Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsRetrenchment STG

Retrenchment STG

Uploaded by

raghavaniyerCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Home Replication StrategyDocument5 pagesHome Replication StrategyChau Hoang100% (19)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MODULE 4 Project-Quality-Management TDocument54 pagesMODULE 4 Project-Quality-Management TTewodros TadesseNo ratings yet

- Lone Pine CaféDocument3 pagesLone Pine Caféchan_han123No ratings yet

- Marketing Functions and Roles and Responsibilities of Marketing ManagerDocument19 pagesMarketing Functions and Roles and Responsibilities of Marketing ManagerFayez ShriedehNo ratings yet

- Impact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaDocument2 pagesImpact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaKundNo ratings yet

- Infolink College: Instructor: Ashenafi NDocument186 pagesInfolink College: Instructor: Ashenafi NBeka AsraNo ratings yet

- Treatment of Assets Under Construction in SAP - From Creation To Settlement - SapGurusDocument14 pagesTreatment of Assets Under Construction in SAP - From Creation To Settlement - SapGurusAnanthakumar ANo ratings yet

- Infosys JobsDocument3 pagesInfosys JobsChandan upadhyayNo ratings yet

- Muhammad Aizuddin Aizat Bin Jumhari: Contact InformationDocument4 pagesMuhammad Aizuddin Aizat Bin Jumhari: Contact InformationAndres ShaonNo ratings yet

- Christina Drumm ResumeDocument2 pagesChristina Drumm Resumeapi-272992635No ratings yet

- RBI Circular On Export Finance - 1Document21 pagesRBI Circular On Export Finance - 1Anonymous l0MTRDGu3MNo ratings yet

- Chap 007Document36 pagesChap 007Lee FeiNo ratings yet

- Patni Ar2009Document174 pagesPatni Ar2009chip_blueNo ratings yet

- BALANCE CASH HOLDING AssignDocument3 pagesBALANCE CASH HOLDING AssignJarra Abdurahman100% (2)

- Marketing Plan: 1: Define Your BusinessDocument12 pagesMarketing Plan: 1: Define Your Businessdrken3No ratings yet

- Pharma Analytics: SFE (Sales Force Effectiveness) Sales Analytics, Incentive Compensation & Reporting CapabilitiesDocument94 pagesPharma Analytics: SFE (Sales Force Effectiveness) Sales Analytics, Incentive Compensation & Reporting CapabilitiesDinesh IitmNo ratings yet

- EquityDerivatives Workbook (Version-January2020)Document80 pagesEquityDerivatives Workbook (Version-January2020)parthNo ratings yet

- Code of Ethics GhellaDocument28 pagesCode of Ethics GhellaMassimilianoTerenziNo ratings yet

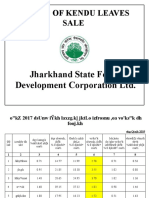

- Status of Kendu Leaves Sale: Jharkhand State Forest Development Corporation LTDDocument11 pagesStatus of Kendu Leaves Sale: Jharkhand State Forest Development Corporation LTDmdNo ratings yet

- 814001-Gabriela GeorgescuDocument86 pages814001-Gabriela GeorgescuJeremiah PacerNo ratings yet

- MA Course Outline (Revised)Document4 pagesMA Course Outline (Revised)Ali Adil0% (1)

- Quality Standards PDFDocument20 pagesQuality Standards PDFmudassarhussainNo ratings yet

- Marketing Notes PDFDocument34 pagesMarketing Notes PDFFRANCIS JOSEPHNo ratings yet

- BT India Factsheet - NewDocument2 pagesBT India Factsheet - NewsunguntNo ratings yet

- MBA HotelDocument46 pagesMBA HotelMamta RanaNo ratings yet

- Slide RMK Chapter 1 - Kelompok 5 - Maksi 43CDocument15 pagesSlide RMK Chapter 1 - Kelompok 5 - Maksi 43CJali FusNo ratings yet

- The Road To Regtech: The (Astonishing) Example of The European UnionDocument12 pagesThe Road To Regtech: The (Astonishing) Example of The European UnionDamero PalominoNo ratings yet

- CompensationDocument36 pagesCompensationabdushababNo ratings yet

- Intellectual CapitalDocument2 pagesIntellectual CapitalraprapNo ratings yet

- Conjoint AnalysisDocument12 pagesConjoint AnalysisvamsibuNo ratings yet

Retrenchment STG

Retrenchment STG

Uploaded by

raghavaniyer0 ratings0% found this document useful (0 votes)

3 views13 pagesOriginal Title

retrenchment stg.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views13 pagesRetrenchment STG

Retrenchment STG

Uploaded by

raghavaniyerCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 13

Retrenchment literally means cutting

down or reduction, particularly of public

expenditure. In other words, it can also be

defined as a set of organizational activities

undertaken to achieve cost and asset

reductions

and

disinvestment,

has

received strong academic and practitioner

support as an expeditious means for

reversing declining financial performance.

