Professional Documents

Culture Documents

APMATH 2014 Midterms

APMATH 2014 Midterms

Uploaded by

GaileCopyright:

Available Formats

You might also like

- Contracte Rompetrol - Virgo TradeDocument13 pagesContracte Rompetrol - Virgo TradeZiarul de GardăNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- EECODocument6 pagesEECOJohnNo ratings yet

- Exercises: Compound Interest and Annuities By: Engr. Calaque, Dario JRDocument1 pageExercises: Compound Interest and Annuities By: Engr. Calaque, Dario JRnajib casanNo ratings yet

- Chapter 2 Time Value of MoneyDocument2 pagesChapter 2 Time Value of MoneyPik Amornrat SNo ratings yet

- Gen - MathDocument4 pagesGen - MathJudith DelRosario De RoxasNo ratings yet

- Time Value of Money AssignmentDocument1 pageTime Value of Money AssignmentawaischeemaNo ratings yet

- Time Value of Money Practice ProblemsDocument5 pagesTime Value of Money Practice ProblemsMarkAntonyA.RosalesNo ratings yet

- Chapter 5 - Practice Questions Set 2Document3 pagesChapter 5 - Practice Questions Set 2Germain LacretteNo ratings yet

- Exercise - Time Value of MoneyDocument1 pageExercise - Time Value of MoneytleminhchauNo ratings yet

- BT Chap 5Document4 pagesBT Chap 5Hang NguyenNo ratings yet

- Topic 2 - APR & EAR ProblemsDocument2 pagesTopic 2 - APR & EAR Problemskar pingNo ratings yet

- Practices: Time Value of MoneyDocument9 pagesPractices: Time Value of MoneysovuthyNo ratings yet

- Bài Tập ThêmDocument9 pagesBài Tập ThêmK59 Vu Nguyen Viet LinhNo ratings yet

- MMW-Final-Term-ACTIVITY 2Document1 pageMMW-Final-Term-ACTIVITY 2JDBNo ratings yet

- Annuity and DepreciationDocument22 pagesAnnuity and DepreciationthekeypadNo ratings yet

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcNo ratings yet

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Time Value of Money 2Document6 pagesTime Value of Money 2k61.2211155018No ratings yet

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- Eb 2 A 97 EfDocument15 pagesEb 2 A 97 EfMẫn ĐứcNo ratings yet

- Simulated Exam - Questions - General MathematicsDocument2 pagesSimulated Exam - Questions - General MathematicsWesly Paul Salazar CortezNo ratings yet

- ES 301 SeatWork 1Document2 pagesES 301 SeatWork 1trixie marie jamoraNo ratings yet

- GM Simple and General AnnuityDocument39 pagesGM Simple and General AnnuityKaizel BritosNo ratings yet

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- Practice Questions AnnuitiesDocument1 pagePractice Questions AnnuitiesSedef ErgülNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Lahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Document2 pagesLahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Ahmed ZafarNo ratings yet

- Engineering Economics Problem Set 1 PDFDocument1 pageEngineering Economics Problem Set 1 PDFMelissa Joy de GuzmanNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Week1 in Class ExerciseDocument12 pagesWeek1 in Class Exercisemuhammad AdeelNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- Tutorial 2Document3 pagesTutorial 2jhagantiniNo ratings yet

- 2.4 Ordinary Annuities: ExercisesDocument2 pages2.4 Ordinary Annuities: ExercisesRinesa SylaNo ratings yet

- Chapter 4: Time Value of Money (Numerical Problems)Document2 pagesChapter 4: Time Value of Money (Numerical Problems)RabinNo ratings yet

- لقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مDocument4 pagesلقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مAhmed RokaNo ratings yet

- 2023 - Tute 4 - Time Value of MoneyDocument3 pages2023 - Tute 4 - Time Value of MoneyThe flying peguine CụtNo ratings yet

