Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsMartha W. Collord Fryer v. Commissioner of Internal Revenue, 434 F.2d 67, 2d Cir. (1970)

Martha W. Collord Fryer v. Commissioner of Internal Revenue, 434 F.2d 67, 2d Cir. (1970)

Uploaded by

Scribd Government DocsThe taxpayer received $5,200 from her former husband pursuant to a separation agreement. The issue before the Tax Court was whether $2,600 of that amount should have been taxed as alimony or excluded as child support. The Tax Court held that the agreement failed to specifically designate the child support amount as required by the Internal Revenue Code. The Court of Appeals affirmed, agreeing that the agreement did not meet the strict requirement set in previous case law that the instrument must specifically designate the amount of child support to qualify for exclusion from income.

Copyright:

Public Domain

Available Formats

Download as PDF or read online from Scribd

You might also like

- Robert Prechter - What A Trader Really Needs To Be SuccessfulDocument5 pagesRobert Prechter - What A Trader Really Needs To Be Successfulfredtag4393No ratings yet

- Bluebook Assignment (Fall 2018)Document4 pagesBluebook Assignment (Fall 2018)kaitNo ratings yet

- Elizabeth H. Bardwell v. Commissioner of Internal Revenue, 318 F.2d 786, 10th Cir. (1963)Document5 pagesElizabeth H. Bardwell v. Commissioner of Internal Revenue, 318 F.2d 786, 10th Cir. (1963)Scribd Government DocsNo ratings yet

- United States v. Jack Cohen, 384 F.2d 699, 2d Cir. (1967)Document3 pagesUnited States v. Jack Cohen, 384 F.2d 699, 2d Cir. (1967)Scribd Government DocsNo ratings yet

- United States Court of Appeals Second Circuit.: No. 157. Docket 24851Document5 pagesUnited States Court of Appeals Second Circuit.: No. 157. Docket 24851Scribd Government DocsNo ratings yet

- Lilley Capodanno v. Commissioner of Internal Revenue, R. T. Capodanno v. Commissioner of Internal Revenue, 602 F.2d 64, 3rd Cir. (1979)Document9 pagesLilley Capodanno v. Commissioner of Internal Revenue, R. T. Capodanno v. Commissioner of Internal Revenue, 602 F.2d 64, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 468. Docket 34142Document4 pagesUnited States Court of Appeals, Second Circuit.: No. 468. Docket 34142Scribd Government DocsNo ratings yet

- Katrina Van Oss v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Murray M. Salzberg, 377 F.2d 812, 2d Cir. (1967)Document4 pagesKatrina Van Oss v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Murray M. Salzberg, 377 F.2d 812, 2d Cir. (1967)Scribd Government DocsNo ratings yet

- Francis J. Dondero v. Anthony J. Celebrezze, Secretary of Health, Education and Welfare, 312 F.2d 677, 2d Cir. (1963)Document3 pagesFrancis J. Dondero v. Anthony J. Celebrezze, Secretary of Health, Education and Welfare, 312 F.2d 677, 2d Cir. (1963)Scribd Government DocsNo ratings yet

- United States Court of Appeals Second Circuit.: No. 271, Docket 23929Document6 pagesUnited States Court of Appeals Second Circuit.: No. 271, Docket 23929Scribd Government DocsNo ratings yet

- Justin H. Kimball v. Commissioner of Internal Revenue, 853 F.2d 120, 2d Cir. (1988)Document7 pagesJustin H. Kimball v. Commissioner of Internal Revenue, 853 F.2d 120, 2d Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 180, Docket 73-2010Document4 pagesUnited States Court of Appeals, Second Circuit.: No. 180, Docket 73-2010Scribd Government DocsNo ratings yet

- John Whiteford v. Commonwealth of Pennsylvania, 3rd Cir. (2013)Document5 pagesJohn Whiteford v. Commonwealth of Pennsylvania, 3rd Cir. (2013)Scribd Government DocsNo ratings yet

- Harold R. McCombs and Clara F. McCombs v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Ruby Mae McCombs, 397 F.2d 4, 10th Cir. (1968)Document6 pagesHarold R. McCombs and Clara F. McCombs v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Ruby Mae McCombs, 397 F.2d 4, 10th Cir. (1968)Scribd Government DocsNo ratings yet

- Commissioner v. Estate of Bosch, 387 U.S. 456 (1967)Document20 pagesCommissioner v. Estate of Bosch, 387 U.S. 456 (1967)Scribd Government DocsNo ratings yet

- City Trust Company, of The Will of Frederick A. Lockwood, Deceased v. United States, 497 F.2d 716, 2d Cir. (1974)Document4 pagesCity Trust Company, of The Will of Frederick A. Lockwood, Deceased v. United States, 497 F.2d 716, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- McCoach v. Pratt, 236 U.S. 562 (1915)Document3 pagesMcCoach v. Pratt, 236 U.S. 562 (1915)Scribd Government DocsNo ratings yet

- Estate of Sol Schildkraut, Deceased, Eugene Schildkraut and Lester Schildkraut, Executors v. Commissioner of Internal Revenue, 368 F.2d 40, 2d Cir. (1966)Document14 pagesEstate of Sol Schildkraut, Deceased, Eugene Schildkraut and Lester Schildkraut, Executors v. Commissioner of Internal Revenue, 368 F.2d 40, 2d Cir. (1966)Scribd Government DocsNo ratings yet

- Robert Rosano, As of The Estate of Mary R. Rosano v. United States, 245 F.3d 212, 2d Cir. (2001)Document4 pagesRobert Rosano, As of The Estate of Mary R. Rosano v. United States, 245 F.3d 212, 2d Cir. (2001)Scribd Government DocsNo ratings yet

