Professional Documents

Culture Documents

Commissioner of Internal Revenue, Petitioner, v. John P. and Eleanor MURDOCH. Henrietta O. MURDOCH, Petitioner, v. Commissioner of Internal Revenue

Commissioner of Internal Revenue, Petitioner, v. John P. and Eleanor MURDOCH. Henrietta O. MURDOCH, Petitioner, v. Commissioner of Internal Revenue

Uploaded by

Scribd Government DocsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commissioner of Internal Revenue, Petitioner, v. John P. and Eleanor MURDOCH. Henrietta O. MURDOCH, Petitioner, v. Commissioner of Internal Revenue

Commissioner of Internal Revenue, Petitioner, v. John P. and Eleanor MURDOCH. Henrietta O. MURDOCH, Petitioner, v. Commissioner of Internal Revenue

Uploaded by

Scribd Government DocsCopyright:

Available Formats

318 F.

2d 414

63-2 USTC P 9523

COMMISSIONER OF INTERNAL REVENUE, Petitioner,

v.

John P. and Eleanor MURDOCH.

Henrietta O. MURDOCH, Petitioner,

v.

COMMISSIONER OF INTERNAL REVENUE.

Nos. 14222, 14223.

United States Court of Appeals Third Circuit.

Argued May 9, 1963.

Decided June 7, 1963, Rehearings Denied July 8, 1963.

David O. Walter, Dept. of Justice, Tax Division, Washington, D.C. (Louis

F. Oberdorfer, Asst. Atty. Gen., Lee A. Jackson, Alan D. Pekelner,

Attorneys, Department of Justice, Washington, D.C., on the brief), for

Com'r of Int. Rev.

David P. Brown, Jr., Philadelphia, Pa. (Andrew B. Young, E. Eugene

Mason, Philadelphia, Pa., on the brief), for John P. and Eleanor Murdoch.

Henry D. O'Connor, Philadelphia, Pa., for Henrietta O. Murdoch.

Before McLAUGHLIN and FORMAN, Circuit Judges, and

COOLAHAN, District judge.

FORMAN, Circuit Judge.

PETITION FOR REVIEW BY HENRIETTA O. MURDOCH, No. 14,223

John P. Murdoch and his brother Eugene K. Murdoch, each owned 49% Of the

stock of John P. Murdoch Company, a business they inherited from their father.

For some years prior to his death, in September of 1945, Eugene K. Murdoch

was ill and John P. Murdoch managed the business. Eugene K. Murdoch

continued to draw a salary until his death, at which time his widow, Henrietta

O. Murdoch, inherited his interest. Shortly thereafter John P. Murdoch and

Mrs. Murdoch agreed that the physical assets, viz., the real estate and

production equipment of the John P. Murdoch Company, at 3630 Haverford

Avenue in Philadelphia, would be transferred to a new corporation in exchange

for its stock, of which 49% Would be issued to Mrs. Murdoch in place of her

shares in the John P. Murdoch Company and 49% Would be held by Mr.

Murdoch. The new corporation was named the 3630 Haverford Avenue

Corporation. On December 31, 1946 it leased the premises and equipment to

the John P. Murdoch Company for $1,200 per year plus taxes and mortgage

interest. This rental arrangement continued until April 1, 1955, when the rent

was increased to $5,000 per year without the obligation of the lessor to pay

taxes or interest. Meanwhile Mr. Murdoch had been paying Mrs. Murdoch

twenty dollars per week which he reduced at this time to ten dollars.

3

In June 1955 Mrs. Murdoch instituted an equity action against her brother-inlaw in which she charged him with having fraudulently induced her to exchange

her 49% Interest in the stock of the John P. Murdoch Company for 49% Of the

shares of the stock of 3630 Haverford Avenue Corporation; that the fair rental

value of the property and machinery was $6,500 per year, and demanded:

'(a) * * * an accounting of all the profits made by him by virtue of his

ownership of 50% Of the stock of the John P. Murdoch Company since the 1st

day of January, 1945.

