Professional Documents

Culture Documents

United States Court of Appeals, Ninth Circuit

United States Court of Appeals, Ninth Circuit

Uploaded by

Scribd Government DocsCopyright:

Available Formats

You might also like

- Rotary Evaporator ManualDocument80 pagesRotary Evaporator ManualJesujoba100% (1)

- Complaint Handling SOPDocument10 pagesComplaint Handling SOPPrashant Khare100% (3)

- Chapter 1 and 2 Obl IconDocument10 pagesChapter 1 and 2 Obl IconPia ValdezNo ratings yet

- United States v. George J. Blusco, 519 F.2d 473, 4th Cir. (1975)Document3 pagesUnited States v. George J. Blusco, 519 F.2d 473, 4th Cir. (1975)Scribd Government DocsNo ratings yet

- United States v. Gardell, 23 F.3d 395, 1st Cir. (1994)Document4 pagesUnited States v. Gardell, 23 F.3d 395, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument9 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Ross P. Upton v. Internal Revenue Service and Gloria A. Hassinger, United States of America, Movant-Appellee, 104 F.3d 543, 2d Cir. (1997)Document6 pagesRoss P. Upton v. Internal Revenue Service and Gloria A. Hassinger, United States of America, Movant-Appellee, 104 F.3d 543, 2d Cir. (1997)Scribd Government DocsNo ratings yet

- Cassell v. Osborn, 23 F.3d 394, 1st Cir. (1994)Document8 pagesCassell v. Osborn, 23 F.3d 394, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- United States v. Raymond M. Midgley, 142 F.3d 174, 3rd Cir. (1998)Document11 pagesUnited States v. Raymond M. Midgley, 142 F.3d 174, 3rd Cir. (1998)Scribd Government DocsNo ratings yet

- Sweeney Devine 093010Document4 pagesSweeney Devine 093010Lamario StillwellNo ratings yet

- United States v. Nevin M. Stewart, Jr. and Melanie Lee McCall, 700 F.2d 702, 11th Cir. (1983)Document6 pagesUnited States v. Nevin M. Stewart, Jr. and Melanie Lee McCall, 700 F.2d 702, 11th Cir. (1983)Scribd Government DocsNo ratings yet

- Steven A. Stepanian, II v. David R. Addis, 782 F.2d 902, 11th Cir. (1986)Document5 pagesSteven A. Stepanian, II v. David R. Addis, 782 F.2d 902, 11th Cir. (1986)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument5 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Louis Ruggerio, JR., Robert Cherry, 107 F.3d 5, 2d Cir. (1997)Document3 pagesUnited States v. Louis Ruggerio, JR., Robert Cherry, 107 F.3d 5, 2d Cir. (1997)Scribd Government DocsNo ratings yet

- Melvin L. Lindsay v. United States, 453 F.2d 867, 3rd Cir. (1972)Document4 pagesMelvin L. Lindsay v. United States, 453 F.2d 867, 3rd Cir. (1972)Scribd Government DocsNo ratings yet

- In Re: Charter Oak Associates, Debtor. Neal Ossen, Trustee v. Department of Social Services, State of Connecticut, 361 F.3d 760, 2d Cir. (2004)Document13 pagesIn Re: Charter Oak Associates, Debtor. Neal Ossen, Trustee v. Department of Social Services, State of Connecticut, 361 F.3d 760, 2d Cir. (2004)Scribd Government DocsNo ratings yet

- Chase Home Finance, LLC.,: 2115 Austin DR., Carrollton, Texas 75006Document10 pagesChase Home Finance, LLC.,: 2115 Austin DR., Carrollton, Texas 75006bruthapNo ratings yet

- Dalis v. United States, 10th Cir. (2000)Document5 pagesDalis v. United States, 10th Cir. (2000)Scribd Government DocsNo ratings yet

- United States v. Carlos Bernard Adams, 96 F.3d 1439, 4th Cir. (1996)Document3 pagesUnited States v. Carlos Bernard Adams, 96 F.3d 1439, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument4 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument17 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument10 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- United Services Automobile Association Charlene Cozart v. United States, 105 F.3d 185, 4th Cir. (1997)Document5 pagesUnited Services Automobile Association Charlene Cozart v. United States, 105 F.3d 185, 4th Cir. (1997)Scribd Government DocsNo ratings yet

- United States v. Sanchez, 10th Cir. (2004)Document8 pagesUnited States v. Sanchez, 10th Cir. (2004)Scribd Government DocsNo ratings yet

