Professional Documents

Culture Documents

John N. Bowers and Alma S. Bowers v. Commissioner of Internal Revenue, 678 F.2d 509, 4th Cir. (1982)

John N. Bowers and Alma S. Bowers v. Commissioner of Internal Revenue, 678 F.2d 509, 4th Cir. (1982)

Uploaded by

Scribd Government DocsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

John N. Bowers and Alma S. Bowers v. Commissioner of Internal Revenue, 678 F.2d 509, 4th Cir. (1982)

John N. Bowers and Alma S. Bowers v. Commissioner of Internal Revenue, 678 F.2d 509, 4th Cir. (1982)

Uploaded by

Scribd Government DocsCopyright:

Available Formats

678 F.

2d 509

82-1 USTC P 9402

John N. BOWERS and Alma S. Bowers, Appellants,

v.

COMMISSIONER OF INTERNAL REVENUE, Appellee.

No. 80-1759.

United States Court of Appeals,

Fourth Circuit.

Submitted Nov. 12, 1981.

Decided May 26, 1982.

John N. Bowers and Alma S. Bowers, pro se.

Christina Burkholder, W. Jerold Cohen, Chief Counsel, I. R. S., M. Carr

Ferguson, Asst. Atty. Gen., Tax Div., U. S. Dept. of Justice, Washington,

D. C., for appellee.

Before HAYNSWORTH, Senior Circuit Judge, and BUTZNER and

RUSSELL, Circuit Judges.

PER CURIAM:

The Commissioner assessed a deficiency based upon the disallowance of a

claimed business bad debt deduction. The Tax Court upheld the Commissioner,

but, since it did not address the taxpayer's contentions, we vacate the decision

of the Tax Court and remand the case to it for further consideration.

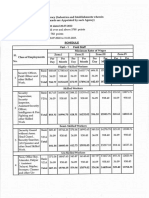

The taxpayer, Bowers,1 was the sole stockholder of a corporation engaged in

the real estate business in Frederick, Maryland. He managed the business and

served as a salesman and representative. He had no stipulated salary, but he

drew as salary, commissions and bonus, each year, all available moneys in the

corporation above a minimal amount for use as working capital. Usually the

retained earnings at the end of each year was a modest sum ranging from

approximately $14,000 to approximately $22,000.

By 1970 Bowers had formed a relationship with George Basiliko, the sole

stockholder of Crown Oil and Wax Company of Delaware, Inc., who was also a

real estate promoter and developer. Basiliko and his corporation became clients

of Bowers Realty, and transactions negotiated on his behalf resulted in an

extraordinary commission income to Bowers Realty in its fiscal years 1972 and

1973. This extraordinary corporate income was paid in substantial part to

Bowers individually in the form of salary, commissions and bonuses. During

the corporation's fiscal years ending 1968, 1969, 1970, 1971, 1974 and 1975

Bowers' compensation by the corporation was never more than $14,000, but in

the corporation's fiscal years 1972 and 1973 his total compensation was

$53,000 and $56,000 respectively.

At the end of the fiscal year 1973, the corporation's retained earnings were

$16,831, from which it is apparent that the extraordinary commission income

realized from the Basiliko transactions was not retained by the corporation.

On May 30, 1972, Basiliko sought and obtained from Bowers, individually, a

loan of $10,000. The loan was never repaid and the Tax Court found it to have

become completely worthless by the end of 1974, the year in which the

taxpayer took a deduction for it.

The Tax Court noticed that there was no basis for a finding that Bowers was in

the business of lending money. Indeed, this, the only loan of which we are

aware, provided no interest. It noted also that the loan could not have been for

the purpose of insuring Bowers' continued employment by the corporation. He

was in complete control of his own corporation and was unconcerned about

loss of employment. The Tax Court, however, never addressed the taxpayer's

real contention.

His contention was that his sole or predominant motivation for the loan was to

maintain the enhanced level of his income as an employee of the corporation

resulting from the handling of the Basiliko transactions. He alleges that

Basiliko's good will and continuing employment of the corporation in real

estate transactions was necessary to maintain the extraordinarily high level of

the taxpayer's remuneration as an employee.

