Professional Documents

Culture Documents

Taxation Trends in The European Union - 2012 41

Taxation Trends in The European Union - 2012 41

Uploaded by

Dimitris ArgyriouCopyright:

Available Formats

You might also like

- Ebp Powerpoint PresentationDocument40 pagesEbp Powerpoint Presentationapi-383379774No ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 82Document1 pageTaxation Trends in The European Union - 2012 82d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 86Document1 pageTaxation Trends in The European Union - 2012 86d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 107Document1 pageTaxation Trends in The European Union - 2012 107d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 59Document1 pageTaxation Trends in The European Union - 2012 59d05registerNo ratings yet

- Taxation Trends in EU in 2010Document42 pagesTaxation Trends in EU in 2010Tatiana TurcanNo ratings yet

- Ireland: Developments in The Member StatesDocument4 pagesIreland: Developments in The Member StatesBogdan PetreNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 90Document1 pageTaxation Trends in The European Union - 2012 90d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 162Document1 pageTaxation Trends in The European Union - 2012 162d05registerNo ratings yet

- Environmental Tax in European Union: Oecd (Document2 pagesEnvironmental Tax in European Union: Oecd (Kris AssNo ratings yet

- Taxation Trends in The European Union - 2012 122Document1 pageTaxation Trends in The European Union - 2012 122d05registerNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 29Document1 pageTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 70Document1 pageTaxation Trends in The European Union - 2012 70d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 174Document1 pageTaxation Trends in The European Union - 2012 174d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 84Document1 pageTaxation Trends in The European Union - 2012 84d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 20Document1 pageTaxation Trends in The European Union - 2012 20d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 67Document1 pageTaxation Trends in The European Union - 2012 67d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 48Document1 pageTaxation Trends in The European Union - 2012 48d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 102Document1 pageTaxation Trends in The European Union - 2012 102d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 74Document1 pageTaxation Trends in The European Union - 2012 74d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 151Document1 pageTaxation Trends in The European Union - 2012 151d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 156Document1 pageTaxation Trends in The European Union - 2012 156d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 159Document1 pageTaxation Trends in The European Union - 2012 159d05registerNo ratings yet

- Faculty - Economic and ManagementDocument5 pagesFaculty - Economic and ManagementBaraawo BaraawoNo ratings yet

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocument44 pagesTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousNo ratings yet

- Taxation Trends in The European Union - 2012 64Document1 pageTaxation Trends in The European Union - 2012 64d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 118Document1 pageTaxation Trends in The European Union - 2012 118d05registerNo ratings yet

- Energy Taxation in Europe, Japan and The United StatesDocument16 pagesEnergy Taxation in Europe, Japan and The United StatesPham Minh CongNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- 1.1tax Burden Eu 2016Document12 pages1.1tax Burden Eu 2016vapevyNo ratings yet

- Do Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataDocument19 pagesDo Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataPilar RiveraNo ratings yet

- Taxation Trends in The European Union - 2012 91Document1 pageTaxation Trends in The European Union - 2012 91d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 21Document1 pageTaxation Trends in The European Union - 2012 21d05registerNo ratings yet

- Eprs Bri (2021) 690663 enDocument6 pagesEprs Bri (2021) 690663 enRohinish DeyNo ratings yet

- Eurof05 SchratzenstallerDocument39 pagesEurof05 SchratzenstallerE. S.No ratings yet

- Taxation Trends in The European Union - 2012 66Document1 pageTaxation Trends in The European Union - 2012 66d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 100Document1 pageTaxation Trends in The European Union - 2012 100d05registerNo ratings yet

- Macroeconomics Report On Ireland's EconomyDocument24 pagesMacroeconomics Report On Ireland's Economynikita.nair.2023No ratings yet

- Taxation Trends in The European Union - 2012 155Document1 pageTaxation Trends in The European Union - 2012 155d05registerNo ratings yet

- UK Tax SystemDocument13 pagesUK Tax SystemMuhammad Sajid Saeed100% (1)

- Effects of Different TaxesDocument5 pagesEffects of Different TaxesErick SantillanNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 16Document1 pageTaxation Trends in The European Union - 2012 16d05registerNo ratings yet

- X Dialnet-TaxPolicyConvergenceInEU-2942147Document28 pagesX Dialnet-TaxPolicyConvergenceInEU-2942147NikolinaNo ratings yet