- 2023 - Tute 4 - Time Value of MoneyDocument3 pages2023 - Tute 4 - Time Value of MoneyThe flying peguine CụtNo ratings yet

- Homework - TVM (Questions)Document1 pageHomework - TVM (Questions)loganramenNo ratings yet

- FM A Assignment 19-40659-1Document11 pagesFM A Assignment 19-40659-1Pacific Hunter JohnnyNo ratings yet

- General Mathematics: Week 11Document10 pagesGeneral Mathematics: Week 11Maria CaneteNo ratings yet

- 1Document2 pages1madsparNo ratings yet

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Assignment 2Document4 pagesAssignment 2Nur Eliyana IzzatieNo ratings yet

- Tut 02 QDocument2 pagesTut 02 QSai Fung Scott TangNo ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- Assignment of Time Value of MoneyDocument3 pagesAssignment of Time Value of MoneyMuxammil IqbalNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Quarter 2 Simply AnnuityDocument36 pagesQuarter 2 Simply Annuitycatherine saldeviaNo ratings yet

- Debt and TaxDocument1 pageDebt and TaxChandramani JhaNo ratings yet

- Assignment Time Value and MoneyDocument2 pagesAssignment Time Value and MoneySaqib Mirza0% (1)

- Tutorial 1 Time Value of Money PDFDocument2 pagesTutorial 1 Time Value of Money PDFLâm TÚc NgânNo ratings yet

- Tutorial 1 - TVM and GrowthDocument2 pagesTutorial 1 - TVM and GrowthowenNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Aiphung - 9p15p16p2Document16 pagesAiphung - 9p15p16p2Trần Minh KhôiNo ratings yet

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138From EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No ratings yet

- The Student Debt Manifesto: How to Pay Off Student Loans Faster and Gain Financial Freedom.From EverandThe Student Debt Manifesto: How to Pay Off Student Loans Faster and Gain Financial Freedom.No ratings yet

- Loan Contract in ParticularDocument2 pagesLoan Contract in ParticularEsthebane GomezNo ratings yet

- PDFDocument5 pagesPDFAngelineNo ratings yet

- Merger of Banking CompaniesDocument25 pagesMerger of Banking CompaniesJane DoeNo ratings yet

- Credit CardsDocument14 pagesCredit Cardsapi-3805188No ratings yet

- Current Account New MewaDocument15 pagesCurrent Account New MewaSonu F1No ratings yet

- Soal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaDocument13 pagesSoal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaegiNo ratings yet

- A Study On Customer Satisfaction in Using Cash Deposit MachinesDocument3 pagesA Study On Customer Satisfaction in Using Cash Deposit MachinesJqwertymaidNo ratings yet

- Manila Standard Today - Business Weekly Stocks Review (September 15, 2013)Document1 pageManila Standard Today - Business Weekly Stocks Review (September 15, 2013)Manila Standard TodayNo ratings yet

- Rhel Bill Top Sheet: 1. Conveyance & Others Submissin DTDocument12 pagesRhel Bill Top Sheet: 1. Conveyance & Others Submissin DTKamrul Hasan Khan ShatilNo ratings yet

- Factura Vtex Abril 2021Document1 pageFactura Vtex Abril 2021Rayssita espinozaNo ratings yet

- PUBLIC SECTOR BANKS Consolidated Balance SheetsDocument2 pagesPUBLIC SECTOR BANKS Consolidated Balance SheetsJogenderNo ratings yet

- Lehman BrothersDocument22 pagesLehman BrothersSunil PurohitNo ratings yet

- Tribhuvan University: QuestionsDocument2 pagesTribhuvan University: QuestionsSabin ShresthaNo ratings yet

- Nomura Asset Management Global Equities Summer Internship Cover Letter - Kuala Lumpur - 2016 - Cover Letter LibraryDocument9 pagesNomura Asset Management Global Equities Summer Internship Cover Letter - Kuala Lumpur - 2016 - Cover Letter Libraryradhika1992No ratings yet