It is quite obviously true that the worthless loan cannot be deducted as a

business bad debt on either of the theories noticed by the Tax Court, but the

unnoticed contention the taxpayer made deserves the Tax Court's explicit

attention and explicit findings of fact. Only after the relevant facts have been

found should the ultimate legal question be addressed.

We conclude that the judgment of the Tax Court should be vacated and the case

remanded to that court for further proceedings consistent with this opinion.

10

VACATED AND REMANDED.

The return was a joint one of the husband and wife, but only the husband's

income and deductions are relevant. Hence, our reference to him as taxpayer

You might also like

- SG12 Team 4 Strategic Audit - BreadTalkDocument32 pagesSG12 Team 4 Strategic Audit - BreadTalkMahalim Fivebuckets100% (1)

- 1 How Did The Laser Cutter Save Peerless Saw CompanyDocument2 pages1 How Did The Laser Cutter Save Peerless Saw CompanyAmit Pandey0% (1)

- Activity Based CostingDocument65 pagesActivity Based CostingOrko AbirNo ratings yet

- Trade Finance Database - Feb'19Document12 pagesTrade Finance Database - Feb'19sheelNo ratings yet

- Bombay Oil Industries LTDDocument17 pagesBombay Oil Industries LTDGautam SoniNo ratings yet

- John N. Bowers and Alma S. Bowers v. Commissioner of Internal Revenue, 716 F.2d 1047, 4th Cir. (1983)Document4 pagesJohn N. Bowers and Alma S. Bowers v. Commissioner of Internal Revenue, 716 F.2d 1047, 4th Cir. (1983)Scribd Government DocsNo ratings yet

- R. A. Bryan and Ruby M. Bryan, C. B. McNairy and Rowena A. McNairy W. H. Weaver and Edith H. Weaver v. Commissioner of Internal Revenue, 281 F.2d 238, 4th Cir. (1960)Document8 pagesR. A. Bryan and Ruby M. Bryan, C. B. McNairy and Rowena A. McNairy W. H. Weaver and Edith H. Weaver v. Commissioner of Internal Revenue, 281 F.2d 238, 4th Cir. (1960)Scribd Government DocsNo ratings yet

- United States v. G. E. Hall and Christine B. Hall, G. E. Hall and Christine B. Hall, Cross-Appellants v. United States of America, Cross-Appellee, 307 F.2d 238, 10th Cir. (1962)Document7 pagesUnited States v. G. E. Hall and Christine B. Hall, G. E. Hall and Christine B. Hall, Cross-Appellants v. United States of America, Cross-Appellee, 307 F.2d 238, 10th Cir. (1962)Scribd Government DocsNo ratings yet

- United States Court of Appeals Third CircuitDocument5 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Bogosian v. Woloohojian, 158 F.3d 1, 1st Cir. (1998)Document16 pagesBogosian v. Woloohojian, 158 F.3d 1, 1st Cir. (1998)Scribd Government DocsNo ratings yet

- Brake & Electric Sales Corporation v. United States, 287 F.2d 426, 1st Cir. (1961)Document5 pagesBrake & Electric Sales Corporation v. United States, 287 F.2d 426, 1st Cir. (1961)Scribd Government DocsNo ratings yet

- Edward M. Selfe and Jane B. Selfe v. United States, 778 F.2d 769, 11th Cir. (1985)Document10 pagesEdward M. Selfe and Jane B. Selfe v. United States, 778 F.2d 769, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- Bair v. Commissioner of Internal Revenue, 199 F.2d 589, 2d Cir. (1952)Document3 pagesBair v. Commissioner of Internal Revenue, 199 F.2d 589, 2d Cir. (1952)Scribd Government DocsNo ratings yet

- American-La France-Foamite Corporation v. Commissioner of Internal Revenue, 284 F.2d 723, 2d Cir. (1960)Document5 pagesAmerican-La France-Foamite Corporation v. Commissioner of Internal Revenue, 284 F.2d 723, 2d Cir. (1960)Scribd Government DocsNo ratings yet