'(b) 49% Of the fair rental value of the real estate and machinery leased by the

3630 Haverford Avenue Corporation to the John P. Murdoch Company from

December 31, 1946 until December 31, 1954.

'(c) A complete accounting of all transactions of the John P. Murdoch Company

and the 3630 Haverford Avenue Corporation from the 1st of January, 1945 to

date.

'(d) Such other and further relief as this court may deem appropriate in the

premises.'

The litigation was settled before trial on December 11, 1957, as a result of

which Mrs. Murdoch executed two documents. One was designated a 'Release'

and provided as consideration for the payment to her of $16,500 that she

released John P. Murdoch from all claims including those encompassed in the

equity action and as well released the John P. Murdoch Company and the 3630

Haverford Avenue Corporation from all claims. The other document was

designated a 'Bill of Sale' and provided that in consideration of the payment to

her of $20,000 she assigned to Mr. Murdoch her stock in the 3630 Haverford

Avenue Corporation. Two checks were made by Mr. Murdoch payable to her

lawyers. One was for $16,500 and contained on its face the statement 'Payment

in release of all claims in suit of Murdoch v. Murdoch, C.P.I.' The other was in

the sum of $20,000 and was marked 'Payment in full for 49% Shares 3630

Haverford Ave. Corp. stock.'

9

In her income tax return for the year 1957 Mrs. Murdoch reported the full

amount of $36,500 received from Mr. Murdoch as proceeds of the sale of 'John

P. Murdoch Co.' and the resulting gain as being long term capital gain. The

Commissioner determined that $16,500 of the $36,500 payment was taxable as

ordinary income.

10

The Tax Court sustained the position of the Commissioner. 1

11

Mrs. Murdoch seeks a review of the determination of the Tax Court. She

asserts that the entire payment of $36,500 to her was a 'sale or exchange' of a

capital asset within the meaning of 1221 and 1222 of the Internal Revenue

Code of 1954 and that no part of it was ordinary income to her.

12

The pith of her argument is that Mr. Murdoch fraudulently induced her to part

with her stock in the Murdoch Company for an amount less than subsequent

disclosure revealed the book value to be; that Mr. Murdoch, individually, owed

her no duty to pay income on her interest in the Murdoch Company; that the

only source to which she could look for income was the Murdoch Company by

way of dividends and that she did not make the company a party to her suit.

Under these circumstances she reasons that her suit was for the restoration of

her stock in the Murdoch Company and that the aggregate sum of $36,500

which she recovered in the settlement represents value for that stock, no part of

which is susceptible of being characterized as ordinary income.

13

The Tax Court considered that the nature and basis of her law suit and its

settlement were revealed in her complaint and the papers which documented

the settlement. It held that, absent other evidence to import meaning to the

writings different from their contents, it was left with no other course than to

find that the taxable nature of the $16,500 payment consistent with her

complaint was in settlement of her demand upon Mr. Murdoch to account to her

for profits to which she claimed to be entitled.

It has been said that:

14

'It is now well settled that the classification for tax purposes, of amounts

received in settlement of litigation is to be determined by the nature and basis

of the action settled. Amounts received in compromise of a claim must be

considered as the same nature as the right compromised.' (Footnotes omitted.)

3B Mertens, Law of Federal Income Taxation, 22.93, at 358-359 (1958).

15

Carter's Estate v. C.I.R. 298 F.2d 192, 195 (8 Cir. 1962), cert. denied 370 U.S.

910, 82 S.Ct. 1257, 8 L.Ed.2d 404 (1962); Fowler Hosiery Co., 36 T.C. 201,

223-224 (1961) aff'd 301 F.2d 394 (7 Cir. 1962); Estate of Longino, 32 T.C.

904 (1959); Goldsmith, 22 T.C. 1137, 1144-1145 (1954); Peter K. Pappas, T.C.

Memo. 1962-203, 7 C.C.H. 1962, Stand. Fed.Tax Rep. P7628(M). The

taxpayer has the burden of proving what protion, if any, of a settlement is

entitled to capital gains treatment. Carter's Estate v. C.I.R., supra, 298 F.2d at

194-195; Peter K. Pappas, supra.

