Professional Documents

Culture Documents

2-3 Capital Allowances

2-3 Capital Allowances

Uploaded by

oddsey0713Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2-3 Capital Allowances

2-3 Capital Allowances

Uploaded by

oddsey0713Copyright:

Available Formats

2.

3 Capital allowances for depreciating assets (Div 40)

Cost

1st element: Expense incurred when TP starts to hold asset (s40-180)

2nd element: $ incurred to bring asset to present condition and location (s40-190)

-freight & delivery

-customs duty and other import levies

-cost of minor rearrangements within the relevant premises

Second element exclusions:

-$ incurred in demolishing existing plant (Mount Isa Mines)

-$ incurred in making structural alterations to building where P&E are housed

(may qualify for Div 43 capital works)

Calculation of

decline in value

Excludes:

-GST

-amts incurred before 1/07/2001 on dep asset that is not plant

-otherwise deductible s40-215

-amts deductible for mining/quarrying/information prospecting s40-80

-expenses not capital s40-220

Other rules:

-assets brought to partnership, cost=MV s40-180(2) Item 5

-asset acq > arms length value, cost=MV s40-180(2) Item 8

-amt taken to have paid usually MV for non-cash benefits s40-185

-car limit = $57009 s40-230

-when car acq @ discount via a trade-in disposed @ <MV, cost will increase by

the discount s40-225

-cost of depn assets are reasonably allocated when acquire in a lum with other

assets s40-195, s40-115, s40-205

Prime cost or

Prime Cost

diminishing value?

-choice made on an

item-by-item basis,

cannot be changed Diminishing value

-need to use for inhouse software, intellectual

property, spectrum license, datacasting

transmitter licence

Low value assets

Immediate deduction s40-80(2)

1) <$300;

2) Predominately used for nonbusiness income (eg salary);

3) Not part of a set of assets with total

cost >$300; AND

4) Not acq with any other substantially

identical assets with total cost >$300

Change effective life s40-110

-no longer accurate due to change in nature

of use of asset

-cost increase by 10% (eg improvements)

-where there are shorter capped effective

useful lives per commissioners det

*could not be changed before 21/09/99

Start Time

When asset is first used or installed

ready for use for any purpose

**tax deduction only available for

taxable purposes need to apportion

Business capital expenditures s40-880

Conditions

-business capital expenditure was or proposed for

taxable purpose s40-880(3)

-5yr deduction available s40-880(2), beginning at time

expenditure was incurred

Types of deductions:

- establish your bus structure

- convert your bus structure into a diff structure

-raise equity

-defend from takeover

-costs to bus of unsuccessfully attempting a takeover

-stop carrying on your business

-liquidation/deregistration costs

-feasibility studies/market research

CGT and Capital Allowance Regime

Rates for software development

pools

Low cost assets (18.75%)

-<$1000

- if election made, need to

pool all low cost assets

Low Value Pool

Yes

Low value assets (37.5%)

-declined in value under

diminishing value with

WDV<$1000

-allocated on item-by-item basis

(no need to pool everything)

Add to LVP

-depreciate o/bal @ 37.5%

-add only proportion for taxable

purpose (% cannot be adjusted later)

Disposal

-deduct termination value from pool

(adj for taxable purpose %)

CGT event K7 s104-235

-capital gains/losses when depn

asset used for purposes other than a

taxable purpose

Calculation

Formula for CG and CL below.

Balancing adj = decline in value for taxable

purpose (if TV>cost) s40-285(1)

*refer to CLP98 for worked example

Capital gain

STS taxpayers

Write-off General STSP

Criteria

<$1000 <25 yrs UL

O/bal

100%

30%

Additions

15%

Effective Life

1) Self-assess assuming it was kept

in good working condition s40-105

or

2) Commissioners determination

s40-100

*refer to s40-95(7) for intangibles

Long-life STSP

>=25 yrs UL

5%

2.50%

Exceptions to STS regime s328-175

1) Primary producers

can chose

STS, 40-F or 40-G

2) Buildings

excl unless qualifies for

Div 40

3) Leases

excl under subdiv 328-D

4) LVP and software dev pools

Capital loss

Ken Choi 2007

You might also like

- IPSAS in Your Pocket - August 2022Document61 pagesIPSAS in Your Pocket - August 2022Daniel AdegboyeNo ratings yet

- Velocity Manager Presentation October 2011Document36 pagesVelocity Manager Presentation October 2011Russell MuldoonNo ratings yet

- Turning Your Dreams Into Reality - DR - Sam PDFDocument23 pagesTurning Your Dreams Into Reality - DR - Sam PDFMhedo Bolarinwa AkanniNo ratings yet

- Primer: Net Working Capital in M&A Deals: February 2022Document5 pagesPrimer: Net Working Capital in M&A Deals: February 2022nsresearch2012No ratings yet