- Pollak v. Commissioner of Internal Revenue, 209 F.2d 57, 3rd Cir. (1954)Document4 pagesPollak v. Commissioner of Internal Revenue, 209 F.2d 57, 3rd Cir. (1954)Scribd Government DocsNo ratings yet

- St. Paul Fire and Marine Insurance Company v. Branch Bank and Trust Company, 834 F.2d 416, 4th Cir. (1987)Document5 pagesSt. Paul Fire and Marine Insurance Company v. Branch Bank and Trust Company, 834 F.2d 416, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- David G. Baird and Mildred B. Baird v. Commissioner of Internal Revenue, 438 F.2d 490, 3rd Cir. (1971)Document8 pagesDavid G. Baird and Mildred B. Baird v. Commissioner of Internal Revenue, 438 F.2d 490, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- Piedmont Minerals Company, Inc. v. United States, 429 F.2d 560, 4th Cir. (1970)Document6 pagesPiedmont Minerals Company, Inc. v. United States, 429 F.2d 560, 4th Cir. (1970)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument11 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- In The Matter of Las Colinas, Inc., Debtors. Appeal of Banco Popular de Puerto Rico. in The Matter of Las Colinas, Inc., Debtors, 453 F.2d 911, 1st Cir. (1972)Document4 pagesIn The Matter of Las Colinas, Inc., Debtors. Appeal of Banco Popular de Puerto Rico. in The Matter of Las Colinas, Inc., Debtors, 453 F.2d 911, 1st Cir. (1972)Scribd Government DocsNo ratings yet

- Joy Manufacturing Company v. Commissioner of Internal Revenue, 230 F.2d 740, 3rd Cir. (1956)Document13 pagesJoy Manufacturing Company v. Commissioner of Internal Revenue, 230 F.2d 740, 3rd Cir. (1956)Scribd Government DocsNo ratings yet

- Asphalt Industries, Inc. v. Commissioner of Internal Revenue, 384 F.2d 229, 3rd Cir. (1967)Document10 pagesAsphalt Industries, Inc. v. Commissioner of Internal Revenue, 384 F.2d 229, 3rd Cir. (1967)Scribd Government DocsNo ratings yet

- Benjamin A. Stratmore and Helen Stratmore v. United States, 420 F.2d 461, 3rd Cir. (1970)Document17 pagesBenjamin A. Stratmore and Helen Stratmore v. United States, 420 F.2d 461, 3rd Cir. (1970)Scribd Government DocsNo ratings yet

- Commissioner of Internal Revenue v. Robert Y. Moffat, SR., and Grace S. Moffat, 373 F.2d 844, 3rd Cir. (1967)Document5 pagesCommissioner of Internal Revenue v. Robert Y. Moffat, SR., and Grace S. Moffat, 373 F.2d 844, 3rd Cir. (1967)Scribd Government DocsNo ratings yet

- Road Materials, Inc. v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Road Materials, Inc., 407 F.2d 1121, 4th Cir. (1969)Document6 pagesRoad Materials, Inc. v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Road Materials, Inc., 407 F.2d 1121, 4th Cir. (1969)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument6 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- First National Industries, Inc. v. Commissioner of Internal Revenue, 404 F.2d 1182, 1st Cir. (1968)Document6 pagesFirst National Industries, Inc. v. Commissioner of Internal Revenue, 404 F.2d 1182, 1st Cir. (1968)Scribd Government DocsNo ratings yet

- UnpublishedDocument9 pagesUnpublishedScribd Government DocsNo ratings yet

- General Banking Act 2000 (HGFF) 2Document13 pagesGeneral Banking Act 2000 (HGFF) 2Marcus-Ruchelle MacadangdangNo ratings yet

- Foronda vs. Alvarez, Jr.Document2 pagesForonda vs. Alvarez, Jr.Andrew AmbrayNo ratings yet

- Benjamin D. and Madeline Prentice Gilbert v. Commissioner of Internal Revenue, 248 F.2d 399, 2d Cir. (1957)Document17 pagesBenjamin D. and Madeline Prentice Gilbert v. Commissioner of Internal Revenue, 248 F.2d 399, 2d Cir. (1957)Scribd Government DocsNo ratings yet

