Professional Documents

Culture Documents

Standalone Financial Results For June 30, 2016 (Result)

Standalone Financial Results For June 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results For June 30, 2016 (Result)

Standalone Financial Results For June 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

Office : 607.

World Trade Centre

Sayaiigul, Vadodara 390 005

Guiarag INDIA

Phone : +9f 765 2363496 I 2363497

Email : utlindustries@gmail.com

Website : utlindustries.com

lll

III

UTL lndustries Limited

cr

fi"t1q,Retollre-v- Qenz'rafing,

|$!

(Formelly nown as Uni-Tubs Limited)

CIN : 127l00GJ 1989P1C012843

To

Corporate Relationship Department

Bombay Stock Exchange Ltd.

P. J. Towers,

Dalal Street, Fort,

Mumbai - 400 001

Date:13/08/2016

Sub.

- : Unaudited financial results for the Quarter ended June 30. 2016

Ref.

-: Scrip Code - 500426

Dear Sir / Madam,

The Board of Directors at their meeting held on 13/08/2016 have approved the unaudited

financial results for the quarter ended June 30, 2016. The Financial Results are encloseo

herewith for vour record.

Kindly take the same on your records and acknowledge the receipt.

Thanking you,

Yours faithfully,

FOR UTL INDUSTRIES

UMESH R. GANDHI i;

[Compliance Officer],.

Led't

Part

UTL Industries Limited

(Previousty known as UniTubes Limited)

clN No. 127100GJ 1989P1C012843

Registered Office: 607 World Trade Centre Sayajigunj

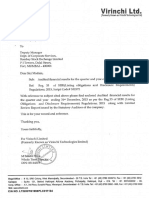

Statement of Standalone Result for the Quarter

VADODARA-o5

Quarter Ended

Particulars

'1,

Script code:500426

nd Month Ended 30th June-2016

(Rs. in lakhs)

Year to Date

Current

Preceding

Corresponding

Current

Corresponding

Annual

30/06/'t6

3'ti 03i 16

30/06/15

30/06/r6

30/06/15

31/03/16

{unaudited)

(Audited)

(Unaudited)

(Unaudited)

(Unaudited)

(Audited)

Income from Ooerations

(a) Net Sales/lncome from New Busrnes!

0.00

2.44

2.14

0.00

2.14

(b) Other Operating Income

0.00

0.00

0.00

0.00

0.00

0.00

Total income from Operations (net)

0.00

2.44

2.10

0.00

2.10

11.23

0.00

0.00

2.19

0.00

1.90

0.00

0.00

0.00

1.90

0.00

10.37

0.00

0.00

0.00

0.00

0.00

0.00

0.00

.15

0.74

1.52

.15

1.52

0.05

0.20

0.00

0.05

0.00

0.20

1.04

0.00

0.00

2.24

1.75

0.00

0.00

4.88

0.00

0.00

1.04

0.00

0.00

2.24

0.00

0.00

000

-2.24

-2.44

0.00

1.06

-2.24

-1.38

0.00

0.00

2. Expenses

(a) Cost of l\raterials consumed

(b) Purchase of stock-rn-trade

(c) Changes in nventories of finished

goods, work-in-progress and stock- intraoe

(d) Employee benefits expense

(e)Depreciation and amortisation

expense

(0Other expenses

Total Expenses

3. Profit / (Loss) from operations

betoae other income, finance costs

and exceotional items l1-2)

4. Other Income

5. Profiu(Loss) from ordinary

activities before finance costs and

0.89

11

.23

5.99

0.00

2't.90

-3.75

-10.67

0.89

2.78

-2.46

-7.89

0.00

0.00

-2.86

-7.89

0.00

0.00

-2.86

-7.89

0.00

0.00

0.00

-2.24

-2.86

-7.89

0.00

exceptional ilems {3 + 4)

6. Finance Costs

7. Protit | (Loss) from ordinary

activities after tinance costs but

before exceptional items (516)

