Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3K viewsAmendment U

Amendment U

Uploaded by

Michael_Lee_RobertsCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Equity and Adequacy in Alabama Schools and DistrictsDocument96 pagesEquity and Adequacy in Alabama Schools and DistrictsTrisha Powell Crain100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Provisional Breed-Restricted License For Owners of Pit Bulls Draft OrdinanceDocument7 pagesProvisional Breed-Restricted License For Owners of Pit Bulls Draft OrdinanceMichael_Lee_RobertsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Estate of Allan George, Et Al., v. City of Rifle, Et Al.Document20 pagesEstate of Allan George, Et Al., v. City of Rifle, Et Al.Michael_Lee_RobertsNo ratings yet

- Dr. William Moreau Lawsuit Press ReleaseDocument1 pageDr. William Moreau Lawsuit Press ReleaseMichael_Lee_RobertsNo ratings yet

- Brandon Valdez Officer-Involved Shooting Decision LetterDocument13 pagesBrandon Valdez Officer-Involved Shooting Decision LetterMichael_Lee_RobertsNo ratings yet

- U.S. Supreme Court Petition: Leo Lech, Et Al., v. City of Greenwood Village, Et Al.Document34 pagesU.S. Supreme Court Petition: Leo Lech, Et Al., v. City of Greenwood Village, Et Al.Michael_Lee_RobertsNo ratings yet

- Lookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators Recommendations With Action StepsDocument20 pagesLookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators Recommendations With Action StepsMichael_Lee_RobertsNo ratings yet

- Lookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators ReportDocument25 pagesLookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators ReportMichael_Lee_RobertsNo ratings yet

- Officer Austin Barela: Denver Police Department Order of DisciplineDocument15 pagesOfficer Austin Barela: Denver Police Department Order of DisciplineMichael_Lee_RobertsNo ratings yet

- Natasha Patnode Settlement AgreementDocument6 pagesNatasha Patnode Settlement AgreementMichael_Lee_RobertsNo ratings yet

- Missing and Murdered Indigenous Women and Girls ReportDocument28 pagesMissing and Murdered Indigenous Women and Girls ReportMichael_Lee_RobertsNo ratings yet

- Officer Susan Mercado: Denver Police Department Order of DisciplineDocument15 pagesOfficer Susan Mercado: Denver Police Department Order of DisciplineMichael_Lee_RobertsNo ratings yet

- Paul Vranas Denver Pit Bull Expert Testimony and Evidence ReviewDocument4 pagesPaul Vranas Denver Pit Bull Expert Testimony and Evidence ReviewMichael_Lee_Roberts0% (1)

- Senate Joint Resolution 20-006Document7 pagesSenate Joint Resolution 20-006Michael_Lee_RobertsNo ratings yet

- Xiaoli Gao and Zhong Wei Zhang IndictmentDocument12 pagesXiaoli Gao and Zhong Wei Zhang IndictmentMichael_Lee_RobertsNo ratings yet

- Denver Dog and Cat Bites by Breed 2019Document2 pagesDenver Dog and Cat Bites by Breed 2019Michael_Lee_RobertsNo ratings yet

- Susan Holmes Judge Recusal MotionDocument12 pagesSusan Holmes Judge Recusal MotionMichael_Lee_RobertsNo ratings yet

- Denver Public Schools Gender-Neutral Bathrooms ResolutionDocument3 pagesDenver Public Schools Gender-Neutral Bathrooms ResolutionMichael_Lee_Roberts100% (1)

- Suicide by Cop: Protocol and Training GuideDocument12 pagesSuicide by Cop: Protocol and Training GuideMichael_Lee_RobertsNo ratings yet

- 2020 Rental Affordability Report DataDocument160 pages2020 Rental Affordability Report DataMichael_Lee_RobertsNo ratings yet

- Travis Cook v. City of Arvada, Et Al.Document19 pagesTravis Cook v. City of Arvada, Et Al.Michael_Lee_RobertsNo ratings yet