- The Determinants of Tax Revenue in Sub Saharan Africa - Tony & JorgenDocument19 pagesThe Determinants of Tax Revenue in Sub Saharan Africa - Tony & Jorgenpriyanthikadilrukshi05No ratings yet

- Carbon Tax Research PapersDocument7 pagesCarbon Tax Research Paperswrglrkrhf100% (1)

- Mintz Online (Oct 09)Document8 pagesMintz Online (Oct 09)SchoolofPublicPolicyNo ratings yet

- Luxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-FuelsDocument3 pagesLuxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-Fuelssagetarius92No ratings yet

- Study On The Taxation of The Air Transport Sector: Final ReportDocument281 pagesStudy On The Taxation of The Air Transport Sector: Final ReportIsmael GouwsNo ratings yet

- Tax System of EstoniaDocument19 pagesTax System of EstoniaEmil SalmanliNo ratings yet

- Tax and British Business Making The Case PDFDocument24 pagesTax and British Business Making The Case PDFNawsher21No ratings yet

- 2011 04 13 Fuel Tax Report Final MergedDocument59 pages2011 04 13 Fuel Tax Report Final MergedDiễm QuỳnhNo ratings yet

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyDocument8 pagesEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanNo ratings yet

- A Common Withholding Tax For The EUDocument12 pagesA Common Withholding Tax For The EUFabricio Ficticio FalacioNo ratings yet

- Investment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeFrom EverandInvestment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeNo ratings yet

- EIB Investment Survey 2023 - European Union overviewFrom EverandEIB Investment Survey 2023 - European Union overviewNo ratings yet

- Taxation Trends in The European Union - 2012 42Document1 pageTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 44Document1 pageTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 35Document1 pageTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 34Document1 pageTaxation Trends in The European Union - 2012 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 29Document1 pageTaxation Trends in The European Union - 2012 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 30Document1 pageTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 29Document1 pageTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 27Document1 pageTaxation Trends in The European Union - 2012 27Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 10Document1 pageTaxation Trends in The European Union - 2012 10Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 36Document1 pageTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 24Document1 pageTaxation Trends in The European Union - 2012 24Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 8Document1 pageTaxation Trends in The European Union - 2012 8Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 26Document1 pageTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 35Document1 pageTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 34Document1 pageTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 37Document1 pageTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 3Document1 pageTaxation Trends in The European Union - 2012 3Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 31Document1 pageTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 33Document1 pageTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouNo ratings yet

- Assignment On Floating Labors of BangladeshDocument11 pagesAssignment On Floating Labors of BangladeshNahid H AshikNo ratings yet

- OutlineDocument2 pagesOutlineAqsa ChaudhryNo ratings yet

- I J C R B Antecedents of Turnover and Absenteeism: Evidence From Public Sector Institutions of PakistanDocument14 pagesI J C R B Antecedents of Turnover and Absenteeism: Evidence From Public Sector Institutions of PakistanselfiNo ratings yet

- NADOOPODDocument2 pagesNADOOPODArif IzzatNo ratings yet

- S-4 Job Analysis PDFDocument7 pagesS-4 Job Analysis PDFshashankNo ratings yet

- Capital One Business Analyst Job Card Ut 20102Document2 pagesCapital One Business Analyst Job Card Ut 20102GouravGargNo ratings yet

- Strategic Leadership at McdonaldsDocument3 pagesStrategic Leadership at McdonaldsAmeya Samant100% (2)

- Case Study UOBDocument3 pagesCase Study UOBAzra IshratNo ratings yet

- Exercise # 2 OrganizationDocument10 pagesExercise # 2 OrganizationJason Neil Clyde CabayaNo ratings yet

- Admission - Complete - Form Priyanshu Chinmya VidDocument3 pagesAdmission - Complete - Form Priyanshu Chinmya VidAvinash KumarNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- First Aid Training 1-2-3Document2 pagesFirst Aid Training 1-2-3Christian Makande0% (1)

- Internship Report For Accounting and FinDocument28 pagesInternship Report For Accounting and FinHãmèéž MughalNo ratings yet

- StrikeDocument3 pagesStrikeMerlin J SheebaNo ratings yet

- Employee Grievances: Prepared By:Jarmonilla, John B. Lubang, John PatricklDocument23 pagesEmployee Grievances: Prepared By:Jarmonilla, John B. Lubang, John PatricklCeejay CarterNo ratings yet

