Professional Documents

Culture Documents

USA v. Travelers Casualty and Surety Company of America, 11th Cir. (2013)

USA v. Travelers Casualty and Surety Company of America, 11th Cir. (2013)

Uploaded by

Scribd Government DocsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

USA v. Travelers Casualty and Surety Company of America, 11th Cir. (2013)

USA v. Travelers Casualty and Surety Company of America, 11th Cir. (2013)

Uploaded by

Scribd Government DocsCopyright:

Available Formats

Case: 12-14405

Date Filed: 03/04/2013

Page: 1 of 7

[PUBLISH]

IN THE UNITED STATES COURT OF APPEALS

FOR THE ELEVENTH CIRCUIT

________________________

No. 12-14405

Non-Argument Calendar

________________________

D.C. Docket No. 6:12-cv-00182-RBD-DAB

UNITED STATES OF AMERICA,

for the use and benefit of Postel Erection Group, L.L.C.,

POSTEL ERECTION GROUP, L.L.C.,

Plaintiffs - Appellants,

versus

TRAVELERS CASUALTY AND SURETY COMPANY OF AMERICA,

FEDERAL INSURANCE COMPANY,

Defendants - Appellees,

CHUBB NATIONAL INSURANCE COMPANY, et al.,

Defendant.

Case: 12-14405

Date Filed: 03/04/2013

Page: 2 of 7

________________________

Appeal from the United States District Court

for the Middle District of Florida

________________________

(March 4, 2013)

Before BARKETT, MARTIN and KRAVITCH, Circuit Judges.

BY THE COURT:

Travelers Casualty and Surety Company of America and Federal Insurance

Company (Travelers) have moved to dismiss Postel Erection Group, L.L.Cs

(Postel), appeal of the district courts stay of Postels lawsuit seeking payment

from Travelers on a surety bond for work that it performed as a subcontractor on

the construction of a Department of Veterans Medical Center in Orlando, Florida.

Postels suit is brought pursuant to the Miller Act, 40 U.S.C. 3131 et seq., which

provides a subcontractor who has supplied labor or materials on federal

government construction projects, but has not been paid, with the right to sue the

surety that provided the primary contractor with the statutorily required payment

bond. The Miller Act requires that such suits be brought in the name of the

United States for the use of the person bringing the action. 40 U.S.C.

3133(b)(3)(A).

Travelers argues that Postels appeal, which was not filed until fifty-five

days after the district courts order, is untimely and must therefore, be dismissed.

2

Case: 12-14405

Date Filed: 03/04/2013

Page: 3 of 7

Postel responds, however, that when a lawsuit is brought in the name of the United

States as required by the Miller Act, it had sixty days in which to appeal.

In a civil case, a notice of appeal generally must be filed with the district

clerk within 30 days after entry of the judgment or order appealed from. Fed. R.

App. P. 4(a)(1)(A). The time allowed is extended to sixty days when one of the

parties is the United States or its officer or agency. See Fed. R. App. P. 4(a)(1)(B).

Because the taking of an appeal within the prescribed time is mandatory and

jurisdictional, Bowles v. Russell, 551 U.S. 205, 209 (2007), we cannot entertain

Postels appeal unless the United States is a party to this litigation within the

meaning of Federal Rule of Appellate Procedure 4(a)(1)(B).

Postel relies on United States Fidelity & Guaranty Co. v. United States for

the Benefit of Kenyon, 204 U.S. 349 (1907), which it argues established that the

United States is a real party in interest for purposes of determining the deadline to

file a notice of appeal. In Kenyon, the Court considered whether the United States

was the plaintiff in an action brought pursuant to the Heard Act, the predecessor

act to the Miller Act, for purposes of establishing jurisdiction in federal court, but

not for determining the time for filing a notice of appeal. 204 U.S. at 354. The

Court concluded that the United States was not merely a nominal or formal

party, id. at 356, and that an action under the Heard Act may fairly be regarded

as one by the United States itself to enforce the specific obligation of the contractor

3

Case: 12-14405

Date Filed: 03/04/2013

Page: 4 of 7

to make prompt payment for labor and materials, id. at 357. In reaching its

conclusion, the Court explained that the statutorily required bond is not simply

one to secure the faithful performance by the contractor of the duties he owes

directly to the government in relation to the specific work undertaken by him, but

that it also contained a special stipulation with the United States that the

contractor shall promptly make payments to all persons supplying labor and

materials. Id. Accordingly, the Court concluded that this payment provision of

the bond ran to the United States, and was therefore enforceable by suit in its

name. Id.