- Beneficial Consumer Discount Company v. David R. Poltonowicz John Poltonowicz The Internal Revenue Service of The United States of America, 47 F.3d 91, 3rd Cir. (1995)Document10 pagesBeneficial Consumer Discount Company v. David R. Poltonowicz John Poltonowicz The Internal Revenue Service of The United States of America, 47 F.3d 91, 3rd Cir. (1995)Scribd Government DocsNo ratings yet

- Garcia v. Lawrence, 10th Cir. (2004)Document5 pagesGarcia v. Lawrence, 10th Cir. (2004)Scribd Government DocsNo ratings yet

- United States v. Thomas J. Pecora, 484 F.2d 1289, 3rd Cir. (1973)Document9 pagesUnited States v. Thomas J. Pecora, 484 F.2d 1289, 3rd Cir. (1973)Scribd Government DocsNo ratings yet

- United States v. Vernon O. Holland and James Davis Drane Mauldin, JR., 956 F.2d 990, 10th Cir. (1992)Document6 pagesUnited States v. Vernon O. Holland and James Davis Drane Mauldin, JR., 956 F.2d 990, 10th Cir. (1992)Scribd Government DocsNo ratings yet

- United States v. William Gilchrist, 215 F.3d 333, 3rd Cir. (2000)Document9 pagesUnited States v. William Gilchrist, 215 F.3d 333, 3rd Cir. (2000)Scribd Government DocsNo ratings yet

- United States v. Oscar R. Smith, 859 F.2d 151, 4th Cir. (1988)Document4 pagesUnited States v. Oscar R. Smith, 859 F.2d 151, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States v. One (1) Douglas A-26b Aircraft, Serial No. 28034, Faa Registration No. N3035 S, and Equipment, Rebel Aviation, Inc., Claimant-Appellant, 662 F.2d 1372, 11th Cir. (1981)Document9 pagesUnited States v. One (1) Douglas A-26b Aircraft, Serial No. 28034, Faa Registration No. N3035 S, and Equipment, Rebel Aviation, Inc., Claimant-Appellant, 662 F.2d 1372, 11th Cir. (1981)Scribd Government DocsNo ratings yet

- United States v. Joseph Forcellati, 610 F.2d 25, 1st Cir. (1979)Document9 pagesUnited States v. Joseph Forcellati, 610 F.2d 25, 1st Cir. (1979)Scribd Government DocsNo ratings yet

- Plaintiff'SReply Motion For Default JudgmentDocument7 pagesPlaintiff'SReply Motion For Default JudgmentManasi Hansa100% (1)

- United States v. Dennis D'AmAto, 507 F.2d 26, 2d Cir. (1974)Document7 pagesUnited States v. Dennis D'AmAto, 507 F.2d 26, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- Not PrecedentialDocument13 pagesNot PrecedentialScribd Government DocsNo ratings yet

- United States v. Aetna Casualty & Surety Co., 338 U.S. 366 (1950)Document13 pagesUnited States v. Aetna Casualty & Surety Co., 338 U.S. 366 (1950)Scribd Government DocsNo ratings yet

- United States v. Zalazar-Torres, 10th Cir. (2001)Document12 pagesUnited States v. Zalazar-Torres, 10th Cir. (2001)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument11 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument10 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Otis Palmer, 809 F.2d 1504, 11th Cir. (1987)Document8 pagesUnited States v. Otis Palmer, 809 F.2d 1504, 11th Cir. (1987)Scribd Government DocsNo ratings yet

- United States v. Salvatore Cirami and James Cirami, 510 F.2d 69, 2d Cir. (1975)Document7 pagesUnited States v. Salvatore Cirami and James Cirami, 510 F.2d 69, 2d Cir. (1975)Scribd Government DocsNo ratings yet

- United States v. Joseph George Helmich, 704 F.2d 547, 11th Cir. (1983)Document5 pagesUnited States v. Joseph George Helmich, 704 F.2d 547, 11th Cir. (1983)Scribd Government DocsNo ratings yet

- Zaharia v. Cross, 10th Cir. (2000)Document5 pagesZaharia v. Cross, 10th Cir. (2000)Scribd Government DocsNo ratings yet

- United States v. Caraballo Cruz, 52 F.3d 390, 1st Cir. (1995)Document6 pagesUnited States v. Caraballo Cruz, 52 F.3d 390, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- United States v. Jackson, 10th Cir. (2003)Document8 pagesUnited States v. Jackson, 10th Cir. (2003)Scribd Government DocsNo ratings yet

- Warren A. Wilkes v. United States, 469 U.S. 964 (1984)Document2 pagesWarren A. Wilkes v. United States, 469 U.S. 964 (1984)Scribd Government DocsNo ratings yet