16

A review of the record in the Tax Court satisfies us that Henrietta O. Murdoch

did not sustain her burden of proof and that there is substantial evidence to

sustain the judgment of the Tax Court that the $16,500 payment was taxable as

ordinary income. Hence, the judgment of the Tax Court sought to be reviewed

in case No. 14,223 will be affirmed.

17

PETITION FOR REVIEW BY COMMISSIONER OF INTERNAL

REVENUE NO. 14,222

18

In the joint return for the year 1957 by John P. Murdoch and his wife, Eleanor,

the payment of $16,500, which is the subject of review in the foregoing case,

No. 14,223, together with $3,582.30 for attorney's fees expended in connection

with the suit of Henrietta O. Murdoch against Mr. Murdoch, was deducted as

an ordinary and necessary business expense under 162(a), or in the alternative,

under 212 of the Internal Revenue Code of 1954. In the Tax Court the

Commissioner conceded that there should be 'consistent treatment of the

payment' in both cases. 2 The Tax Court accordingly, having found against the

claim of deductibility by Mrs. Murdoch, held that Mr. Murdoch was entitled to

the deduction of $16,500, based on the concession of the Commissioner, as

well as the deduction of the attorney's fees, since the Commissioner had also

expressed no objections to the same treatment of the fees as accorded the

payment of $16,500.

19

The present petition for review by the Commissioner is of a 'protective' nature

to cover the contingency that would ensue if the Tax Court's judgment against

the claim for deduction by Mrs. Murdoch were reversed. We intimate no

opinion on the merits of the deductibility of the items claimed by Mr.

Murdoch. The judgment of the Tax Court that he is entitled to deduct the

payment of $16,500 and attorney's fees of $3,582.30, based on the concession

made by the Commissioner, will be affirmed.

John P. Murdoch, T.C.Memo. 1962-196, 7 C.C.H. 1962, Stand.Fed.Tax Rep.

P7615(M)

The issues underlying the petitions for review in No. 14,223 and No. 14.222

were heard together both in the Tax Court and here

You might also like

- Strategies of A Fashion Organisation - The RealRealDocument44 pagesStrategies of A Fashion Organisation - The RealRealMaggie Tan100% (1)

- Preliminary Title ReportDocument24 pagesPreliminary Title Reportpournima mohiteNo ratings yet

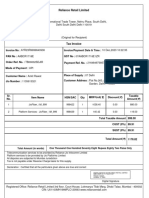

- Next Gen Pharma: (Original For Recipient) Sold byDocument2 pagesNext Gen Pharma: (Original For Recipient) Sold bydarpajNo ratings yet

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- McCord v. Granger, Collector of Internal Revenue For 23rd District of Pennsylvania, 201 F.2d 103, 3rd Cir. (1952)Document7 pagesMcCord v. Granger, Collector of Internal Revenue For 23rd District of Pennsylvania, 201 F.2d 103, 3rd Cir. (1952)Scribd Government DocsNo ratings yet

- Commissioner of Internal Revenue v. Otto C. Doering, JR., and Lucy T. Doering, 335 F.2d 738, 2d Cir. (1964)Document7 pagesCommissioner of Internal Revenue v. Otto C. Doering, JR., and Lucy T. Doering, 335 F.2d 738, 2d Cir. (1964)Scribd Government DocsNo ratings yet

- United States Court of Appeals Second Circuit.: Nos. 595-597, Docket 32576-32578Document10 pagesUnited States Court of Appeals Second Circuit.: Nos. 595-597, Docket 32576-32578Scribd Government DocsNo ratings yet

- Fed. Sec. L. Rep. P 96,552 United States of America v. Douglas P. Fields, Frederick M. Friedman, Peter S. Davis, Alan E. Sandberg, Anderic Berge, 592 F.2d 638, 2d Cir. (1979)Document20 pagesFed. Sec. L. Rep. P 96,552 United States of America v. Douglas P. Fields, Frederick M. Friedman, Peter S. Davis, Alan E. Sandberg, Anderic Berge, 592 F.2d 638, 2d Cir. (1979)Scribd Government DocsNo ratings yet