Although the Court in Kenyon concluded that the United States is a real

party in interest for purposes of federal court jurisdiction under the Heard Act, we

are not persuaded that it supports the conclusion that the United States is a party in

an action brought under the Miller Act for purposes of determining the deadline for

filing a notice of appeal. We have previously explained that the Miller Act made

changes to the original Heard Act, specifically with regard to the contractors

obligation to post a bond. United States Fidelity & Guaranty Co. v. Hendry Corp.,

391 F.2d 13, 19 (5th Cir. 1968).1 Under the Heard Act, the contractor was

required to post only one bond, which was to protect both the Government and the

In Bonner v. City of Prichard, 661 F.2d 1206, 1209 (11th Cir. 1981) (en banc), the

Eleventh Circuit adopted as binding precedent all Fifth Circuit decisions handed down prior to

the close of business on September 30, 1981.

4

Case: 12-14405

Date Filed: 03/04/2013

Page: 5 of 7

suppliers of labor and materials. Id. However, the Miller Act amended the statute

to require the contractor to post two bonds, one protection [sic] the government

against failure to perform, the other protecting the subcontractor. Id. Thus,

whereas the one bond required under the Heard Act secured not only the

contractors performance obligation to the government but also contained the

specific, special obligation directly to the United States that the contractor would

make payments to the subcontractor for labor and supplies, Kenyon, 204 U.S. at

357, under the Miller Act, [t]he government, being safeguarded by the

performance bond, had no direct interest on the payment bond. Hendry, 391 F.2d

at 19. Accordingly, the Courts rationale in Kenyon for concluding that the

government is a real party in interest to a subcontractors claim for payment under

the Heard Act is inapplicable to a claim brought against the payment bond under

the Miller Act, and thus, does not resolve the jurisdictional question here.

Although the Miller Act requires a subcontractor to bring suit in the name

of the United States for the use of the person bringing the action, 40 U.S.C.

3133(b)(3)(A), this requirement does nothing more than make the United States a

nominal party, which by itself is insufficient for party status under Rule 4(a)(1)(B).

In United States ex rel. Eisenstein v. New York, New York, 556 U.S. 928 (2009),

the Supreme Court considered whether the United States was a party to a qui tam

action under the False Claims Act (FCA) for purposes of the sixty-day filing

5

Case: 12-14405

Date Filed: 03/04/2013

Page: 6 of 7

deadline for a notice of appeal. The Court concluded that where the United States

did not formally intervene in a qui tam action under the FCA, it was not a party for

purposes of the sixty-day notice of appeal deadline, even though the FCA required

the action to be brought in the name of the United States. Eisenstein, 556 U.S. at

935. The Court explained that [a] person or entity can be named in the caption of

a complaint without necessarily becoming a party to the action. Id. The Court

reasoned that Congress choice of the term party in Rule 4(a)(1)(B) and

2107(b), and not the distinctive phrase, real party in interest, indicates that the

60day time limit applies only when the United States is an actual party in qui

tam actions. Id.

The Courts decision in Eisenstein persuades us that the United States is not

a party under Rule 4(a)(1)(B) for purposes of Postels Miller Act claim. Miller Act

claims, which must be brought in the name of the United States, are not unlike qui

tam actions brought under the FCA in which the United States has chosen not to

intervene. Neither requires the United States to be an actual party to the litigation.

Because Postel does not argue that the United States has any involvement in this

case, but instead relies solely on the statutory requirement that it bring its Miller

Act claim in the name of the United States, we conclude that it was required to file

its notice of appeal within thirty days under Rule 4(a)(1)(A).