- William C. West and Virginia B. West v. United States, 413 F.2d 294, 4th Cir. (1969)Document3 pagesWilliam C. West and Virginia B. West v. United States, 413 F.2d 294, 4th Cir. (1969)Scribd Government DocsNo ratings yet

- Real Estate Investment Trust of America v. Commissioner of Internal Revenue, 334 F.2d 986, 1st Cir. (1964)Document6 pagesReal Estate Investment Trust of America v. Commissioner of Internal Revenue, 334 F.2d 986, 1st Cir. (1964)Scribd Government DocsNo ratings yet

- Bertha Lemle v. United States, 579 F.2d 185, 2d Cir. (1978)Document5 pagesBertha Lemle v. United States, 579 F.2d 185, 2d Cir. (1978)Scribd Government DocsNo ratings yet

- Dorothy Olster v. Commissioner of Internal Revenue Service, 751 F.2d 1168, 11th Cir. (1985)Document13 pagesDorothy Olster v. Commissioner of Internal Revenue Service, 751 F.2d 1168, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- In Re Theodore W. Spong, Debtor. Raymond J. Pauley v. Theodore W. Spong, 661 F.2d 6, 2d Cir. (1981)Document8 pagesIn Re Theodore W. Spong, Debtor. Raymond J. Pauley v. Theodore W. Spong, 661 F.2d 6, 2d Cir. (1981)Scribd Government DocsNo ratings yet

- Muriel Dodge Neeman (Formerly Muriel Dodge) v. Commissioner of Internal Revenue, 255 F.2d 841, 2d Cir. (1958)Document7 pagesMuriel Dodge Neeman (Formerly Muriel Dodge) v. Commissioner of Internal Revenue, 255 F.2d 841, 2d Cir. (1958)Scribd Government DocsNo ratings yet

- Estate of Milton S. Wycoff, Deceased, Zions First National Bank v. Commissioner of Internal Revenue, 506 F.2d 1144, 1st Cir. (1974)Document13 pagesEstate of Milton S. Wycoff, Deceased, Zions First National Bank v. Commissioner of Internal Revenue, 506 F.2d 1144, 1st Cir. (1974)Scribd Government DocsNo ratings yet

- Inter-Regional Financial Group, Inc. v. Cyrus Hashemi, 562 F.2d 152, 2d Cir. (1977)Document5 pagesInter-Regional Financial Group, Inc. v. Cyrus Hashemi, 562 F.2d 152, 2d Cir. (1977)Scribd Government DocsNo ratings yet

- Webb v. IRS, 15 F.3d 203, 1st Cir. (1994)Document7 pagesWebb v. IRS, 15 F.3d 203, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Albert B. Poe v. Margaret G. Poe, 452 F.2d 999, 3rd Cir. (1971)Document2 pagesAlbert B. Poe v. Margaret G. Poe, 452 F.2d 999, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- Samuel H. Salisbury, As Under The Will of Ora S. Hitchcock v. United States, 377 F.2d 700, 2d Cir. (1967)Document12 pagesSamuel H. Salisbury, As Under The Will of Ora S. Hitchcock v. United States, 377 F.2d 700, 2d Cir. (1967)Scribd Government DocsNo ratings yet

- Rushton v. State Bank of South, 164 F.3d 1338, 10th Cir. (1999)Document11 pagesRushton v. State Bank of South, 164 F.3d 1338, 10th Cir. (1999)Scribd Government DocsNo ratings yet

- Commissioner v. Stern, 357 U.S. 39 (1958)Document9 pagesCommissioner v. Stern, 357 U.S. 39 (1958)Scribd Government DocsNo ratings yet

- Estate of Genevieve Rolin, Deceased, Haydee Rolin and Marine Midland Bank New York, Executors v. Commissioner of Internal Revenue, 588 F.2d 368, 2d Cir. (1978)Document5 pagesEstate of Genevieve Rolin, Deceased, Haydee Rolin and Marine Midland Bank New York, Executors v. Commissioner of Internal Revenue, 588 F.2d 368, 2d Cir. (1978)Scribd Government DocsNo ratings yet

- Jose Tavares v. Commissioner of Internal Revenue, 275 F.2d 369, 1st Cir. (1960)Document5 pagesJose Tavares v. Commissioner of Internal Revenue, 275 F.2d 369, 1st Cir. (1960)Scribd Government DocsNo ratings yet

- Likins-Foster Honolulu Corp. v. Commissioner of Internal Revenue, 417 F.2d 285, 10th Cir. (1969)Document13 pagesLikins-Foster Honolulu Corp. v. Commissioner of Internal Revenue, 417 F.2d 285, 10th Cir. (1969)Scribd Government DocsNo ratings yet

- Earl A. Barrows v. Ruth A. Barrows, 489 F.2d 661, 3rd Cir. (1974)Document3 pagesEarl A. Barrows v. Ruth A. Barrows, 489 F.2d 661, 3rd Cir. (1974)Scribd Government DocsNo ratings yet

- Arthur G. B. Metcalf v. Commissioner of Internal Revenue, 271 F.2d 288, 1st Cir. (1959)Document5 pagesArthur G. B. Metcalf v. Commissioner of Internal Revenue, 271 F.2d 288, 1st Cir. (1959)Scribd Government DocsNo ratings yet

- The Connecticut Bank and Trust Company, of The Estate of Charles A. Hunter v. United States, 439 F.2d 931, 2d Cir. (1971)Document10 pagesThe Connecticut Bank and Trust Company, of The Estate of Charles A. Hunter v. United States, 439 F.2d 931, 2d Cir. (1971)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument11 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 971, Docket 76-7101Document10 pagesUnited States Court of Appeals, Second Circuit.: No. 971, Docket 76-7101Scribd Government DocsNo ratings yet

