuttaparthyNo ratings yet

- Form16 - 02 - Fy 2014-15 - 1964Document5 pagesForm16 - 02 - Fy 2014-15 - 1964nrp_rahulNo ratings yet

- Form 16 Due Date_ Timeline For F.Y. 2023-24_Document2 pagesForm 16 Due Date_ Timeline For F.Y. 2023-24_Madhan SNo ratings yet

- 2316 (1) 2Document2 pages2316 (1) 2jonbelzaNo ratings yet

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishNo ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNo ratings yet

- Summary of Tax Deducted at Source: TotalDocument2 pagesSummary of Tax Deducted at Source: Totaladithya604No ratings yet

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- Amplidyne: VIVEK KUMAR (20109018) VINEET KUMAR SINGH (20108079)Document6 pagesAmplidyne: VIVEK KUMAR (20109018) VINEET KUMAR SINGH (20108079)Sukanta ParidaNo ratings yet

- Travelling Allowance Rule 2Document50 pagesTravelling Allowance Rule 2Sukanta ParidaNo ratings yet

- ANSI Device Numbers - Wikipedia, The Free EncyclopediaDocument3 pagesANSI Device Numbers - Wikipedia, The Free EncyclopediaSukanta ParidaNo ratings yet

- Repulsion MotorDocument9 pagesRepulsion MotorSukanta Parida50% (2)

- Power Transformers (ISD: 2026 (Part - 1) - 1977)Document3 pagesPower Transformers (ISD: 2026 (Part - 1) - 1977)Sukanta ParidaNo ratings yet

- Alexander - Second Edition SadikuDocument26 pagesAlexander - Second Edition SadikuAlbert TjoandaNo ratings yet

- Signals, Continuous Time and Discrete TimeDocument27 pagesSignals, Continuous Time and Discrete TimeSukanta ParidaNo ratings yet

- KV Shaala Darpan Will Write A New Definition of E-Governance, Good Governance and Digital India, Says Union Human Resource Development MinisterDocument1 pageKV Shaala Darpan Will Write A New Definition of E-Governance, Good Governance and Digital India, Says Union Human Resource Development MinisterSukanta ParidaNo ratings yet

- Anti-Defection Law - ErewiseDocument3 pagesAnti-Defection Law - ErewiseSukanta ParidaNo ratings yet

- Indian Citizen Act, 1955 Amended - ErewiseDocument3 pagesIndian Citizen Act, 1955 Amended - ErewiseSukanta ParidaNo ratings yet

- Inter Regional Transfer CapacityDocument1 pageInter Regional Transfer CapacitySukanta ParidaNo ratings yet

- Callletter RRBDocument1 pageCallletter RRBSukanta ParidaNo ratings yet

- List of Empanelled HCOs-Mumbai As On 15 Sep 2020Document3 pagesList of Empanelled HCOs-Mumbai As On 15 Sep 2020zemse11715No ratings yet

- T3TSCO - Securities Back Office - R13 1Document457 pagesT3TSCO - Securities Back Office - R13 1Gnana Sambandam100% (2)

- 32 Etcherla Auction NoteDocument15 pages32 Etcherla Auction Notepandu123456No ratings yet

- Section 47 General Banking Law of 2000Document1 pageSection 47 General Banking Law of 2000AngelaNo ratings yet

- Bob Rtgs Format NewDocument1 pageBob Rtgs Format NewNeerajNo ratings yet

- Customer Satisfaction of ATM Services inDocument11 pagesCustomer Satisfaction of ATM Services inEswari GkNo ratings yet

- Sample Group FIT Rate Agreement T CsDocument1 pageSample Group FIT Rate Agreement T CsBharatRajNo ratings yet

- Chapter 10a - Long Term Finance - BondsDocument6 pagesChapter 10a - Long Term Finance - BondsTAN YUN YUNNo ratings yet

- Equity Research Report Sbi CardsDocument4 pagesEquity Research Report Sbi CardsYash devgariaNo ratings yet

- Reviewer Civil Procedure Ateneo 2007Document35 pagesReviewer Civil Procedure Ateneo 2007Sheena ValenzuelaNo ratings yet

- Crisis Economics Nouriel RoubiniDocument1 pageCrisis Economics Nouriel Roubiniaquinas03No ratings yet

- People of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Document3 pagesPeople of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Lexa L. DotyalNo ratings yet

- House Hearing, 112TH Congress - Examining The Settlement Practices of U.S. Financial RegulatorsDocument134 pagesHouse Hearing, 112TH Congress - Examining The Settlement Practices of U.S. Financial RegulatorsScribd Government DocsNo ratings yet

- TOA Midterm Exam 2010Document22 pagesTOA Midterm Exam 2010Patrick WaltersNo ratings yet

- FAC1502 - Study Unit 5 - 2023Document43 pagesFAC1502 - Study Unit 5 - 2023Olwethu PhikeNo ratings yet

- 200160807Document9 pages200160807Muhd DeenNo ratings yet

- Marketing-of-Financial-Services SAKSHIDocument9 pagesMarketing-of-Financial-Services SAKSHINageshwar SinghNo ratings yet

- Aayushi EcoDocument3 pagesAayushi EcoezekielNo ratings yet

- Inversion of US Yield CurveDocument5 pagesInversion of US Yield CurveKhushboo SharmaNo ratings yet

- Dispute Transaction FormDocument1 pageDispute Transaction FormAli Naeem SheikhNo ratings yet

- SB-1605 April-1Document11 pagesSB-1605 April-1Pankaj PandeyNo ratings yet

- ICICIDocument2 pagesICICIs1v2000No ratings yet

- Question - 1. Write A Letter To Your Friend Describing Your Experience in Banking ServiceDocument15 pagesQuestion - 1. Write A Letter To Your Friend Describing Your Experience in Banking Servicerajin_rammsteinNo ratings yet

- Chapter 6 Power Point - ASSIGNDocument10 pagesChapter 6 Power Point - ASSIGNmuluNo ratings yet

- Case Digest - IntroductionDocument10 pagesCase Digest - IntroductionAnonymous b4ycWuoIcNo ratings yet

- Annual Report Le MeridienDocument60 pagesAnnual Report Le MeridienKavitha Reddy100% (1)

- Fintech 2024 v6Document41 pagesFintech 2024 v6mansiNo ratings yet

- Curriculum Vitae JumaDocument6 pagesCurriculum Vitae JumaEvance JumaNo ratings yet