- HRM FinalsDocument15 pagesHRM FinalsQuenie De la CruzNo ratings yet

- 12-7-22 VSP Statement On Ex-Employee EdwardsDocument1 page12-7-22 VSP Statement On Ex-Employee EdwardsNews 5 WCYBNo ratings yet

- Competency Mapping - Health CareDocument31 pagesCompetency Mapping - Health Carebhairavi_bhatt100% (1)

- United States Court of Appeals, First CircuitDocument4 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- Amit JCB Project Report Final With ObjectivesDocument73 pagesAmit JCB Project Report Final With Objectivessoniakaushik2021No ratings yet

- Attendance - WikipediaDocument2 pagesAttendance - WikipediaEwi BenardNo ratings yet

- Selected Questions Chapter 22Document5 pagesSelected Questions Chapter 22Pranta SahaNo ratings yet

- Banking G.KDocument20 pagesBanking G.Kvishal tyagiNo ratings yet

- Construction Project Manager in Chicago IL Resume James KickDocument2 pagesConstruction Project Manager in Chicago IL Resume James KickJames KickNo ratings yet

- LABOR STANDARDS SYLLABUS Part 3 of ATTY BOYDocument35 pagesLABOR STANDARDS SYLLABUS Part 3 of ATTY BOYJanine Prelle DacanayNo ratings yet

- St. Luke's Medical Center Employees Association-AFW v. National Labor Relations Commission, G.R. No. 162053, 7 March 2007Document4 pagesSt. Luke's Medical Center Employees Association-AFW v. National Labor Relations Commission, G.R. No. 162053, 7 March 2007Ashley Kate PatalinjugNo ratings yet

- OB Chapter 5Document37 pagesOB Chapter 5SOM TUNo ratings yet

- Dimensions of CultureDocument5 pagesDimensions of CulturefunshareNo ratings yet

- Igc 1 Element - 4Document12 pagesIgc 1 Element - 4Dump FacilityNo ratings yet

Taxation Trends in The European Union - 2012 41

Taxation Trends in The European Union - 2012 41

Uploaded by

Dimitris ArgyriouOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Trends in The European Union - 2012 41

Taxation Trends in The European Union - 2012 41

Uploaded by

Dimitris ArgyriouCopyright:

Available Formats

Part I

Overall tax revenue

capital and business income of households and the selfemployed (in the form of rents, dividends, interest,

insurance income, etc.)(22).

O

v

e

r

a

l

l

Graph 1.19: Implicit tax rate on capital and business

income

2010, in %

40%

35%

30%

25%

20%

t

a

x

15%

Currently, roughly one euro out of every sixteen in

revenue is raised from environmental taxes. As a

percentage of GDP, environmental tax revenues

declined slowly during 2004-2008, first in the euro area

and progressively applying also to the majority of the

Member States, reversing a previous clear progression.

However, as of 2009 environmental tax revenue started

increasing again and by now there is practically no

difference in revenue between the NMS-12 and the

EU-15 Member States. Nevertheless, higher energy

intensity of the economy in the NMS-12 countries

tends to drive up environmental tax revenue and offset

lower excise rates in revenue terms.

10%

Graph 1.20: Environmental tax revenues,

5%

2000-2010, % of GDP

0%

SE

IT

CY

FI

UK

AT

ITR Capital and business income

Note:

r

e

v

e

n

u

e

PT

DK

ES

FR

SI

ITR Corporate income

BE

PL

EL

CZ

SK

IE

NL

HU

EE

LT

LV

NO

ITR Capital and business income of households and self-employed

no data for BG, DE, LU, MT, RO and IS; data for DK, ES and UK refer to

2009; data for PT (corporate income, household and self-employed) refer

to 2008

Source: Commission services

2.9%

2.8%

2.7%

2.6%

2.5%

Environmental taxation

2.4%

2.3%

Environmental taxation regaining importance

lately

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-27 arithmetic averages

EU-27 weighted averages

Source: Commission services

Environmental

taxes

(officially

denoted

as

"environmentally related taxes") are defined as a tax

whose tax base is a physical unit (or a proxy of a

physical unit) of something that has a proven, specific

negative impact on the environment. Main examples of

such taxes are excise duties on energy products, taxes

on transport vehicles as well as pollution taxes.