- Daniel F. McCarthy and First National Bank & Trust Company of Evanston, Trustees of The Melanie B. McCarthy Trust v. United States, 806 F.2d 129, 1st Cir. (1987)Document6 pagesDaniel F. McCarthy and First National Bank & Trust Company of Evanston, Trustees of The Melanie B. McCarthy Trust v. United States, 806 F.2d 129, 1st Cir. (1987)Scribd Government DocsNo ratings yet

- In Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Document2 pagesIn Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Scribd Government DocsNo ratings yet

- Newton v. Pedrick, 212 F.2d 357, 2d Cir. (1954)Document7 pagesNewton v. Pedrick, 212 F.2d 357, 2d Cir. (1954)Scribd Government DocsNo ratings yet

- Schner-Block Company, Inc. v. Commissioner of Internal Revenue, 329 F.2d 875, 2d Cir. (1964)Document3 pagesSchner-Block Company, Inc. v. Commissioner of Internal Revenue, 329 F.2d 875, 2d Cir. (1964)Scribd Government DocsNo ratings yet

- United States v. General Douglas MacArthur Senior Village, Inc., D.C.R. Holding Corp., 508 F.2d 377, 2d Cir. (1974)Document13 pagesUnited States v. General Douglas MacArthur Senior Village, Inc., D.C.R. Holding Corp., 508 F.2d 377, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- John M. Coady v. Aguadilla Terminal Inc., and The Home Insurance Company, 456 F.2d 677, 1st Cir. (1972)Document2 pagesJohn M. Coady v. Aguadilla Terminal Inc., and The Home Insurance Company, 456 F.2d 677, 1st Cir. (1972)Scribd Government DocsNo ratings yet

- Smith v. Shaughnessy, 318 U.S. 176 (1943)Document6 pagesSmith v. Shaughnessy, 318 U.S. 176 (1943)Scribd Government DocsNo ratings yet

- Elizabeth Taft V Wells Fargo Bank, CASE 0.10-Cv-02084-SRN-FLNDocument16 pagesElizabeth Taft V Wells Fargo Bank, CASE 0.10-Cv-02084-SRN-FLNNeil GillespieNo ratings yet

- Wayne S. Marteney v. United States, 245 F.2d 135, 10th Cir. (1957)Document6 pagesWayne S. Marteney v. United States, 245 F.2d 135, 10th Cir. (1957)Scribd Government DocsNo ratings yet

- Bankr. L. Rep. P 71,535 in Re Brian Tibbetts Yeates, Debtor. Paulette B. Yeates v. Brian Tibbetts Yeates, 807 F.2d 874, 10th Cir. (1986)Document7 pagesBankr. L. Rep. P 71,535 in Re Brian Tibbetts Yeates, Debtor. Paulette B. Yeates v. Brian Tibbetts Yeates, 807 F.2d 874, 10th Cir. (1986)Scribd Government DocsNo ratings yet

- United States v. Lesniewski, 205 F.2d 802, 2d Cir. (1953)Document6 pagesUnited States v. Lesniewski, 205 F.2d 802, 2d Cir. (1953)Scribd Government DocsNo ratings yet

- Gary T. Napotnik v. Equibank and Parkvale Savings Association, 679 F.2d 316, 3rd Cir. (1982)Document9 pagesGary T. Napotnik v. Equibank and Parkvale Savings Association, 679 F.2d 316, 3rd Cir. (1982)Scribd Government DocsNo ratings yet

- Inez de Amodio, in No. 13740, John Amodio (Marquis Deamodio), in No. 13741 v. Commissioner of Internatal Revenue, 299 F.2d 623, 3rd Cir. (1962)Document4 pagesInez de Amodio, in No. 13740, John Amodio (Marquis Deamodio), in No. 13741 v. Commissioner of Internatal Revenue, 299 F.2d 623, 3rd Cir. (1962)Scribd Government DocsNo ratings yet

- Estate of Ross H. Compton, Deceased, by First National Bank of Middletown v. Commissioner of Internal Revenue, 532 F.2d 1086, 1st Cir. (1976)Document4 pagesEstate of Ross H. Compton, Deceased, by First National Bank of Middletown v. Commissioner of Internal Revenue, 532 F.2d 1086, 1st Cir. (1976)Scribd Government DocsNo ratings yet

- Emma R. Dorl v. Commissioner of Internal Revenue, 507 F.2d 406, 2d Cir. (1974)Document2 pagesEmma R. Dorl v. Commissioner of Internal Revenue, 507 F.2d 406, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- Ruby Adair v. Robert H. Finch, Secretary of Health, Education and Welfare, 421 F.2d 652, 10th Cir. (1970)Document3 pagesRuby Adair v. Robert H. Finch, Secretary of Health, Education and Welfare, 421 F.2d 652, 10th Cir. (1970)Scribd Government DocsNo ratings yet

- United States v. William M. Bottenfield, and Evelyn G. Bottenfield, Frankstown Land Development Company, Inc, 442 F.2d 1007, 3rd Cir. (1971)Document3 pagesUnited States v. William M. Bottenfield, and Evelyn G. Bottenfield, Frankstown Land Development Company, Inc, 442 F.2d 1007, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- United States v. Mary M. Porter, 90 F.3d 64, 2d Cir. (1996)Document12 pagesUnited States v. Mary M. Porter, 90 F.3d 64, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- Arthur G. B. Metcalf v. Commissioner of Internal Revenue, 343 F.2d 66, 1st Cir. (1965)Document4 pagesArthur G. B. Metcalf v. Commissioner of Internal Revenue, 343 F.2d 66, 1st Cir. (1965)Scribd Government DocsNo ratings yet