- United States v. Israel Broyde, 22 F.3d 441, 2d Cir. (1994)Document3 pagesUnited States v. Israel Broyde, 22 F.3d 441, 2d Cir. (1994)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument17 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- 953 F.2d 1556 16 UCC Rep - Serv.2d 1150: United States Court of Appeals, Eleventh CircuitDocument7 pages953 F.2d 1556 16 UCC Rep - Serv.2d 1150: United States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Estate of Loren Doherty, Deceased, Dan A. Doherty, Personal Representative v. Commissioner of Internal Revenue, 982 F.2d 450, 10th Cir. (1992)Document12 pagesEstate of Loren Doherty, Deceased, Dan A. Doherty, Personal Representative v. Commissioner of Internal Revenue, 982 F.2d 450, 10th Cir. (1992)Scribd Government DocsNo ratings yet

- Cook v. MOFFAT, 46 U.S. 295 (1847)Document25 pagesCook v. MOFFAT, 46 U.S. 295 (1847)Scribd Government DocsNo ratings yet

- Delaney v. Gardner, 204 F.2d 855, 1st Cir. (1953)Document14 pagesDelaney v. Gardner, 204 F.2d 855, 1st Cir. (1953)Scribd Government DocsNo ratings yet

- CaseeDocument4 pagesCaseestephanie leeNo ratings yet

- United States Court of Appeals, Third CircuitDocument11 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- In Re International Match Corp. Ehrhorn v. International Match Realization Co., Limited, 190 F.2d 458, 2d Cir. (1951)Document21 pagesIn Re International Match Corp. Ehrhorn v. International Match Realization Co., Limited, 190 F.2d 458, 2d Cir. (1951)Scribd Government DocsNo ratings yet

- Henderson Supplee, Jr. v. Francis R. Smith, Collector of Internal Revenue For The First District of Pennsylvania, 242 F.2d 855, 1st Cir. (1957)Document7 pagesHenderson Supplee, Jr. v. Francis R. Smith, Collector of Internal Revenue For The First District of Pennsylvania, 242 F.2d 855, 1st Cir. (1957)Scribd Government DocsNo ratings yet

- Merchant v. Corder, 4th Cir. (1999)Document5 pagesMerchant v. Corder, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Monte de Piedad V RodrigoDocument5 pagesMonte de Piedad V RodrigoShieWon WooNo ratings yet

- United States v. Eduardo Flores, 535 F.2d 135, 1st Cir. (1976)Document7 pagesUnited States v. Eduardo Flores, 535 F.2d 135, 1st Cir. (1976)Scribd Government DocsNo ratings yet

- In Re: Anne L. O'DOwD Anne L. O'DOwD v. Howard C. Trueger David B. Biunno Vincent D. Commisa Marisa A. Taormina Biunno, Commisa and Taormina, P.C, 233 F.3d 197, 3rd Cir. (2000)Document9 pagesIn Re: Anne L. O'DOwD Anne L. O'DOwD v. Howard C. Trueger David B. Biunno Vincent D. Commisa Marisa A. Taormina Biunno, Commisa and Taormina, P.C, 233 F.3d 197, 3rd Cir. (2000)Scribd Government DocsNo ratings yet

- George Fischer v. Commissioner of Internal Revenue, 288 F.2d 574, 3rd Cir. (1961)Document7 pagesGeorge Fischer v. Commissioner of Internal Revenue, 288 F.2d 574, 3rd Cir. (1961)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument7 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Monte de Piedad Vs RodrigoDocument4 pagesMonte de Piedad Vs RodrigoEricson Sarmiento Dela CruzNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 299, Docket 93-7064Document11 pagesUnited States Court of Appeals, Second Circuit.: No. 299, Docket 93-7064Scribd Government DocsNo ratings yet