Environmental taxation has played an important role in

policy debates, in the context of both current and

previous economic crises, as it is considered that

raising environmental taxes could create scope for

labour tax cuts and thus deliver a double dividend in

the sense of boosting employment and improving the

quality of the environment at the same time.

(22) No data are available for Bulgaria, Luxembourg, Malta and Romania. Data

coverage for Estonia and Spain starts in 2000, for Ireland in 2002, for Greece

in 2005. Data for 2010 for Denmark, Spain and the United Kingdom refer to

2009. In addition, the coverage of the last two ITRs is lower than for the ITR on

capital and business income and some adjustments are necessary. For Austria

and Portugal the ITR on corporate income represents the tax burden on all

companies including the self-employed. This correction is necessary because

of the sectoral mismatch in the recording of unincorporated partnerships in

national accounts. The profits of partnerships, treated as quasi-corporations in

national accounts, are booked in the corporations sector while the

corresponding tax payments are recorded in the households sector, given that

the owners of the partnership are taxed under the personal income tax

scheme. In theory, also for Germany, where partnerships are an important part

of companies, a similar correction could be calculated. However, owing to

reservations regarding comparability with other Member States, it has been

decided not to publish these results.

40

Taxation trends in the European Union

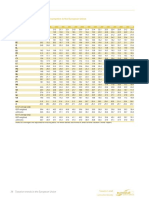

Environmental taxation raises on average 3 %

of GDP

Table 1.6 shows the environmental tax-to-GDP ratio by

Member State. The vast majority of Member States

tend to fall in a band ranging from 2 % to 3 % of GDP.

Only four Member States show levels below 2 % of

GDP, while in three other countries environmental tax

revenues exceed 3.5 % of GDP. At 4.0 % in 2010,

Denmark and the Netherlands display the highest level

of green taxes followed by Slovenia (3.6 %). The

lowest environmental tax revenues in relation to GDP

are instead found in Spain, France and Lithuania and

Slovakia, all below 2 % in 2010.

The predominance of energy taxes is common to most

Member States; however, in some countries the

contribution of taxes on vehicles is significant: for

instance, in Denmark, Ireland, Cyprus and Malta they

account for between 36 % and 44 % of environmental

taxes. In 2010 tax revenue from these taxes amounted

to 0.5 % of GDP in the EU-27, while taxes on

pollution/resources raised only 0.1 % of GDP (see

Annex A).

You might also like

- Ebp Powerpoint PresentationDocument40 pagesEbp Powerpoint Presentationapi-383379774No ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 82Document1 pageTaxation Trends in The European Union - 2012 82d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 86Document1 pageTaxation Trends in The European Union - 2012 86d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 107Document1 pageTaxation Trends in The European Union - 2012 107d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 59Document1 pageTaxation Trends in The European Union - 2012 59d05registerNo ratings yet

- Taxation Trends in EU in 2010Document42 pagesTaxation Trends in EU in 2010Tatiana TurcanNo ratings yet

- Ireland: Developments in The Member StatesDocument4 pagesIreland: Developments in The Member StatesBogdan PetreNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 90Document1 pageTaxation Trends in The European Union - 2012 90d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 162Document1 pageTaxation Trends in The European Union - 2012 162d05registerNo ratings yet

- Environmental Tax in European Union: Oecd (Document2 pagesEnvironmental Tax in European Union: Oecd (Kris AssNo ratings yet

- Taxation Trends in The European Union - 2012 122Document1 pageTaxation Trends in The European Union - 2012 122d05registerNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 29Document1 pageTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 70Document1 pageTaxation Trends in The European Union - 2012 70d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 174Document1 pageTaxation Trends in The European Union - 2012 174d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 84Document1 pageTaxation Trends in The European Union - 2012 84d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 20Document1 pageTaxation Trends in The European Union - 2012 20d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 67Document1 pageTaxation Trends in The European Union - 2012 67d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 48Document1 pageTaxation Trends in The European Union - 2012 48d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 102Document1 pageTaxation Trends in The European Union - 2012 102d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 74Document1 pageTaxation Trends in The European Union - 2012 74d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 151Document1 pageTaxation Trends in The European Union - 2012 151d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 156Document1 pageTaxation Trends in The European Union - 2012 156d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 159Document1 pageTaxation Trends in The European Union - 2012 159d05registerNo ratings yet

