Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

You might also like

- Accounting Text & Cases Ed 13th Case 6-3Document1 pageAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNo ratings yet

- MAS - Agamata - 2012 Ed. (Solution Manual)Document175 pagesMAS - Agamata - 2012 Ed. (Solution Manual)King Mercado100% (2)

- Nike, Inc Cost of CapitalDocument6 pagesNike, Inc Cost of CapitalSilvia Regina100% (1)

- Quiz Home Office and Branch AccountingDocument4 pagesQuiz Home Office and Branch AccountingJhaybie San Buenaventura50% (2)

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results 201920Document26 pagesFinancial Results 201920Ankush AgrawalNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Jaihind Synthetics Limited: S BusDocument4 pagesJaihind Synthetics Limited: S BusShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Exercises 4Document19 pagesExercises 4Mrcool AtifNo ratings yet

- Foundations in Accountancy FFA/ACCA FDocument94 pagesFoundations in Accountancy FFA/ACCA FTrần Thu TrangNo ratings yet

- Cost Chapter 15Document13 pagesCost Chapter 15Marica Shane100% (3)

- Testbanks PrelimsDocument32 pagesTestbanks PrelimsSharmaine LiasosNo ratings yet

- Listed Company ProjectDocument43 pagesListed Company ProjectAditi MahaleNo ratings yet

- ch03 Part7Document6 pagesch03 Part7Sergio HoffmanNo ratings yet

- ACC 202 Project WorkbookDocument11 pagesACC 202 Project WorkbookKarli KulpNo ratings yet

- Ratio Analysis Example 1 Solution With CommentsDocument5 pagesRatio Analysis Example 1 Solution With CommentsMohammad AnisuzzamanNo ratings yet

- Ias7/Mfrs 107 Statement of Cash Flows: Yousuf SiyamDocument13 pagesIas7/Mfrs 107 Statement of Cash Flows: Yousuf Siyameidbadshah zazaiNo ratings yet

- CH 02Document53 pagesCH 02Linh Trần Thị KhánhNo ratings yet

- Module 1Document11 pagesModule 1Karelle MalasagaNo ratings yet

- Exercise 9-4 ADocument3 pagesExercise 9-4 AArdilla Noor Paramashanti WirahadikusumaNo ratings yet

- Single Entry Bookkeeping SystemDocument3 pagesSingle Entry Bookkeeping System=shey=No ratings yet

- Prepare The Report Form of Balance Sheet 2. Compute The Results of Operation 3. Explain The Effect of Net Income/loss On Owner's EquityDocument4 pagesPrepare The Report Form of Balance Sheet 2. Compute The Results of Operation 3. Explain The Effect of Net Income/loss On Owner's EquityRevise PastralisNo ratings yet

- R. Geetha Priya: S Cafe Coffee Shop Business Plan Project ReportDocument18 pagesR. Geetha Priya: S Cafe Coffee Shop Business Plan Project ReportMohan Lal KalyankarNo ratings yet

- Accounting EquationDocument12 pagesAccounting EquationAishah Rafat Abdussattar100% (1)

- Accounting Cycle of A Service BusinessDocument27 pagesAccounting Cycle of A Service BusinessTariga, Dharen Joy J.No ratings yet

- Fa 2Document2 pagesFa 2vietdung25112003No ratings yet

- Prelims - Basic AccountingDocument10 pagesPrelims - Basic AccountingBlairEmrallafNo ratings yet

- Module I. Business Combination - Date of Acquisition (NA)Document13 pagesModule I. Business Combination - Date of Acquisition (NA)Melanie SamsonaNo ratings yet

- Module 5 QuestionsDocument5 pagesModule 5 QuestionsJester MartinNo ratings yet

- Income Flows Versus Cash Flows: Understanding The Statement of Cash FlowsDocument26 pagesIncome Flows Versus Cash Flows: Understanding The Statement of Cash Flowscarlos chavesNo ratings yet

- 7792 A Ncs 015 2021 Entrepreneurial Finance PDFDocument34 pages7792 A Ncs 015 2021 Entrepreneurial Finance PDFlilibaharom.kelabmgtNo ratings yet

