Professional Documents

Culture Documents

FTG Irs Form 990 2004

FTG Irs Form 990 2004

Uploaded by

L. A. PatersonCopyright:

Available Formats

You might also like

- Real Estate ProjectDocument63 pagesReal Estate Projectmeetabhishek_kgp90% (10)

- T4 AA Retail PDFDocument481 pagesT4 AA Retail PDFShaqif Hasan Sajib100% (2)

- FTG Irs Form 990 2006Document19 pagesFTG Irs Form 990 2006L. A. PatersonNo ratings yet

- FTG Irs Form 990 2005Document17 pagesFTG Irs Form 990 2005L. A. PatersonNo ratings yet

- Cfi - Fy2004 - F990Document37 pagesCfi - Fy2004 - F990Didi RemezNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921Document3 pagesShort Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921lesliebrodieNo ratings yet

- LJ LJ: Return of Organization Exempt From Income TaxDocument20 pagesLJ LJ: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- Bloomberg Family Foundation 2008 Tax ReturnDocument105 pagesBloomberg Family Foundation 2008 Tax ReturnCeleste KatzNo ratings yet

- East Carolina Development Co Inc 56-2044953: Neon Trust or Private Rwraabon)Document10 pagesEast Carolina Development Co Inc 56-2044953: Neon Trust or Private Rwraabon)NC Policy WatchNo ratings yet

- ExxonMobil Foundation 2005 990PFDocument174 pagesExxonMobil Foundation 2005 990PFJustin ElliottNo ratings yet

- David H Koch Charitable Foundation 480926946 2006 0325BAD4Document24 pagesDavid H Koch Charitable Foundation 480926946 2006 0325BAD4cmf8926No ratings yet

- Justice 990 2003Document2 pagesJustice 990 2003TheSceneOfTheCrimeNo ratings yet

- Institute For Liberty 202641983 2008 076b44aeDocument4 pagesInstitute For Liberty 202641983 2008 076b44aecmf8926No ratings yet

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926No ratings yet

- Center For Science in The Public Interst (CSPI) IRS 990s, 2001-2014Document487 pagesCenter For Science in The Public Interst (CSPI) IRS 990s, 2001-2014Peter M. HeimlichNo ratings yet

- FreedomWorks Foundation 521526916 2006 0317E2DASearchableDocument25 pagesFreedomWorks Foundation 521526916 2006 0317E2DASearchablecmf8926No ratings yet

- 990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953Document10 pages990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953NC Policy WatchNo ratings yet

- PDC 2006Document10 pagesPDC 2006NC Policy WatchNo ratings yet

- Sarah Scaife Foundation 251113452 2005 02496419searchableDocument47 pagesSarah Scaife Foundation 251113452 2005 02496419searchablecmf8926No ratings yet

- Threshold Foundation 2006 990Document29 pagesThreshold Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Charles G. Koch Charitable Foundation 2004Document34 pagesCharles G. Koch Charitable Foundation 2004cmf8926No ratings yet

- Farview Foundation 2010 990Document36 pagesFarview Foundation 2010 990TheSceneOfTheCrimeNo ratings yet

- David H Koch Charitable Foundation 480926946 2008 05426897Document28 pagesDavid H Koch Charitable Foundation 480926946 2008 05426897cmf8926No ratings yet

- Claude R Lambe Charitable Foundation 480935563 2012 0a025892Document25 pagesClaude R Lambe Charitable Foundation 480935563 2012 0a025892cmf8926No ratings yet

- 2008b 990 PFDocument360 pages2008b 990 PFChristian FaltermeierNo ratings yet

- DT 2007 990Document34 pagesDT 2007 990shimeralumNo ratings yet

- 2008 Form 990 Carpenter Charity FundDocument30 pages2008 Form 990 Carpenter Charity FundLatisha WalkerNo ratings yet

- Farview Foundation 2006 990Document30 pagesFarview Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Lillian Kaplan 2006-300127083-0373d0e6-F-1Document25 pagesLillian Kaplan 2006-300127083-0373d0e6-F-1yadmosheNo ratings yet

- Institute For Humane Studies 941623852 2006 03A6717CDocument15 pagesInstitute For Humane Studies 941623852 2006 03A6717Ccmf8926No ratings yet

- DT 2008 990Document53 pagesDT 2008 990shimeralumNo ratings yet

- Sarah Scaife Foundation 251113452 2013 0a7d2f9dsearchableDocument87 pagesSarah Scaife Foundation 251113452 2013 0a7d2f9dsearchablecmf8926No ratings yet

- Tides Foundation 2008 990Document163 pagesTides Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterNo ratings yet

- David H Koch Charitable Foundation 480926946 2009 0689FA5BDocument23 pagesDavid H Koch Charitable Foundation 480926946 2009 0689FA5Bcmf8926No ratings yet

- Return of Organization Exempt From Income Tax: See '2 312 Hodges Road (252) 523-7700 Tip. Ki Ns Ton NC 2 8 5 0 4Document19 pagesReturn of Organization Exempt From Income Tax: See '2 312 Hodges Road (252) 523-7700 Tip. Ki Ns Ton NC 2 8 5 0 4NC Policy WatchNo ratings yet

- Return of Organization Exempt From Income Tax °'"e"°'5"5-°°"'Document10 pagesReturn of Organization Exempt From Income Tax °'"e"°'5"5-°°"'NC Policy WatchNo ratings yet

- Received: Return of Organization Exempt From Income TaxDocument16 pagesReceived: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- Short Form Form 990-EZ Return of Organization Exempt From Income TaxDocument9 pagesShort Form Form 990-EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrimeNo ratings yet

- Carpenters Charity Fund 2007Document25 pagesCarpenters Charity Fund 2007Latisha WalkerNo ratings yet

- Olive Branch Foundation 2006 990Document28 pagesOlive Branch Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Farview Foundation 2011 990Document34 pagesFarview Foundation 2011 990TheSceneOfTheCrimeNo ratings yet

- The Barbara Streisand Foundation 2006 990Document31 pagesThe Barbara Streisand Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Farview Foundation 2008 990Document38 pagesFarview Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- Barbara and Barrie Seid Foundation 363342443 2011 08e875b6searchableDocument22 pagesBarbara and Barrie Seid Foundation 363342443 2011 08e875b6searchablecmf8926No ratings yet

- Chick-Fil-A 2009 Tax RecordsDocument57 pagesChick-Fil-A 2009 Tax RecordsSergio Nahuel CandidoNo ratings yet

- Olive Branch Foundation 2007 990Document25 pagesOlive Branch Foundation 2007 990TheSceneOfTheCrimeNo ratings yet

- FreedomWorks Foundation 521526916 2007 040FCA34SearchableDocument16 pagesFreedomWorks Foundation 521526916 2007 040FCA34Searchablecmf8926No ratings yet

- Return of Organization Exempt From Income TaxDocument19 pagesReturn of Organization Exempt From Income TaxshimeralumNo ratings yet

- Return of Organization Exempt From Income Tax: - Ogden, UtDocument24 pagesReturn of Organization Exempt From Income Tax: - Ogden, Utcmf8926No ratings yet

- Claude R Lambe Charitable Foundation 480935563 2011 08d6a523Document24 pagesClaude R Lambe Charitable Foundation 480935563 2011 08d6a523cmf8926No ratings yet

- l111l l11l I L, 111I: Lil LilDocument26 pagesl111l l11l I L, 111I: Lil Lilcmf8926No ratings yet

- Short Form - EZ Return of Organization Exempt From Income TaxDocument6 pagesShort Form - EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrime100% (1)

- ECDC 2005 Add-OnDocument2 pagesECDC 2005 Add-OnNC Policy WatchNo ratings yet

- Short Form Return of Organization Exempt From Income TaxDocument9 pagesShort Form Return of Organization Exempt From Income TaxHalosNo ratings yet

- Tsunami Relief Inc. 2005 IRS FormDocument17 pagesTsunami Relief Inc. 2005 IRS FormDealBookNo ratings yet

- Cincinnati Arts Wave IRS Form 990 2009Document42 pagesCincinnati Arts Wave IRS Form 990 2009deanNo ratings yet

- Return of Organization Exempt From Income TaxDocument11 pagesReturn of Organization Exempt From Income TaxEnvironmental Working GroupNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- IRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Document392 pagesIRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Peter M. Heimlich100% (1)