Case: 12-14405

Date Filed: 03/04/2013

Page: 7 of 7

Accordingly, we hereby grant Travelers motion to dismiss this appeal for

lack of jurisdiction. 2 See Bowles, 551 U.S. at 209 (holding that the time for filing

a notice of appeal is mandatory and jurisdictional).

DISMISSED.

Travelers also filed a motion for sanctions on the grounds that Postels appeal is

frivolous, which we deny.

7

You might also like

- 2020 National Conference of Bar Examiners (NCBE) Civil Procedure Sample MBE Questions Question # 1Document24 pages2020 National Conference of Bar Examiners (NCBE) Civil Procedure Sample MBE Questions Question # 1LALA100% (1)

- Soveriegn Immunity BriefDocument15 pagesSoveriegn Immunity Briefwolf woodNo ratings yet

- Wattle & DaubDocument9 pagesWattle & DaubRemya R. KumarNo ratings yet

- J. Carpio-Morales: Surveillance If Such Importations Are Delivered Immediately and For Use Solely Within The SubicDocument3 pagesJ. Carpio-Morales: Surveillance If Such Importations Are Delivered Immediately and For Use Solely Within The SubicTippy Dos SantosNo ratings yet

- United States Court of Appeals First CircuitDocument5 pagesUnited States Court of Appeals First CircuitScribd Government DocsNo ratings yet

- United States v. Yellow Cab Co., 340 U.S. 543 (1951)Document12 pagesUnited States v. Yellow Cab Co., 340 U.S. 543 (1951)Scribd Government DocsNo ratings yet

- Non-Argument Calendar. United States Court of Appeals, Eleventh CircuitDocument7 pagesNon-Argument Calendar. United States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Patrick W. Barron, Plaintiff/appellant/cross-Appellee v. United States of America, Defendant/appellee/cross-Appellant v. Maitland Brothers Company, Third-Party, 654 F.2d 644, 3rd Cir. (1981)Document8 pagesPatrick W. Barron, Plaintiff/appellant/cross-Appellee v. United States of America, Defendant/appellee/cross-Appellant v. Maitland Brothers Company, Third-Party, 654 F.2d 644, 3rd Cir. (1981)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument20 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Armor Elevator Co., Inc. v. Phoenix Urban Corporation, 655 F.2d 19, 1st Cir. (1981)Document6 pagesArmor Elevator Co., Inc. v. Phoenix Urban Corporation, 655 F.2d 19, 1st Cir. (1981)Scribd Government DocsNo ratings yet

- United States Ex Rel. Eisenstein v. City of New York, 556 U.S. 928 (2009)Document11 pagesUnited States Ex Rel. Eisenstein v. City of New York, 556 U.S. 928 (2009)Scribd Government DocsNo ratings yet

- Joan Carol Nagy v. United States Postal Service, 773 F.2d 1190, 11th Cir. (1985)Document5 pagesJoan Carol Nagy v. United States Postal Service, 773 F.2d 1190, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- United States Court of Appeals, First CircuitDocument6 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- Christobal Rosario v. American Export-Isbrandtsen Lines, Inc. v. United States, 531 F.2d 1227, 3rd Cir. (1976)Document9 pagesChristobal Rosario v. American Export-Isbrandtsen Lines, Inc. v. United States, 531 F.2d 1227, 3rd Cir. (1976)Scribd Government DocsNo ratings yet

- Federal Tort Claims ActDocument12 pagesFederal Tort Claims ActDevaughn Immanuel Corrica-El100% (1)

- Motion To DismissDocument15 pagesMotion To DismissCircuit MediaNo ratings yet

- Joseph Drake v. Treadwell Construction Company, and Third-Party v. United States of America, Third-Party, 299 F.2d 789, 3rd Cir. (1962)Document4 pagesJoseph Drake v. Treadwell Construction Company, and Third-Party v. United States of America, Third-Party, 299 F.2d 789, 3rd Cir. (1962)Scribd Government DocsNo ratings yet