- Phillip J. McNellis As Trustee of Donald S. Potter, Bankrupt v. First Federal Savings and Loan Association of Rochester, New York, Defendant-Appellee, 364 F.2d 251, 1st Cir. (1966)Document8 pagesPhillip J. McNellis As Trustee of Donald S. Potter, Bankrupt v. First Federal Savings and Loan Association of Rochester, New York, Defendant-Appellee, 364 F.2d 251, 1st Cir. (1966)Scribd Government DocsNo ratings yet

- Bank Brussels Lambert v. Fiddler Gonzalez & Rodriguez, 305 F.3d 120, 2d Cir. (2002)Document12 pagesBank Brussels Lambert v. Fiddler Gonzalez & Rodriguez, 305 F.3d 120, 2d Cir. (2002)Scribd Government DocsNo ratings yet

- Feinberg V Commissioner of Internal Revenue, 198 F.2d 260, 3rd Cir. (1952)Document6 pagesFeinberg V Commissioner of Internal Revenue, 198 F.2d 260, 3rd Cir. (1952)Scribd Government DocsNo ratings yet

- Feine v. McGowan Collector of Internal Revenue, 188 F.2d 738, 2d Cir. (1951)Document4 pagesFeine v. McGowan Collector of Internal Revenue, 188 F.2d 738, 2d Cir. (1951)Scribd Government DocsNo ratings yet

- In Re Solar Mfg. Corp. (Three Cases), 215 F.2d 555, 3rd Cir. (1954)Document11 pagesIn Re Solar Mfg. Corp. (Three Cases), 215 F.2d 555, 3rd Cir. (1954)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 94, Docket 78-5034Document12 pagesUnited States Court of Appeals, Second Circuit.: No. 94, Docket 78-5034Scribd Government DocsNo ratings yet

- Estate Taxation - Compiled DigestsDocument33 pagesEstate Taxation - Compiled Digestsmarydalem100% (1)

- Irving Trust Company and Ernest Crawford May, As Executors of The Will of Charles H. Hastings, Deceased v. United States, 221 F.2d 303, 2d Cir. (1955)Document4 pagesIrving Trust Company and Ernest Crawford May, As Executors of The Will of Charles H. Hastings, Deceased v. United States, 221 F.2d 303, 2d Cir. (1955)Scribd Government DocsNo ratings yet

- Transfer Tax Case DigestDocument30 pagesTransfer Tax Case DigestErneylou RanayNo ratings yet

- I. A. Dress Co., Inc. v. Commissioner of Internal Revenue, 273 F.2d 543, 2d Cir. (1960)Document3 pagesI. A. Dress Co., Inc. v. Commissioner of Internal Revenue, 273 F.2d 543, 2d Cir. (1960)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third Circuit, 797 F.2d 1197, 3rd Cir. (1986)Document21 pagesUnited States Court of Appeals, Third Circuit, 797 F.2d 1197, 3rd Cir. (1986)Scribd Government DocsNo ratings yet

- Francia Vs IAC FULLDocument4 pagesFrancia Vs IAC FULLristocratNo ratings yet

- Newton v. Pedrick, 212 F.2d 357, 2d Cir. (1954)Document7 pagesNewton v. Pedrick, 212 F.2d 357, 2d Cir. (1954)Scribd Government DocsNo ratings yet

- Ballard v. CIR, 522 F.3d 1229, 11th Cir. (2003)Document13 pagesBallard v. CIR, 522 F.3d 1229, 11th Cir. (2003)Scribd Government DocsNo ratings yet

- Department of Treasury of Ind. v. Ingram-Richardson Mfg. Co. of Ind., 313 U.S. 252 (1941)Document4 pagesDepartment of Treasury of Ind. v. Ingram-Richardson Mfg. Co. of Ind., 313 U.S. 252 (1941)Scribd Government DocsNo ratings yet

- Federal Home Loan Mortgage Corporation ("Freddie Mac") Federal Insurance Company v. Scottsdale Insurance Company, 316 F.3d 431, 3rd Cir. (2003)Document24 pagesFederal Home Loan Mortgage Corporation ("Freddie Mac") Federal Insurance Company v. Scottsdale Insurance Company, 316 F.3d 431, 3rd Cir. (2003)Scribd Government DocsNo ratings yet