Exceptronal ltems

10. Tax exoense

11.Net Profit / (Loss) from ordinary

activities after tax (9110)

i)

15. Minorily Interest*

0.00

-1.38

(Loss) from ordinary

9.Profit

activities betore tax {7 + 8)

12. Extraordinary items

Sale of office

13. Net Profit / (Loss) for the period ('l

+ 12\

14. Share of Profit / (loss) of associates

0.00

0.00

0.00

0.00

-2.24

-'t.38

000

0.00

-2.24

-'t.38

0.00

0.00

0.00

0.00

000

0.00

-2.24

-t.38

-2.86

-2.24

-2.86

-7.89

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

-2.24

-'1.38

-2.86

-7.89

32.55

32.55

32.55

32.55

32.55

-150.79

-148.55

-137.72

-150.7S

-0.07

-0.07

-0.04

-0.04

-0.09

-0.09

-0.07

-0.07

0.00

0.00

16. Net Profit / (Loss) after taxes,

minority interest and share of profit /

(loss) of associates (13114115) -

17. Paid-up equity share capital (Face

Value of Rs 1f)

18. Reserve excluding Revaluation

Reserves as per balance sheet of

previous accountinq year

-137.72

148 55

19.i Earnings Per Sha.e (before

extraordinary items)of Rs 10^ each):

(a) Basic

(b) Diiuted

rr,\\

-0.24

24

//0d :{/6_\\.0

llJ|'

'.9,

'1g.ii Earnings Per Share (after

extraordinary items) of Rs.10/- each:

(a) Basic

(b) Diluted

See accompanying note

to

-0.07

-0.04

-0.09

-0.07

-0.09

-0.24

-0.07

-0.04

-0.09

-0.07

-0.09

-0.24

the

Financial Results

Note: (1) RESULT WERE REVIEWED BY THE AUDIT COIIIMITTEE AND APPROVED BY THE BOARD OF DIRECTORS AT I\4EETING HELD

ON 13/08/2016. (2) THE COMPANY'S REPORTS ARE BASED ON ACCOUNTING STANDARDS ISSUED BY THE INSTITUTE OF

CHARTERED ACCOUNTANT OF INDIA. (3)NON PROVISION OF INTEREST PAYABLE TO NSIC LTD INTERfulS OF AGREED SETTLEMNT.

(4) PREVIOUS YEAR FIGURES HAVE BEEN REGROUPED AND REARRANGED.

Part ll

Information for the Quarter and Months Ended

Year to Date

Quarter Ended

Particulars

30/06/16

Current

Precedinq

Corresponding

Current

Correspondinq

Annual

30/06/16

31/03/16

30/06/15

30/06/16

30/06/15

31t03t16

A PARTICULARS OF SHAREHOLDING

1.

P!blic Sharehold ing

'Number of Shares

- Percentage of shareholding

2801100

2801'100

2801100

2801100

2801100

2801100

86.06

86.06

86.06

86.06

86.06

86.06

PROIVIOTER AND PROMOTERS

GROUP

a) Pledged/ Encumbered

-Number of Shares

Percentage of shares (as a % of the total

shareholding of promoter and promoter

group)

Percentage of shares (as a % of the total

share capital of the company)

453900

453900

453900

453900

453900

453900

- Percentage of shares (as a % of the

total shareholding of promoter and

promorer group)

100

100

100

100

100

100

- Percentage of shares (as a o/o of the

total share capital of the company)

13.94

13.94

13.94

13.94

13.94

13.94

b) Non-Encumbered

-Number of Shares

B.

