Professional Documents

Culture Documents

M20 01 Black Scholes

M20 01 Black Scholes

Uploaded by

JN0 ratings0% found this document useful (0 votes)

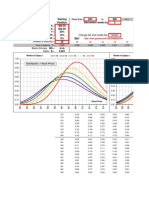

17 views1 pageThis document contains the results of a Black-Scholes model calculation for the price of a call option with various underlying stock prices. The model inputs include a risk-free rate of 5%, a time to maturity of 1 year, and a strike price of $25. It then shows the calculated values for d1, d2, the standard normal cumulative distribution function N(d1) and N(d2), and the resulting call option price for each stock price between $3 and $50.

Original Description:

Black Scholes

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains the results of a Black-Scholes model calculation for the price of a call option with various underlying stock prices. The model inputs include a risk-free rate of 5%, a time to maturity of 1 year, and a strike price of $25. It then shows the calculated values for d1, d2, the standard normal cumulative distribution function N(d1) and N(d2), and the resulting call option price for each stock price between $3 and $50.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

17 views1 pageM20 01 Black Scholes

M20 01 Black Scholes

Uploaded by

JNThis document contains the results of a Black-Scholes model calculation for the price of a call option with various underlying stock prices. The model inputs include a risk-free rate of 5%, a time to maturity of 1 year, and a strike price of $25. It then shows the calculated values for d1, d2, the standard normal cumulative distribution function N(d1) and N(d2), and the resulting call option price for each stock price between $3 and $50.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 1

Model 20-01

Black-Scholes Call Option Pricing

Inputs:

Risk-free rate = RF =

Time to maturity (yrs) = T =

Strike price = X =

Std deviation = =

Stock Price (S)

$3.00

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

$40.00

$45.00

$46.75

$50.00

5.00%

1.00000

$25.00

0.1

d1

-20.65264

-8.61291

-4.55826

-1.68144

0.55000

2.37322

3.91472

5.25004

6.42787

6.80938

7.48147

d2

-20.75264

-8.71291

-4.65826

-1.78144

0.45000

2.27322

3.81472

5.15004

6.32787

6.70938

7.38147

N(d1)

0.00000

0.00000

0.00000

0.04634

0.70884

0.99118

0.99995

1.00000

1.00000

1.00000

1.00000

N(d2)

0.00000

0.00000

0.00000

0.03742

0.67364

0.98849

0.99993

1.00000

1.00000

1.00000

1.00000

Call Price (C)

$0.00

$0.00

$0.00

$0.04

$1.70

$6.23

$11.22

$16.22

$21.22

$22.97

$26.22

You might also like

- 2012 04 MLC Exam SolDocument20 pages2012 04 MLC Exam SolAki TsukiyomiNo ratings yet

- Bank-Wise List of Wilful Defaulters-1Document372 pagesBank-Wise List of Wilful Defaulters-1usf69No ratings yet

- Delta HedgeDocument3 pagesDelta Hedgeshiva19892006No ratings yet

- Answer 4.1Document22 pagesAnswer 4.1Ankit AgarwalNo ratings yet

- Pfe Exer25Document23 pagesPfe Exer25bhabani348No ratings yet

- 20MIS1115 - Matlab CodesDocument64 pages20MIS1115 - Matlab CodesSam100% (4)

- Uas Algoritma - Novera SafitriDocument3 pagesUas Algoritma - Novera SafitriNOVERA SAFITRINo ratings yet

- Uas Algoritma - Novera SafitriDocument3 pagesUas Algoritma - Novera SafitriNOVERA SAFITRINo ratings yet

- Data Final RegressionDocument10 pagesData Final RegressionisaacbougherabNo ratings yet

- Midsem SolutionDocument4 pagesMidsem SolutionEklavyaNo ratings yet

- Labo 2 Fluidos2Document9 pagesLabo 2 Fluidos2Andrew HernandezNo ratings yet

- Solution To 4.13Document5 pagesSolution To 4.13Niyati ShahNo ratings yet

- Hw5 Mfe Au14 SolutionDocument8 pagesHw5 Mfe Au14 SolutionWenn Zhang100% (2)

- Semi-Custom Line (Lindo)Document6 pagesSemi-Custom Line (Lindo)mborjal22No ratings yet

- Codificación 3:: 'Grafica'Document4 pagesCodificación 3:: 'Grafica'Angie Santillán ValquiNo ratings yet