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Direct Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandDirect Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument7 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- MPRWA Agenda Closed Session 10-25-18Document1 pageMPRWA Agenda Closed Session 10-25-18L. A. PatersonNo ratings yet

- Special Meeting Minutes October 1, 2018 11-05-18Document1 pageSpecial Meeting Minutes October 1, 2018 11-05-18L. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- Minutes Mprwa September 27, 2018Document2 pagesMinutes Mprwa September 27, 2018L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City Council Agenda 10-02-18Document3 pagesCity Council Agenda 10-02-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument30 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 10-25-18Document6 pagesMPRWA Agenda Packet 10-25-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Monthly Reports August 10-02-18Document48 pagesMonthly Reports August 10-02-18L. A. PatersonNo ratings yet

- Hybrid Financing: Preferred Stock, Leasing, Warrants, and ConvertiblesDocument2 pagesHybrid Financing: Preferred Stock, Leasing, Warrants, and ConvertiblesKristel SumabatNo ratings yet

- Coronel Vs Capati - DigestDocument2 pagesCoronel Vs Capati - DigestRowena GallegoNo ratings yet

- Milano Pizza: Williamstown's Favorite Pizza ShopDocument36 pagesMilano Pizza: Williamstown's Favorite Pizza ShoptodaysshopperNo ratings yet

- Ariviyal AayiramDocument8 pagesAriviyal AayiramGopinathGnNo ratings yet

- Sip Project On Uco BankDocument117 pagesSip Project On Uco Banksid270878% (9)

- EwrfDocument15 pagesEwrfcamilleNo ratings yet

- (Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionDocument2 pages(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionHRish BhimberNo ratings yet

- First Metro Investment vs. Este. Del SolDocument10 pagesFirst Metro Investment vs. Este. Del Solcmv mendozaNo ratings yet

- Non-S 42 Exceptions To IndefeasibilityDocument42 pagesNon-S 42 Exceptions To IndefeasibilitynegromansirnmNo ratings yet

- Project On State Bank of PakistanDocument41 pagesProject On State Bank of PakistanSaimSafdarNo ratings yet

- HSBC Brand Basic ElementsDocument28 pagesHSBC Brand Basic ElementsRouzbeh HoseinabadiNo ratings yet

- LM LHDocument3 pagesLM LHmuraliMuNo ratings yet

- Aryadhan Financial Solutions - R - 18052018 PDFDocument7 pagesAryadhan Financial Solutions - R - 18052018 PDFCH Nitin TyagiNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- High-Flying Fund May Bar EntryDocument8 pagesHigh-Flying Fund May Bar EntryamvonaNo ratings yet

- Learning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Document5 pagesLearning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Von Violo BuenavidesNo ratings yet

- Class X Social Science (Code 087) Sample Question Paper 2018-19Document15 pagesClass X Social Science (Code 087) Sample Question Paper 2018-19Arijit KarNo ratings yet

- Loan Officer Financial Sales in Houston TX Resume Ralph GardnerDocument1 pageLoan Officer Financial Sales in Houston TX Resume Ralph GardnerRalphGardnerNo ratings yet

- Capital Structure Analysis OF: BY: Group 5Document36 pagesCapital Structure Analysis OF: BY: Group 5Thanga RajNo ratings yet

- Week 2 - Lecture NoteDocument33 pagesWeek 2 - Lecture NoteChip choiNo ratings yet

- Development of Financial Institution in NepalDocument91 pagesDevelopment of Financial Institution in NepalAdy MdrNo ratings yet

- BHEL Valuation FinalDocument33 pagesBHEL Valuation FinalragulNo ratings yet

- Finthech EvolutionDocument44 pagesFinthech EvolutionThéo RoigNo ratings yet

- G.R. No 160408Document5 pagesG.R. No 160408Jake Bryson DancelNo ratings yet

- Basel IIIDocument18 pagesBasel IIIPayal SawhneyNo ratings yet

- Spotting Error Questions PDFDocument66 pagesSpotting Error Questions PDFBalwant ChavanNo ratings yet

- GMADA Permission For Mortage by NutanDocument6 pagesGMADA Permission For Mortage by NutanAnonymous Pyp1vVNo ratings yet

- Greater Thal CanalDocument113 pagesGreater Thal CanalAvais KhanNo ratings yet

FTG Irs Form 990 2004

FTG Irs Form 990 2004

Uploaded by

L. A. PatersonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTG Irs Form 990 2004

FTG Irs Form 990 2004

Uploaded by

L. A. PatersonCopyright:

Available Formats

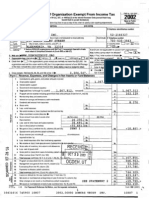

OMS No.

15450047

Return of Organization Exempt from Income Tax

i

'1

2004

Under section 501(c), 527, or 4S47(a)(1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

Department of the Treasury

Internal Revenue Service

Open to Public

Inspection

Number

Check if applicable:

Address

Forest Theatre

change

Guild,

P.O. Box 2325

Carmel, CA 93921

Name change

Initial return

Inc.

Final return

Accrual

Amended return

Application

pending

Contributions, gifts, grants, and similar amounts received:

a Direct public support

b Indirect public support.

c Government contributions (grants)

d Total

(add

la through

lines

lc) (cash

1-.:....::i-----==-=-'-'-=.;....:;-i;Y

107 ,. 826

noncash

L-';"';:~

2

3

Program service revenue including government fees and contracts (from Part VII, line 93)

Membership dues and assessments

I-=-~

I-=-~

Interest on savings and temporary cash investments

1-..:-+-

Dividends and interest from securities

Other investment income (describe. .

1---------+.....:;;.-'+-------1-+-=:-'+

--,

'---------"'--"'---------l

Special events and activities (attach schedule). If any amount is from gaming, check here. . . ..

a Gross revenue (not including

$

of contributions

reported on line 1a)

E

X

P

E

N

S

E

S

~.;...;."'----------.f

Other revenue (from Part VII, line 103)

Total

Program services (from line 44, column (8

Management and general (from line 44, column (C)}

Fundraising (from line 44, column (D

Payments to affiliates (attach schedule)

Total

lines 16 and 44 column

~D

1-;;.;;;.1-

c Grossprofitor (loss)fromsalesof inventory(attachschedule)

(subtractlinelObfromlinelOa)

12

L-'::"':::~--------f'

b Less: direct expenses other than fundraising expenses

C Net income or (loss) from special events (subtract line 9b from line 9a)

lOa Gross sales of inventory, less returns and allowances

.

b Less: cost of goods sold

.

13

14

15

16

I--"-"+---------i't,;i~~~

c Gainor (loss)(attachschedule)

d Net gain or (loss) (combine line Sc, columns (A) and (8

11

-=:""::"::::..L..'::"::'=-=-

~----''-----------r---.----=-:-::~---'-+-~+--------

Sa Gross amount from sales of assets other

than inventory

b Less: cost or other basis and sales expenses

__

6a Gross rents

b Less: rental expenses

c Net rental income or (loss) (subtract line 6b from line 6a)

R

E

V

E

N

U

E

1---'1-

~-=-+~::.......j

~':;""i------

N

E

T

~AA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

-~-------~

::"":'..::....I.:"":::'=-';::-=-

I-=o-=-+-----=-:...!..=-:;...;:....:...

TEEA01071

n1on,lnC

--=:..::...!~:":="":""

__-

form 990 (2004)

Forest

Theatre

Guild

Inc.

23-7227328

Pa e 2

All organizations must complete column (A). Columns (8), (C), and (D) are

for section 501(c)(3) and (4) organizations and section 4947(a)(1) nonexempt charitable trusts but optional for others.

,~ar1:ill~;i."; Statement of Functional Expenses

\

,required

Do not include amounts reported on line

6b, Bb, 9b, lOb, or 16 of Part I.

22 Grantsandallocations

(attsch)

(cash

$

non-cash

$

)........

23 Specificassistance

to individuals

(at! sch) ......

24 Benefitspaidto or for members

(at!sch).......

25 Compensation

of officers,directors,etc.........

Other salaries and wages..............

26

31

Accountingfues

32 Legal fees. . .

33

Supplies

34

Telephone.....