- Williams v. United States, 10th Cir. (2002)Document5 pagesWilliams v. United States, 10th Cir. (2002)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument5 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- United States v. Elton Wellington Davis, 92 F.3d 1183, 4th Cir. (1996)Document4 pagesUnited States v. Elton Wellington Davis, 92 F.3d 1183, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- United States v. Richard A. Gellman, 677 F.2d 65, 11th Cir. (1982)Document3 pagesUnited States v. Richard A. Gellman, 677 F.2d 65, 11th Cir. (1982)Scribd Government DocsNo ratings yet

- Joseph Wise v. Thomas A. Fulcomer, Superintendent The Attorney General of The State of Pennsylvania Ronald D. Castille, District Attorney For Philadelphia County, 958 F.2d 30, 3rd Cir. (1992)Document9 pagesJoseph Wise v. Thomas A. Fulcomer, Superintendent The Attorney General of The State of Pennsylvania Ronald D. Castille, District Attorney For Philadelphia County, 958 F.2d 30, 3rd Cir. (1992)Scribd Government DocsNo ratings yet

- Douglas F. Moeller v. Orlando A. Rodriguez, 113 F.3d 1246, 10th Cir. (1997)Document3 pagesDouglas F. Moeller v. Orlando A. Rodriguez, 113 F.3d 1246, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument6 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- United States v. George Decosta, JR., 435 F.2d 630, 1st Cir. (1970)Document4 pagesUnited States v. George Decosta, JR., 435 F.2d 630, 1st Cir. (1970)Scribd Government DocsNo ratings yet

- Mason v. Hutton, 141 F.3d 1185, 10th Cir. (1998)Document6 pagesMason v. Hutton, 141 F.3d 1185, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- United States v. Antonio Dorsey, 4 F.3d 986, 4th Cir. (1993)Document5 pagesUnited States v. Antonio Dorsey, 4 F.3d 986, 4th Cir. (1993)Scribd Government DocsNo ratings yet

- Sarner v. Luce, 10th Cir. (1997)Document5 pagesSarner v. Luce, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- United States v. Alfred Grassia, 354 F.2d 27, 2d Cir. (1965)Document3 pagesUnited States v. Alfred Grassia, 354 F.2d 27, 2d Cir. (1965)Scribd Government DocsNo ratings yet

- United States v. Fatima Garcia, A/K/A Fatima Garcia-Nuine, 166 F.3d 519, 2d Cir. (1999)Document4 pagesUnited States v. Fatima Garcia, A/K/A Fatima Garcia-Nuine, 166 F.3d 519, 2d Cir. (1999)Scribd Government DocsNo ratings yet

- El Dia, Inc. v. Rossello, 165 F.3d 106, 1st Cir. (1999)Document6 pagesEl Dia, Inc. v. Rossello, 165 F.3d 106, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- No. 94-8931, 66 F.3d 1164, 11th Cir. (1995)Document5 pagesNo. 94-8931, 66 F.3d 1164, 11th Cir. (1995)Scribd Government DocsNo ratings yet

- United States v. McCarty, 99 F.3d 383, 11th Cir. (1996)Document5 pagesUnited States v. McCarty, 99 F.3d 383, 11th Cir. (1996)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Parker Excavating v. LaFarge West, 10th Cir. (2017)Document24 pagesParker Excavating v. LaFarge West, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Piramal Ar Full 2015 16Document292 pagesPiramal Ar Full 2015 16Naman TandonNo ratings yet

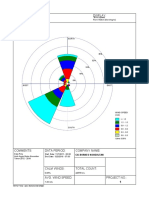

- Wind Rose Plot: DisplayDocument1 pageWind Rose Plot: Displaydhiecha309No ratings yet

- Leakage Power Optimization Using Gate Length Biasing and Multiple VTDocument13 pagesLeakage Power Optimization Using Gate Length Biasing and Multiple VTSanupKumarSinghNo ratings yet

- (Download PDF) Foundations of Mobile Radio Engineering First Edition Yacoub Online Ebook All Chapter PDFDocument42 pages(Download PDF) Foundations of Mobile Radio Engineering First Edition Yacoub Online Ebook All Chapter PDFarturo.williams321100% (13)

- BANAT V COMELEC G.R. No. 179271 April 21, 2009Document2 pagesBANAT V COMELEC G.R. No. 179271 April 21, 2009abethzkyyyyNo ratings yet

- Neural DesignerDocument2 pagesNeural Designerwatson191No ratings yet

- 11 Spring Security Registration Rememberme EmailverificationDocument5 pages11 Spring Security Registration Rememberme EmailverificationvigneshNo ratings yet

- IJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFDocument8 pagesIJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFAli jeffreyNo ratings yet