- B.D.W. Associates, Inc., Debtor v. Busy Beaver Building Centers, Inc., Fagen's, Inc. and Jackel Development Co., 865 F.2d 65, 3rd Cir. (1989)Document6 pagesB.D.W. Associates, Inc., Debtor v. Busy Beaver Building Centers, Inc., Fagen's, Inc. and Jackel Development Co., 865 F.2d 65, 3rd Cir. (1989)Scribd Government DocsNo ratings yet

- In Re J. M. Wells, Inc., Bankrupt, in Re J. M. Wells, Inc., Bankrupt, Harold A. Leventhal, 575 F.2d 329, 1st Cir. (1978)Document5 pagesIn Re J. M. Wells, Inc., Bankrupt, in Re J. M. Wells, Inc., Bankrupt, Harold A. Leventhal, 575 F.2d 329, 1st Cir. (1978)Scribd Government DocsNo ratings yet

- In The Matter of Louis C. Ostrer, Bankrupt-Appellant, The Meadow Brook National Bank, Objecting Creditor-Appellee, 393 F.2d 646, 2d Cir. (1968)Document8 pagesIn The Matter of Louis C. Ostrer, Bankrupt-Appellant, The Meadow Brook National Bank, Objecting Creditor-Appellee, 393 F.2d 646, 2d Cir. (1968)Scribd Government DocsNo ratings yet

- 6 City State Savings Vs TobiasDocument8 pages6 City State Savings Vs TobiasMary Fatima BerongoyNo ratings yet

- Industrial Trust Co. v. Commissioner of Internal Revenue, 206 F.2d 229, 1st Cir. (1953)Document8 pagesIndustrial Trust Co. v. Commissioner of Internal Revenue, 206 F.2d 229, 1st Cir. (1953)Scribd Government DocsNo ratings yet

- PNB V Phil Vegetable Oil CoDocument22 pagesPNB V Phil Vegetable Oil CoJonah Mark AvilaNo ratings yet

- United States Court of Appeals Third CircuitDocument4 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- L & M Realty Corporation, Alleged Bankrupt v. Rena C. Leo, of The Estate of Dr. Louis S. Leo, Deceased, Petitioning Creditor, 249 F.2d 668, 4th Cir. (1957)Document5 pagesL & M Realty Corporation, Alleged Bankrupt v. Rena C. Leo, of The Estate of Dr. Louis S. Leo, Deceased, Petitioning Creditor, 249 F.2d 668, 4th Cir. (1957)Scribd Government DocsNo ratings yet

- Commissioner of Internal Revenue v. State-Adams Corporation, 283 F.2d 395, 2d Cir. (1960)Document6 pagesCommissioner of Internal Revenue v. State-Adams Corporation, 283 F.2d 395, 2d Cir. (1960)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument5 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Commissioner v. Bollinger, 485 U.S. 340 (1988)Document8 pagesCommissioner v. Bollinger, 485 U.S. 340 (1988)Scribd Government DocsNo ratings yet

- Commissioner of Internal Revenue v. George J. Schaefer, 240 F.2d 381, 2d Cir. (1957)Document5 pagesCommissioner of Internal Revenue v. George J. Schaefer, 240 F.2d 381, 2d Cir. (1957)Scribd Government DocsNo ratings yet

- Citystate Savings Bank vs. Teresita Tobias and Shellidie ValdezDocument2 pagesCitystate Savings Bank vs. Teresita Tobias and Shellidie ValdezJunelyn T. Ella100% (1)

- Estate of Philip Landau, Deceased, Herbert Landau and Sidney Landau, Executors v. Commissioner of Internal Revenue, 219 F.2d 278, 3rd Cir. (1955)Document6 pagesEstate of Philip Landau, Deceased, Herbert Landau and Sidney Landau, Executors v. Commissioner of Internal Revenue, 219 F.2d 278, 3rd Cir. (1955)Scribd Government DocsNo ratings yet

- Joseph N. Romm and Helen K. Romm, His Wife v. Commissioner of Internal Revenue, 245 F.2d 730, 4th Cir. (1957)Document9 pagesJoseph N. Romm and Helen K. Romm, His Wife v. Commissioner of Internal Revenue, 245 F.2d 730, 4th Cir. (1957)Scribd Government DocsNo ratings yet