- Sample Problems in Annuity For Ceit-03-302a and Ceit-04-501ADocument12 pagesSample Problems in Annuity For Ceit-03-302a and Ceit-04-501AAngeli Mae SantosNo ratings yet

- Bank StatmentDocument73 pagesBank StatmentSURANA1973No ratings yet

- A Study On CRM in Icici BankDocument64 pagesA Study On CRM in Icici BankDines.hadwale0% (1)

- Macariola Auditing Solutions Manual-1 PDFDocument157 pagesMacariola Auditing Solutions Manual-1 PDFTrisha CabralNo ratings yet

- IMChap 012Document16 pagesIMChap 012MaiNguyen100% (1)

- Mba II 2021-22 Project TitleDocument5 pagesMba II 2021-22 Project TitlePankaj VishwakarmaNo ratings yet

- Idbi BankDocument57 pagesIdbi BankRajVishwakarmaNo ratings yet

- 1542438436593Document1 page1542438436593kushalNo ratings yet

- Persiapan BSEM 2024 - Materi SosialisasiDocument57 pagesPersiapan BSEM 2024 - Materi SosialisasiNovi Trisadi LubisNo ratings yet

- Chapter 29 - Problem Sets - ChosenDocument2 pagesChapter 29 - Problem Sets - ChosenMinh AnhNo ratings yet

- Exam 55136Document4 pagesExam 55136piyushNo ratings yet

- Chapter 7 Homework - Pratik JogDocument2 pagesChapter 7 Homework - Pratik JogPratik JogNo ratings yet

- European Central BankDocument24 pagesEuropean Central Bankchhadwaharshit50% (2)

- E-Challan Science ComDocument1 pageE-Challan Science ComJyotish JhaNo ratings yet

- CH 12 - Commercial Banks Financial Statements and Analysis - Anthony Saunders-5th EditionDocument13 pagesCH 12 - Commercial Banks Financial Statements and Analysis - Anthony Saunders-5th EditionRosenna99No ratings yet

APMATH 2014 Midterms

APMATH 2014 Midterms

Uploaded by

GaileOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

APMATH 2014 Midterms

APMATH 2014 Midterms

Uploaded by

GaileCopyright:

Available Formats

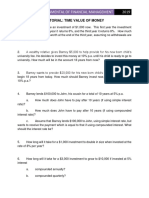

Applied Mathematics Departmental Midterm Exam; AGSB Auditorium; June 21,

2014; 6 pm 8 pm

Write your complete solutions and answers on yellow pad. You may use

your notes, books, laptops and calculators. Use of internet, email, or cell

phone is not allowed. Kindly return the problem sheet together with your

answer sheet.

1. A loan of Php 500,000 is due 5 years from today. (a) The borrower wants to make

annual deposits at the end of each year into a sinking fund that will earn interest at

an annual rate of 8%, compounded monthly. How much will the annual deposits

have to be? (b) If the interest is 6% per year, compounded quarterly, how much will

the annual deposits have to be?

2. You buy a second hand BMW car for Php 945,000 from a local bank summer sale.

The bank asks for a 20% down payment, with the remaining amount payable in

equal quarterly payments in the next four years. The interest rate is 9.7% per year,

compounded monthly. After paying the quarterly amounts for one year, you decide

to pay off the current loan by getting a new loan from another bank. The new loan

would be paid in equal quarterly amounts for a period of five years. If the interest

rate of the new loan is 7.2% per year, compounded quarterly, how much would be

your new quarterly payments?

3. Should Pedro buy a lot he believes will be worth Php 1,500,000 at the end of 10

years? He sees that the annual interest rate on this investment will be 10%

compounded annually for the first five years, and 7% compounded annually for the

last five years. The owners are asking for Php 650,000 for this lot.