- Segmented ReportingDocument36 pagesSegmented ReportingmakrocbNo ratings yet

- Presentation On "Funds Flow & Cash Flow Analysis"Document15 pagesPresentation On "Funds Flow & Cash Flow Analysis"Chaitanya PrasadNo ratings yet

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

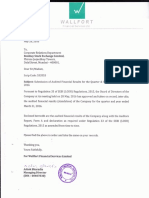

/'

PRIME

Ju~,2016

~~::ate Relationship Department

Bombay Stock Exchange Limited

Phiroze Jeejeebhoy Towers, Dalal Street,

Fort, Mumbai 400001

Capital Markets-Listing

National Stock Exchange of India Ltd

Exchange Plaza, 5th Floor, Plot No. CII,

G Block, Bandra Kurla Complex, Bandra (East),

Mumbai 400051

Dear Sir,

Sub:

Regulation 33 of Securities and Exchange Board of India (Listing Obligations

and Disclosure Requirements) Regulations, 2015

Re:

Stock Code: 500337 (BSE) I PRIMESECU (NSE)

Pursuant to the provisions of regulation 33 of the Securities and Exchange Board of India

(Listing Obligations and Disclosure Requirements) Regulations, 2015, the board of directors

of the Company, at their meeting held today, have taken on record the unaudited financial

results of the Company for the quarter ended June 30, 2016.

Please find attached the following:

1. Unaudited financial results (Standalone) for the quarter ended June 30, 2016;

2. Limited review report by the statutory auditors on unaudited financial results

(Standalone) for the quarter ended June 30,2016;

3. Unaudited financial results (Consolidated) for the quarter ended June 30,2016

Please note that the unaudited financial results will be published in the newspapers as per the

provisions of regulation 47 of the Securities and Exchange Board of India (Listing

Obligations and Disclosure Requirements) Regulations, 2015.

This is for your information and records.

P~~~~~4~S

Limited

Prime Securities Limited

1109/1110, Maker Chambers V,

Nariman Point, Mumbai 400 021.

CIN: L67120MH1982PLC026724

Tel: +91-22-61842525

Fax: +91-22-2497 0777

PRIME SECURITIES LIMITED

Regd. Office: 1109/1110, Maker Chambers V, Nariman Point, Mumbai 400021 (CIN: L67120MHI982PLC026724)

Tel: +91-22-61842525 Fax: +91-22-24970777 Website: www.primesec.comEmail:prime@primesec.com

PRJM~)

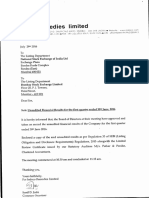

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED JUNE 30, 2016

Amt Rs. Lacs

Quarter

Quarter

Year

Quarter

..t;lqged

ended

ended

ended

30-1un-16 31-Mar-16 30-Jun-1531-Mar-16

1. Income from Operations

Income from Operations

Other Operating Income

I 'fotaImcome from Operations

Expenses

.

Employee Benefit Expense

I Depreciation & Amortisation Expense

Fixed Assets Written-off

Other Expenses

Total Expenses

13. Profit I (Loss) from Operations before Other Income,

Finance Cost & Exceptional Items

14. Other Income

15. Profitl (Loss) froID Ordinary Adivities before

Finance Cost and EiCeptiooalItems .

16. Finance Cost ... .... .

..

12

1

.1",

318

575

63

1,041

318

575

63

1,041

22

3

70

16

21

56

81

237

6

(2)

72

146

429

76

(13)

118

63

70

212

463

578

194

431

43

472

(158)

(171)

(104)

474

39

(1)

472

(171)

Profit! (LOss)from OrdiQary Activities.aft1.'

431

473

FUlance (:ost but before ExceP90nai I~~s .

8. Diminution in Value ofInvestments

995

99

350

(~)

19. Other (Provisions I Write offs) I Write Backs

1,468

110. Profit! (Loss) from OrdinaryAdivities before Tax

530

422

179

!11. Tax Expenses

(146)

63

! - Current Tax

109

36

I - Income Tax ofEarlier Years

112. Net Profit I (Loss) for the Period

143

1,405'

421

568

! l3. Paid-up Equity Share Capital (Face Value Rs. 51- each)

1,328

1,328

1,328

1,328

! 14. Reserves (excluding Revaluation Reserves)

15. Earnings per Share (in Rs. not annualised)

(Equity Shares ofFV ofRs. 51- each)

\

1.59

2.14

0.54

5.31

- Basic EPS before and after Extraordinary Items

I - Diluted EPS before(lIl~=aft=er~E=x=tra=o=rd=in=ary~It=em=,,-s_ _ _ _~_-=1.=5"_9_ _--=:2.=14_'___ __=0;.;.:.54_'___ __=5..:;:.3'_'1_'

Notes:

1. The above results were reviewed by the Audit Committee and taken on record by the Board of Directors at its

Meeting held on July 26, 2016.

