Professional Documents

Culture Documents

ST ST

ST ST

Uploaded by

saifuliu0 ratings0% found this document useful (0 votes)

14 views1 page1. This document provides information and questions for an income tax exam, including:

2. The exam is for a 1st year B.B.S. 1st term improvement examination in 1992 on the subject of income tax. It is 3 hours long and worth 40 total marks.

3. Students must answer 4 out of the 6 multi-part questions provided, which cover topics like defining income tax, sources of income, filing returns, penalties, types of securities, agricultural vs. non-agricultural income, and elements of salary.

Original Description:

Original Title

122.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This document provides information and questions for an income tax exam, including:

2. The exam is for a 1st year B.B.S. 1st term improvement examination in 1992 on the subject of income tax. It is 3 hours long and worth 40 total marks.

3. Students must answer 4 out of the 6 multi-part questions provided, which cover topics like defining income tax, sources of income, filing returns, penalties, types of securities, agricultural vs. non-agricultural income, and elements of salary.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views1 pageST ST

ST ST

Uploaded by

saifuliu1. This document provides information and questions for an income tax exam, including:

2. The exam is for a 1st year B.B.S. 1st term improvement examination in 1992 on the subject of income tax. It is 3 hours long and worth 40 total marks.

3. Students must answer 4 out of the 6 multi-part questions provided, which cover topics like defining income tax, sources of income, filing returns, penalties, types of securities, agricultural vs. non-agricultural income, and elements of salary.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

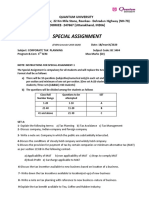

1st Year B.B.S.

1st term Improvement Examination 1992

Department of Management

Subject: Income Tax

Course No: 122

Total Time: 3 Hours

Total Marks: 40

( Marks for each question are given on the right margin. Answer any four of the

following questions.)

1. a) Define income tax.

b) Discuss the characteristics of income from the view point of income tax.

c) State the various sources of income

02

04

04

2. a) To whom return of income is to be submitted?

b) Discuss the steps for submission of return of income.

c) What are the conditions for self-assessment.

02

05

03

3.

02

08

b)

What are the authority to impose penalty?

Under what circumstances and how appeal can be filed to the appellate

Tribunal? Discuss with its settlement procedure.

4. a) Discuss the different classes of securities.

b) State the rules of grossing-up of interest of securities.

c) Explain the procedure of settling of losses.

04

02

04

5. a) State the feature of agricultural income.

b) Distinguish between agricultural income and non-agricultural income.

c) Explain the allowable deductions in case of agricultural income.

02

02

06

6. a) Define Salary.

b) Explain the elements of salary.

c) What is approved gratuity fund.

02

02

06

You might also like

- Evsjv Abyev'Document2 pagesEvsjv Abyev'saifuliuNo ratings yet

- Corporate Tax Planning - 2Document3 pagesCorporate Tax Planning - 2sarthak guptaNo ratings yet

- POB Paper 2 June 2010Document4 pagesPOB Paper 2 June 2010Duhguy Marvin CharlesNo ratings yet

- Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeDocument2 pagesApproximately of 400 Words. Each Question Is Followed by Evaluation SchemeBadder DanbadNo ratings yet

- 103 Ecn (Eng)Document6 pages103 Ecn (Eng)crisgk1234No ratings yet

- EXAMINATION NO. - The Public Accountants Examination Council of Malawi 2014 Examinations Accounting Technician Programme Paper TC 5: EconomicsDocument9 pagesEXAMINATION NO. - The Public Accountants Examination Council of Malawi 2014 Examinations Accounting Technician Programme Paper TC 5: EconomicsmavinNo ratings yet

- MF0012Document3 pagesMF0012Rajesh SinghNo ratings yet

- Terminal Test March 2018Document6 pagesTerminal Test March 2018Laksh VermaniNo ratings yet

- TaxationDocument3 pagesTaxationKavish BablaNo ratings yet

- Nr-310106-Manageria Econ and Prin AcDocument4 pagesNr-310106-Manageria Econ and Prin AcSRINIVASA RAO GANTANo ratings yet