- Estate of James H. Waters, JR., Deceased William Roger Waters and John B. McMillan Co-Executors v. Commissioner of The Internal Revenue Service, 48 F.3d 838, 4th Cir. (1995)Document20 pagesEstate of James H. Waters, JR., Deceased William Roger Waters and John B. McMillan Co-Executors v. Commissioner of The Internal Revenue Service, 48 F.3d 838, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Lopez, 10th Cir. (2017)Document4 pagesUnited States v. Lopez, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- UD BUANA - Laporan KeuanganDocument12 pagesUD BUANA - Laporan KeuanganKartika WulandhariNo ratings yet

- Nomura Power FY11previewDocument15 pagesNomura Power FY11previewGeorg KuNo ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- Company Law and Allied RulesDocument11 pagesCompany Law and Allied RulesFaisalNo ratings yet

- The DJMC Cookie Shop: SS12 Social Enterprise/ Social Entrepreneurship Planning (Business Plan)Document25 pagesThe DJMC Cookie Shop: SS12 Social Enterprise/ Social Entrepreneurship Planning (Business Plan)Ic Rose2No ratings yet

- COPA Interview QuestionsDocument6 pagesCOPA Interview QuestionsPriyaNo ratings yet

- Annual Report 2007 08 PDFDocument111 pagesAnnual Report 2007 08 PDFyogesh wadikhayeNo ratings yet

- CIR V Cebu Portland CementDocument6 pagesCIR V Cebu Portland CementAnonymous mv3Y0KgNo ratings yet

- Horizontal Analysis: Income Statement Analysis InterpretationsDocument2 pagesHorizontal Analysis: Income Statement Analysis InterpretationsShanzay JuttNo ratings yet

- Ch.11 Microeconomic Ch11Document19 pagesCh.11 Microeconomic Ch11AldiffNo ratings yet

- CMA PGP23 ClassPPT Module4 PDFDocument41 pagesCMA PGP23 ClassPPT Module4 PDFSaransh Chauhan 23No ratings yet

- Chapter 8 6Document116 pagesChapter 8 6Yogesh SharmaNo ratings yet

- Major Account PlanDocument17 pagesMajor Account PlanIchsanul Anam100% (2)

- Interim Financial ReportingDocument37 pagesInterim Financial ReportingDebbie Grace Latiban LinazaNo ratings yet

- CommissionDocument2 pagesCommissionvincevillamora2k11No ratings yet

- Eimco Elecon Equity Research Report July 2016Document19 pagesEimco Elecon Equity Research Report July 2016sriramrangaNo ratings yet

- Income TaxDocument38 pagesIncome TaxNaiza Mae R. BinayaoNo ratings yet

- (P1) Retained EarningsDocument6 pages(P1) Retained Earningslooter198No ratings yet

- 03 Risk Management Applications of Option Strategies1Document15 pages03 Risk Management Applications of Option Strategies1Jaco GreeffNo ratings yet

- Financial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsDocument32 pagesFinancial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsHE HUNo ratings yet

- Financial Literacy 101 PDFDocument24 pagesFinancial Literacy 101 PDFDenver John Melecio TurtogaNo ratings yet

- CanaanDocument5 pagesCanaanForkLogNo ratings yet

- Nitin Auto Works ProjectDocument40 pagesNitin Auto Works ProjectSohel BangiNo ratings yet

- Department of Labor: Ca-5Document4 pagesDepartment of Labor: Ca-5USA_DepartmentOfLaborNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- Introduction To Financial AccountingDocument19 pagesIntroduction To Financial AccountingRONALD SSEKYANZINo ratings yet

- Advanced Accounting Week 3Document3 pagesAdvanced Accounting Week 3rahmaNo ratings yet

- Eeca QB PDFDocument6 pagesEeca QB PDFJeevanandam ShanmugaNo ratings yet

Martha W. Collord Fryer v. Commissioner of Internal Revenue, 434 F.2d 67, 2d Cir. (1970)

Martha W. Collord Fryer v. Commissioner of Internal Revenue, 434 F.2d 67, 2d Cir. (1970)

Uploaded by

Scribd Government Docs0 ratings0% found this document useful (0 votes)

8 views2 pagesThe taxpayer received $5,200 from her former husband pursuant to a separation agreement. The issue before the Tax Court was whether $2,600 of that amount should have been taxed as alimony or excluded as child support. The Tax Court held that the agreement failed to specifically designate the child support amount as required by the Internal Revenue Code. The Court of Appeals affirmed, agreeing that the agreement did not meet the strict requirement set in previous case law that the instrument must specifically designate the amount of child support to qualify for exclusion from income.

Original Description:

Filed: 1970-11-02

Precedential Status: Precedential

Citations: 434 F.2d 67

Docket: 34652_1

Copyright

© Public Domain

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe taxpayer received $5,200 from her former husband pursuant to a separation agreement. The issue before the Tax Court was whether $2,600 of that amount should have been taxed as alimony or excluded as child support. The Tax Court held that the agreement failed to specifically designate the child support amount as required by the Internal Revenue Code. The Court of Appeals affirmed, agreeing that the agreement did not meet the strict requirement set in previous case law that the instrument must specifically designate the amount of child support to qualify for exclusion from income.

Copyright:

Public Domain

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

8 views2 pagesMartha W. Collord Fryer v. Commissioner of Internal Revenue, 434 F.2d 67, 2d Cir. (1970)

Martha W. Collord Fryer v. Commissioner of Internal Revenue, 434 F.2d 67, 2d Cir. (1970)

Uploaded by

Scribd Government DocsThe taxpayer received $5,200 from her former husband pursuant to a separation agreement. The issue before the Tax Court was whether $2,600 of that amount should have been taxed as alimony or excluded as child support. The Tax Court held that the agreement failed to specifically designate the child support amount as required by the Internal Revenue Code. The Court of Appeals affirmed, agreeing that the agreement did not meet the strict requirement set in previous case law that the instrument must specifically designate the amount of child support to qualify for exclusion from income.