- Erik Jensen Sentence Commutation LetterDocument1 pageErik Jensen Sentence Commutation LetterMichael_Lee_RobertsNo ratings yet

- IHeartMedia Markets Group Division President BiosDocument3 pagesIHeartMedia Markets Group Division President BiosMichael_Lee_RobertsNo ratings yet

- Iheart Media Division Presidents and Market NamesDocument3 pagesIheart Media Division Presidents and Market NamesMichael_Lee_RobertsNo ratings yet

- Johnny Leon-Alvarez Probable Cause StatementDocument3 pagesJohnny Leon-Alvarez Probable Cause StatementMichael_Lee_RobertsNo ratings yet

- Colorado Senate Bill 20-065Document7 pagesColorado Senate Bill 20-065Michael_Lee_RobertsNo ratings yet

- Comcast Motion To Dismiss Altitude Sports & Entertainment LawsuitDocument23 pagesComcast Motion To Dismiss Altitude Sports & Entertainment LawsuitMichael_Lee_RobertsNo ratings yet

- Timmy Henley Decision LetterDocument13 pagesTimmy Henley Decision LetterMichael_Lee_RobertsNo ratings yet

- Ending A Broken System: Colorado's Expensive, Ineffective and Unjust Death PenaltyDocument60 pagesEnding A Broken System: Colorado's Expensive, Ineffective and Unjust Death PenaltyMichael_Lee_RobertsNo ratings yet

- Estate of Timmy Henley v. City of Westminster, Et Al.Document34 pagesEstate of Timmy Henley v. City of Westminster, Et Al.Michael_Lee_RobertsNo ratings yet

- Trevante Johnson Officer-Involved Shooting Decision LetterDocument5 pagesTrevante Johnson Officer-Involved Shooting Decision LetterMichael_Lee_RobertsNo ratings yet

- Icct Colleges Foundation Inc. Accounting For Government and Non-Profit OrganizationsDocument3 pagesIcct Colleges Foundation Inc. Accounting For Government and Non-Profit OrganizationsJr VillariezNo ratings yet

- Flint Water and Strategic-Structural Racism FinalDocument67 pagesFlint Water and Strategic-Structural Racism FinalJaimeNo ratings yet

- Cutler Property Tax Relief PlanDocument24 pagesCutler Property Tax Relief Plangerald7783No ratings yet

- MIAA Vs CADocument6 pagesMIAA Vs CAInnah Agito-RamosNo ratings yet

- Senior Subcabinet: Montgomery County Property Tax Credit Programs For SeniorsDocument12 pagesSenior Subcabinet: Montgomery County Property Tax Credit Programs For SeniorsPublic Information OfficeNo ratings yet

- 2022 Larimer County General Election Sample BallotDocument4 pages2022 Larimer County General Election Sample BallotColoradoanNo ratings yet

- 12 2023 Value Adjustment Board TrainingDocument292 pages12 2023 Value Adjustment Board Trainingjdosmer3No ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Telecom Law - Case DigestsDocument7 pagesTelecom Law - Case DigestsJERepaldoNo ratings yet

- TaxationreviewDocument11 pagesTaxationreviewmarvin barlisoNo ratings yet

- Transfer Taxes: Philippine Law School (Taxation 2) Atty. VelaDocument73 pagesTransfer Taxes: Philippine Law School (Taxation 2) Atty. VelapogsNo ratings yet

- Manila International Airport Authority Vs CA - 495 SCRA 591Document62 pagesManila International Airport Authority Vs CA - 495 SCRA 591westernwound82No ratings yet

- MCIAA Vs City of Lapu Lapu G.R. No. 181756 June 15, 2015Document5 pagesMCIAA Vs City of Lapu Lapu G.R. No. 181756 June 15, 2015Albert CuizonNo ratings yet

- Cag Report On Local Governance in Kerala 2004 - 2005Document132 pagesCag Report On Local Governance in Kerala 2004 - 2005K RajasekharanNo ratings yet