- Harry Deaktor v. Fox Grocery Company, A Pennsylvania Corporation and John F. Fox, 475 F.2d 1112, 3rd Cir. (1973)Document6 pagesHarry Deaktor v. Fox Grocery Company, A Pennsylvania Corporation and John F. Fox, 475 F.2d 1112, 3rd Cir. (1973)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument31 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Francia vs. IacDocument7 pagesFrancia vs. IacLeBron DurantNo ratings yet

- Federal Deposit Insurance Corporation v. Caledonia Investment Corporation, 862 F.2d 378, 1st Cir. (1988)Document9 pagesFederal Deposit Insurance Corporation v. Caledonia Investment Corporation, 862 F.2d 378, 1st Cir. (1988)Scribd Government DocsNo ratings yet

- Dunn v. Marrelli, 10th Cir. (2001)Document10 pagesDunn v. Marrelli, 10th Cir. (2001)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument25 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Damages (For November 19) - Lazatin Until PALDocument61 pagesDamages (For November 19) - Lazatin Until PALMarlene TongsonNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument8 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, First CircuitDocument8 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- First Kentucky Company v. William M. Gray, District Director of Internal Revenue For Kentucky, 309 F.2d 845, 1st Cir. (1962)Document6 pagesFirst Kentucky Company v. William M. Gray, District Director of Internal Revenue For Kentucky, 309 F.2d 845, 1st Cir. (1962)Scribd Government DocsNo ratings yet

- Comte Guy Dubern v. Girard Trust Bank, 454 F.2d 565, 3rd Cir. (1972)Document10 pagesComte Guy Dubern v. Girard Trust Bank, 454 F.2d 565, 3rd Cir. (1972)Scribd Government DocsNo ratings yet

- Ontario Land Co. v. Wilfong, 223 U.S. 543 (1912)Document10 pagesOntario Land Co. v. Wilfong, 223 U.S. 543 (1912)Scribd Government DocsNo ratings yet

- Tito Oliveras and Henry Compta v. Sergio Miranda Lopo, 800 F.2d 3, 1st Cir. (1986)Document8 pagesTito Oliveras and Henry Compta v. Sergio Miranda Lopo, 800 F.2d 3, 1st Cir. (1986)Scribd Government DocsNo ratings yet

- Guillermo Bonilla-Aviles, Maria Velazquez, C/P Bonilla-Velazquez v. Southmark San Juan, Inc., 992 F.2d 391, 1st Cir. (1993)Document5 pagesGuillermo Bonilla-Aviles, Maria Velazquez, C/P Bonilla-Velazquez v. Southmark San Juan, Inc., 992 F.2d 391, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- Ella Freidus v. First National Bank of Council Bluffs, A National Banking Corporation, 928 F.2d 793, 1st Cir. (1991)Document4 pagesElla Freidus v. First National Bank of Council Bluffs, A National Banking Corporation, 928 F.2d 793, 1st Cir. (1991)Scribd Government DocsNo ratings yet

- Smith v. Commissioner of Internal Revenue, 192 F.2d 841, 1st Cir. (1951)Document6 pagesSmith v. Commissioner of Internal Revenue, 192 F.2d 841, 1st Cir. (1951)Scribd Government DocsNo ratings yet

- Boris S. Nadiak v. Commissioner of Internal Revenue, 356 F.2d 911, 2d Cir. (1966)Document2 pagesBoris S. Nadiak v. Commissioner of Internal Revenue, 356 F.2d 911, 2d Cir. (1966)Scribd Government DocsNo ratings yet

- 79 - StipulationDocument8 pages79 - StipulationMetro Puerto RicoNo ratings yet

- Filed: Patrick FisherDocument17 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Diane W. Wolf v. Commissioner of The Internal Revenue Service, 74 F.3d 1235, 4th Cir. (1996)Document9 pagesDiane W. Wolf v. Commissioner of The Internal Revenue Service, 74 F.3d 1235, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261From EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261No ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Lopez, 10th Cir. (2017)Document4 pagesUnited States v. Lopez, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- PayRegister Jan-2024Document2 pagesPayRegister Jan-2024pramod.yadavNo ratings yet