- 5 - Principles of Taxation07092021Document10 pages5 - Principles of Taxation07092021Jahirul IslamNo ratings yet

- R1.LEBO - .L Question CMA May 2022 ExaminationDocument5 pagesR1.LEBO - .L Question CMA May 2022 ExaminationMd. Showkat IslamNo ratings yet

- Income Tax IDocument4 pagesIncome Tax InishatNo ratings yet

- 1 Complex Exam Question BankDocument16 pages1 Complex Exam Question BankScribdTranslationsNo ratings yet

- Phonetic Keyboard LayoutDocument1 pagePhonetic Keyboard LayoutSafdar RazaNo ratings yet

- CC CCDocument24 pagesCC CCManish SinghNo ratings yet

- Bcom 5 Sem Co Operative Legal System 21101660 Jul 2021Document2 pagesBcom 5 Sem Co Operative Legal System 21101660 Jul 2021Internet 223No ratings yet

- Econ 1 EndDocument2 pagesEcon 1 EndMuwanguzi JonathanNo ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90Anonymous VaYaLmoX4No ratings yet

- MCOM Entrance QuestionDocument10 pagesMCOM Entrance QuestionAnju AsokNo ratings yet

- Mms Mbs Apr2012Document32 pagesMms Mbs Apr2012Fernandes RudolfNo ratings yet

- Economics Set BDocument3 pagesEconomics Set Bapp storeNo ratings yet

- Fin 303 PDFDocument4 pagesFin 303 PDFSimanta KalitaNo ratings yet

- Caft 001: Common Accounting and Finance TestDocument21 pagesCaft 001: Common Accounting and Finance TestNaren JangirNo ratings yet

- 427 Question PaperDocument2 pages427 Question PaperPacific TigerNo ratings yet

- ECONOMICS QUESTION BANKDocument1 pageECONOMICS QUESTION BANKspiceamuza237No ratings yet

- AccountancyDocument9 pagesAccountancyPiyush JhamNo ratings yet

- Attempts All Questions From Part I and Any Five Questions From Part IIDocument1 pageAttempts All Questions From Part I and Any Five Questions From Part IINimesh GoyalNo ratings yet

- Assignments MADocument4 pagesAssignments MAYashi SinghNo ratings yet

- C04 - Advanced TaxationDocument8 pagesC04 - Advanced TaxationDAVID KIWIANo ratings yet

- 11th Accounts, Assign. 111th Accounts, Assign. 1Document8 pages11th Accounts, Assign. 111th Accounts, Assign. 1Prachiii SharmaNo ratings yet

- Taxation in BangladeshDocument6 pagesTaxation in BangladeshSakibNo ratings yet

- Fundamental of AccountingDocument4 pagesFundamental of AccountingGuruKPONo ratings yet

- Nov 06Document24 pagesNov 06Vascilly TerentievNo ratings yet

- Itlp Question BankDocument4 pagesItlp Question BankHimanshu SethiNo ratings yet

- CSEC June 2010 - Economics - Paper 02Document5 pagesCSEC June 2010 - Economics - Paper 02Richard Bhainie100% (5)

- Public Finance & Taxation 2021Document341 pagesPublic Finance & Taxation 2021sebastgeofreyNo ratings yet

- C4 - Advanced Taxation - SyllabusDocument6 pagesC4 - Advanced Taxation - SyllabusEmmaNo ratings yet

- Taxation EMDocument2 pagesTaxation EMtadepalli patanjaliNo ratings yet

- Commerce&AuditDocument72 pagesCommerce&AuditTaniya MahturNo ratings yet

- Commercial StudiesDocument3 pagesCommercial StudiesChandu SagiliNo ratings yet

- Acc312 SummerDocument1 pageAcc312 SummerAdeyemo KingsleyNo ratings yet

- Public Finance and Taxation - 1 Nbaa Cpa-1Document265 pagesPublic Finance and Taxation - 1 Nbaa Cpa-1Osmund100% (1)