- JLL - The Rise of Alternative Real Estate in Asia Pacific (2018)Document12 pagesJLL - The Rise of Alternative Real Estate in Asia Pacific (2018)DexterNo ratings yet

- Assignment ACC106Document13 pagesAssignment ACC106aydolssNo ratings yet

- Thinklite TTL Camera Flash: For FujiDocument14 pagesThinklite TTL Camera Flash: For Fujimmonteiro_5No ratings yet

- Discrete Choice Modeling: William Greene Stern School of Business New York UniversityDocument25 pagesDiscrete Choice Modeling: William Greene Stern School of Business New York UniversityTharun SriramNo ratings yet

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- Video Production TimelineDocument1 pageVideo Production TimelineLeisuread 2No ratings yet

- HyperthermiaDocument5 pagesHyperthermiaRapunzel Leanne100% (1)

- Responsible Leadership ReportDocument7 pagesResponsible Leadership ReportRNo ratings yet

- Coal Based Direct Reduction of Preoxidized Chromite Ore at High TemperatureDocument10 pagesCoal Based Direct Reduction of Preoxidized Chromite Ore at High TemperatureWaleedSubhanNo ratings yet

- GNLD - International and Foster Sponsoring - NewDocument9 pagesGNLD - International and Foster Sponsoring - NewNishit KotakNo ratings yet

- Custom MillingDocument2 pagesCustom MillingLionel YdeNo ratings yet

- Unified Power Flow Controller (Phasor Type) : LibraryDocument22 pagesUnified Power Flow Controller (Phasor Type) : LibrarypavanNo ratings yet

- Ca 450 en 1609Document2 pagesCa 450 en 1609Randolf WenholdNo ratings yet

- Dates Time School RoutineDocument85 pagesDates Time School RoutineCristina BariNo ratings yet

- Globaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDocument7 pagesGlobaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDyaji Charles BalaNo ratings yet

- Device InfoDocument22 pagesDevice Infosimwa VictorNo ratings yet

- Managerial Accounting 10th Edition Crosson Solutions Manual 1Document36 pagesManagerial Accounting 10th Edition Crosson Solutions Manual 1josehernandezoimexwyftk100% (38)

- DIMM Replacement On X400 NodeDocument7 pagesDIMM Replacement On X400 NodewalkerNo ratings yet

- Module 5. Part 1 PPEDocument64 pagesModule 5. Part 1 PPElord kwantoniumNo ratings yet

United States Court of Appeals, Ninth Circuit

United States Court of Appeals, Ninth Circuit

Uploaded by

Scribd Government DocsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

United States Court of Appeals, Ninth Circuit

United States Court of Appeals, Ninth Circuit

Uploaded by

Scribd Government DocsCopyright:

Available Formats

978 F.

2d 1265

NOTICE: Ninth Circuit Rule 36-3 provides that dispositions

other than opinions or orders designated for publication are

not precedential and should not be cited except when relevant

under the doctrines of law of the case, res judicata, or collateral

estoppel.

Phil CHAPMAN, Plaintiff,

v.

Howard F. COULSON, et al., Defendant-Appellant,

v.

UNITED STATES of America, Director Internal Revenue

Service,

Third-Party-Defendant-Appellee,

Jerry Gastineau, Cross-Defendant-Appellee.

No. 92-35063.

United States Court of Appeals, Ninth Circuit.

Submitted Nov. 4, 1992.*

Decided Nov. 10, 1992.

Before SCHROEDER, FLETCHER and PREGERSON, Circuit Judges.

1MEMORANDUM**

2

Howard Coulson appeals pro se the district court's dismissal of his third-party

complaint against the United States for lack of jurisdiction. In his third-party

complaint seeking compensatory damages, Coulson alleged the Internal

Revenue Service ("IRS") filed a tax lien on his property "based upon hearsay,

false charges and without prior notice." We have jurisdiction pursuant to 28

U.S.C. 1291. We review de novo a district court's dismissal for lack of

subject matter jurisdiction, Kruso v. International Tel. & Tel. Corp., 872 F.2d

1416, 1421 (9th Cir.1989), cert. denied, 496 U.S. 937 (1990), and we affirm.

3* Background

Phil Chapman filed a judicial foreclosure action against Howard Coulson in the

Circuit Court of Oregon. Coulson answered and named Jerry Gastineau as a

cross-defendant and the United States as a third-party defendant. The United

States removed the action to district court pursuant to 28 U.S.C. 1441(c),

1442, and 1446(d). The United States then moved for dismissal for lack of

subject matter jurisdiction. The district court granted the United States' motion

to dismiss the government and remanded the action to state court. Coulson

appeals the district court's dismissal.1

II

Merits

5

The United States, as sovereign, may not be sued without its consent, and the

terms of consent define the court's jurisdiction. United States v. Dalm, 494 U.S.