- Christy Corporation v. The United States, and Harco Engineering, A Division of Harbor Boat Building Company, Third-Party DefendantDocument5 pagesChristy Corporation v. The United States, and Harco Engineering, A Division of Harbor Boat Building Company, Third-Party DefendantScribd Government DocsNo ratings yet

- United States v. Aetna Casualty & Surety Co., 338 U.S. 366 (1950)Document13 pagesUnited States v. Aetna Casualty & Surety Co., 338 U.S. 366 (1950)Scribd Government DocsNo ratings yet

- 21 2325.opinion.5 22 2023 - 2130243Document15 pages21 2325.opinion.5 22 2023 - 2130243Shelby DeweyNo ratings yet

- Bonnie Bailey, As Personal Representative of The Estate of Clarence W. Bailey, On Behalf of The Estate and Survivors v. Carnival Cruise Lines, Inc., 774 F.2d 1577, 11th Cir. (1985)Document7 pagesBonnie Bailey, As Personal Representative of The Estate of Clarence W. Bailey, On Behalf of The Estate and Survivors v. Carnival Cruise Lines, Inc., 774 F.2d 1577, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- Michael Alan Crooker v. United States Parole Commission, 776 F.2d 366, 1st Cir. (1985)Document6 pagesMichael Alan Crooker v. United States Parole Commission, 776 F.2d 366, 1st Cir. (1985)Scribd Government DocsNo ratings yet

- United States of America, For The Use and Benefit of Telesfor (Ted) Romero v. Douglas Construction Co., Inc., A Corp., 531 F.2d 478, 10th Cir. (1976)Document5 pagesUnited States of America, For The Use and Benefit of Telesfor (Ted) Romero v. Douglas Construction Co., Inc., A Corp., 531 F.2d 478, 10th Cir. (1976)Scribd Government DocsNo ratings yet

- United States v. Green, 10th Cir. (2015)Document5 pagesUnited States v. Green, 10th Cir. (2015)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument7 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Lindsay, 202 F.2d 239, 1st Cir. (1953)Document4 pagesUnited States v. Lindsay, 202 F.2d 239, 1st Cir. (1953)Scribd Government DocsNo ratings yet

- Webster Bivens v. Six Unknown Named Agents of The Federal Bureau of Narcotics, 409 F.2d 718, 2d Cir. (1969)Document12 pagesWebster Bivens v. Six Unknown Named Agents of The Federal Bureau of Narcotics, 409 F.2d 718, 2d Cir. (1969)Scribd Government DocsNo ratings yet

- United States v. Richard A. Holcombe, JR., 277 F.2d 143, 4th Cir. (1960)Document5 pagesUnited States v. Richard A. Holcombe, JR., 277 F.2d 143, 4th Cir. (1960)Scribd Government DocsNo ratings yet

- Rainwater v. United States, 356 U.S. 590 (1958)Document4 pagesRainwater v. United States, 356 U.S. 590 (1958)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument8 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Pinkey White v. United States Fidelity and Guaranty Company, 356 F.2d 746, 1st Cir. (1966)Document4 pagesPinkey White v. United States Fidelity and Guaranty Company, 356 F.2d 746, 1st Cir. (1966)Scribd Government DocsNo ratings yet

- Broadway Open Air Theatre, Inc. v. United States, 208 F.2d 257, 4th Cir. (1953)Document4 pagesBroadway Open Air Theatre, Inc. v. United States, 208 F.2d 257, 4th Cir. (1953)Scribd Government DocsNo ratings yet

- Clinton E. Gardner v. United States of America, United States of America, Third-Party v. Alastair Kyle, Third-Party, 446 F.2d 1195, 2d Cir. (1971)Document4 pagesClinton E. Gardner v. United States of America, United States of America, Third-Party v. Alastair Kyle, Third-Party, 446 F.2d 1195, 2d Cir. (1971)Scribd Government DocsNo ratings yet

