Professional Documents

Culture Documents

General 4-Stage Model: Model 10-05A (Revenue Growth Model)

General 4-Stage Model: Model 10-05A (Revenue Growth Model)

Uploaded by

JNCopyright:

Available Formats

You might also like

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- Final Exam Corporate Finance CFVG 2016-2017Document8 pagesFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuNo ratings yet

- NPV CalculationDocument19 pagesNPV CalculationmschotoNo ratings yet

- M Fin 202 CH 13 SolutionsDocument9 pagesM Fin 202 CH 13 SolutionsNguyenThiTuOanhNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Bank-Wise List of Wilful Defaulters-1Document372 pagesBank-Wise List of Wilful Defaulters-1usf69No ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- EXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Document16 pagesEXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Ana MarkovićNo ratings yet

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDocument25 pagesChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanNo ratings yet

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDocument4 pagesDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaNo ratings yet

- SneakerDocument8 pagesSneakerFelicity YuanNo ratings yet

- Home Work Excel SolutionDocument16 pagesHome Work Excel SolutionSunil KumarNo ratings yet

- Chapter 3 Prob SolutionsDocument33 pagesChapter 3 Prob SolutionsMehak Ayoub100% (1)

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Exercise FCFF ValDocument4 pagesExercise FCFF ValElena Denisa CioinacNo ratings yet

- MTP Soln 1Document14 pagesMTP Soln 1Anonymous 8wg4eowIdzNo ratings yet

- EconomicsDocument5 pagesEconomicsbrian mochez01No ratings yet

- Tutorial 4 SolutionsDocument6 pagesTutorial 4 SolutionsNokubongaNo ratings yet

- EE - Assignment Chapter 5 SolutionDocument10 pagesEE - Assignment Chapter 5 SolutionXuân ThànhNo ratings yet

- Solution For Numerical Review QuestionDocument85 pagesSolution For Numerical Review QuestionAparajith GuhaNo ratings yet

- 6886 Valuation 2Document25 pages6886 Valuation 2api-3699305100% (1)

- Chap 4 - Other DCF ModelsDocument35 pagesChap 4 - Other DCF Modelsrafat.jalladNo ratings yet

- Capital BudgetingDocument62 pagesCapital BudgetingAshwin AroraNo ratings yet

- Capital Budgeting TemplateDocument33 pagesCapital Budgeting TemplateMark MarsulexNo ratings yet

- Si7 - Tarquin (1) 9 22Document14 pagesSi7 - Tarquin (1) 9 22Luis Eduardo Perez GonzalezNo ratings yet

- Avance 1 - Financial ManagementDocument8 pagesAvance 1 - Financial ManagementValery M. AnguloNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- Sampa VideoDocument24 pagesSampa VideoPranav AggarwalNo ratings yet

- FM09-CH 16Document12 pagesFM09-CH 16Mukul KadyanNo ratings yet

- Finalrevision Handout SolutionDocument7 pagesFinalrevision Handout SolutionBao Ngoc LeNo ratings yet

- ch14 SolDocument16 pagesch14 SolAnsleyNo ratings yet

- ECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDocument7 pagesECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDaniyal AsifNo ratings yet

- Chapter Four Evaluation (Appraisal) of Transport Projects: 2014E.C. Oda Bultum UniversityDocument28 pagesChapter Four Evaluation (Appraisal) of Transport Projects: 2014E.C. Oda Bultum UniversityGirmaye Kebede100% (1)

- Feruz BelarusDocument2 pagesFeruz BelarusabdulazizbakhshilloevNo ratings yet

- Capital Budgeting TemplateDocument36 pagesCapital Budgeting TemplateJayaram ParlikadNo ratings yet

- Solow-Swan Growth Model:: Calibration Tutorial Using MS-ExcelDocument16 pagesSolow-Swan Growth Model:: Calibration Tutorial Using MS-ExcelSharjeel Ahmed Khan100% (1)

- Chapter 13 Equity ValuationDocument33 pagesChapter 13 Equity Valuationsharktale2828No ratings yet