2 Pursuant to Clause 41 of the Listing Agreement, the Statutory Auditors have carried out a Limited Review of the

results.

3. Other Income includes Gain/(Loss) on Investments.

4. The Auditors ofthe Company in their Limited Review Report for the Quarter ended June 30, 2016 and Audit Report for

the Year ended March 31,2016 have recorded their views about the following:

a) No provision has been made in the carrying value of financial exposure in the subsidiary having regard to the

erosion in the net worth. Management clarification: The management is cotifident of generating sufficient

income to restore its networth.

b) Write-back of unsecured loan. Management clarification: The said unsecured loan is no longer payable.

c) Non-provision for diminution in the value of non-current investments. Management clarification: No provision

for diminution is required as the same is oftemporary nature.

5. The Auditors of the Company in their Audit Report for the Year ended March 31, 2016 have recorded their views

about the following:

a) No adjustments have been made in the carrying value of the assets and liabilities in the financial statements

prepared on a going concern basis. Management clarification: The management has since, succesfully concluded

discussions with lenders and has restroctured the obligations. This observation, is therefore, no longer valid.

b) Assignment ofloan to subsidiary company pending consent oflender. Management clarification: The Company

is in the process ofnegotiating terms with the lender.

c) Unable to ascertain impact ofoutstanding inter-corporate deposits received by the Company, in respect of which

confirmation ofbalances, terms ofrepayment & charges ofinterest are not available. Management clarification:

These are unsecured advances, terms ofwhich the Company is in the process ofnegotiation.

d) Non-provision ofinterest on certain secured loans, which would have increased the amount of secured loans had

the provision been made. Management clarification: The management has since, succesfully concluded

discussions with lenders and has restroctured the obligations.

6. The Company does not have any identifiable segment as required by Accounting Standard 17 issued by ICAI.

7. Previous period figures have be

ed I re-classified wherever necessary.

17.

Mumbai

July 26, 2016

HEAD OFFICE: BRANCH OFFICE:

208 Han Chambers, 2nd Floor, 28/32 Bank Street, 2nd Floor,

58/64 Shahid Bhagat Singh Road, G. N. Vaidya Marg,

Fort, Mumbai - 400 001 Fort. Mumbai - 400001

Tel: 66104832 Tel.: 22664510

cityoffice@gandhi-associates.com

To,

The Board of Directors

Prime Securities Limited

We have reviewed the accompanying statement of standalone unaudited financial

results of Prime Securities Limited (the 'Company') for the quarter ended 30th June

2016 being submitted by the Company pursuant to the requirements of Regulation 33 of

the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

This statement is the responsibility of the Company's Management and has been

approved by the Board of Directors. Our responsibility is to issue a report on these

financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE)

2410, "Review of Interim Financial Information Performed by the Independent Auditor of

the EntityH issued by the Institute of Chartered Accountants of India. This standard

requires that we plan and perform the review to obtain moderate assurance as to

whether the financial statements are free of material misstatement. A review is limited

primarily to inquiries of company personnel and analytical procedures applied to

financial data and thus provide less assurance than an audit. We have not performed an

audit and accordingly, we do not express an audit opinion.

Attention is invited to the following:

(a) During the quarter, the Company has written-back Rs. 175 Lacs being part of an

unsecured loan based on the management's assessment of the situation. Had the

Company not made such write-back, the profit for the quarter would have been

lower by that amount.

(b) The Company has substantial financial exposure in its subsidiary Primesec

Investments Limited whose net worth has been eroded; but having regard to the

negotiations with lender and realization of investments by the subsidiary; no

provision/adjustment is made to the carrying amount of financial exposure in the

subsidiary.