- United States v. Township of Muskegon, 355 U.S. 484 (1958)Document4 pagesUnited States v. Township of Muskegon, 355 U.S. 484 (1958)Scribd Government DocsNo ratings yet

- Prod - Liab.Rep. (CCH) P 10,721 in Re All Maine Asbestos Litigation (Pns Cases) - Petition of UNITED STATES of AmericaDocument14 pagesProd - Liab.Rep. (CCH) P 10,721 in Re All Maine Asbestos Litigation (Pns Cases) - Petition of UNITED STATES of AmericaScribd Government DocsNo ratings yet

- United Pacific Insurance Company v. The UNITED STATES and Tinkham GILBERT, Trustee in Bankruptcy of Floyd R. Grubb, Third-PartyDocument5 pagesUnited Pacific Insurance Company v. The UNITED STATES and Tinkham GILBERT, Trustee in Bankruptcy of Floyd R. Grubb, Third-PartyScribd Government DocsNo ratings yet

- Bradley, Stephen G., Sr. and Bradley, Stephen M., Jr. and Bradley, Regina and Bradley, Timothy v. United States, 856 F.2d 575, 3rd Cir. (1988)Document7 pagesBradley, Stephen G., Sr. and Bradley, Stephen M., Jr. and Bradley, Regina and Bradley, Timothy v. United States, 856 F.2d 575, 3rd Cir. (1988)Scribd Government DocsNo ratings yet

- United States of America and Jordan Lilienthal v. City of Pittsburgh, A Municipal Corporation and Stephen A. Schillo, Treasurer of The City of Pittsburgh, 757 F.2d 43, 3rd Cir. (1985)Document7 pagesUnited States of America and Jordan Lilienthal v. City of Pittsburgh, A Municipal Corporation and Stephen A. Schillo, Treasurer of The City of Pittsburgh, 757 F.2d 43, 3rd Cir. (1985)Scribd Government DocsNo ratings yet

- Angora Enterprises, Inc., and Joseph Kosow v. Condominium Association of Lakeside Village, Inc., 796 F.2d 384, 11th Cir. (1986)Document7 pagesAngora Enterprises, Inc., and Joseph Kosow v. Condominium Association of Lakeside Village, Inc., 796 F.2d 384, 11th Cir. (1986)Scribd Government DocsNo ratings yet

- B.C. Morton International Corporation v. Federal Deposit Insurance Corporation, 305 F.2d 692, 1st Cir. (1962)Document10 pagesB.C. Morton International Corporation v. Federal Deposit Insurance Corporation, 305 F.2d 692, 1st Cir. (1962)Scribd Government DocsNo ratings yet

- Cecile Industries, Inc. and John Miller v. United States, 793 F.2d 97, 3rd Cir. (1986)Document5 pagesCecile Industries, Inc. and John Miller v. United States, 793 F.2d 97, 3rd Cir. (1986)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument14 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument6 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- United States of America and Vincent A. Distazio, Special Agent, Internal Revenue Service v. Vernon F. Waltman, President, Waltman Furniture Company, and Waltman Furniture Company, 525 F.2d 371, 3rd Cir. (1975)Document4 pagesUnited States of America and Vincent A. Distazio, Special Agent, Internal Revenue Service v. Vernon F. Waltman, President, Waltman Furniture Company, and Waltman Furniture Company, 525 F.2d 371, 3rd Cir. (1975)Scribd Government DocsNo ratings yet

- United States v. Wright Contracting Company, United States of America v. Mid-Atlantic Paving Company, Inc., 728 F.2d 648, 4th Cir. (1984)Document9 pagesUnited States v. Wright Contracting Company, United States of America v. Mid-Atlantic Paving Company, Inc., 728 F.2d 648, 4th Cir. (1984)Scribd Government DocsNo ratings yet

- Opinion - U.S. Ex Rel. Little v. Shell (July 31, 2012, 5th Cir. 2012)Document21 pagesOpinion - U.S. Ex Rel. Little v. Shell (July 31, 2012, 5th Cir. 2012)GovtfraudlawyerNo ratings yet