Copyright:

Public Domain

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

434 F.

2d 67

70-2 USTC P 9682

Martha W. Collord FRYER, Appellant,

v.

COMMISSIONER OF INTERNAL REVENUE, Appellee.

No. 264, Docket 34652.

United States Court of Appeals, Second Circuit.

Submitted Oct. 21, 1970.

Decided Nov. 2, 1970.

Robert C. Fryer, for appellant.

Johnnie M. Walters, Asst. Atty. Gen., Lee A. Jackson, Meyer Rothwacks,

Wesley J. Filer, Washington, D.C., Attys., for appellee.

Before WATERMAN, FRIENDLY and FEINBERG, Circuit Judges.

PER CURIAM:

Martha W. Collord Fryer appeals from a decision of the Tax Court,

Tannenwald, J., holding that there was a deficiency of $228 for the year 1966.

In that year, appellant received a total of $5,200 from her former husband

pursuant to a separation agreement. The issue before the Tax Court was

whether $2,600 of that amount should have been taxed to appellant as alimony

or excluded from her income as child support. Although the Tax Court had

'little doubt' that the parties intended 'to provide $50 per week as alimony and

$25 per week for the support of each of the two minor children,' it held that the

agreement failed to fix the latter amount with the specificity required by section

71(b) of the Internal Revenue Code. The Tax Court felt bound to reach this

result by Commissioner v. Lester, 366 U.S. 299, 81 S.Ct. 1343, 6 L.Ed.2d 306

(1961), which held that for the section 71(b) exclusion from gross income to

apply, the instrument must 'specifically designate' or 'fix' the amount or portion

to be applied to child support. The court below distinguished Commissioner v.

Gotthelf, 407 F.2d 491 (2d Cir.), cert. denied, 396 U.S. 828, 90 S.Ct. 78, 24

L.Ed.2d 79 (1969), where there was a rider to the separation agreement which

transformed the allocation implicit in the main agreement into the specific

designation required by section 71(b).

2

We agree with the Tax Court that the agreement in this case 1 does not meet the

strict requirement of Lester, and that Gotthelf is distinguishable. Any

reconsideration of Lester should come from the Supreme Court or Congress.

Judgment affirmed.

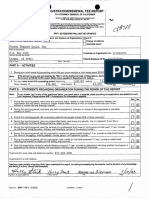

The crucial paragraph provided:

The husband shall pay to the wife the sum of One Hundred Dollars ($100.00)

each week for the support and maintenance of the wife and children. In the

event of the remarriage of the wife, the amount shall be reduced to the sum of

Fifty Dollars ($50.00) per week. In the event of the reaching of the age of

twenty-one (21) years, sooner emancipation, or sooner death of each respective

child, the amount that the husband shall pay to the wife shall be reduced by the

sum of Twenty-five Dollars ($25.00) per week in each respective instance;

provided, however, that so long as either child is attending an institution of

higher education, and continues to reside with the wife, and has not become

emancipated, and has not reached the age of twenty-five (25) years, said

reduction with respect to such child shall not take place.

You might also like

- Robert Prechter - What A Trader Really Needs To Be SuccessfulDocument5 pagesRobert Prechter - What A Trader Really Needs To Be Successfulfredtag4393No ratings yet

- Bluebook Assignment (Fall 2018)Document4 pagesBluebook Assignment (Fall 2018)kaitNo ratings yet

- Elizabeth H. Bardwell v. Commissioner of Internal Revenue, 318 F.2d 786, 10th Cir. (1963)Document5 pagesElizabeth H. Bardwell v. Commissioner of Internal Revenue, 318 F.2d 786, 10th Cir. (1963)Scribd Government DocsNo ratings yet

- United States v. Jack Cohen, 384 F.2d 699, 2d Cir. (1967)Document3 pagesUnited States v. Jack Cohen, 384 F.2d 699, 2d Cir. (1967)Scribd Government DocsNo ratings yet

- United States Court of Appeals Second Circuit.: No. 157. Docket 24851Document5 pagesUnited States Court of Appeals Second Circuit.: No. 157. Docket 24851Scribd Government DocsNo ratings yet

- Lilley Capodanno v. Commissioner of Internal Revenue, R. T. Capodanno v. Commissioner of Internal Revenue, 602 F.2d 64, 3rd Cir. (1979)Document9 pagesLilley Capodanno v. Commissioner of Internal Revenue, R. T. Capodanno v. Commissioner of Internal Revenue, 602 F.2d 64, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 468. Docket 34142Document4 pagesUnited States Court of Appeals, Second Circuit.: No. 468. Docket 34142Scribd Government DocsNo ratings yet

- Katrina Van Oss v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Murray M. Salzberg, 377 F.2d 812, 2d Cir. (1967)Document4 pagesKatrina Van Oss v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Murray M. Salzberg, 377 F.2d 812, 2d Cir. (1967)Scribd Government DocsNo ratings yet

- Francis J. Dondero v. Anthony J. Celebrezze, Secretary of Health, Education and Welfare, 312 F.2d 677, 2d Cir. (1963)Document3 pagesFrancis J. Dondero v. Anthony J. Celebrezze, Secretary of Health, Education and Welfare, 312 F.2d 677, 2d Cir. (1963)Scribd Government DocsNo ratings yet

- United States Court of Appeals Second Circuit.: No. 271, Docket 23929Document6 pagesUnited States Court of Appeals Second Circuit.: No. 271, Docket 23929Scribd Government DocsNo ratings yet

- Justin H. Kimball v. Commissioner of Internal Revenue, 853 F.2d 120, 2d Cir. (1988)Document7 pagesJustin H. Kimball v. Commissioner of Internal Revenue, 853 F.2d 120, 2d Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 180, Docket 73-2010Document4 pagesUnited States Court of Appeals, Second Circuit.: No. 180, Docket 73-2010Scribd Government DocsNo ratings yet