- Regresi ParabolaDocument6 pagesRegresi Parabolakuliah ridwanNo ratings yet

- 2 and 3Document6 pages2 and 3Radhika KhandelwalNo ratings yet

- Hoja de Calculos AuxiliaresDocument4 pagesHoja de Calculos Auxiliaresjoe_yashiroNo ratings yet

- Lampiran R StudioDocument25 pagesLampiran R StudioSkripsi GorontaloNo ratings yet

- đồ thịDocument2 pagesđồ thịhuynhtuyen01062000No ratings yet

- KTL - MocktestDocument3 pagesKTL - MocktestFTU.CS2 Bùi Võ Song ThươngNo ratings yet

- AppendixDocument12 pagesAppendixsadyehclenNo ratings yet

- WEEK: 3&4: Simple RegressionDocument6 pagesWEEK: 3&4: Simple RegressionatNo ratings yet

- M X P1 P2: Prueba de Bondad de Ajuste Kolmogorov SmirnovDocument8 pagesM X P1 P2: Prueba de Bondad de Ajuste Kolmogorov SmirnovDeibyVanderNo ratings yet

- Answer For Past YearDocument4 pagesAnswer For Past YearSobrinaSaadon0% (1)

- C 0.1905 X - 0.7619 X - 0.9524 X + 4.0000: %graficas de F y El PolinomioDocument15 pagesC 0.1905 X - 0.7619 X - 0.9524 X + 4.0000: %graficas de F y El PolinomioGabriela Elízabeth Sánchez SánchezNo ratings yet

- Hoja de Calculos Auxiliares Mathcad 15.0Document4 pagesHoja de Calculos Auxiliares Mathcad 15.0joe_yashiroNo ratings yet

- Template For Linear RegressionDocument6 pagesTemplate For Linear RegressionVyl CebrerosNo ratings yet

- Yadunandan Sharma 500826933 MTH480 Due Date: April 15, 2021Document16 pagesYadunandan Sharma 500826933 MTH480 Due Date: April 15, 2021danNo ratings yet

- California 1673295505Document18 pagesCalifornia 1673295505doudoudzNo ratings yet

- Aplicatia 3Document4 pagesAplicatia 3Robert GeorgeNo ratings yet

- Data PercobaanDocument28 pagesData PercobaanYessiStaniBeataSiahaanNo ratings yet

- FD CheatsheetDocument11 pagesFD CheatsheetHarleen KaurNo ratings yet

- Task DescriptionDocument6 pagesTask DescriptionSulman ShahzadNo ratings yet

- Black Scholes Discrete DividendsDocument4 pagesBlack Scholes Discrete DividendsSyahrizkaNo ratings yet

- BUS 173 Final AssignmentDocument7 pagesBUS 173 Final AssignmentDinha ChowdhuryNo ratings yet

- Eur/Usd Daily Quotation Forecast: Hosein Nooriaan E714 Econometrics Final ProjectDocument18 pagesEur/Usd Daily Quotation Forecast: Hosein Nooriaan E714 Econometrics Final ProjectnooriaanNo ratings yet

- Lab Title: Objectives: Material Required:: Sinusoidal Steady StateDocument11 pagesLab Title: Objectives: Material Required:: Sinusoidal Steady Stateahmed shahNo ratings yet

- Chart Title: 40.000 45.000 F (X) 23.1572162076x + 0.0227231781 R 0.9926136441 Column F Linear (Column F)Document3 pagesChart Title: 40.000 45.000 F (X) 23.1572162076x + 0.0227231781 R 0.9926136441 Column F Linear (Column F)Saad AnisNo ratings yet

- 01 TrabajoDocument18 pages01 TrabajoYuliza Carolina Capuñay SiesquenNo ratings yet

- Prac 5 PandasDocument6 pagesPrac 5 PandasheilNo ratings yet

- Curva Reflectometro 1Document12 pagesCurva Reflectometro 1mch152No ratings yet

- Stat 245 Problem Set #6Document9 pagesStat 245 Problem Set #6yoachallengeNo ratings yet

- StatsDocument9 pagesStatsعلی رضاNo ratings yet

- Option ExampleDocument7 pagesOption ExampleKaren LiuNo ratings yet

- Inflasi ARIMA ModelDocument7 pagesInflasi ARIMA ModelAnto TomodachiRent SusiloNo ratings yet

- Statassignment 3Document9 pagesStatassignment 3sudhindra deshmukhNo ratings yet