- A Roadmap To Accounting For Equity Method Investments and Joint Ventures - November 2020Document253 pagesA Roadmap To Accounting For Equity Method Investments and Joint Ventures - November 2020pravinreddyNo ratings yet

- Financial Management MCQsDocument27 pagesFinancial Management MCQsYogesh KamraNo ratings yet

- Current Trends in International BusinessDocument4 pagesCurrent Trends in International BusinessAamir TankiwalaNo ratings yet

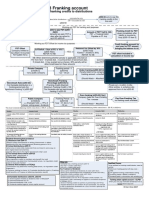

- 3-3 Franking AccountDocument1 page3-3 Franking Accountoddsey0713No ratings yet

- 1-8 GST - GST Payable or ITC AvalDocument2 pages1-8 GST - GST Payable or ITC Avaloddsey0713No ratings yet

- Does FBT Apply?: Div 13 ExclusionsDocument1 pageDoes FBT Apply?: Div 13 Exclusionsoddsey0713No ratings yet

- 4-3 Part IVA General AntiAvoidanceDocument1 page4-3 Part IVA General AntiAvoidanceoddsey0713No ratings yet

- 3-3 Div 7A Deemed Divs - VLDocument1 page3-3 Div 7A Deemed Divs - VLoddsey0713No ratings yet

- CPA TAX Notes - Module 1Document4 pagesCPA TAX Notes - Module 1wumel01No ratings yet

- Adjustments at The End of An Accounting PeriodDocument18 pagesAdjustments at The End of An Accounting PeriodTevabless Suoived SpotlightbabeNo ratings yet

- Ratio Analysis Is Very Useful Tool of Management AccountingDocument13 pagesRatio Analysis Is Very Useful Tool of Management AccountingSonal PorwalNo ratings yet

- Module 4 Companies SlidesDocument77 pagesModule 4 Companies SlidesChua Rui TingNo ratings yet

- Income Taxes (IAS 12)Document15 pagesIncome Taxes (IAS 12)Mahir RahmanNo ratings yet

- Accounting Policies and Procedures For Early Stage CompaniesDocument49 pagesAccounting Policies and Procedures For Early Stage CompaniesJoud H Abu HashishNo ratings yet

- Housing Finance For Ems EbookDocument540 pagesHousing Finance For Ems EbookIurii SocolNo ratings yet

- Capital Budgeting Decision - SBSDocument43 pagesCapital Budgeting Decision - SBSSahil SherasiyaNo ratings yet

- Ethics & Governance: Study Guide ErrataDocument1 pageEthics & Governance: Study Guide ErrataYoNo ratings yet

- Module 5 Consolisations SlidesDocument50 pagesModule 5 Consolisations SlidesChua Rui TingNo ratings yet

- Module 2Document12 pagesModule 2zoyaNo ratings yet

- IFRS Practice Issues Revenue NIIF 15 Sept14Document204 pagesIFRS Practice Issues Revenue NIIF 15 Sept14prof_fids100% (1)

- Superannuation Splitting Laws - Frequently Asked QuestionsDocument44 pagesSuperannuation Splitting Laws - Frequently Asked QuestionsmaryNo ratings yet

- Acca Atx Course Notes Ty 2019Document592 pagesAcca Atx Course Notes Ty 201921000021No ratings yet

- ACCA AFM S22 NotesDocument66 pagesACCA AFM S22 NotesdakshinNo ratings yet

- Module 2: Chart of Accounts Module Overview: ObjectivesDocument22 pagesModule 2: Chart of Accounts Module Overview: ObjectivesmatejkahuNo ratings yet

- FAC1501 Learning Unit 4 PDFDocument29 pagesFAC1501 Learning Unit 4 PDFMasixole BokweNo ratings yet

- FAC1501 Study Guide 2022 - Learning Unit 11Document53 pagesFAC1501 Study Guide 2022 - Learning Unit 11carlynnNo ratings yet

- Sound EnglishDocument276 pagesSound EnglishAnonymous nEhWtE100% (1)

- Accounting For Property Classification Is KeyDocument6 pagesAccounting For Property Classification Is KeyAmanda7No ratings yet

- CA Inter Cost & Management Accounting Theory Book by CA Purushottam AggarwalDocument125 pagesCA Inter Cost & Management Accounting Theory Book by CA Purushottam Aggarwalabhinesh243No ratings yet

- Tax Function Effectiveness Best Practice ChecklistDocument2 pagesTax Function Effectiveness Best Practice ChecklistGbengaNo ratings yet

- AC2091 Financial Reporting: Session 4Document40 pagesAC2091 Financial Reporting: Session 4NadiaIssabellaNo ratings yet