Retrenchment revolves around cutting

sales. Retrenchment is a corporate-level

strategy that seeks to reduce the size or

diversity of an organization's operations. It

is also a reduction of expenditures in

order to become financially stable.

Retrenchment is a pullback or a

withdrawal from offering some current

products or serving some markets.

Retrenchment is often a strategy

employed prior to or as part of a

Turnaround strategy. Retrenchment is

something akin to downsizing. When a

company or government goes through

retrenchment, it reduces outgoing money

or expenditures or redirects focus in an

attempt to become more financially

solvent. Many companies that are being

pressured by stockholders or have had

flagging profit reports may resort to

retrenchment to shore up their operations

and make them more profitable. Although

retrenchment is most often used in

countries throughout the world to refer to

layoffs, it can also label the more general

tactic of cutting back and downsizing.

Companies can employ this tactic in two

different ways. One way is to slash

expenditures by laying-off employees,

closing superfluous offices or branches,

reducing benefits such as medical

coverage or retirement plans, freezing

hiring or salaries, or even cutting salaries.

There are numerous other ways in which

a company can employ retrenchment.

These can be non-employee related, such

as reducing the quality of the materials

used in a product, streamlining the

process in which a product is

manufactured or produced, or moving

headquarters to a location where

operating costs are lower.

The second way in which a company may

practice retrenchment is to downsize in

one market that is proving unprofitable

and build up the company in a more

profitable market. If one market has

become obsolete due to modernization or

technology, then a company may decide

to change with the times to remain

profitable.

Retrenchment is of special importance to

small firms during recession. Therefore, it

would seem that small firms need to

understand retrenchment as a possible

response

to

poor

macroeconomic

conditions. States or governments may

also use retrenchment as a means to

become more financially stable. In

capitalist nations, retrenchment is effected

by lowering taxes in the hopes of pumping

more money into the economy. This tactic

is always healthily debated throughout all

levels of government. When applied to

governments, retrenchment may also

refer to a state cutting cost by making jobs

obsolete, closing governmental offices,

and cutting government programs and

services. However, this is not a classic

example of retrenchment, because when

expenses are cut in one area, politicians

tend to re-direct them to other areas.

Types of Retrenchment Strategies:

Turnaround

Captive Company

Selling out

Divestment

Bankruptcy

Liquidation

The above are explained in brief below:

Captive Company - Essentially, a captive

company's destiny is tied to a larger

company. For some companies, the only

way to stay viable is to act as an exclusive

supplier to a giant company. A company

may also be taken captive if their

competitive position is irreparably weak.

Turnaround - If a company is steadily

losing profit or market share, a turnaround

strategy may be needed. There are two

forms of turnarounds. Firstly, one may

choose contractions (cutting labor costs,

PP&E and Marketing). Secondly, a

company may decide to consolidate.

Bankruptcy - This may also be a viable

legal protective strategy. Bankruptcy

without a customer base is truly a bad

place.

However, if

one

declares

bankruptcy with loyal customers, there is

at least a possibility of a turnaround.

Divestment - This is a form of

retrenchment strategy used by businesses

when they downsize the scope of their

business activities. Divestment usually

involves eliminating a portion of a

business. Firms may elect to sell, close, or

spin-off a strategic business unit, major

operating division, or product line. This

move often is the final decision to

eliminate unrelated, unprofitable or

unmanageable operations

Liquidation " It is the process by

which a company (or part of a company)

is brought to an end, and the assets and

property of the company redistributed.

Liquidation may either be compulsory

(sometimes referred to as a creditors'

liquidation) or voluntary (sometimes

referred to as a shareholders' liquidation,

although some voluntary liquidations are

controlled by the creditors. Liquidation can

also be referred to as winding-up or

dissolution,

although

dissolution

technically refers to the last stage of

liquidation.

Of the above the most important one is

Turnaround. If a company is steadily

losing profit or market share, a turnaround

strategy may be needed. There are two

forms of turnarounds: First, one may

choose contractions (cutting labor costs,

etc.). Second, they may decide to

consolidate the business with new

ventures and revamping the existing

structure. However, turnaround can be

expensive and hence should be well

planned and requires sufficient expertise

and time.