- GDV: TDC:: Per PeriodDocument9 pagesGDV: TDC:: Per PeriodM. HfizzNo ratings yet

- DcfDocument7 pagesDcfManish MohapatraNo ratings yet

- Running Head: VALUE PER SHARE: Bond and Equity Value Name InstitutionDocument3 pagesRunning Head: VALUE PER SHARE: Bond and Equity Value Name InstitutionCarlos AlphonceNo ratings yet

- Solution de Cas Lady M ConfectionsDocument10 pagesSolution de Cas Lady M ConfectionsScribdTranslationsNo ratings yet

- Workshop 7 Suggested SolutionsDocument42 pagesWorkshop 7 Suggested SolutionsDweep KapadiaNo ratings yet

- Sampa VideoDocument24 pagesSampa Videopawangadiya1210No ratings yet

- Closure in Valuation: Estimating Terminal Value: Problem 1Document3 pagesClosure in Valuation: Estimating Terminal Value: Problem 1Silviu TrebuianNo ratings yet

- IPF Assignment 4Document12 pagesIPF Assignment 4Nitesh MehlaNo ratings yet

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- FM Practice Sheet Booklet SOLUTIONS - Nov 2022Document135 pagesFM Practice Sheet Booklet SOLUTIONS - Nov 2022Dhruvi VachhaniNo ratings yet

- Chapter 13: Real Options, Investment Strategy and Process: d SE r t t 2 = + + ln / / σ σDocument2 pagesChapter 13: Real Options, Investment Strategy and Process: d SE r t t 2 = + + ln / / σ σAbhishek ChopraNo ratings yet

- Project AppraisalDocument34 pagesProject AppraisalWilly Mwangi KiarieNo ratings yet

- Ie463 CHP5 (2010-2011)Document6 pagesIe463 CHP5 (2010-2011)Gözde ŞençimenNo ratings yet

- 9706 s10 Ms 43Document6 pages9706 s10 Ms 43cherylllimclNo ratings yet

- Lahore School of Economics Financial Management II The Cost of CapitalDocument3 pagesLahore School of Economics Financial Management II The Cost of CapitalDaniyal AliNo ratings yet

- Fundamental AnalysisDocument18 pagesFundamental AnalysissahiwalgurnoorNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelsanket patilNo ratings yet

- HP FilterDocument10 pagesHP FilterKevin AndrewNo ratings yet

- 9706 s15 Ms 211Document8 pages9706 s15 Ms 211nistha4444_89385228No ratings yet

- PPAC AssignDocument19 pagesPPAC AssignDerickMwansaNo ratings yet

- Solution Assigment Chapter 5Document11 pagesSolution Assigment Chapter 5Hoang Thao NhiNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Customer Service Software Landscape May 2017Document320 pagesCustomer Service Software Landscape May 2017JNNo ratings yet

- Model 16-01A LBO Model - Loan Amortization, 5 Year PeriodDocument5 pagesModel 16-01A LBO Model - Loan Amortization, 5 Year PeriodJNNo ratings yet

- M20 01 Black ScholesDocument1 pageM20 01 Black ScholesJNNo ratings yet

- Model 10-04 Merger Valuation Application: Panel A - Value DriversDocument1 pageModel 10-04 Merger Valuation Application: Panel A - Value DriversJNNo ratings yet

- Comparable Companies ValuationDocument1 pageComparable Companies ValuationJNNo ratings yet

- Model 01-01 Basic Arbitrage Model Month 0 Month 1 Bidder (B) Target (T) Arbitrage FirmDocument1 pageModel 01-01 Basic Arbitrage Model Month 0 Month 1 Bidder (B) Target (T) Arbitrage FirmJNNo ratings yet

- Model 03-02A Effects On Leverage of A Cash PurchaseDocument3 pagesModel 03-02A Effects On Leverage of A Cash PurchaseJNNo ratings yet

- CMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalDocument12 pagesCMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalJNNo ratings yet

- Info Edge (INFEDG) : Healthy Recovery in NaukriDocument8 pagesInfo Edge (INFEDG) : Healthy Recovery in NaukriJNNo ratings yet