- Taxing Land and Property in Emerging Economies: Raising Revenue and More? Richard M. Bird and Enid SlackDocument46 pagesTaxing Land and Property in Emerging Economies: Raising Revenue and More? Richard M. Bird and Enid SlackAnisa QorriNo ratings yet

- Administrative Order No. 23 Compliance Report TemplateDocument11 pagesAdministrative Order No. 23 Compliance Report TemplateVILMA BASENo ratings yet

- rp5217 Form For New York PDFDocument8 pagesrp5217 Form For New York PDFRichard WiseNo ratings yet

- Philippine Heart Center Vs LGU of Quezon CityDocument3 pagesPhilippine Heart Center Vs LGU of Quezon CityRiena MaeNo ratings yet

- City of Pasig Vs RepublicDocument5 pagesCity of Pasig Vs Republicjovani emaNo ratings yet

- OM - Town Center Oaks - Kennesaw GA - c12804ff8589Document29 pagesOM - Town Center Oaks - Kennesaw GA - c12804ff8589Mazher Ahmed KhanNo ratings yet

- 23 Napocor vs. CbaaDocument23 pages23 Napocor vs. CbaaAnonymous 12BvdWEWyNo ratings yet

- JCPS Tentative Budget For FY25Document33 pagesJCPS Tentative Budget For FY25Krista JohnsonNo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptCHRISNo ratings yet

- 51 GST Flyer Chapter41Document9 pages51 GST Flyer Chapter41Pranav TannaNo ratings yet

- James McKenna's 2013-14 Proposed Budget Presentation, March 14, 2013.Document33 pagesJames McKenna's 2013-14 Proposed Budget Presentation, March 14, 2013.Suffolk TimesNo ratings yet

- 2013 Bill of Local Self-Government of Islamabad-1Document20 pages2013 Bill of Local Self-Government of Islamabad-1Huda NoorNo ratings yet

- Com Sale DeedDocument22 pagesCom Sale Deedjahangirgill254No ratings yet

- Republic vs. City of ParanaqueDocument17 pagesRepublic vs. City of ParanaqueMariaFaithFloresFelisartaNo ratings yet

Amendment U

Amendment U

Uploaded by

Michael_Lee_Roberts0 ratings0% found this document useful (0 votes)

3K views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3K views4 pagesAmendment U

Amendment U

Uploaded by

Michael_Lee_RobertsCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

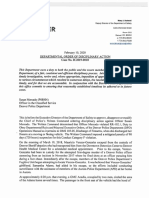

NOTE: This bill has been prepared for the signatures of the appropriate legislative

officers and the Governor. To determine whether the Governor has signed the bill

or taken other action on it, please consult the legislative status sheet, the legislative

history, or the Session Laws.

SENATE CONCURRENT RESOLUTION 16-002

BY SENATOR(S) Baumgardner, Steadman, Garcia, Holbert, Lambert,

Lundberg, Marble, Martinez Humenik, Neville T., Scheffel, Scott,

Sonnenberg, Woods;

also REPRESENTATIVE(S) Vigil, Arndt, Conti, Duran, Fields, Kagan,

Klingenschmitt, Moreno, Neville P., Pettersen, Ryden, Saine, Van Winkle,

Williams, Windholz, Young, Hullinghorst.

SUBMITTING TO THE REGISTERED ELECTORS OF THE STATE OF COLORADO

AN AMENDMENT TO THE COLORADO CONSTITUTION CONCERNING AN

EXEMPTION FROM PROPERTY TAXATION FOR A POSSESSORY INTEREST

IN REAL PROPERTY IF THE ACTUAL VALUE OF THE INTEREST IS LESS

THAN OR EQUAL TO SIX THOUSAND DOLLARS OR SUCH AMOUNT

ADJUSTED FOR INFLATION.