- Code of Ethics Part C Professional Accountants in Business 1 Jan 2011Document11 pagesCode of Ethics Part C Professional Accountants in Business 1 Jan 2011James De Torres CarilloNo ratings yet

- NFRS AuditDocument32 pagesNFRS AuditBidhan Sapkota100% (1)

- Module 6 Business Structures SlidesDocument49 pagesModule 6 Business Structures SlidesChua Rui TingNo ratings yet

- Lutilsky - Accounting Lecture/predavanja BDIBDocument464 pagesLutilsky - Accounting Lecture/predavanja BDIBreny_ostojic100% (1)

- Types of Financial RisksDocument5 pagesTypes of Financial RisksShaharyar QayumNo ratings yet

- AA153501 1427378053 BookDocument193 pagesAA153501 1427378053 BooklentinieNo ratings yet

- Chicken Masala Recipe How To Make Chicken Masala Recipe at Home Homemade Chicken Masala Recipe - Times Food PDFDocument1 pageChicken Masala Recipe How To Make Chicken Masala Recipe at Home Homemade Chicken Masala Recipe - Times Food PDFKavitha a/p ThayagarajanNo ratings yet

- Ind As 8 PDFDocument56 pagesInd As 8 PDFmanan3466No ratings yet

- AC2091 ZB Final For UoLDocument16 pagesAC2091 ZB Final For UoLkikiNo ratings yet

- CBIDocument39 pagesCBIVMRONo ratings yet

- Tax Book 2016-17 - Version 1.0a USB PDFDocument372 pagesTax Book 2016-17 - Version 1.0a USB PDFemc2_mcv100% (2)

- FNCE 625-12ChairApprovedDocument8 pagesFNCE 625-12ChairApprovedAjay TankNo ratings yet

- Peter Taylor: Fully Revised and UpdatedDocument244 pagesPeter Taylor: Fully Revised and Updatedpillypang1230No ratings yet

- CMA FormulaDocument4 pagesCMA FormulaKanniha SuryavanshiNo ratings yet

- Bonds and DerivativesDocument149 pagesBonds and DerivativesLinh LinhNo ratings yet

- Introduction To Methamatical Finance (2018, 133 Pages)Document133 pagesIntroduction To Methamatical Finance (2018, 133 Pages)Kate PapasNo ratings yet

- Academy Course NotesDocument208 pagesAcademy Course NotesPhebin PhilipNo ratings yet

- Introduction To Financial Statement AnalysisDocument114 pagesIntroduction To Financial Statement AnalysisHuy PanhaNo ratings yet

- CIMA F2 Refresher - Qunber RazaDocument91 pagesCIMA F2 Refresher - Qunber RazaMr RizviNo ratings yet

- ACCA P7 December 2015 NotesDocument146 pagesACCA P7 December 2015 NotesopentuitionIDNo ratings yet

- Finance Compendium X-FINDocument70 pagesFinance Compendium X-FINkanikabhateja7No ratings yet

- 2024 IFRS Diploma Study TextDocument26 pages2024 IFRS Diploma Study TextcraigsappletreeNo ratings yet

- An Overview of SingerBDDocument19 pagesAn Overview of SingerBDEmon Hossain100% (1)

- 15 Byrdchen Ctp22 PP Ch15 Summer 2022Document75 pages15 Byrdchen Ctp22 PP Ch15 Summer 2022peeyush aggarwalNo ratings yet

- Advanced Financial Reporting Strathmore University Notes and Revision KitDocument590 pagesAdvanced Financial Reporting Strathmore University Notes and Revision Kitsamnjiru466No ratings yet

- AUE Study Guide 001 - 2020 - 4 - BDocument170 pagesAUE Study Guide 001 - 2020 - 4 - BLindelwe NeneNo ratings yet

- Additional Deferred Tax Examples.2Document3 pagesAdditional Deferred Tax Examples.2milton1986100% (1)

- Does FBT Apply?: Div 13 ExclusionsDocument1 pageDoes FBT Apply?: Div 13 Exclusionsoddsey0713No ratings yet

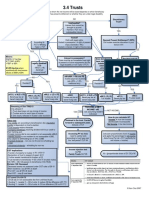

- 3-4 TrustsDocument1 page3-4 Trustsoddsey0713No ratings yet

- 1-8 GST - GST Payable or ITC AvalDocument2 pages1-8 GST - GST Payable or ITC Avaloddsey0713No ratings yet

- 3-3 Company LossesDocument1 page3-3 Company Lossesoddsey0713No ratings yet

- 4-3 Part IVA General AntiAvoidanceDocument1 page4-3 Part IVA General AntiAvoidanceoddsey0713No ratings yet