- John Whiteford v. Commonwealth of Pennsylvania, 3rd Cir. (2013)Document5 pagesJohn Whiteford v. Commonwealth of Pennsylvania, 3rd Cir. (2013)Scribd Government DocsNo ratings yet

- Harold R. McCombs and Clara F. McCombs v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Ruby Mae McCombs, 397 F.2d 4, 10th Cir. (1968)Document6 pagesHarold R. McCombs and Clara F. McCombs v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Ruby Mae McCombs, 397 F.2d 4, 10th Cir. (1968)Scribd Government DocsNo ratings yet

- Commissioner v. Estate of Bosch, 387 U.S. 456 (1967)Document20 pagesCommissioner v. Estate of Bosch, 387 U.S. 456 (1967)Scribd Government DocsNo ratings yet

- City Trust Company, of The Will of Frederick A. Lockwood, Deceased v. United States, 497 F.2d 716, 2d Cir. (1974)Document4 pagesCity Trust Company, of The Will of Frederick A. Lockwood, Deceased v. United States, 497 F.2d 716, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- McCoach v. Pratt, 236 U.S. 562 (1915)Document3 pagesMcCoach v. Pratt, 236 U.S. 562 (1915)Scribd Government DocsNo ratings yet

- Estate of Sol Schildkraut, Deceased, Eugene Schildkraut and Lester Schildkraut, Executors v. Commissioner of Internal Revenue, 368 F.2d 40, 2d Cir. (1966)Document14 pagesEstate of Sol Schildkraut, Deceased, Eugene Schildkraut and Lester Schildkraut, Executors v. Commissioner of Internal Revenue, 368 F.2d 40, 2d Cir. (1966)Scribd Government DocsNo ratings yet

- Robert Rosano, As of The Estate of Mary R. Rosano v. United States, 245 F.3d 212, 2d Cir. (2001)Document4 pagesRobert Rosano, As of The Estate of Mary R. Rosano v. United States, 245 F.3d 212, 2d Cir. (2001)Scribd Government DocsNo ratings yet

- William C. West and Virginia B. West v. United States, 413 F.2d 294, 4th Cir. (1969)Document3 pagesWilliam C. West and Virginia B. West v. United States, 413 F.2d 294, 4th Cir. (1969)Scribd Government DocsNo ratings yet

- Real Estate Investment Trust of America v. Commissioner of Internal Revenue, 334 F.2d 986, 1st Cir. (1964)Document6 pagesReal Estate Investment Trust of America v. Commissioner of Internal Revenue, 334 F.2d 986, 1st Cir. (1964)Scribd Government DocsNo ratings yet

- Bertha Lemle v. United States, 579 F.2d 185, 2d Cir. (1978)Document5 pagesBertha Lemle v. United States, 579 F.2d 185, 2d Cir. (1978)Scribd Government DocsNo ratings yet

- Dorothy Olster v. Commissioner of Internal Revenue Service, 751 F.2d 1168, 11th Cir. (1985)Document13 pagesDorothy Olster v. Commissioner of Internal Revenue Service, 751 F.2d 1168, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- In Re Theodore W. Spong, Debtor. Raymond J. Pauley v. Theodore W. Spong, 661 F.2d 6, 2d Cir. (1981)Document8 pagesIn Re Theodore W. Spong, Debtor. Raymond J. Pauley v. Theodore W. Spong, 661 F.2d 6, 2d Cir. (1981)Scribd Government DocsNo ratings yet

- Muriel Dodge Neeman (Formerly Muriel Dodge) v. Commissioner of Internal Revenue, 255 F.2d 841, 2d Cir. (1958)Document7 pagesMuriel Dodge Neeman (Formerly Muriel Dodge) v. Commissioner of Internal Revenue, 255 F.2d 841, 2d Cir. (1958)Scribd Government DocsNo ratings yet

- Estate of Milton S. Wycoff, Deceased, Zions First National Bank v. Commissioner of Internal Revenue, 506 F.2d 1144, 1st Cir. (1974)Document13 pagesEstate of Milton S. Wycoff, Deceased, Zions First National Bank v. Commissioner of Internal Revenue, 506 F.2d 1144, 1st Cir. (1974)Scribd Government DocsNo ratings yet

- Inter-Regional Financial Group, Inc. v. Cyrus Hashemi, 562 F.2d 152, 2d Cir. (1977)Document5 pagesInter-Regional Financial Group, Inc. v. Cyrus Hashemi, 562 F.2d 152, 2d Cir. (1977)Scribd Government DocsNo ratings yet

- Webb v. IRS, 15 F.3d 203, 1st Cir. (1994)Document7 pagesWebb v. IRS, 15 F.3d 203, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Albert B. Poe v. Margaret G. Poe, 452 F.2d 999, 3rd Cir. (1971)Document2 pagesAlbert B. Poe v. Margaret G. Poe, 452 F.2d 999, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- Samuel H. Salisbury, As Under The Will of Ora S. Hitchcock v. United States, 377 F.2d 700, 2d Cir. (1967)Document12 pagesSamuel H. Salisbury, As Under The Will of Ora S. Hitchcock v. United States, 377 F.2d 700, 2d Cir. (1967)Scribd Government DocsNo ratings yet

- Rushton v. State Bank of South, 164 F.3d 1338, 10th Cir. (1999)Document11 pagesRushton v. State Bank of South, 164 F.3d 1338, 10th Cir. (1999)Scribd Government DocsNo ratings yet

- Commissioner v. Stern, 357 U.S. 39 (1958)Document9 pagesCommissioner v. Stern, 357 U.S. 39 (1958)Scribd Government DocsNo ratings yet