- Cort v. Ash, 422 U.S. 66 (1975)Document16 pagesCort v. Ash, 422 U.S. 66 (1975)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument5 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Barbara Falzarano v. United States of America, 607 F.2d 506, 1st Cir. (1979)Document10 pagesBarbara Falzarano v. United States of America, 607 F.2d 506, 1st Cir. (1979)Scribd Government DocsNo ratings yet

- Not A LevyDocument21 pagesNot A LevyLucy Maysonet100% (1)

- First National Bank of Emlenton, Pennsylvania v. United States, 265 F.2d 297, 1st Cir. (1959)Document4 pagesFirst National Bank of Emlenton, Pennsylvania v. United States, 265 F.2d 297, 1st Cir. (1959)Scribd Government DocsNo ratings yet

- AQUA BAR & LOUNGE, INC., Appellant, v. United States of America Department of Treasury Internal REVENUE SERVICE and Joseph B. SaltzDocument12 pagesAQUA BAR & LOUNGE, INC., Appellant, v. United States of America Department of Treasury Internal REVENUE SERVICE and Joseph B. SaltzScribd Government DocsNo ratings yet

- 31 Fair Empl - Prac.cas. 969, 31 Empl. Prac. Dec. P 33,574 Patricia H. Rogero v. B.M. Noone, Individually and As Putnam County Tax Collector, 704 F.2d 518, 11th Cir. (1983)Document7 pages31 Fair Empl - Prac.cas. 969, 31 Empl. Prac. Dec. P 33,574 Patricia H. Rogero v. B.M. Noone, Individually and As Putnam County Tax Collector, 704 F.2d 518, 11th Cir. (1983)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument21 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- United States v. Martin Tieger, 234 F.2d 589, 3rd Cir. (1956)Document10 pagesUnited States v. Martin Tieger, 234 F.2d 589, 3rd Cir. (1956)Scribd Government DocsNo ratings yet

- United Services Automobile Association Charlene Cozart v. United States, 105 F.3d 185, 4th Cir. (1997)Document5 pagesUnited Services Automobile Association Charlene Cozart v. United States, 105 F.3d 185, 4th Cir. (1997)Scribd Government DocsNo ratings yet

- FOP V PG County - Motion For Stay Pending AppealDocument10 pagesFOP V PG County - Motion For Stay Pending AppealJonMummoloNo ratings yet

- Conyers V Bush - ORDER GRANTING DEFENDANTS' MOTIONS TO DISMISS 11-06-2006Document9 pagesConyers V Bush - ORDER GRANTING DEFENDANTS' MOTIONS TO DISMISS 11-06-2006Beverly TranNo ratings yet

- United States v. American Insurance Company, 18 F.3d 1104, 3rd Cir. (1994)Document13 pagesUnited States v. American Insurance Company, 18 F.3d 1104, 3rd Cir. (1994)Scribd Government DocsNo ratings yet

- United States v. Hyman G. Saxe, Executors, (Two Cases), 261 F.2d 316, 1st Cir. (1958)Document6 pagesUnited States v. Hyman G. Saxe, Executors, (Two Cases), 261 F.2d 316, 1st Cir. (1958)Scribd Government DocsNo ratings yet

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Lopez, 10th Cir. (2017)Document4 pagesUnited States v. Lopez, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Lecture 2: Drawing Basics - P1 : 1Document9 pagesLecture 2: Drawing Basics - P1 : 1roseNo ratings yet

- ADR Nego PlanDocument4 pagesADR Nego PlanDeeshaNo ratings yet

- Smart Home: An-Najah National University Faculty of EngineeringDocument27 pagesSmart Home: An-Najah National University Faculty of Engineeringمعتز بسام محمود مرداوي معتز بسام محمود مرداويNo ratings yet

- Monitoring Neuromuskular Kuantitatif Pada Penggunaan Muscle RelaxantDocument17 pagesMonitoring Neuromuskular Kuantitatif Pada Penggunaan Muscle RelaxantWidi Yuli HariantoNo ratings yet