596, 608 (1990). No suit may be maintained against the sovereign unless it is

brought in compliance with the terms of a statute under which the sovereign has

consented to be sued. Hutchinson v. United States, 677 F.2d 1322, 1327 (9th

Cir.1982). Waivers of sovereign immunity must be "unequivocally expressed."

Gilbert v. DaGrossa, 756 F.2d 1455, 1458 (9th Cir.1985).

The Federal Torts Claims Act ("FTCA"), 28 U.S.C. 2671 et seq., excludes

from the district court's jurisdiction any claim arising "in respect of the

assessment or collection of any tax...." 28 U.S.C. 2680(c); Hutchinson, 677

F.2d at 1327. Here, the federal tax lien at issue was placed on the property

pursuant to 26 U.S.C. 6321, which is in respect of the collection of a tax.

Therefore, section 2680(c) barred Coulson's claim for damages.2 Likewise,

section 2680(c) barred any claim based upon tortious conduct by IRS agents.

See Morris v. United States, 521 F.2d 872, 874 (9th Cir.1975) (even if IRS

agents' collection activities went "beyond the normal scope of authority and

amounted to tortious conduct," a claim stemming from such activity falls

"squarely within the exempted group of tort claims arising out of tax collection

efforts").3

AFFIRMED.

The panel unanimously finds this case suitable for decision without oral

argument. Fed.R.App.P. 34(a); 9th Cir.R. 34-4

**

This disposition is not appropriate for publication and may not be cited to or by

the courts of this circuit except as provided by 9th Cir.R. 36-3

This court has jurisdiction over appeals from district court orders dismissing the

United States and remanding the remaining action to state court. Gallea v.

United States, 779 F.2d 1403, 1404 (9th Cir.1986)

Moreover, as a prerequisite to filing an action under the FTCA, Coulson was

required first to present his claim to the appropriate federal agency. 28 U.S.C.

2675(a). Coulson neither alleges nor offers evidence that he met this

jurisdictional prerequisite

On appeal, Coulson contends his suit is not one in connection with tax

collection but is one involving civil rights violations. Coulson failed to raise this

in his third-party complaint and, therefore, may not raise it on appeal.

Winebrenner v. United States, 924 F.2d 851, 856 n. 7 (9th Cir.1991)

You might also like

- Rotary Evaporator ManualDocument80 pagesRotary Evaporator ManualJesujoba100% (1)

- Complaint Handling SOPDocument10 pagesComplaint Handling SOPPrashant Khare100% (3)

- Chapter 1 and 2 Obl IconDocument10 pagesChapter 1 and 2 Obl IconPia ValdezNo ratings yet

- United States v. George J. Blusco, 519 F.2d 473, 4th Cir. (1975)Document3 pagesUnited States v. George J. Blusco, 519 F.2d 473, 4th Cir. (1975)Scribd Government DocsNo ratings yet

- United States v. Gardell, 23 F.3d 395, 1st Cir. (1994)Document4 pagesUnited States v. Gardell, 23 F.3d 395, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument9 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Ross P. Upton v. Internal Revenue Service and Gloria A. Hassinger, United States of America, Movant-Appellee, 104 F.3d 543, 2d Cir. (1997)Document6 pagesRoss P. Upton v. Internal Revenue Service and Gloria A. Hassinger, United States of America, Movant-Appellee, 104 F.3d 543, 2d Cir. (1997)Scribd Government DocsNo ratings yet

- Cassell v. Osborn, 23 F.3d 394, 1st Cir. (1994)Document8 pagesCassell v. Osborn, 23 F.3d 394, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- United States v. Raymond M. Midgley, 142 F.3d 174, 3rd Cir. (1998)Document11 pagesUnited States v. Raymond M. Midgley, 142 F.3d 174, 3rd Cir. (1998)Scribd Government DocsNo ratings yet

- Sweeney Devine 093010Document4 pagesSweeney Devine 093010Lamario StillwellNo ratings yet

- United States v. Nevin M. Stewart, Jr. and Melanie Lee McCall, 700 F.2d 702, 11th Cir. (1983)Document6 pagesUnited States v. Nevin M. Stewart, Jr. and Melanie Lee McCall, 700 F.2d 702, 11th Cir. (1983)Scribd Government DocsNo ratings yet