Equ~ment rental and maintenance

Travel

Coofureoce~wnw~oo~a~m~tin~

Interest

39

41

4,640.

(0) Fundraising

4,640.

~3~1~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

..............

38 Printing and publications

40

22

23

24

25

(C) Management

and general

~2:8~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~29~~~~~~2~~~0~2~7~.~~~~~~~~~~~~~~~~~~~~~~~

~3~0~~~~~1~6~,8=2~0~.~~~~~~~~~~~~~~~~~~~~~~~~

35 Postage and shipping

36 Occupancy

37

(B) Program

services

(A) Total

27

28 Other employee benefi~

Payroll taxes

Professional fundraising fees

I:'~~,;:::

26

27 Pension plan contributions .............

29

30

1;:ri,;~1

42 Depre~atio~dep~tio~e~~t!achschedu~)

43 Otherexpenses

notcoveredabove(itemize):

r--::-32=--j1-~~~-=1:..<..:1:...:9:...;8:...;.+~~~~--'~"-'--1r-~~~~--:-.:'-=-'+~~~~---::-::-::-'~33~~~~~~2~fO~81~.~~~~~~~~~~~~~~~~~~~~~~

r--::-34'"'--11-~~~-=2:...L,-=2:...:8:...:8:...;.+~~~~~:....::..:~1-~~~~-'-'~+~

~3:5~~~~~:3~4=5~7~.~~_~--'~~~~~~~~~~~~

~3:6~~~~~~~~~~~

__

~ __

~~~_~

__

~~-=-=~

__

__

~~~~~

~~~~~~~~~~

~3~7~~~~_~~~~~~~~~~~~~~~~~~~~~~_~~~~~

~3=8~~~~~_7~1~9=2~.~_~~~~~~~~~~~~~~~~_~~~~~~

r--::-3~9~

__

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~4~0~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~4~1~~~~~~~~~~~~~~~_~~~~~~~~~~~~~~~~~

~4=2~~~~~~~~~~~~~~~~~~~_~~~~~~~_~~~~~

a~~~~~~J

~~:...:a~~~-=1:...;7-=6~,~3~5~8~.~~~-=1:...:5:...;4~,-=4-=4

__

~1~3~,~2~1~5~.~~

~7~.~

~43:..:b=+-~~~~~~+-~~~~~~-I-~~~~~_--t~~~_~~~

f---=!:43:::.;c~

--+~

~+

__

~8~,_69_6_.

~_~-t

~_

e

44 l'otaituiictionaieXiieiises(add"ifnes"2i-=- .i3f" -I---'.:;..:..~~~~~~~~~-~~~~~~-I-~~~~~~~-+~~~~~--Organizations

compl~tingcolumns(B) - (D),

carrythesetotalstolmes13-15

44

237,061.

170,098.

47,258.

19,705.

1-4..:.:3:...:d=+-_~~_~~~~_~_~_~_~~~_---1~~~_~~_

43e

Joint Costs. Check.

~D if you are following SOP 98-2.

~D

IKl

Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program

services?

. . . . ..

Yes

No

If 'Yes,' enter (i) the aggregate amount of these joint costs

$

; (ii) the amount allocated to Program services

$

; (iii) the amount allocated to Management and general $

; and (iv) the amount allocated

to Fundraisi'l!l

$

IRa'f,t;lIb;:~1Statement of Program Service Accomplishments

What is the organization's primary exempt purposej >

_c.9'!!.mJI!!it'y

_~d}lC!..t.!Q.n...9.J:

_s~f'{.iS~

_

All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number of

9lie(1ts served, Rublications issued, etc. Discuss achievements that are not measurable. (Section 501(c) (3) & (4) orcanizations and 4947(a)(1) nonexempl charitable trusts must also enter the amount of grants & allocations to others.)

ProgramServiceExpenses

(Required for 501 (c)(3) and

(4) organizations

anc

4947(a)(1) trusts: but

optional for others.)

a See

Statement

2

----------------------------------------------------_.

(Grants and allocations $

170,098.

(Grants and allocations $

(Grants and allocations $

d

e Other program services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Grants and allocations $

f Total of Program Service Expenses (should egual line 44, column (8), Program services)

BAA

TEEA0102L

01107/05

)

~

170,098.

Form 990 (2004)

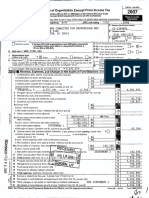

form 99~ (2004)

Forest

!palt\IMY0 Balance

Note:

Theatre

Guild,

Inc.

23-7227328

Sheets (See Instructions)

Cash - non-interest-bearing ................................................

Savings and temporary cash investments ....................................

b Less: allowance for doubtful accounts ......

48a Pledges receivable .........

s

s

. I:i~~'::

" ..................

b Less: allowance for doubtful accounts ............

Grants receivable. .............................

..... ..

56

...........

. . . . ...............

~

~

I~~

51 c

52

53

~D Cost 0

. .........

I~~!

57a

58

36,69Q

~

63

64a

64b

65

through 69 and lines 73 and 74.

67

36 690.

Unrestricted ................................................................

73

Total net assets or fund balances (add lines 67 through 69 or lines 70 through

72; column (A) must equal line 19; column (B) must equal line 21)............

74 Total liabilities and net assetslfund .

"'.,," Jadd lines 66 and 73) ...........

48 946.

60

61

and complete lines 67

68 Temporarily restricted ......................................................

E

69 Permanently restricted. ......................................................

~

0 Organizations that do not follow SFAS 117, check here ~

and complete lines

R

70

through

74.

F

u

70 Capital stock, trust principal, or current funds ................................

N

0

71 Paid-in or capital surplus, or land, building, and equipment fund. ..............

B

72 Retained earnings, endowment, accumulated income, or other funds ..........

c

E

s

"

A

N

li~llt

SSe

.........

b Less: accumulated depreciation

(attach schedule) ................................

57b

58 Other assets (describe ~

}.

59 Total assets (add lines 45 through 58) (must equal line 74) ...................

60 Accounts payable and accrued expenses ....................................

61 Grants payable.............................................................

62 Deferred revenue...........................................................

63 Loansfromofficers,directors,trustees,andkeyemployees

(attachschedule)

..................

64a Tax-exempt bond liabilities (attach schedule) .................................

b Mortgages

andothernotespayable(attachschedule)

............................

'........

65 Other liabilities (describe ~

}.

66 Total liabilities (add lines 60 through 65) ....................................

Organizations that follow SFAS 117, check here ~

54

FMV

55b

Investments - other (attach schedule) ..................

57a Land, buildings, and equipment: basis ............

N

E

Prepaid expenses and deferred charges .....................................

.'j

48c

48b

.

Receivables from officers, directors, trustees, and key

employees (attach schedule) ................................................

51 a Othernotes& loansreceivable

(attachsch)................

51 a

b Less: allowance for doubtful accounts ............

51 b

52 Inventories for sale or use ..................................................

b Less: accumulated depreciation

(attach schedule) .......

.... .......

I';

"

Investments - securities (attach schedule)...............

55a Investments - land, buildings, & equipment: basis 55a

I

E

48 946

I~

I:;~/::~I

47a

4IIJ

......

45

46

50

53

54

L

I

A

B

I

L

I

36,690.

45

46

47 a Accounts receivable .............................

(B)

End of year

(A)

Beginning of year

Where required, attached schedules and amounts within the description

column should be tor end-oi-yesr amounts only.

49

Page 3

66

I~~i?i~

67

0

48 946.

68

IE

2!l

]1

72

I~j:~\:(;~j

36 690. 73

J6 69Q JA

48 946.

48 946

Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular

organization. How the public perceives an organization in such cases may be determined by the information presented on its return. Therefore,

please make sure the return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments.

BAA

TEEA0103L

01/07/05

Forest Theatre

Guild

Inc.

23-7227328

~!!:,!::!:,~'~";UiReconciliation

of Revenue per Audited

Financial Statements with Revenue

per Return

ee instructions.)

Total revenue,gains,andothersupport

per auditedfinancial statements

.

Total expenses and losses per a

financial statements

.

Amounts included on line a but

not on line 12, Form 990:

Amounts included on line' a but not

on line 17, Form 990:

(1) Net unrealized

(1) Donated services and use

of facilities. . . . .. $

gains on

investments. . .. $-------H:i~.~

(2) Donated servo

ices and use

of facilities .....

$

_

(3) Lossesreportedon

line 20,Form990.

. .. $---------1I;~~,f

(4) Other (specify):

Add amountson lines (1) through(4) .

Line a minus line b . , , ..... ' ...

Add amountson lines (1) through(4)... ' ' , .

Line a minus line b ...

Amounts included on line 12,

Form 990 but not on line a:

Amounts included on line 17,

Form 990 but not on line a:

(1) Investmentexpenses

not includedon line

6b, Form990.

. . . .. $-------I'~4;

(2) Other (specify):

(A) Name and address

(1) Investmentexpenses

not includedon line

6b, Form990

.... '" $----~-I;I'iI

(2) Other (specify):

(B) Title and average hours

per week devoted

to position

(C) Compensation

(if not paid,

enter -0-)

21 000.

75

(2) Prioryearadlustmentsreportedon

line 20,Form990.

. .. $---------1I~1li

(4) Other (specify):

of Expenses per Audited

Financial Statements with Expenses

per Return

(3) Recoveriesof prior

year grants. . . . . ..

Pa