4. You wish to have a million pesos fifteen years from now. Two banks in your

neighborhood invite you to make regular deposits of equal amounts of money every

start of the year, for fifteen years. The first bank, BC Bank, offers an interest rate of

5.05% per year, compounded semi-annually. As a new depositor, you will be entitled

to a Php 70,000 cash gift upon making your first deposit. The second bank, DE

Bank, offers an interest of 6.03% per year, compounded quarterly. To which bank

should you make your deposits, and how much should be your annual deposits?

5. Juans Cafe charges Php 80 per cup of coffee. The variable cost per cup is Php 50

while the total monthly fixed cost is Php 60,000. (a) Find the monthly break even

quantity. (b) If the cafe targets a monthly profit of Php 15,000 how many cups of

coffee must be served? (c) The caf wants to add a sandwich to their menu. As a

start, they expect to sell 600 sandwiches monthly, in addition to their forecast of

2,400 cups of coffee. The sandwich will be priced at Php 120 each and is estimated

to have a variable cost ratio of 60%. The total monthly fixed cost however would

increase to Php 90,000. Find the resulting break even quantities, as well as the

resulting profit for the month. Is it a good idea to add the sandwich to their menu?

Applied Mathematics Departmental Midterm Exam; AGSB Auditorium; June 21,

2014; 6 pm 8 pm

6. You want your son to have enough money by his 17th birthday to pay for his

college education. You want him to be able to withdraw Php 80,000 each time on his

18th, 19th, 20th, and 21st birthdays. You deposit equal amounts of money every

year, starting from his 5th birthday up to his 16th birthday. How much would be

your annual deposits? Assume interest rate is 9.4% per year, compounded monthly.

7. A man lends Php 4,500 for 5 years at 12.0% per year simple interest. At the end

of the 5 years, he invests the total amount with interest for another 9 years at 8.2%

interest per year, compounded monthly. How much money will he have at the end

of the 14- year period?

You might also like

- Contracte Rompetrol - Virgo TradeDocument13 pagesContracte Rompetrol - Virgo TradeZiarul de GardăNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- EECODocument6 pagesEECOJohnNo ratings yet

- Exercises: Compound Interest and Annuities By: Engr. Calaque, Dario JRDocument1 pageExercises: Compound Interest and Annuities By: Engr. Calaque, Dario JRnajib casanNo ratings yet

- Chapter 2 Time Value of MoneyDocument2 pagesChapter 2 Time Value of MoneyPik Amornrat SNo ratings yet

- Gen - MathDocument4 pagesGen - MathJudith DelRosario De RoxasNo ratings yet

- Time Value of Money AssignmentDocument1 pageTime Value of Money AssignmentawaischeemaNo ratings yet

- Time Value of Money Practice ProblemsDocument5 pagesTime Value of Money Practice ProblemsMarkAntonyA.RosalesNo ratings yet

- Chapter 5 - Practice Questions Set 2Document3 pagesChapter 5 - Practice Questions Set 2Germain LacretteNo ratings yet

- Exercise - Time Value of MoneyDocument1 pageExercise - Time Value of MoneytleminhchauNo ratings yet

- BT Chap 5Document4 pagesBT Chap 5Hang NguyenNo ratings yet

- Topic 2 - APR & EAR ProblemsDocument2 pagesTopic 2 - APR & EAR Problemskar pingNo ratings yet

- Practices: Time Value of MoneyDocument9 pagesPractices: Time Value of MoneysovuthyNo ratings yet

- Bài Tập ThêmDocument9 pagesBài Tập ThêmK59 Vu Nguyen Viet LinhNo ratings yet

- MMW-Final-Term-ACTIVITY 2Document1 pageMMW-Final-Term-ACTIVITY 2JDBNo ratings yet

- Annuity and DepreciationDocument22 pagesAnnuity and DepreciationthekeypadNo ratings yet