- Meterial 20240501 114815Document8 pagesMeterial 20240501 114815pothalaharish123No ratings yet

- (sEM R) : Il) TiltDocument4 pages(sEM R) : Il) TiltSameer KhanNo ratings yet

- B. B. M. (I.B.) (Semester - I) Examination - 2011: Total No. of Questions: 4) (Total No. of Printed Pages: 2Document103 pagesB. B. M. (I.B.) (Semester - I) Examination - 2011: Total No. of Questions: 4) (Total No. of Printed Pages: 2Smruti Mehta100% (1)

- Adjustments:: B.Sc. Degree Examination, 2012Document3 pagesAdjustments:: B.Sc. Degree Examination, 2012Priyanka ChoudhuryNo ratings yet

- TC5 Ecomics QD14Document7 pagesTC5 Ecomics QD14mavin100% (1)

- ICSE - Economics Sample Paper-1-Class 10 Question PaperDocument2 pagesICSE - Economics Sample Paper-1-Class 10 Question PaperFirdosh Khan100% (1)

- POB Revision Questions 2Document6 pagesPOB Revision Questions 2Khalil Weir100% (1)

- Eco 121 Set 2 Fundamentals of EconomicsDocument3 pagesEco 121 Set 2 Fundamentals of EconomicsShadreck CharlesNo ratings yet

- 19ptrl12io s2 Exam - May 2019Document3 pages19ptrl12io s2 Exam - May 2019abdelfatahshirefNo ratings yet

- Multiple-Choice 06052024Document9 pagesMultiple-Choice 06052024quejotemaryclaireNo ratings yet

- R1.LEBO - .L Question CMA June 2021 Exam.Document5 pagesR1.LEBO - .L Question CMA June 2021 Exam.Md. Showkat IslamNo ratings yet

- BCA 3rd Sem 2019 AccountingDocument3 pagesBCA 3rd Sem 2019 Accountingeshanarayan101No ratings yet

- Financial Accounting - I One WordsDocument14 pagesFinancial Accounting - I One WordsEswari GkNo ratings yet

- 4 XII Economics EnglishDocument5 pages4 XII Economics EnglishZod LuffyNo ratings yet

- Elements of Accountancy TermDocument12 pagesElements of Accountancy TermSwaapnil ShindeNo ratings yet

- Accountants' Handbook, Special Industries and Special TopicsFrom EverandAccountants' Handbook, Special Industries and Special TopicsNo ratings yet

- RD NDDocument2 pagesRD NDsaifuliuNo ratings yet

- CommunicationDocument1 pageCommunicationsaifuliuNo ratings yet

- DX X XDocument2 pagesDX X XsaifuliuNo ratings yet

- 3rd Year BBSDocument1 page3rd Year BBSsaifuliuNo ratings yet

- (Evsjv Abyev') 1 - K) Kvievi WK? GKRB MDJ E Emvqxi Az Vek KXQ Bvejx WK WK? 05 L) Kviev Ii MVGVWRK 'Vwqz¡Mgyn Ey©Bv Ki 05Document2 pages(Evsjv Abyev') 1 - K) Kvievi WK? GKRB MDJ E Emvqxi Az Vek KXQ Bvejx WK WK? 05 L) Kviev Ii MVGVWRK 'Vwqz¡Mgyn Ey©Bv Ki 05saifuliuNo ratings yet

- Evsjv Abyev'Document2 pagesEvsjv Abyev'saifuliuNo ratings yet

- International Management SyllabusDocument2 pagesInternational Management SyllabussaifuliuNo ratings yet

- Evsjv Abyev') 1 - KDocument2 pagesEvsjv Abyev') 1 - KsaifuliuNo ratings yet

- Third Year B.B.A. (Hon's) First Semester Final Examination 2005 Management Course # 315 (Cost Accounting) Full Marks - 80 Time - 4 HoursDocument2 pagesThird Year B.B.A. (Hon's) First Semester Final Examination 2005 Management Course # 315 (Cost Accounting) Full Marks - 80 Time - 4 HourssaifuliuNo ratings yet