~~~!:!lliReconciliation

Did any officer, director, trustee, or key employee receive aggregate compensation of more

than $100,000 from your organization and ali related organizations, of which more than

$10,000 was provided by the related organizations?

If 'Yes,' attach schedule - see instructions.

BAA

(0) Contributions

to

employee benefit

plans and deferred

compensation

O.

~ DYes

[RlNo

Form 990 (2004)

TEEA0104L

01/07/05

23-7227328

Inc.

76

Did the organization engage in any activity not previously reported to the IRS? If 'Yes,'

attach a detailed description of each activity

,

.

Were any changes made in the organizing or governing documents but not reported to the IRS?,

If 'Yes,' attach a conformed copy of the changes.

77

78a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return? .. f-'-:::":::'f---+,-:-=-b If 'Yes,' has it filed a tax return on Form 990T for this year? . , " , , " , , , , , , " , , " , , , , , , , , , , , , , , , , , , ' , , , , " , , , " " , '" I---+"="~=""

79

Was there a liquidation, dissolution, termination, or substantial contraction during the

year? If 'Yes,' attach a statement.

,

,

, .. , , ,

,

,,

, .. , , , . , , , .. , , ,

,,

,,

,,

, , , , .. , , , ,

"

~=--i=d=;;""'"

80 a Is the organization related (other than by association with a statewide or nationwide organization) through common

membership, governing bodies, trustees, officers, etc, to any other exempt or nonexempt organization? , .. , , ... " , ... , r==jl:i:iv;;:g~;;;;;::

b If 'Yes,' enter the name of the organization ~

_N.L~_ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ and check whether it is

81 a Enter direct and indirect political expenditures, See line 81 instructions .....

b Did the organization file Form 1120POL for this year?

TI

,.,..

______

exempt or

' . ..

TInonexempt.

0.

81 a

82 a~~~i~en~~91~1~;ii~~a~e1:i~;e~~~la~~~U~~~~i~.e.s

~.r,t.~~,u~~,~f.~a~~ri~~~'.eq~.ip~~n:,. o~f~,cHi~i~S,

~~.~~.~~a~g~.~r.at

f--.=:::..=.j~--.-:l""":;:""-

b If 'Yes,' you may indicate the value of these items here, Do not include this amount as

revenue in Part I or as an expense in Part II. (See instructions in Part III.) .. , , .... , , ... , , . L....::;82:;;..;;;;JL-..

...;;.;.:'-=f

83a Did the organization comply with the public inspection requirements for returns and exemption applications? ."

".,

b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? .. , , . , .. , , ,

84a Did the organization solicit any contributions or gifts that were not tax deductible? . ,

, , , .. ,. ,

,

,

f--.=:=-ir---:'~--

, , " I--"'~r-.:.~-,,

r~~:w;t~~

b If 'Yes,' did the or~anization include with every solicitation an express statement that such contributions or gifts were

not tax deductible

,,

,

,

,,,

,,

, .. , , .. , ,

, .. , , , , , . , , ,

,,

,,

,,

, . , , . . .. I-=-~I-~'='_

85 50 I(c)(4), (5), or (6) organizations, a Were substantially all dues nondeductible by members?

I--"'~r------'r--b Did the organization make only in-house lobbying expenditures of $2,000 or less?

,,

, .. ,

,,,

,

~::..=.jl-"=t:=.::----.If 'Yes' was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a

waiver for proxy tax owed for the prior year,

c Dues, assessments, and similar amounts from members. ,

, .. , ,

,,

, ... , , ,

, ... ~=I-

"":':':...,:.=.j

r~t-------=~

d Section 162(e) lobbying and political expenditures .. , ... , ,

,,.,,

,

,,.,,

, . , , ..

e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices.,.,

"

" ... ,. ~=If Taxable amount of lobbying and political expenditures (line 85d less 85e) .. , , ,

, , , .. , , , . ~~'-g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f?, , ,

,,

"":':':...,:.=.j

--'-~

,.,,

,,

f--.=:::.aI.II-~'='-

h If section6033(e)(1)(A)

duesnoticesweresent,doestheorganization

agreeto addtheamountonlineSSfto its reasonable

estimateof

duesallocableto nondeductible

lobbyingandpoliticalexpenditures

forthefollowingtaxyear?,, , , .. , , , .. , , , ... , . , ... , . , , .... , , , , . , . , , , ....

86

SOl (c) (7) organizations. Enter: a Initiation fees and capital contributions included on

line 12 .. ,

, .. ,

,

, .. ,

,

"

"

,

,

b Gross receipts, included on line 12, for public use of club facilities, ,

, , .. , , , . , , ,

87

"

501(c)(12) organizations, Enter: a Gross income from members or shareholders,

b Gross income from other sources, (Do not net amounts due or paid to other sources

against amounts due or received from thern.). .. ,

,.,

,

, .. ,

,

,,,

,,

, , ..

r=t-------=~

r~t-------=~

, ... I--"'':'''':O'f--------~

L....::.:....:;.'--

....:.:.:..=j

88

At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership,

or an entity disregarded as separate from the organization under Regulations sections 301,7701-2 and 301,7701-3?

If 'Yes,' complete Part IX. ,

, .. , ,

,

,

,,

, .. ,

,,

,,

,

, .. , , ,

,,,

,

,

89a 501 (c)(3) organizations, Enter: Amount of tax imposed on the organization during the year under:

section 4911 ~

O. ; section 4912 ~

O. ; section 4955 ~----------"-.:..;O.

b 501 (c)(3) and 501 (c)(4) organizations, Did the organization engage in any section 4958 excess benefit transaction

during the year or did it become aware of an excess benefit transaction from a prior year? If 'Yes,' attach a statement

explaining each transaction.

, .. ,

, .. , , ,

,

,

, .. ,

, .. , ,

,,

,,,

,

,

,,,

f~~~~~~

,~~~i~~.:~~,

c ;~~;r~~~~~~~t?~~~X4~~~~lg5~na~~e4'9~~,~i~~~i.O~

,~~.~~~~r~." ~~~~~~~i~i,~~

d Enter: Amount of tax on line 89c, above, reimbursed by the organization. ,

,

,

,

,,

90a List the states with which a copy of this return is filed ~ None

b Number of employees employed in the pay period that indude-;

2004-(Se~ j;,~r~cti~;:)~

91

92

.PEyi_d_~C!F~~r

1'...:.Q._.1?Q.~~~2...?L

_C_a!I1!.e}L _CJI.

The books are in care of ~

Locatedat ~

M;~ 12.

,. ~

O.

O.

J!l!.-_6~.-}..1

ZIP + 4 ~

Section 4947(a)(l) nonexempt charitable trusts filing Form 990 in lieu of Form 7047 - Check here

BAA

L....::;:::..;:..L-.._1-...:;X-=--

~ ~ ~ ~ ~ ~ ~ ~ ~ ~r90

Telephone number ~

and enter the amount of tax-exempt interest received or accrued during the tax year .. " .... ".,

I-"-~=-+

bJ - - - - 0

Jl~2}

~I92 I

N/A

~

N/A

Form 990 (2004)

TEEA0105L

01107/05

orm 99u~(2004)

Forest Theatre Guild

Inc.