- 4 Revenue 10 QuestionsDocument2 pages4 Revenue 10 QuestionsEzer Cruz BarrantesNo ratings yet

- Theoretical FrameworkDocument7 pagesTheoretical FrameworkArianne June AbarquezNo ratings yet

- Dinshaw's Dairy Foods P. LTDDocument1 pageDinshaw's Dairy Foods P. LTDRohanNo ratings yet

- 2019 Assessor PDFDocument15 pages2019 Assessor PDFJohn Karlo P. FernandezNo ratings yet

- Statcon - AmendmentsDocument15 pagesStatcon - AmendmentsVic RabayaNo ratings yet

- Erd.1.f.008 Quality Finished Goods 1Document2 pagesErd.1.f.008 Quality Finished Goods 1Jonalyn BalerosNo ratings yet

- 2014 Tax CommitmentDocument737 pages2014 Tax Commitmentashes_xNo ratings yet

- Murphy and Nagel The Myth of Ownership PDFDocument239 pagesMurphy and Nagel The Myth of Ownership PDFDaisy Anita SusiloNo ratings yet

- Statement of Earning & Deductions: Congo BomokoDocument4 pagesStatement of Earning & Deductions: Congo BomokoKeller Brown JnrNo ratings yet

- Department of Management Studies BMS Semester 3 Syllabus June 2019 OnwardsDocument20 pagesDepartment of Management Studies BMS Semester 3 Syllabus June 2019 OnwardsAleena Clare ThomasNo ratings yet

- KMF - DharwadDocument69 pagesKMF - DharwadkodiraRakshithNo ratings yet

- RMBN Sample Computation 20-20 (11) - 60Document1 pageRMBN Sample Computation 20-20 (11) - 60amiel pugatNo ratings yet

- Installment On CGT Subject To Mortgage2Document5 pagesInstallment On CGT Subject To Mortgage2Joneric RamosNo ratings yet

- T Ax Invo Ice: Mukul Singh Mukul SinghDocument1 pageT Ax Invo Ice: Mukul Singh Mukul SinghMukul Singh100% (1)

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- How Intellectual Capital Effects Firm's Financial PerformanceDocument8 pagesHow Intellectual Capital Effects Firm's Financial PerformanceHendra GunawanNo ratings yet

- BAAFM P30898 AFR Lecture Slides - TaxationDocument23 pagesBAAFM P30898 AFR Lecture Slides - TaxationGrace TanNo ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- Diagnostic Examination Air Lev2 3 AccountingDocument17 pagesDiagnostic Examination Air Lev2 3 AccountingRobert CastilloNo ratings yet

- CIR V Far East BankDocument7 pagesCIR V Far East BankChristiane Marie BajadaNo ratings yet

- Supports and Information For The Self-EmployedDocument32 pagesSupports and Information For The Self-EmployedAhmedTagAlserNo ratings yet

- Ankit Rawat JioFiber December 2023 BillDocument2 pagesAnkit Rawat JioFiber December 2023 BillAnkit RawatNo ratings yet

- Tutorial 10-2021-PIT2 ProblemsDocument8 pagesTutorial 10-2021-PIT2 ProblemsHien Bach Thi Tra QTKD-3KT-18No ratings yet

- The Effect of Tax Officer Services, Tax Knowledge and Tax Sanctions On Taxpayer Perceptions of Land Tax Payment Compliance For Rural and Urban Bildings of Musi Banyuasin RegencyDocument6 pagesThe Effect of Tax Officer Services, Tax Knowledge and Tax Sanctions On Taxpayer Perceptions of Land Tax Payment Compliance For Rural and Urban Bildings of Musi Banyuasin RegencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 132 Studymat FM Nov 2009Document72 pages132 Studymat FM Nov 2009Ashish NarulaNo ratings yet