Be It Resolved by the Senate of the Seventieth General Assembly of the

State of Colorado, the House of Representatives concurring herein:

SECTION 1. At the election held on November 8, 2016, the

secretary of state shall submit to the registered electors of the state the

ballot title set forth in section 2 for the following amendment to the state

constitution:

In the constitution of the state of Colorado, section 3 of article X,

________

Capital letters indicate new material added to existing statutes; dashes through words indicate

deletions from existing statutes and such material not part of act.

amend (1) (b) as follows:

Section 3. Uniform taxation - exemptions. (1) (b) (I) Residential

real property, which shall include all residential dwelling units and the

land, as defined by law, on which such units are located, and mobile home

parks, but shall not include hotels and motels, shall be valued for

assessment at twenty-one percent of its actual value. For the property tax

year commencing January 1, 1985, the general assembly shall determine the

percentage of the aggregate statewide valuation for assessment which is

attributable to residential real property. For each subsequent year, the

general assembly shall again determine the percentage of the aggregate

statewide valuation for assessment which is attributable to each class of

taxable property, after adding in the increased valuation for assessment

attributable to new construction and to increased volume of mineral and oil

and gas production. For each year in which there is a change in the level of

value used in determining actual value, the general assembly shall adjust

the ratio of valuation for assessment for residential real property which is

set forth in this paragraph (b) as is necessary to insure that the percentage

of the aggregate statewide valuation for assessment which is attributable to

residential real property shall remain the same as it was in the year

immediately preceding the year in which such change occurs. Such

adjusted ratio shall be the ratio of valuation for assessment for residential

real property for those years for which such new level of value is used. In

determining the adjustment to be made in the ratio of valuation for

assessment for residential real property, the aggregate statewide valuation

for assessment that is attributable to residential real property shall be

calculated as if the full actual value of all owner-occupied primary

residences that are partially exempt from taxation pursuant to section 3.5

of this article was subject to taxation. All other taxable property shall be

valued for assessment at twenty-nine percent of its actual value. However,

the valuation for assessment for producing mines, as defined by law, and

lands or leaseholds producing oil or gas, as defined by law, shall be a

portion of the actual annual or actual average annual production therefrom,

based upon the value of the unprocessed material, according to procedures

prescribed by law for different types of minerals. Non-producing

unpatented mining claims, which are possessory interests in real property

by virtue of leases from the United States of America, shall be exempt from

property taxation. OTHER POSSESSORY INTERESTS IN REAL PROPERTY SHALL

BE EXEMPT FROM PROPERTY TAXATION AS SPECIFIED IN SUBPARAGRAPH (II)

OF THIS PARAGRAPH (b).

PAGE 2-SENATE CONCURRENT RESOLUTION 16-002

(II) (A) FOR THE PROPERTY TAX YEAR COMMENCING ON JANUARY

1, 2018, A POSSESSORY INTEREST IN REAL PROPERTY SHALL BE EXEMPT

FROM THE LEVY AND COLLECTION OF PROPERTY TAX IF THE ACTUAL VALUE

OF SUCH POSSESSORY INTEREST IN REAL PROPERTY IS LESS THAN OR EQUAL

TO SIX THOUSAND DOLLARS.