23-7227328

l'iRci't1NIHIAnalySIS of lncome-Producinq Activities

Note: Enter gross amounts unless

otherwise indicated.

93

Program

a

b

c

d

e

Unre@!e

(A)

Business code

Page 6

(See instrLJctio~.:

business

income

Excluded by section 512, 511_or 514

(C)

(D)

Exclusioncode

Amount

(B)

Amount

(E)

Related or exempt

function income

service revenue:

Film Series

Theatre Productions,

12 501

128 990

f Medicare/Medicaid

payments ... .... .

g Fees & contracts from government agencies...

94 Membership

dues and assessments ..

95 Interest on savings & temporary cash invmnts..

96 Dividends & interest from securities ..

It~~:1;.,<r;#;c':.

97 Net rental income or (loss) from real estate:

a debt-financed

property. ..............

b not debt-financed

property ...........

98 Net rental income or (loss) from pers prop ....

99 Other investment income ............

100 Gain or (loss) from sales of assets

other than inventory .................

101 Net income or (loss) from special events......

102 Grossprofit or (loss) from sales of inventory.....

103 Other revenue: a

1'":;"E'V,.":~;;xr'; :1,,'

b

~""

~:)

~~'.)';S""4i.~ll~I~,);;;r~t:

;;}~

..-:

'"';;:.'t:',':;":i,c,

I"h',t"-:""~

:~~::'i:b::?Ji#;;.:,,;:y_';:~~';";;:1/;';'"

t~\;'~~~

..,... :,;

;:"

,.:

..~!;J,t.!i:',;",C",';'

c

d

e

141 491.

141.491

104

Subtotal (add columns (B), (D), and (E .....

Total (add line 104, columns (8), (D), and (E .........................................................

Note: Line 705 plus line l d, Part I, should equal the amount on line 72, Part I.

lOS

lieifi't~lII; Relationship of Activities to the Accomplishment of Exempt Purposes

Line No,

N/A

(See instructions.)

Explain how each activity for which income is reported in column (E) of Part VII contributed

of the organization's

exempt purposes (other than by providing funds for such purposes) .

IU~artTIX);Information Regarding Taxable Subsidiaries and Disreqarded Entities

(A)

Percentageof

ownership interest

N/A

to the accomplishment

(See instructions.)

(C)

(B)

Name, address, and EIN of corporation,

partnership,

or disregarded entity

importantly

Nature of activities

(D)

(E)

Total

income

End -of-year

assets

%

%

%

9,.

0

j'r"P.ai1.*'7'\

Information Reqardinq Transfers Associated with Personal Benefit Contracts

(See instructions.)

a Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contract?................

BYes

~NO

No

b Did the organization,

during the year, pay premiums, directly or indirectly, on a personal benefit contract? .........

Yes

Note: If 'Yes' to (b), file Form 8870 and Form 4720 (see instructions).

Underpenaltiesof periu~, I declarethat I haveexaminedthis return,Includingaccompanyingschedulesand statements,and to the bestof my knowledgeand belief. it is

true, correct,and complee. Declarationof preparer (otherthan officer) is basedon altmtormation of whichpreparerhasany knowledge.

Please

Sign

Here

BAA

Date

~

Type or print name and title.

Paid

PreBarer's

se

Only

Signatureof officer

Preparer's

signature

Firm's name (or

yours if selfemployed), ~

address,and

ZIP + 4

J. Daniel Clarke

280 Reeside Ave.

Monterey, CA 93940

Date

Checkif

employed

sett-

EIN

!XlI GeneralInstruction

Preparer'sSSNor PTIN(See

N/A

~ N/A

~ (831)

Phoneno.

TEEA0106L 10103/03

W)

375-6230

Form 990 (2004)

OMS No. 1545-0047

Organization Exempt Under

'SCHEduLE A

I(Form 9~Oor 990EZ)

Section 501(c)(3)

(Except Private Foundation) and Section 501(e), 501(1), 501(k),

501{n), or Section 4947{a){1) Nonexempt Charitable Trust

Supplementary

~ MUST be completed

Information

(See separate

by the above organizations

2004

instructions.)

and attached

to their Form 990 or 990EZ.

Name of the organization

Employer identification number

Forest Theatre Guild

Inc.

23-7227328

'P,iirtli":"'~ Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees

(See instructions.

List each one. If there are none, enter 'None.')

(a) Name and address of each

employee ~aid more

than $ 0,000

(b) Title and average

hours per week

devoted to position

(c) Compensation

(d) Contributions

to employeebenefit

plans and deferred

compensation

(e) Expense

account and other

allowances

None

-------------------------

-------------------------------------------------

------------------------------------------------Total number of other employees

over $50,000 ...................

paid

................

1~;:~[;:;,:,!i'C,

..:

o

'iG.;;\~i...i<!

,7,.""

>~

.,

'.'

"

UBat;t~Wi;'8!(;}1 Compensation of the Five Highest Paid Independent Contractors for Professional Services

(See Instructions.

(a) Name and address

List each one (whether

of each independent

individuals

contractor

or firms).

If there are none, enter 'None.')

paid more than $50,000

(b) Type of service

None

----------------------------------------

Total number of others receiving over

$50,000 for professional

services

,

BAA

For Paperwork

Reduction

Act Notice,

~

see the Instructions

0

for Form 990 and Form 990EZ.

TEEA0401 L

07/22/04

(c) Compensation

23-7227328

nParl:~III;J~f:~1

Statements About Activities

1

(See instructions.)

Yes

No

DUring the year, has the organization attempted to influence national, state, or local legislation, including any attempt

to influence public opinion on a legislative matter or referendum? If 'Yes,' enter the total expenses paid

or incurred in connection with the lobbying activities .... ~ $

NIA

(Must equal amounts on line 38, Part VIA, or line i of Part VIB.)

Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VIA. Other

organizations checking 'Yes' must complete Part VIB AND attach a statement giving a detailed description of the

lobbying activities.

.

During t~e year, .has the organization, either directly or indirectly, engaged in any of the following acts with any

substantial contributors, trustees, directors, officers, creators, key employees, or members of their families, or with any

taxable organization with which any such person is affiliated as an officer, director, trustee, majority owner, or principal

beneficiary? (If the answer to any question is 'Yes,' attach a detailed statement explaining the transactions.)

a Sale, exchange, or leasing of property?

~::"::"f--t---'''--

b Lending of money or other extension of credit?

c Furnishing of goods, services, or facilities?

d Payment of compensation (or payment or reimbursement of expenses if more than $1 ,OOO)?...

2b

2c

2d

e Transfer of any part Ofits income or assets? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. I---'~_--I

3a Do you make grants for scholarships, fellowships, student loans, etc? (If 'Yes,' attach an

explanation of how you determine that recipients qualify to receive payments.)

f-::"::"f--t---'''--

b Do you have a section 403(b) annuity plan for your employees?

f-~f--t---'-"--

4 a ~~dth~uu~a~td\~t~ibtti~~~N~nd~?~.u.~t. ~~r.~.~r~i.c.i~ati.~~

.~~~~~~.~~~~~.~~~.o.r~.

~~~.e.""

b Do

credit counselin

credit

H:~art\IVj?;~'11

Reason for Non-Private Foundation Status

__

or debt

~i~~.t.t~.~~~~~~~.

~~~~~~

services?

I--~I---f---

(See instructions.)

The organization is not a private foundation because it is: (Please check only ONE applicable box.)

5

6

A church, convention of churches, or association of churches. Section 170(b)(1)(A)(i).

A hospital or a cooperative hospital service organization. Section 170(b)(1)(A)(iii).

A Federal, state, or local government or governmental unit. Section 170(b)(1)(A)(v).

A medical research organization operated in conjunction with a hospital. Section 170(b)(1)(A)(iii). Enter the hospital's name, city,

and state

An organizatio~ op;crted fo~the-b-;n~fit ;f~ -;;oli~; ~ ~~v;r~ty ;;-w~~ ~;-ope-;:ated by-ag;;-v;r;:;-~;:;-t~ ~nit.-S-;cti~ 170(b)(1)(A)0v).

(Also complete the Support Schedule in Part IVA.)

A school. Section 170(b)(1)(A)(ii). (Also complete Part V.)

9

10

11 a

0 An

organization that normally receives a substantial part of its support from a governmental unit or from the general public.