- Estate of Genevieve Rolin, Deceased, Haydee Rolin and Marine Midland Bank New York, Executors v. Commissioner of Internal Revenue, 588 F.2d 368, 2d Cir. (1978)Document5 pagesEstate of Genevieve Rolin, Deceased, Haydee Rolin and Marine Midland Bank New York, Executors v. Commissioner of Internal Revenue, 588 F.2d 368, 2d Cir. (1978)Scribd Government DocsNo ratings yet

- Jose Tavares v. Commissioner of Internal Revenue, 275 F.2d 369, 1st Cir. (1960)Document5 pagesJose Tavares v. Commissioner of Internal Revenue, 275 F.2d 369, 1st Cir. (1960)Scribd Government DocsNo ratings yet

- Likins-Foster Honolulu Corp. v. Commissioner of Internal Revenue, 417 F.2d 285, 10th Cir. (1969)Document13 pagesLikins-Foster Honolulu Corp. v. Commissioner of Internal Revenue, 417 F.2d 285, 10th Cir. (1969)Scribd Government DocsNo ratings yet

- Earl A. Barrows v. Ruth A. Barrows, 489 F.2d 661, 3rd Cir. (1974)Document3 pagesEarl A. Barrows v. Ruth A. Barrows, 489 F.2d 661, 3rd Cir. (1974)Scribd Government DocsNo ratings yet

- Arthur G. B. Metcalf v. Commissioner of Internal Revenue, 271 F.2d 288, 1st Cir. (1959)Document5 pagesArthur G. B. Metcalf v. Commissioner of Internal Revenue, 271 F.2d 288, 1st Cir. (1959)Scribd Government DocsNo ratings yet

- The Connecticut Bank and Trust Company, of The Estate of Charles A. Hunter v. United States, 439 F.2d 931, 2d Cir. (1971)Document10 pagesThe Connecticut Bank and Trust Company, of The Estate of Charles A. Hunter v. United States, 439 F.2d 931, 2d Cir. (1971)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument11 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 971, Docket 76-7101Document10 pagesUnited States Court of Appeals, Second Circuit.: No. 971, Docket 76-7101Scribd Government DocsNo ratings yet

- Daniel F. McCarthy and First National Bank & Trust Company of Evanston, Trustees of The Melanie B. McCarthy Trust v. United States, 806 F.2d 129, 1st Cir. (1987)Document6 pagesDaniel F. McCarthy and First National Bank & Trust Company of Evanston, Trustees of The Melanie B. McCarthy Trust v. United States, 806 F.2d 129, 1st Cir. (1987)Scribd Government DocsNo ratings yet

- In Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Document2 pagesIn Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Scribd Government DocsNo ratings yet

- Newton v. Pedrick, 212 F.2d 357, 2d Cir. (1954)Document7 pagesNewton v. Pedrick, 212 F.2d 357, 2d Cir. (1954)Scribd Government DocsNo ratings yet

- Schner-Block Company, Inc. v. Commissioner of Internal Revenue, 329 F.2d 875, 2d Cir. (1964)Document3 pagesSchner-Block Company, Inc. v. Commissioner of Internal Revenue, 329 F.2d 875, 2d Cir. (1964)Scribd Government DocsNo ratings yet

- United States v. General Douglas MacArthur Senior Village, Inc., D.C.R. Holding Corp., 508 F.2d 377, 2d Cir. (1974)Document13 pagesUnited States v. General Douglas MacArthur Senior Village, Inc., D.C.R. Holding Corp., 508 F.2d 377, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- John M. Coady v. Aguadilla Terminal Inc., and The Home Insurance Company, 456 F.2d 677, 1st Cir. (1972)Document2 pagesJohn M. Coady v. Aguadilla Terminal Inc., and The Home Insurance Company, 456 F.2d 677, 1st Cir. (1972)Scribd Government DocsNo ratings yet

- Smith v. Shaughnessy, 318 U.S. 176 (1943)Document6 pagesSmith v. Shaughnessy, 318 U.S. 176 (1943)Scribd Government DocsNo ratings yet

- Elizabeth Taft V Wells Fargo Bank, CASE 0.10-Cv-02084-SRN-FLNDocument16 pagesElizabeth Taft V Wells Fargo Bank, CASE 0.10-Cv-02084-SRN-FLNNeil GillespieNo ratings yet

- Wayne S. Marteney v. United States, 245 F.2d 135, 10th Cir. (1957)Document6 pagesWayne S. Marteney v. United States, 245 F.2d 135, 10th Cir. (1957)Scribd Government DocsNo ratings yet

- Bankr. L. Rep. P 71,535 in Re Brian Tibbetts Yeates, Debtor. Paulette B. Yeates v. Brian Tibbetts Yeates, 807 F.2d 874, 10th Cir. (1986)Document7 pagesBankr. L. Rep. P 71,535 in Re Brian Tibbetts Yeates, Debtor. Paulette B. Yeates v. Brian Tibbetts Yeates, 807 F.2d 874, 10th Cir. (1986)Scribd Government DocsNo ratings yet

- United States v. Lesniewski, 205 F.2d 802, 2d Cir. (1953)Document6 pagesUnited States v. Lesniewski, 205 F.2d 802, 2d Cir. (1953)Scribd Government DocsNo ratings yet

- Gary T. Napotnik v. Equibank and Parkvale Savings Association, 679 F.2d 316, 3rd Cir. (1982)Document9 pagesGary T. Napotnik v. Equibank and Parkvale Savings Association, 679 F.2d 316, 3rd Cir. (1982)Scribd Government DocsNo ratings yet

- Inez de Amodio, in No. 13740, John Amodio (Marquis Deamodio), in No. 13741 v. Commissioner of Internatal Revenue, 299 F.2d 623, 3rd Cir. (1962)Document4 pagesInez de Amodio, in No. 13740, John Amodio (Marquis Deamodio), in No. 13741 v. Commissioner of Internatal Revenue, 299 F.2d 623, 3rd Cir. (1962)Scribd Government DocsNo ratings yet