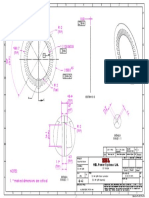

- 5.5 KW SyRM Stator Lamination - 8 02 67 0015 - R00Document1 page5.5 KW SyRM Stator Lamination - 8 02 67 0015 - R00rakesh bardepurNo ratings yet

- Fluke Bangladesh 368 FC Leakage Current Clamp MeterDocument4 pagesFluke Bangladesh 368 FC Leakage Current Clamp MeterFluke BangladeshNo ratings yet

- I-765 Online Filing Instructions - FINALDocument13 pagesI-765 Online Filing Instructions - FINALTrân LêNo ratings yet

- 05 - Quiz - 1 - HRMDocument3 pages05 - Quiz - 1 - HRMMillania ThanaNo ratings yet

- Labrel Midterms and FinalsDocument186 pagesLabrel Midterms and Finalsjanine nenariaNo ratings yet

- On Fedrel Mogul Goetze Training ReportDocument22 pagesOn Fedrel Mogul Goetze Training Report98960169600% (1)

- Novia - Paper Teknik Sipil - Analisa Faktor-Faktor Peyebab Change Order Pada Proyek Peningkatan Jalan Inspeksi (Jalan Duyung Lanjutan)Document10 pagesNovia - Paper Teknik Sipil - Analisa Faktor-Faktor Peyebab Change Order Pada Proyek Peningkatan Jalan Inspeksi (Jalan Duyung Lanjutan)noviaNo ratings yet

- Calina - Patterson - Resistance To Change Discussion Handout #1Document2 pagesCalina - Patterson - Resistance To Change Discussion Handout #1Calina PattersonNo ratings yet

- Final BSR Road Bridge Nagaur of 2019Document66 pagesFinal BSR Road Bridge Nagaur of 2019Jakhar MukeshNo ratings yet

- Bunkers Quality and Quantity ClaimsDocument36 pagesBunkers Quality and Quantity ClaimsParthiban NagarajanNo ratings yet

- 202010398-Kiran Shrestha-Assessment I - Network TopologiesDocument31 pages202010398-Kiran Shrestha-Assessment I - Network Topologieskimo shresthaNo ratings yet

- Magpie Lab Student Guide Updated 2014 FinalDocument13 pagesMagpie Lab Student Guide Updated 2014 FinalAmanueNo ratings yet

- Diass-Week 3Document8 pagesDiass-Week 3Gia MarieNo ratings yet

- Fill The Form Below:: Sonia SharmaDocument1 pageFill The Form Below:: Sonia SharmaDr BalakrishnaNo ratings yet

- Rent Agreement FormatDocument3 pagesRent Agreement FormatyasinNo ratings yet

- CAN 14245938 K9ccty15dowhwthbDocument1 pageCAN 14245938 K9ccty15dowhwthbrakhi.bhashkerNo ratings yet

- Valve Employee HandbookDocument37 pagesValve Employee HandbookMilan ThakkerNo ratings yet

- Design and Implementation of A Web Based Hosipital Management System .....Document42 pagesDesign and Implementation of A Web Based Hosipital Management System .....Mikel King100% (1)

- Budget Choux EkondjeDocument4 pagesBudget Choux EkondjePikol WeladjiNo ratings yet

- Using The SQL Transformation in An Informatica Developer MappingDocument10 pagesUsing The SQL Transformation in An Informatica Developer MappingShannonNo ratings yet

- Sema V COMELEC DigestDocument5 pagesSema V COMELEC DigestTrizia VeluyaNo ratings yet

- Accounting Question BankDocument217 pagesAccounting Question BankFaiza TahreemNo ratings yet

- TPC Repository Whitepaper v1 2Document55 pagesTPC Repository Whitepaper v1 2buxabuxa32No ratings yet

- Masabong Elementary School: Reading Action PlanDocument27 pagesMasabong Elementary School: Reading Action PlanMaribel BelarminoNo ratings yet