- Amedeo Louis Mariorenzi and Grace Mary Mariorenzi v. Commissioner of Internal Revenue, 490 F.2d 92, 1st Cir. (1974)Document2 pagesAmedeo Louis Mariorenzi and Grace Mary Mariorenzi v. Commissioner of Internal Revenue, 490 F.2d 92, 1st Cir. (1974)Scribd Government DocsNo ratings yet

- Samuel Towers v. Commissioner of Internal Revenue, and Three Related Cases, 247 F.2d 233, 2d Cir. (1957)Document6 pagesSamuel Towers v. Commissioner of Internal Revenue, and Three Related Cases, 247 F.2d 233, 2d Cir. (1957)Scribd Government DocsNo ratings yet

- Nego Chapter V NotesDocument40 pagesNego Chapter V Notesmelaniem_1No ratings yet

- Guillermo Gonzalez Hernandez, Debtor v. Jacqueline Borgos, 343 F.2d 802, 1st Cir. (1965)Document6 pagesGuillermo Gonzalez Hernandez, Debtor v. Jacqueline Borgos, 343 F.2d 802, 1st Cir. (1965)Scribd Government DocsNo ratings yet

- William K. Carpenter and Frances K. Carpenter v. Commissioner of Internal Revenue, 322 F.2d 733, 3rd Cir. (1963)Document5 pagesWilliam K. Carpenter and Frances K. Carpenter v. Commissioner of Internal Revenue, 322 F.2d 733, 3rd Cir. (1963)Scribd Government DocsNo ratings yet

- Idaho First National Bank v. United States, 265 F.2d 6, 1st Cir. (1959)Document5 pagesIdaho First National Bank v. United States, 265 F.2d 6, 1st Cir. (1959)Scribd Government DocsNo ratings yet

- Ocwen Not Debt Collector Nor ServicerDocument19 pagesOcwen Not Debt Collector Nor ServicerJulio Cesar NavasNo ratings yet

- Julius Garfinckel & Co., Incorporated (Successor To Brooks Brothers, Inc., Formerly The A. Depinna Company) v. Commissioner of Internal Revenue, 335 F.2d 744, 2d Cir. (1964)Document8 pagesJulius Garfinckel & Co., Incorporated (Successor To Brooks Brothers, Inc., Formerly The A. Depinna Company) v. Commissioner of Internal Revenue, 335 F.2d 744, 2d Cir. (1964)Scribd Government DocsNo ratings yet

- Mutual Savings & Loan Association v. McCants in Re Broome's Men's Shop, 183 F.2d 423, 4th Cir. (1950)Document5 pagesMutual Savings & Loan Association v. McCants in Re Broome's Men's Shop, 183 F.2d 423, 4th Cir. (1950)Scribd Government DocsNo ratings yet

- Max P. Lash v. Commissioner of Internal Revenue, 245 F.2d 20, 1st Cir. (1957)Document3 pagesMax P. Lash v. Commissioner of Internal Revenue, 245 F.2d 20, 1st Cir. (1957)Scribd Government DocsNo ratings yet

- Jerome L. Garsky v. United States of America, and Third-Party v. Ralph Bitters, Third-Party, 600 F.2d 86, 3rd Cir. (1979)Document8 pagesJerome L. Garsky v. United States of America, and Third-Party v. Ralph Bitters, Third-Party, 600 F.2d 86, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- The Motel Company v. The Commissioner of Internal Revenue, 340 F.2d 445, 2d Cir. (1965)Document6 pagesThe Motel Company v. The Commissioner of Internal Revenue, 340 F.2d 445, 2d Cir. (1965)Scribd Government DocsNo ratings yet

- Jesse Johnson and Virginia D. Johnson v. Commissioner of Internal Revenue, 233 F.2d 752, 4th Cir. (1956)Document5 pagesJesse Johnson and Virginia D. Johnson v. Commissioner of Internal Revenue, 233 F.2d 752, 4th Cir. (1956)Scribd Government DocsNo ratings yet