- Faculty - Economic and ManagementDocument5 pagesFaculty - Economic and ManagementBaraawo BaraawoNo ratings yet

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocument44 pagesTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousNo ratings yet

- Taxation Trends in The European Union - 2012 64Document1 pageTaxation Trends in The European Union - 2012 64d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 118Document1 pageTaxation Trends in The European Union - 2012 118d05registerNo ratings yet

- Energy Taxation in Europe, Japan and The United StatesDocument16 pagesEnergy Taxation in Europe, Japan and The United StatesPham Minh CongNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- 1.1tax Burden Eu 2016Document12 pages1.1tax Burden Eu 2016vapevyNo ratings yet

- Do Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataDocument19 pagesDo Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataPilar RiveraNo ratings yet

- Taxation Trends in The European Union - 2012 91Document1 pageTaxation Trends in The European Union - 2012 91d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 21Document1 pageTaxation Trends in The European Union - 2012 21d05registerNo ratings yet

- Eprs Bri (2021) 690663 enDocument6 pagesEprs Bri (2021) 690663 enRohinish DeyNo ratings yet

- Eurof05 SchratzenstallerDocument39 pagesEurof05 SchratzenstallerE. S.No ratings yet

- Taxation Trends in The European Union - 2012 66Document1 pageTaxation Trends in The European Union - 2012 66d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 100Document1 pageTaxation Trends in The European Union - 2012 100d05registerNo ratings yet

- Macroeconomics Report On Ireland's EconomyDocument24 pagesMacroeconomics Report On Ireland's Economynikita.nair.2023No ratings yet

- Taxation Trends in The European Union - 2012 155Document1 pageTaxation Trends in The European Union - 2012 155d05registerNo ratings yet

- UK Tax SystemDocument13 pagesUK Tax SystemMuhammad Sajid Saeed100% (1)

- Effects of Different TaxesDocument5 pagesEffects of Different TaxesErick SantillanNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 16Document1 pageTaxation Trends in The European Union - 2012 16d05registerNo ratings yet

- X Dialnet-TaxPolicyConvergenceInEU-2942147Document28 pagesX Dialnet-TaxPolicyConvergenceInEU-2942147NikolinaNo ratings yet

- The Determinants of Tax Revenue in Sub Saharan Africa - Tony & JorgenDocument19 pagesThe Determinants of Tax Revenue in Sub Saharan Africa - Tony & Jorgenpriyanthikadilrukshi05No ratings yet

- Carbon Tax Research PapersDocument7 pagesCarbon Tax Research Paperswrglrkrhf100% (1)

- Mintz Online (Oct 09)Document8 pagesMintz Online (Oct 09)SchoolofPublicPolicyNo ratings yet

- Luxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-FuelsDocument3 pagesLuxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-Fuelssagetarius92No ratings yet

- Study On The Taxation of The Air Transport Sector: Final ReportDocument281 pagesStudy On The Taxation of The Air Transport Sector: Final ReportIsmael GouwsNo ratings yet

- Tax System of EstoniaDocument19 pagesTax System of EstoniaEmil SalmanliNo ratings yet

- Tax and British Business Making The Case PDFDocument24 pagesTax and British Business Making The Case PDFNawsher21No ratings yet

- 2011 04 13 Fuel Tax Report Final MergedDocument59 pages2011 04 13 Fuel Tax Report Final MergedDiễm QuỳnhNo ratings yet

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyDocument8 pagesEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanNo ratings yet

- A Common Withholding Tax For The EUDocument12 pagesA Common Withholding Tax For The EUFabricio Ficticio FalacioNo ratings yet

- Investment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeFrom EverandInvestment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeNo ratings yet

- EIB Investment Survey 2023 - European Union overviewFrom EverandEIB Investment Survey 2023 - European Union overviewNo ratings yet

- Taxation Trends in The European Union - 2012 42Document1 pageTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 44Document1 pageTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 35Document1 pageTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 34Document1 pageTaxation Trends in The European Union - 2012 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 29Document1 pageTaxation Trends in The European Union - 2012 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 30Document1 pageTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 29Document1 pageTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 27Document1 pageTaxation Trends in The European Union - 2012 27Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 10Document1 pageTaxation Trends in The European Union - 2012 10Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 36Document1 pageTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 24Document1 pageTaxation Trends in The European Union - 2012 24Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 8Document1 pageTaxation Trends in The European Union - 2012 8Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 26Document1 pageTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 35Document1 pageTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 34Document1 pageTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 37Document1 pageTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 3Document1 pageTaxation Trends in The European Union - 2012 3Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 31Document1 pageTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 33Document1 pageTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouNo ratings yet