HEAD OFFICE : BRANCH OFFICE:

208 Han Chambers, 2nd Floor, 28/32 Bank Street, 2nd Floor,

58/64 Shahid Bhagat Singh Road, G. N. Vaidya Marg.

Fort, Mumbai - 400 001 Fort, Mumbai - 400001

Tel: 6610 4832 Tel.: 2266 4510

cityoffice@gandhi-associates.com

(c) As per the Company's policy, diminution in value of investments is determined only

th

at financial year-end. Consequently, diminution of Rs.1,016.96 Lacs as on 30 June

2016 is not accounted.

Based on our review conducted as above and subject to clauses (a) to (e) above nothing

has come to our attention that causes us to believe that the accompanying statement of

standalone unaudited financial results prepared in accordance with applicable

accounting standards notified under section 133 of the Companies Act 2013 read with

relevant rules issued there under and other recognized accounting practices and policies

has not disclosed the information required to be disclosed in terms of Regulation 33 of

the SEBI (listing Obligations and Disclosure Requirements) Regulations, 2015 including

the manner in which it is to be disclosed, or that it contains any material misstatement.

For GANDHI & ASSOCIATES

Chartered Accountants

[FRN: 102965W}

Partner

Membership No. 043194

Place: Mumbai

th

Dated: 26 July 2016

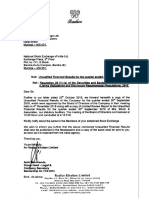

PRIME SECURITIES LIMITED - CONSOLIDATED

Regd. Office: II 09/1110, Maker Chambers V, Nariman Point, Mumbai 400021 (CIN: L67120MHI982PLC026724)

Tel: +91-22-61842525 Fax: +91-22-24970777 Website: www.primesec.comEmail:prime@primesec.com

PRIME.) "

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED JUNE 30, 2016

Amt Rs. Lacs

Quarter

ended

30-Jun-16

Quarter

ended

31-Mar-16

Year

Quarter

ended

ended

30-Jun-15 31-Mar-16

(Audited)

1. Income from Operations

63

1,041

Income from Operations

318

575

Other Operating Income

63

1,041

318

575

TotalIBcome from Operations

2 Expenses

24

149

Employee Benefit Expense

30

79

12

28

85

Depreciation & Amortisation Expense

9

Fixed Assets Written-off

(2)

70

225

Other Expenses

40

57

81

529

Total Expenses

170

92

96

3. Profltl(LOss) from Operations before Other Income,

222

(29)

512

405

Finance Cost & Exceptional Items

4. Other Income

194

(261)

150

395

(290)

662

5. Profit/ (Loss) from Ordinary Activities before

416

800

Finance Cost and Exceptional Items

(1)

6. Finance Cost

(290)

661

7. Profit / (Loss) from OrdinaryActivities after

416

800

FinanceCost but before Exceptional Items

8. Diminution in Value ofInvestments

(270)

823

9. Other (Provisions / Write offs) / Write Backs

99

350

1,484

10. Profit/ (Loss) from Ordinary Activities before Tax

515

ro

530

11. Tax Expenses

64

109

36

- Current Tax

(146)

Deferred Tax

24

1,420

12. Net Profit / (Loss) for the Period

406

676

1,328

13. Paid-up Equity Share Capital (Face Value Rs. 5/- each)

1,328

1,328

1,328

14. Reserves (excluding Revaluation Reserves)

15. Earnings per Share (in Rs. not annualised)

(Equity Shares ofFV ofRs. 5/- each)

5.36

2.55

0.09

1.53

- Basic EPS before and after Extraordinary Items

5.36

2.55

0.09

1.53

- Diluted EPS before and after Extraordinary Items

Notes:

1. The above results were reviewed by Audit Committee and taken on record by the Board ofDirectors at its Meeting

held on July 26, 2016.