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcNo ratings yet

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Time Value of Money 2Document6 pagesTime Value of Money 2k61.2211155018No ratings yet

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- Eb 2 A 97 EfDocument15 pagesEb 2 A 97 EfMẫn ĐứcNo ratings yet

- Simulated Exam - Questions - General MathematicsDocument2 pagesSimulated Exam - Questions - General MathematicsWesly Paul Salazar CortezNo ratings yet

- ES 301 SeatWork 1Document2 pagesES 301 SeatWork 1trixie marie jamoraNo ratings yet

- GM Simple and General AnnuityDocument39 pagesGM Simple and General AnnuityKaizel BritosNo ratings yet

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- Practice Questions AnnuitiesDocument1 pagePractice Questions AnnuitiesSedef ErgülNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Lahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Document2 pagesLahore School of Economics Financial Management I Time Value of Money - 2 Assignment 3Ahmed ZafarNo ratings yet

- Engineering Economics Problem Set 1 PDFDocument1 pageEngineering Economics Problem Set 1 PDFMelissa Joy de GuzmanNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Week1 in Class ExerciseDocument12 pagesWeek1 in Class Exercisemuhammad AdeelNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- Tutorial 2Document3 pagesTutorial 2jhagantiniNo ratings yet

- 2.4 Ordinary Annuities: ExercisesDocument2 pages2.4 Ordinary Annuities: ExercisesRinesa SylaNo ratings yet

- Chapter 4: Time Value of Money (Numerical Problems)Document2 pagesChapter 4: Time Value of Money (Numerical Problems)RabinNo ratings yet

- لقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مDocument4 pagesلقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مAhmed RokaNo ratings yet

- 2023 - Tute 4 - Time Value of MoneyDocument3 pages2023 - Tute 4 - Time Value of MoneyThe flying peguine CụtNo ratings yet

- 2023 - Tute 4 - Time Value of MoneyDocument3 pages2023 - Tute 4 - Time Value of MoneyThe flying peguine CụtNo ratings yet

- Homework - TVM (Questions)Document1 pageHomework - TVM (Questions)loganramenNo ratings yet

- FM A Assignment 19-40659-1Document11 pagesFM A Assignment 19-40659-1Pacific Hunter JohnnyNo ratings yet

- General Mathematics: Week 11Document10 pagesGeneral Mathematics: Week 11Maria CaneteNo ratings yet

- 1Document2 pages1madsparNo ratings yet

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Assignment 2Document4 pagesAssignment 2Nur Eliyana IzzatieNo ratings yet

- Tut 02 QDocument2 pagesTut 02 QSai Fung Scott TangNo ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- Assignment of Time Value of MoneyDocument3 pagesAssignment of Time Value of MoneyMuxammil IqbalNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Quarter 2 Simply AnnuityDocument36 pagesQuarter 2 Simply Annuitycatherine saldeviaNo ratings yet

- Debt and TaxDocument1 pageDebt and TaxChandramani JhaNo ratings yet

- Assignment Time Value and MoneyDocument2 pagesAssignment Time Value and MoneySaqib Mirza0% (1)

- Tutorial 1 Time Value of Money PDFDocument2 pagesTutorial 1 Time Value of Money PDFLâm TÚc NgânNo ratings yet

- Tutorial 1 - TVM and GrowthDocument2 pagesTutorial 1 - TVM and GrowthowenNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Aiphung - 9p15p16p2Document16 pagesAiphung - 9p15p16p2Trần Minh KhôiNo ratings yet

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138From EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No ratings yet

- The Student Debt Manifesto: How to Pay Off Student Loans Faster and Gain Financial Freedom.From EverandThe Student Debt Manifesto: How to Pay Off Student Loans Faster and Gain Financial Freedom.No ratings yet

- Loan Contract in ParticularDocument2 pagesLoan Contract in ParticularEsthebane GomezNo ratings yet