- Steven A. Stepanian, II v. David R. Addis, 782 F.2d 902, 11th Cir. (1986)Document5 pagesSteven A. Stepanian, II v. David R. Addis, 782 F.2d 902, 11th Cir. (1986)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument5 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Louis Ruggerio, JR., Robert Cherry, 107 F.3d 5, 2d Cir. (1997)Document3 pagesUnited States v. Louis Ruggerio, JR., Robert Cherry, 107 F.3d 5, 2d Cir. (1997)Scribd Government DocsNo ratings yet

- Melvin L. Lindsay v. United States, 453 F.2d 867, 3rd Cir. (1972)Document4 pagesMelvin L. Lindsay v. United States, 453 F.2d 867, 3rd Cir. (1972)Scribd Government DocsNo ratings yet

- In Re: Charter Oak Associates, Debtor. Neal Ossen, Trustee v. Department of Social Services, State of Connecticut, 361 F.3d 760, 2d Cir. (2004)Document13 pagesIn Re: Charter Oak Associates, Debtor. Neal Ossen, Trustee v. Department of Social Services, State of Connecticut, 361 F.3d 760, 2d Cir. (2004)Scribd Government DocsNo ratings yet

- Chase Home Finance, LLC.,: 2115 Austin DR., Carrollton, Texas 75006Document10 pagesChase Home Finance, LLC.,: 2115 Austin DR., Carrollton, Texas 75006bruthapNo ratings yet

- Dalis v. United States, 10th Cir. (2000)Document5 pagesDalis v. United States, 10th Cir. (2000)Scribd Government DocsNo ratings yet

- United States v. Carlos Bernard Adams, 96 F.3d 1439, 4th Cir. (1996)Document3 pagesUnited States v. Carlos Bernard Adams, 96 F.3d 1439, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument4 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument17 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument10 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- United Services Automobile Association Charlene Cozart v. United States, 105 F.3d 185, 4th Cir. (1997)Document5 pagesUnited Services Automobile Association Charlene Cozart v. United States, 105 F.3d 185, 4th Cir. (1997)Scribd Government DocsNo ratings yet

- United States v. Sanchez, 10th Cir. (2004)Document8 pagesUnited States v. Sanchez, 10th Cir. (2004)Scribd Government DocsNo ratings yet

- Beneficial Consumer Discount Company v. David R. Poltonowicz John Poltonowicz The Internal Revenue Service of The United States of America, 47 F.3d 91, 3rd Cir. (1995)Document10 pagesBeneficial Consumer Discount Company v. David R. Poltonowicz John Poltonowicz The Internal Revenue Service of The United States of America, 47 F.3d 91, 3rd Cir. (1995)Scribd Government DocsNo ratings yet

- Garcia v. Lawrence, 10th Cir. (2004)Document5 pagesGarcia v. Lawrence, 10th Cir. (2004)Scribd Government DocsNo ratings yet

- United States v. Thomas J. Pecora, 484 F.2d 1289, 3rd Cir. (1973)Document9 pagesUnited States v. Thomas J. Pecora, 484 F.2d 1289, 3rd Cir. (1973)Scribd Government DocsNo ratings yet

- United States v. Vernon O. Holland and James Davis Drane Mauldin, JR., 956 F.2d 990, 10th Cir. (1992)Document6 pagesUnited States v. Vernon O. Holland and James Davis Drane Mauldin, JR., 956 F.2d 990, 10th Cir. (1992)Scribd Government DocsNo ratings yet

- United States v. William Gilchrist, 215 F.3d 333, 3rd Cir. (2000)Document9 pagesUnited States v. William Gilchrist, 215 F.3d 333, 3rd Cir. (2000)Scribd Government DocsNo ratings yet

- United States v. Oscar R. Smith, 859 F.2d 151, 4th Cir. (1988)Document4 pagesUnited States v. Oscar R. Smith, 859 F.2d 151, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States v. One (1) Douglas A-26b Aircraft, Serial No. 28034, Faa Registration No. N3035 S, and Equipment, Rebel Aviation, Inc., Claimant-Appellant, 662 F.2d 1372, 11th Cir. (1981)Document9 pagesUnited States v. One (1) Douglas A-26b Aircraft, Serial No. 28034, Faa Registration No. N3035 S, and Equipment, Rebel Aviation, Inc., Claimant-Appellant, 662 F.2d 1372, 11th Cir. (1981)Scribd Government DocsNo ratings yet

- United States v. Joseph Forcellati, 610 F.2d 25, 1st Cir. (1979)Document9 pagesUnited States v. Joseph Forcellati, 610 F.2d 25, 1st Cir. (1979)Scribd Government DocsNo ratings yet

- Plaintiff'SReply Motion For Default JudgmentDocument7 pagesPlaintiff'SReply Motion For Default JudgmentManasi Hansa100% (1)