(B) FOR PROPERTY TAX YEARS COMMENCING ON OR AFTER JANUARY

1, 2019, A POSSESSORY INTEREST IN REAL PROPERTY SHALL BE EXEMPT

FROM THE LEVY AND COLLECTION OF PROPERTY TAX IF THE ACTUAL VALUE

OF SUCH POSSESSORY INTEREST IN REAL PROPERTY IS LESS THAN OR EQUAL

TO SIX THOUSAND DOLLARS ADJUSTED BIENNIALLY TO ACCOUNT FOR

INFLATION AS DEFINED IN SECTION 20 (2) (f) OF ARTICLE X OF THIS

CONSTITUTION. ON OR BEFORE NOVEMBER 1, 2018, AND ON OR BEFORE

NOVEMBER 1 OF EACH EVEN-NUMBERED YEAR THEREAFTER, THE PROPERTY

TAX ADMINISTRATOR SHALL CALCULATE THE AMOUNT OF THE EXEMPTION

FOR THE NEXT TWO-YEAR CYCLE USING INFLATION FOR THE PRIOR TWO

CALENDAR YEARS AS OF THE DATE OF THE CALCULATION. THE ADJUSTED

EXEMPTION SHALL BE ROUNDED UPWARD TO THE NEAREST

ONE-HUNDRED-DOLLAR INCREMENT. THE ADMINISTRATOR SHALL CERTIFY

THE AMOUNT OF THE EXEMPTION FOR THE NEXT TWO-YEAR CYCLE AND

PUBLISH THE AMOUNT IN A MANNER PROVIDED BY LAW.

SECTION 2. Each elector voting at the election may cast a vote

either "Yes/For" or "No/Against" on the following ballot title: "Shall there

be an amendment to the Colorado constitution concerning an exemption

from property taxation for a possessory interest in real property if the actual

value of the interest is less than or equal to six thousand dollars or such

amount adjusted for inflation?"

PAGE 3-SENATE CONCURRENT RESOLUTION 16-002

SECTION 3. Except as otherwise provided in section 1-40-123,

Colorado Revised Statutes, if a majority of the electors voting on the ballot

title vote "Yes/For", then the amendment will become part of the state

constitution.

____________________________ ____________________________

Bill L. Cadman

Dickey Lee Hullinghorst

PRESIDENT OF

SPEAKER OF THE HOUSE

THE SENATE

OF REPRESENTATIVES

____________________________ ____________________________

Effie Ameen

Marilyn Eddins

SECRETARY OF

CHIEF CLERK OF THE HOUSE

THE SENATE

OF REPRESENTATIVES

PAGE 4-SENATE CONCURRENT RESOLUTION 16-002

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Equity and Adequacy in Alabama Schools and DistrictsDocument96 pagesEquity and Adequacy in Alabama Schools and DistrictsTrisha Powell Crain100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Provisional Breed-Restricted License For Owners of Pit Bulls Draft OrdinanceDocument7 pagesProvisional Breed-Restricted License For Owners of Pit Bulls Draft OrdinanceMichael_Lee_RobertsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Estate of Allan George, Et Al., v. City of Rifle, Et Al.Document20 pagesEstate of Allan George, Et Al., v. City of Rifle, Et Al.Michael_Lee_RobertsNo ratings yet

- Dr. William Moreau Lawsuit Press ReleaseDocument1 pageDr. William Moreau Lawsuit Press ReleaseMichael_Lee_RobertsNo ratings yet

- Brandon Valdez Officer-Involved Shooting Decision LetterDocument13 pagesBrandon Valdez Officer-Involved Shooting Decision LetterMichael_Lee_RobertsNo ratings yet

- U.S. Supreme Court Petition: Leo Lech, Et Al., v. City of Greenwood Village, Et Al.Document34 pagesU.S. Supreme Court Petition: Leo Lech, Et Al., v. City of Greenwood Village, Et Al.Michael_Lee_RobertsNo ratings yet

- Lookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators Recommendations With Action StepsDocument20 pagesLookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators Recommendations With Action StepsMichael_Lee_RobertsNo ratings yet

- Lookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators ReportDocument25 pagesLookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators ReportMichael_Lee_RobertsNo ratings yet

- Officer Austin Barela: Denver Police Department Order of DisciplineDocument15 pagesOfficer Austin Barela: Denver Police Department Order of DisciplineMichael_Lee_RobertsNo ratings yet

- Natasha Patnode Settlement AgreementDocument6 pagesNatasha Patnode Settlement AgreementMichael_Lee_RobertsNo ratings yet

- Missing and Murdered Indigenous Women and Girls ReportDocument28 pagesMissing and Murdered Indigenous Women and Girls ReportMichael_Lee_RobertsNo ratings yet