- PDFDocument5 pagesPDFAngelineNo ratings yet

- Merger of Banking CompaniesDocument25 pagesMerger of Banking CompaniesJane DoeNo ratings yet

- Credit CardsDocument14 pagesCredit Cardsapi-3805188No ratings yet

- Current Account New MewaDocument15 pagesCurrent Account New MewaSonu F1No ratings yet

- Soal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaDocument13 pagesSoal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaegiNo ratings yet

- A Study On Customer Satisfaction in Using Cash Deposit MachinesDocument3 pagesA Study On Customer Satisfaction in Using Cash Deposit MachinesJqwertymaidNo ratings yet

- Manila Standard Today - Business Weekly Stocks Review (September 15, 2013)Document1 pageManila Standard Today - Business Weekly Stocks Review (September 15, 2013)Manila Standard TodayNo ratings yet

- Rhel Bill Top Sheet: 1. Conveyance & Others Submissin DTDocument12 pagesRhel Bill Top Sheet: 1. Conveyance & Others Submissin DTKamrul Hasan Khan ShatilNo ratings yet

- Factura Vtex Abril 2021Document1 pageFactura Vtex Abril 2021Rayssita espinozaNo ratings yet

- PUBLIC SECTOR BANKS Consolidated Balance SheetsDocument2 pagesPUBLIC SECTOR BANKS Consolidated Balance SheetsJogenderNo ratings yet

- Lehman BrothersDocument22 pagesLehman BrothersSunil PurohitNo ratings yet

- Tribhuvan University: QuestionsDocument2 pagesTribhuvan University: QuestionsSabin ShresthaNo ratings yet

- Nomura Asset Management Global Equities Summer Internship Cover Letter - Kuala Lumpur - 2016 - Cover Letter LibraryDocument9 pagesNomura Asset Management Global Equities Summer Internship Cover Letter - Kuala Lumpur - 2016 - Cover Letter Libraryradhika1992No ratings yet

- Sample Problems in Annuity For Ceit-03-302a and Ceit-04-501ADocument12 pagesSample Problems in Annuity For Ceit-03-302a and Ceit-04-501AAngeli Mae SantosNo ratings yet

- Bank StatmentDocument73 pagesBank StatmentSURANA1973No ratings yet

- A Study On CRM in Icici BankDocument64 pagesA Study On CRM in Icici BankDines.hadwale0% (1)

- Macariola Auditing Solutions Manual-1 PDFDocument157 pagesMacariola Auditing Solutions Manual-1 PDFTrisha CabralNo ratings yet

- IMChap 012Document16 pagesIMChap 012MaiNguyen100% (1)

- Mba II 2021-22 Project TitleDocument5 pagesMba II 2021-22 Project TitlePankaj VishwakarmaNo ratings yet

- Idbi BankDocument57 pagesIdbi BankRajVishwakarmaNo ratings yet

- 1542438436593Document1 page1542438436593kushalNo ratings yet

- Persiapan BSEM 2024 - Materi SosialisasiDocument57 pagesPersiapan BSEM 2024 - Materi SosialisasiNovi Trisadi LubisNo ratings yet

- Chapter 29 - Problem Sets - ChosenDocument2 pagesChapter 29 - Problem Sets - ChosenMinh AnhNo ratings yet

- Exam 55136Document4 pagesExam 55136piyushNo ratings yet

- Chapter 7 Homework - Pratik JogDocument2 pagesChapter 7 Homework - Pratik JogPratik JogNo ratings yet

- European Central BankDocument24 pagesEuropean Central Bankchhadwaharshit50% (2)

- E-Challan Science ComDocument1 pageE-Challan Science ComJyotish JhaNo ratings yet

- CH 12 - Commercial Banks Financial Statements and Analysis - Anthony Saunders-5th EditionDocument13 pagesCH 12 - Commercial Banks Financial Statements and Analysis - Anthony Saunders-5th EditionRosenna99No ratings yet