General 4-Stage Model: Model 10-05A (Revenue Growth Model)

General 4-Stage Model: Model 10-05A (Revenue Growth Model)

Uploaded by

JNOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General 4-Stage Model: Model 10-05A (Revenue Growth Model)

General 4-Stage Model: Model 10-05A (Revenue Growth Model)

Uploaded by

JNCopyright:

Available Formats

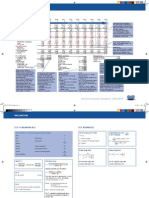

Model 10-05A

General 4-Stage Model

(Revenue Growth Model)

Revenue Period 0 (R0)

$1,000

Number of Periods (n)

Growth Rate of Revenues (g)

Operating Margin (m)

Tax Rate (T)

Cost of Capital (k)

Investment Requirements Rate (I)

h = (1+g)/(1+k)

Stage 1: Period 1- 5

Stage 2: Period 6- 15

Stage1

Stage2

Stage3

Stage4

5

55.6%

-5.0%

10

33.0%

30.0%

5

5.0%

15.0%

3.0%

10.0%

0.0%

15.0%

6.0%

1.353

20.0%

15.0%

6.0%

1.157

40.0%

15.0%

6.0%

0.913

40.0%

15.0%

2.0%

0.896

n1

1

V 0 =R0 m1 ( 1T 1 )I 1 h t

t=1 1

V 20 =R0h n1 m2 (1T 2 )I 2

1

n2

] h2

(1,490)

19,788

2,235

4,229

t=1

Stage 3: Period 16- 20

Stage 4: Period 21 ==> Inf

V 30 =R0h n1h n2

2

1

[ m3 ( 1T 3 )I 3 ] h3

t=1

V 40 =R 0h n 1h 2 h 3 [ m 4 (1T 4 )I 4 ]

n

(1+ g4 )

(k 4 g4 )

Total PV = $

Total PV / REV1

Total PV / NOIstage 2, period 1

1 / (k4 - g4)

24,762

15.91

6.80

8.33

Notes:

V0i = PV of Stage i free cash flows at time 0. For example, V 01 = PV of Stage 1 free cash flows at time 0

Terminal Value = Vn4 = (NOIN4+1(1-T4) - RN4+1I4) / (k4 - g4)

NOIN4+1 = NOI for Period 1 in Stage 4

REV1 = R1 = revenues for Period 1 in Stage 1

NOI1 = net operating income for Period 1 in Stage 1

Model 10-05B

General 4-Stage Model

(Based on rb=g)

Net Operating Income Period 0 (X0)

Number of Periods (n)

Growth Rate of Net Operating Inc. (g)

Tax Rate (T)

Cost of Capital (k)

Investment Opportunities Rate (b)

Marginal Profitability Rate (r)

h = (1+g)/(1+k)

Stage 1: Period 1- 5

Stage 2: Period 6- 10

Stage 3: Period 11- 20

Stage 4: Period 21 ==> Inf

$2,535

Stage1

Stage2

Stage3

Stage4

5

16.0%

5

22.0%

10

14.0%

3.0%

35.0%

11.9%

130.0%

12.3%

1.037

35.0%

11.9%

90.0%

24.4%

1.090

35.0%

11.9%

80.0%

17.5%

1.019

35.0%

11.9%

20.0%

15.0%

0.920

n1

1

V 0 =X 0( 1T 1 )( 1b1 ) h t

t =1 1

n2

h2

V 20 =X 0h n ( 1T 2 )( 1b2 )

1 1

t =1

h3

1,288

6,741

33,882

( 1+ g 4 )

V 40 = X 0h n1h 2 h 3 ( 1T 4 )( 1b 4 )

2

3

( k 4 g4 )

1

n

(2,757)

3

V 0 =X 0h n 1h n2 ( 1T 3 )(1b 3 )

2

1

t =1

n

Total PV = $

Total PV / X1

Total PV / Xstage 2, period 1

13.31

1 / (k4 - g4)

11.24

39,154

6.03

Notes:

V0i = PV of Stage i free cash flows at time 0. For example, V 01 = PV of Stage 1 free cash flows at time 0