2. Other Income includes Gain / (Loss) on Investments.

2 Previous period figures have been re-grouped / re-classified wherever necessary.

For1;ime,s;.urities Limite

M,I"I-"

Mumbai

July 26, 2016

.,

~Jayakumar

Managing Director..J

You might also like

- Accounting Text & Cases Ed 13th Case 6-3Document1 pageAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNo ratings yet

- MAS - Agamata - 2012 Ed. (Solution Manual)Document175 pagesMAS - Agamata - 2012 Ed. (Solution Manual)King Mercado100% (2)

- Nike, Inc Cost of CapitalDocument6 pagesNike, Inc Cost of CapitalSilvia Regina100% (1)

- Quiz Home Office and Branch AccountingDocument4 pagesQuiz Home Office and Branch AccountingJhaybie San Buenaventura50% (2)

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results 201920Document26 pagesFinancial Results 201920Ankush AgrawalNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Jaihind Synthetics Limited: S BusDocument4 pagesJaihind Synthetics Limited: S BusShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Exercises 4Document19 pagesExercises 4Mrcool AtifNo ratings yet

- Foundations in Accountancy FFA/ACCA FDocument94 pagesFoundations in Accountancy FFA/ACCA FTrần Thu TrangNo ratings yet

- Cost Chapter 15Document13 pagesCost Chapter 15Marica Shane100% (3)

- Testbanks PrelimsDocument32 pagesTestbanks PrelimsSharmaine LiasosNo ratings yet

- Listed Company ProjectDocument43 pagesListed Company ProjectAditi MahaleNo ratings yet

- ch03 Part7Document6 pagesch03 Part7Sergio HoffmanNo ratings yet

- ACC 202 Project WorkbookDocument11 pagesACC 202 Project WorkbookKarli KulpNo ratings yet

- Ratio Analysis Example 1 Solution With CommentsDocument5 pagesRatio Analysis Example 1 Solution With CommentsMohammad AnisuzzamanNo ratings yet

- Ias7/Mfrs 107 Statement of Cash Flows: Yousuf SiyamDocument13 pagesIas7/Mfrs 107 Statement of Cash Flows: Yousuf Siyameidbadshah zazaiNo ratings yet

- CH 02Document53 pagesCH 02Linh Trần Thị KhánhNo ratings yet

- Module 1Document11 pagesModule 1Karelle MalasagaNo ratings yet

- Exercise 9-4 ADocument3 pagesExercise 9-4 AArdilla Noor Paramashanti WirahadikusumaNo ratings yet

- Single Entry Bookkeeping SystemDocument3 pagesSingle Entry Bookkeeping System=shey=No ratings yet

- Prepare The Report Form of Balance Sheet 2. Compute The Results of Operation 3. Explain The Effect of Net Income/loss On Owner's EquityDocument4 pagesPrepare The Report Form of Balance Sheet 2. Compute The Results of Operation 3. Explain The Effect of Net Income/loss On Owner's EquityRevise PastralisNo ratings yet

- R. Geetha Priya: S Cafe Coffee Shop Business Plan Project ReportDocument18 pagesR. Geetha Priya: S Cafe Coffee Shop Business Plan Project ReportMohan Lal KalyankarNo ratings yet

- Accounting EquationDocument12 pagesAccounting EquationAishah Rafat Abdussattar100% (1)

- Accounting Cycle of A Service BusinessDocument27 pagesAccounting Cycle of A Service BusinessTariga, Dharen Joy J.No ratings yet

- Fa 2Document2 pagesFa 2vietdung25112003No ratings yet

- Prelims - Basic AccountingDocument10 pagesPrelims - Basic AccountingBlairEmrallafNo ratings yet

- Module I. Business Combination - Date of Acquisition (NA)Document13 pagesModule I. Business Combination - Date of Acquisition (NA)Melanie SamsonaNo ratings yet

- Module 5 QuestionsDocument5 pagesModule 5 QuestionsJester MartinNo ratings yet

- Income Flows Versus Cash Flows: Understanding The Statement of Cash FlowsDocument26 pagesIncome Flows Versus Cash Flows: Understanding The Statement of Cash Flowscarlos chavesNo ratings yet

- 7792 A Ncs 015 2021 Entrepreneurial Finance PDFDocument34 pages7792 A Ncs 015 2021 Entrepreneurial Finance PDFlilibaharom.kelabmgtNo ratings yet

- Segmented ReportingDocument36 pagesSegmented ReportingmakrocbNo ratings yet

- Presentation On "Funds Flow & Cash Flow Analysis"Document15 pagesPresentation On "Funds Flow & Cash Flow Analysis"Chaitanya PrasadNo ratings yet