Section 170(b)(1)(A)(vi). (Also complete the Support Schedule in Part IVA.)

11 bOA

community trust. Section 170(b)(1)(A)(vi). (Also complete the Support Schedule in Part IVA.)

12

[R] An organization

13

0 An

organization that is not controlled by any disqualified persons (other than foundation managers) and supports organizations

described in: (1) lines 5 through 12 above; or (2) section 501(c)(4) , (5), or (6), if they meet the test of section 509(a)(2). (See

that normally receives: (1) more than 33113%of its support from contributions, membership fees, and gross receipts

from activities related to its charitable, etc, functions - subject to certain exceptions, and (2) no more than 331/3% of its support

from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the

organization after June 30, 1975. See section 509(a)(2). (Also complete the Support Schedule in Part IVA.)

section 509(a)(3).)

Provide the following information about the supported organizations. (See instructions.)

(a) Name(s) of supported organization(s)

14

BAA

0 An organization

(b) Line number

from above

organized and operated to test for public safety. Section 509(a)(4). (See instructions.)

TEEA0402L

07/27104

Schedule A (Form 990 or Form 990EZ) 2004

chedule:A

(Form 990 or 990-EZ) 2004

Forest

Theatre

Guild,

23-7227328

Inc.

Page

~al1~:I'V~jA,.c::lSupportSchedule

Note: You

(Complete only if you checked a box on line 10, 11, or 12.) Use cash method of accounting.

use the worksheet in the insrrnrmorv:

Cal~nd!lr Y!lar (or fiscal year

beginning In). . . . . . . . . . . . . . . . . . . . .

15

17

(e)

Total

Grossreceiptsfrom admissions,

merchandisesold or servicesperformed,

or furnishingof facilities in anyactivity

that is relatedto the organization's

i

.............

18 Grossincomefrom interest,dividends,

138 671.

127 881.

73 090.

113 032.

5 740.

3 080.

36 890.

452 674.

amountsreceivedfrom paymentson

securitiesloans(section512(a)(5,

rents,royalties,and unrelatedbusiness

taxableincome(less section511taxes)

from businesses

by the organafter

.

19 Net incomefrom unrelatedbusiness

activitiesnot includedin line 18

20

sprv,<:o's or

furni

to the

organization by a governmental

unit without charge. Do not

include the value of services or

facilities ge

furnished to

the

.

t"'rlllt!<>c:

N./.A

a Enter 2% of amount in column (e), line 24

b Preparea list for your recordsto showthe nameof andamountcontributedby eachperson(otherthan a governmentalunit or publicly

supportedorganization)whosetotal gifts for 2000through2003exceededthe amountshownin line 26a.Do not file this list with your

return. Enterthe total of all theseexcessamounts

.

c Total support for section 509(a)(1) test: Enter line 24, column (e)

d Add: Amounts from column (e) for lines:

18

22

19

26b

e Public support (line 26c minus line 26d total)

.

f Public su

rcenta

26e

27 Organizations described on line 12:

a For amounts included in lines 15, 16, and 17 that were received from a 'disqualified person,' prepare a list for your records to show the

name of, and total amounts received in each year from, each 'disqualified person.' Do not file this list with your return. Enter the sum of

such amounts for each year:

(2003)

..Q.:... (2002)

Q:.... (2001)

Q:.... (2000)

Q.._

b For any amount included in line 17 that was received from each person (other than 'disqualified persons'), prepare a list for your records to

show the name of, and amount received for eachJear, that was more than the larger of (1) the amount on line 25 for the year or (2)

$5,000. (Include in the list organizations describe in lines 5 through 11, as well as individuals.) Do not file this list with your return. After

computing the difference between the amount received and the larger amount described in (1) or (2), enter the sum of these differences

(the excess amounts) for each year:

(2003)

..Q.:.. (2002)

Q :....(2001)

Q:.... (2000)

Q.._

cAdd:Amountsfromcolumn(e)forlines:

17

452 ,

674.

15

20

d Add: Line 27a total. . . .

O.

e Public support (line 27c total minus line 27d total)

262,350.

16

21

93,361.

27 c

and line 27b total. . . .

0.

1--""27'--d'+-

808

~_

854 095.

27h

28

Unusual Grants: For an organization described in line 10, l l, or 12 that received any unusual grants during 2000 through 2003, prepare a

list for your records to show, for each year, the name of the contributor, the date and amount of the grant, and a brief description of the

nature of the grant. Do not file this list with your return. Do not include these grants in line 15.

BAA

TEEA0403L

07/23/04

Schedule A (Form 990 or 990-EZ) 2004

Schedule A (Form 990 or 990-EZ) 2004

l#areV~N':li:;;1Private

Forest

Theatre Guild,

Inc.

23-7227328

School Questionnaire (See instructions.)

(To be completed ONLY by schools that checked the box on line 6 in Part IV)

29 . Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws,

other governing instrument, or in a resolution of its governing body?

j.,.;:::-"I-:-...,..-r-,...,-.,.

30

Does the organization include a statement of its racially nondiscriminatory policy toward students in all its brochures,

catalogues, and other written communications with the public dealing with student admissions, programs,

and scholarships? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

31

Has the organization publicized its racially nondiscriminatory policy through newspaper or broadcast media during

the period of solicitation for students, or during the registration period if it has no solicitation program, in a way that

makes the policy known to all parts of the general community it serves?

If 'Yes,' please describe; if 'No,' please explain. (If you need more space, attach a separate statement.)

32

Page 4

Does the organization maintain the following:

a Records indicating the racial composition of the student body, faculty, and administrative staff?

f--"o:;;"';;';'/--/--

b Records documenting that scholarships and other financial assistance are awarded on a racially

nondiscriminatory basis? .. _

_

c Copies of all catalogues, brochures, announcements, and other written communications to the public dealing

with student admissions, programs, and scholarships?

d Copies of all material used by the organization or on its behalf to solicit contributions? , ,

~=1i--I--

If you answered 'No' to any of the above, please explain. (If you need more space, attach a separate statement.)

33

Does the organization discriminate by race in any way with respect to:

b Admissions policies".

"

" .. ,

c Employment of faculty or administrative staff? .. ,

,.,",

,."

d Scholarships or other financial assistance?

e Educational policies?

f Use of facilities?,

gAthletic programs?

_

,

,.,.,.,.,.,

,.,

,,.,

_, ,

,.,.

f-'---II--/--

, , . ,. ~~I-_!-_

,

f--"o.;;....;;../--t--

, .. f--"o33,;;..,e"-f-_-+- __

f--"o33,;;...,;;...f /--t--

h Other extracurricular activities? .. , , . , . , .. ,

,

,

,

,

, _.. ,

,,

,.,

,.,

, .. , . , . ,

~~f--I-.

If you answered 'Yes' to any of the above, please explain. (If you need more space, attach a separate statement.)

b Has the organization's right to such aid ever been revoked or suspended?

If you answered 'Yes' to either 34a or b, please explain using an attached statement.

35

BAA

Does the organization certify that it has complied with the applicable requirements of

sections 4.01 through 4,05 of Rev Proc 75-50 1975-2 C.B, 587, covering racial

ndiscrimination? If 'No' attach an

,

,.,.,.,.,

,, .

TEEA0404L

07/23104

''Schedul~

A (Form 990 or 990-EZ)

Forest

2004

Theatre Guild,

Inc.

23-7227328

Page 5

JPaa;:v,HA't~1Lobbying Expenditures by Electing Public Charities

(To be completed

ONLY by an eligible

(The term 'expenditures'

36

Total

organization

means amounts

lobbying

expenditures

to influence

public opinion

37

Total lobbying

expenditures

to influence

a legislative

38

Total lobbying

expenditures

(add lines 36 and 37)

39

Other exempt

purpose

40

Total exempt

41

Lobbying

If the amount

(grassroots

~~l---------+--------

lobbying)

f-.::!-j_--------t--------

body (direct lobbying)

expenditures

amount.

tl

(add lines 38 and 39)

on line 40 is -

The lobbying

nontaxable

table amount

is -

20% of the amount on line 4Q

Over$500,000but not over $1,000,000

$100,000plus 15% of the excessover $500,000

Over$1,000,000but not over $1,500,000

$175,000plus 10% of the excessover $1,000,000

Over$1,500,000but not over $17,000,000

$225,000plus 5% of the excessover $1,500,000

Over $17,000,000

$1,000,000

nontaxable

amount

I-=~j_--------t-------I-=~j_--------t--------

(enter 25% of line 41)

line 42 from line 36. Enter -0- if line 42 is more than line 36

Subtract

~~l---------+-------~~l---------+--------

Enter the amount from the following

Not over $500,000

42Grassroots

43

44

paid or incurred.)

expenditures.

purpose

nontaxable

(See instructions.)

that filed Form 5768)

4 -Year Averaging Period Under Section 501(h)

(Some organizations

that made a section 501 (h) election do not have to complete

See the instructions for lines 45 through 50.)