- Delta HedgingDocument3 pagesDelta HedgingGallo SolarisNo ratings yet

- Chap 8Document94 pagesChap 8Sumathi AmbunathanNo ratings yet

- MGT 3500 Review #1Document7 pagesMGT 3500 Review #1荳荳No ratings yet

- HW 4Document12 pagesHW 4d_rampalNo ratings yet

- Krm8 Ism Ch11Document34 pagesKrm8 Ism Ch11Saif Ullah Qureshi100% (2)

- Linear RegressionDocument6 pagesLinear Regressionrxn114392No ratings yet

- Series NotesDocument3 pagesSeries Notesapi-362845526No ratings yet

- 02 MulticollinearityDocument8 pages02 MulticollinearityGabriel Gheorghe100% (1)

- Assignment For Plant Design and EconomicsDocument1 pageAssignment For Plant Design and EconomicsDionie Wilson DiestroNo ratings yet

- Free Vibration and Undamped Structure: 𝑢 (𝑡) =𝐴 cos 〖𝜔 - 𝑛 𝑡+𝐵 sin 〖𝜔 - 𝑛 𝑡 〗 〗 𝑢 ̇ (𝑡) =−𝜔 - 𝑛 𝐴 𝑠𝑖𝑛𝜔 - 𝑛 𝑡+ 𝜔 - 𝑛 𝐵 cos 〖𝜔 - 𝑛 𝑡 〗Document12 pagesFree Vibration and Undamped Structure: 𝑢 (𝑡) =𝐴 cos 〖𝜔 - 𝑛 𝑡+𝐵 sin 〖𝜔 - 𝑛 𝑡 〗 〗 𝑢 ̇ (𝑡) =−𝜔 - 𝑛 𝐴 𝑠𝑖𝑛𝜔 - 𝑛 𝑡+ 𝜔 - 𝑛 𝐵 cos 〖𝜔 - 𝑛 𝑡 〗Tommy LapudoohNo ratings yet

- Business Data Final Exam June 2022Document13 pagesBusiness Data Final Exam June 2022Fungai MajuriraNo ratings yet

- ExcelDocument1 pageExcelPramudi ArsiwiNo ratings yet

- Kwame Nkrumah University of Science and Technololgy College of Arts and Social Sciences School of BusinessDocument5 pagesKwame Nkrumah University of Science and Technololgy College of Arts and Social Sciences School of BusinessYAKUBU ISSAHAKU SAIDNo ratings yet

- Interpolatingfunction : Bla Ndsolve ( (F ''' (T) + F (T) F '' (T) 0, F (0) 0, F ' (0) 0, F ' (100 000) 1), F, T)Document7 pagesInterpolatingfunction : Bla Ndsolve ( (F ''' (T) + F (T) F '' (T) 0, F (0) 0, F ' (0) 0, F ' (100 000) 1), F, T)Alexis CastleNo ratings yet

- Customer Service Software Landscape May 2017Document320 pagesCustomer Service Software Landscape May 2017JNNo ratings yet

- Model 10-04 Merger Valuation Application: Panel A - Value DriversDocument1 pageModel 10-04 Merger Valuation Application: Panel A - Value DriversJNNo ratings yet

- Model 16-01A LBO Model - Loan Amortization, 5 Year PeriodDocument5 pagesModel 16-01A LBO Model - Loan Amortization, 5 Year PeriodJNNo ratings yet

- General 4-Stage Model: Model 10-05A (Revenue Growth Model)Document2 pagesGeneral 4-Stage Model: Model 10-05A (Revenue Growth Model)JNNo ratings yet

- Comparable Companies ValuationDocument1 pageComparable Companies ValuationJNNo ratings yet

- Model 01-01 Basic Arbitrage Model Month 0 Month 1 Bidder (B) Target (T) Arbitrage FirmDocument1 pageModel 01-01 Basic Arbitrage Model Month 0 Month 1 Bidder (B) Target (T) Arbitrage FirmJNNo ratings yet

- Model 03-02A Effects On Leverage of A Cash PurchaseDocument3 pagesModel 03-02A Effects On Leverage of A Cash PurchaseJNNo ratings yet

- CMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalDocument12 pagesCMP: INR353 TP: INR420 (+19%) Buy: Muted Volumes Not The New NormalJNNo ratings yet

- Info Edge (INFEDG) : Healthy Recovery in NaukriDocument8 pagesInfo Edge (INFEDG) : Healthy Recovery in NaukriJNNo ratings yet