Terminal Value = Vn4 = XN4+1(1-T4)(1-b4) / (k4 - g4)

XN4+1 = net operating income for Period 1 in Stage 4

X1 = net operating income for Period 1 in Stage 1

You might also like

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- Final Exam Corporate Finance CFVG 2016-2017Document8 pagesFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuNo ratings yet

- NPV CalculationDocument19 pagesNPV CalculationmschotoNo ratings yet

- M Fin 202 CH 13 SolutionsDocument9 pagesM Fin 202 CH 13 SolutionsNguyenThiTuOanhNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Bank-Wise List of Wilful Defaulters-1Document372 pagesBank-Wise List of Wilful Defaulters-1usf69No ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- EXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Document16 pagesEXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Ana MarkovićNo ratings yet

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDocument25 pagesChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanNo ratings yet

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDocument4 pagesDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaNo ratings yet

- SneakerDocument8 pagesSneakerFelicity YuanNo ratings yet

- Home Work Excel SolutionDocument16 pagesHome Work Excel SolutionSunil KumarNo ratings yet

- Chapter 3 Prob SolutionsDocument33 pagesChapter 3 Prob SolutionsMehak Ayoub100% (1)

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Exercise FCFF ValDocument4 pagesExercise FCFF ValElena Denisa CioinacNo ratings yet

- MTP Soln 1Document14 pagesMTP Soln 1Anonymous 8wg4eowIdzNo ratings yet

- EconomicsDocument5 pagesEconomicsbrian mochez01No ratings yet

- Tutorial 4 SolutionsDocument6 pagesTutorial 4 SolutionsNokubongaNo ratings yet

- EE - Assignment Chapter 5 SolutionDocument10 pagesEE - Assignment Chapter 5 SolutionXuân ThànhNo ratings yet

- Solution For Numerical Review QuestionDocument85 pagesSolution For Numerical Review QuestionAparajith GuhaNo ratings yet

- 6886 Valuation 2Document25 pages6886 Valuation 2api-3699305100% (1)

- Chap 4 - Other DCF ModelsDocument35 pagesChap 4 - Other DCF Modelsrafat.jalladNo ratings yet

- Capital BudgetingDocument62 pagesCapital BudgetingAshwin AroraNo ratings yet

- Capital Budgeting TemplateDocument33 pagesCapital Budgeting TemplateMark MarsulexNo ratings yet

- Si7 - Tarquin (1) 9 22Document14 pagesSi7 - Tarquin (1) 9 22Luis Eduardo Perez GonzalezNo ratings yet

- Avance 1 - Financial ManagementDocument8 pagesAvance 1 - Financial ManagementValery M. AnguloNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- Sampa VideoDocument24 pagesSampa VideoPranav AggarwalNo ratings yet

- FM09-CH 16Document12 pagesFM09-CH 16Mukul KadyanNo ratings yet

- Finalrevision Handout SolutionDocument7 pagesFinalrevision Handout SolutionBao Ngoc LeNo ratings yet

- ch14 SolDocument16 pagesch14 SolAnsleyNo ratings yet

- ECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDocument7 pagesECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDaniyal AsifNo ratings yet

- Chapter Four Evaluation (Appraisal) of Transport Projects: 2014E.C. Oda Bultum UniversityDocument28 pagesChapter Four Evaluation (Appraisal) of Transport Projects: 2014E.C. Oda Bultum UniversityGirmaye Kebede100% (1)

- Feruz BelarusDocument2 pagesFeruz BelarusabdulazizbakhshilloevNo ratings yet

- Capital Budgeting TemplateDocument36 pagesCapital Budgeting TemplateJayaram ParlikadNo ratings yet

- Solow-Swan Growth Model:: Calibration Tutorial Using MS-ExcelDocument16 pagesSolow-Swan Growth Model:: Calibration Tutorial Using MS-ExcelSharjeel Ahmed Khan100% (1)

- Chapter 13 Equity ValuationDocument33 pagesChapter 13 Equity Valuationsharktale2828No ratings yet