Case:

In 1999, the revenues of Xerox Corp

(Xerox), the world's largest photocopier

maker, began to fall, and in 2000 it

reported a loss of $273 million. Xerox also

lost $20 billion in stock market value (from

April 1999 to May 2000). Xerox cited

many reasons for its bad performance

including the huge reorganization effort

initiated by the then CEO, Richard

Thoman. In May 2000, he was replaced

by his predecessor Paul Allaire, and Anne

Mulcahy (Mulcahy) was made COO.

Xerox revealed a Turnaround Programme

in December 2000, which included cutting

$1 billion in costs, and raising up to $4

billion through the sale of assets, exiting

non-core

businesses

and

lay-offs.

Subsequently, in August 2001, Mulcahy

was made CEO.

Xerox continued to report losses in 2001,

but it returned to profit in 2002 and

continued to report profits in 2003. The

case examines the events that led to the

decline of Xerox, and in particular how

major reorganization strategies can affect

a company.

Bankruptcy is a legally declared inability

or impairment of ability of an individual or

organization to pay its creditors. Creditors

may file a bankruptcy petition against a

debtor ("involuntary bankruptcy") in an

effort to recoup a portion of what they are

owed or initiate a restructuring. In the

majority of cases, however, bankruptcy is

initiated by the debtor (a "voluntary

bankruptcy" that is filed by the insolvent

individual or organization).

Case:

Lehman Brothers Holdings Inc. was a

global financial-services firm which, until

declaring bankruptcy in 2008, participated

in business in investment banking, equity

and fixed-income sales, research and

trading, investment management, private

equity, and private banking. It was a

primary dealer in the U.S. Treasury

securities market. On September 15,

2008, the firm filed for bankruptcy

protection following the massive exodus of

most of its clients, drastic losses in its

stock, and devaluation of its assets by

credit rating agencies. The filing marked

the largest bankruptcy in U.S. history.

During the week of September 22, 2008,

Nomura Holdings announced that it would

acquire Lehman Brothers' franchise in the

Asia Pacific region, including Japan, Hong

Kong and Australia as well as, Lehman

Brothers' investment banking and equities

businesses in Europe and the Middle

East. The deal became effective on

Monday, 13 October. In 2007, non-U.S.

subsidiaries of Lehman Brothers were

responsible for over 50% of global

revenue produced. Lehman Brothers'

Investment

Management

business,

including Neuberger Berman, was sold to

its management on December 3, 2008.

In finance and economics, divestment is

the reduction of some kind of asset for

either financial or ethical objectives or sale

of an existing business by a firm. A

divestment is the opposite of an

investment. A firm may divest (sell)

businesses that are not part of its core

operations so that it can focus on what it

does best. Many other firms also sell

various businesses that were not closely

related to their core businesses. Another

motive for divestitures is to obtain funds.

Divestment generates funds for the firm

because it is selling one of its businesses

in exchange for cash. A third motive for

divesting is that a firm's "break-up" value

is sometimes believed to be greater than

the value of the firm as a whole. In other

words, the sum of a firm's individual asset

liquidation values exceeds the market

value of the firm's combined assets. This

encourages firms to sell off what would be

worth more when liquidated than when

retained. A fourth motive to divest a part of

a firm may be to create stability. A fifth

motive for firms to divest a part of the

company

is

that

a

division

is

underperforming or even failing. Often the

term is used as a means to grow

financially in which a company sells off a

business unit in order to focus their

resources on a market it judges to be

more profitable, or promising. Sometimes,

such an action can be a spin-off.

Case

The Bell System was the AT&T monopoly

that provided telephone service in the

United States from 1877 to 1984. In 1984,

the company was broken up into separate

companies, by a Federal mandate. Before

the 1984 break-up, the Bell System

consisted of AT&T Inc, Cincinnati Bell Inc,

Qwest

Communication

International,

Verizon communication Inc, AlcatelLucent, Avaya Inc, Nortel Networks, NEC,

etc. These companies were divested from

AT&T in 1984. The breakup of AT&T was

initiated by the filing in 1974 by the U.S.

Department of Justice of an antitrust

lawsuit against AT&T. The case, United

States v. AT&T, led to a settlement

finalized on January 8, 1982, under which

"Ma Bell" agreed to divest its local

exchange service operating companies, in

return for a chance to go into the

computer business, AT&T Computer

Systems. Effective January 1, 1984,

AT&T's local operations were split into

seven independent Regional Holding

Companies, also known as Regional Bell

Operating Companies (RBOCs), or "Baby

Bells". Afterwards, AT&T, reduced in value

by approximately 70%, continued to

operate all of its long-distance services.