- Estate of Ross H. Compton, Deceased, by First National Bank of Middletown v. Commissioner of Internal Revenue, 532 F.2d 1086, 1st Cir. (1976)Document4 pagesEstate of Ross H. Compton, Deceased, by First National Bank of Middletown v. Commissioner of Internal Revenue, 532 F.2d 1086, 1st Cir. (1976)Scribd Government DocsNo ratings yet

- Emma R. Dorl v. Commissioner of Internal Revenue, 507 F.2d 406, 2d Cir. (1974)Document2 pagesEmma R. Dorl v. Commissioner of Internal Revenue, 507 F.2d 406, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- Ruby Adair v. Robert H. Finch, Secretary of Health, Education and Welfare, 421 F.2d 652, 10th Cir. (1970)Document3 pagesRuby Adair v. Robert H. Finch, Secretary of Health, Education and Welfare, 421 F.2d 652, 10th Cir. (1970)Scribd Government DocsNo ratings yet

- United States v. William M. Bottenfield, and Evelyn G. Bottenfield, Frankstown Land Development Company, Inc, 442 F.2d 1007, 3rd Cir. (1971)Document3 pagesUnited States v. William M. Bottenfield, and Evelyn G. Bottenfield, Frankstown Land Development Company, Inc, 442 F.2d 1007, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- United States v. Mary M. Porter, 90 F.3d 64, 2d Cir. (1996)Document12 pagesUnited States v. Mary M. Porter, 90 F.3d 64, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- Arthur G. B. Metcalf v. Commissioner of Internal Revenue, 343 F.2d 66, 1st Cir. (1965)Document4 pagesArthur G. B. Metcalf v. Commissioner of Internal Revenue, 343 F.2d 66, 1st Cir. (1965)Scribd Government DocsNo ratings yet

- Estate of James H. Waters, JR., Deceased William Roger Waters and John B. McMillan Co-Executors v. Commissioner of The Internal Revenue Service, 48 F.3d 838, 4th Cir. (1995)Document20 pagesEstate of James H. Waters, JR., Deceased William Roger Waters and John B. McMillan Co-Executors v. Commissioner of The Internal Revenue Service, 48 F.3d 838, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Lopez, 10th Cir. (2017)Document4 pagesUnited States v. Lopez, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- UD BUANA - Laporan KeuanganDocument12 pagesUD BUANA - Laporan KeuanganKartika WulandhariNo ratings yet

- Nomura Power FY11previewDocument15 pagesNomura Power FY11previewGeorg KuNo ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- Company Law and Allied RulesDocument11 pagesCompany Law and Allied RulesFaisalNo ratings yet

- The DJMC Cookie Shop: SS12 Social Enterprise/ Social Entrepreneurship Planning (Business Plan)Document25 pagesThe DJMC Cookie Shop: SS12 Social Enterprise/ Social Entrepreneurship Planning (Business Plan)Ic Rose2No ratings yet

- COPA Interview QuestionsDocument6 pagesCOPA Interview QuestionsPriyaNo ratings yet

- Annual Report 2007 08 PDFDocument111 pagesAnnual Report 2007 08 PDFyogesh wadikhayeNo ratings yet

- CIR V Cebu Portland CementDocument6 pagesCIR V Cebu Portland CementAnonymous mv3Y0KgNo ratings yet

- Horizontal Analysis: Income Statement Analysis InterpretationsDocument2 pagesHorizontal Analysis: Income Statement Analysis InterpretationsShanzay JuttNo ratings yet

- Ch.11 Microeconomic Ch11Document19 pagesCh.11 Microeconomic Ch11AldiffNo ratings yet

- CMA PGP23 ClassPPT Module4 PDFDocument41 pagesCMA PGP23 ClassPPT Module4 PDFSaransh Chauhan 23No ratings yet

- Chapter 8 6Document116 pagesChapter 8 6Yogesh SharmaNo ratings yet

- Major Account PlanDocument17 pagesMajor Account PlanIchsanul Anam100% (2)

- Interim Financial ReportingDocument37 pagesInterim Financial ReportingDebbie Grace Latiban LinazaNo ratings yet

- CommissionDocument2 pagesCommissionvincevillamora2k11No ratings yet

- Eimco Elecon Equity Research Report July 2016Document19 pagesEimco Elecon Equity Research Report July 2016sriramrangaNo ratings yet

- Income TaxDocument38 pagesIncome TaxNaiza Mae R. BinayaoNo ratings yet

- (P1) Retained EarningsDocument6 pages(P1) Retained Earningslooter198No ratings yet

- 03 Risk Management Applications of Option Strategies1Document15 pages03 Risk Management Applications of Option Strategies1Jaco GreeffNo ratings yet

- Financial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsDocument32 pagesFinancial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsHE HUNo ratings yet

- Financial Literacy 101 PDFDocument24 pagesFinancial Literacy 101 PDFDenver John Melecio TurtogaNo ratings yet

- CanaanDocument5 pagesCanaanForkLogNo ratings yet

- Nitin Auto Works ProjectDocument40 pagesNitin Auto Works ProjectSohel BangiNo ratings yet

- Department of Labor: Ca-5Document4 pagesDepartment of Labor: Ca-5USA_DepartmentOfLaborNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- Introduction To Financial AccountingDocument19 pagesIntroduction To Financial AccountingRONALD SSEKYANZINo ratings yet

- Advanced Accounting Week 3Document3 pagesAdvanced Accounting Week 3rahmaNo ratings yet

- Eeca QB PDFDocument6 pagesEeca QB PDFJeevanandam ShanmugaNo ratings yet