- 3-3 Franking AccountDocument1 page3-3 Franking Accountoddsey0713No ratings yet

- 2-4,5 Capital WorksDocument1 page2-4,5 Capital Worksoddsey0713No ratings yet

- Case Summaries 1 193Document54 pagesCase Summaries 1 193oddsey0713100% (1)

- 3-3 Div 7A Deemed Divs - VLDocument1 page3-3 Div 7A Deemed Divs - VLoddsey0713No ratings yet

- T6 Chapter 5 Solutions To The Essential ActivitiesDocument12 pagesT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713No ratings yet

- T7 Chapter 6 Solutions To The Essential ActivitiesDocument26 pagesT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713No ratings yet

- NIBC 2016 - Conference Fact SheetDocument3 pagesNIBC 2016 - Conference Fact SheetAnonymous 3C3e3wNo ratings yet

- Strategic Management Full Notes 1Document137 pagesStrategic Management Full Notes 1ArihantAskiGoswami100% (1)

- Globalization-It's Socio-Economic Impact in India: Research ArticleDocument3 pagesGlobalization-It's Socio-Economic Impact in India: Research ArticleAbhi ChandraNo ratings yet

- CV Distribution Service Dubai Uae Top Companies List FreezoneDocument1,105 pagesCV Distribution Service Dubai Uae Top Companies List Freezonebisankhe2No ratings yet

- ch04 ShortDocument16 pagesch04 ShortMohammed Saeed Al-rashdiNo ratings yet

- Competitive Strategies Followed by FMCG Sector in India: What Are HUL and ITC LTD.? HUL (Hindustan Unilever LTD.)Document16 pagesCompetitive Strategies Followed by FMCG Sector in India: What Are HUL and ITC LTD.? HUL (Hindustan Unilever LTD.)Sagar DonNo ratings yet

- Analyze The Effects of The Transactions On The Accounting Equation.eDocument4 pagesAnalyze The Effects of The Transactions On The Accounting Equation.eShesharam ChouhanNo ratings yet

- HWVP Fund VII LP MemoDocument26 pagesHWVP Fund VII LP MemobytemealNo ratings yet

- Career As Lic AgentDocument68 pagesCareer As Lic AgentSandeep Orlov100% (1)

- QA NextDocument10 pagesQA NextvijithacvijayanNo ratings yet

- Chapter 3 Auding and AssuranceDocument24 pagesChapter 3 Auding and AssuranceCheng Yuet JoeNo ratings yet

- International Financial Management: 7 EditionDocument47 pagesInternational Financial Management: 7 Editionbiradardnyaneshwar90No ratings yet

- Analisis Laporan Keuangan: Ni Ketut SurasniDocument56 pagesAnalisis Laporan Keuangan: Ni Ketut SurasnipikriNo ratings yet

- Alb Ani A LeatherDocument40 pagesAlb Ani A LeatherkoyluNo ratings yet

- STUDY MATERIAL FOR NISM Depository Operations Exam (DOCE) - NISM MOCK TEST AT WWW - MODELEXAM.INDocument28 pagesSTUDY MATERIAL FOR NISM Depository Operations Exam (DOCE) - NISM MOCK TEST AT WWW - MODELEXAM.INThiagarajan Srinivasan74% (19)

- Nismadmin NISM SERIES IX Merchant Banking (2019)Document80 pagesNismadmin NISM SERIES IX Merchant Banking (2019)prabNo ratings yet

- 25 Premium Calculation For Life-InsuranceDocument2 pages25 Premium Calculation For Life-Insuranceanujsharma0001No ratings yet

- ABL Annual Report 2013Document270 pagesABL Annual Report 2013Muhammad Hamza ShahidNo ratings yet

- ProjectDocument26 pagesProjectAlishaNo ratings yet

- What Are The Financial Objectives For Mba Finance Project ReportsDocument4 pagesWhat Are The Financial Objectives For Mba Finance Project ReportsBabasab Patil (Karrisatte)No ratings yet

- 2.fundmentals of Futures & Options.2022Document182 pages2.fundmentals of Futures & Options.2022Nilay ShethNo ratings yet

- Federal Housing Finance Agency Vs Bank of AmericaDocument92 pagesFederal Housing Finance Agency Vs Bank of AmericaNikki D WhiteNo ratings yet

- Where Financial Reporting Still Falls ShortDocument8 pagesWhere Financial Reporting Still Falls ShortRavikanth ReddyNo ratings yet

- Strategic Analysis of Bata Shoe Banglade PDFDocument23 pagesStrategic Analysis of Bata Shoe Banglade PDFRakib HasanNo ratings yet

- AbbreviationDocument5 pagesAbbreviationShanky RanaNo ratings yet

- 16 Anwar Amar IqbalDocument38 pages16 Anwar Amar IqbalVaibhav KaushikNo ratings yet