Lobbying

Calendar year

(or fiscal year

beginning

in) ~

45

Lobbying

amount

Expenditures

all of the five columns

During 4 -Year Averaging

below.

Period

(a)

(b)

(c)

(d)

(e)

2004

2003

2002

2001

Total

nontaxable

.

46

47

48

49

50

Grassroots lobbying

ditures

During the year, did the organization

attempt to influence national, state or local legislation, including

attempt to Influence public opinion on a legislative matter or referendum, through the use of:

any

a Volunteers

(Include

compensation

in expenses

reported

on lines c through

h.)

t---t--

1--1----1r--------1-_1--1

_

1--+----1r--------1-_1--1

_

1--+----11--------

c Media advertisements

to members,

e Publications,

legislators,

or published

h Rallies,

with legislators,

demonstrations,

Total lobbying

or the public

or broadcast

f Grants to other organizations

g Direct contact

No

1----1--

b Paid staff or management

d Mailings

Yes

purposes

their staffs, government

seminars,

expenditures

statements

for lobbying

conventions,

(add lines c through

officials,

speeches,

or a legislative

lectures,

body

or any other means

h.)

~~~,--j

~~":-':"..:....:IL..-.

If 'Yes' to any of the above, also attach a statement giving a detailed description of the lobbying activities.

BAA

TEEA0405L

07/23104

Schedule

A (Form 990 or 990-EZ)

2004

~cheduleJA (Form 990or 990-EZ)2004

Forest

Theatre

Guild,

Inc.

23-7227328

Page 6

l~artMm~,llnformation Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt. Organizations

51

(See instructions)

Did .the reporting organization directly or indirectly engage in any of the following with any other organization described in section 501(c)

of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations?

Yes No

a Transfers from the reporting organization to a noncharitable exempt organization of:

X

(i)Cash

. 51 a (i)

a (ii)

X

(ii)Other assets

.

b Other. transactions:

b (i)

X

(i) Sales or exchanges of assets with a noncharitable exempt organization

.

b (ii)

X

(ii)Purchases of assets from a noncharitable exempt organization

.

(iii) Rental of facilities, equipment, or other assets

(iv)Reimbursement

arrangements

b (iii)

III

(iv'

b (v)

b (vi

(v)Loans or loan guarantees. . . . . . . . . . . . . . . . . . . . . . . . .

...............................

.

.

(vi)Performance of services or membership or fundraising soucitations

,

, .. , . , .. , . , .. , , .. , , . ',' , , , , .

X

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees

.

c

d If the answer to any of the above is 'Yes,' complete the following schedule, Column (b) should always show the fair market vaiue of

th e ~oo d s, 0 th er asse ts, or services

..

. tiion. If th e orqaruzarIon receive

. cf Iess than taiair mar ket vaIue In

given by th e re~or tiIn~(or~anlza

anv ransaction or sharing arrangement, show in co umn d) t e value of the qoods, other assets, or services received:

(a)

(b)

(d)

~c)

Line no.

Amount involved

Description

oftransfers,transactions,

andsharingarrangements

Name of noncharitab e exempt organization

N/A

52 a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations

described in section 501(c) of the Code (other than section 501(c)(3)) or in section 52?? . , .. '

b If 'Yes', complete the following schedule'

(a)

Name of organization

(b)

Type of organization

, .. ~

D Yes

No

(c)

Description of relationship

N/A

BAA

Schedule A (Form 990 or 990-EZ) 2004

TEEA0406L

11/29/04

2004

Page 1

Federal Statements

23-7227328

Forest Theatre Guild, Inc.

Statement 1

Form 990, Part II, Line 43

Other Expenses

(A)

,-

Total

4,800.

5,160.

2,833.

Artistic Director

Bank charges

Insurance

Marketing

Miscellaneous admin

Production Costs

Rent

Ticket Manager

Workers Comp Insurance & Fees

Total $

(B)

Program

Services

4,800.

2,967.

19,713.

3,544.

135,915.

1,980.

90.

2323.

176358. $

(D)

(C)

Management

& General

Fundraising

2,193.

944.

945.

944.

6,571.

6,572 .

6,570.

1,18I.

135,915.

1,980.

90.

1,18I.

1,182.

2323.

13215. $

154447. $

8696.

Statement 2

Form 990, Part III, Line a

Statement of Program Service Accomplishments

Description

Education of performers, musicians, & theatre technicians

creating, producing and performing stage productions of

"Evita" and "The Sound of Music" and other performances for

4000 or more people in the community for a period of 10 to

14 weeks at the Forest Theatre.

Program

Service

Expenses

Grants and

Allocations

170,098.

170098.

=$====O=:. $

Statement 3

Form 990, Part V

List of Officers, Directors, Trustees, and Key Employees

Name and Address

Lorel Farber

P.O. Box 7284

Carmel, CA 93921

Title and

Average Hours

Per Week Devoted

Secretary

2-4

Expense

Account/

Other

Contribution to

EBP & DC

Compensation

O.

O.

O.

Safwat Malek

P.O. Box 1734

Pebble Beach, CA 93953

Vice President

2-4

O.

O.

o.

Brian Grossi

3012 Cormorant Road

Pebble Beach, CA 93953

President

1-2

O.

O.

O.

2004

Page 2

Federal Statements

23-7227328

Forest Theatre Guild, Inc.

Statement ~ (continued)

Form 990, Part V

List of Officers, Directors, Trustees, and Key Employees

Name and Address

Title and

Average Hours

Per Wek Devoted

Expense

Account!

Other

Contribution .t o

~BP & DC

Compensation

Dave Parker

1072 Navajo Road

Pebble Beach, CA 93953

Treasurer

Hamish Tyler

25 Sandpiper Road

Seaside, CA 93955

Executive Direc

5-10

O.

o.

O.

Mia McKee

P.O. Box 223462

Carmel, CA 93922

Trustee

0-1

O.

O.

O.

Holly Stock

P.O. Box 6554

Carmel, CA 93921

Mgr Director

30-40

21,000.

O.

O.

Wendy Buck

5 Harris Court

Monterey, CA 93940

Legal Advisor

1-2

O.

O.

O.

Nancy Budd

25 Glen Lake Drive

Pacific Grove, CA 93950

Trustee

1-2

O.

O.

O.

Joan Palasota

P.O. Box 22070

Carmel, CA 93922

Trustee

1-2

O.

O.

O.

Wayne Faber

P.O. Box 7284

Carmel, CA 93921

Vice President

2-4

O.

O.

O.

Barbara Mossberg

P.O. Box 97

CArmel, CA 93921

Trustee

1-2

O.

o.

O.

Christina Harland

P.O. Box 6414

Carmel, CA 93921

Trustee

1-2

O.

O.

O.

Baird Pittman

25579 Morse Drive

Carmel, CA 93923

Trustee

1-2

O.

o.

O.

Sue Storm

21009 Century Park Road

Salinas, CA 93908

Trustee

1-2

O.

o.

O.

2-4

O.

O.

O.

2004

Page 3

Federal Statements

23-7227328

Forest Theatre Guild, Inc.

Statement 3 (continued)

Form 990, Part V

list of Officers, Directors, Trustees, and Key Employees

Name and Address

Michel Willey

P.O. Box 3773

Carmel, CA 93921

Robert Hale

242 Crossroads Blvd

Carmel, CA 93923

Title and

Average Hours

Per Week Devoted

Trustee

1-2

Trustee

1-2

O.

O.

Total $

Expense

Account/

Other

Contribution to

EBP & DC

Compensation

21/000. $

O.

O.

O.

O.

O. $

O.

You might also like

- Real Estate ProjectDocument63 pagesReal Estate Projectmeetabhishek_kgp90% (10)

- T4 AA Retail PDFDocument481 pagesT4 AA Retail PDFShaqif Hasan Sajib100% (2)

- FTG Irs Form 990 2006Document19 pagesFTG Irs Form 990 2006L. A. PatersonNo ratings yet