- United States v. Dennis D'AmAto, 507 F.2d 26, 2d Cir. (1974)Document7 pagesUnited States v. Dennis D'AmAto, 507 F.2d 26, 2d Cir. (1974)Scribd Government DocsNo ratings yet

- Not PrecedentialDocument13 pagesNot PrecedentialScribd Government DocsNo ratings yet

- United States v. Aetna Casualty & Surety Co., 338 U.S. 366 (1950)Document13 pagesUnited States v. Aetna Casualty & Surety Co., 338 U.S. 366 (1950)Scribd Government DocsNo ratings yet

- United States v. Zalazar-Torres, 10th Cir. (2001)Document12 pagesUnited States v. Zalazar-Torres, 10th Cir. (2001)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument11 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument10 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Otis Palmer, 809 F.2d 1504, 11th Cir. (1987)Document8 pagesUnited States v. Otis Palmer, 809 F.2d 1504, 11th Cir. (1987)Scribd Government DocsNo ratings yet

- United States v. Salvatore Cirami and James Cirami, 510 F.2d 69, 2d Cir. (1975)Document7 pagesUnited States v. Salvatore Cirami and James Cirami, 510 F.2d 69, 2d Cir. (1975)Scribd Government DocsNo ratings yet

- United States v. Joseph George Helmich, 704 F.2d 547, 11th Cir. (1983)Document5 pagesUnited States v. Joseph George Helmich, 704 F.2d 547, 11th Cir. (1983)Scribd Government DocsNo ratings yet

- Zaharia v. Cross, 10th Cir. (2000)Document5 pagesZaharia v. Cross, 10th Cir. (2000)Scribd Government DocsNo ratings yet

- United States v. Caraballo Cruz, 52 F.3d 390, 1st Cir. (1995)Document6 pagesUnited States v. Caraballo Cruz, 52 F.3d 390, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- United States v. Jackson, 10th Cir. (2003)Document8 pagesUnited States v. Jackson, 10th Cir. (2003)Scribd Government DocsNo ratings yet

- Warren A. Wilkes v. United States, 469 U.S. 964 (1984)Document2 pagesWarren A. Wilkes v. United States, 469 U.S. 964 (1984)Scribd Government DocsNo ratings yet

- Williams v. United States, 10th Cir. (2002)Document5 pagesWilliams v. United States, 10th Cir. (2002)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument5 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- United States v. Elton Wellington Davis, 92 F.3d 1183, 4th Cir. (1996)Document4 pagesUnited States v. Elton Wellington Davis, 92 F.3d 1183, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- United States v. Richard A. Gellman, 677 F.2d 65, 11th Cir. (1982)Document3 pagesUnited States v. Richard A. Gellman, 677 F.2d 65, 11th Cir. (1982)Scribd Government DocsNo ratings yet

- Joseph Wise v. Thomas A. Fulcomer, Superintendent The Attorney General of The State of Pennsylvania Ronald D. Castille, District Attorney For Philadelphia County, 958 F.2d 30, 3rd Cir. (1992)Document9 pagesJoseph Wise v. Thomas A. Fulcomer, Superintendent The Attorney General of The State of Pennsylvania Ronald D. Castille, District Attorney For Philadelphia County, 958 F.2d 30, 3rd Cir. (1992)Scribd Government DocsNo ratings yet

- Douglas F. Moeller v. Orlando A. Rodriguez, 113 F.3d 1246, 10th Cir. (1997)Document3 pagesDouglas F. Moeller v. Orlando A. Rodriguez, 113 F.3d 1246, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument6 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- United States v. George Decosta, JR., 435 F.2d 630, 1st Cir. (1970)Document4 pagesUnited States v. George Decosta, JR., 435 F.2d 630, 1st Cir. (1970)Scribd Government DocsNo ratings yet

- Mason v. Hutton, 141 F.3d 1185, 10th Cir. (1998)Document6 pagesMason v. Hutton, 141 F.3d 1185, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- United States v. Antonio Dorsey, 4 F.3d 986, 4th Cir. (1993)Document5 pagesUnited States v. Antonio Dorsey, 4 F.3d 986, 4th Cir. (1993)Scribd Government DocsNo ratings yet

- Sarner v. Luce, 10th Cir. (1997)Document5 pagesSarner v. Luce, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- United States v. Alfred Grassia, 354 F.2d 27, 2d Cir. (1965)Document3 pagesUnited States v. Alfred Grassia, 354 F.2d 27, 2d Cir. (1965)Scribd Government DocsNo ratings yet