- Burnet v. Commonwealth Improvement Co., 287 U.S. 415 (1932)Document4 pagesBurnet v. Commonwealth Improvement Co., 287 U.S. 415 (1932)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument14 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Thomas M. Ferrill, Jr. and Louise B. Ferrill v. Commissioner of Internal Revenue, 684 F.2d 261, 3rd Cir. (1982)Document7 pagesThomas M. Ferrill, Jr. and Louise B. Ferrill v. Commissioner of Internal Revenue, 684 F.2d 261, 3rd Cir. (1982)Scribd Government DocsNo ratings yet

- United States Court of Appeals Third CircuitDocument7 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Fox Rothschild LLP Yann Geron Nicole N. Santucci 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Document22 pagesFox Rothschild LLP Yann Geron Nicole N. Santucci 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Chapter 11 DocketsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Parker Excavating v. LaFarge West, 10th Cir. (2017)Document24 pagesParker Excavating v. LaFarge West, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHunterNo ratings yet

- Decision Theory: Identifies The FeaturesDocument60 pagesDecision Theory: Identifies The FeaturesTamiruNo ratings yet

- Intellectual Property ADR Vs Litigation Resolving Intellectual Property Disputes Outside of Court Using ADR To Take Control of Your CaseDocument10 pagesIntellectual Property ADR Vs Litigation Resolving Intellectual Property Disputes Outside of Court Using ADR To Take Control of Your CasesanjeevchaswalNo ratings yet

- Chapter 18Document24 pagesChapter 18Baby KhorNo ratings yet

- Report On Capital StructureDocument89 pagesReport On Capital StructureAbhishek Jain0% (1)

- Marketing Strategies of Liberty FootwearDocument35 pagesMarketing Strategies of Liberty FootwearSumeet MhamunkarNo ratings yet

- TongHeer Brouchure)Document10 pagesTongHeer Brouchure)bkprodhNo ratings yet

- Case Study On Ethics and ValuesDocument2 pagesCase Study On Ethics and ValuesSubhasish Mitra100% (1)

- Statement For 1229832 005001200003576Document8 pagesStatement For 1229832 005001200003576PDRK BABIUNo ratings yet

- Customer Service Quiz 1ADocument5 pagesCustomer Service Quiz 1Abarnes33414100% (1)

- Adani Enterprises or Adani Enterprises LTDDocument38 pagesAdani Enterprises or Adani Enterprises LTDSaloni Sharma100% (2)

- Milstein Family Foundation 2002Document26 pagesMilstein Family Foundation 2002cmf8926No ratings yet

- Lecture - Decentralization and Responsibility AcctgDocument23 pagesLecture - Decentralization and Responsibility AcctgNick JagolinoNo ratings yet

- Law3 NotesDocument3 pagesLaw3 NotesLeon Genaro NaragaNo ratings yet

- Corporation Definition The Most Common Form ofDocument20 pagesCorporation Definition The Most Common Form ofmtayyab_786100% (2)

- 8 Edition: Steven P. Robbins Mary CoulterDocument43 pages8 Edition: Steven P. Robbins Mary CoulterTeddy León ZegarraNo ratings yet

- AttachmentDocument2 pagesAttachmentEngr Jehangir KhanNo ratings yet

- Week 1Document35 pagesWeek 1flora tasiNo ratings yet

- Overview of Elements of The Financial Report Audit ProcessDocument47 pagesOverview of Elements of The Financial Report Audit ProcessPardeep Ramesh Agarval100% (1)

- Types of BorrowersDocument20 pagesTypes of BorrowersklllllllaNo ratings yet

- SECURITY (Revised) 28-7-22 To 31-3-23Document3 pagesSECURITY (Revised) 28-7-22 To 31-3-23ATGS GNo ratings yet

- DatabaseDocument526 pagesDatabaseapi-19482514100% (2)

- Securing AnexgateDocument2 pagesSecuring Anexgatebsatish_70No ratings yet

- Resume VikasDocument4 pagesResume VikasBaljeetNo ratings yet

- Financial Accounting and Reporting IDocument5 pagesFinancial Accounting and Reporting IKim Cristian Maaño50% (2)