- FTG Irs Form 990 2005Document17 pagesFTG Irs Form 990 2005L. A. PatersonNo ratings yet

- Cfi - Fy2004 - F990Document37 pagesCfi - Fy2004 - F990Didi RemezNo ratings yet

- Short Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921Document3 pagesShort Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921lesliebrodieNo ratings yet

- LJ LJ: Return of Organization Exempt From Income TaxDocument20 pagesLJ LJ: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- Bloomberg Family Foundation 2008 Tax ReturnDocument105 pagesBloomberg Family Foundation 2008 Tax ReturnCeleste KatzNo ratings yet

- East Carolina Development Co Inc 56-2044953: Neon Trust or Private Rwraabon)Document10 pagesEast Carolina Development Co Inc 56-2044953: Neon Trust or Private Rwraabon)NC Policy WatchNo ratings yet

- ExxonMobil Foundation 2005 990PFDocument174 pagesExxonMobil Foundation 2005 990PFJustin ElliottNo ratings yet

- David H Koch Charitable Foundation 480926946 2006 0325BAD4Document24 pagesDavid H Koch Charitable Foundation 480926946 2006 0325BAD4cmf8926No ratings yet

- Justice 990 2003Document2 pagesJustice 990 2003TheSceneOfTheCrimeNo ratings yet

- Institute For Liberty 202641983 2008 076b44aeDocument4 pagesInstitute For Liberty 202641983 2008 076b44aecmf8926No ratings yet

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926No ratings yet

- Center For Science in The Public Interst (CSPI) IRS 990s, 2001-2014Document487 pagesCenter For Science in The Public Interst (CSPI) IRS 990s, 2001-2014Peter M. HeimlichNo ratings yet

- FreedomWorks Foundation 521526916 2006 0317E2DASearchableDocument25 pagesFreedomWorks Foundation 521526916 2006 0317E2DASearchablecmf8926No ratings yet

- 990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953Document10 pages990 Return of Organization Exempt From Income Tax: Use IRS East Carolina Development CO, INC 56-2044953NC Policy WatchNo ratings yet

- PDC 2006Document10 pagesPDC 2006NC Policy WatchNo ratings yet

- Sarah Scaife Foundation 251113452 2005 02496419searchableDocument47 pagesSarah Scaife Foundation 251113452 2005 02496419searchablecmf8926No ratings yet

- Threshold Foundation 2006 990Document29 pagesThreshold Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Charles G. Koch Charitable Foundation 2004Document34 pagesCharles G. Koch Charitable Foundation 2004cmf8926No ratings yet

- Farview Foundation 2010 990Document36 pagesFarview Foundation 2010 990TheSceneOfTheCrimeNo ratings yet

- David H Koch Charitable Foundation 480926946 2008 05426897Document28 pagesDavid H Koch Charitable Foundation 480926946 2008 05426897cmf8926No ratings yet

- Claude R Lambe Charitable Foundation 480935563 2012 0a025892Document25 pagesClaude R Lambe Charitable Foundation 480935563 2012 0a025892cmf8926No ratings yet

- 2008b 990 PFDocument360 pages2008b 990 PFChristian FaltermeierNo ratings yet

- DT 2007 990Document34 pagesDT 2007 990shimeralumNo ratings yet

- 2008 Form 990 Carpenter Charity FundDocument30 pages2008 Form 990 Carpenter Charity FundLatisha WalkerNo ratings yet

- Farview Foundation 2006 990Document30 pagesFarview Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Lillian Kaplan 2006-300127083-0373d0e6-F-1Document25 pagesLillian Kaplan 2006-300127083-0373d0e6-F-1yadmosheNo ratings yet

- Institute For Humane Studies 941623852 2006 03A6717CDocument15 pagesInstitute For Humane Studies 941623852 2006 03A6717Ccmf8926No ratings yet

- DT 2008 990Document53 pagesDT 2008 990shimeralumNo ratings yet

- Sarah Scaife Foundation 251113452 2013 0a7d2f9dsearchableDocument87 pagesSarah Scaife Foundation 251113452 2013 0a7d2f9dsearchablecmf8926No ratings yet

- Tides Foundation 2008 990Document163 pagesTides Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterNo ratings yet

- David H Koch Charitable Foundation 480926946 2009 0689FA5BDocument23 pagesDavid H Koch Charitable Foundation 480926946 2009 0689FA5Bcmf8926No ratings yet

- Return of Organization Exempt From Income Tax: See '2 312 Hodges Road (252) 523-7700 Tip. Ki Ns Ton NC 2 8 5 0 4Document19 pagesReturn of Organization Exempt From Income Tax: See '2 312 Hodges Road (252) 523-7700 Tip. Ki Ns Ton NC 2 8 5 0 4NC Policy WatchNo ratings yet

- Return of Organization Exempt From Income Tax °'"e"°'5"5-°°"'Document10 pagesReturn of Organization Exempt From Income Tax °'"e"°'5"5-°°"'NC Policy WatchNo ratings yet

- Received: Return of Organization Exempt From Income TaxDocument16 pagesReceived: Return of Organization Exempt From Income Taxcmf8926No ratings yet

- Short Form Form 990-EZ Return of Organization Exempt From Income TaxDocument9 pagesShort Form Form 990-EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrimeNo ratings yet

- Carpenters Charity Fund 2007Document25 pagesCarpenters Charity Fund 2007Latisha WalkerNo ratings yet

- Olive Branch Foundation 2006 990Document28 pagesOlive Branch Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Farview Foundation 2011 990Document34 pagesFarview Foundation 2011 990TheSceneOfTheCrimeNo ratings yet

- The Barbara Streisand Foundation 2006 990Document31 pagesThe Barbara Streisand Foundation 2006 990TheSceneOfTheCrimeNo ratings yet

- Farview Foundation 2008 990Document38 pagesFarview Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- Barbara and Barrie Seid Foundation 363342443 2011 08e875b6searchableDocument22 pagesBarbara and Barrie Seid Foundation 363342443 2011 08e875b6searchablecmf8926No ratings yet

- Chick-Fil-A 2009 Tax RecordsDocument57 pagesChick-Fil-A 2009 Tax RecordsSergio Nahuel CandidoNo ratings yet

- Olive Branch Foundation 2007 990Document25 pagesOlive Branch Foundation 2007 990TheSceneOfTheCrimeNo ratings yet

- FreedomWorks Foundation 521526916 2007 040FCA34SearchableDocument16 pagesFreedomWorks Foundation 521526916 2007 040FCA34Searchablecmf8926No ratings yet

- Return of Organization Exempt From Income TaxDocument19 pagesReturn of Organization Exempt From Income TaxshimeralumNo ratings yet

- Return of Organization Exempt From Income Tax: - Ogden, UtDocument24 pagesReturn of Organization Exempt From Income Tax: - Ogden, Utcmf8926No ratings yet

- Claude R Lambe Charitable Foundation 480935563 2011 08d6a523Document24 pagesClaude R Lambe Charitable Foundation 480935563 2011 08d6a523cmf8926No ratings yet

- l111l l11l I L, 111I: Lil LilDocument26 pagesl111l l11l I L, 111I: Lil Lilcmf8926No ratings yet

- Short Form - EZ Return of Organization Exempt From Income TaxDocument6 pagesShort Form - EZ Return of Organization Exempt From Income TaxTheSceneOfTheCrime100% (1)

- ECDC 2005 Add-OnDocument2 pagesECDC 2005 Add-OnNC Policy WatchNo ratings yet

- Short Form Return of Organization Exempt From Income TaxDocument9 pagesShort Form Return of Organization Exempt From Income TaxHalosNo ratings yet

- Tsunami Relief Inc. 2005 IRS FormDocument17 pagesTsunami Relief Inc. 2005 IRS FormDealBookNo ratings yet

- Cincinnati Arts Wave IRS Form 990 2009Document42 pagesCincinnati Arts Wave IRS Form 990 2009deanNo ratings yet