The breakup led to a surge of competition

in the long distance telecommunications

market by companies such as Sprint and

MCI. Long-distance rates, meanwhile,

have fallen due both to

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Home Replication StrategyDocument5 pagesHome Replication StrategyChau Hoang100% (19)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MODULE 4 Project-Quality-Management TDocument54 pagesMODULE 4 Project-Quality-Management TTewodros TadesseNo ratings yet

- Lone Pine CaféDocument3 pagesLone Pine Caféchan_han123No ratings yet

- Marketing Functions and Roles and Responsibilities of Marketing ManagerDocument19 pagesMarketing Functions and Roles and Responsibilities of Marketing ManagerFayez ShriedehNo ratings yet

- Impact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaDocument2 pagesImpact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaKundNo ratings yet

- Infolink College: Instructor: Ashenafi NDocument186 pagesInfolink College: Instructor: Ashenafi NBeka AsraNo ratings yet

- Treatment of Assets Under Construction in SAP - From Creation To Settlement - SapGurusDocument14 pagesTreatment of Assets Under Construction in SAP - From Creation To Settlement - SapGurusAnanthakumar ANo ratings yet

- Infosys JobsDocument3 pagesInfosys JobsChandan upadhyayNo ratings yet

- Muhammad Aizuddin Aizat Bin Jumhari: Contact InformationDocument4 pagesMuhammad Aizuddin Aizat Bin Jumhari: Contact InformationAndres ShaonNo ratings yet

- Christina Drumm ResumeDocument2 pagesChristina Drumm Resumeapi-272992635No ratings yet

- RBI Circular On Export Finance - 1Document21 pagesRBI Circular On Export Finance - 1Anonymous l0MTRDGu3MNo ratings yet

- Chap 007Document36 pagesChap 007Lee FeiNo ratings yet

- Patni Ar2009Document174 pagesPatni Ar2009chip_blueNo ratings yet

- BALANCE CASH HOLDING AssignDocument3 pagesBALANCE CASH HOLDING AssignJarra Abdurahman100% (2)

- Marketing Plan: 1: Define Your BusinessDocument12 pagesMarketing Plan: 1: Define Your Businessdrken3No ratings yet

- Pharma Analytics: SFE (Sales Force Effectiveness) Sales Analytics, Incentive Compensation & Reporting CapabilitiesDocument94 pagesPharma Analytics: SFE (Sales Force Effectiveness) Sales Analytics, Incentive Compensation & Reporting CapabilitiesDinesh IitmNo ratings yet

- EquityDerivatives Workbook (Version-January2020)Document80 pagesEquityDerivatives Workbook (Version-January2020)parthNo ratings yet

- Code of Ethics GhellaDocument28 pagesCode of Ethics GhellaMassimilianoTerenziNo ratings yet

- Status of Kendu Leaves Sale: Jharkhand State Forest Development Corporation LTDDocument11 pagesStatus of Kendu Leaves Sale: Jharkhand State Forest Development Corporation LTDmdNo ratings yet

- 814001-Gabriela GeorgescuDocument86 pages814001-Gabriela GeorgescuJeremiah PacerNo ratings yet

- MA Course Outline (Revised)Document4 pagesMA Course Outline (Revised)Ali Adil0% (1)

- Quality Standards PDFDocument20 pagesQuality Standards PDFmudassarhussainNo ratings yet

- Marketing Notes PDFDocument34 pagesMarketing Notes PDFFRANCIS JOSEPHNo ratings yet

- BT India Factsheet - NewDocument2 pagesBT India Factsheet - NewsunguntNo ratings yet

- MBA HotelDocument46 pagesMBA HotelMamta RanaNo ratings yet

- Slide RMK Chapter 1 - Kelompok 5 - Maksi 43CDocument15 pagesSlide RMK Chapter 1 - Kelompok 5 - Maksi 43CJali FusNo ratings yet

- The Road To Regtech: The (Astonishing) Example of The European UnionDocument12 pagesThe Road To Regtech: The (Astonishing) Example of The European UnionDamero PalominoNo ratings yet

- CompensationDocument36 pagesCompensationabdushababNo ratings yet

- Intellectual CapitalDocument2 pagesIntellectual CapitalraprapNo ratings yet

- Conjoint AnalysisDocument12 pagesConjoint AnalysisvamsibuNo ratings yet