- GDV: TDC:: Per PeriodDocument9 pagesGDV: TDC:: Per PeriodM. HfizzNo ratings yet

- DcfDocument7 pagesDcfManish MohapatraNo ratings yet

- Running Head: VALUE PER SHARE: Bond and Equity Value Name InstitutionDocument3 pagesRunning Head: VALUE PER SHARE: Bond and Equity Value Name InstitutionCarlos AlphonceNo ratings yet

- Solution de Cas Lady M ConfectionsDocument10 pagesSolution de Cas Lady M ConfectionsScribdTranslationsNo ratings yet

- Workshop 7 Suggested SolutionsDocument42 pagesWorkshop 7 Suggested SolutionsDweep KapadiaNo ratings yet

- Sampa VideoDocument24 pagesSampa Videopawangadiya1210No ratings yet

- Closure in Valuation: Estimating Terminal Value: Problem 1Document3 pagesClosure in Valuation: Estimating Terminal Value: Problem 1Silviu TrebuianNo ratings yet

- IPF Assignment 4Document12 pagesIPF Assignment 4Nitesh MehlaNo ratings yet

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- FM Practice Sheet Booklet SOLUTIONS - Nov 2022Document135 pagesFM Practice Sheet Booklet SOLUTIONS - Nov 2022Dhruvi VachhaniNo ratings yet

- Chapter 13: Real Options, Investment Strategy and Process: d SE r t t 2 = + + ln / / σ σDocument2 pagesChapter 13: Real Options, Investment Strategy and Process: d SE r t t 2 = + + ln / / σ σAbhishek ChopraNo ratings yet

- Project AppraisalDocument34 pagesProject AppraisalWilly Mwangi KiarieNo ratings yet

- Ie463 CHP5 (2010-2011)Document6 pagesIe463 CHP5 (2010-2011)Gözde ŞençimenNo ratings yet

- 9706 s10 Ms 43Document6 pages9706 s10 Ms 43cherylllimclNo ratings yet

- Lahore School of Economics Financial Management II The Cost of CapitalDocument3 pagesLahore School of Economics Financial Management II The Cost of CapitalDaniyal AliNo ratings yet

- Fundamental AnalysisDocument18 pagesFundamental AnalysissahiwalgurnoorNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelsanket patilNo ratings yet

- HP FilterDocument10 pagesHP FilterKevin AndrewNo ratings yet

- 9706 s15 Ms 211Document8 pages9706 s15 Ms 211nistha4444_89385228No ratings yet

- PPAC AssignDocument19 pagesPPAC AssignDerickMwansaNo ratings yet

- Solution Assigment Chapter 5Document11 pagesSolution Assigment Chapter 5Hoang Thao NhiNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Customer Service Software Landscape May 2017Document320 pagesCustomer Service Software Landscape May 2017JNNo ratings yet

- Model 16-01A LBO Model - Loan Amortization, 5 Year PeriodDocument5 pagesModel 16-01A LBO Model - Loan Amortization, 5 Year PeriodJNNo ratings yet

- M20 01 Black ScholesDocument1 pageM20 01 Black ScholesJNNo ratings yet

- Model 10-04 Merger Valuation Application: Panel A - Value DriversDocument1 pageModel 10-04 Merger Valuation Application: Panel A - Value DriversJNNo ratings yet

- Comparable Companies ValuationDocument1 pageComparable Companies ValuationJNNo ratings yet

- Model 01-01 Basic Arbitrage Model Month 0 Month 1 Bidder (B) Target (T) Arbitrage FirmDocument1 pageModel 01-01 Basic Arbitrage Model Month 0 Month 1 Bidder (B) Target (T) Arbitrage FirmJNNo ratings yet

- Model 03-02A Effects On Leverage of A Cash PurchaseDocument3 pagesModel 03-02A Effects On Leverage of A Cash PurchaseJNNo ratings yet

- CMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalDocument12 pagesCMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalJNNo ratings yet

- Info Edge (INFEDG) : Healthy Recovery in NaukriDocument8 pagesInfo Edge (INFEDG) : Healthy Recovery in NaukriJNNo ratings yet