INVESTOR COMPLAINTS Particulars

3 months ended current

quarter

Pendiflg at the beginning of the quarter Received during

Nil

the quarter

Disposed of during the quader

Nrl

Remaining unresolved at the end of the quarter

Nil

Place: Vadodara

For UTL Industries Limited

Date: 13/08/2016

Umesh Gandhi

Comoliance officer

You might also like

- Country Manager Final PresentationDocument15 pagesCountry Manager Final PresentationRahul Bhosale100% (4)

- Clothing Retail Business PlanDocument11 pagesClothing Retail Business PlanAlhaji Daramy100% (1)

- HSC Business Study NotesDocument53 pagesHSC Business Study Notesmatt100% (2)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document13 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- M iYN: Standalone Limited BoDocument5 pagesM iYN: Standalone Limited BoHimanshuNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Updates On Financial Results For June 30, 2016 (Result)Document4 pagesUpdates On Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- 2020 21 H1 30.09.2020Document12 pages2020 21 H1 30.09.2020wekepix890No ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document16 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- OM Chapter-1Document55 pagesOM Chapter-1TIZITAW MASRESHANo ratings yet

- Lkas 38Document28 pagesLkas 38SaneejNo ratings yet

- Activity Based CostingDocument14 pagesActivity Based CostingMusthari KhanNo ratings yet

- Need, Want and DemandDocument3 pagesNeed, Want and Demandm_gadhvi6840100% (1)

- Disney Case StudyDocument17 pagesDisney Case StudyNahid HawkNo ratings yet

- ch3 RatioDocument18 pagesch3 RatioEman Samir100% (1)

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- A212 - EXE - Chapter5 INV - QDocument3 pagesA212 - EXE - Chapter5 INV - QCarylChooNo ratings yet

- Balance Scorecard (BSC) PLDTDocument8 pagesBalance Scorecard (BSC) PLDTPrincess Mae DumagatNo ratings yet

- Carbon BlackDocument28 pagesCarbon BlackHabtu AsratNo ratings yet

- Assignment - 1 - Principles of EconomicsDocument16 pagesAssignment - 1 - Principles of EconomicsChinmoyNo ratings yet

- AE4 Module 12 ReportDocument11 pagesAE4 Module 12 ReportJaime PalizardoNo ratings yet

- 1976 Bank - Police and Certi PDFDocument232 pages1976 Bank - Police and Certi PDFManuelaVonLudwigshafenNo ratings yet

- Ychallenge2011 PrelimRound Case (DO NOT DISTRIBUTE)Document0 pagesYchallenge2011 PrelimRound Case (DO NOT DISTRIBUTE)crazyfrog1991No ratings yet

- Jenga Cashflow ExerciseDocument2 pagesJenga Cashflow ExerciseHue PhamNo ratings yet

- PB Xii Economics 2023-24Document7 pagesPB Xii Economics 2023-24nhag720207No ratings yet

- Project On Tafe TractorsDocument27 pagesProject On Tafe TractorsRahul Ruthvik100% (2)

- UntitledDocument259 pagesUntitledAnurag KandariNo ratings yet

- Trade Like A Pro With Japanese Candlesticks EbookDocument78 pagesTrade Like A Pro With Japanese Candlesticks EbookL M50% (2)

- Yoplait YogurtDocument4 pagesYoplait YogurtRohan SrivastavaNo ratings yet

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- Cost Results and FindingsDocument5 pagesCost Results and FindingsRomlan Akman DuranoNo ratings yet

- Avon Brand Amplification Prepared by Arnab BhattacharyaDocument48 pagesAvon Brand Amplification Prepared by Arnab BhattacharyaArnab BhattacharyaNo ratings yet

- Negotiation Plan TemplateDocument7 pagesNegotiation Plan TemplateshajibayliNo ratings yet

- 4 Ingredients of Promotional Methods That Constitute The Promotion-Mix PDFDocument5 pages4 Ingredients of Promotional Methods That Constitute The Promotion-Mix PDFsalsabila harahapNo ratings yet

- Porter's Five Force Model and Ratios Analysis of SQUARE PharmaceuticalDocument42 pagesPorter's Five Force Model and Ratios Analysis of SQUARE PharmaceuticalFarhad Sarker100% (2)

- Business Unit Performance Measurement: Mcgraw-Hill/IrwinDocument17 pagesBusiness Unit Performance Measurement: Mcgraw-Hill/Irwinimran_chaudhryNo ratings yet