- United States v. Fatima Garcia, A/K/A Fatima Garcia-Nuine, 166 F.3d 519, 2d Cir. (1999)Document4 pagesUnited States v. Fatima Garcia, A/K/A Fatima Garcia-Nuine, 166 F.3d 519, 2d Cir. (1999)Scribd Government DocsNo ratings yet

- El Dia, Inc. v. Rossello, 165 F.3d 106, 1st Cir. (1999)Document6 pagesEl Dia, Inc. v. Rossello, 165 F.3d 106, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- No. 94-8931, 66 F.3d 1164, 11th Cir. (1995)Document5 pagesNo. 94-8931, 66 F.3d 1164, 11th Cir. (1995)Scribd Government DocsNo ratings yet

- United States v. McCarty, 99 F.3d 383, 11th Cir. (1996)Document5 pagesUnited States v. McCarty, 99 F.3d 383, 11th Cir. (1996)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Parker Excavating v. LaFarge West, 10th Cir. (2017)Document24 pagesParker Excavating v. LaFarge West, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Piramal Ar Full 2015 16Document292 pagesPiramal Ar Full 2015 16Naman TandonNo ratings yet

- Wind Rose Plot: DisplayDocument1 pageWind Rose Plot: Displaydhiecha309No ratings yet

- Leakage Power Optimization Using Gate Length Biasing and Multiple VTDocument13 pagesLeakage Power Optimization Using Gate Length Biasing and Multiple VTSanupKumarSinghNo ratings yet

- (Download PDF) Foundations of Mobile Radio Engineering First Edition Yacoub Online Ebook All Chapter PDFDocument42 pages(Download PDF) Foundations of Mobile Radio Engineering First Edition Yacoub Online Ebook All Chapter PDFarturo.williams321100% (13)

- BANAT V COMELEC G.R. No. 179271 April 21, 2009Document2 pagesBANAT V COMELEC G.R. No. 179271 April 21, 2009abethzkyyyyNo ratings yet

- Neural DesignerDocument2 pagesNeural Designerwatson191No ratings yet

- 11 Spring Security Registration Rememberme EmailverificationDocument5 pages11 Spring Security Registration Rememberme EmailverificationvigneshNo ratings yet

- IJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFDocument8 pagesIJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFAli jeffreyNo ratings yet

- JLL - The Rise of Alternative Real Estate in Asia Pacific (2018)Document12 pagesJLL - The Rise of Alternative Real Estate in Asia Pacific (2018)DexterNo ratings yet

- Assignment ACC106Document13 pagesAssignment ACC106aydolssNo ratings yet

- Thinklite TTL Camera Flash: For FujiDocument14 pagesThinklite TTL Camera Flash: For Fujimmonteiro_5No ratings yet

- Discrete Choice Modeling: William Greene Stern School of Business New York UniversityDocument25 pagesDiscrete Choice Modeling: William Greene Stern School of Business New York UniversityTharun SriramNo ratings yet

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- Video Production TimelineDocument1 pageVideo Production TimelineLeisuread 2No ratings yet

- HyperthermiaDocument5 pagesHyperthermiaRapunzel Leanne100% (1)

- Responsible Leadership ReportDocument7 pagesResponsible Leadership ReportRNo ratings yet

- Coal Based Direct Reduction of Preoxidized Chromite Ore at High TemperatureDocument10 pagesCoal Based Direct Reduction of Preoxidized Chromite Ore at High TemperatureWaleedSubhanNo ratings yet

- GNLD - International and Foster Sponsoring - NewDocument9 pagesGNLD - International and Foster Sponsoring - NewNishit KotakNo ratings yet

- Custom MillingDocument2 pagesCustom MillingLionel YdeNo ratings yet

- Unified Power Flow Controller (Phasor Type) : LibraryDocument22 pagesUnified Power Flow Controller (Phasor Type) : LibrarypavanNo ratings yet

- Ca 450 en 1609Document2 pagesCa 450 en 1609Randolf WenholdNo ratings yet

- Dates Time School RoutineDocument85 pagesDates Time School RoutineCristina BariNo ratings yet

- Globaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDocument7 pagesGlobaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDyaji Charles BalaNo ratings yet

- Device InfoDocument22 pagesDevice Infosimwa VictorNo ratings yet

- Managerial Accounting 10th Edition Crosson Solutions Manual 1Document36 pagesManagerial Accounting 10th Edition Crosson Solutions Manual 1josehernandezoimexwyftk100% (38)

- DIMM Replacement On X400 NodeDocument7 pagesDIMM Replacement On X400 NodewalkerNo ratings yet

- Module 5. Part 1 PPEDocument64 pagesModule 5. Part 1 PPElord kwantoniumNo ratings yet