- Officer Susan Mercado: Denver Police Department Order of DisciplineDocument15 pagesOfficer Susan Mercado: Denver Police Department Order of DisciplineMichael_Lee_RobertsNo ratings yet

- Paul Vranas Denver Pit Bull Expert Testimony and Evidence ReviewDocument4 pagesPaul Vranas Denver Pit Bull Expert Testimony and Evidence ReviewMichael_Lee_Roberts0% (1)

- Senate Joint Resolution 20-006Document7 pagesSenate Joint Resolution 20-006Michael_Lee_RobertsNo ratings yet

- Xiaoli Gao and Zhong Wei Zhang IndictmentDocument12 pagesXiaoli Gao and Zhong Wei Zhang IndictmentMichael_Lee_RobertsNo ratings yet

- Denver Dog and Cat Bites by Breed 2019Document2 pagesDenver Dog and Cat Bites by Breed 2019Michael_Lee_RobertsNo ratings yet

- Susan Holmes Judge Recusal MotionDocument12 pagesSusan Holmes Judge Recusal MotionMichael_Lee_RobertsNo ratings yet

- Denver Public Schools Gender-Neutral Bathrooms ResolutionDocument3 pagesDenver Public Schools Gender-Neutral Bathrooms ResolutionMichael_Lee_Roberts100% (1)

- Suicide by Cop: Protocol and Training GuideDocument12 pagesSuicide by Cop: Protocol and Training GuideMichael_Lee_RobertsNo ratings yet

- 2020 Rental Affordability Report DataDocument160 pages2020 Rental Affordability Report DataMichael_Lee_RobertsNo ratings yet

- Travis Cook v. City of Arvada, Et Al.Document19 pagesTravis Cook v. City of Arvada, Et Al.Michael_Lee_RobertsNo ratings yet

- Erik Jensen Sentence Commutation LetterDocument1 pageErik Jensen Sentence Commutation LetterMichael_Lee_RobertsNo ratings yet

- IHeartMedia Markets Group Division President BiosDocument3 pagesIHeartMedia Markets Group Division President BiosMichael_Lee_RobertsNo ratings yet

- Iheart Media Division Presidents and Market NamesDocument3 pagesIheart Media Division Presidents and Market NamesMichael_Lee_RobertsNo ratings yet

- Johnny Leon-Alvarez Probable Cause StatementDocument3 pagesJohnny Leon-Alvarez Probable Cause StatementMichael_Lee_RobertsNo ratings yet

- Colorado Senate Bill 20-065Document7 pagesColorado Senate Bill 20-065Michael_Lee_RobertsNo ratings yet

- Comcast Motion To Dismiss Altitude Sports & Entertainment LawsuitDocument23 pagesComcast Motion To Dismiss Altitude Sports & Entertainment LawsuitMichael_Lee_RobertsNo ratings yet

- Timmy Henley Decision LetterDocument13 pagesTimmy Henley Decision LetterMichael_Lee_RobertsNo ratings yet

- Ending A Broken System: Colorado's Expensive, Ineffective and Unjust Death PenaltyDocument60 pagesEnding A Broken System: Colorado's Expensive, Ineffective and Unjust Death PenaltyMichael_Lee_RobertsNo ratings yet

- Estate of Timmy Henley v. City of Westminster, Et Al.Document34 pagesEstate of Timmy Henley v. City of Westminster, Et Al.Michael_Lee_RobertsNo ratings yet

- Trevante Johnson Officer-Involved Shooting Decision LetterDocument5 pagesTrevante Johnson Officer-Involved Shooting Decision LetterMichael_Lee_RobertsNo ratings yet

- Icct Colleges Foundation Inc. Accounting For Government and Non-Profit OrganizationsDocument3 pagesIcct Colleges Foundation Inc. Accounting For Government and Non-Profit OrganizationsJr VillariezNo ratings yet

- Flint Water and Strategic-Structural Racism FinalDocument67 pagesFlint Water and Strategic-Structural Racism FinalJaimeNo ratings yet