- Assignment On Floating Labors of BangladeshDocument11 pagesAssignment On Floating Labors of BangladeshNahid H AshikNo ratings yet

- OutlineDocument2 pagesOutlineAqsa ChaudhryNo ratings yet

- I J C R B Antecedents of Turnover and Absenteeism: Evidence From Public Sector Institutions of PakistanDocument14 pagesI J C R B Antecedents of Turnover and Absenteeism: Evidence From Public Sector Institutions of PakistanselfiNo ratings yet

- NADOOPODDocument2 pagesNADOOPODArif IzzatNo ratings yet

- S-4 Job Analysis PDFDocument7 pagesS-4 Job Analysis PDFshashankNo ratings yet

- Capital One Business Analyst Job Card Ut 20102Document2 pagesCapital One Business Analyst Job Card Ut 20102GouravGargNo ratings yet

- Strategic Leadership at McdonaldsDocument3 pagesStrategic Leadership at McdonaldsAmeya Samant100% (2)

- Case Study UOBDocument3 pagesCase Study UOBAzra IshratNo ratings yet

- Exercise # 2 OrganizationDocument10 pagesExercise # 2 OrganizationJason Neil Clyde CabayaNo ratings yet

- Admission - Complete - Form Priyanshu Chinmya VidDocument3 pagesAdmission - Complete - Form Priyanshu Chinmya VidAvinash KumarNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- First Aid Training 1-2-3Document2 pagesFirst Aid Training 1-2-3Christian Makande0% (1)

- Internship Report For Accounting and FinDocument28 pagesInternship Report For Accounting and FinHãmèéž MughalNo ratings yet

- StrikeDocument3 pagesStrikeMerlin J SheebaNo ratings yet

- Employee Grievances: Prepared By:Jarmonilla, John B. Lubang, John PatricklDocument23 pagesEmployee Grievances: Prepared By:Jarmonilla, John B. Lubang, John PatricklCeejay CarterNo ratings yet

- HRM FinalsDocument15 pagesHRM FinalsQuenie De la CruzNo ratings yet

- 12-7-22 VSP Statement On Ex-Employee EdwardsDocument1 page12-7-22 VSP Statement On Ex-Employee EdwardsNews 5 WCYBNo ratings yet

- Competency Mapping - Health CareDocument31 pagesCompetency Mapping - Health Carebhairavi_bhatt100% (1)

- United States Court of Appeals, First CircuitDocument4 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- Amit JCB Project Report Final With ObjectivesDocument73 pagesAmit JCB Project Report Final With Objectivessoniakaushik2021No ratings yet

- Attendance - WikipediaDocument2 pagesAttendance - WikipediaEwi BenardNo ratings yet

- Selected Questions Chapter 22Document5 pagesSelected Questions Chapter 22Pranta SahaNo ratings yet

- Banking G.KDocument20 pagesBanking G.Kvishal tyagiNo ratings yet

- Construction Project Manager in Chicago IL Resume James KickDocument2 pagesConstruction Project Manager in Chicago IL Resume James KickJames KickNo ratings yet

- LABOR STANDARDS SYLLABUS Part 3 of ATTY BOYDocument35 pagesLABOR STANDARDS SYLLABUS Part 3 of ATTY BOYJanine Prelle DacanayNo ratings yet

- St. Luke's Medical Center Employees Association-AFW v. National Labor Relations Commission, G.R. No. 162053, 7 March 2007Document4 pagesSt. Luke's Medical Center Employees Association-AFW v. National Labor Relations Commission, G.R. No. 162053, 7 March 2007Ashley Kate PatalinjugNo ratings yet

- OB Chapter 5Document37 pagesOB Chapter 5SOM TUNo ratings yet

- Dimensions of CultureDocument5 pagesDimensions of CulturefunshareNo ratings yet

- Igc 1 Element - 4Document12 pagesIgc 1 Element - 4Dump FacilityNo ratings yet