- Cutler Property Tax Relief PlanDocument24 pagesCutler Property Tax Relief Plangerald7783No ratings yet

- MIAA Vs CADocument6 pagesMIAA Vs CAInnah Agito-RamosNo ratings yet

- Senior Subcabinet: Montgomery County Property Tax Credit Programs For SeniorsDocument12 pagesSenior Subcabinet: Montgomery County Property Tax Credit Programs For SeniorsPublic Information OfficeNo ratings yet

- 2022 Larimer County General Election Sample BallotDocument4 pages2022 Larimer County General Election Sample BallotColoradoanNo ratings yet

- 12 2023 Value Adjustment Board TrainingDocument292 pages12 2023 Value Adjustment Board Trainingjdosmer3No ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Telecom Law - Case DigestsDocument7 pagesTelecom Law - Case DigestsJERepaldoNo ratings yet

- TaxationreviewDocument11 pagesTaxationreviewmarvin barlisoNo ratings yet

- Transfer Taxes: Philippine Law School (Taxation 2) Atty. VelaDocument73 pagesTransfer Taxes: Philippine Law School (Taxation 2) Atty. VelapogsNo ratings yet

- Manila International Airport Authority Vs CA - 495 SCRA 591Document62 pagesManila International Airport Authority Vs CA - 495 SCRA 591westernwound82No ratings yet

- MCIAA Vs City of Lapu Lapu G.R. No. 181756 June 15, 2015Document5 pagesMCIAA Vs City of Lapu Lapu G.R. No. 181756 June 15, 2015Albert CuizonNo ratings yet

- Cag Report On Local Governance in Kerala 2004 - 2005Document132 pagesCag Report On Local Governance in Kerala 2004 - 2005K RajasekharanNo ratings yet

- Taxing Land and Property in Emerging Economies: Raising Revenue and More? Richard M. Bird and Enid SlackDocument46 pagesTaxing Land and Property in Emerging Economies: Raising Revenue and More? Richard M. Bird and Enid SlackAnisa QorriNo ratings yet

- Administrative Order No. 23 Compliance Report TemplateDocument11 pagesAdministrative Order No. 23 Compliance Report TemplateVILMA BASENo ratings yet

- rp5217 Form For New York PDFDocument8 pagesrp5217 Form For New York PDFRichard WiseNo ratings yet

- Philippine Heart Center Vs LGU of Quezon CityDocument3 pagesPhilippine Heart Center Vs LGU of Quezon CityRiena MaeNo ratings yet

- City of Pasig Vs RepublicDocument5 pagesCity of Pasig Vs Republicjovani emaNo ratings yet

- OM - Town Center Oaks - Kennesaw GA - c12804ff8589Document29 pagesOM - Town Center Oaks - Kennesaw GA - c12804ff8589Mazher Ahmed KhanNo ratings yet

- 23 Napocor vs. CbaaDocument23 pages23 Napocor vs. CbaaAnonymous 12BvdWEWyNo ratings yet

- JCPS Tentative Budget For FY25Document33 pagesJCPS Tentative Budget For FY25Krista JohnsonNo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptCHRISNo ratings yet

- 51 GST Flyer Chapter41Document9 pages51 GST Flyer Chapter41Pranav TannaNo ratings yet

- James McKenna's 2013-14 Proposed Budget Presentation, March 14, 2013.Document33 pagesJames McKenna's 2013-14 Proposed Budget Presentation, March 14, 2013.Suffolk TimesNo ratings yet

- 2013 Bill of Local Self-Government of Islamabad-1Document20 pages2013 Bill of Local Self-Government of Islamabad-1Huda NoorNo ratings yet

- Com Sale DeedDocument22 pagesCom Sale Deedjahangirgill254No ratings yet

- Republic vs. City of ParanaqueDocument17 pagesRepublic vs. City of ParanaqueMariaFaithFloresFelisartaNo ratings yet